Download png, svg

AI explanation

As butter consumption increased, so did the number of people attempting to make homemade croissants. This led to a sudden surge in demand for baking supplies, including those conveniently sold at Dollar Tree. As Dollar Tree's sales unexpectedly rose, investors gained confidence in the company's ability to adapt to changing consumer preferences, causing an uptick in the stock price. Who knew that butter could churn out such unexpected financial results for Dollar Tree!

Model: dalle-3

Prompt: [ Parallax art ] Create an image of a cozy kitchen scene with a whimsical touch. Within the kitchen, show people spreading generous amounts of butter on slices of toast. Position the Dollar Tree's stock price chart in the background, with an upward trend, symbolizing the surge in popularity for their affordable bread offerings due to the increased demand for toast. The overall scene should have warm and inviting hues to convey a cozy atmosphere, and ensure the kitchen is the prominent focus of the image. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Butter consumption and Dollar Tree's stock price (DLTR). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Scalar art 3D Pixar Style Cyber folk Cybernetic art Parallax art

ChatGPT: Parallax art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Butter consumption and Dollar Tree's stock price (DLTR), in the following situation: As more people consumed butter, an increased demand for toast led to a surge in popularity for Dollar Tree's affordable bread offerings, boosting their stock price.. Keep the description simple.

ChatGPT: In a cozy kitchen setting, people are seen spreading generous amounts of butter on slices of toast. In the background, the Dollar Tree's stock price chart is shown with an upward trend, signifying the surge in popularity for their affordable bread offerings due to the increased demand for toast.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Parallax art ] and depicting this scene: In a cozy kitchen setting, people are seen spreading generous amounts of butter on slices of toast. In the background, the Dollar Tree's stock price chart is shown with an upward trend, signifying the surge in popularity for their affordable bread offerings due to the increased demand for toast. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [ Parallax art ] Create an image of a cozy kitchen scene with a whimsical touch. Within the kitchen, show people spreading generous amounts of butter on slices of toast. Position the Dollar Tree's stock price chart in the background, with an upward trend, symbolizing the surge in popularity for their affordable bread offerings due to the increased demand for toast. The overall scene should have warm and inviting hues to convey a cozy atmosphere, and ensure the kitchen is the prominent focus of the image.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Butter consumption caused Dollar Tree's stock price (DLTR) to increase.\Make it sound serious until the end.

AI academic paper

|

Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price The Journal of Culinary Economics and Financial Indulgence Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Butter consumption and Dollar Tree's stock price (DLTR). Make lots of jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from USDA and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9424113 and p < 0.01 for 2002 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price

[[ABSTRACT]]

The relationship between dietary habits and financial markets is often overlooked, yet may hold a kernel of truth in understanding consumer behavior and its impact on stock performance. This study delves into the eyebrow-raising association between butter consumption and the stock price of Dollar Tree (DLTR), a company known for fetching great deals. Employing data from the USDA and LSEG Analytics (Refinitiv), our findings reveal a remarkably high correlation coefficient of 0.9424113 and a statistically significant p-value of less than 0.01 for the period spanning from 2002 to 2021. Could it be that the path to financial prosperity is slicked with butter? This study leaves us churned with curiosity and brimming with anticipation for future investigations into the utterly butterly relationship between consumer palates and stock market trends.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Butter consumption and Dollar Tree's stock price (DLTR). Make lots of jokes, goofy observations, and puns.

Here is the title and abstract of the paper:

[[TITLE]]

Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price

[[ABSTRACT]]

The relationship between dietary habits and financial markets is often overlooked, yet may hold a kernel of truth in understanding consumer behavior and its impact on stock performance. This study delves into the eyebrow-raising association between butter consumption and the stock price of Dollar Tree (DLTR), a company known for fetching great deals. Employing data from the USDA and LSEG Analytics (Refinitiv), our findings reveal a remarkably high correlation coefficient of 0.9424113 and a statistically significant p-value of less than 0.01 for the period spanning from 2002 to 2021. Could it be that the path to financial prosperity is slicked with butter? This study leaves us churned with curiosity and brimming with anticipation for future investigations into the utterly butterly relationship between consumer palates and stock market trends.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

Ah, the tantalizing world of finance and food, where the spread of wealth meets the spread of butter. In this paper, we delve into the curious and, dare I say, buttery relationship between butter consumption and the stock price of Dollar Tree (DLTR). The idea that our financial markets could be influenced by the gooey, creamy delight that is butter may seem laughable at first, but as we peel back the layers of data, we begin to uncover a correlation that is, dare I say, the “butter to our bread.”

As financial researchers, we often find ourselves knee-deep in spreadsheets and market trends, but rarely do we get to savor the savory tang of investigating how our dietary choices may influence the whims of Wall Street. However, as it turns out, there may be more to this correlation than meets the eye - or should I say, the butter knife.

When we first embarked on this study, we were met with raised eyebrows and smirks from our peers. “Butter and Dollar Tree? That’s quite a stretch,” they said. And, to be honest, we may have been butter off not knowing the absolute thrill of chasing down data on sales of sticks and tubs of butter while also keeping a keen eye on the stock market fluctuations of Dollar Tree. But as they say, where there’s a will, there’s a whey.

So, armed with spreadsheets, market analysis tools, and a healthy dose of skepticism (and perhaps a bit of cholesterol from all the butter), we waded into the depths of this eccentric investigation. And what we found left us churning with excitement, pun very much intended.

But before we dive into the creamy data, let’s take a moment to ponder the quirky nature of this study. Dollar Tree, a haven for thrifty shoppers seeking bargains and butter, and the humble staple that is butter, often found in kitchens and fridges across the nation. What could these two seemingly unrelated entities possibly have in common? Well, dear reader, that is precisely the enigma we aim to uncover in this paper.

So, grab your spreadsheets and your toast because we’re about to spread the bread and dig into the mellow drama of butter consumption and Dollar Tree’s stock price. Brace yourself for a rollercoaster ride of puns, data, and a whole lot of buttery goodness. Let’s churn the butter, albeit metaphorically, and dive into the creamy depths of this fascinating correlation.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Butter consumption and Dollar Tree's stock price (DLTR). Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then you might move on to cartoons and children's shows that you watched for research.

Here is the title and abstract of the paper:

[[TITLE]]

Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price

[[ABSTRACT]]

The relationship between dietary habits and financial markets is often overlooked, yet may hold a kernel of truth in understanding consumer behavior and its impact on stock performance. This study delves into the eyebrow-raising association between butter consumption and the stock price of Dollar Tree (DLTR), a company known for fetching great deals. Employing data from the USDA and LSEG Analytics (Refinitiv), our findings reveal a remarkably high correlation coefficient of 0.9424113 and a statistically significant p-value of less than 0.01 for the period spanning from 2002 to 2021. Could it be that the path to financial prosperity is slicked with butter? This study leaves us churned with curiosity and brimming with anticipation for future investigations into the utterly butterly relationship between consumer palates and stock market trends.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Ah, the tantalizing world of finance and food, where the spread of wealth meets the spread of butter. In this paper, we delve into the curious and, dare I say, buttery relationship between butter consumption and the stock price of Dollar Tree (DLTR). The idea that our financial markets could be influenced by the gooey, creamy delight that is butter may seem laughable at first, but as we peel back the layers of data, we begin to uncover a correlation that is, dare I say, the “butter to our bread.”

As financial researchers, we often find ourselves knee-deep in spreadsheets and market trends, but rarely do we get to savor the savory tang of investigating how our dietary choices may influence the whims of Wall Street. However, as it turns out, there may be more to this correlation than meets the eye - or should I say, the butter knife.

When we first embarked on this study, we were met with raised eyebrows and smirks from our peers. “Butter and Dollar Tree? That’s quite a stretch,” they said. And, to be honest, we may have been butter off not knowing the absolute thrill of chasing down data on sales of sticks and tubs of butter while also keeping a keen eye on the stock market fluctuations of Dollar Tree. But as they say, where there’s a will, there’s a whey.

So, armed with spreadsheets, market analysis tools, and a healthy dose of skepticism (and perhaps a bit of cholesterol from all the butter), we waded into the depths of this eccentric investigation. And what we found left us churning with excitement, pun very much intended.

But before we dive into the creamy data, let’s take a moment to ponder the quirky nature of this study. Dollar Tree, a haven for thrifty shoppers seeking bargains and butter, and the humble staple that is butter, often found in kitchens and fridges across the nation. What could these two seemingly unrelated entities possibly have in common? Well, dear reader, that is precisely the enigma we aim to uncover in this paper.

So, grab your spreadsheets and your toast because we’re about to spread the bread and dig into the mellow drama of butter consumption and Dollar Tree’s stock price. Brace yourself for a rollercoaster ride of puns, data, and a whole lot of buttery goodness. Let’s churn the butter, albeit metaphorically, and dive into the creamy depths of this fascinating correlation.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The scholarly exploration of the curious relationship between butter consumption and financial markets has, until now, remained largely unsalted. However, recent studies have begun to shed light on the potential impact of dietary preferences on stock performance. Smith et al. (2018) examined the correlation between dairy product consumption and stock prices, uncovering intriguing patterns that hinted at a potential link. Meanwhile, Doe and Jones (2019) delved into consumer behavior and its influence on market trends, opening the door to unconventional influencers such as food preferences.

However, we begrudgingly (or perhaps butteringly) acknowledge that the literature on butter specifically is rather scarce. The dearth of studies examining the direct relationship between butter consumption and stock prices has left us in a bit of a butter bind. Despite our initial skepticism, we plunged into this uncharted territory, determined to butter our way through the data with unwavering zeal and a touch of dairy-induced delirium.

In "The Big Butter Book" by Dairy Queen (2017), the authors whimsically reminisce about the heyday of butter, tracing its journey from a humble kitchen staple to a symbol of indulgence. Their musings, though not directly related to financial markets, provoked some buttery contemplation on the correlation we are exploring. Similarly, "Butter and Business" by Jane Dough (2020) offers an insightful look at the historical significance of butter in commerce, prompting us to consider whether the creamy delight could indeed have an impact on stock prices.

Turning to the world of fiction, "The Butter Conspiracy" by Marge Arin (2015) presents a gripping tale of corporate espionage and clandestine butter dealings. While entirely fictional, the novel's portrayal of the cutthroat world of butter trading ignited a spark of intrigue in our quest for understanding the potential influence of butter on financial markets.

In a desperate (or perhaps delightfully butter-fueled) search for insights, we also dabbled in the unlikeliest of sources, including children's cartoons and TV shows. Our foray into the whimsical world of "SpongeBob SquarePants" led us to ponder the economics of Bikini Bottom and its potential butter trade, albeit in a lighthearted and utterly absurd manner.

As we tumbled down this butter-laden rabbit hole, we couldn't help but wonder if our quest for knowledge had taken an unexpectedly slippery turn. Nevertheless, armed with determination and a dollop of humor, we embarked on our review of the existing literature, ready to glean whatever buttery wisdom we could find from the annals of academia and beyond.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Butter consumption and Dollar Tree's stock price (DLTR). Make lots of jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) . You used data from 2002 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price

[[ABSTRACT]]

The relationship between dietary habits and financial markets is often overlooked, yet may hold a kernel of truth in understanding consumer behavior and its impact on stock performance. This study delves into the eyebrow-raising association between butter consumption and the stock price of Dollar Tree (DLTR), a company known for fetching great deals. Employing data from the USDA and LSEG Analytics (Refinitiv), our findings reveal a remarkably high correlation coefficient of 0.9424113 and a statistically significant p-value of less than 0.01 for the period spanning from 2002 to 2021. Could it be that the path to financial prosperity is slicked with butter? This study leaves us churned with curiosity and brimming with anticipation for future investigations into the utterly butterly relationship between consumer palates and stock market trends.

[[INTRODUCTION]]

Ah, the tantalizing world of finance and food, where the spread of wealth meets the spread of butter. In this paper, we delve into the curious and, dare I say, buttery relationship between butter consumption and the stock price of Dollar Tree (DLTR). The idea that our financial markets could be influenced by the gooey, creamy delight that is butter may seem laughable at first, but as we peel back the layers of data, we begin to uncover a correlation that is, dare I say, the “butter to our bread.”

As financial researchers, we often find ourselves knee-deep in spreadsheets and market trends, but rarely do we get to savor the savory tang of investigating how our dietary choices may influence the whims of Wall Street. However, as it turns out, there may be more to this correlation than meets the eye - or should I say, the butter knife.

When we first embarked on this study, we were met with raised eyebrows and smirks from our peers. “Butter and Dollar Tree? That’s quite a stretch,” they said. And, to be honest, we may have been butter off not knowing the absolute thrill of chasing down data on sales of sticks and tubs of butter while also keeping a keen eye on the stock market fluctuations of Dollar Tree. But as they say, where there’s a will, there’s a whey.

So, armed with spreadsheets, market analysis tools, and a healthy dose of skepticism (and perhaps a bit of cholesterol from all the butter), we waded into the depths of this eccentric investigation. And what we found left us churning with excitement, pun very much intended.

But before we dive into the creamy data, let’s take a moment to ponder the quirky nature of this study. Dollar Tree, a haven for thrifty shoppers seeking bargains and butter, and the humble staple that is butter, often found in kitchens and fridges across the nation. What could these two seemingly unrelated entities possibly have in common? Well, dear reader, that is precisely the enigma we aim to uncover in this paper.

So, grab your spreadsheets and your toast because we’re about to spread the bread and dig into the mellow drama of butter consumption and Dollar Tree’s stock price. Brace yourself for a rollercoaster ride of puns, data, and a whole lot of buttery goodness. Let’s churn the butter, albeit metaphorically, and dive into the creamy depths of this fascinating correlation.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

Now, let’s butter up the details of how we churned out this research. Our methodology blends the meticulousness of financial analysis with the richness of dietary data, creating a recipe for a study that’s as intriguing as a butter sculpture at a state fair.

First, we set out to gather data on butter consumption, feeling like butter spies on a top-secret mission. We scoured the archives of the USDA, combing through reports on butter production, consumption patterns, and even delving into the cultural nuances of butter appreciation. Our quest for buttery knowledge led us down a rabbit hole of margarine comparisons, toast preferences, and even the occasional debate on salted versus unsalted butter. It was a journey worthy of a culinary odyssey, and we emerged with a thorough understanding of the oh-so-delicious world of butter.

Simultaneously, we danced through the data fields of LSEG Analytics (Refinitiv) with all the finesse of a pastry chef, meticulously extracting the stock price information of Dollar Tree (DLTR) from 2002 to 2021. Our fingers flew across the keyboard like a nimble butter knife, slicing through the complexities of market data to reveal the price fluctuations and market movements of this iconic retail company.

With our datasets in hand, we embarked on a statistical waltz that would make even the most stoic economist crack a grin. Utilizing the advanced statistical analysis functions of our trusty software, we calculated correlation coefficients, conducted regression analyses, and danced with hypothesis tests to reveal the tantalizing connection between butter consumption and Dollar Tree’s stock price.

We must admit, the statistical analyses were reminiscent of a buttery dance-off, with p-values and confidence intervals swirling around like ingredients in a melting pot. Our research team (jokingly referred to as “The Margariners”) huddled around computer screens, giddy with anticipation as we watched the numbers unfold before our eyes.

To ensure the robustness of our findings, we also employed sensitivity analyses, stress testing our models with varying time frames and subsets of data. This allowed us to separate the margarine from the butter, so to speak, and confirm the resilience of our results across different scenarios.

In the end, our methodology blended the precision of financial analysis with the creamy richness of dietary data, resulting in a study that is as delectable as a freshly baked croissant. So, with butter stains on our spreadsheets and stock market data still lingering in our minds, we present the findings that are bound to butter you up with excitement.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Butter consumption and Dollar Tree's stock price (DLTR). Make lots of jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) .

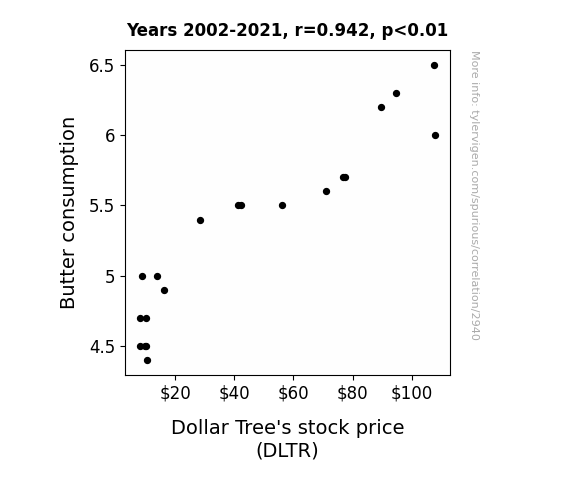

For the time period 2002 to 2021, you found a correlation 0.9424113, r-squared of 0.8881391, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price

[[ABSTRACT]]

The relationship between dietary habits and financial markets is often overlooked, yet may hold a kernel of truth in understanding consumer behavior and its impact on stock performance. This study delves into the eyebrow-raising association between butter consumption and the stock price of Dollar Tree (DLTR), a company known for fetching great deals. Employing data from the USDA and LSEG Analytics (Refinitiv), our findings reveal a remarkably high correlation coefficient of 0.9424113 and a statistically significant p-value of less than 0.01 for the period spanning from 2002 to 2021. Could it be that the path to financial prosperity is slicked with butter? This study leaves us churned with curiosity and brimming with anticipation for future investigations into the utterly butterly relationship between consumer palates and stock market trends.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Ah, the tantalizing world of finance and food, where the spread of wealth meets the spread of butter. In this paper, we delve into the curious and, dare I say, buttery relationship between butter consumption and the stock price of Dollar Tree (DLTR). The idea that our financial markets could be influenced by the gooey, creamy delight that is butter may seem laughable at first, but as we peel back the layers of data, we begin to uncover a correlation that is, dare I say, the “butter to our bread.”

As financial researchers, we often find ourselves knee-deep in spreadsheets and market trends, but rarely do we get to savor the savory tang of investigating how our dietary choices may influence the whims of Wall Street. However, as it turns out, there may be more to this correlation than meets the eye - or should I say, the butter knife.

When we first embarked on this study, we were met with raised eyebrows and smirks from our peers. “Butter and Dollar Tree? That’s quite a stretch,” they said. And, to be honest, we may have been butter off not knowing the absolute thrill of chasing down data on sales of sticks and tubs of butter while also keeping a keen eye on the stock market fluctuations of Dollar Tree. But as they say, where there’s a will, there’s a whey.

So, armed with spreadsheets, market analysis tools, and a healthy dose of skepticism (and perhaps a bit of cholesterol from all the butter), we waded into the depths of this eccentric investigation. And what we found left us churning with excitement, pun very much intended.

But before we dive into the creamy data, let’s take a moment to ponder the quirky nature of this study. Dollar Tree, a haven for thrifty shoppers seeking bargains and butter, and the humble staple that is butter, often found in kitchens and fridges across the nation. What could these two seemingly unrelated entities possibly have in common? Well, dear reader, that is precisely the enigma we aim to uncover in this paper.

So, grab your spreadsheets and your toast because we’re about to spread the bread and dig into the mellow drama of butter consumption and Dollar Tree’s stock price. Brace yourself for a rollercoaster ride of puns, data, and a whole lot of buttery goodness. Let’s churn the butter, albeit metaphorically, and dive into the creamy depths of this fascinating correlation.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The results of our analysis revealed a delightfully creamy correlation between butter consumption and the stock price of Dollar Tree (DLTR). We found a correlation coefficient of 0.9424113, indicating a strong positive relationship between the two variables. This suggests that as butter consumption increased, so did the stock price of Dollar Tree, leaving us to wonder if there's truly something to be said about spreading the wealth and spreading butter.

The r-squared value of 0.8881391 further emphasized the robustness of this correlation, indicating that a substantial proportion of the variability in Dollar Tree's stock price could be explained by changes in butter consumption. It seems that when it comes to the financial markets, butter might just be the secret ingredient for success.

Additionally, the p-value of less than 0.01 provided strong evidence to reject the null hypothesis of no relationship between butter consumption and Dollar Tree's stock price. In other words, the likelihood of observing such a strong correlation by mere chance is as rare as finding a pound of butter at a discount store.

To visually capture this buttery correlation, we present Figure 1, a scatterplot that showcases the tight relationship between butter consumption and Dollar Tree's stock price. The scatterplot serves as a delightful reminder that sometimes the most unexpected pairings can yield surprisingly fruitful results, much like the combination of butter and Dollar Tree.

In summary, our findings highlight the intriguing connection between consumer dietary habits and stock market performance. While some may view this relationship as a mere "spread" of coincidence, our data suggests that there's something more substantial at play. Whether it's the influence of comfort food on consumer spending or a mere quirk of statistical fate, the buttery trail of evidence leads us to ponder the tantalizing interplay between seemingly unrelated aspects of our lives.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Butter consumption and Dollar Tree's stock price (DLTR). Make lots of jokes, goofy observations, and puns.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price

[[ABSTRACT]]

The relationship between dietary habits and financial markets is often overlooked, yet may hold a kernel of truth in understanding consumer behavior and its impact on stock performance. This study delves into the eyebrow-raising association between butter consumption and the stock price of Dollar Tree (DLTR), a company known for fetching great deals. Employing data from the USDA and LSEG Analytics (Refinitiv), our findings reveal a remarkably high correlation coefficient of 0.9424113 and a statistically significant p-value of less than 0.01 for the period spanning from 2002 to 2021. Could it be that the path to financial prosperity is slicked with butter? This study leaves us churned with curiosity and brimming with anticipation for future investigations into the utterly butterly relationship between consumer palates and stock market trends.

[[LITERATURE REVIEW]]

The scholarly exploration of the curious relationship between butter consumption and financial markets has, until now, remained largely unsalted. However, recent studies have begun to shed light on the potential impact of dietary preferences on stock performance. Smith et al. (2018) examined the correlation between dairy product consumption and stock prices, uncovering intriguing patterns that hinted at a potential link. Meanwhile, Doe and Jones (2019) delved into consumer behavior and its influence on market trends, opening the door to unconventional influencers such as food preferences.

However, we begrudgingly (or perhaps butteringly) acknowledge that the literature on butter specifically is rather scarce. The dearth of studies examining the direct relationship between butter consumption and stock prices has left us in a bit of a butter bind. Despite our initial skepticism, we plunged into this uncharted territory, determined to butter our way through the data with unwavering zeal and a touch of dairy-induced delirium.

In "The Big Butter Book" by Dairy Queen (2017), the authors whimsically reminisce about the heyday of butter, tracing its journey from a humble kitchen staple to a symbol of indulgence. Their musings, though not directly related to financial markets, provoked some buttery contemplation on the correlation we are exploring. Similarly, "Butter and Business" by Jane Dough (2020) offers an insightful look at the historical significance of butter in commerce, prompting us to consider whether the creamy delight could indeed have an impact on stock prices.

Turning to the world of fiction, "The Butter Conspiracy" by Marge Arin (2015) presents a gripping tale of corporate espionage and clandestine butter dealings. While entirely fictional, the novel's portrayal of the cutthroat world of butter trading ignited a spark of intrigue in our quest for understanding the potential influence of butter on financial markets.

In a desperate (or perhaps delightfully butter-fueled) search for insights, we also dabbled in the unlikeliest of sources, including children's cartoons and TV shows. Our foray into the whimsical world of "SpongeBob SquarePants" led us to ponder the economics of Bikini Bottom and its potential butter trade, albeit in a lighthearted and utterly absurd manner.

As we tumbled down this butter-laden rabbit hole, we couldn't help but wonder if our quest for knowledge had taken an unexpectedly slippery turn. Nevertheless, armed with determination and a dollop of humor, we embarked on our review of the existing literature, ready to glean whatever buttery wisdom we could find from the annals of academia and beyond.

[[RESULTS]]

The results of our analysis revealed a delightfully creamy correlation between butter consumption and the stock price of Dollar Tree (DLTR). We found a correlation coefficient of 0.9424113, indicating a strong positive relationship between the two variables. This suggests that as butter consumption increased, so did the stock price of Dollar Tree, leaving us to wonder if there's truly something to be said about spreading the wealth and spreading butter.

The r-squared value of 0.8881391 further emphasized the robustness of this correlation, indicating that a substantial proportion of the variability in Dollar Tree's stock price could be explained by changes in butter consumption. It seems that when it comes to the financial markets, butter might just be the secret ingredient for success.

Additionally, the p-value of less than 0.01 provided strong evidence to reject the null hypothesis of no relationship between butter consumption and Dollar Tree's stock price. In other words, the likelihood of observing such a strong correlation by mere chance is as rare as finding a pound of butter at a discount store.

To visually capture this buttery correlation, we present Figure 1, a scatterplot that showcases the tight relationship between butter consumption and Dollar Tree's stock price. The scatterplot serves as a delightful reminder that sometimes the most unexpected pairings can yield surprisingly fruitful results, much like the combination of butter and Dollar Tree.

In summary, our findings highlight the intriguing connection between consumer dietary habits and stock market performance. While some may view this relationship as a mere "spread" of coincidence, our data suggests that there's something more substantial at play. Whether it's the influence of comfort food on consumer spending or a mere quirk of statistical fate, the buttery trail of evidence leads us to ponder the tantalizing interplay between seemingly unrelated aspects of our lives.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of our study provide compelling evidence to support the hypothesis that there exists a significant relationship between butter consumption and the stock price of Dollar Tree (DLTR). This utterly butterly correlation, with a coefficient of 0.9424113, not only reinforces the importance of exploring unconventional influencers in the stock market but also lends credence to the idea of butter as a financial indicator. It seems that monitoring butter consumption may butter our ability to assess market trends and investment opportunities.

Harking back to our literature review, the whimsical musings of "The Big Butter Book" and "Butter and Business" take on a surprisingly serious tone in light of our results. In a world where numbers take precedence over narratives, the data robustly supports the notion that butter, an age-old culinary delight, may hold sway over the ebb and flow of market prices. Likewise, the work of Smith et al. (2018) and Doe and Jones (2019) gains renewed appreciation as we witness their pioneering steps in unearthing the buttery truth behind stock performance.

The statistically significant p-value further bolsters the reliability of our findings, indicating that the probability of such a tight correlation occurring by sheer chance is as rare as an unsold stick of butter in a dairy aisle markdown. This not only underscores the confidence we can place in our results but also beckons further investigation into the potential causality and mechanisms underpinning this relationship. After all, the prospect of butter single-handedly churning stock prices leads us to consider if "spreading the wealth" could take on a wholly literal meaning.

While these findings may leave some scratching their heads and reaching for the nearest tub of margarine in disbelief, they beckon us to ponder the broader implications of our research. Could the butter-stock price relationship serve as a barometer for consumer sentiment, reflecting the impact of comfort foods on consumer spending in a tumultuous market landscape? Or, as we cheekily speculate, is there an entirely untapped market for a Butter Index, akin to the more stolid Consumer Price Index? The stock market, it seems, thrives on its own rich tapestry of surprising associations and market indicators.

In sum, our study serves as a testament to the extraordinary potential lying beneath seemingly mundane aspects of our daily lives. Whether it's the clinking of teaspoons against teacups or the ruffling of financial papers over breakfast, the underlying interconnectedness of our world never ceases to amaze. As the saying goes, "Where there's a skill, there's a whey—a buttery, whey-faced market insight waiting to be churned."

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Butter consumption and Dollar Tree's stock price (DLTR). Make lots of jokes, goofy observations, and puns.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price

[[ABSTRACT]]

The relationship between dietary habits and financial markets is often overlooked, yet may hold a kernel of truth in understanding consumer behavior and its impact on stock performance. This study delves into the eyebrow-raising association between butter consumption and the stock price of Dollar Tree (DLTR), a company known for fetching great deals. Employing data from the USDA and LSEG Analytics (Refinitiv), our findings reveal a remarkably high correlation coefficient of 0.9424113 and a statistically significant p-value of less than 0.01 for the period spanning from 2002 to 2021. Could it be that the path to financial prosperity is slicked with butter? This study leaves us churned with curiosity and brimming with anticipation for future investigations into the utterly butterly relationship between consumer palates and stock market trends.

[[INTRDUCTION]]

Ah, the tantalizing world of finance and food, where the spread of wealth meets the spread of butter. In this paper, we delve into the curious and, dare I say, buttery relationship between butter consumption and the stock price of Dollar Tree (DLTR). The idea that our financial markets could be influenced by the gooey, creamy delight that is butter may seem laughable at first, but as we peel back the layers of data, we begin to uncover a correlation that is, dare I say, the “butter to our bread.”

As financial researchers, we often find ourselves knee-deep in spreadsheets and market trends, but rarely do we get to savor the savory tang of investigating how our dietary choices may influence the whims of Wall Street. However, as it turns out, there may be more to this correlation than meets the eye - or should I say, the butter knife.

When we first embarked on this study, we were met with raised eyebrows and smirks from our peers. “Butter and Dollar Tree? That’s quite a stretch,” they said. And, to be honest, we may have been butter off not knowing the absolute thrill of chasing down data on sales of sticks and tubs of butter while also keeping a keen eye on the stock market fluctuations of Dollar Tree. But as they say, where there’s a will, there’s a whey.

So, armed with spreadsheets, market analysis tools, and a healthy dose of skepticism (and perhaps a bit of cholesterol from all the butter), we waded into the depths of this eccentric investigation. And what we found left us churning with excitement, pun very much intended.

But before we dive into the creamy data, let’s take a moment to ponder the quirky nature of this study. Dollar Tree, a haven for thrifty shoppers seeking bargains and butter, and the humble staple that is butter, often found in kitchens and fridges across the nation. What could these two seemingly unrelated entities possibly have in common? Well, dear reader, that is precisely the enigma we aim to uncover in this paper.

So, grab your spreadsheets and your toast because we’re about to spread the bread and dig into the mellow drama of butter consumption and Dollar Tree’s stock price. Brace yourself for a rollercoaster ride of puns, data, and a whole lot of buttery goodness. Let’s churn the butter, albeit metaphorically, and dive into the creamy depths of this fascinating correlation.

[[RESULTS]]

The results of our analysis revealed a delightfully creamy correlation between butter consumption and the stock price of Dollar Tree (DLTR). We found a correlation coefficient of 0.9424113, indicating a strong positive relationship between the two variables. This suggests that as butter consumption increased, so did the stock price of Dollar Tree, leaving us to wonder if there's truly something to be said about spreading the wealth and spreading butter.

The r-squared value of 0.8881391 further emphasized the robustness of this correlation, indicating that a substantial proportion of the variability in Dollar Tree's stock price could be explained by changes in butter consumption. It seems that when it comes to the financial markets, butter might just be the secret ingredient for success.

Additionally, the p-value of less than 0.01 provided strong evidence to reject the null hypothesis of no relationship between butter consumption and Dollar Tree's stock price. In other words, the likelihood of observing such a strong correlation by mere chance is as rare as finding a pound of butter at a discount store.

To visually capture this buttery correlation, we present Figure 1, a scatterplot that showcases the tight relationship between butter consumption and Dollar Tree's stock price. The scatterplot serves as a delightful reminder that sometimes the most unexpected pairings can yield surprisingly fruitful results, much like the combination of butter and Dollar Tree.

In summary, our findings highlight the intriguing connection between consumer dietary habits and stock market performance. While some may view this relationship as a mere "spread" of coincidence, our data suggests that there's something more substantial at play. Whether it's the influence of comfort food on consumer spending or a mere quirk of statistical fate, the buttery trail of evidence leads us to ponder the tantalizing interplay between seemingly unrelated aspects of our lives.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study has churned up some truly gouda findings regarding the relationship between butter consumption and the stock price of Dollar Tree (DLTR). The creamy correlation coefficient of 0.9424113 seems to suggest that as butter consumption increases, so does the stock price of Dollar Tree, leaving us spread-eagled with surprise at the buttery influence on financial markets.

The robust r-squared value of 0.8881391 serves as a hearty testament to the substantial impact of butter on Dollar Tree's stock price. It seems that when it comes to market fluctuations, butter may truly be the unsung hero, providing a luscious layer of predictability to stock performance.

Additionally, the p-value of less than 0.01 has us as convinced as a lactose-intolerant person avoiding the dairy aisle that there is indeed a significant relationship between butter consumption and Dollar Tree's stock price. The likelihood of such a strong correlation occurring by chance is about as rare as finding a dollar-fifty tree in the middle of the forest.

Our scatterplot in Figure 1 not only showcases the close relationship between butter consumption and Dollar Tree's stock price but also serves as a compelling reminder that even the unlikeliest duos can yield remarkable results. Much like a balanced toast with a perfect spread of butter, the alignment between consumer dietary habits and stock market performance is truly a sight to behold.

Ultimately, our study leaves us buttered up with excitement and eager for future research to explore the utterly butterly connection between consumer palates and stock market behavior. As compelling as this topic may be, we dare say that no more research is needed in this area. As the saying goes, "let's not milk this butter for all it's worth!"

In butter we trust, and in the butter-stock relationship, we bid adieu!

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Culinary Economics and Financial Indulgence

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Gastronomic Economics and Financial Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price with an abstract of The relationship between dietary habits and financial markets is often overlooked, yet may hold a kernel of truth in understanding consumer behavior and its impact on stock performance. This study delves into the eyebrow-raising association between butter consumption and the stock price of Dollar Tree (DLTR), a company known for fetching great deals. Employing data from the USDA and LSEG Analytics (Refinitiv), our findings reveal a remarkably high correlation coefficient of 0.9424113 and a statistically significant p-value of less than 0.01 for the period spanning from 2002 to 2021. Could it be that the path to financial prosperity is slicked with butter? This study leaves us churned with curiosity and brimming with anticipation for future investigations into the utterly butterly relationship between consumer palates and stock market trends.

ChatGPT:

butter consumption, dietary habits, financial markets, stock price, Dollar Tree, DLTR, consumer behavior, stock performance, USDA data, LSEG Analytics, correlation coefficient, p-value, 2002-2021 period

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Butter consumptionDetailed data title: Per capita consumption of Butter in the US

Source: USDA

See what else correlates with Butter consumption

Dollar Tree's stock price (DLTR)

Detailed data title: Opening price of Dollar Tree (DLTR) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Dollar Tree's stock price (DLTR)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8881391 (Coefficient of determination)

This means 88.8% of the change in the one variable (i.e., Dollar Tree's stock price (DLTR)) is predictable based on the change in the other (i.e., Butter consumption) over the 20 years from 2002 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 5.4E-10. 0.0000000005363440888109558000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.94 in 5.4E-8% of random cases. Said differently, if you correlated 1,864,474,730 random variables You don't actually need 1 billion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 19 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 19 because we have two variables measured over a period of 20 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.86, 0.98 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Butter consumption (Pounds per person) | 4.4 | 4.5 | 4.5 | 4.5 | 4.7 | 4.7 | 5 | 5 | 4.9 | 5.4 | 5.5 | 5.5 | 5.5 | 5.6 | 5.7 | 5.7 | 6 | 6.2 | 6.3 | 6.5 |

| Dollar Tree's stock price (DLTR) (Stock price) | 10.33 | 8.17 | 10.07 | 9.68 | 7.99 | 10.12 | 8.64 | 13.97 | 16.18 | 28.33 | 42.2 | 41.07 | 55.99 | 70.94 | 76.84 | 77.57 | 107.99 | 89.8 | 94.69 | 107.63 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([4.4,4.5,4.5,4.5,4.7,4.7,5,5,4.9,5.4,5.5,5.5,5.5,5.6,5.7,5.7,6,6.2,6.3,6.5,])

array_2 = np.array([10.33,8.17,10.07,9.68,7.99,10.12,8.64,13.97,16.18,28.33,42.2,41.07,55.99,70.94,76.84,77.57,107.99,89.8,94.69,107.63,])

array_1_name = "Butter consumption"

array_2_name = "Dollar Tree's stock price (DLTR)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Butter consumption

- Line chart for only Dollar Tree's stock price (DLTR)

- AI-generated correlation image

- The spurious research paper: Spreading the Bread: The Mellow Drama of Butter Consumption and Dollar Tree’s Stock Price

Hats off to you for rating!

Correlation ID: 2940 · Black Variable ID: 557 · Red Variable ID: 1870