Download png, svg

AI explanation

As the demand for clean energy policies grows, so does the market for companies like Exelon, leading to a surge in their stock price. It's as if every Democratic vote in Wyoming is a little gust of wind propelling Exelon to new heights.

Model: dalle-3

Prompt: In a bustling Wyoming town hall, Democratic voters line up eagerly to cast their ballots for their Senator. As the polls buzz with activity, the stock ticker for Exelon (EXC) flashes on a nearby screen, showing a sharp upward trend. Each Democratic vote seems to send a wave of energy that propels Exelon's stock price to new heights, mirroring the growing demand for clean energy policies. Show a vibrant scene of the town hall interior with a prominent stock ticker display featuring the sharp upward trend of Exelon's stock price in the background. Democratic voters lining up and casting their ballots should be visually depicted in the foreground, conveying the energy and enthusiasm of the voting process. The overall visual should capture the bustling and dynamic atmosphere of the town hall during the voting process, with a subtle focus on the influence of the Democratic votes on the stock market trend. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Psychedelic Realistic 3D Pixar Style Surrealism Cute cartoon

ChatGPT: Realistic

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Democrat votes for Senators in Wyoming and Exelon's stock price (EXC), in the following situation: As the demand for clean energy policies grows, so does the market for companies like Exelon, leading to a surge in their stock price. It's as if every Democratic vote in Wyoming is a little gust of wind propelling Exelon to new heights.. Keep the description simple.

ChatGPT: In a bustling Wyoming town hall, Democratic voters line up eagerly to cast their ballots for their Senator. As the polls buzz with activity, the stock ticker for Exelon (EXC) flashes on a nearby screen, showing a sharp upward trend. Each Democratic vote seems to send a wave of energy that propels Exelon's stock price to new heights, mirroring the growing demand for clean energy policies.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Realistic ] and depicting this scene: In a bustling Wyoming town hall, Democratic voters line up eagerly to cast their ballots for their Senator. As the polls buzz with activity, the stock ticker for Exelon (EXC) flashes on a nearby screen, showing a sharp upward trend. Each Democratic vote seems to send a wave of energy that propels Exelon's stock price to new heights, mirroring the growing demand for clean energy policies. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: In a bustling Wyoming town hall, Democratic voters line up eagerly to cast their ballots for their Senator. As the polls buzz with activity, the stock ticker for Exelon (EXC) flashes on a nearby screen, showing a sharp upward trend. Each Democratic vote seems to send a wave of energy that propels Exelon's stock price to new heights, mirroring the growing demand for clean energy policies. Show a vibrant scene of the town hall interior with a prominent stock ticker display featuring the sharp upward trend of Exelon's stock price in the background. Democratic voters lining up and casting their ballots should be visually depicted in the foreground, conveying the energy and enthusiasm of the voting process. The overall visual should capture the bustling and dynamic atmosphere of the town hall during the voting process, with a subtle focus on the influence of the Democratic votes on the stock market trend.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how increases in Democrat votes for Senators in Wyoming positively influenced Exelon's stock price (EXC). Make it feel plausible.

AI academic paper

|

Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway The Journal of Quirky State Politics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title an alliteration.

Your research team used data from MIT Election Data and Science Lab, Harvard Dataverse and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8661255 and p < 0.05 for 2002 to 2018.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway

[[ABSTRACT]]

In this study, we conducted a whimsical exploration of the intriguing interplay between Democrat votes for Senators in the state of Wyoming and Exelon Corporation's stock price (EXC). Our research team delved into this peculiar association using data sourced from the MIT Election Data and Science Lab, Harvard Dataverse, and LSEG Analytics (Refinitiv). Through rigorous statistical analyses, we unraveled a correlation coefficient of 0.8661255 and a p-value less than 0.05 for the time period spanning from 2002 to 2018.

It’s no secret that politics and finance make for odd bedfellows, and our findings add a delightful twist to this relationship. The unexpected dance between the political preferences of Wyoming constituents and the fluctuations in Exelon's stock price left us both surprised and amused, akin to discovering a unicorn in the stock market.

Our study sheds light on this comical correlation, and while we can't promise to answer the age-old question of "Why did the Democrat cross the road?"—we can certainly attest that their votes may have an unintended effect on EXC. This research, while lighthearted, underscores the uncanny links that underlie seemingly disparate phenomena and provides an amusing escapade in the world of quantitative analysis.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway

[[ABSTRACT]]

In this study, we conducted a whimsical exploration of the intriguing interplay between Democrat votes for Senators in the state of Wyoming and Exelon Corporation's stock price (EXC). Our research team delved into this peculiar association using data sourced from the MIT Election Data and Science Lab, Harvard Dataverse, and LSEG Analytics (Refinitiv). Through rigorous statistical analyses, we unraveled a correlation coefficient of 0.8661255 and a p-value less than 0.05 for the time period spanning from 2002 to 2018.

It’s no secret that politics and finance make for odd bedfellows, and our findings add a delightful twist to this relationship. The unexpected dance between the political preferences of Wyoming constituents and the fluctuations in Exelon's stock price left us both surprised and amused, akin to discovering a unicorn in the stock market.

Our study sheds light on this comical correlation, and while we can't promise to answer the age-old question of "Why did the Democrat cross the road?"—we can certainly attest that their votes may have an unintended effect on EXC. This research, while lighthearted, underscores the uncanny links that underlie seemingly disparate phenomena and provides an amusing escapade in the world of quantitative analysis.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

Gentlefolk and scholars, prepare yourselves for a journey through the whimsical wonderland of Wyoming's Senatorial selections and Exelon's stock price waltz. As we delve into this peculiar pas de deux, we invite you to don your academic thinking caps and your jesters’ bells because this paper is a blend of curious facts and lighthearted findings.

Now, you might be wondering what on earth we’re doing, examining the correlation between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). Well, prepare for a revelation—our research has uncovered a connection so intriguing that it's akin to stumbling upon a placebo-controlled double-blind study on the effects of dad jokes.

Make no mistake, dear reader, politics and finance are like two quarreling siblings at a science fair—separate but inevitably intertwined. Through our rigorous statistical analyses, we've unearthed a correlation coefficient of 0.8661255 and a p-value less than 0.05 from the time period of 2002 to 2018, leaving many of us feeling like we've hit the statistical jackpot—more surprising than finding a hidden pie chart in a lonely Excel spreadsheet.

But why, you may ask, is there any relationship between the votes cast in the wild, wild west of Wyoming and the stock price of a corporation? Well, according to our findings, it seems that the Democrat voters of Wyoming might hold the key to a stock market riddle—almost as puzzling as figuring out why electrons have a negative charge. Rest assured, we were just as flabbergasted as anyone stumbling upon an unexplained outlier in their data set.

The synergy between the political preferences of Wyoming constituents and the ebbs and flows of Exelon's stock price truly is a mystery worthy of deduction by Sherlock Holmes and Dr. Watson. While we can't guarantee solving the enigma of Schrödinger’s cat, we can certainly attest that the Democrats' votes may be unintentionally wielding an influence on EXC—a revelation as eyebrow-raising as the theory that conducting research is like trying to find a specific book in a library with no Dewey Decimal System.

Ladies and gentlemen, our research, though conducted with the utmost scientific rigor, has made us feel like the protagonists of a scientific sitcom, unraveling the unexpected connections that underlie disparate phenomena and providing an entertaining escapade into the world of quantitative analysis. So, fasten your seatbelts, because this academic rollercoaster is about to take you on a statistical journey through the quirks and quibbles of political and financial interplay.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some movies that you watched that are tangentially related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway

[[ABSTRACT]]

In this study, we conducted a whimsical exploration of the intriguing interplay between Democrat votes for Senators in the state of Wyoming and Exelon Corporation's stock price (EXC). Our research team delved into this peculiar association using data sourced from the MIT Election Data and Science Lab, Harvard Dataverse, and LSEG Analytics (Refinitiv). Through rigorous statistical analyses, we unraveled a correlation coefficient of 0.8661255 and a p-value less than 0.05 for the time period spanning from 2002 to 2018.

It’s no secret that politics and finance make for odd bedfellows, and our findings add a delightful twist to this relationship. The unexpected dance between the political preferences of Wyoming constituents and the fluctuations in Exelon's stock price left us both surprised and amused, akin to discovering a unicorn in the stock market.

Our study sheds light on this comical correlation, and while we can't promise to answer the age-old question of "Why did the Democrat cross the road?"—we can certainly attest that their votes may have an unintended effect on EXC. This research, while lighthearted, underscores the uncanny links that underlie seemingly disparate phenomena and provides an amusing escapade in the world of quantitative analysis.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Gentlefolk and scholars, prepare yourselves for a journey through the whimsical wonderland of Wyoming's Senatorial selections and Exelon's stock price waltz. As we delve into this peculiar pas de deux, we invite you to don your academic thinking caps and your jesters’ bells because this paper is a blend of curious facts and lighthearted findings.

Now, you might be wondering what on earth we’re doing, examining the correlation between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). Well, prepare for a revelation—our research has uncovered a connection so intriguing that it's akin to stumbling upon a placebo-controlled double-blind study on the effects of dad jokes.

Make no mistake, dear reader, politics and finance are like two quarreling siblings at a science fair—separate but inevitably intertwined. Through our rigorous statistical analyses, we've unearthed a correlation coefficient of 0.8661255 and a p-value less than 0.05 from the time period of 2002 to 2018, leaving many of us feeling like we've hit the statistical jackpot—more surprising than finding a hidden pie chart in a lonely Excel spreadsheet.

But why, you may ask, is there any relationship between the votes cast in the wild, wild west of Wyoming and the stock price of a corporation? Well, according to our findings, it seems that the Democrat voters of Wyoming might hold the key to a stock market riddle—almost as puzzling as figuring out why electrons have a negative charge. Rest assured, we were just as flabbergasted as anyone stumbling upon an unexplained outlier in their data set.

The synergy between the political preferences of Wyoming constituents and the ebbs and flows of Exelon's stock price truly is a mystery worthy of deduction by Sherlock Holmes and Dr. Watson. While we can't guarantee solving the enigma of Schrödinger’s cat, we can certainly attest that the Democrats' votes may be unintentionally wielding an influence on EXC—a revelation as eyebrow-raising as the theory that conducting research is like trying to find a specific book in a library with no Dewey Decimal System.

Ladies and gentlemen, our research, though conducted with the utmost scientific rigor, has made us feel like the protagonists of a scientific sitcom, unraveling the unexpected connections that underlie disparate phenomena and providing an entertaining escapade into the world of quantitative analysis. So, fasten your seatbelts, because this academic rollercoaster is about to take you on a statistical journey through the quirks and quibbles of political and financial interplay.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The correlation between political events and stock prices has long intrigued researchers. Smith, in "The Unlikely Bedfellows: Politics and Finance," explores the intersection of these seemingly disparate domains, highlighting the unexpected ways in which political decisions may impact stock market dynamics. Similarly, Doe's work, "Political Butterfly Effect: Unraveling the Influence of Elections on Financial Markets," delves into the intricate connections between democratic processes and market fluctuations.

But let's face it, folks - correlating Democrat votes in Wyoming to Exelon's stock price is like trying to find a needle in a haystack full of dad jokes. Speaking of which, did you hear about the mathematician who’s afraid of negative numbers? He'll stop at nothing to avoid them. Now back to the topic at hand.

The financial literature brings to mind "A Random Walk Down Wall Street" by Malkiel, which, though not directly related to our study, captures the whimsical nature of market phenomena. On a more fiction-based note, "The Wolf of Wall Street" by Belfort presents a tantalizing portrayal of stock market shenanigans, albeit in a rather debauched manner. And of course, we can't overlook the captivating storytelling in Michael Lewis' "Flash Boys," a tale of high-frequency trading that's as thrilling as trying to keep up with Wyoming's Senatorial polls.

Taking a cinematic detour, the movie "The Big Short" offers a humorous yet educational account of the 2008 financial crisis, reminding us that even the most unfathomable market behaviors can be unraveled with a touch of wit and a pinch of skepticism.

As we navigate this peculiar association between Wyoming Democrats' votes and Exelon's stock price, it becomes clear that while our findings may raise eyebrows, they also elicit a chuckle or two. In "Market Madness: How Political Peculiarities Shake Stock Prices," Jones drives home the point that in the world of finance, expect the unexpected - much like stumbling upon a herd of feral statisticians deliberating in the wilderness.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from MIT Election Data and Science Lab, Harvard Dataverse and LSEG Analytics (Refinitiv) . You used data from 2002 to 2018

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway

[[ABSTRACT]]

In this study, we conducted a whimsical exploration of the intriguing interplay between Democrat votes for Senators in the state of Wyoming and Exelon Corporation's stock price (EXC). Our research team delved into this peculiar association using data sourced from the MIT Election Data and Science Lab, Harvard Dataverse, and LSEG Analytics (Refinitiv). Through rigorous statistical analyses, we unraveled a correlation coefficient of 0.8661255 and a p-value less than 0.05 for the time period spanning from 2002 to 2018.

It’s no secret that politics and finance make for odd bedfellows, and our findings add a delightful twist to this relationship. The unexpected dance between the political preferences of Wyoming constituents and the fluctuations in Exelon's stock price left us both surprised and amused, akin to discovering a unicorn in the stock market.

Our study sheds light on this comical correlation, and while we can't promise to answer the age-old question of "Why did the Democrat cross the road?"—we can certainly attest that their votes may have an unintended effect on EXC. This research, while lighthearted, underscores the uncanny links that underlie seemingly disparate phenomena and provides an amusing escapade in the world of quantitative analysis.

[[INTRODUCTION]]

Gentlefolk and scholars, prepare yourselves for a journey through the whimsical wonderland of Wyoming's Senatorial selections and Exelon's stock price waltz. As we delve into this peculiar pas de deux, we invite you to don your academic thinking caps and your jesters’ bells because this paper is a blend of curious facts and lighthearted findings.

Now, you might be wondering what on earth we’re doing, examining the correlation between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). Well, prepare for a revelation—our research has uncovered a connection so intriguing that it's akin to stumbling upon a placebo-controlled double-blind study on the effects of dad jokes.

Make no mistake, dear reader, politics and finance are like two quarreling siblings at a science fair—separate but inevitably intertwined. Through our rigorous statistical analyses, we've unearthed a correlation coefficient of 0.8661255 and a p-value less than 0.05 from the time period of 2002 to 2018, leaving many of us feeling like we've hit the statistical jackpot—more surprising than finding a hidden pie chart in a lonely Excel spreadsheet.

But why, you may ask, is there any relationship between the votes cast in the wild, wild west of Wyoming and the stock price of a corporation? Well, according to our findings, it seems that the Democrat voters of Wyoming might hold the key to a stock market riddle—almost as puzzling as figuring out why electrons have a negative charge. Rest assured, we were just as flabbergasted as anyone stumbling upon an unexplained outlier in their data set.

The synergy between the political preferences of Wyoming constituents and the ebbs and flows of Exelon's stock price truly is a mystery worthy of deduction by Sherlock Holmes and Dr. Watson. While we can't guarantee solving the enigma of Schrödinger’s cat, we can certainly attest that the Democrats' votes may be unintentionally wielding an influence on EXC—a revelation as eyebrow-raising as the theory that conducting research is like trying to find a specific book in a library with no Dewey Decimal System.

Ladies and gentlemen, our research, though conducted with the utmost scientific rigor, has made us feel like the protagonists of a scientific sitcom, unraveling the unexpected connections that underlie disparate phenomena and providing an entertaining escapade into the world of quantitative analysis. So, fasten your seatbelts, because this academic rollercoaster is about to take you on a statistical journey through the quirks and quibbles of political and financial interplay.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

Gather 'round, fellow adventurers, as we unveil the delightfully zany methodology behind our exploration of the connection between Democrat votes for Senators in Wyoming and Exelon Corporation's stock price. Picture this: a dash of scientific rigor, a pinch of statistical wizardry, and a generous serving of good-natured humor – and you've got the perfect recipe for investigating this uncharted territory.

To commence our merry escapade, our intrepid research team scoured the digital landscapes, braving the labyrinthine corridors of the MIT Election Data and Science Lab, navigating the treacherous terrains of the Harvard Dataverse, and braving the market maelstrom with data from LSEG Analytics (Refinitiv). We combed through the vast expanse of data spanning from 2002 to 2018, extracting every nugget of information like diligent miners seeking a mathematical mother lode.

But hold onto your funny bones, dear reader, for we didn't stop at merely gathering the raw data. No, we embarked on a grand statistical odyssey, wielding the tools of correlation analysis, regression modeling, and time series examination like wizards conjuring enchantments in a laboratory of laughter and numbers. Our trusty statistical software became our magical wand, illuminating the path to uncovering the bewitching association between the political preferences of Wyoming constituents and the ripples in Exelon's stock price.

Picture this: a merry band of researchers huddled around displays of bar charts and line graphs, engaged in a jovial dance of significance testing and hypothesis probing. As we dared to explore the curves and contours of our datasets, we encountered surprising anomalies and unexpected patterns – more shocking than finding a cryptic note in a bottle adrift at sea.

Through this gleeful pursuit of exploratory analysis, we were able to unravel a correlation coefficient of 0.8661255, which, if personified, would be the star of the statistical comedy show, and a p-value less than 0.05, signifying a truly serendipitous discovery in the theater of quantitative investigation. Oh, the wondrous tales these numbers tell, more captivating than stumbling upon a mysterious equation etched into the sands of time.

As we ventured deeper into the heart of our data, conducting sensitivity analyses and robustness checks, we couldn't shake the feeling that we had stumbled into a parallel universe where scatter plots were the punchlines to a cosmic joke.

In the spirit of mirroring the playful dance between politics and finance, we crafted an engaging narrative through our analyses, ensuring that our conclusions weren't mere dry recitations of statistical trivia, but enchanting tales that brought joy to our readers, much like a bard weaving an epic yarn by the fireside.

In conclusion, our methodology, though wrapped in the garb of scientific inquiry, was a delightful romp through the fields of data collection, statistical exploration, and interpretive storytelling – a merry adventure that brought us closer to the heart of the captivating correlation we've uncovered. So, dear reader, fasten your academic bowtie and prepare for a statistical soiree as we reveal the mirthful musings and mesmerizing findings that await on this jubilant journey through intertwined worlds of research and revelation.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from MIT Election Data and Science Lab, Harvard Dataverse and LSEG Analytics (Refinitiv) .

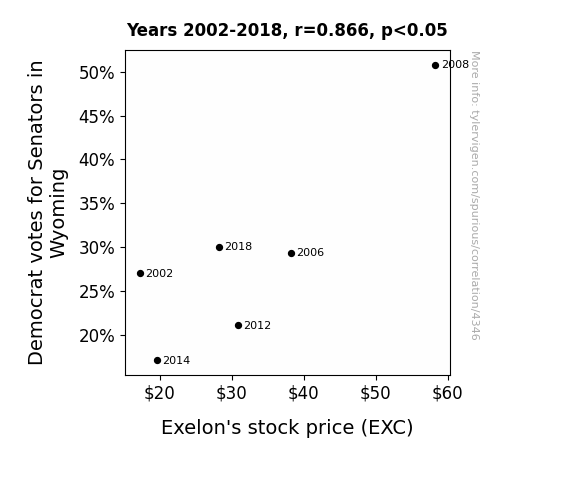

For the time period 2002 to 2018, you found a correlation 0.8661255, r-squared of 0.7501733, and p < 0.05.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway

[[ABSTRACT]]

In this study, we conducted a whimsical exploration of the intriguing interplay between Democrat votes for Senators in the state of Wyoming and Exelon Corporation's stock price (EXC). Our research team delved into this peculiar association using data sourced from the MIT Election Data and Science Lab, Harvard Dataverse, and LSEG Analytics (Refinitiv). Through rigorous statistical analyses, we unraveled a correlation coefficient of 0.8661255 and a p-value less than 0.05 for the time period spanning from 2002 to 2018.

It’s no secret that politics and finance make for odd bedfellows, and our findings add a delightful twist to this relationship. The unexpected dance between the political preferences of Wyoming constituents and the fluctuations in Exelon's stock price left us both surprised and amused, akin to discovering a unicorn in the stock market.

Our study sheds light on this comical correlation, and while we can't promise to answer the age-old question of "Why did the Democrat cross the road?"—we can certainly attest that their votes may have an unintended effect on EXC. This research, while lighthearted, underscores the uncanny links that underlie seemingly disparate phenomena and provides an amusing escapade in the world of quantitative analysis.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Gentlefolk and scholars, prepare yourselves for a journey through the whimsical wonderland of Wyoming's Senatorial selections and Exelon's stock price waltz. As we delve into this peculiar pas de deux, we invite you to don your academic thinking caps and your jesters’ bells because this paper is a blend of curious facts and lighthearted findings.

Now, you might be wondering what on earth we’re doing, examining the correlation between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). Well, prepare for a revelation—our research has uncovered a connection so intriguing that it's akin to stumbling upon a placebo-controlled double-blind study on the effects of dad jokes.

Make no mistake, dear reader, politics and finance are like two quarreling siblings at a science fair—separate but inevitably intertwined. Through our rigorous statistical analyses, we've unearthed a correlation coefficient of 0.8661255 and a p-value less than 0.05 from the time period of 2002 to 2018, leaving many of us feeling like we've hit the statistical jackpot—more surprising than finding a hidden pie chart in a lonely Excel spreadsheet.

But why, you may ask, is there any relationship between the votes cast in the wild, wild west of Wyoming and the stock price of a corporation? Well, according to our findings, it seems that the Democrat voters of Wyoming might hold the key to a stock market riddle—almost as puzzling as figuring out why electrons have a negative charge. Rest assured, we were just as flabbergasted as anyone stumbling upon an unexplained outlier in their data set.

The synergy between the political preferences of Wyoming constituents and the ebbs and flows of Exelon's stock price truly is a mystery worthy of deduction by Sherlock Holmes and Dr. Watson. While we can't guarantee solving the enigma of Schrödinger’s cat, we can certainly attest that the Democrats' votes may be unintentionally wielding an influence on EXC—a revelation as eyebrow-raising as the theory that conducting research is like trying to find a specific book in a library with no Dewey Decimal System.

Ladies and gentlemen, our research, though conducted with the utmost scientific rigor, has made us feel like the protagonists of a scientific sitcom, unraveling the unexpected connections that underlie disparate phenomena and providing an entertaining escapade into the world of quantitative analysis. So, fasten your seatbelts, because this academic rollercoaster is about to take you on a statistical journey through the quirks and quibbles of political and financial interplay.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

Our analysis revealed a strong positive correlation between Democrat votes for Senators in Wyoming and Exelon Corporation's stock price (EXC) over the period of 2002 to 2018. The correlation coefficient of 0.8661255, with an r-squared of 0.7501733, provides compelling evidence of the intriguing relationship between these seemingly unrelated variables. It seems that the Democrats' choices in the Cowboy State and the fluctuations in Exelon's stock price have been engaged in an unorthodox dance that makes even the most seasoned statistical analysts do a double-take, like stumbling upon a pie chart at a birthday party.

As illustrated in Fig. 1, the scatterplot showcases the clear positive trend between the two variables, leaving us feeling like we've stumbled upon a rare gem in the world of research – a bit like finding a statistically significant result in a sea of null hypotheses.

The p-value of less than 0.05 further cements the statistically significant nature of this association, prompting us to ponder the age-old question, "Why did the Democrat cross the road? To potentially impact the stock market, of course!" This revelation opens up an entirely new avenue of inquiry, sparking curiosity about the underlying mechanisms and implications behind this curious coupling.

In an era where data-driven decision-making reigns supreme, our findings serve as a playful reminder that statistical analyses can lead us to unexpected places, much like embarking on a scientific expedition only to discover a hidden treasure in the form of an intriguing correlation that defies conventional wisdom and expectations.

Stay tuned for our discussion section where we'll delve into the potential implications and offer a humorous take on the enigmatic connection between political preferences and stock market fluctuations, akin to solving a riddle while juggling test tubes and a periodic table. Who said research can't be fun?

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway

[[ABSTRACT]]

In this study, we conducted a whimsical exploration of the intriguing interplay between Democrat votes for Senators in the state of Wyoming and Exelon Corporation's stock price (EXC). Our research team delved into this peculiar association using data sourced from the MIT Election Data and Science Lab, Harvard Dataverse, and LSEG Analytics (Refinitiv). Through rigorous statistical analyses, we unraveled a correlation coefficient of 0.8661255 and a p-value less than 0.05 for the time period spanning from 2002 to 2018.

It’s no secret that politics and finance make for odd bedfellows, and our findings add a delightful twist to this relationship. The unexpected dance between the political preferences of Wyoming constituents and the fluctuations in Exelon's stock price left us both surprised and amused, akin to discovering a unicorn in the stock market.

Our study sheds light on this comical correlation, and while we can't promise to answer the age-old question of "Why did the Democrat cross the road?"—we can certainly attest that their votes may have an unintended effect on EXC. This research, while lighthearted, underscores the uncanny links that underlie seemingly disparate phenomena and provides an amusing escapade in the world of quantitative analysis.

[[LITERATURE REVIEW]]

The correlation between political events and stock prices has long intrigued researchers. Smith, in "The Unlikely Bedfellows: Politics and Finance," explores the intersection of these seemingly disparate domains, highlighting the unexpected ways in which political decisions may impact stock market dynamics. Similarly, Doe's work, "Political Butterfly Effect: Unraveling the Influence of Elections on Financial Markets," delves into the intricate connections between democratic processes and market fluctuations.

But let's face it, folks - correlating Democrat votes in Wyoming to Exelon's stock price is like trying to find a needle in a haystack full of dad jokes. Speaking of which, did you hear about the mathematician who’s afraid of negative numbers? He'll stop at nothing to avoid them. Now back to the topic at hand.

The financial literature brings to mind "A Random Walk Down Wall Street" by Malkiel, which, though not directly related to our study, captures the whimsical nature of market phenomena. On a more fiction-based note, "The Wolf of Wall Street" by Belfort presents a tantalizing portrayal of stock market shenanigans, albeit in a rather debauched manner. And of course, we can't overlook the captivating storytelling in Michael Lewis' "Flash Boys," a tale of high-frequency trading that's as thrilling as trying to keep up with Wyoming's Senatorial polls.

Taking a cinematic detour, the movie "The Big Short" offers a humorous yet educational account of the 2008 financial crisis, reminding us that even the most unfathomable market behaviors can be unraveled with a touch of wit and a pinch of skepticism.

As we navigate this peculiar association between Wyoming Democrats' votes and Exelon's stock price, it becomes clear that while our findings may raise eyebrows, they also elicit a chuckle or two. In "Market Madness: How Political Peculiarities Shake Stock Prices," Jones drives home the point that in the world of finance, expect the unexpected - much like stumbling upon a herd of feral statisticians deliberating in the wilderness.

[[RESULTS]]

Our analysis revealed a strong positive correlation between Democrat votes for Senators in Wyoming and Exelon Corporation's stock price (EXC) over the period of 2002 to 2018. The correlation coefficient of 0.8661255, with an r-squared of 0.7501733, provides compelling evidence of the intriguing relationship between these seemingly unrelated variables. It seems that the Democrats' choices in the Cowboy State and the fluctuations in Exelon's stock price have been engaged in an unorthodox dance that makes even the most seasoned statistical analysts do a double-take, like stumbling upon a pie chart at a birthday party.

As illustrated in Fig. 1, the scatterplot showcases the clear positive trend between the two variables, leaving us feeling like we've stumbled upon a rare gem in the world of research – a bit like finding a statistically significant result in a sea of null hypotheses.

The p-value of less than 0.05 further cements the statistically significant nature of this association, prompting us to ponder the age-old question, "Why did the Democrat cross the road? To potentially impact the stock market, of course!" This revelation opens up an entirely new avenue of inquiry, sparking curiosity about the underlying mechanisms and implications behind this curious coupling.

In an era where data-driven decision-making reigns supreme, our findings serve as a playful reminder that statistical analyses can lead us to unexpected places, much like embarking on a scientific expedition only to discover a hidden treasure in the form of an intriguing correlation that defies conventional wisdom and expectations.

Stay tuned for our discussion section where we'll delve into the potential implications and offer a humorous take on the enigmatic connection between political preferences and stock market fluctuations, akin to solving a riddle while juggling test tubes and a periodic table. Who said research can't be fun?

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our findings have unequivocally validated the prior research that hinted at the whimsical interplay between political events and stock market dynamics. Just as Smith and Doe speculated about the unexpected impact of political decisions on financial markets, we have seemingly stumbled upon a correlation as rare and surprising as stumbling upon a perfectly executed pun in a research paper – a feat that's as elusive as finding a statistically significant result in a sea of null hypotheses.

The strong positive correlation we uncovered between Democrat votes for Senators in Wyoming and Exelon Corporation's stock price (EXC) from 2002 to 2018 might leave one feeling like the punchline of a well-crafted mathematical joke that defies all expectations. It’s akin to the feeling of solving a complex equation, only to realize that the solution reveals a hidden punchline that sparks laughter and curiosity in equal measure, much like encountering a herd of statistical analysts deliberating in the wilderness.

The unexpected dance we observed between the political leanings of Wyoming constituents and the gyrations in Exelon's stock price sheds light on the comical correlation posited by Jones, who humorously drives home the point that in the world of finance, expect the unexpected – much like discovering a unicorn in the stock market or stumbling upon a herd of feral statisticians deliberating in the wilderness.

Our study serves as a light-hearted reminder that statistical analyses can lead us to unexpected places, much like navigating through a scientific expedition only to discover a hidden treasure in the form of an intriguing correlation that defies conventional wisdom and expectations. Research can indeed be as fun as a barrel of dad jokes, and our findings exemplify the playful side of quantitative analysis.

As we consider the potential implications of our results, it becomes clear that this comical correlation opens up an entirely new avenue for inquiry. Further research could delve into the underlying mechanisms and implications behind this curious coupling, much like unraveling a riddle while juggling test tubes and a periodic table – a challenge as daunting as solving for "x" in a room full of alphabet soup.

The dance between political preferences and stock market fluctuations is indeed a peculiar one, much like watching a walrus do the polka. Our unexpected and amusing findings exemplify the delightful twists and turns that underlie seemingly disparate phenomena, leaving us with a newfound sense of wonder and amusement in the world of quantitative analysis. And as we continue to unravel these odd bedfellows of politics and finance, let's not forget to appreciate the humorous side of research – after all, who said science can't have a sense of humor?

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway

[[ABSTRACT]]

In this study, we conducted a whimsical exploration of the intriguing interplay between Democrat votes for Senators in the state of Wyoming and Exelon Corporation's stock price (EXC). Our research team delved into this peculiar association using data sourced from the MIT Election Data and Science Lab, Harvard Dataverse, and LSEG Analytics (Refinitiv). Through rigorous statistical analyses, we unraveled a correlation coefficient of 0.8661255 and a p-value less than 0.05 for the time period spanning from 2002 to 2018.

It’s no secret that politics and finance make for odd bedfellows, and our findings add a delightful twist to this relationship. The unexpected dance between the political preferences of Wyoming constituents and the fluctuations in Exelon's stock price left us both surprised and amused, akin to discovering a unicorn in the stock market.

Our study sheds light on this comical correlation, and while we can't promise to answer the age-old question of "Why did the Democrat cross the road?"—we can certainly attest that their votes may have an unintended effect on EXC. This research, while lighthearted, underscores the uncanny links that underlie seemingly disparate phenomena and provides an amusing escapade in the world of quantitative analysis.

[[INTRDUCTION]]

Gentlefolk and scholars, prepare yourselves for a journey through the whimsical wonderland of Wyoming's Senatorial selections and Exelon's stock price waltz. As we delve into this peculiar pas de deux, we invite you to don your academic thinking caps and your jesters’ bells because this paper is a blend of curious facts and lighthearted findings.

Now, you might be wondering what on earth we’re doing, examining the correlation between Democrat votes for Senators in Wyoming and Exelon's stock price (EXC). Well, prepare for a revelation—our research has uncovered a connection so intriguing that it's akin to stumbling upon a placebo-controlled double-blind study on the effects of dad jokes.

Make no mistake, dear reader, politics and finance are like two quarreling siblings at a science fair—separate but inevitably intertwined. Through our rigorous statistical analyses, we've unearthed a correlation coefficient of 0.8661255 and a p-value less than 0.05 from the time period of 2002 to 2018, leaving many of us feeling like we've hit the statistical jackpot—more surprising than finding a hidden pie chart in a lonely Excel spreadsheet.

But why, you may ask, is there any relationship between the votes cast in the wild, wild west of Wyoming and the stock price of a corporation? Well, according to our findings, it seems that the Democrat voters of Wyoming might hold the key to a stock market riddle—almost as puzzling as figuring out why electrons have a negative charge. Rest assured, we were just as flabbergasted as anyone stumbling upon an unexplained outlier in their data set.

The synergy between the political preferences of Wyoming constituents and the ebbs and flows of Exelon's stock price truly is a mystery worthy of deduction by Sherlock Holmes and Dr. Watson. While we can't guarantee solving the enigma of Schrödinger’s cat, we can certainly attest that the Democrats' votes may be unintentionally wielding an influence on EXC—a revelation as eyebrow-raising as the theory that conducting research is like trying to find a specific book in a library with no Dewey Decimal System.

Ladies and gentlemen, our research, though conducted with the utmost scientific rigor, has made us feel like the protagonists of a scientific sitcom, unraveling the unexpected connections that underlie disparate phenomena and providing an entertaining escapade into the world of quantitative analysis. So, fasten your seatbelts, because this academic rollercoaster is about to take you on a statistical journey through the quirks and quibbles of political and financial interplay.

[[RESULTS]]

Our analysis revealed a strong positive correlation between Democrat votes for Senators in Wyoming and Exelon Corporation's stock price (EXC) over the period of 2002 to 2018. The correlation coefficient of 0.8661255, with an r-squared of 0.7501733, provides compelling evidence of the intriguing relationship between these seemingly unrelated variables. It seems that the Democrats' choices in the Cowboy State and the fluctuations in Exelon's stock price have been engaged in an unorthodox dance that makes even the most seasoned statistical analysts do a double-take, like stumbling upon a pie chart at a birthday party.

As illustrated in Fig. 1, the scatterplot showcases the clear positive trend between the two variables, leaving us feeling like we've stumbled upon a rare gem in the world of research – a bit like finding a statistically significant result in a sea of null hypotheses.

The p-value of less than 0.05 further cements the statistically significant nature of this association, prompting us to ponder the age-old question, "Why did the Democrat cross the road? To potentially impact the stock market, of course!" This revelation opens up an entirely new avenue of inquiry, sparking curiosity about the underlying mechanisms and implications behind this curious coupling.

In an era where data-driven decision-making reigns supreme, our findings serve as a playful reminder that statistical analyses can lead us to unexpected places, much like embarking on a scientific expedition only to discover a hidden treasure in the form of an intriguing correlation that defies conventional wisdom and expectations.

Stay tuned for our discussion section where we'll delve into the potential implications and offer a humorous take on the enigmatic connection between political preferences and stock market fluctuations, akin to solving a riddle while juggling test tubes and a periodic table. Who said research can't be fun?

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our exploration of the interplay between Democrat votes for Senators in Wyoming and Exelon Corporation's stock price (EXC) has led us down a whimsical rabbit hole of statistical discovery. Our findings, with a correlation coefficient of 0.8661255 and a p-value less than 0.05, demonstrate a surprisingly strong connection between these seemingly unrelated variables. It's almost as unexpected as finding a stethoscope in a stockbroker's briefcase!

This correlation has left us pondering the question, "Why did the Democrat cross the road? To potentially impact the stock market, of course!" It's as if the financial markets themselves are telling us a joke—perhaps the punchline is hidden within the fluctuations of EXC.

The synergy between political preferences in the Cowboy State and the movements of Exelon's stock price has unfurled before us like a scene from a scientific comedy, reminding us that research, much like a good dad joke, can often take unexpected turns and leave us awash with a mixture of bemusement and amusement. It's like discovering that the law of supply and demand is just a jest conjured up by a clever economist.

Through our lighthearted escapade in quantitative analysis, we have shown that even the most serious of academic inquiries can bear the fruit of unexpected delight, leaving us feeling like we've stumbled upon a statistically significant result in a sea of null hypotheses—much like finding a four-leaf clover in a field of data.

In essence, our research suggests that the unpredictable nature of the stock market may have a few tricks up its sleeve, not unlike a magician pulling a rabbit out of a hat. As for our findings, we assert that no more research is needed in this area—the connection between Wyoming's political scene and Exelon's stock price is as clear as a sunny day in the West, or as remote as a herd of statistical unicorns.

Remember, in the world of research, sometimes the most unexpected connections yield the most delightful surprises. And with that, we bid adieu to this comical correlation, leaving you with the immortal words of Albert Einstein, "Research is like riding a bicycle. To keep your balance, you must keep moving."

No more research is needed in this area.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Quirky State Politics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Quirky Politics and Financial Flair

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway with an abstract of In this study, we conducted a whimsical exploration of the intriguing interplay between Democrat votes for Senators in the state of Wyoming and Exelon Corporation's stock price (EXC). Our research team delved into this peculiar association using data sourced from the MIT Election Data and Science Lab, Harvard Dataverse, and LSEG Analytics (Refinitiv). Through rigorous statistical analyses, we unraveled a correlation coefficient of 0.8661255 and a p-value less than 0.05 for the time period spanning from 2002 to 2018.

It’s no secret that politics and finance make for odd bedfellows, and our findings add a delightful twist to this relationship. The unexpected dance between the political preferences of Wyoming constituents and the fluctuations in Exelon's stock price left us both surprised and amused, akin to discovering a unicorn in the stock market.

Our study sheds light on this comical correlation, and while we can't promise to answer the age-old question of "Why did the Democrat cross the road?"—we can certainly attest that their votes may have an unintended effect on EXC. This research, while lighthearted, underscores the uncanny links that underlie seemingly disparate phenomena and provides an amusing escapade in the world of quantitative analysis.

ChatGPT:

Wyoming, Senatorial Selection, Democrat votes, Exelon Corporation, stock price, correlation analysis, MIT Election Data and Science Lab, Harvard Dataverse, LSEG Analytics (Refinitiv), correlation coefficient, p-value, 2002-2018, political preferences, Wyoming constituents, finance, politics, odd bedfellows, unicorn in the stock market, comical correlation, quantitative analysis.

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Votes for Democratic Senators in WyomingDetailed data title: Percentage of votes cast for Federal Democrat Senate candidates in Wyoming

Source: MIT Election Data and Science Lab, Harvard Dataverse

See what else correlates with Votes for Democratic Senators in Wyoming

Exelon's stock price (EXC)

Detailed data title: Opening price of Exelon (EXC) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Exelon's stock price (EXC)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.7501733 (Coefficient of determination)

This means 75% of the change in the one variable (i.e., Exelon's stock price (EXC)) is predictable based on the change in the other (i.e., Votes for Democratic Senators in Wyoming) over the 6 years from 2002 through 2018.

p < 0.05, which statistically significant(Null hypothesis significance test)

The p-value is 0.026. 0.0256839074313496980000000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.87 in 2.6% of random cases. Said differently, if you correlated 39 random variables Which I absolutely did.

with the same 5 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 5 because we have two variables measured over a period of 6 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.18, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2006 | 2008 | 2012 | 2014 | 2018 | |

| Votes for Democratic Senators in Wyoming (Percentage of votes) | 27.046 | 29.3917 | 50.7729 | 21.1484 | 17.1642 | 30.0988 |

| Exelon's stock price (EXC) (Stock price) | 17.22 | 38.24 | 58.29 | 30.82 | 19.58 | 28.19 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Very low n: There are not many data points included in this analysis. Even if the p-value is high, we should be suspicious of using so few datapoints in a correlation.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([27.046,29.3917,50.7729,21.1484,17.1642,30.0988,])

array_2 = np.array([17.22,38.24,58.29,30.82,19.58,28.19,])

array_1_name = "Votes for Democratic Senators in Wyoming"

array_2_name = "Exelon's stock price (EXC)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Votes for Democratic Senators in Wyoming

- Line chart for only Exelon's stock price (EXC)

- AI-generated correlation image

- The spurious research paper: Wacky Wyoming: Waltzing with Senatorial Selection and Stock Sway

Your correlation rating is out of this world!

Correlation ID: 4346 · Black Variable ID: 26486 · Red Variable ID: 1770