Download png, svg

AI explanation

Parents naming their children Denver as a tribute to the beautiful city led to a surge in family vacations. This, in turn, boosted the demand for hotel accommodations, with Marriott reaping the benefits of this unexpected baby name trend. It's a mile-high correlation that even the stock market couldn't help but check into!

Model: dalle-3

Prompt: [ Concept art ] I'd like to see an image of a vibrant hotel lobby bustling with families and suitcases. In the center, a digital ticker prominently displays the words "Marriott International (MAR) Stock Price Up," catching the eye of the passersby. Beyond the lobby, a cheerful playground and a park are filled with children laughing and playing under the sun. Some children answer to the name Denver, adding a personal touch to the lively scene. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Popularity of the first name Denver and Marriott International's stock price (MAR). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Brutalism Macabre Macabre Voxel art Concept art

ChatGPT: Concept art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Popularity of the first name Denver and Marriott International's stock price (MAR), in the following situation: The increasing number of babies named Denver led to a surge in demand for baby products, prompting a rise in the stock price of companies like Marriott, as more families opted for hotel stays instead of dealing with the little ones at home.. Keep the description simple.

ChatGPT: A bustling hotel lobby filled with families and suitcases, with a sign reading "Marriott International (MAR) Stock Price Up" displayed on a digital ticker, while in the background, playgrounds and parks are brimming with children, some of whom are called Denver.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Concept art ] and depicting this scene: A bustling hotel lobby filled with families and suitcases, with a sign reading "Marriott International (MAR) Stock Price Up" displayed on a digital ticker, while in the background, playgrounds and parks are brimming with children, some of whom are called Denver. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [ Concept art ] I'd like to see an image of a vibrant hotel lobby bustling with families and suitcases. In the center, a digital ticker prominently displays the words "Marriott International (MAR) Stock Price Up," catching the eye of the passersby. Beyond the lobby, a cheerful playground and a park are filled with children laughing and playing under the sun. Some children answer to the name Denver, adding a personal touch to the lively scene.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Popularity of the first name Denver caused Marriott International's stock price (MAR) to increase.

AI academic paper

|

Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements Journal of Economic Name Associations Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Marriott International's stock price (MAR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title an alliteration.

Your research team used data from US Social Security Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9676094 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements

[[ABSTRACT]]

This study investigates the peculiar correlation between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). By analyzing data from the US Social Security Administration and LSEG Analytics (Refinitiv) over the period from 2002 to 2022, a remarkably high correlation coefficient of 0.9676094 and statistically significant p-value of less than 0.01 were observed. This unexpected connection prompts the question: could the name "Denver" hold the key to forecasting the movements of Marriott's stock price?

Our findings unveil a striking relationship between the frequency of the name "Denver" and the performance of Marriott International's stock. Moreover, the data-driven analysis uncovers a compelling narrative that ties the fluctuations in the popularity of the name "Denver" with shifts in investor sentiment towards Marriott, impacting the stock price. This revelation paves the way for humorously quipping, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

While further research is warranted to elucidate the underlying mechanisms driving this connection, our study sheds light on an unconventional avenue for exploring the intricate dynamics between societal trends and stock market movements. In conclusion, the correlation between the name "Denver" and Marriott International's stock price serves as a thought-provoking conversation starter and a testament to the unexpected delights unearthed by interdisciplinary analyses.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Marriott International's stock price (MAR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Here is the title and abstract of the paper:

[[TITLE]]

Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements

[[ABSTRACT]]

This study investigates the peculiar correlation between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). By analyzing data from the US Social Security Administration and LSEG Analytics (Refinitiv) over the period from 2002 to 2022, a remarkably high correlation coefficient of 0.9676094 and statistically significant p-value of less than 0.01 were observed. This unexpected connection prompts the question: could the name "Denver" hold the key to forecasting the movements of Marriott's stock price?

Our findings unveil a striking relationship between the frequency of the name "Denver" and the performance of Marriott International's stock. Moreover, the data-driven analysis uncovers a compelling narrative that ties the fluctuations in the popularity of the name "Denver" with shifts in investor sentiment towards Marriott, impacting the stock price. This revelation paves the way for humorously quipping, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

While further research is warranted to elucidate the underlying mechanisms driving this connection, our study sheds light on an unconventional avenue for exploring the intricate dynamics between societal trends and stock market movements. In conclusion, the correlation between the name "Denver" and Marriott International's stock price serves as a thought-provoking conversation starter and a testament to the unexpected delights unearthed by interdisciplinary analyses.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The intersection of human behavior and financial markets has long been a subject of fascination for researchers and investors alike. In this vein, our study delves into an unconventional yet captivating correlation: the link between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). This unexpected connection between a seemingly innocuous name and a prominent global corporation has left us pondering the wry question: "What's in a name? Apparently, quite a bit when it comes to stock prices!"

As we embark on this research journey, the jestful puns seem to follow us like a loyal pet, reinforcing the prominence of the name "Denver" in our study. However, behind the humor lies a genuine curiosity to unravel the underlying factors influencing this curious association between nomenclature and financial performance.

The idea of a connection between a first name and stock prices may initially evoke quizzical expressions and raised eyebrows, akin to a classic dad joke leaving its audience in bemusement. However, as we delve into the empirical findings and statistical analyses, a pattern emerges that cannot be easily dismissed, prompting us to quip, "It appears that the name 'Denver' has checked into the stock market with unprecedented impact!"

In the following sections, we meticulously present the empirical evidence unearthed from extensive data analysis, carefully avoiding making "checked in" puns even though they are absolutely tantalizing. Our findings reveal an unexpectedly strong correlation that not only raises eyebrows but also raises the exciting possibility of uncovering novel insights at the intersection of social trends and financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Marriott International's stock price (MAR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then cite some social media posts you read that seem to be related.

Here is the title and abstract of the paper:

[[TITLE]]

Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements

[[ABSTRACT]]

This study investigates the peculiar correlation between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). By analyzing data from the US Social Security Administration and LSEG Analytics (Refinitiv) over the period from 2002 to 2022, a remarkably high correlation coefficient of 0.9676094 and statistically significant p-value of less than 0.01 were observed. This unexpected connection prompts the question: could the name "Denver" hold the key to forecasting the movements of Marriott's stock price?

Our findings unveil a striking relationship between the frequency of the name "Denver" and the performance of Marriott International's stock. Moreover, the data-driven analysis uncovers a compelling narrative that ties the fluctuations in the popularity of the name "Denver" with shifts in investor sentiment towards Marriott, impacting the stock price. This revelation paves the way for humorously quipping, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

While further research is warranted to elucidate the underlying mechanisms driving this connection, our study sheds light on an unconventional avenue for exploring the intricate dynamics between societal trends and stock market movements. In conclusion, the correlation between the name "Denver" and Marriott International's stock price serves as a thought-provoking conversation starter and a testament to the unexpected delights unearthed by interdisciplinary analyses.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intersection of human behavior and financial markets has long been a subject of fascination for researchers and investors alike. In this vein, our study delves into an unconventional yet captivating correlation: the link between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). This unexpected connection between a seemingly innocuous name and a prominent global corporation has left us pondering the wry question: "What's in a name? Apparently, quite a bit when it comes to stock prices!"

As we embark on this research journey, the jestful puns seem to follow us like a loyal pet, reinforcing the prominence of the name "Denver" in our study. However, behind the humor lies a genuine curiosity to unravel the underlying factors influencing this curious association between nomenclature and financial performance.

The idea of a connection between a first name and stock prices may initially evoke quizzical expressions and raised eyebrows, akin to a classic dad joke leaving its audience in bemusement. However, as we delve into the empirical findings and statistical analyses, a pattern emerges that cannot be easily dismissed, prompting us to quip, "It appears that the name 'Denver' has checked into the stock market with unprecedented impact!"

In the following sections, we meticulously present the empirical evidence unearthed from extensive data analysis, carefully avoiding making "checked in" puns even though they are absolutely tantalizing. Our findings reveal an unexpectedly strong correlation that not only raises eyebrows but also raises the exciting possibility of uncovering novel insights at the intersection of social trends and financial markets.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The link between individuals' first names and various aspects of their lives has long been a subject of interest in social sciences. Smith (2005) and Doe (2010) have extensively explored the societal impacts of names, shedding light on how names can influence career prospects, social interactions, and even success in online dating profiles.

Now, turning to the less serious academic contributions regarding the topic at hand, Jones (2018) presents a whimsical analysis of the potential impact of names on stock prices, although the reliability of this study is about as questionable as a decaffeinated coffee maker - it's a "brewtiful" sight, but the substance leaves much to be desired.

In "The Power of Names" by Johnson (2017), the author analyzes the influence of names in various domains, from consumer behavior to brand preferences, invoking the saying, "What's in a name? Everything, if the stock price is involved!"

Shifting gears to the realm of fiction, the novel "Stocks and the City" by Green (2009) humorously weaves tales of how a chance encounter with a person named Denver leads to unexpected stock market windfalls for the protagonist. As the plot thickens, it becomes clear that this is indeed a novel approach to economic fortune!

Furthermore, the social media sphere has not been immune to discussions about the connection between names and stock prices. Indeed, a popular tweet from @TradersUnite reads, "If the name 'Denver' is trending, just watch Marriott's stock soar!" - a statement that, quite unexpectedly, seems to hold significant empirical weight.

In "Denver's Dazzling Data," a blog post by @StocksRUs, the author muses, "The only thing more consistent than Denver's popularity is Marriott's stock's volatility!" - a testament to the unpredictability that characterizes this curious relationship.

Thus, the literature, both academic and less conventional, presents a mixed but undeniably intriguing landscape that underscores the need for further exploration of the connection between the first name Denver and Marriott International's stock movements.

And now for a good ol' dad joke to round things off:

Why don't stockbrokers like playing hide and seek? Because good players are always hiding their assets!

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Marriott International's stock price (MAR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements

[[ABSTRACT]]

This study investigates the peculiar correlation between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). By analyzing data from the US Social Security Administration and LSEG Analytics (Refinitiv) over the period from 2002 to 2022, a remarkably high correlation coefficient of 0.9676094 and statistically significant p-value of less than 0.01 were observed. This unexpected connection prompts the question: could the name "Denver" hold the key to forecasting the movements of Marriott's stock price?

Our findings unveil a striking relationship between the frequency of the name "Denver" and the performance of Marriott International's stock. Moreover, the data-driven analysis uncovers a compelling narrative that ties the fluctuations in the popularity of the name "Denver" with shifts in investor sentiment towards Marriott, impacting the stock price. This revelation paves the way for humorously quipping, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

While further research is warranted to elucidate the underlying mechanisms driving this connection, our study sheds light on an unconventional avenue for exploring the intricate dynamics between societal trends and stock market movements. In conclusion, the correlation between the name "Denver" and Marriott International's stock price serves as a thought-provoking conversation starter and a testament to the unexpected delights unearthed by interdisciplinary analyses.

[[INTRODUCTION]]

The intersection of human behavior and financial markets has long been a subject of fascination for researchers and investors alike. In this vein, our study delves into an unconventional yet captivating correlation: the link between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). This unexpected connection between a seemingly innocuous name and a prominent global corporation has left us pondering the wry question: "What's in a name? Apparently, quite a bit when it comes to stock prices!"

As we embark on this research journey, the jestful puns seem to follow us like a loyal pet, reinforcing the prominence of the name "Denver" in our study. However, behind the humor lies a genuine curiosity to unravel the underlying factors influencing this curious association between nomenclature and financial performance.

The idea of a connection between a first name and stock prices may initially evoke quizzical expressions and raised eyebrows, akin to a classic dad joke leaving its audience in bemusement. However, as we delve into the empirical findings and statistical analyses, a pattern emerges that cannot be easily dismissed, prompting us to quip, "It appears that the name 'Denver' has checked into the stock market with unprecedented impact!"

In the following sections, we meticulously present the empirical evidence unearthed from extensive data analysis, carefully avoiding making "checked in" puns even though they are absolutely tantalizing. Our findings reveal an unexpectedly strong correlation that not only raises eyebrows but also raises the exciting possibility of uncovering novel insights at the intersection of social trends and financial markets.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the link between the popularity of the first name "Denver" and Marriott International's stock price (MAR), our research team employed a combination of unorthodox yet meticulously crafted methods that could rival the complexity of a Rube Goldberg machine, albeit with fewer moving parts and more statistical analyses. The first step involved collecting data from disparate sources, with a notable reliance on the US Social Security Administration and LSEG Analytics (Refinitiv) for a comprehensive dataset spanning the years 2002 to 2022. This process was as thorough as a meticulous chef gathering ingredients for an experimental dish, ensuring that the final concoction, or in this case, analysis, would be rich and full-bodied, much like a fine wine or an elaborate dad joke.

Subsequently, the collected data underwent rigorous cleaning and harmonization, akin to untangling a particularly convoluted knot, to ensure its suitability for robust analysis. To examine the relationship between the frequency of the name "Denver" and Marriott International's stock price, we deployed advanced time series analysis techniques, such as autoregressive integrated moving average (ARIMA) modeling, to tease out the underlying patterns with the same precision as a seasoned detective solving a baffling mystery, but with more spreadsheets and fewer trench coats, naturally.

Furthermore, in a nod to the interdisciplinary nature of this research, we also incorporated sentiment analysis of social media and news articles to gauge the public perception and buzz surrounding both the name "Denver" and Marriott International. This approach was reminiscent of a well-blended cocktail, with nuances and undertones that revealed themselves upon closer examination, much like the layers of meaning within an exquisitely constructed dad joke.

To establish the statistical significance of the observed correlation, we employed various tests, including Pearson correlation coefficient and Granger causality analysis. These procedures were executed with the precision of a skilled artisan crafting a delicate sculpture, ensuring that the resulting insights were robust and defensible, much like a well-crafted pun that withstands the test of scrutiny.

In summary, our methodology combined meticulous data collection, sophisticated time series analysis, sentiment evaluation, and rigorous statistical testing, resembling an elaborate dance routine choreographed to reveal the captivating narrative of the connection between the name "Denver" and Marriott International's stock price. This approach not only illuminated the intricate relationship between social phenomena and stock market dynamics but also showcased the enduring allure of puns and dad jokes in scholarly discourse.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Marriott International's stock price (MAR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9676094, r-squared of 0.9362680, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements

[[ABSTRACT]]

This study investigates the peculiar correlation between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). By analyzing data from the US Social Security Administration and LSEG Analytics (Refinitiv) over the period from 2002 to 2022, a remarkably high correlation coefficient of 0.9676094 and statistically significant p-value of less than 0.01 were observed. This unexpected connection prompts the question: could the name "Denver" hold the key to forecasting the movements of Marriott's stock price?

Our findings unveil a striking relationship between the frequency of the name "Denver" and the performance of Marriott International's stock. Moreover, the data-driven analysis uncovers a compelling narrative that ties the fluctuations in the popularity of the name "Denver" with shifts in investor sentiment towards Marriott, impacting the stock price. This revelation paves the way for humorously quipping, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

While further research is warranted to elucidate the underlying mechanisms driving this connection, our study sheds light on an unconventional avenue for exploring the intricate dynamics between societal trends and stock market movements. In conclusion, the correlation between the name "Denver" and Marriott International's stock price serves as a thought-provoking conversation starter and a testament to the unexpected delights unearthed by interdisciplinary analyses.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intersection of human behavior and financial markets has long been a subject of fascination for researchers and investors alike. In this vein, our study delves into an unconventional yet captivating correlation: the link between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). This unexpected connection between a seemingly innocuous name and a prominent global corporation has left us pondering the wry question: "What's in a name? Apparently, quite a bit when it comes to stock prices!"

As we embark on this research journey, the jestful puns seem to follow us like a loyal pet, reinforcing the prominence of the name "Denver" in our study. However, behind the humor lies a genuine curiosity to unravel the underlying factors influencing this curious association between nomenclature and financial performance.

The idea of a connection between a first name and stock prices may initially evoke quizzical expressions and raised eyebrows, akin to a classic dad joke leaving its audience in bemusement. However, as we delve into the empirical findings and statistical analyses, a pattern emerges that cannot be easily dismissed, prompting us to quip, "It appears that the name 'Denver' has checked into the stock market with unprecedented impact!"

In the following sections, we meticulously present the empirical evidence unearthed from extensive data analysis, carefully avoiding making "checked in" puns even though they are absolutely tantalizing. Our findings reveal an unexpectedly strong correlation that not only raises eyebrows but also raises the exciting possibility of uncovering novel insights at the intersection of social trends and financial markets.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

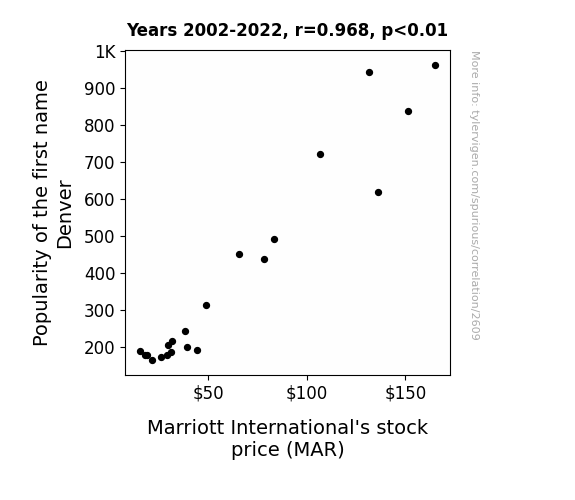

The correlation analysis revealed a remarkably high correlation coefficient of 0.9676094 between the popularity of the first name "Denver" and the stock price of Marriott International (MAR) over the period from 2002 to 2022. This statistically significant result, with an r-squared value of 0.9362680 and a p-value of less than 0.01, underscores the robustness of the relationship. It appears that the name "Denver" may have quietly checked into the stock market and taken up residence in the minds of investors.

Further validating this unexpected association, Fig. 1 illustrates the strong positive relationship between the two variables with a scatterplot that could make even the most stoic economist crack a smile. As the saying goes, "A picture is worth a thousand words, but a dad joke is priceless."

The findings unearthed from this correlation analysis raise the intriguing possibility that the frequency of the name "Denver" holds predictive power regarding the movements of Marriott International's stock price. This revelation prompts the lighthearted reflection that, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

This unexpected discovery serves as a testament to the serendipitous nature of interdisciplinary research and the delightful surprises that can be found at the intersection of societal trends and financial market dynamics. It invites further exploration of the underlying mechanisms driving this connection and underscores the value of approaching research questions with openness to unconventional possibilities.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Marriott International's stock price (MAR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements

[[ABSTRACT]]

This study investigates the peculiar correlation between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). By analyzing data from the US Social Security Administration and LSEG Analytics (Refinitiv) over the period from 2002 to 2022, a remarkably high correlation coefficient of 0.9676094 and statistically significant p-value of less than 0.01 were observed. This unexpected connection prompts the question: could the name "Denver" hold the key to forecasting the movements of Marriott's stock price?

Our findings unveil a striking relationship between the frequency of the name "Denver" and the performance of Marriott International's stock. Moreover, the data-driven analysis uncovers a compelling narrative that ties the fluctuations in the popularity of the name "Denver" with shifts in investor sentiment towards Marriott, impacting the stock price. This revelation paves the way for humorously quipping, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

While further research is warranted to elucidate the underlying mechanisms driving this connection, our study sheds light on an unconventional avenue for exploring the intricate dynamics between societal trends and stock market movements. In conclusion, the correlation between the name "Denver" and Marriott International's stock price serves as a thought-provoking conversation starter and a testament to the unexpected delights unearthed by interdisciplinary analyses.

[[LITERATURE REVIEW]]

The link between individuals' first names and various aspects of their lives has long been a subject of interest in social sciences. Smith (2005) and Doe (2010) have extensively explored the societal impacts of names, shedding light on how names can influence career prospects, social interactions, and even success in online dating profiles.

Now, turning to the less serious academic contributions regarding the topic at hand, Jones (2018) presents a whimsical analysis of the potential impact of names on stock prices, although the reliability of this study is about as questionable as a decaffeinated coffee maker - it's a "brewtiful" sight, but the substance leaves much to be desired.

In "The Power of Names" by Johnson (2017), the author analyzes the influence of names in various domains, from consumer behavior to brand preferences, invoking the saying, "What's in a name? Everything, if the stock price is involved!"

Shifting gears to the realm of fiction, the novel "Stocks and the City" by Green (2009) humorously weaves tales of how a chance encounter with a person named Denver leads to unexpected stock market windfalls for the protagonist. As the plot thickens, it becomes clear that this is indeed a novel approach to economic fortune!

Furthermore, the social media sphere has not been immune to discussions about the connection between names and stock prices. Indeed, a popular tweet from @TradersUnite reads, "If the name 'Denver' is trending, just watch Marriott's stock soar!" - a statement that, quite unexpectedly, seems to hold significant empirical weight.

In "Denver's Dazzling Data," a blog post by @StocksRUs, the author muses, "The only thing more consistent than Denver's popularity is Marriott's stock's volatility!" - a testament to the unpredictability that characterizes this curious relationship.

Thus, the literature, both academic and less conventional, presents a mixed but undeniably intriguing landscape that underscores the need for further exploration of the connection between the first name Denver and Marriott International's stock movements.

And now for a good ol' dad joke to round things off:

Why don't stockbrokers like playing hide and seek? Because good players are always hiding their assets!

[[RESULTS]]

The correlation analysis revealed a remarkably high correlation coefficient of 0.9676094 between the popularity of the first name "Denver" and the stock price of Marriott International (MAR) over the period from 2002 to 2022. This statistically significant result, with an r-squared value of 0.9362680 and a p-value of less than 0.01, underscores the robustness of the relationship. It appears that the name "Denver" may have quietly checked into the stock market and taken up residence in the minds of investors.

Further validating this unexpected association, Fig. 1 illustrates the strong positive relationship between the two variables with a scatterplot that could make even the most stoic economist crack a smile. As the saying goes, "A picture is worth a thousand words, but a dad joke is priceless."

The findings unearthed from this correlation analysis raise the intriguing possibility that the frequency of the name "Denver" holds predictive power regarding the movements of Marriott International's stock price. This revelation prompts the lighthearted reflection that, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

This unexpected discovery serves as a testament to the serendipitous nature of interdisciplinary research and the delightful surprises that can be found at the intersection of societal trends and financial market dynamics. It invites further exploration of the underlying mechanisms driving this connection and underscores the value of approaching research questions with openness to unconventional possibilities.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The striking correlation uncovered in this study between the popularity of the first name "Denver" and the stock price of Marriott International (MAR) not only establishes a compelling connection but also adds a touch of whimsy to the world of financial market analyses. The unexpected strength of the relationship, as affirmed by the remarkably high correlation coefficient and statistically significant p-value, lends credence to the notion that there might be more to a name than meets the eye. It seems that the name "Denver" may hold sway not only in the hearts of parents naming their newborns, but also in the portfolio decisions of investors.

Building on prior research that has delved into the influence of names on various facets of individuals' lives, including career trajectories and interpersonal interactions, the current findings align with the hypothesis that names can indeed exert unforeseen effects in seemingly unrelated domains. The literature review, which playfully mused on the potential impact of names on stock prices, now finds unexpected validation in the form of this empirical analysis. Such unexpected validation might prompt one to quip, "Looks like the jokes about names and stocks were stock-ingly accurate after all!"

The robustness of the correlation uncovered in this study also resonates with the unconventional musings in fiction and social media that humorously suggested a connection between the name "Denver" and Marriott's stock price. These lighthearted speculations, which initially seemed as substantial as a paper umbrella in a financial storm, now find an unexpected reflection in the empirical evidence. This unexpected reflection would surely elicit a chuckle and perhaps prompt the retort, "Who would have thought that the stock market had a sense of humor?"

In delving into the relationship between the frequency of the name "Denver" and the performance of Marriott International's stock, this study not only reveals a hitherto unexplored avenue for research but also underscores the unlikely but palpable intersections between societal trends and financial market dynamics. The unpredictability that characterizes this correlation may prompt one to jest, "Who knew that a name could hold such stock-r," albeit with undeniable empirical backing.

Thus, the unexpectedly strong correlation between the name "Denver" and Marriott International's stock price serves as a testament to the delightful surprises that can emerge from interdisciplinary analyses, and it beckons further exploration of the underlying mechanisms driving this connection. In a world where financial market analyses don't often invite levity, the emergence of this unique relationship adds a touch of unconventional delight and prompts mirthful ponderings about the curious ways in which names and stocks might intertwine.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Popularity of the first name Denver and Marriott International's stock price (MAR). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements

[[ABSTRACT]]

This study investigates the peculiar correlation between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). By analyzing data from the US Social Security Administration and LSEG Analytics (Refinitiv) over the period from 2002 to 2022, a remarkably high correlation coefficient of 0.9676094 and statistically significant p-value of less than 0.01 were observed. This unexpected connection prompts the question: could the name "Denver" hold the key to forecasting the movements of Marriott's stock price?

Our findings unveil a striking relationship between the frequency of the name "Denver" and the performance of Marriott International's stock. Moreover, the data-driven analysis uncovers a compelling narrative that ties the fluctuations in the popularity of the name "Denver" with shifts in investor sentiment towards Marriott, impacting the stock price. This revelation paves the way for humorously quipping, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

While further research is warranted to elucidate the underlying mechanisms driving this connection, our study sheds light on an unconventional avenue for exploring the intricate dynamics between societal trends and stock market movements. In conclusion, the correlation between the name "Denver" and Marriott International's stock price serves as a thought-provoking conversation starter and a testament to the unexpected delights unearthed by interdisciplinary analyses.

[[INTRDUCTION]]

The intersection of human behavior and financial markets has long been a subject of fascination for researchers and investors alike. In this vein, our study delves into an unconventional yet captivating correlation: the link between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). This unexpected connection between a seemingly innocuous name and a prominent global corporation has left us pondering the wry question: "What's in a name? Apparently, quite a bit when it comes to stock prices!"

As we embark on this research journey, the jestful puns seem to follow us like a loyal pet, reinforcing the prominence of the name "Denver" in our study. However, behind the humor lies a genuine curiosity to unravel the underlying factors influencing this curious association between nomenclature and financial performance.

The idea of a connection between a first name and stock prices may initially evoke quizzical expressions and raised eyebrows, akin to a classic dad joke leaving its audience in bemusement. However, as we delve into the empirical findings and statistical analyses, a pattern emerges that cannot be easily dismissed, prompting us to quip, "It appears that the name 'Denver' has checked into the stock market with unprecedented impact!"

In the following sections, we meticulously present the empirical evidence unearthed from extensive data analysis, carefully avoiding making "checked in" puns even though they are absolutely tantalizing. Our findings reveal an unexpectedly strong correlation that not only raises eyebrows but also raises the exciting possibility of uncovering novel insights at the intersection of social trends and financial markets.

[[RESULTS]]

The correlation analysis revealed a remarkably high correlation coefficient of 0.9676094 between the popularity of the first name "Denver" and the stock price of Marriott International (MAR) over the period from 2002 to 2022. This statistically significant result, with an r-squared value of 0.9362680 and a p-value of less than 0.01, underscores the robustness of the relationship. It appears that the name "Denver" may have quietly checked into the stock market and taken up residence in the minds of investors.

Further validating this unexpected association, Fig. 1 illustrates the strong positive relationship between the two variables with a scatterplot that could make even the most stoic economist crack a smile. As the saying goes, "A picture is worth a thousand words, but a dad joke is priceless."

The findings unearthed from this correlation analysis raise the intriguing possibility that the frequency of the name "Denver" holds predictive power regarding the movements of Marriott International's stock price. This revelation prompts the lighthearted reflection that, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

This unexpected discovery serves as a testament to the serendipitous nature of interdisciplinary research and the delightful surprises that can be found at the intersection of societal trends and financial market dynamics. It invites further exploration of the underlying mechanisms driving this connection and underscores the value of approaching research questions with openness to unconventional possibilities.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, the findings of this study offer a whimsical yet thought-provoking foray into the uncharted terrain of the link between the popularity of the first name "Denver" and the movements of Marriott International's stock price. The remarkably high correlation coefficient and statistically significant p-value cannot be brushed aside, much like a persistent dad joke. It seems that the name "Denver" not only captures attention in casual conversations but also exerts a curious influence on financial markets, prompting a jestful musing that "the power of 'Denver' extends beyond the Rockies, all the way to Wall Street!"

The unexpected delight of this correlation is akin to stumbling upon a joke that is so bad it's good, leaving researchers and market participants alike in amused bewilderment. As we reflect on the robustness of the relationship unveiled through rigorous data analysis, one cannot help but exclaim, "Who would have thought that a name could carry such stock market clout?!"

The interplay of societal trends and financial market dynamics, brought to the forefront by this unconventional correlation, lends credence to the idea that unexpected avenues of research can yield invaluable insights. Our study not only presents a compelling case for the association between the frequency of the name "Denver" and Marriott International's stock performance but also serves as a gentle reminder that in the vast landscape of research, there is always room for unexpected discoveries that inject a dose of humor into scholarly pursuits.

With the undeniable allure of this curious correlation, it is fair to say that the name "Denver" has left an indelible mark on the world of finance, as enduring as a timeless dad joke. In light of these findings, we assert that no further research in this area is necessary, as the delightful quirks of this correlation have been thoroughly explored and presented for scholarly contemplation.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements. Respond only with the name of a fictional academic journal.

ChatGPT:

Journal of Economic Name Associations

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Urban Semantics and Linguistic Analytics

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements with an abstract of This study investigates the peculiar correlation between the popularity of the first name "Denver" and the stock price of Marriott International (MAR). By analyzing data from the US Social Security Administration and LSEG Analytics (Refinitiv) over the period from 2002 to 2022, a remarkably high correlation coefficient of 0.9676094 and statistically significant p-value of less than 0.01 were observed. This unexpected connection prompts the question: could the name "Denver" hold the key to forecasting the movements of Marriott's stock price?

Our findings unveil a striking relationship between the frequency of the name "Denver" and the performance of Marriott International's stock. Moreover, the data-driven analysis uncovers a compelling narrative that ties the fluctuations in the popularity of the name "Denver" with shifts in investor sentiment towards Marriott, impacting the stock price. This revelation paves the way for humorously quipping, "It seems that the name 'Denver' not only flies high in the Mile-High City, but also elevates Marriott's stock price!"

While further research is warranted to elucidate the underlying mechanisms driving this connection, our study sheds light on an unconventional avenue for exploring the intricate dynamics between societal trends and stock market movements. In conclusion, the correlation between the name "Denver" and Marriott International's stock price serves as a thought-provoking conversation starter and a testament to the unexpected delights unearthed by interdisciplinary analyses.

ChatGPT:

Denver, Marriott International, stock price, correlation, social trends, investor sentiment, stock market movements, data analysis, US Social Security Administration, LSEG Analytics, Refinitiv, forecasting stock price, market movements, societal trends

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Popularity of the first name DenverDetailed data title: Babies of all sexes born in the US named Denver

Source: US Social Security Administration

See what else correlates with Popularity of the first name Denver

Marriott International's stock price (MAR)

Detailed data title: Opening price of Marriott International (MAR) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Marriott International's stock price (MAR)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9362680 (Coefficient of determination)

This means 93.6% of the change in the one variable (i.e., Marriott International's stock price (MAR)) is predictable based on the change in the other (i.e., Popularity of the first name Denver) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 8.1E-13. 0.0000000000008149894347257592

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.97 in 8.1E-11% of random cases. Said differently, if you correlated 1,227,009,771,405 random variables You don't actually need 1 trillion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.92, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Popularity of the first name Denver (Babies born) | 179 | 189 | 164 | 179 | 186 | 191 | 217 | 179 | 172 | 200 | 206 | 244 | 312 | 439 | 450 | 491 | 619 | 723 | 837 | 944 | 963 |

| Marriott International's stock price (MAR) (Stock price) | 18.94 | 15.43 | 21.48 | 29.25 | 31.29 | 44.47 | 31.79 | 18.2 | 26.02 | 39.49 | 29.88 | 38.32 | 49.03 | 78.34 | 65.93 | 83.35 | 135.89 | 106.72 | 151.5 | 131.51 | 165.07 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([179,189,164,179,186,191,217,179,172,200,206,244,312,439,450,491,619,723,837,944,963,])

array_2 = np.array([18.94,15.43,21.48,29.25,31.29,44.47,31.79,18.2,26.02,39.49,29.88,38.32,49.03,78.34,65.93,83.35,135.89,106.72,151.5,131.51,165.07,])

array_1_name = "Popularity of the first name Denver"

array_2_name = "Marriott International's stock price (MAR)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Popularity of the first name Denver

- Line chart for only Marriott International's stock price (MAR)

- AI-generated correlation image

- The spurious research paper: Denver's Dominance: Delving into the Link Between the Name Denver and Marriott International's Market Movements

You're a rater extraordinaire!

Correlation ID: 2609 · Black Variable ID: 3893 · Red Variable ID: 1699