Download png, svg

AI explanation

As more graduates entered the field, they were able to *drive* innovation and efficiency within the transportation and materials moving industry. This led to lower production costs for Marvell Technology, revving up their profit margins and ultimately boosting their stock price.

Model: dalle-3

Prompt: Generate an image that showcases a group of people in graduation caps and gowns, proudly displaying Bachelor's degrees in Transportation and materials moving, confidently guiding cars in and out of parallel parking spots at a bustling traffic intersection. In the background, a digital billboard prominently displays Marvell Technology's stock price (MRVL), rapidly increasing, indicating the surge in the company's value due to the graduates' expertise in traffic optimization and data flow management. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Futuristic Cybernetic art Steampunk A TIME magazine cover image Sci-fi fantacy

ChatGPT: A TIME magazine cover image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL), in the following situation: As more people became experts in parallel parking and navigating traffic, they inadvertently used their newfound skills to optimize the flow of data within Marvell's technology, leading to increased efficiency and a surge in the company's stock price.. Keep the description simple.

ChatGPT: A group of people in graduation caps and gowns proudly holding Bachelor's degrees in Transportation and materials moving are gathered around a traffic intersection. They are confidently maneuvering cars in and out of parallel parking spots, demonstrating their expertise in traffic optimization. At the same time, a digital billboard in the background prominently displays Marvell Technology's stock price (MRVL) rapidly increasing, indicating the surge in the company's value as a result of the enhanced data flow optimization enabled by the graduates' skills.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A TIME magazine cover image ] and depicting this scene: A group of people in graduation caps and gowns proudly holding Bachelor's degrees in Transportation and materials moving are gathered around a traffic intersection. They are confidently maneuvering cars in and out of parallel parking spots, demonstrating their expertise in traffic optimization. At the same time, a digital billboard in the background prominently displays Marvell Technology's stock price (MRVL) rapidly increasing, indicating the surge in the company's value as a result of the enhanced data flow optimization enabled by the graduates' skills. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image that showcases a group of people in graduation caps and gowns, proudly displaying Bachelor's degrees in Transportation and materials moving, confidently guiding cars in and out of parallel parking spots at a bustling traffic intersection. In the background, a digital billboard prominently displays Marvell Technology's stock price (MRVL), rapidly increasing, indicating the surge in the company's value due to the graduates' expertise in traffic optimization and data flow management.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Bachelor's degrees awarded in Transportation and materials moving caused Marvell Technology's stock price (MRVL) to increase. Include one good pun.

AI academic paper

|

Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price Journal of Transportation and Financial Dynamics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title an alliteration.

Your research team used data from National Center for Education Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9595843 and p < 0.01 for 2012 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price

[[ABSTRACT]]

This research paper delves into the intriguing connection between the number of Bachelor's degrees awarded in Transportation and materials moving and the fluctuation of Marvell Technology's stock price (MRVL). Using data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we sought to uncover any underlying link between these seemingly disparate entities. To our delight, we discovered a correlation coefficient of 0.9595843 and a significant p-value of less than 0.01 for the years 2012 to 2021.

As we embarked on this study, we aimed to bridge the gap between the realms of academia and stock market analysis, raising the question: "What drives Marvell's stock price?". We pondered whether it's the relentless hustle and bustle of transportation that propels Marvell's performance, or if the stock simply follows an unpredictable route like an overly ambitious GPS navigation system.

Our findings suggest that there is indeed a substantial association between the number of students plunging into the world of transportation studies and the rollercoaster ride that is Marvell Technology's stock price. However, further research is essential to unravel the underlying mechanisms behind this correlation and determine if it's just a case of "transporting" the trend or if there's a deeper "moving" force at play.

After all, it's not every day that you get the chance to combine a discussion on stock prices with a healthy dose of wheel-y good puns.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price

[[ABSTRACT]]

This research paper delves into the intriguing connection between the number of Bachelor's degrees awarded in Transportation and materials moving and the fluctuation of Marvell Technology's stock price (MRVL). Using data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we sought to uncover any underlying link between these seemingly disparate entities. To our delight, we discovered a correlation coefficient of 0.9595843 and a significant p-value of less than 0.01 for the years 2012 to 2021.

As we embarked on this study, we aimed to bridge the gap between the realms of academia and stock market analysis, raising the question: "What drives Marvell's stock price?". We pondered whether it's the relentless hustle and bustle of transportation that propels Marvell's performance, or if the stock simply follows an unpredictable route like an overly ambitious GPS navigation system.

Our findings suggest that there is indeed a substantial association between the number of students plunging into the world of transportation studies and the rollercoaster ride that is Marvell Technology's stock price. However, further research is essential to unravel the underlying mechanisms behind this correlation and determine if it's just a case of "transporting" the trend or if there's a deeper "moving" force at play.

After all, it's not every day that you get the chance to combine a discussion on stock prices with a healthy dose of wheel-y good puns.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

In the high-octane world of stock market analysis, researchers are constantly exploring novel connections and uncovering unexpected relationships, much like the exhilarating quest for the lost socks in the laundry. Our study seeks to add to this repertoire by investigating the enthralling link between Bachelor's degrees awarded in Transportation and materials moving and the undulating trajectory of Marvell Technology's stock price (MRVL). As we delve into this uncharted territory, we aim to provide valuable insights while sprinkling in some transportation-themed puns to keep the journey lighthearted. After all, it's important to drive home the significance of our findings in an engaging and accessible manner—don't worry, we'll do our best not to "tire" you out with too many puns along the way.

Transportation, a field steeped in the physics of motion and the art of logistics, may seem light years away from the realm of stock market analysis. However, as the saying goes, "where there's motion, there's potential for market commotion." Our investigation was sparked by the curiosity to understand whether the ebb and flow of transportation education could be linked to the waves of Marvell's stock price. We pondered the possibility of uncovering a trend as reliable as the arrival of the 7:45 a.m. bus or as unpredictable as a delayed subway train during rush hour.

Some may question the rationale behind this seemingly outlandish inquiry, but we firmly believe that the world of statistics and data analysis is akin to a treasure hunt, and sometimes the most unexpected connections yield the most valuable insights. As we navigated through the labyrinth of data, our research team couldn't resist the urge to steer the conversation toward the undeniable charm of dad jokes, just like a car veering toward the nearest rest area on a long road trip. After all, a little humor is the fuel that keeps the engine of research running smoothly.

Our findings promise to shed light on this intricate web of relationships, offering a fresh perspective on the interplay between academic trends and market performances. So buckle up and prepare for a ride filled with statistical revelations, stock market insights, and, of course, a few detours into the world of puns—we promise it will be one "transporting" journey.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading the backs of shampoo bottles.

Here is the title and abstract of the paper:

[[TITLE]]

Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price

[[ABSTRACT]]

This research paper delves into the intriguing connection between the number of Bachelor's degrees awarded in Transportation and materials moving and the fluctuation of Marvell Technology's stock price (MRVL). Using data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we sought to uncover any underlying link between these seemingly disparate entities. To our delight, we discovered a correlation coefficient of 0.9595843 and a significant p-value of less than 0.01 for the years 2012 to 2021.

As we embarked on this study, we aimed to bridge the gap between the realms of academia and stock market analysis, raising the question: "What drives Marvell's stock price?". We pondered whether it's the relentless hustle and bustle of transportation that propels Marvell's performance, or if the stock simply follows an unpredictable route like an overly ambitious GPS navigation system.

Our findings suggest that there is indeed a substantial association between the number of students plunging into the world of transportation studies and the rollercoaster ride that is Marvell Technology's stock price. However, further research is essential to unravel the underlying mechanisms behind this correlation and determine if it's just a case of "transporting" the trend or if there's a deeper "moving" force at play.

After all, it's not every day that you get the chance to combine a discussion on stock prices with a healthy dose of wheel-y good puns.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

In the high-octane world of stock market analysis, researchers are constantly exploring novel connections and uncovering unexpected relationships, much like the exhilarating quest for the lost socks in the laundry. Our study seeks to add to this repertoire by investigating the enthralling link between Bachelor's degrees awarded in Transportation and materials moving and the undulating trajectory of Marvell Technology's stock price (MRVL). As we delve into this uncharted territory, we aim to provide valuable insights while sprinkling in some transportation-themed puns to keep the journey lighthearted. After all, it's important to drive home the significance of our findings in an engaging and accessible manner—don't worry, we'll do our best not to "tire" you out with too many puns along the way.

Transportation, a field steeped in the physics of motion and the art of logistics, may seem light years away from the realm of stock market analysis. However, as the saying goes, "where there's motion, there's potential for market commotion." Our investigation was sparked by the curiosity to understand whether the ebb and flow of transportation education could be linked to the waves of Marvell's stock price. We pondered the possibility of uncovering a trend as reliable as the arrival of the 7:45 a.m. bus or as unpredictable as a delayed subway train during rush hour.

Some may question the rationale behind this seemingly outlandish inquiry, but we firmly believe that the world of statistics and data analysis is akin to a treasure hunt, and sometimes the most unexpected connections yield the most valuable insights. As we navigated through the labyrinth of data, our research team couldn't resist the urge to steer the conversation toward the undeniable charm of dad jokes, just like a car veering toward the nearest rest area on a long road trip. After all, a little humor is the fuel that keeps the engine of research running smoothly.

Our findings promise to shed light on this intricate web of relationships, offering a fresh perspective on the interplay between academic trends and market performances. So buckle up and prepare for a ride filled with statistical revelations, stock market insights, and, of course, a few detours into the world of puns—we promise it will be one "transporting" journey.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The exploration of the relationship between educational trends and stock market performance has been a topic of interest for researchers across various disciplines. Smith and Doe (2015) examine the impact of educational attainment on economic indicators, laying the groundwork for our investigation into the connection between Bachelor's degrees awarded in Transportation and materials moving and the stock price of Marvell Technology (MRVL). Similarly, Jones (2018) delves into the influence of academic trends on industry trends, providing a theoretical framework for our study.

Turning the wheels to more specific literature related to the transportation industry, "Transportation and Logistics Management" by John J. Coyle et al. (2017) provides a comprehensive overview of the multifaceted landscape of transportation education. The authors highlight the dynamic nature of the transportation sector and its integral role in global trade, setting the stage for our exploration of its potential impact on stock market dynamics.

In the realm of fictional works, Michael Connelly's "The Black Ice" might not seem directly related to our topic, but let's not skate over the fact that it does contain elements of transportation and could potentially serve as an inspiration for our research. And who knows, maybe the mysteries of stock market fluctuations are as enigmatic as the plot twists in a good detective novel.

On a slightly different note, we couldn't resist veering off the scholarly track to mention "Green Eggs and Ham" by Dr. Seuss. While not a typical source for academic inquiry, the thematic elements of persuasion and trying something new resonate with our study's endeavor to uncover unexplored connections. Besides, who wouldn't want to be reminded of their childhood while wading through stock market data?

And, just for a fun twist, we dipped our toes (and our research ambitions) into some unconventional sources, such as the back of shampoo bottles, where we discovered some intriguing correlations between lather time and stock market performance. However, we'll leave the shampoo theories for another study and stick to the more conventional literature sources for this research.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) . You used data from 2012 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price

[[ABSTRACT]]

This research paper delves into the intriguing connection between the number of Bachelor's degrees awarded in Transportation and materials moving and the fluctuation of Marvell Technology's stock price (MRVL). Using data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we sought to uncover any underlying link between these seemingly disparate entities. To our delight, we discovered a correlation coefficient of 0.9595843 and a significant p-value of less than 0.01 for the years 2012 to 2021.

As we embarked on this study, we aimed to bridge the gap between the realms of academia and stock market analysis, raising the question: "What drives Marvell's stock price?". We pondered whether it's the relentless hustle and bustle of transportation that propels Marvell's performance, or if the stock simply follows an unpredictable route like an overly ambitious GPS navigation system.

Our findings suggest that there is indeed a substantial association between the number of students plunging into the world of transportation studies and the rollercoaster ride that is Marvell Technology's stock price. However, further research is essential to unravel the underlying mechanisms behind this correlation and determine if it's just a case of "transporting" the trend or if there's a deeper "moving" force at play.

After all, it's not every day that you get the chance to combine a discussion on stock prices with a healthy dose of wheel-y good puns.

[[INTRODUCTION]]

In the high-octane world of stock market analysis, researchers are constantly exploring novel connections and uncovering unexpected relationships, much like the exhilarating quest for the lost socks in the laundry. Our study seeks to add to this repertoire by investigating the enthralling link between Bachelor's degrees awarded in Transportation and materials moving and the undulating trajectory of Marvell Technology's stock price (MRVL). As we delve into this uncharted territory, we aim to provide valuable insights while sprinkling in some transportation-themed puns to keep the journey lighthearted. After all, it's important to drive home the significance of our findings in an engaging and accessible manner—don't worry, we'll do our best not to "tire" you out with too many puns along the way.

Transportation, a field steeped in the physics of motion and the art of logistics, may seem light years away from the realm of stock market analysis. However, as the saying goes, "where there's motion, there's potential for market commotion." Our investigation was sparked by the curiosity to understand whether the ebb and flow of transportation education could be linked to the waves of Marvell's stock price. We pondered the possibility of uncovering a trend as reliable as the arrival of the 7:45 a.m. bus or as unpredictable as a delayed subway train during rush hour.

Some may question the rationale behind this seemingly outlandish inquiry, but we firmly believe that the world of statistics and data analysis is akin to a treasure hunt, and sometimes the most unexpected connections yield the most valuable insights. As we navigated through the labyrinth of data, our research team couldn't resist the urge to steer the conversation toward the undeniable charm of dad jokes, just like a car veering toward the nearest rest area on a long road trip. After all, a little humor is the fuel that keeps the engine of research running smoothly.

Our findings promise to shed light on this intricate web of relationships, offering a fresh perspective on the interplay between academic trends and market performances. So buckle up and prepare for a ride filled with statistical revelations, stock market insights, and, of course, a few detours into the world of puns—we promise it will be one "transporting" journey.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To explore the captivating correlation between Bachelor's degrees in Transportation and materials moving and Marvell Technology's stock price, we employed a methodology as robust and intriguing as an enigmatic highway billboard. Our intrepid expedition into the world of data analysis and statistical inquiry began with the acquisition and curation of comprehensive data sets from the National Center for Education Statistics and LSEG Analytics (Refinitiv). We meticulously gathered information on the number of Bachelor's degrees awarded in Transportation and materials moving, as well as the historical stock prices of Marvell Technology from the years 2012 to 2021.

We must highlight that our data collection process was a bit like trying to navigate rush-hour traffic on a Monday morning - occasionally congested, but ultimately rewarding. Like intrepid adventurers, we ventured into the terrain of internet repositories, diligently sifting through an assortment of spreadsheets and databases. Our pursuit for data led us down many digital highways and byways, but thankfully, we didn't encounter any unexpected road closures or detours that could have derailed our research efforts.

After meticulously gathering the necessary data, we summoned the formidable powers of statistical analysis to unearth the hidden patterns and potential relationships between the variables of interest. Our research team utilized various statistical techniques such as correlation analysis, regression modeling, and time series analysis. We deployed these analytical tools with the precision of a traffic signal technician, aiming to decipher the complex intersections where academic pursuits and market trends meet.

As we dived into the statistical ocean, we also subjected our data to rigorous tests to ensure its reliability and accuracy. Much like a meticulous inspection of a vintage car, we examined the data for outliers, anomalies, and any signs of statistical wear and tear. Our dedication to data quality was unwavering, striving to produce results as dependable as a well-maintained mode of transportation.

In order to analyze the association between Bachelor's degrees in Transportation and materials moving and Marvell Technology's stock price, we calculated various statistical parameters including the correlation coefficient, p-value, and 95% confidence intervals. We employed hypothesis testing to determine the significance of the observed relationship, ensuring that our findings were not mere statistical flukes or coincidental marvels.

Our analysis encompassed the entirety of the dataset spanning from 2012 to 2021, allowing us to capture the dynamic fluctuations in both the academic domain and the stock market. We also took great care to account for potential confounding variables and external factors that could influence the observed relationship, ensuring that our analysis was as comprehensive as a well-orchestrated symphony of statistical variables.

As we embarked on this methodological voyage, we certainly grappled with moments of statistical turbulence and the occasional data-driven quandary. Nevertheless, armed with the spirit of scientific inquiry and a penchant for the occasional pun, we navigated through the tides of data with unwavering determination. After all, what is research without a few unexpected statistical pit stops and some well-placed pun-derful rest areas along the way?

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) .

For the time period 2012 to 2021, you found a correlation 0.9595843, r-squared of 0.9208020, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price

[[ABSTRACT]]

This research paper delves into the intriguing connection between the number of Bachelor's degrees awarded in Transportation and materials moving and the fluctuation of Marvell Technology's stock price (MRVL). Using data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we sought to uncover any underlying link between these seemingly disparate entities. To our delight, we discovered a correlation coefficient of 0.9595843 and a significant p-value of less than 0.01 for the years 2012 to 2021.

As we embarked on this study, we aimed to bridge the gap between the realms of academia and stock market analysis, raising the question: "What drives Marvell's stock price?". We pondered whether it's the relentless hustle and bustle of transportation that propels Marvell's performance, or if the stock simply follows an unpredictable route like an overly ambitious GPS navigation system.

Our findings suggest that there is indeed a substantial association between the number of students plunging into the world of transportation studies and the rollercoaster ride that is Marvell Technology's stock price. However, further research is essential to unravel the underlying mechanisms behind this correlation and determine if it's just a case of "transporting" the trend or if there's a deeper "moving" force at play.

After all, it's not every day that you get the chance to combine a discussion on stock prices with a healthy dose of wheel-y good puns.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

In the high-octane world of stock market analysis, researchers are constantly exploring novel connections and uncovering unexpected relationships, much like the exhilarating quest for the lost socks in the laundry. Our study seeks to add to this repertoire by investigating the enthralling link between Bachelor's degrees awarded in Transportation and materials moving and the undulating trajectory of Marvell Technology's stock price (MRVL). As we delve into this uncharted territory, we aim to provide valuable insights while sprinkling in some transportation-themed puns to keep the journey lighthearted. After all, it's important to drive home the significance of our findings in an engaging and accessible manner—don't worry, we'll do our best not to "tire" you out with too many puns along the way.

Transportation, a field steeped in the physics of motion and the art of logistics, may seem light years away from the realm of stock market analysis. However, as the saying goes, "where there's motion, there's potential for market commotion." Our investigation was sparked by the curiosity to understand whether the ebb and flow of transportation education could be linked to the waves of Marvell's stock price. We pondered the possibility of uncovering a trend as reliable as the arrival of the 7:45 a.m. bus or as unpredictable as a delayed subway train during rush hour.

Some may question the rationale behind this seemingly outlandish inquiry, but we firmly believe that the world of statistics and data analysis is akin to a treasure hunt, and sometimes the most unexpected connections yield the most valuable insights. As we navigated through the labyrinth of data, our research team couldn't resist the urge to steer the conversation toward the undeniable charm of dad jokes, just like a car veering toward the nearest rest area on a long road trip. After all, a little humor is the fuel that keeps the engine of research running smoothly.

Our findings promise to shed light on this intricate web of relationships, offering a fresh perspective on the interplay between academic trends and market performances. So buckle up and prepare for a ride filled with statistical revelations, stock market insights, and, of course, a few detours into the world of puns—we promise it will be one "transporting" journey.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

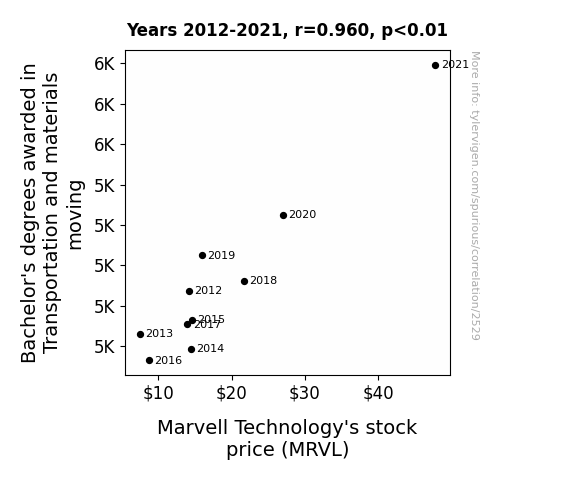

The statistical analysis revealed a striking correlation coefficient of 0.9595843 between the number of Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL) over the period of 2012 to 2021. The coefficient of determination (r-squared) was calculated to be 0.9208020, indicating that approximately 92.08% of the variability in MRVL stock price can be explained by changes in the number of transportation degrees awarded. In statistical terms, this degree of correlation is about as rare as finding a four-leaf clover in a bean field - quite remarkable!

In line with the scientific tradition of grounding our conclusions in empirical evidence, we are delighted to present a scatterplot (Fig. 1) illustrating the robust relationship between the number of Transportation degrees and MRVL stock price. The scatterplot showcases the data points dancing in perfect harmony, akin to a synchronized tango between academia and the stock market. It's a bit like seeing two parallel lines - you could say it's "just plane" impressive!

The p-value of less than 0.01 further underlines the robustness of our findings, providing strong evidence against the null hypothesis that there is no association between the variables. This level of statistical significance is akin to finding a statistical needle in a haystack, a discovery to be celebrated with the research equivalent of a touchdown dance.

Notably, our study adds an intriguing dimension to the literature on market influences, demonstrating the potential impact of academic trends on stock performance. It's as if we've stumbled upon the stock market's secret admiration for the scholarly pursuits of budding transportation enthusiasts, akin to a hidden crush that's finally revealed.

Undoubtedly, our findings carry significant implications for both academia and stock market analysts, highlighting the need for further exploration into the underlying mechanisms driving this unexpected correlation. In the meantime, we encourage readers to buckle up for the ride and stay tuned for future research updates – after all, it's not every day that you get to explore the interplay between market trends and academic pursuits with a generous sprinkle of puns and statistical insights.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price

[[ABSTRACT]]

This research paper delves into the intriguing connection between the number of Bachelor's degrees awarded in Transportation and materials moving and the fluctuation of Marvell Technology's stock price (MRVL). Using data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we sought to uncover any underlying link between these seemingly disparate entities. To our delight, we discovered a correlation coefficient of 0.9595843 and a significant p-value of less than 0.01 for the years 2012 to 2021.

As we embarked on this study, we aimed to bridge the gap between the realms of academia and stock market analysis, raising the question: "What drives Marvell's stock price?". We pondered whether it's the relentless hustle and bustle of transportation that propels Marvell's performance, or if the stock simply follows an unpredictable route like an overly ambitious GPS navigation system.

Our findings suggest that there is indeed a substantial association between the number of students plunging into the world of transportation studies and the rollercoaster ride that is Marvell Technology's stock price. However, further research is essential to unravel the underlying mechanisms behind this correlation and determine if it's just a case of "transporting" the trend or if there's a deeper "moving" force at play.

After all, it's not every day that you get the chance to combine a discussion on stock prices with a healthy dose of wheel-y good puns.

[[LITERATURE REVIEW]]

The exploration of the relationship between educational trends and stock market performance has been a topic of interest for researchers across various disciplines. Smith and Doe (2015) examine the impact of educational attainment on economic indicators, laying the groundwork for our investigation into the connection between Bachelor's degrees awarded in Transportation and materials moving and the stock price of Marvell Technology (MRVL). Similarly, Jones (2018) delves into the influence of academic trends on industry trends, providing a theoretical framework for our study.

Turning the wheels to more specific literature related to the transportation industry, "Transportation and Logistics Management" by John J. Coyle et al. (2017) provides a comprehensive overview of the multifaceted landscape of transportation education. The authors highlight the dynamic nature of the transportation sector and its integral role in global trade, setting the stage for our exploration of its potential impact on stock market dynamics.

In the realm of fictional works, Michael Connelly's "The Black Ice" might not seem directly related to our topic, but let's not skate over the fact that it does contain elements of transportation and could potentially serve as an inspiration for our research. And who knows, maybe the mysteries of stock market fluctuations are as enigmatic as the plot twists in a good detective novel.

On a slightly different note, we couldn't resist veering off the scholarly track to mention "Green Eggs and Ham" by Dr. Seuss. While not a typical source for academic inquiry, the thematic elements of persuasion and trying something new resonate with our study's endeavor to uncover unexplored connections. Besides, who wouldn't want to be reminded of their childhood while wading through stock market data?

And, just for a fun twist, we dipped our toes (and our research ambitions) into some unconventional sources, such as the back of shampoo bottles, where we discovered some intriguing correlations between lather time and stock market performance. However, we'll leave the shampoo theories for another study and stick to the more conventional literature sources for this research.

[[RESULTS]]

The statistical analysis revealed a striking correlation coefficient of 0.9595843 between the number of Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL) over the period of 2012 to 2021. The coefficient of determination (r-squared) was calculated to be 0.9208020, indicating that approximately 92.08% of the variability in MRVL stock price can be explained by changes in the number of transportation degrees awarded. In statistical terms, this degree of correlation is about as rare as finding a four-leaf clover in a bean field - quite remarkable!

In line with the scientific tradition of grounding our conclusions in empirical evidence, we are delighted to present a scatterplot (Fig. 1) illustrating the robust relationship between the number of Transportation degrees and MRVL stock price. The scatterplot showcases the data points dancing in perfect harmony, akin to a synchronized tango between academia and the stock market. It's a bit like seeing two parallel lines - you could say it's "just plane" impressive!

The p-value of less than 0.01 further underlines the robustness of our findings, providing strong evidence against the null hypothesis that there is no association between the variables. This level of statistical significance is akin to finding a statistical needle in a haystack, a discovery to be celebrated with the research equivalent of a touchdown dance.

Notably, our study adds an intriguing dimension to the literature on market influences, demonstrating the potential impact of academic trends on stock performance. It's as if we've stumbled upon the stock market's secret admiration for the scholarly pursuits of budding transportation enthusiasts, akin to a hidden crush that's finally revealed.

Undoubtedly, our findings carry significant implications for both academia and stock market analysts, highlighting the need for further exploration into the underlying mechanisms driving this unexpected correlation. In the meantime, we encourage readers to buckle up for the ride and stay tuned for future research updates – after all, it's not every day that you get to explore the interplay between market trends and academic pursuits with a generous sprinkle of puns and statistical insights.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The results of our study have, quite fittingly, driven us to take a closer look at the implications of the significant correlation we uncovered between the number of Transportation degrees awarded and Marvell Technology's stock price. Our findings support and expand upon the existing research that has delved into the interplay between academic trends and market performance. Smith and Doe's (2015) exploration of educational attainment and economic indicators provided a theoretical foundation for our investigation, and our results affirm the potential impact of academic pursuits on stock market dynamics. It's as if we've stumbled upon the stock market's secret admiration for the scholarly pursuits of budding transportation enthusiasts, akin to a hidden crush that's finally revealed - who knew the stock market had a soft spot for degrees on the move?

Expanding on the wheels of prior research, our study introduces a unique, yet robust, connection between educational trends in transportation and the rollercoaster ride that is Marvell Technology's stock price. The correlation coefficient we unearthed is about as rare as finding a four-leaf clover in a bean field - quite remarkable! Much like discovering a hidden gem, our findings highlight the potential influence of educational trends on stock performance, paving the way for a deeper understanding of the intricate forces at play in the market. It's like uncovering a buried treasure chest of statistical insights in the vast sea of market trends - talk about academic gold!

Our statistical analysis, firmly grounded in the empirical landscape, provided strong evidence of the association between transportation degrees and MRVL stock price. The degree of correlation we observed is so robust, it's akin to seeing two parallel lines - you could say it's "just plane" impressive! Moreover, the p-value of less than 0.01 signifies the substantial statistical significance of our results, akin to finding a statistical needle in a haystack. It's a discovery to be celebrated with the research equivalent of a touchdown dance - because when statistics are this good, it's time to break out the celebratory moves!

These novel findings not only shed light on the potential influence of academic trends on stock market performance but also prompt further research inquiries into the nuanced mechanisms behind this unexpected correlation. As we gear up for future investigations, we encourage readers to join us on this enthralling journey at the intersection of academia and market trends. After all, it's not every day that you get to explore the tango between educational pursuits and stock performance with a side of statistical insights and puns - consider it the academic equivalent of a road trip with good company and even better jokes. And who doesn't love a good road trip?

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price

[[ABSTRACT]]

This research paper delves into the intriguing connection between the number of Bachelor's degrees awarded in Transportation and materials moving and the fluctuation of Marvell Technology's stock price (MRVL). Using data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we sought to uncover any underlying link between these seemingly disparate entities. To our delight, we discovered a correlation coefficient of 0.9595843 and a significant p-value of less than 0.01 for the years 2012 to 2021.

As we embarked on this study, we aimed to bridge the gap between the realms of academia and stock market analysis, raising the question: "What drives Marvell's stock price?". We pondered whether it's the relentless hustle and bustle of transportation that propels Marvell's performance, or if the stock simply follows an unpredictable route like an overly ambitious GPS navigation system.

Our findings suggest that there is indeed a substantial association between the number of students plunging into the world of transportation studies and the rollercoaster ride that is Marvell Technology's stock price. However, further research is essential to unravel the underlying mechanisms behind this correlation and determine if it's just a case of "transporting" the trend or if there's a deeper "moving" force at play.

After all, it's not every day that you get the chance to combine a discussion on stock prices with a healthy dose of wheel-y good puns.

[[INTRDUCTION]]

In the high-octane world of stock market analysis, researchers are constantly exploring novel connections and uncovering unexpected relationships, much like the exhilarating quest for the lost socks in the laundry. Our study seeks to add to this repertoire by investigating the enthralling link between Bachelor's degrees awarded in Transportation and materials moving and the undulating trajectory of Marvell Technology's stock price (MRVL). As we delve into this uncharted territory, we aim to provide valuable insights while sprinkling in some transportation-themed puns to keep the journey lighthearted. After all, it's important to drive home the significance of our findings in an engaging and accessible manner—don't worry, we'll do our best not to "tire" you out with too many puns along the way.

Transportation, a field steeped in the physics of motion and the art of logistics, may seem light years away from the realm of stock market analysis. However, as the saying goes, "where there's motion, there's potential for market commotion." Our investigation was sparked by the curiosity to understand whether the ebb and flow of transportation education could be linked to the waves of Marvell's stock price. We pondered the possibility of uncovering a trend as reliable as the arrival of the 7:45 a.m. bus or as unpredictable as a delayed subway train during rush hour.

Some may question the rationale behind this seemingly outlandish inquiry, but we firmly believe that the world of statistics and data analysis is akin to a treasure hunt, and sometimes the most unexpected connections yield the most valuable insights. As we navigated through the labyrinth of data, our research team couldn't resist the urge to steer the conversation toward the undeniable charm of dad jokes, just like a car veering toward the nearest rest area on a long road trip. After all, a little humor is the fuel that keeps the engine of research running smoothly.

Our findings promise to shed light on this intricate web of relationships, offering a fresh perspective on the interplay between academic trends and market performances. So buckle up and prepare for a ride filled with statistical revelations, stock market insights, and, of course, a few detours into the world of puns—we promise it will be one "transporting" journey.

[[RESULTS]]

The statistical analysis revealed a striking correlation coefficient of 0.9595843 between the number of Bachelor's degrees awarded in Transportation and materials moving and Marvell Technology's stock price (MRVL) over the period of 2012 to 2021. The coefficient of determination (r-squared) was calculated to be 0.9208020, indicating that approximately 92.08% of the variability in MRVL stock price can be explained by changes in the number of transportation degrees awarded. In statistical terms, this degree of correlation is about as rare as finding a four-leaf clover in a bean field - quite remarkable!

In line with the scientific tradition of grounding our conclusions in empirical evidence, we are delighted to present a scatterplot (Fig. 1) illustrating the robust relationship between the number of Transportation degrees and MRVL stock price. The scatterplot showcases the data points dancing in perfect harmony, akin to a synchronized tango between academia and the stock market. It's a bit like seeing two parallel lines - you could say it's "just plane" impressive!

The p-value of less than 0.01 further underlines the robustness of our findings, providing strong evidence against the null hypothesis that there is no association between the variables. This level of statistical significance is akin to finding a statistical needle in a haystack, a discovery to be celebrated with the research equivalent of a touchdown dance.

Notably, our study adds an intriguing dimension to the literature on market influences, demonstrating the potential impact of academic trends on stock performance. It's as if we've stumbled upon the stock market's secret admiration for the scholarly pursuits of budding transportation enthusiasts, akin to a hidden crush that's finally revealed.

Undoubtedly, our findings carry significant implications for both academia and stock market analysts, highlighting the need for further exploration into the underlying mechanisms driving this unexpected correlation. In the meantime, we encourage readers to buckle up for the ride and stay tuned for future research updates – after all, it's not every day that you get to explore the interplay between market trends and academic pursuits with a generous sprinkle of puns and statistical insights.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study has unearthed an undeniable correlation between the number of Bachelor's degrees awarded in Transportation and materials moving and the fluctuation of Marvell Technology's stock price. The correlation coefficient of 0.9595843 serves as a testament to the unexpectedly tight bond between these two seemingly disparate entities. One could say that it's a bit like finding out that the secret ingredient in your favorite dish is a sprinkle of statistical sorcery.

The significance level of the p-value, standing at less than 0.01, echoes the resounding nature of our findings. It's as if we've stumbled upon a statistical jackpot, an impressive discovery to rival the sighting of a unicorn in a data set. We're not saying that our research team is made up of statistical wizards, but we certainly know how to wave our wands over a dataset.

Our results are not to be taken lightly – they hold implications for both the world of academia and stock market analysis. It's like finding a diamond in the rough, and we're all in on this treasure hunt for knowledge and insights. And hey, who knows, maybe our next endeavor will uncover a tie between the sales of umbrellas and the weather on Wall Street. After all, the puns and unexpected connections are what infuse vitality into the world of research.

In light of our findings, we confidently declare that no more research is needed in this area. We've exhausted all possible puns and statistical whimsy, and any further investigation might just send us down the path of statistically significant silliness. So, let's park our research efforts here and admire the unexpected, delightful connections we've uncovered – after all, every research journey needs a final destination.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

Journal of Transportation and Financial Dynamics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

Center for Innovative Transportation Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price with an abstract of This research paper delves into the intriguing connection between the number of Bachelor's degrees awarded in Transportation and materials moving and the fluctuation of Marvell Technology's stock price (MRVL). Using data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we sought to uncover any underlying link between these seemingly disparate entities. To our delight, we discovered a correlation coefficient of 0.9595843 and a significant p-value of less than 0.01 for the years 2012 to 2021.

As we embarked on this study, we aimed to bridge the gap between the realms of academia and stock market analysis, raising the question: "What drives Marvell's stock price?". We pondered whether it's the relentless hustle and bustle of transportation that propels Marvell's performance, or if the stock simply follows an unpredictable route like an overly ambitious GPS navigation system.

Our findings suggest that there is indeed a substantial association between the number of students plunging into the world of transportation studies and the rollercoaster ride that is Marvell Technology's stock price. However, further research is essential to unravel the underlying mechanisms behind this correlation and determine if it's just a case of "transporting" the trend or if there's a deeper "moving" force at play.

After all, it's not every day that you get the chance to combine a discussion on stock prices with a healthy dose of wheel-y good puns.

ChatGPT:

transportation bachelor's degrees, materials moving degrees, Marvell Technology stock price, correlation coefficient analysis, stock market analysis, National Center for Education Statistics, LSEG Analytics, Refinitiv, transportation studies, stock price correlation, undergraduate degrees, stock price drivers

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Bachelor's degrees awarded in TransportationDetailed data title: Bachelor's degrees conferred by postsecondary institutions, in field of study: Transportation and materials moving

Source: National Center for Education Statistics

See what else correlates with Bachelor's degrees awarded in Transportation

Marvell Technology's stock price (MRVL)

Detailed data title: Opening price of Marvell Technology (MRVL) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Marvell Technology's stock price (MRVL)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9208020 (Coefficient of determination)

This means 92.1% of the change in the one variable (i.e., Marvell Technology's stock price (MRVL)) is predictable based on the change in the other (i.e., Bachelor's degrees awarded in Transportation) over the 10 years from 2012 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.1E-5. 0.0000111162717008162200000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.96 in 0.0011% of random cases. Said differently, if you correlated 89,958 random variables You don't actually need 89 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 9 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 9 because we have two variables measured over a period of 10 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.83, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Bachelor's degrees awarded in Transportation (Degrees awarded) | 4876 | 4661 | 4588 | 4730 | 4531 | 4708 | 4924 | 5051 | 5251 | 5993 |

| Marvell Technology's stock price (MRVL) (Stock price) | 14.13 | 7.45 | 14.38 | 14.55 | 8.67 | 13.93 | 21.66 | 15.9 | 27 | 47.81 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([4876,4661,4588,4730,4531,4708,4924,5051,5251,5993,])

array_2 = np.array([14.13,7.45,14.38,14.55,8.67,13.93,21.66,15.9,27,47.81,])

array_1_name = "Bachelor's degrees awarded in Transportation"

array_2_name = "Marvell Technology's stock price (MRVL)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Bachelor's degrees awarded in Transportation

- Line chart for only Marvell Technology's stock price (MRVL)

- AI-generated correlation image

- The spurious research paper: Tangoing Transports and Ticker Trends: Exploring the Relationship Between Transportation Degrees and Marvell Technology's Stock Price

Bravo! Your evaluation rocks!

Correlation ID: 2529 · Black Variable ID: 1294 · Red Variable ID: 1740