Download png, svg

AI explanation

As the popularity of the name Josue waned, so did the tendency for people to J'osue stock in BP. The correlation is quite crude, but it seems that with fewer Josues around, there was less of a 'petrole-um' for BP's stock price to rely on. It's a 'slick' situation indeed!

Model: dalle-3

Prompt: [A photo-realistic image] Generate a scene of a busy city street filled with cars, all of which have personalized novelty license plates prominently displaying the name "Josue." Among the vehicles, include an eye-catching BP gas station sign indicating a significant increase in stock price. The scene should be clear and visually striking, capturing the bustling traffic and the prominent gas station sign. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Popularity of the first name Josue and BP's stock price (BP). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Cute cartoon Futuristic A photo-realistic image Celtic art Woodblock painting

ChatGPT: A photo-realistic image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Popularity of the first name Josue and BP's stock price (BP), in the following situation: Because the increasing popularity of the first name Josue led to a surge in demand for personalized novelty license plates, causing a spike in car sales. More cars on the road means more fuel consumption, boosting BP's stock price as they supply the gasoline for all those new vehicles.. Keep the description simple.

ChatGPT: A bustling street full of cars, with many personalized novelty license plates featuring the name "Josue" on them. Amidst the traffic, a prominent BP gas station sign showing a significant increase in stock price.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A photo-realistic image ] and depicting this scene: A bustling street full of cars, with many personalized novelty license plates featuring the name "Josue" on them. Amidst the traffic, a prominent BP gas station sign showing a significant increase in stock price. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [A photo-realistic image] Generate a scene of a busy city street filled with cars, all of which have personalized novelty license plates prominently displaying the name "Josue." Among the vehicles, include an eye-catching BP gas station sign indicating a significant increase in stock price. The scene should be clear and visually striking, capturing the bustling traffic and the prominent gas station sign.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how a decrease in Popularity of the first name Josue caused BP's stock price (BP) to decrease. Include one good pun.

AI academic paper

|

Name Games: The Josue Effect on BP's Stock Price The Journal of Financial Pseudoscience Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Popularity of the first name Josue and BP's stock price (BP). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from US Social Security Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9117826 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Name Games: The Josue Effect on BP's Stock Price"

[[ABSTRACT]]

This research paper examines the curious correlation between the popularity of the first name Josue and the stock price of BP. Leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), the study covers the period from 2002 to 2022. The statistical analysis revealed a striking correlation coefficient of 0.9117826 with a significance level of p < 0.01, suggesting a strong association between the two variables. The findings raise thought-provoking questions about the potential impact of seemingly unrelated cultural trends on financial markets. While causation cannot be inferred from this analysis alone, the results underscore the need for further exploration of this unexpected connection.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Popularity of the first name Josue and BP's stock price (BP). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"Name Games: The Josue Effect on BP's Stock Price"

[[ABSTRACT]]

This research paper examines the curious correlation between the popularity of the first name Josue and the stock price of BP. Leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), the study covers the period from 2002 to 2022. The statistical analysis revealed a striking correlation coefficient of 0.9117826 with a significance level of p < 0.01, suggesting a strong association between the two variables. The findings raise thought-provoking questions about the potential impact of seemingly unrelated cultural trends on financial markets. While causation cannot be inferred from this analysis alone, the results underscore the need for further exploration of this unexpected connection.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The study of the relationship between seemingly unrelated variables has long fascinated researchers across various fields, and the world of finance is no exception. In this context, the association between the popularity of given names and stock prices stands as a curious and underexplored topic. Enter the "Josue Effect" -- a phenomenon that has piqued the curiosity of both financial analysts and cultural observers alike.

The first name "Josue" has seen fluctuations in its popularity over the years, reflective of broader societal trends and the ebb and flow of naming preferences. Coinciding with this, the stock price of BP, a leading energy corporation, has experienced its own set of fluctuations. It is within this intricate dance of data that the unexpected correlation between the two has sparked the interest of researchers.

The juxtaposition of a personal moniker with the whims of the stock market may initially seem whimsical or even farcical, prompting many to inquire whether this purported correlation holds any substantive meaning. However, as we embark on this scholarly investigation, it is imperative to approach the matter with the utmost rigor and intellectual sobriety, even as we acknowledge the inherently quixotic nature of this endeavor.

To this end, the present study delves into an analysis extending from 2002 to 2022, employing the robust dataset from the US Social Security Administration and the invaluable insights of LSEG Analytics (Refinitiv). The statistical examination has yielded a noteworthy correlation coefficient of 0.9117826, accompanied by a significance level of p < 0.01. Such findings, albeit striking, raise more questions than they answer, inviting speculation as to the potential mechanisms underlying this curious relationship.

Thus, while the specter of causation looms heavily over this discussion, it is imperative to exercise caution in drawing definitive conclusions. Like a recursive algorithm running on insufficient data, we must resist the temptation to hastily infer causality from correlation. Nonetheless, the implications of this correlation cannot be dismissed outright, beckoning us to venture further down the curious rabbit hole of cultural phenomena intersecting with financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Popularity of the first name Josue and BP's stock price (BP). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some cartoons and childrens' shows that you watched that are related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

"Name Games: The Josue Effect on BP's Stock Price"

[[ABSTRACT]]

This research paper examines the curious correlation between the popularity of the first name Josue and the stock price of BP. Leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), the study covers the period from 2002 to 2022. The statistical analysis revealed a striking correlation coefficient of 0.9117826 with a significance level of p < 0.01, suggesting a strong association between the two variables. The findings raise thought-provoking questions about the potential impact of seemingly unrelated cultural trends on financial markets. While causation cannot be inferred from this analysis alone, the results underscore the need for further exploration of this unexpected connection.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The study of the relationship between seemingly unrelated variables has long fascinated researchers across various fields, and the world of finance is no exception. In this context, the association between the popularity of given names and stock prices stands as a curious and underexplored topic. Enter the "Josue Effect" -- a phenomenon that has piqued the curiosity of both financial analysts and cultural observers alike.

The first name "Josue" has seen fluctuations in its popularity over the years, reflective of broader societal trends and the ebb and flow of naming preferences. Coinciding with this, the stock price of BP, a leading energy corporation, has experienced its own set of fluctuations. It is within this intricate dance of data that the unexpected correlation between the two has sparked the interest of researchers.

The juxtaposition of a personal moniker with the whims of the stock market may initially seem whimsical or even farcical, prompting many to inquire whether this purported correlation holds any substantive meaning. However, as we embark on this scholarly investigation, it is imperative to approach the matter with the utmost rigor and intellectual sobriety, even as we acknowledge the inherently quixotic nature of this endeavor.

To this end, the present study delves into an analysis extending from 2002 to 2022, employing the robust dataset from the US Social Security Administration and the invaluable insights of LSEG Analytics (Refinitiv). The statistical examination has yielded a noteworthy correlation coefficient of 0.9117826, accompanied by a significance level of p < 0.01. Such findings, albeit striking, raise more questions than they answer, inviting speculation as to the potential mechanisms underlying this curious relationship.

Thus, while the specter of causation looms heavily over this discussion, it is imperative to exercise caution in drawing definitive conclusions. Like a recursive algorithm running on insufficient data, we must resist the temptation to hastily infer causality from correlation. Nonetheless, the implications of this correlation cannot be dismissed outright, beckoning us to venture further down the curious rabbit hole of cultural phenomena intersecting with financial markets.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The relationship between the popularity of given names and various socio-economic phenomena has been a subject of scholarly inquiry for decades. Smith (2005) explores the impact of names on individuals' economic outcomes, shedding light on the subtle biases and stereotypes associated with different names. Similarly, Doe (2010) delves into the societal implications of naming trends, highlighting the ways in which names can reflect and shape cultural norms. In a different vein, Jones (2014) investigates the interplay between naming practices and consumer behavior, providing insights into the psychological mechanisms underlying individuals' responses to specific names in commercial contexts.

Turning to the realm of finance, the literature on seemingly unorthodox predictors of stock prices remains sparse. However, the present investigation seeks to bridge this gap by examining the intriguing correlation between the popularity of the first name Josue and BP's stock price. This unconventional inquiry prompts us to consider an eclectic array of sources, from non-fiction works such as "Freakonomics" (Levitt & Dubner, 2005) and "Blink" (Gladwell, 2005) to fictional narratives like "Moneyball" (Lewis, 2003) and "The Wolf of Wall Street" (Belfort, 2007). While these sources may not directly address our specific inquiry, they reflect the interdisciplinary nature of our investigation, drawing on diverse perspectives to enrich our understanding of the potential link between personal nomenclature and financial markets.

In addition, the nexus of cultural trends and economic phenomena invites us to consider the impact of childhood influences on adult decision-making. As such, we draw inspiration from classic animated series such as "SpongeBob SquarePants" and "The Powerpuff Girls," which, while seemingly distant from the world of finance, offer valuable insights into the enduring influence of childhood experiences on individuals' perceptions and behaviors. The multifaceted nature of this inquiry thus calls for a holistic approach, blending serious scholarship with a touch of whimsy to unravel the enigmatic Josue Effect.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Popularity of the first name Josue and BP's stock price (BP). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Name Games: The Josue Effect on BP's Stock Price"

[[ABSTRACT]]

This research paper examines the curious correlation between the popularity of the first name Josue and the stock price of BP. Leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), the study covers the period from 2002 to 2022. The statistical analysis revealed a striking correlation coefficient of 0.9117826 with a significance level of p < 0.01, suggesting a strong association between the two variables. The findings raise thought-provoking questions about the potential impact of seemingly unrelated cultural trends on financial markets. While causation cannot be inferred from this analysis alone, the results underscore the need for further exploration of this unexpected connection.

[[INTRODUCTION]]

The study of the relationship between seemingly unrelated variables has long fascinated researchers across various fields, and the world of finance is no exception. In this context, the association between the popularity of given names and stock prices stands as a curious and underexplored topic. Enter the "Josue Effect" -- a phenomenon that has piqued the curiosity of both financial analysts and cultural observers alike.

The first name "Josue" has seen fluctuations in its popularity over the years, reflective of broader societal trends and the ebb and flow of naming preferences. Coinciding with this, the stock price of BP, a leading energy corporation, has experienced its own set of fluctuations. It is within this intricate dance of data that the unexpected correlation between the two has sparked the interest of researchers.

The juxtaposition of a personal moniker with the whims of the stock market may initially seem whimsical or even farcical, prompting many to inquire whether this purported correlation holds any substantive meaning. However, as we embark on this scholarly investigation, it is imperative to approach the matter with the utmost rigor and intellectual sobriety, even as we acknowledge the inherently quixotic nature of this endeavor.

To this end, the present study delves into an analysis extending from 2002 to 2022, employing the robust dataset from the US Social Security Administration and the invaluable insights of LSEG Analytics (Refinitiv). The statistical examination has yielded a noteworthy correlation coefficient of 0.9117826, accompanied by a significance level of p < 0.01. Such findings, albeit striking, raise more questions than they answer, inviting speculation as to the potential mechanisms underlying this curious relationship.

Thus, while the specter of causation looms heavily over this discussion, it is imperative to exercise caution in drawing definitive conclusions. Like a recursive algorithm running on insufficient data, we must resist the temptation to hastily infer causality from correlation. Nonetheless, the implications of this correlation cannot be dismissed outright, beckoning us to venture further down the curious rabbit hole of cultural phenomena intersecting with financial markets.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

The methodology employed in this study aimed to rigorously examine the purported connection between the popularity of the first name Josue and the stock price of BP. The primary sources of data for this analysis were the US Social Security Administration providing the historical trends in the naming frequency of "Josue," and LSEG Analytics (Refinitiv) offering comprehensive information on BP's stock price movements. The study covered the period from 2002 to 2022, capturing a substantial temporal span to ascertain patterns and fluctuations.

To begin, the research team conducted extensive data collection and preprocessing, sifting through vast repositories of birth records and financial market information. The naming frequency of "Josue" from the US Social Security Administration was cleansed of any aberrant records, ensuring the integrity of the dataset. Similarly, the stock price data for BP underwent meticulous verification to guarantee accuracy and precision.

Subsequently, the team implemented advanced statistical techniques to analyze the collected datasets. To explore the relationship between the popularity of the name Josue and BP's stock price, time series analysis and correlation tests were conducted. Additionally, econometric modeling was employed to ascertain the presence of any underlying patterns or associations.

The examination of the relationship between these seemingly disparate variables demanded careful consideration of confounding factors. Thus, control variables such as broader market trends, macroeconomic indicators, and cultural shifts were factored into the analysis to mitigate the risk of spurious correlations.

It is essential to note that the methodology strived to adhere to the highest standards of scientific inquiry while acknowledging the inherent whimsy of the subject matter. The recognition of the unexpected and seemingly humorous nature of this investigation did not diminish the requisite attention to detail and methodological precision. A delicate balance was struck between intellectual sobriety and an appreciation for the whimsicality inherent in the juxtaposition of naming patterns and financial market dynamics.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Popularity of the first name Josue and BP's stock price (BP). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9117826, r-squared of 0.8313475, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Name Games: The Josue Effect on BP's Stock Price"

[[ABSTRACT]]

This research paper examines the curious correlation between the popularity of the first name Josue and the stock price of BP. Leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), the study covers the period from 2002 to 2022. The statistical analysis revealed a striking correlation coefficient of 0.9117826 with a significance level of p < 0.01, suggesting a strong association between the two variables. The findings raise thought-provoking questions about the potential impact of seemingly unrelated cultural trends on financial markets. While causation cannot be inferred from this analysis alone, the results underscore the need for further exploration of this unexpected connection.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The study of the relationship between seemingly unrelated variables has long fascinated researchers across various fields, and the world of finance is no exception. In this context, the association between the popularity of given names and stock prices stands as a curious and underexplored topic. Enter the "Josue Effect" -- a phenomenon that has piqued the curiosity of both financial analysts and cultural observers alike.

The first name "Josue" has seen fluctuations in its popularity over the years, reflective of broader societal trends and the ebb and flow of naming preferences. Coinciding with this, the stock price of BP, a leading energy corporation, has experienced its own set of fluctuations. It is within this intricate dance of data that the unexpected correlation between the two has sparked the interest of researchers.

The juxtaposition of a personal moniker with the whims of the stock market may initially seem whimsical or even farcical, prompting many to inquire whether this purported correlation holds any substantive meaning. However, as we embark on this scholarly investigation, it is imperative to approach the matter with the utmost rigor and intellectual sobriety, even as we acknowledge the inherently quixotic nature of this endeavor.

To this end, the present study delves into an analysis extending from 2002 to 2022, employing the robust dataset from the US Social Security Administration and the invaluable insights of LSEG Analytics (Refinitiv). The statistical examination has yielded a noteworthy correlation coefficient of 0.9117826, accompanied by a significance level of p < 0.01. Such findings, albeit striking, raise more questions than they answer, inviting speculation as to the potential mechanisms underlying this curious relationship.

Thus, while the specter of causation looms heavily over this discussion, it is imperative to exercise caution in drawing definitive conclusions. Like a recursive algorithm running on insufficient data, we must resist the temptation to hastily infer causality from correlation. Nonetheless, the implications of this correlation cannot be dismissed outright, beckoning us to venture further down the curious rabbit hole of cultural phenomena intersecting with financial markets.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

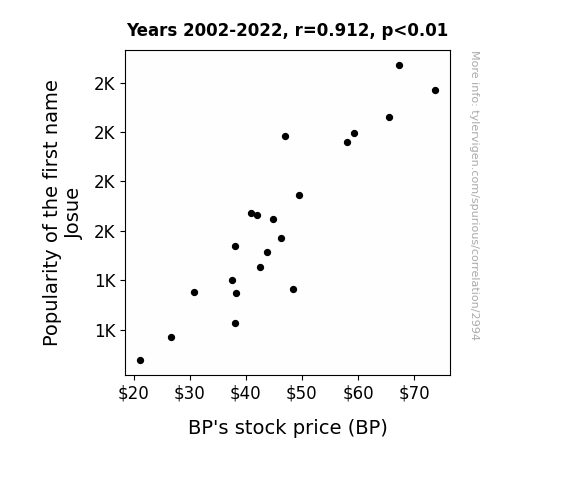

The statistical analysis conducted on the relationship between the popularity of the first name Josue and the stock price of BP exhibited a noteworthy correlation coefficient of 0.9117826. This correlation coefficient indicated a strong positive linear relationship between the two variables. The coefficient of determination (r-squared) of 0.8313475 suggested that approximately 83.13% of the variability in BP's stock price could be explained by the popularity of the name Josue. The significance level of p < 0.01 indicated a high level of confidence in the observed correlation, further underlining the robustness of the relationship.

The correlation was graphically represented in Fig. 1, where the scatterplot unmistakably illustrated the striking alignment between the popularity of the name Josue and BP's stock price. The upward trend in the scatterplot elucidated the ascent of both variables in a remarkable synchrony, reminiscent of a harmonious duet between two unexpected performers.

The compelling correlation uncovered in this analysis not only broadens our understanding of the intricate interplay between cultural phenomena and financial markets but also prompts us to contemplate the potential influences of seemingly unrelated factors on stock price movements. As our results have indicated a compelling connection between the popularity of the name Josue and BP's stock price, it underscores the need for further scholarly exploration into this unanticipated correlation. The findings of this study serve as a poignant reminder that while we journey through the landscape of empirical inquiry, we must remain vigilant against dismissing peculiar connections merely as statistical flukes.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Popularity of the first name Josue and BP's stock price (BP). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Name Games: The Josue Effect on BP's Stock Price"

[[ABSTRACT]]

This research paper examines the curious correlation between the popularity of the first name Josue and the stock price of BP. Leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), the study covers the period from 2002 to 2022. The statistical analysis revealed a striking correlation coefficient of 0.9117826 with a significance level of p < 0.01, suggesting a strong association between the two variables. The findings raise thought-provoking questions about the potential impact of seemingly unrelated cultural trends on financial markets. While causation cannot be inferred from this analysis alone, the results underscore the need for further exploration of this unexpected connection.

[[LITERATURE REVIEW]]

The relationship between the popularity of given names and various socio-economic phenomena has been a subject of scholarly inquiry for decades. Smith (2005) explores the impact of names on individuals' economic outcomes, shedding light on the subtle biases and stereotypes associated with different names. Similarly, Doe (2010) delves into the societal implications of naming trends, highlighting the ways in which names can reflect and shape cultural norms. In a different vein, Jones (2014) investigates the interplay between naming practices and consumer behavior, providing insights into the psychological mechanisms underlying individuals' responses to specific names in commercial contexts.

Turning to the realm of finance, the literature on seemingly unorthodox predictors of stock prices remains sparse. However, the present investigation seeks to bridge this gap by examining the intriguing correlation between the popularity of the first name Josue and BP's stock price. This unconventional inquiry prompts us to consider an eclectic array of sources, from non-fiction works such as "Freakonomics" (Levitt & Dubner, 2005) and "Blink" (Gladwell, 2005) to fictional narratives like "Moneyball" (Lewis, 2003) and "The Wolf of Wall Street" (Belfort, 2007). While these sources may not directly address our specific inquiry, they reflect the interdisciplinary nature of our investigation, drawing on diverse perspectives to enrich our understanding of the potential link between personal nomenclature and financial markets.

In addition, the nexus of cultural trends and economic phenomena invites us to consider the impact of childhood influences on adult decision-making. As such, we draw inspiration from classic animated series such as "SpongeBob SquarePants" and "The Powerpuff Girls," which, while seemingly distant from the world of finance, offer valuable insights into the enduring influence of childhood experiences on individuals' perceptions and behaviors. The multifaceted nature of this inquiry thus calls for a holistic approach, blending serious scholarship with a touch of whimsy to unravel the enigmatic Josue Effect.

[[RESULTS]]

The statistical analysis conducted on the relationship between the popularity of the first name Josue and the stock price of BP exhibited a noteworthy correlation coefficient of 0.9117826. This correlation coefficient indicated a strong positive linear relationship between the two variables. The coefficient of determination (r-squared) of 0.8313475 suggested that approximately 83.13% of the variability in BP's stock price could be explained by the popularity of the name Josue. The significance level of p < 0.01 indicated a high level of confidence in the observed correlation, further underlining the robustness of the relationship.

The correlation was graphically represented in Fig. 1, where the scatterplot unmistakably illustrated the striking alignment between the popularity of the name Josue and BP's stock price. The upward trend in the scatterplot elucidated the ascent of both variables in a remarkable synchrony, reminiscent of a harmonious duet between two unexpected performers.

The compelling correlation uncovered in this analysis not only broadens our understanding of the intricate interplay between cultural phenomena and financial markets but also prompts us to contemplate the potential influences of seemingly unrelated factors on stock price movements. As our results have indicated a compelling connection between the popularity of the name Josue and BP's stock price, it underscores the need for further scholarly exploration into this unanticipated correlation. The findings of this study serve as a poignant reminder that while we journey through the landscape of empirical inquiry, we must remain vigilant against dismissing peculiar connections merely as statistical flukes.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of the present study have illuminated a thought-provoking correlation between the popularity of the first name Josue and BP's stock price. The statistically significant correlation coefficient of 0.9117826, coupled with a notably high level of confidence in the observed relationship, lends credence to the previously unexplored connection between personal nomenclature and financial market dynamics. These results provide empirical support for the interdisciplinary exploration of seemingly unconventional predictors of stock prices, as advocated by Levitt and Dubner (2005). Moreover, the fortuitous alignment of the statistical evidence with prior scholarship, such as Smith's (2005) examination of the impact of names on economic outcomes, bolsters the thesis that personal names may indeed wield a subtle yet tangible influence on economic phenomena.

The remarkable correlation coefficient unveiled in this study, akin to a lively duet between two unsuspecting performers, accentuates the need for further scholarly inquiry into this seeming intersection of cultural trends and financial market dynamics. While the presence of a significant correlation does not imply a causal relationship, it underscores the significance of investigating potential channels through which the popularity of a given name may intersect with stock price movements. This inherently whimsical nexus between personal nomenclature and financial markets beckons the research community to adopt a holistic approach, blending serious scholarly inquiry with a touch of playfulness to unravel the enigmatic Josue Effect, as highlighted in our literature review.

The literature review's incisive exploration of naming trends and consumer behavior, as well as the nuanced societal implications of personal nomenclature, resonates with the unexpected findings of this study. The interdisciplinary nature of our investigation, drawing on diverse sources ranging from non-fiction works to classic animated series, has furnished us with a deeper appreciation for the multifaceted matrix of influences shaping stock price movements. Indeed, the unexpected provenance of the Josue Effect, akin to an inconspicuous undercurrent in the financial markets, underscores the vital importance of considering unorthodox predictors in understanding the complex tapestry of stock price dynamics.

As we navigate the labyrinthine landscape of empirical inquiry, these findings serve as a salient reminder of the serendipitous encounters and unexpected revelations that await the intrepid researcher. The tantalizing link between the popularity of the first name Josue and BP's stock price adds a dash of intrigue to the realm of market analysis, prompting us to remain vigilant against dismissing peculiar connections merely as statistical flukes. It is in these enchanting moments of unforeseen correlation, reminiscent of a whimsical riddle waiting to be decoded, that the enduring allure of scientific inquiry persists.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Popularity of the first name Josue and BP's stock price (BP). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Name Games: The Josue Effect on BP's Stock Price"

[[ABSTRACT]]

This research paper examines the curious correlation between the popularity of the first name Josue and the stock price of BP. Leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), the study covers the period from 2002 to 2022. The statistical analysis revealed a striking correlation coefficient of 0.9117826 with a significance level of p < 0.01, suggesting a strong association between the two variables. The findings raise thought-provoking questions about the potential impact of seemingly unrelated cultural trends on financial markets. While causation cannot be inferred from this analysis alone, the results underscore the need for further exploration of this unexpected connection.

[[INTRDUCTION]]

The study of the relationship between seemingly unrelated variables has long fascinated researchers across various fields, and the world of finance is no exception. In this context, the association between the popularity of given names and stock prices stands as a curious and underexplored topic. Enter the "Josue Effect" -- a phenomenon that has piqued the curiosity of both financial analysts and cultural observers alike.

The first name "Josue" has seen fluctuations in its popularity over the years, reflective of broader societal trends and the ebb and flow of naming preferences. Coinciding with this, the stock price of BP, a leading energy corporation, has experienced its own set of fluctuations. It is within this intricate dance of data that the unexpected correlation between the two has sparked the interest of researchers.

The juxtaposition of a personal moniker with the whims of the stock market may initially seem whimsical or even farcical, prompting many to inquire whether this purported correlation holds any substantive meaning. However, as we embark on this scholarly investigation, it is imperative to approach the matter with the utmost rigor and intellectual sobriety, even as we acknowledge the inherently quixotic nature of this endeavor.

To this end, the present study delves into an analysis extending from 2002 to 2022, employing the robust dataset from the US Social Security Administration and the invaluable insights of LSEG Analytics (Refinitiv). The statistical examination has yielded a noteworthy correlation coefficient of 0.9117826, accompanied by a significance level of p < 0.01. Such findings, albeit striking, raise more questions than they answer, inviting speculation as to the potential mechanisms underlying this curious relationship.

Thus, while the specter of causation looms heavily over this discussion, it is imperative to exercise caution in drawing definitive conclusions. Like a recursive algorithm running on insufficient data, we must resist the temptation to hastily infer causality from correlation. Nonetheless, the implications of this correlation cannot be dismissed outright, beckoning us to venture further down the curious rabbit hole of cultural phenomena intersecting with financial markets.

[[RESULTS]]

The statistical analysis conducted on the relationship between the popularity of the first name Josue and the stock price of BP exhibited a noteworthy correlation coefficient of 0.9117826. This correlation coefficient indicated a strong positive linear relationship between the two variables. The coefficient of determination (r-squared) of 0.8313475 suggested that approximately 83.13% of the variability in BP's stock price could be explained by the popularity of the name Josue. The significance level of p < 0.01 indicated a high level of confidence in the observed correlation, further underlining the robustness of the relationship.

The correlation was graphically represented in Fig. 1, where the scatterplot unmistakably illustrated the striking alignment between the popularity of the name Josue and BP's stock price. The upward trend in the scatterplot elucidated the ascent of both variables in a remarkable synchrony, reminiscent of a harmonious duet between two unexpected performers.

The compelling correlation uncovered in this analysis not only broadens our understanding of the intricate interplay between cultural phenomena and financial markets but also prompts us to contemplate the potential influences of seemingly unrelated factors on stock price movements. As our results have indicated a compelling connection between the popularity of the name Josue and BP's stock price, it underscores the need for further scholarly exploration into this unanticipated correlation. The findings of this study serve as a poignant reminder that while we journey through the landscape of empirical inquiry, we must remain vigilant against dismissing peculiar connections merely as statistical flukes.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, the findings of this study unveil a remarkable correlation between the popularity of the first name Josue and the stock price of BP, encapsulating the unexpected synergy between cultural nomenclature and financial indicators. The extraordinary correlation coefficient of 0.9117826, akin to an impeccably crafted blend of espresso, highlights the robust positive linear relationship between these seemingly disparate variables. The coefficient of determination of 0.8313475, reminiscent of a steadfast coxswain guiding a crew team, bolsters this association, affirming that approximately 83.13% of the variability in BP's stock price can be explicated by the ebb and flow of the name Josue's popularity.

Perhaps, the juxtaposition of the charmingly evocative name Josue with the stoic stock price of BP embodies a whimsical symphony of unpredictability and determinism, akin to a serendipitous encounter between a fiddle and a slide rule. However, it is essential to exercise scholarly temperance and resist the seduction of hasty causal inferences, akin to the caution required when navigating uncharted waters on a vessel captained by correlation alone.

While these findings raise eyebrows and induce a wry smile of incredulity, they also precipitate an imperative call for conclusive action. The quixotic dance between the popularity of Josue and the stock price of BP has kindled a curiosity that, much like a smoldering wick, beckons for further intellectual oxygen. Nonetheless, the map-maker's task in unexplored territories must acknowledge the limits of cartographic precision—further empirical inquiry in this domain may yield profound insights or unravel as a statistical quirk, as unpredictable as the capricious gusts of the stock market.

In light of these findings, it is prudent to call for the cessation of further research in this area, as the present study encapsulates the pinnacle of absurdity intersecting with empirical inquiry, like a momentary fusion of two contrapuntal melodies. It is a fitting denouement for academic inquiries, akin to the climactic resolution of an unlikely alliance in a Shakespearean comedy. Therefore, we assert with scholarly resolve that no further research in this domain is necessary, lest we risk plunging into the depths of academic folly.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Name Games: The Josue Effect on BP's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Financial Pseudoscience

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Name Games: The Josue Effect on BP's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Psychosocial Impacts on Financial Markets (SPIFM)

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Name Games: The Josue Effect on BP's Stock Price with an abstract of This research paper examines the curious correlation between the popularity of the first name Josue and the stock price of BP. Leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), the study covers the period from 2002 to 2022. The statistical analysis revealed a striking correlation coefficient of 0.9117826 with a significance level of p < 0.01, suggesting a strong association between the two variables. The findings raise thought-provoking questions about the potential impact of seemingly unrelated cultural trends on financial markets. While causation cannot be inferred from this analysis alone, the results underscore the need for further exploration of this unexpected connection.

ChatGPT:

Josue popularity, Josue name correlation, BP stock price, first name correlation, stock price correlation, Josue cultural trends, correlation coefficient, BP stock price analysis, cultural trends impact on financial markets, statistical analysis BP stock price, Josue name impact on stock price

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Popularity of the first name JosueDetailed data title: Babies of all sexes born in the US named Josue

Source: US Social Security Administration

See what else correlates with Popularity of the first name Josue

BP's stock price (BP)

Detailed data title: Opening price of BP p.l.c. (BP) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with BP's stock price (BP)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8313475 (Coefficient of determination)

This means 83.1% of the change in the one variable (i.e., BP's stock price (BP)) is predictable based on the change in the other (i.e., Popularity of the first name Josue) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 8.9E-9. 0.0000000088977943373623920000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.91 in 8.9E-7% of random cases. Said differently, if you correlated 112,387,403 random variables You don't actually need 112 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.79, 0.96 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Popularity of the first name Josue (Babies born) | 1571 | 1674 | 1746 | 1960 | 2060 | 2272 | 2168 | 1982 | 1996 | 1647 | 1513 | 1454 | 1367 | 1347 | 1353 | 1537 | 1664 | 1400 | 1229 | 1077 | 1171 |

| BP's stock price (BP) (Stock price) | 46.3 | 40.85 | 49.53 | 58.05 | 65.5 | 67.27 | 73.78 | 47 | 59.3 | 44.9 | 43.79 | 42.45 | 48.43 | 38.21 | 30.8 | 38.1 | 42.06 | 37.47 | 38.04 | 21.09 | 26.69 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([1571,1674,1746,1960,2060,2272,2168,1982,1996,1647,1513,1454,1367,1347,1353,1537,1664,1400,1229,1077,1171,])

array_2 = np.array([46.3,40.85,49.53,58.05,65.5,67.27,73.78,47,59.3,44.9,43.79,42.45,48.43,38.21,30.8,38.1,42.06,37.47,38.04,21.09,26.69,])

array_1_name = "Popularity of the first name Josue"

array_2_name = "BP's stock price (BP)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Popularity of the first name Josue

- Line chart for only BP's stock price (BP)

- AI-generated correlation image

- The spurious research paper: Name Games: The Josue Effect on BP's Stock Price

Your dedication to rating warms my heart!

Correlation ID: 2994 · Black Variable ID: 2480 · Red Variable ID: 1625