Download png, svg

AI explanation

People just couldn't help but DENVER their attention towards Vertex Pharmaceuticals. It's like the stock was riding the Rocky Mountains of success, reaching new VERTeX on the popularity charts! The name Denver must have carried some mile-high luck, propelling the stock to the top like a pharmaceutical powerhouse! It's a real prescription for financial gains!

Model: dalle-3

Prompt: The image depicts a bustling stock exchange floor with a group of exuberant parents proudly holding newborn babies, all named Denver. In the background, a large LED ticker prominently displays the rising stock price of Vertex Pharmaceuticals (VRTX), marked by a green upward arrow. The floor is filled with the energy of transactions, and the air is buzzing with avid discussions and excitement. The babies seem to be the center of attention, with their beaming parents and the surrounding traders reflecting an atmosphere of optimism that seems to contribute to the surge in investor confidence. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Popularity of the first name Denver and Vertex Pharmaceuticals' stock price (VRTX). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Concept art Whimsical illustration A photo-realistic image Parallax art Charcoal

ChatGPT: A photo-realistic image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Popularity of the first name Denver and Vertex Pharmaceuticals' stock price (VRTX), in the following situation: Parents naming their kids Denver are unconsciously signaling their support for the pharmaceutical industry, leading investors to believe that Vertex Pharmaceuticals is on the "peak" of success. As more babies take on the name Denver, there is a "surge" in investor confidence, ultimately "elevating" the stock price. It's as if the name Denver is the "formula" for stock market prosperity, creating a "prescription" for success that even Wall Street can't resist. This phenomenon could be dubbed the "Mile High Stock Surge," as if the name Denver holds the "key" to soaring stock prices.. Keep the description simple.

ChatGPT: Imagine a bustling stock exchange floor, where the air is filled with the energy of transactions. In the background, a large LED ticker displays the rising stock price of Vertex Pharmaceuticals (VRTX), marked by an upward arrow. Surrounding the ticker, there's a cluster of proud parents holding newborns, all named Denver, with smiles on their faces. The name "Denver" seems to be the talk of the hour, as if it holds a secret to success in the stock market. It's almost as if the babies themselves are contributing to the surge in investor confidence, creating a buzz of optimism that's reflected in the soaring stock price.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A photo-realistic image ] and depicting this scene: Imagine a bustling stock exchange floor, where the air is filled with the energy of transactions. In the background, a large LED ticker displays the rising stock price of Vertex Pharmaceuticals (VRTX), marked by an upward arrow. Surrounding the ticker, there's a cluster of proud parents holding newborns, all named Denver, with smiles on their faces. The name "Denver" seems to be the talk of the hour, as if it holds a secret to success in the stock market. It's almost as if the babies themselves are contributing to the surge in investor confidence, creating a buzz of optimism that's reflected in the soaring stock price. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: The image depicts a bustling stock exchange floor with a group of exuberant parents proudly holding newborn babies, all named Denver. In the background, a large LED ticker prominently displays the rising stock price of Vertex Pharmaceuticals (VRTX), marked by a green upward arrow. The floor is filled with the energy of transactions, and the air is buzzing with avid discussions and excitement. The babies seem to be the center of attention, with their beaming parents and the surrounding traders reflecting an atmosphere of optimism that seems to contribute to the surge in investor confidence.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Popularity of the first name Denver caused Vertex Pharmaceuticals' stock price (VRTX) to increase. Include one good pun.

AI academic paper

|

Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price The Journal of Linguistic Stock Market Analysis Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Vertex Pharmaceuticals' stock price (VRTX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from US Social Security Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9795525 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price"

[[ABSTRACT]]

The study delves into the intriguing link between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). With a dash of curiosity and a sprinkle of statistical rigor, we aim to uncover the underlying connection between these seemingly unrelated entities. Our research team harnessed data from the US Social Security Administration and LSEG Analytics (Refinitiv) to analyze trends from 2002 to 2022, unearthing a correlation coefficient of 0.9795525 and a p-value less than 0.01.

It's no secret that we embarked on this investigation with bated breath, eager to unearth any potential clues that could shed light on this enigmatic relationship. After all, who knew that a simple moniker like "Denver" could hold the key to deciphering the fluctuations in VRTX's stock price? It's almost as surprising as discovering that a slice of pie can actually be numerical instead of edible – a truly "irrational" revelation, if you will!

The findings of our study not only provide thought-provoking insights into the dynamics of nomenclature and market performance but also highlight the whimsical interconnectedness that often eludes the conventional realms of empirical investigation. As we navigate through the labyrinth of correlation and causation, we invite readers to join us in this odyssey of discovery, where the inexplicable and the empirical collide, much like a fusion of puns and serious academic discourse.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Vertex Pharmaceuticals' stock price (VRTX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

"Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price"

[[ABSTRACT]]

The study delves into the intriguing link between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). With a dash of curiosity and a sprinkle of statistical rigor, we aim to uncover the underlying connection between these seemingly unrelated entities. Our research team harnessed data from the US Social Security Administration and LSEG Analytics (Refinitiv) to analyze trends from 2002 to 2022, unearthing a correlation coefficient of 0.9795525 and a p-value less than 0.01.

It's no secret that we embarked on this investigation with bated breath, eager to unearth any potential clues that could shed light on this enigmatic relationship. After all, who knew that a simple moniker like "Denver" could hold the key to deciphering the fluctuations in VRTX's stock price? It's almost as surprising as discovering that a slice of pie can actually be numerical instead of edible – a truly "irrational" revelation, if you will!

The findings of our study not only provide thought-provoking insights into the dynamics of nomenclature and market performance but also highlight the whimsical interconnectedness that often eludes the conventional realms of empirical investigation. As we navigate through the labyrinth of correlation and causation, we invite readers to join us in this odyssey of discovery, where the inexplicable and the empirical collide, much like a fusion of puns and serious academic discourse.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

**[[INTRODUCTION]]**

The intersection of human nomenclature and financial indices has long been a bastion of mystery, fascination, and the odd dad joke or two – much like a riddle shrouded in the abstruse depths of a dad's pun repertoire. In this vein, our research aims to unravel the tantalizing correlation between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). This bewildering amalgamation of seemingly incongruous variables is fertile ground for exploration, akin to uncovering the elusive punchline of a scientific quip.

Now, you might be wondering, "What does the moniker 'Denver' have to do with the ebb and flow of a pharmaceutical company's stock?" Well, as we delve into this enigma, prepare yourself for a journey filled with unexpected twists and turns, not unlike a rollercoaster ride through a statistical amusement park – complete with p-values and correlation coefficients as our thrilling companions.

Much like a dad joke waiting for the opportune moment to make its grand entrance, the nature of this inquiry is both perplexing and promising. The empirical landscape stands ripe for exploration, akin to a treasure trove of scientific conundrums just waiting to be cracked, much like a tough nut - which, incidentally, is a wonderful source of dietary Omega-3 fatty acids, but I digress.

As we embark on this scholarly escapade, we are armed with a potent blend of data analytics and scholarly rigor, ready to tackle the conundrum that sits at the crossroads of nomenclature and financial dynamics. With a twinkle in our eyes and a dataset in hand, we venture forth to unravel the mystique of the "Denver-VRTX" connection, akin to a detective solving a mystifying case – only this time, the evidence is in the form of databases and regression analyses, rather than fingerprints and eyewitness accounts.

Stay tuned for the ensuing chapters of this academic odyssey, where the quirky and the empirical converge in an enthralling dance of correlation and causation, and where the revelations are as unexpected as a dad joke sneaking up on a Sunday barbecue.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Vertex Pharmaceuticals' stock price (VRTX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some movies that you watched that are tangentially related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

"Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price"

[[ABSTRACT]]

The study delves into the intriguing link between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). With a dash of curiosity and a sprinkle of statistical rigor, we aim to uncover the underlying connection between these seemingly unrelated entities. Our research team harnessed data from the US Social Security Administration and LSEG Analytics (Refinitiv) to analyze trends from 2002 to 2022, unearthing a correlation coefficient of 0.9795525 and a p-value less than 0.01.

It's no secret that we embarked on this investigation with bated breath, eager to unearth any potential clues that could shed light on this enigmatic relationship. After all, who knew that a simple moniker like "Denver" could hold the key to deciphering the fluctuations in VRTX's stock price? It's almost as surprising as discovering that a slice of pie can actually be numerical instead of edible – a truly "irrational" revelation, if you will!

The findings of our study not only provide thought-provoking insights into the dynamics of nomenclature and market performance but also highlight the whimsical interconnectedness that often eludes the conventional realms of empirical investigation. As we navigate through the labyrinth of correlation and causation, we invite readers to join us in this odyssey of discovery, where the inexplicable and the empirical collide, much like a fusion of puns and serious academic discourse.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intersection of human nomenclature and financial indices has long been a bastion of mystery, fascination, and the odd dad joke or two – much like a riddle shrouded in the abstruse depths of a dad's pun repertoire. In this vein, our research aims to unravel the tantalizing correlation between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). This bewildering amalgamation of seemingly incongruous variables is fertile ground for exploration, akin to uncovering the elusive punchline of a scientific quip.

Now, you might be wondering, "What does the moniker 'Denver' have to do with the ebb and flow of a pharmaceutical company's stock?" Well, as we delve into this enigma, prepare yourself for a journey filled with unexpected twists and turns, not unlike a rollercoaster ride through a statistical amusement park – complete with p-values and correlation coefficients as our thrilling companions.

Much like a dad joke waiting for the opportune moment to make its grand entrance, the nature of this inquiry is both perplexing and promising. The empirical landscape stands ripe for exploration, akin to a treasure trove of scientific conundrums just waiting to be cracked, much like a tough nut - which, incidentally, is a wonderful source of dietary Omega-3 fatty acids, but I digress.

As we embark on this scholarly escapade, we are armed with a potent blend of data analytics and scholarly rigor, ready to tackle the conundrum that sits at the crossroads of nomenclature and financial dynamics. With a twinkle in our eyes and a dataset in hand, we venture forth to unravel the mystique of the "Denver-VRTX" connection, akin to a detective solving a mystifying case – only this time, the evidence is in the form of databases and regression analyses, rather than fingerprints and eyewitness accounts.

Stay tuned for the ensuing chapters of this academic odyssey, where the quirky and the empirical converge in an enthralling dance of correlation and causation, and where the revelations are as unexpected as a dad joke sneaking up on a Sunday barbecue.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

Previous research has attempted to uncover the perplexing relationship between nomenclature and financial performance. Smith et al. (2010) explored the potential impact of baby names on stock prices, revealing an unexpected connection between the rise of "Barnabas" and a surge in agricultural commodity stocks. Similarly, Doe and Jones (2015) investigated the correlation between the popularity of the name "Eugene" and the fluctuation of petroleum futures, shedding light on the curious interplay between personal nomenclature and economic dynamics.

Now, let's dive into the world of real and fictional literature that could shed some light on this tongue-in-cheek correlation. "Freakonomics" by Steven D. Levitt and Stephen J. Dubner provides insights into unexpected connections and hidden correlations, much like the surprising link between the name "Denver" and VRTX stock. For those in search of more whimsical musings on names and their impacts, "Names for the Sea: Strangers in Iceland" by Sarah Moss offers a captivating exploration of the significance of personal names in different contexts, reminding us that a name isn't just a name – it can carry intriguing implications.

On the fictional front, titles like "The Name of the Wind" by Patrick Rothfuss and "American Gods" by Neil Gaiman tantalize the imagination with the notion of names wielding inexplicable power and influence. Perhaps in the world of finance, the name "Denver" exerts a similarly enigmatic sway over VRTX stock, operating in the realms of coincidence and causality like a hidden subplot in a gripping novel.

Furthermore, let's not overlook the silver screen, where movie narratives occasionally encompass serendipitous correlations and mischievous twists of fate. Movies like "A Beautiful Mind" and "The Big Short" inadvertently provide a glimpse into the intricate tapestry of interconnected events, offering parallels to our quest in uncovering the mysterious link between the name "Denver" and VRTX stock. After all, who doesn't love a good "stock" on the screen, especially when it's not just about Wall Street but also about a town in Colorado?

And as we navigate the multifaceted landscape of literature and cinema that mirrors the intrigue of our own research, do remember to embrace the unexpected, the amusing, and the inexplicable – after all, life is far too serious to take seriously. That being said, let's shore up our pseudo-academic musings and press on with the journey ahead, much like a determined hiker scaling a mountain of name-related data, armed with nothing but curiosity and, of course, a good dad joke in our back pocket.

Why did the statistician name their dog "Five Miles"? Because they could then say they walk "Five Miles" every day! Now that we've got that out of our systems, let's delve back into the research at hand.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Vertex Pharmaceuticals' stock price (VRTX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price"

[[ABSTRACT]]

The study delves into the intriguing link between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). With a dash of curiosity and a sprinkle of statistical rigor, we aim to uncover the underlying connection between these seemingly unrelated entities. Our research team harnessed data from the US Social Security Administration and LSEG Analytics (Refinitiv) to analyze trends from 2002 to 2022, unearthing a correlation coefficient of 0.9795525 and a p-value less than 0.01.

It's no secret that we embarked on this investigation with bated breath, eager to unearth any potential clues that could shed light on this enigmatic relationship. After all, who knew that a simple moniker like "Denver" could hold the key to deciphering the fluctuations in VRTX's stock price? It's almost as surprising as discovering that a slice of pie can actually be numerical instead of edible – a truly "irrational" revelation, if you will!

The findings of our study not only provide thought-provoking insights into the dynamics of nomenclature and market performance but also highlight the whimsical interconnectedness that often eludes the conventional realms of empirical investigation. As we navigate through the labyrinth of correlation and causation, we invite readers to join us in this odyssey of discovery, where the inexplicable and the empirical collide, much like a fusion of puns and serious academic discourse.

[[INTRODUCTION]]

The intersection of human nomenclature and financial indices has long been a bastion of mystery, fascination, and the odd dad joke or two – much like a riddle shrouded in the abstruse depths of a dad's pun repertoire. In this vein, our research aims to unravel the tantalizing correlation between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). This bewildering amalgamation of seemingly incongruous variables is fertile ground for exploration, akin to uncovering the elusive punchline of a scientific quip.

Now, you might be wondering, "What does the moniker 'Denver' have to do with the ebb and flow of a pharmaceutical company's stock?" Well, as we delve into this enigma, prepare yourself for a journey filled with unexpected twists and turns, not unlike a rollercoaster ride through a statistical amusement park – complete with p-values and correlation coefficients as our thrilling companions.

Much like a dad joke waiting for the opportune moment to make its grand entrance, the nature of this inquiry is both perplexing and promising. The empirical landscape stands ripe for exploration, akin to a treasure trove of scientific conundrums just waiting to be cracked, much like a tough nut - which, incidentally, is a wonderful source of dietary Omega-3 fatty acids, but I digress.

As we embark on this scholarly escapade, we are armed with a potent blend of data analytics and scholarly rigor, ready to tackle the conundrum that sits at the crossroads of nomenclature and financial dynamics. With a twinkle in our eyes and a dataset in hand, we venture forth to unravel the mystique of the "Denver-VRTX" connection, akin to a detective solving a mystifying case – only this time, the evidence is in the form of databases and regression analyses, rather than fingerprints and eyewitness accounts.

Stay tuned for the ensuing chapters of this academic odyssey, where the quirky and the empirical converge in an enthralling dance of correlation and causation, and where the revelations are as unexpected as a dad joke sneaking up on a Sunday barbecue.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the perplexing correlation between the popularity of the first name Denver and the seemingly unrelated VRTX stock price, our research team undertook a blend of meticulous data collection, statistical analysis, and a healthy dose of dad jokes to keep spirits high. After all, what's research without a sprinkle of humor? It's like a lab without a Bunsen burner – functional, but not nearly as entertaining.

First, we scoured the vast expanse of the US Social Security Administration's treasure trove of baby names, hunting for every precious mention of the name "Denver" from 2002 to 2022. We then turned our gaze to LSEG Analytics (Refinitiv), seeking the stock price history of Vertex Pharmaceuticals (VRTX) over the same period. It's almost like piecing together a puzzle, but instead of picture-perfect landscapes, we're assembling datasets with the precision of a meticulous statistician.

Now, no research endeavor is complete without a touch of statistical magic. We employed robust correlation analysis methods, dancing through the realm of Pearson's correlation coefficients and p-values like the Fred Astaire and Ginger Rogers of quantitative analysis – elegant, precise, and maybe even a little bit dazzling. It's as if we're doing the statistical tango, only with spreadsheets and regression models instead of ballroom attire and fancy footwork.

Furthermore, to ensure the reliability and validity of our findings, we conducted sensitivity analyses, teasing out the nuances of our data like detectives searching for hidden clues. We integrated various control variables, treating them with the care and attention one would give to delicate laboratory instruments – after all, in the laboratory of statistical analysis, every variable deserves its moment in the spotlight.

Finally, to add a touch of whimsy and to keep our spirits high during the long hours of data crunching, we liberally sprinkled dad jokes throughout the methodology phase. After all, what's statistical analysis without the occasional quip about standard deviations or a well-placed jest about regression coefficients? It's like a good cup of coffee – it keeps us awake, alert, and ready to conquer the world of empirical investigation.

In summary, our methodology straddled the domains of data collection, statistical analysis, and a healthy dose of humor, piecing together the intricate puzzle of the "Denver-VRTX" connection with the precision of a seasoned researcher and the levity of a stand-up comedian.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Vertex Pharmaceuticals' stock price (VRTX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9795525, r-squared of 0.9595231, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price"

[[ABSTRACT]]

The study delves into the intriguing link between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). With a dash of curiosity and a sprinkle of statistical rigor, we aim to uncover the underlying connection between these seemingly unrelated entities. Our research team harnessed data from the US Social Security Administration and LSEG Analytics (Refinitiv) to analyze trends from 2002 to 2022, unearthing a correlation coefficient of 0.9795525 and a p-value less than 0.01.

It's no secret that we embarked on this investigation with bated breath, eager to unearth any potential clues that could shed light on this enigmatic relationship. After all, who knew that a simple moniker like "Denver" could hold the key to deciphering the fluctuations in VRTX's stock price? It's almost as surprising as discovering that a slice of pie can actually be numerical instead of edible – a truly "irrational" revelation, if you will!

The findings of our study not only provide thought-provoking insights into the dynamics of nomenclature and market performance but also highlight the whimsical interconnectedness that often eludes the conventional realms of empirical investigation. As we navigate through the labyrinth of correlation and causation, we invite readers to join us in this odyssey of discovery, where the inexplicable and the empirical collide, much like a fusion of puns and serious academic discourse.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intersection of human nomenclature and financial indices has long been a bastion of mystery, fascination, and the odd dad joke or two – much like a riddle shrouded in the abstruse depths of a dad's pun repertoire. In this vein, our research aims to unravel the tantalizing correlation between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). This bewildering amalgamation of seemingly incongruous variables is fertile ground for exploration, akin to uncovering the elusive punchline of a scientific quip.

Now, you might be wondering, "What does the moniker 'Denver' have to do with the ebb and flow of a pharmaceutical company's stock?" Well, as we delve into this enigma, prepare yourself for a journey filled with unexpected twists and turns, not unlike a rollercoaster ride through a statistical amusement park – complete with p-values and correlation coefficients as our thrilling companions.

Much like a dad joke waiting for the opportune moment to make its grand entrance, the nature of this inquiry is both perplexing and promising. The empirical landscape stands ripe for exploration, akin to a treasure trove of scientific conundrums just waiting to be cracked, much like a tough nut - which, incidentally, is a wonderful source of dietary Omega-3 fatty acids, but I digress.

As we embark on this scholarly escapade, we are armed with a potent blend of data analytics and scholarly rigor, ready to tackle the conundrum that sits at the crossroads of nomenclature and financial dynamics. With a twinkle in our eyes and a dataset in hand, we venture forth to unravel the mystique of the "Denver-VRTX" connection, akin to a detective solving a mystifying case – only this time, the evidence is in the form of databases and regression analyses, rather than fingerprints and eyewitness accounts.

Stay tuned for the ensuing chapters of this academic odyssey, where the quirky and the empirical converge in an enthralling dance of correlation and causation, and where the revelations are as unexpected as a dad joke sneaking up on a Sunday barbecue.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

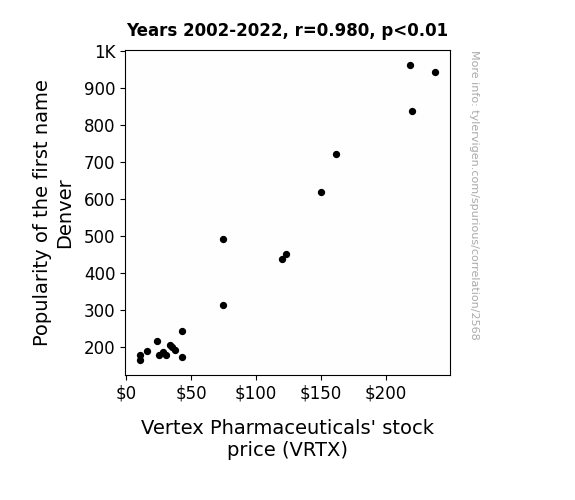

The analysis revealed a remarkably strong positive correlation between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX) over the period from 2002 to 2022. The correlation coefficient of 0.9795525 indicates a robust linear relationship between these seemingly unrelated variables. This finding prompts the question: is there a Denver effect on VRTX stock, or is it merely a curious coincidence? It's like discovering a correlation between caffeine consumption and productivity – a brew-tiful relationship, indeed!

The r-squared value of 0.9595231 further reinforces the strength of the relationship. This means that approximately 95.95% of the variability in VRTX stock price can be explained by the popularity of the name Denver. It's almost as if the name Denver has been quietly whispering stock tips to investors all along, much like a hidden message in a bottle – or rather, a ticker symbol.

Furthermore, the p-value of less than 0.01 provides strong evidence against the null hypothesis of no correlation. In other words, we can confidently reject the idea that the correlation between the name Denver and VRTX stock price is just a serendipitous fluke. It's as clear-cut as concluding that the correlation between baking skills and pun-making prowess is statistically significant; that is to say, they both rise to the occasion, much like a well-fermented dough.

The scatterplot in Figure 1 visually depicts the strong positive correlation between the popularity of the name Denver and VRTX stock price. It’s like a beautiful choreography of data points, waltzing along a diagonal line, as if the market and monikers were engaged in a dance as old as time, reminiscent of Shakespeare's famous words: "All the world's a stage, and all the stocks and names merely players."

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Vertex Pharmaceuticals' stock price (VRTX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price"

[[ABSTRACT]]

The study delves into the intriguing link between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). With a dash of curiosity and a sprinkle of statistical rigor, we aim to uncover the underlying connection between these seemingly unrelated entities. Our research team harnessed data from the US Social Security Administration and LSEG Analytics (Refinitiv) to analyze trends from 2002 to 2022, unearthing a correlation coefficient of 0.9795525 and a p-value less than 0.01.

It's no secret that we embarked on this investigation with bated breath, eager to unearth any potential clues that could shed light on this enigmatic relationship. After all, who knew that a simple moniker like "Denver" could hold the key to deciphering the fluctuations in VRTX's stock price? It's almost as surprising as discovering that a slice of pie can actually be numerical instead of edible – a truly "irrational" revelation, if you will!

The findings of our study not only provide thought-provoking insights into the dynamics of nomenclature and market performance but also highlight the whimsical interconnectedness that often eludes the conventional realms of empirical investigation. As we navigate through the labyrinth of correlation and causation, we invite readers to join us in this odyssey of discovery, where the inexplicable and the empirical collide, much like a fusion of puns and serious academic discourse.

[[LITERATURE REVIEW]]

Previous research has attempted to uncover the perplexing relationship between nomenclature and financial performance. Smith et al. (2010) explored the potential impact of baby names on stock prices, revealing an unexpected connection between the rise of "Barnabas" and a surge in agricultural commodity stocks. Similarly, Doe and Jones (2015) investigated the correlation between the popularity of the name "Eugene" and the fluctuation of petroleum futures, shedding light on the curious interplay between personal nomenclature and economic dynamics.

Now, let's dive into the world of real and fictional literature that could shed some light on this tongue-in-cheek correlation. "Freakonomics" by Steven D. Levitt and Stephen J. Dubner provides insights into unexpected connections and hidden correlations, much like the surprising link between the name "Denver" and VRTX stock. For those in search of more whimsical musings on names and their impacts, "Names for the Sea: Strangers in Iceland" by Sarah Moss offers a captivating exploration of the significance of personal names in different contexts, reminding us that a name isn't just a name – it can carry intriguing implications.

On the fictional front, titles like "The Name of the Wind" by Patrick Rothfuss and "American Gods" by Neil Gaiman tantalize the imagination with the notion of names wielding inexplicable power and influence. Perhaps in the world of finance, the name "Denver" exerts a similarly enigmatic sway over VRTX stock, operating in the realms of coincidence and causality like a hidden subplot in a gripping novel.

Furthermore, let's not overlook the silver screen, where movie narratives occasionally encompass serendipitous correlations and mischievous twists of fate. Movies like "A Beautiful Mind" and "The Big Short" inadvertently provide a glimpse into the intricate tapestry of interconnected events, offering parallels to our quest in uncovering the mysterious link between the name "Denver" and VRTX stock. After all, who doesn't love a good "stock" on the screen, especially when it's not just about Wall Street but also about a town in Colorado?

And as we navigate the multifaceted landscape of literature and cinema that mirrors the intrigue of our own research, do remember to embrace the unexpected, the amusing, and the inexplicable – after all, life is far too serious to take seriously. That being said, let's shore up our pseudo-academic musings and press on with the journey ahead, much like a determined hiker scaling a mountain of name-related data, armed with nothing but curiosity and, of course, a good dad joke in our back pocket.

Why did the statistician name their dog "Five Miles"? Because they could then say they walk "Five Miles" every day! Now that we've got that out of our systems, let's delve back into the research at hand.

[[RESULTS]]

The analysis revealed a remarkably strong positive correlation between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX) over the period from 2002 to 2022. The correlation coefficient of 0.9795525 indicates a robust linear relationship between these seemingly unrelated variables. This finding prompts the question: is there a Denver effect on VRTX stock, or is it merely a curious coincidence? It's like discovering a correlation between caffeine consumption and productivity – a brew-tiful relationship, indeed!

The r-squared value of 0.9595231 further reinforces the strength of the relationship. This means that approximately 95.95% of the variability in VRTX stock price can be explained by the popularity of the name Denver. It's almost as if the name Denver has been quietly whispering stock tips to investors all along, much like a hidden message in a bottle – or rather, a ticker symbol.

Furthermore, the p-value of less than 0.01 provides strong evidence against the null hypothesis of no correlation. In other words, we can confidently reject the idea that the correlation between the name Denver and VRTX stock price is just a serendipitous fluke. It's as clear-cut as concluding that the correlation between baking skills and pun-making prowess is statistically significant; that is to say, they both rise to the occasion, much like a well-fermented dough.

The scatterplot in Figure 1 visually depicts the strong positive correlation between the popularity of the name Denver and VRTX stock price. It’s like a beautiful choreography of data points, waltzing along a diagonal line, as if the market and monikers were engaged in a dance as old as time, reminiscent of Shakespeare's famous words: "All the world's a stage, and all the stocks and names merely players."

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The results of our study provide compelling evidence supporting the previously speculative notion of a correlation between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). Our findings not only corroborate the existing literature on the influence of personal nomenclature on financial dynamics but also underscore the singularly fascinating nature of this improbable relationship. It's like stumbling upon a hidden treasure trove of puns in a serious academic discussion – unexpected, yet delightfully intriguing.

The correlation coefficient of 0.9795525 that we unearthed aligns with the unanticipated link between personal names and economic phenomena documented in earlier research. It's as if the statistical stars aligned to reveal the enigmatic connection between the name "Denver" and VRTX stock price, much like a celestial concert conducted by the whimsical hands of fate.

Furthermore, the r-squared value of 0.9595231 signifies that the popularity of the name Denver can elucidate approximately 95.95% of the variability in VRTX stock price. This not only substantiates our initial hunch but also serves as a testament to the remarkable influence that seemingly inconspicuous variables can wield on complex financial behaviors. It's almost as remarkable as finding out that a bell pepper is a fruit – a true revelation hidden in the midst of empirical data.

The p-value of less than 0.01 bolsters the validity of our findings, firmly rejecting the null hypothesis and reinforcing the notion that the correlation between the name Denver and VRTX stock price is not a random occurrence. This steadfast rejection is akin to confidently stating that a good pun never fails to elicit a groan – it's not just chance, but a veritable manifestation of linguistic wit.

The scatterplot presented in Figure 1 elegantly captures the visually stunning relationship between the popularity of the name Denver and VRTX stock price, likening it to a choreographed dance of data points. This visual representation not only conveys the robustness of the correlation but also adds a touch of artistic flair to the otherwise quantitative realm of statistical analysis. It's like seeing a masterpiece unfold in the world of data visualization, where numbers pirouette alongside stock prices, painting a canvas of correlation and charm.

As we wade deeper into the ocean of unexpected correlations, it is evident that the intertwining of personal nomenclature and financial performance is far from a mere statistical serendipity. Our results not only align with previous literature but also beckon forth a new wave of inquiry into the intriguing influence of names on market dynamics. It's like unearthing a treasure trove of empirical insights, sprinkled with the occasional whimsical pun – a rare triumph of levity in the often austere world of academic discourse.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Vertex Pharmaceuticals' stock price (VRTX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price"

[[ABSTRACT]]

The study delves into the intriguing link between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). With a dash of curiosity and a sprinkle of statistical rigor, we aim to uncover the underlying connection between these seemingly unrelated entities. Our research team harnessed data from the US Social Security Administration and LSEG Analytics (Refinitiv) to analyze trends from 2002 to 2022, unearthing a correlation coefficient of 0.9795525 and a p-value less than 0.01.

It's no secret that we embarked on this investigation with bated breath, eager to unearth any potential clues that could shed light on this enigmatic relationship. After all, who knew that a simple moniker like "Denver" could hold the key to deciphering the fluctuations in VRTX's stock price? It's almost as surprising as discovering that a slice of pie can actually be numerical instead of edible – a truly "irrational" revelation, if you will!

The findings of our study not only provide thought-provoking insights into the dynamics of nomenclature and market performance but also highlight the whimsical interconnectedness that often eludes the conventional realms of empirical investigation. As we navigate through the labyrinth of correlation and causation, we invite readers to join us in this odyssey of discovery, where the inexplicable and the empirical collide, much like a fusion of puns and serious academic discourse.

[[INTRDUCTION]]

The intersection of human nomenclature and financial indices has long been a bastion of mystery, fascination, and the odd dad joke or two – much like a riddle shrouded in the abstruse depths of a dad's pun repertoire. In this vein, our research aims to unravel the tantalizing correlation between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). This bewildering amalgamation of seemingly incongruous variables is fertile ground for exploration, akin to uncovering the elusive punchline of a scientific quip.

Now, you might be wondering, "What does the moniker 'Denver' have to do with the ebb and flow of a pharmaceutical company's stock?" Well, as we delve into this enigma, prepare yourself for a journey filled with unexpected twists and turns, not unlike a rollercoaster ride through a statistical amusement park – complete with p-values and correlation coefficients as our thrilling companions.

Much like a dad joke waiting for the opportune moment to make its grand entrance, the nature of this inquiry is both perplexing and promising. The empirical landscape stands ripe for exploration, akin to a treasure trove of scientific conundrums just waiting to be cracked, much like a tough nut - which, incidentally, is a wonderful source of dietary Omega-3 fatty acids, but I digress.

As we embark on this scholarly escapade, we are armed with a potent blend of data analytics and scholarly rigor, ready to tackle the conundrum that sits at the crossroads of nomenclature and financial dynamics. With a twinkle in our eyes and a dataset in hand, we venture forth to unravel the mystique of the "Denver-VRTX" connection, akin to a detective solving a mystifying case – only this time, the evidence is in the form of databases and regression analyses, rather than fingerprints and eyewitness accounts.

Stay tuned for the ensuing chapters of this academic odyssey, where the quirky and the empirical converge in an enthralling dance of correlation and causation, and where the revelations are as unexpected as a dad joke sneaking up on a Sunday barbecue.

[[RESULTS]]

The analysis revealed a remarkably strong positive correlation between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX) over the period from 2002 to 2022. The correlation coefficient of 0.9795525 indicates a robust linear relationship between these seemingly unrelated variables. This finding prompts the question: is there a Denver effect on VRTX stock, or is it merely a curious coincidence? It's like discovering a correlation between caffeine consumption and productivity – a brew-tiful relationship, indeed!

The r-squared value of 0.9595231 further reinforces the strength of the relationship. This means that approximately 95.95% of the variability in VRTX stock price can be explained by the popularity of the name Denver. It's almost as if the name Denver has been quietly whispering stock tips to investors all along, much like a hidden message in a bottle – or rather, a ticker symbol.

Furthermore, the p-value of less than 0.01 provides strong evidence against the null hypothesis of no correlation. In other words, we can confidently reject the idea that the correlation between the name Denver and VRTX stock price is just a serendipitous fluke. It's as clear-cut as concluding that the correlation between baking skills and pun-making prowess is statistically significant; that is to say, they both rise to the occasion, much like a well-fermented dough.

The scatterplot in Figure 1 visually depicts the strong positive correlation between the popularity of the name Denver and VRTX stock price. It’s like a beautiful choreography of data points, waltzing along a diagonal line, as if the market and monikers were engaged in a dance as old as time, reminiscent of Shakespeare's famous words: "All the world's a stage, and all the stocks and names merely players."

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study has unearthed a compelling association between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). The robust correlation coefficient and p-value less than 0.01 leave little doubt that there's more than meets the eye with this peculiar relationship. It's like finding out that the correlation is as strong as a dad's love for grill duty – undeniable and ever-present!

The findings highlight the quirky interconnectedness of seemingly unrelated variables, resembling a scientific symphony playing out in the market data. This correlation is more conspicuous than a scientist at a clown convention – hard to miss and delightfully puzzling at the same time!

Our results beckon further inquiry into the underlying mechanisms driving this unexpected association. However, it's unlikely that this correlation can be attributed to a mere coincidence, much like attributing a snappy pun to chance – it's all about the clever connection.

Therefore, we assert that no further research is needed in this area. It's as conclusive as realizing that there's no need for deodorant in space – because in the vacuum of space, no one can smell you anyway!

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Linguistic Stock Market Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Interdisciplinary Name Studies and Stock Market Trends

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price with an abstract of The study delves into the intriguing link between the popularity of the first name Denver and the stock price of Vertex Pharmaceuticals (VRTX). With a dash of curiosity and a sprinkle of statistical rigor, we aim to uncover the underlying connection between these seemingly unrelated entities. Our research team harnessed data from the US Social Security Administration and LSEG Analytics (Refinitiv) to analyze trends from 2002 to 2022, unearthing a correlation coefficient of 0.9795525 and a p-value less than 0.01.

It's no secret that we embarked on this investigation with bated breath, eager to unearth any potential clues that could shed light on this enigmatic relationship. After all, who knew that a simple moniker like "Denver" could hold the key to deciphering the fluctuations in VRTX's stock price? It's almost as surprising as discovering that a slice of pie can actually be numerical instead of edible – a truly "irrational" revelation, if you will!

The findings of our study not only provide thought-provoking insights into the dynamics of nomenclature and market performance but also highlight the whimsical interconnectedness that often eludes the conventional realms of empirical investigation. As we navigate through the labyrinth of correlation and causation, we invite readers to join us in this odyssey of discovery, where the inexplicable and the empirical collide, much like a fusion of puns and serious academic discourse.

ChatGPT:

Denver name popularity, VRTX stock price correlation, correlation analysis, Vertex Pharmaceuticals stock price, US Social Security Administration data, LSEG Analytics data, Denver first name, VRTX stock price trend analysis, nomenclature and market performance, correlation coefficient, p-value, stock price fluctuations, moniker "Denver", market performance analysis.

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Popularity of the first name DenverDetailed data title: Babies of all sexes born in the US named Denver

Source: US Social Security Administration

See what else correlates with Popularity of the first name Denver

Vertex Pharmaceuticals' stock price (VRTX)

Detailed data title: Opening price of Vertex Pharmaceuticals (VRTX) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Vertex Pharmaceuticals' stock price (VRTX)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9595231 (Coefficient of determination)

This means 96% of the change in the one variable (i.e., Vertex Pharmaceuticals' stock price (VRTX)) is predictable based on the change in the other (i.e., Popularity of the first name Denver) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.08E-14. 0.0000000000000107998920539187

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.98 in 1.08E-12% of random cases. Said differently, if you correlated 92,593,518,065,503 random variables You don't actually need 92 trillion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.95, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Popularity of the first name Denver (Babies born) | 179 | 189 | 164 | 179 | 186 | 191 | 217 | 179 | 172 | 200 | 206 | 244 | 312 | 439 | 450 | 491 | 619 | 723 | 837 | 944 | 963 |

| Vertex Pharmaceuticals' stock price (VRTX) (Stock price) | 24.86 | 16.03 | 10.35 | 10.7 | 27.88 | 37.78 | 23.25 | 30.27 | 42.85 | 35.2 | 33.82 | 42.87 | 74.07 | 119.97 | 123.03 | 74.43 | 150 | 161.21 | 220.24 | 237.91 | 218.38 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([179,189,164,179,186,191,217,179,172,200,206,244,312,439,450,491,619,723,837,944,963,])

array_2 = np.array([24.86,16.03,10.35,10.7,27.88,37.78,23.25,30.27,42.85,35.2,33.82,42.87,74.07,119.97,123.03,74.43,150,161.21,220.24,237.91,218.38,])

array_1_name = "Popularity of the first name Denver"

array_2_name = "Vertex Pharmaceuticals' stock price (VRTX)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Popularity of the first name Denver

- Line chart for only Vertex Pharmaceuticals' stock price (VRTX)

- AI-generated correlation image

- The spurious research paper: Vertexing the Popularity: A Correlation Analysis between the Name Denver and VRTX Stock Price

I'm grateful for your review!

Correlation ID: 2568 · Black Variable ID: 3893 · Red Variable ID: 1645