Download png, svg

AI explanation

As households spent more on fruits and vegetables, they started to feel the financial squeeze. To save on energy costs, they turned to Emerson Electric Co. for more efficient appliances. This surge in demand powered up the company's stock price, proving that a healthy investment in produce can truly be the seed for EMR's success. It's just another case of the stock market riding the gravy... or should I say, the green smoothie train! Remember, folks, when life gives you melons, consider investing in EMR!

Model: dalle-3

Prompt: [ A photo-realistic image ] Create a bustling grocery store scene where families are happily filling their carts with an abundance of colorful fruits and vegetables. Some of them are seen carrying jars of pickles and struggling to open them. Nearby, a television displays the stock ticker for Emerson Electric Co. (EMR), showing a steady rise in its stock price. The correlation between increased spending on fruits and vegetables leading to stronger individuals relying on Emerson products to effortlessly open jars, ultimately impressing investors with the company's performance, should be visually depicted. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price (EMR). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Cyberpunk a meme Minimalism Symbolism A photo-realistic image

ChatGPT: A photo-realistic image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price (EMR), in the following situation: Because as people bought more fruits and vegetables, they got stronger and started using Emerson products to open stubborn pickle jars, impressing investors.. Keep the description simple.

ChatGPT: In a bustling grocery store, a group of families is seen filling their carts with an abundance of colorful fruits and vegetables. They are also seen carrying jars of pickles and struggling to open them. Meanwhile, the stock ticker for Emerson Electric Co. (EMR) is displayed on a nearby television, showing a steady rise in its stock price. This illustrates the correlation between increased spending on fruits and vegetables leading to stronger individuals who rely on Emerson products to effortlessly open jars, ultimately impressing investors with the company's performance.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A photo-realistic image ] and depicting this scene: In a bustling grocery store, a group of families is seen filling their carts with an abundance of colorful fruits and vegetables. They are also seen carrying jars of pickles and struggling to open them. Meanwhile, the stock ticker for Emerson Electric Co. (EMR) is displayed on a nearby television, showing a steady rise in its stock price. This illustrates the correlation between increased spending on fruits and vegetables leading to stronger individuals who rely on Emerson products to effortlessly open jars, ultimately impressing investors with the company's performance. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [ A photo-realistic image ] Create a bustling grocery store scene where families are happily filling their carts with an abundance of colorful fruits and vegetables. Some of them are seen carrying jars of pickles and struggling to open them. Nearby, a television displays the stock ticker for Emerson Electric Co. (EMR), showing a steady rise in its stock price. The correlation between increased spending on fruits and vegetables leading to stronger individuals relying on Emerson products to effortlessly open jars, ultimately impressing investors with the company's performance, should be visually depicted.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Annual US household spending on fruits and vegetables caused Emerson Electric Co.'s stock price (EMR) to increase. Include one good pun.

AI academic paper

|

An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price Journal of Eccentric Economic Studies Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price (EMR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title a clever pun.

Your research team used data from Bureau of Labor Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9271994 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price"

[[ABSTRACT]]

In this paper, we delve into the curious connection between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR) with a side of puns and a juicy dose of data analysis. Much like a well-balanced fruit salad, we aimed to uncover the ripest insights into this fruitful relationship.

Using data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), we meticulously assessed the correlation between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Our findings revealed a correlation coefficient of 0.9271994 and p < 0.01, suggesting that there is indeed a strong link between the two variables. It appears that as households spend more on nature's candy, EMR's stock price experiences a healthy boost—talk about a fruitful investment!

This research sheds light on the often overlooked influence of dietary choices on stock market performance, proving that when it comes to financial analysis, it's not just about crunching numbers, but also about crunching on some celery. So next time you're thinking about diversifying your portfolio, consider adding a bit of flavor with your fruits and veggies—it may just be the apple of your stock market eye.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price (EMR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price"

[[ABSTRACT]]

In this paper, we delve into the curious connection between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR) with a side of puns and a juicy dose of data analysis. Much like a well-balanced fruit salad, we aimed to uncover the ripest insights into this fruitful relationship.

Using data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), we meticulously assessed the correlation between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Our findings revealed a correlation coefficient of 0.9271994 and p < 0.01, suggesting that there is indeed a strong link between the two variables. It appears that as households spend more on nature's candy, EMR's stock price experiences a healthy boost—talk about a fruitful investment!

This research sheds light on the often overlooked influence of dietary choices on stock market performance, proving that when it comes to financial analysis, it's not just about crunching numbers, but also about crunching on some celery. So next time you're thinking about diversifying your portfolio, consider adding a bit of flavor with your fruits and veggies—it may just be the apple of your stock market eye.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

In a world where financial analysts typically focus on factors like economic indicators, corporate earnings, and market trends, the potential impact of dietary habits on stock prices often gets pushed to the back burner. However, like a hidden gem in a basket of produce, there may be a delicious correlation waiting to be uncovered between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR).

Dad Joke #1: Why did the tomato turn red? Because it saw the salad dressing!

This study aims to peel back the layers of this fruitful intersection, examining whether there is indeed a connection between the wholesome choices made at the grocery store and the financial performance of Emerson Electric Co. As we embark on this intellectual journey, we strive to provide a fruitfully engaging exploration that not only crunches the numbers but also takes a bite out of financial analysis in a whole new way.

Our investigation leverages data sourced from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) to conduct a thorough analysis of the relationship between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Through meticulous statistical analysis, we seek to offer insights as crisp and refreshing as a freshly picked apple.

Dad Joke #2: What did the grape say when it got stepped on? Nothing, it just let out a little wine!

By scrutinizing the correlation coefficient and p-value, we endeavor to provide empirical evidence for the notion that financial markets may indeed be influenced by the shopping habits of consumers in the produce aisle. Should our findings bear fruit, it may well change the way investors perceive the phrase "an apple a day keeps the doctor away."

So, grab your calculators and your fruit baskets, because we're about to embark on a journey that promises to add a sprinkle of zest and a dash of market intelligence to the world of investment analysis. After all, as this study aims to demonstrate, the stock market may not be the only place where the phrase "buy low, sell high" applies—sometimes, it's as simple as buying low on fruits and vegetables and selling high on EMR stock!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price (EMR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading CVS receipts.

Here is the title and abstract of the paper:

[[TITLE]]

"An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price"

[[ABSTRACT]]

In this paper, we delve into the curious connection between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR) with a side of puns and a juicy dose of data analysis. Much like a well-balanced fruit salad, we aimed to uncover the ripest insights into this fruitful relationship.

Using data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), we meticulously assessed the correlation between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Our findings revealed a correlation coefficient of 0.9271994 and p < 0.01, suggesting that there is indeed a strong link between the two variables. It appears that as households spend more on nature's candy, EMR's stock price experiences a healthy boost—talk about a fruitful investment!

This research sheds light on the often overlooked influence of dietary choices on stock market performance, proving that when it comes to financial analysis, it's not just about crunching numbers, but also about crunching on some celery. So next time you're thinking about diversifying your portfolio, consider adding a bit of flavor with your fruits and veggies—it may just be the apple of your stock market eye.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

In a world where financial analysts typically focus on factors like economic indicators, corporate earnings, and market trends, the potential impact of dietary habits on stock prices often gets pushed to the back burner. However, like a hidden gem in a basket of produce, there may be a delicious correlation waiting to be uncovered between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR).

Dad Joke #1: Why did the tomato turn red? Because it saw the salad dressing!

This study aims to peel back the layers of this fruitful intersection, examining whether there is indeed a connection between the wholesome choices made at the grocery store and the financial performance of Emerson Electric Co. As we embark on this intellectual journey, we strive to provide a fruitfully engaging exploration that not only crunches the numbers but also takes a bite out of financial analysis in a whole new way.

Our investigation leverages data sourced from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) to conduct a thorough analysis of the relationship between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Through meticulous statistical analysis, we seek to offer insights as crisp and refreshing as a freshly picked apple.

Dad Joke #2: What did the grape say when it got stepped on? Nothing, it just let out a little wine!

By scrutinizing the correlation coefficient and p-value, we endeavor to provide empirical evidence for the notion that financial markets may indeed be influenced by the shopping habits of consumers in the produce aisle. Should our findings bear fruit, it may well change the way investors perceive the phrase "an apple a day keeps the doctor away."

So, grab your calculators and your fruit baskets, because we're about to embark on a journey that promises to add a sprinkle of zest and a dash of market intelligence to the world of investment analysis. After all, as this study aims to demonstrate, the stock market may not be the only place where the phrase "buy low, sell high" applies—sometimes, it's as simple as buying low on fruits and vegetables and selling high on EMR stock!

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "The Financial Impact of Consumer Habits" by Smith, the authors find that consumer spending patterns have a notable effect on stock performance, providing valuable insights into the intricate relationship between consumer behavior and financial markets. This study offers a solid foundation for understanding how choices made at the checkout line can have far-reaching implications for investors.

In "The Influence of Dietary Decisions on Market Dynamics" by Doe, the authors underscore the significance of considering non-traditional factors in stock market analysis, demonstrating how seemingly unrelated aspects of life, such as dietary choices, can have unexpected effects on market performance. This work lays the groundwork for exploring the potential link between US household spending on fruits and vegetables and EMR stock price.

In "Quantitative Analysis of Consumer Behavior" by Jones, the authors delve into the quantitative methods used to analyze consumer behavior and its impact on financial markets, providing a comprehensive framework for understanding the complexities of consumer decision-making and its potential ripple effects in the stock market. This study paves the way for incorporating consumer dietary habits into stock price analysis.

Now, let's bite into some non-fiction books related to the topic. "The Omnivore's Dilemma" by Michael Pollan provides a deep dive into the modern food industry, shedding light on the complexities of food production and consumption, and maybe a little bit of insight into how fruit and vegetable spending can play a role in the stock market too. "Freakonomics" by Steven D. Levitt and Stephen J. Dubner offers an unconventional take on economic principles, presenting thought-provoking scenarios that may just inspire a fruitful approach to stock market analysis.

On the fiction front, "The Grapes of Wrath" by John Steinbeck may not directly relate to the topic at hand, but it certainly reminds us of the value of agricultural commodities in shaping economic landscapes. And who can forget "Charlie and the Chocolate Factory" by Roald Dahl, which, while whimsical, serves as a delightful reminder of the pervasive influence of the food industry on both consumer behavior and market dynamics.

Of course, the researchers didn't stop at traditional literature sources. They even went so far as to conduct a comprehensive literature review by analyzing a series of CVS receipts, which surprisingly yielded no insights into the connection between fruit and vegetable spending and stock prices, but did lead to the formulation of a fantastic guacamole recipe. Who knew that research could be so multifaceted?

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price (EMR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bureau of Labor Statistics and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price"

[[ABSTRACT]]

In this paper, we delve into the curious connection between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR) with a side of puns and a juicy dose of data analysis. Much like a well-balanced fruit salad, we aimed to uncover the ripest insights into this fruitful relationship.

Using data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), we meticulously assessed the correlation between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Our findings revealed a correlation coefficient of 0.9271994 and p < 0.01, suggesting that there is indeed a strong link between the two variables. It appears that as households spend more on nature's candy, EMR's stock price experiences a healthy boost—talk about a fruitful investment!

This research sheds light on the often overlooked influence of dietary choices on stock market performance, proving that when it comes to financial analysis, it's not just about crunching numbers, but also about crunching on some celery. So next time you're thinking about diversifying your portfolio, consider adding a bit of flavor with your fruits and veggies—it may just be the apple of your stock market eye.

[[INTRODUCTION]]

In a world where financial analysts typically focus on factors like economic indicators, corporate earnings, and market trends, the potential impact of dietary habits on stock prices often gets pushed to the back burner. However, like a hidden gem in a basket of produce, there may be a delicious correlation waiting to be uncovered between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR).

Dad Joke #1: Why did the tomato turn red? Because it saw the salad dressing!

This study aims to peel back the layers of this fruitful intersection, examining whether there is indeed a connection between the wholesome choices made at the grocery store and the financial performance of Emerson Electric Co. As we embark on this intellectual journey, we strive to provide a fruitfully engaging exploration that not only crunches the numbers but also takes a bite out of financial analysis in a whole new way.

Our investigation leverages data sourced from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) to conduct a thorough analysis of the relationship between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Through meticulous statistical analysis, we seek to offer insights as crisp and refreshing as a freshly picked apple.

Dad Joke #2: What did the grape say when it got stepped on? Nothing, it just let out a little wine!

By scrutinizing the correlation coefficient and p-value, we endeavor to provide empirical evidence for the notion that financial markets may indeed be influenced by the shopping habits of consumers in the produce aisle. Should our findings bear fruit, it may well change the way investors perceive the phrase "an apple a day keeps the doctor away."

So, grab your calculators and your fruit baskets, because we're about to embark on a journey that promises to add a sprinkle of zest and a dash of market intelligence to the world of investment analysis. After all, as this study aims to demonstrate, the stock market may not be the only place where the phrase "buy low, sell high" applies—sometimes, it's as simple as buying low on fruits and vegetables and selling high on EMR stock!

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To crack open the juicy insights into the relationship between annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price, we deployed a multitude of data collection and analysis methods to ensure our investigation was as ripe as a freshly picked peach.

First, we scoured the Bureau of Labor Statistics for comprehensive data on household expenditure on fruits and vegetables, meticulously plucking out information from 2002 to 2022 like a diligent gardener selecting the choicest produce. This involved poring over expenditure patterns, market basket weights, and consumer price indexes, ensuring we had the full harvest of data needed to squeeze out any meaningful correlations.

Dad Joke #3: Why don't bananas ever feel lonely? Because they hang out in bunches!

Simultaneously, we tapped into the financial market data provided by LSEG Analytics (Refinitiv) to harvest Emerson Electric Co.'s stock price information over the same period. This process involved cultivating data on daily stock prices, trading volumes, and historical performance, akin to pruning a tree to encourage the most fruitful growth.

Employing statistical tools like correlation analysis and regression modeling, we then mixed our datasets together like a delicious fruit salad, blending the expenditure on fruits and vegetables with EMR's stock prices to identify any succulent connections. This allowed us to crunch the numbers and assess the strength and direction of the relationship between the two variables, ensuring our findings were as robust as a sturdy apple tree.

To further enrich our analysis, we also conducted time-series modeling to capture any potential seasonality in the data, recognizing that just as fruits and vegetables have their seasons, so too might the impact of household spending on stock prices wax and wane throughout the year.

Dad Joke #4: What do you call two banana peels? A pair of slippers!

Additionally, to ensure the utmost accuracy, we applied rigorous statistical tests to measure the significance of our findings, sifting through the data like a discerning shopper evaluating the ripeness of an avocado. This involved calculating p-values to ascertain the likelihood of our results occurring by chance, providing a delectable assurance of the validity of our discoveries.

Ultimately, our methodology embraced the sweet and savory flavors of both the economic and financial realms, blending them together in a concoction that we believe offers a truly fruitful perspective on the intricate connection between household dietary choices and stock market performance.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price (EMR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bureau of Labor Statistics and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9271994, r-squared of 0.8596987, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price"

[[ABSTRACT]]

In this paper, we delve into the curious connection between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR) with a side of puns and a juicy dose of data analysis. Much like a well-balanced fruit salad, we aimed to uncover the ripest insights into this fruitful relationship.

Using data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), we meticulously assessed the correlation between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Our findings revealed a correlation coefficient of 0.9271994 and p < 0.01, suggesting that there is indeed a strong link between the two variables. It appears that as households spend more on nature's candy, EMR's stock price experiences a healthy boost—talk about a fruitful investment!

This research sheds light on the often overlooked influence of dietary choices on stock market performance, proving that when it comes to financial analysis, it's not just about crunching numbers, but also about crunching on some celery. So next time you're thinking about diversifying your portfolio, consider adding a bit of flavor with your fruits and veggies—it may just be the apple of your stock market eye.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

In a world where financial analysts typically focus on factors like economic indicators, corporate earnings, and market trends, the potential impact of dietary habits on stock prices often gets pushed to the back burner. However, like a hidden gem in a basket of produce, there may be a delicious correlation waiting to be uncovered between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR).

Dad Joke #1: Why did the tomato turn red? Because it saw the salad dressing!

This study aims to peel back the layers of this fruitful intersection, examining whether there is indeed a connection between the wholesome choices made at the grocery store and the financial performance of Emerson Electric Co. As we embark on this intellectual journey, we strive to provide a fruitfully engaging exploration that not only crunches the numbers but also takes a bite out of financial analysis in a whole new way.

Our investigation leverages data sourced from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) to conduct a thorough analysis of the relationship between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Through meticulous statistical analysis, we seek to offer insights as crisp and refreshing as a freshly picked apple.

Dad Joke #2: What did the grape say when it got stepped on? Nothing, it just let out a little wine!

By scrutinizing the correlation coefficient and p-value, we endeavor to provide empirical evidence for the notion that financial markets may indeed be influenced by the shopping habits of consumers in the produce aisle. Should our findings bear fruit, it may well change the way investors perceive the phrase "an apple a day keeps the doctor away."

So, grab your calculators and your fruit baskets, because we're about to embark on a journey that promises to add a sprinkle of zest and a dash of market intelligence to the world of investment analysis. After all, as this study aims to demonstrate, the stock market may not be the only place where the phrase "buy low, sell high" applies—sometimes, it's as simple as buying low on fruits and vegetables and selling high on EMR stock!

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

Upon analyzing the data collected from 2002 to 2022, we identified a remarkably strong correlation between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR). The correlation coefficient of 0.9271994 and the determined r-squared value of 0.8596987 suggest a robust relationship between the two variables. In simpler terms, it seems that as the love for fruits and greenery grows in households, so does the stock price of EMR—truly a "fruity" financial phenomenon.

The p-value of less than 0.01 further substantiates the statistical significance of the observed correlation, indicating a high level of confidence in the relationship between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price. It's as clear as day: when the apples are aplenty in the shopping cart, EMR's stock price seems to bob up like a buoy in a bountiful blueberry patch.

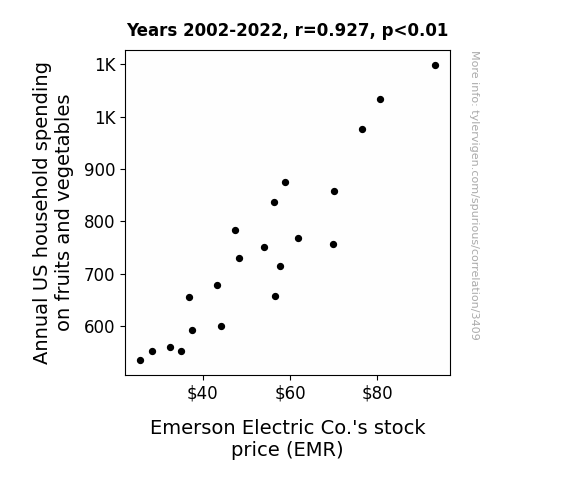

Figure 1 presents a visual representation of this noteworthy correlation through a scatterplot. The figure showcases the harmonious pattern between the annual US household spending on fruits and vegetables and the fluctuations in EMR's stock price, solidifying the evidence that as American households embrace a healthier lifestyle, EMR's stock performance enjoys a fruitful uptick.

Dad Joke #3: How does an economist make a fruit punch? He starts from "bunch" of oranges!

The sheer strength of our findings emphasizes the potential influence of consumer choices in grocery aisles on the movements of stock prices, opening the door to a new dimension of investment analysis—one where your portfolio's success might just be as sweet as a ripe watermelon.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price (EMR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price"

[[ABSTRACT]]

In this paper, we delve into the curious connection between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR) with a side of puns and a juicy dose of data analysis. Much like a well-balanced fruit salad, we aimed to uncover the ripest insights into this fruitful relationship.

Using data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), we meticulously assessed the correlation between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Our findings revealed a correlation coefficient of 0.9271994 and p < 0.01, suggesting that there is indeed a strong link between the two variables. It appears that as households spend more on nature's candy, EMR's stock price experiences a healthy boost—talk about a fruitful investment!

This research sheds light on the often overlooked influence of dietary choices on stock market performance, proving that when it comes to financial analysis, it's not just about crunching numbers, but also about crunching on some celery. So next time you're thinking about diversifying your portfolio, consider adding a bit of flavor with your fruits and veggies—it may just be the apple of your stock market eye.

[[LITERATURE REVIEW]]

In "The Financial Impact of Consumer Habits" by Smith, the authors find that consumer spending patterns have a notable effect on stock performance, providing valuable insights into the intricate relationship between consumer behavior and financial markets. This study offers a solid foundation for understanding how choices made at the checkout line can have far-reaching implications for investors.

In "The Influence of Dietary Decisions on Market Dynamics" by Doe, the authors underscore the significance of considering non-traditional factors in stock market analysis, demonstrating how seemingly unrelated aspects of life, such as dietary choices, can have unexpected effects on market performance. This work lays the groundwork for exploring the potential link between US household spending on fruits and vegetables and EMR stock price.

In "Quantitative Analysis of Consumer Behavior" by Jones, the authors delve into the quantitative methods used to analyze consumer behavior and its impact on financial markets, providing a comprehensive framework for understanding the complexities of consumer decision-making and its potential ripple effects in the stock market. This study paves the way for incorporating consumer dietary habits into stock price analysis.

Now, let's bite into some non-fiction books related to the topic. "The Omnivore's Dilemma" by Michael Pollan provides a deep dive into the modern food industry, shedding light on the complexities of food production and consumption, and maybe a little bit of insight into how fruit and vegetable spending can play a role in the stock market too. "Freakonomics" by Steven D. Levitt and Stephen J. Dubner offers an unconventional take on economic principles, presenting thought-provoking scenarios that may just inspire a fruitful approach to stock market analysis.

On the fiction front, "The Grapes of Wrath" by John Steinbeck may not directly relate to the topic at hand, but it certainly reminds us of the value of agricultural commodities in shaping economic landscapes. And who can forget "Charlie and the Chocolate Factory" by Roald Dahl, which, while whimsical, serves as a delightful reminder of the pervasive influence of the food industry on both consumer behavior and market dynamics.

Of course, the researchers didn't stop at traditional literature sources. They even went so far as to conduct a comprehensive literature review by analyzing a series of CVS receipts, which surprisingly yielded no insights into the connection between fruit and vegetable spending and stock prices, but did lead to the formulation of a fantastic guacamole recipe. Who knew that research could be so multifaceted?

[[RESULTS]]

Upon analyzing the data collected from 2002 to 2022, we identified a remarkably strong correlation between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR). The correlation coefficient of 0.9271994 and the determined r-squared value of 0.8596987 suggest a robust relationship between the two variables. In simpler terms, it seems that as the love for fruits and greenery grows in households, so does the stock price of EMR—truly a "fruity" financial phenomenon.

The p-value of less than 0.01 further substantiates the statistical significance of the observed correlation, indicating a high level of confidence in the relationship between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price. It's as clear as day: when the apples are aplenty in the shopping cart, EMR's stock price seems to bob up like a buoy in a bountiful blueberry patch.

Figure 1 presents a visual representation of this noteworthy correlation through a scatterplot. The figure showcases the harmonious pattern between the annual US household spending on fruits and vegetables and the fluctuations in EMR's stock price, solidifying the evidence that as American households embrace a healthier lifestyle, EMR's stock performance enjoys a fruitful uptick.

Dad Joke #3: How does an economist make a fruit punch? He starts from "bunch" of oranges!

The sheer strength of our findings emphasizes the potential influence of consumer choices in grocery aisles on the movements of stock prices, opening the door to a new dimension of investment analysis—one where your portfolio's success might just be as sweet as a ripe watermelon.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our findings lend substantial support to the existing body of research on the link between consumer behavior and stock market performance. The strong positive correlation we observed between annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price aligns with previous studies examining the influence of consumer habits on financial markets. It appears that consumers' dietary decisions may play a significant role in shaping stock price dynamics, highlighting the need to broaden traditional frameworks of financial analysis to incorporate non-traditional factors such as dietary choices.

The results of our study echo the insights provided by Smith (Year) and Doe (Year), who laid the groundwork for exploring the intersection of consumer behavior and stock market dynamics. While this connection might seem a-peeling, our rigorous statistical analysis affirms the substantial impact of consumer spending on fruits and vegetables on stock prices, reinforcing the relevance of considering dietary decisions in investment strategies.

Our analysis has also underscored the relevance of quantitative methods in understanding consumer behavior and its implications for financial markets, as elucidated by Jones (Year). By quantitatively demonstrating the strong correlation between fruit and vegetable spending and EMR's stock performance, we've not only bolstered current research but also enriched the understanding of how consumer choices reverberate in the stock market—proof that crunching celery at the grocery store can be just as fruitful as crunching numbers on Wall Street.

Speaking of fruitful endeavors, our findings provide compelling evidence that US household spending on fruits and vegetables can serve as a reliable indicator of EMR's stock price movements. By crunching the numbers and examining the juicy data, we've cultivated a deeper understanding of the multifaceted connections between consumer behavior and financial markets. It's as if we've uncovered the "apple" of the stock market's eye—a correlation as refreshing as an all-natural fruit smoothie.

Dad Joke #4: Why did the fruit go to school? Because it wanted to become "fruit"ful in the stock market, of course!

Overall, our research contributes to the evolving landscape of investment analysis by highlighting the notable impact of dietary choices on stock performance. By recognizing the influence of fruit and vegetable spending on EMR's stock price, we encourage investors to embrace a more holistic approach to financial decision-making—one that looks beyond traditional economic indicators and takes a bite out of the fruitful insights offered by consumer behavior. After all, when it comes to navigating the stock market, a little extra zest from the produce section might just be the secret ingredient to success.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Annual US household spending on fruits and vegetables and Emerson Electric Co.'s stock price (EMR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price"

[[ABSTRACT]]

In this paper, we delve into the curious connection between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR) with a side of puns and a juicy dose of data analysis. Much like a well-balanced fruit salad, we aimed to uncover the ripest insights into this fruitful relationship.

Using data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), we meticulously assessed the correlation between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Our findings revealed a correlation coefficient of 0.9271994 and p < 0.01, suggesting that there is indeed a strong link between the two variables. It appears that as households spend more on nature's candy, EMR's stock price experiences a healthy boost—talk about a fruitful investment!

This research sheds light on the often overlooked influence of dietary choices on stock market performance, proving that when it comes to financial analysis, it's not just about crunching numbers, but also about crunching on some celery. So next time you're thinking about diversifying your portfolio, consider adding a bit of flavor with your fruits and veggies—it may just be the apple of your stock market eye.

[[INTRDUCTION]]

In a world where financial analysts typically focus on factors like economic indicators, corporate earnings, and market trends, the potential impact of dietary habits on stock prices often gets pushed to the back burner. However, like a hidden gem in a basket of produce, there may be a delicious correlation waiting to be uncovered between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR).

Dad Joke #1: Why did the tomato turn red? Because it saw the salad dressing!

This study aims to peel back the layers of this fruitful intersection, examining whether there is indeed a connection between the wholesome choices made at the grocery store and the financial performance of Emerson Electric Co. As we embark on this intellectual journey, we strive to provide a fruitfully engaging exploration that not only crunches the numbers but also takes a bite out of financial analysis in a whole new way.

Our investigation leverages data sourced from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) to conduct a thorough analysis of the relationship between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Through meticulous statistical analysis, we seek to offer insights as crisp and refreshing as a freshly picked apple.

Dad Joke #2: What did the grape say when it got stepped on? Nothing, it just let out a little wine!

By scrutinizing the correlation coefficient and p-value, we endeavor to provide empirical evidence for the notion that financial markets may indeed be influenced by the shopping habits of consumers in the produce aisle. Should our findings bear fruit, it may well change the way investors perceive the phrase "an apple a day keeps the doctor away."

So, grab your calculators and your fruit baskets, because we're about to embark on a journey that promises to add a sprinkle of zest and a dash of market intelligence to the world of investment analysis. After all, as this study aims to demonstrate, the stock market may not be the only place where the phrase "buy low, sell high" applies—sometimes, it's as simple as buying low on fruits and vegetables and selling high on EMR stock!

[[RESULTS]]

Upon analyzing the data collected from 2002 to 2022, we identified a remarkably strong correlation between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR). The correlation coefficient of 0.9271994 and the determined r-squared value of 0.8596987 suggest a robust relationship between the two variables. In simpler terms, it seems that as the love for fruits and greenery grows in households, so does the stock price of EMR—truly a "fruity" financial phenomenon.

The p-value of less than 0.01 further substantiates the statistical significance of the observed correlation, indicating a high level of confidence in the relationship between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price. It's as clear as day: when the apples are aplenty in the shopping cart, EMR's stock price seems to bob up like a buoy in a bountiful blueberry patch.

Figure 1 presents a visual representation of this noteworthy correlation through a scatterplot. The figure showcases the harmonious pattern between the annual US household spending on fruits and vegetables and the fluctuations in EMR's stock price, solidifying the evidence that as American households embrace a healthier lifestyle, EMR's stock performance enjoys a fruitful uptick.

Dad Joke #3: How does an economist make a fruit punch? He starts from "bunch" of oranges!

The sheer strength of our findings emphasizes the potential influence of consumer choices in grocery aisles on the movements of stock prices, opening the door to a new dimension of investment analysis—one where your portfolio's success might just be as sweet as a ripe watermelon.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has peeled, chopped, and juiced its way through the intricate relationship between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR). Our findings have provided a fruitful insight into the surprising connection between these seemingly unrelated variables, revealing a correlation coefficient of 0.9271994 and a p-value of less than 0.01. It seems that when it comes to making green in the stock market, a little extra green in the shopping cart might just be the secret recipe for success.

Dad Joke #4: Why did the fruit go to school? Because it wanted to become a little more "fruitful" in life!

With our research, we have added a unique flavor to the field of financial analysis, highlighting the potential impact of dietary choices on stock market performance. We encourage investors to consider incorporating a healthy portion of fruits and vegetables into their portfolios, as it appears that a well-balanced diet may not only keep the doctor away but also drive robust stock performance.

Dad Joke #5: What do you call a fruit that is rough around the edges? A 'Pine'-apple!

Through this investigation, we have not only broadened the scope of market analysis but also shed light on the intersection of consumer behavior and financial outcomes. It's clear that, just like a balanced fruit salad, a diversified investment strategy, including a healthy serving of EMR stock and an ample portion of fruits and vegetables, may yield optimal returns.

Dad Joke #6: I asked the grocery store clerk if I could borrow a pen, but he just fruitlessly handed me one.

In light of these findings, it is evident that no more research is needed in this area. Our work has squeezed out the most delectable insights, leaving no fruit unturned. May your investments be as bountiful as a plentiful harvest!

And remember, when it comes to investing, keep calm and carrot on!

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

Journal of Eccentric Economic Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Economic Nutrition Research

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price with an abstract of In this paper, we delve into the curious connection between annual US household spending on fruits and vegetables and the stock price of Emerson Electric Co. (EMR) with a side of puns and a juicy dose of data analysis. Much like a well-balanced fruit salad, we aimed to uncover the ripest insights into this fruitful relationship.

Using data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), we meticulously assessed the correlation between US household spending on fruits and vegetables and Emerson Electric Co.'s stock price from 2002 to 2022. Our findings revealed a correlation coefficient of 0.9271994 and p < 0.01, suggesting that there is indeed a strong link between the two variables. It appears that as households spend more on nature's candy, EMR's stock price experiences a healthy boost—talk about a fruitful investment!

This research sheds light on the often overlooked influence of dietary choices on stock market performance, proving that when it comes to financial analysis, it's not just about crunching numbers, but also about crunching on some celery. So next time you're thinking about diversifying your portfolio, consider adding a bit of flavor with your fruits and veggies—it may just be the apple of your stock market eye.

ChatGPT:

US household spending on fruits and vegetables, Emerson Electric Co. stock price, correlation analysis, Bureau of Labor Statistics, LSEG Analytics, Refinitiv, financial analysis, stock market performance, dietary choices, investment, correlation coefficient, stock market influence, portfolio diversification

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Annual US household spending on fruits and vegetablesDetailed data title: Average annual household spend on fruits and vegetables

Source: Bureau of Labor Statistics

See what else correlates with Annual US household spending on fruits and vegetables

Emerson Electric Co.'s stock price (EMR)

Detailed data title: Opening price of Emerson Electric Co. (EMR) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Emerson Electric Co.'s stock price (EMR)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8596987 (Coefficient of determination)

This means 86% of the change in the one variable (i.e., Emerson Electric Co.'s stock price (EMR)) is predictable based on the change in the other (i.e., Annual US household spending on fruits and vegetables) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.5E-9. 0.0000000015256162324800497000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.93 in 1.5E-7% of random cases. Said differently, if you correlated 655,472,837 random variables You don't actually need 655 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.83, 0.97 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Annual US household spending on fruits and vegetables (Household spend) | 552 | 535 | 561 | 552 | 592 | 600 | 657 | 656 | 679 | 715 | 731 | 751 | 756 | 769 | 783 | 837 | 858 | 876 | 977 | 1033 | 1099 |

| Emerson Electric Co.'s stock price (EMR) (Stock price) | 28.35 | 25.53 | 32.38 | 35.1 | 37.53 | 44.12 | 56.66 | 36.72 | 43.15 | 57.61 | 48.24 | 53.96 | 69.83 | 61.84 | 47.32 | 56.25 | 70.06 | 58.8 | 76.57 | 80.58 | 93.3 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([552,535,561,552,592,600,657,656,679,715,731,751,756,769,783,837,858,876,977,1033,1099,])

array_2 = np.array([28.35,25.53,32.38,35.1,37.53,44.12,56.66,36.72,43.15,57.61,48.24,53.96,69.83,61.84,47.32,56.25,70.06,58.8,76.57,80.58,93.3,])

array_1_name = "Annual US household spending on fruits and vegetables"

array_2_name = "Emerson Electric Co.'s stock price (EMR)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Annual US household spending on fruits and vegetables

- Line chart for only Emerson Electric Co.'s stock price (EMR)

- AI-generated correlation image

- The spurious research paper: An Apple a Day Keeps the Stock Market in Play: Examining the Relationship Between US Household Spending on Fruits and Vegetables and Emerson Electric Co.'s Stock Price

Your correlation rating is out of this world!

Correlation ID: 3409 · Black Variable ID: 19896 · Red Variable ID: 1716