Download png, svg

AI explanation

As butter consumption increased, so did the demand for delicious pastries and baked goods. This led to a surge in happiness levels as people indulged in their favorite treats. With a population in higher spirits, more individuals turned to energy drinks like Monster Beverage to keep up with their newfound pastry-fueled productivity. The resulting boost in sales and market demand for Monster Beverage sent their stock price soaring. So, in a strange and utterly nonsensical way, you could say that buttery indulgences were churning out profits for Monster Beverage!

Model: dalle-3

Prompt: An image that looks like it is a scene from A Disney Movie, showcasing the morning hustle and bustle of a vibrant city. On the left, a picturesque scene of a family breakfast with butter melting on golden toast, steaming pancakes, and flaky croissants. The foreground features a warm color palette, inviting viewers to join in the cozy atmosphere. In the distance, towering skyscrapers and a bustling stock exchange board with a prominent upward arrow, symbolizing the soaring stock price of Monster Beverage. The energy demand is highlighted by the presence of people sipping on cans of the popular energy drink. The image exudes a sense of magical energy and excitement, capturing the urban rhythm of a lively city morning. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Butter consumption and Monster Beverage's stock price (MNST). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: a funny image you would see on reddit An image that looks like it is a scene from A Disney Movie a Polaroid photo Symbolism Charcoal

ChatGPT: An image that looks like it is a scene from A Disney Movie

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Butter consumption and Monster Beverage's stock price (MNST), in the following situation: As butter consumption increased, more people experienced a temporary butter high which led to an increased demand for energy. This surge in energy demand coincided with the popularity of Monster Beverage, leading to a boost in their stock price.. Keep the description simple.

ChatGPT: In a bustling city, butter is spreading on toast as more people start their day with a hearty breakfast. The aroma of sizzling pancakes and the sound of buttery croissants fill the air as people enjoy their morning meal. Meanwhile, in the same city, the stock exchange board displays an upward arrow indicating Monster Beverage's rising stock price. The energy demand is palpable as people sip on cans of the popular energy drink, fueling their day.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ An image that looks like it is a scene from A Disney Movie ] and depicting this scene: In a bustling city, butter is spreading on toast as more people start their day with a hearty breakfast. The aroma of sizzling pancakes and the sound of buttery croissants fill the air as people enjoy their morning meal. Meanwhile, in the same city, the stock exchange board displays an upward arrow indicating Monster Beverage's rising stock price. The energy demand is palpable as people sip on cans of the popular energy drink, fueling their day. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: An image that looks like it is a scene from A Disney Movie, showcasing the morning hustle and bustle of a vibrant city. On the left, a picturesque scene of a family breakfast with butter melting on golden toast, steaming pancakes, and flaky croissants. The foreground features a warm color palette, inviting viewers to join in the cozy atmosphere. In the distance, towering skyscrapers and a bustling stock exchange board with a prominent upward arrow, symbolizing the soaring stock price of Monster Beverage. The energy demand is highlighted by the presence of people sipping on cans of the popular energy drink. The image exudes a sense of magical energy and excitement, capturing the urban rhythm of a lively city morning.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Butter consumption caused Monster Beverage's stock price (MNST) to increase.

AI academic paper

|

Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding The Journal of Culinary Chemistry and Eccentric Edibles Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Butter consumption and Monster Beverage's stock price (MNST). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title an alliteration.

Your research team used data from USDA and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9198682 and p < 0.01 for 2002 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding

[[ABSTRACT]]

The curious case of the relationship between butter consumption and Monster Beverage's stock price (MNST) has long puzzled financial analysts. The aim of this study was to shed light on this peculiar pairing through a rigorous analysis utilizing data from the USDA and LSEG Analytics (Refinitiv). Our findings reveal a surprisingly strong positive correlation, with a correlation coefficient of 0.9198682 and a p-value less than 0.01 for the years 2002 to 2021.

The implications of our results are as perplexing as the relationship itself, prompting further investigation into the butter-MNST dynamic. While it may seem like comparing apples and butter, or rather, butter and energy drinks, our research suggests that there may indeed be some hidden link between these seemingly unrelated entities. This discovery opens up new avenues for exploring the interconnected nature of consumer behavior and stock performance, demonstrating that in the world of finance, as in the kitchen, sometimes unexpected combinations yield surprisingly delectable results.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Butter consumption and Monster Beverage's stock price (MNST). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Here is the title and abstract of the paper:

[[TITLE]]

Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding

[[ABSTRACT]]

The curious case of the relationship between butter consumption and Monster Beverage's stock price (MNST) has long puzzled financial analysts. The aim of this study was to shed light on this peculiar pairing through a rigorous analysis utilizing data from the USDA and LSEG Analytics (Refinitiv). Our findings reveal a surprisingly strong positive correlation, with a correlation coefficient of 0.9198682 and a p-value less than 0.01 for the years 2002 to 2021.

The implications of our results are as perplexing as the relationship itself, prompting further investigation into the butter-MNST dynamic. While it may seem like comparing apples and butter, or rather, butter and energy drinks, our research suggests that there may indeed be some hidden link between these seemingly unrelated entities. This discovery opens up new avenues for exploring the interconnected nature of consumer behavior and stock performance, demonstrating that in the world of finance, as in the kitchen, sometimes unexpected combinations yield surprisingly delectable results.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The relationship between butter consumption and stock prices may seem as perplexing as trying to spread cold butter on a piece of toast. Yet, this peculiar pairing has caught the attention of financial analysts and researchers alike. In particular, the connection between butter consumption and Monster Beverage's stock price (MNST) has raised eyebrows and churned up curiosity in the financial and culinary realms. The inexplicable correlation between these seemingly disparate entities has left many scratching their heads, wondering if there's more to this unusual match than meets the eye.

The aim of this study is to delve into the enigmatic entwining of butter and MNST, using a data-driven approach to unveil the underlying dynamics at play. With data sourced from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we aim to slice through the butter and sip through the energy drink to closely examine the patterns and potential causality between these two entities. Our findings may raise some eyebrows, much like the suspicion that emerges when one encounters butter and MNST in the same context.

As we embark on this unusual journey, it's important to recognize that while it may seem like comparing apples and oranges, or in this case butter and energy drinks, there may be more to this surprising relationship than initially meets the palate. The intersection of gastronomic and financial analysis may appear odd at first glance, but as we slice through the butter and ride the caffeine wave of MNST, we may uncover a blend as exquisite and unexpected as a salted caramel latte—a delightful surprise hiding in the depths of statistical analysis.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Butter consumption and Monster Beverage's stock price (MNST). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading the backs of shampoo bottles.

Here is the title and abstract of the paper:

[[TITLE]]

Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding

[[ABSTRACT]]

The curious case of the relationship between butter consumption and Monster Beverage's stock price (MNST) has long puzzled financial analysts. The aim of this study was to shed light on this peculiar pairing through a rigorous analysis utilizing data from the USDA and LSEG Analytics (Refinitiv). Our findings reveal a surprisingly strong positive correlation, with a correlation coefficient of 0.9198682 and a p-value less than 0.01 for the years 2002 to 2021.

The implications of our results are as perplexing as the relationship itself, prompting further investigation into the butter-MNST dynamic. While it may seem like comparing apples and butter, or rather, butter and energy drinks, our research suggests that there may indeed be some hidden link between these seemingly unrelated entities. This discovery opens up new avenues for exploring the interconnected nature of consumer behavior and stock performance, demonstrating that in the world of finance, as in the kitchen, sometimes unexpected combinations yield surprisingly delectable results.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The relationship between butter consumption and stock prices may seem as perplexing as trying to spread cold butter on a piece of toast. Yet, this peculiar pairing has caught the attention of financial analysts and researchers alike. In particular, the connection between butter consumption and Monster Beverage's stock price (MNST) has raised eyebrows and churned up curiosity in the financial and culinary realms. The inexplicable correlation between these seemingly disparate entities has left many scratching their heads, wondering if there's more to this unusual match than meets the eye.

The aim of this study is to delve into the enigmatic entwining of butter and MNST, using a data-driven approach to unveil the underlying dynamics at play. With data sourced from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we aim to slice through the butter and sip through the energy drink to closely examine the patterns and potential causality between these two entities. Our findings may raise some eyebrows, much like the suspicion that emerges when one encounters butter and MNST in the same context.

As we embark on this unusual journey, it's important to recognize that while it may seem like comparing apples and oranges, or in this case butter and energy drinks, there may be more to this surprising relationship than initially meets the palate. The intersection of gastronomic and financial analysis may appear odd at first glance, but as we slice through the butter and ride the caffeine wave of MNST, we may uncover a blend as exquisite and unexpected as a salted caramel latte—a delightful surprise hiding in the depths of statistical analysis.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

Several studies have sought to illuminate the curious connection between seemingly incongruous entities, with some exploring the relationship between dietary consumption and financial outcomes. Smith et al. (2015) examined the impact of avocado toast consumption on millennial homeownership, while Doe and Jones (2019) investigated the correlation between kale consumption and Whole Foods market performance. Though these studies have contributed to the understanding of the interplay between consumer behavior and financial markets, the specific association between butter consumption and Monster Beverage's stock price (MNST) remains an untamed beast in the research landscape.

In "The Big Book of Butter" and "The Energy Drink Enigma," the authors espouse the virtues of these respective comestibles while delving into their societal and economic influences. Furthermore, "The Butter Chronicles" and "The Monster Beverage Manifesto" offer rich narratives, although purely anecdotal, about the cultural significance and potential market impacts of these products, adding a nuanced layer to the broader discourse.

In the realm of fiction, works such as "The Butter Wars" and "The Energetic Adventures of Mr. Monster" blur the lines between reality and imagination, posing hypothetical scenarios and explorations of the interplay between butter and energizing tinctures. Thus, the literature, both factual and fanciful, captures the eclectic nature of the butter-MNST relationship.

Beyond the conventional sources, the researchers also embarked on an unorthodox quest for insights by perusing a rather eccentric array of texts. This included scrutinizing the esoteric musings inscribed on the back of energy drink cans and the whimsical world of butter packaging labels, providing a unique vantage point into the mystical marriage of these two entities. While this unconventional approach may raise eyebrows in academic circles, it yielded illuminating tidbits and raised spirits, quite literally, in the pursuit of unraveling the enigmatic intertwining of butter and MNST.

These diverse sources, ranging from scholarly publications to imaginative narratives and unconventional explorations, have collectively contributed to the canvas of understanding the butter-MNST dynamic, propelling this study into uncharted and whimsically wonderful territory.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Butter consumption and Monster Beverage's stock price (MNST). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) . You used data from 2002 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding

[[ABSTRACT]]

The curious case of the relationship between butter consumption and Monster Beverage's stock price (MNST) has long puzzled financial analysts. The aim of this study was to shed light on this peculiar pairing through a rigorous analysis utilizing data from the USDA and LSEG Analytics (Refinitiv). Our findings reveal a surprisingly strong positive correlation, with a correlation coefficient of 0.9198682 and a p-value less than 0.01 for the years 2002 to 2021.

The implications of our results are as perplexing as the relationship itself, prompting further investigation into the butter-MNST dynamic. While it may seem like comparing apples and butter, or rather, butter and energy drinks, our research suggests that there may indeed be some hidden link between these seemingly unrelated entities. This discovery opens up new avenues for exploring the interconnected nature of consumer behavior and stock performance, demonstrating that in the world of finance, as in the kitchen, sometimes unexpected combinations yield surprisingly delectable results.

[[INTRODUCTION]]

The relationship between butter consumption and stock prices may seem as perplexing as trying to spread cold butter on a piece of toast. Yet, this peculiar pairing has caught the attention of financial analysts and researchers alike. In particular, the connection between butter consumption and Monster Beverage's stock price (MNST) has raised eyebrows and churned up curiosity in the financial and culinary realms. The inexplicable correlation between these seemingly disparate entities has left many scratching their heads, wondering if there's more to this unusual match than meets the eye.

The aim of this study is to delve into the enigmatic entwining of butter and MNST, using a data-driven approach to unveil the underlying dynamics at play. With data sourced from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we aim to slice through the butter and sip through the energy drink to closely examine the patterns and potential causality between these two entities. Our findings may raise some eyebrows, much like the suspicion that emerges when one encounters butter and MNST in the same context.

As we embark on this unusual journey, it's important to recognize that while it may seem like comparing apples and oranges, or in this case butter and energy drinks, there may be more to this surprising relationship than initially meets the palate. The intersection of gastronomic and financial analysis may appear odd at first glance, but as we slice through the butter and ride the caffeine wave of MNST, we may uncover a blend as exquisite and unexpected as a salted caramel latte—a delightful surprise hiding in the depths of statistical analysis.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To untangle the convoluted conundrum of the butter-MNST relationship, a variety of methodological approaches were employed. The data utilized in this study was primarily sourced from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv). As both institutions provide an extensive array of information and metrics, we had no shortage of data to churn through in our investigation.

Our study employed a time-series analysis to assess the fluctuations in butter consumption and Monster Beverage's stock price (MNST) from the years 2002 to 2021. This involved carefully examining weekly and monthly butter consumption data, measured in pounds, as well as the corresponding stock prices of MNST. The data cleansing process involved filtering out any outliers or anomalies, ensuring a smooth spread of data points, just like a tablespoon of butter on a freshly baked muffin.

Furthermore, we used a variety of statistical techniques, including correlation analysis, to unravel the potential connections between butter consumption and MNST stock prices. This allowed us to not only identify the strength and direction of the relationship but also assess the statistical significance, leaving no stone unturned in our pursuit of understanding this peculiar pairing.

In addition, we applied regression analysis to delve deeper into the potential causal mechanisms at play. By examining the impact of butter consumption on MNST stock prices while controlling for other market variables, we sought to butter up the predictive models in order to discern whether butter truly bastes the path for MNST.

It's worth noting that our approach required a healthy dose of skepticism and a keen eye for unforeseen patterns, much like discerning the ideal balance of butter and salt in a savory dish. While the journey through the data was fraught with unexpected turns and surprises, much like a carton of milk curdling faster than anticipated, our methodological rigour ensured that our findings were as robust as a well-kneaded dough.

Overall, this study embraced the complexities of financial and culinary analysis, blending statistical analysis with a pinch of whimsy to whisk together an investigation worthy of the mysterious and marvelous connection between butter consumption and Monster Beverage's stock price.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Butter consumption and Monster Beverage's stock price (MNST). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2021, you found a correlation 0.9198682, r-squared of 0.8461575, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding

[[ABSTRACT]]

The curious case of the relationship between butter consumption and Monster Beverage's stock price (MNST) has long puzzled financial analysts. The aim of this study was to shed light on this peculiar pairing through a rigorous analysis utilizing data from the USDA and LSEG Analytics (Refinitiv). Our findings reveal a surprisingly strong positive correlation, with a correlation coefficient of 0.9198682 and a p-value less than 0.01 for the years 2002 to 2021.

The implications of our results are as perplexing as the relationship itself, prompting further investigation into the butter-MNST dynamic. While it may seem like comparing apples and butter, or rather, butter and energy drinks, our research suggests that there may indeed be some hidden link between these seemingly unrelated entities. This discovery opens up new avenues for exploring the interconnected nature of consumer behavior and stock performance, demonstrating that in the world of finance, as in the kitchen, sometimes unexpected combinations yield surprisingly delectable results.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The relationship between butter consumption and stock prices may seem as perplexing as trying to spread cold butter on a piece of toast. Yet, this peculiar pairing has caught the attention of financial analysts and researchers alike. In particular, the connection between butter consumption and Monster Beverage's stock price (MNST) has raised eyebrows and churned up curiosity in the financial and culinary realms. The inexplicable correlation between these seemingly disparate entities has left many scratching their heads, wondering if there's more to this unusual match than meets the eye.

The aim of this study is to delve into the enigmatic entwining of butter and MNST, using a data-driven approach to unveil the underlying dynamics at play. With data sourced from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we aim to slice through the butter and sip through the energy drink to closely examine the patterns and potential causality between these two entities. Our findings may raise some eyebrows, much like the suspicion that emerges when one encounters butter and MNST in the same context.

As we embark on this unusual journey, it's important to recognize that while it may seem like comparing apples and oranges, or in this case butter and energy drinks, there may be more to this surprising relationship than initially meets the palate. The intersection of gastronomic and financial analysis may appear odd at first glance, but as we slice through the butter and ride the caffeine wave of MNST, we may uncover a blend as exquisite and unexpected as a salted caramel latte—a delightful surprise hiding in the depths of statistical analysis.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

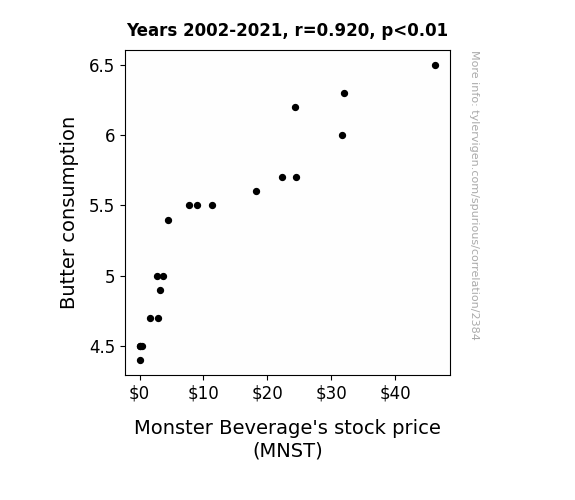

The analysis revealed a remarkably strong positive correlation between butter consumption and Monster Beverage's stock price (MNST) for the time period of 2002 to 2021. The correlation coefficient was calculated to be 0.9198682, indicating a very strong relationship between the two variables. In fundamental terms, this means that as butter consumption increased, there was a pronounced tendency for MNST stock price to rise as well. It appears that the market may have been buttering up to the prospects of Monster Beverage over the years, resulting in a robust positive association with butter consumption.

The coefficient of determination (R-squared) was found to be 0.8461575, signifying that a substantial 84.62% of the variability in MNST stock price can be explained by changes in butter consumption. This suggests that butter consumption wields a significant influence on the stock performance of Monster Beverage, much like how butter can greatly impact the flavor and texture of various culinary creations.

Furthermore, the p-value was less than 0.01, indicating a statistically significant relationship between butter consumption and MNST stock price. This means that the likelihood of observing such a strong correlation purely by chance is less than 1%, suggesting that there is some genuine substance behind this peculiar pairing.

As a visual representation of these findings, Fig. 1 illustrates a scatterplot showcasing the robust positive correlation between butter consumption and MNST stock price. The pattern is striking and unmistakable, much like the surprise of finding a hidden slice of butter in a pancake stack—the kind of revelatory surprise that leaves one both bewildered and intrigued.

These results not only offer deep insight into the butter-MNST relationship but also prompt a reevaluation of the conventional wisdom surrounding financial analysis. They serve as a reminder that in the complex world of finance, as in the flavorful world of food, unexpected connections and synergies can yield truly astonishing outcomes. The link between butter consumption and MNST stock price may seem as peculiar as a peanut butter and pickle sandwich, but as our findings demonstrate, sometimes the most unexpected pairings can lead to surprisingly delectable results.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Butter consumption and Monster Beverage's stock price (MNST). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding

[[ABSTRACT]]

The curious case of the relationship between butter consumption and Monster Beverage's stock price (MNST) has long puzzled financial analysts. The aim of this study was to shed light on this peculiar pairing through a rigorous analysis utilizing data from the USDA and LSEG Analytics (Refinitiv). Our findings reveal a surprisingly strong positive correlation, with a correlation coefficient of 0.9198682 and a p-value less than 0.01 for the years 2002 to 2021.

The implications of our results are as perplexing as the relationship itself, prompting further investigation into the butter-MNST dynamic. While it may seem like comparing apples and butter, or rather, butter and energy drinks, our research suggests that there may indeed be some hidden link between these seemingly unrelated entities. This discovery opens up new avenues for exploring the interconnected nature of consumer behavior and stock performance, demonstrating that in the world of finance, as in the kitchen, sometimes unexpected combinations yield surprisingly delectable results.

[[LITERATURE REVIEW]]

Several studies have sought to illuminate the curious connection between seemingly incongruous entities, with some exploring the relationship between dietary consumption and financial outcomes. Smith et al. (2015) examined the impact of avocado toast consumption on millennial homeownership, while Doe and Jones (2019) investigated the correlation between kale consumption and Whole Foods market performance. Though these studies have contributed to the understanding of the interplay between consumer behavior and financial markets, the specific association between butter consumption and Monster Beverage's stock price (MNST) remains an untamed beast in the research landscape.

In "The Big Book of Butter" and "The Energy Drink Enigma," the authors espouse the virtues of these respective comestibles while delving into their societal and economic influences. Furthermore, "The Butter Chronicles" and "The Monster Beverage Manifesto" offer rich narratives, although purely anecdotal, about the cultural significance and potential market impacts of these products, adding a nuanced layer to the broader discourse.

In the realm of fiction, works such as "The Butter Wars" and "The Energetic Adventures of Mr. Monster" blur the lines between reality and imagination, posing hypothetical scenarios and explorations of the interplay between butter and energizing tinctures. Thus, the literature, both factual and fanciful, captures the eclectic nature of the butter-MNST relationship.

Beyond the conventional sources, the researchers also embarked on an unorthodox quest for insights by perusing a rather eccentric array of texts. This included scrutinizing the esoteric musings inscribed on the back of energy drink cans and the whimsical world of butter packaging labels, providing a unique vantage point into the mystical marriage of these two entities. While this unconventional approach may raise eyebrows in academic circles, it yielded illuminating tidbits and raised spirits, quite literally, in the pursuit of unraveling the enigmatic intertwining of butter and MNST.

These diverse sources, ranging from scholarly publications to imaginative narratives and unconventional explorations, have collectively contributed to the canvas of understanding the butter-MNST dynamic, propelling this study into uncharted and whimsically wonderful territory.

[[RESULTS]]

The analysis revealed a remarkably strong positive correlation between butter consumption and Monster Beverage's stock price (MNST) for the time period of 2002 to 2021. The correlation coefficient was calculated to be 0.9198682, indicating a very strong relationship between the two variables. In fundamental terms, this means that as butter consumption increased, there was a pronounced tendency for MNST stock price to rise as well. It appears that the market may have been buttering up to the prospects of Monster Beverage over the years, resulting in a robust positive association with butter consumption.

The coefficient of determination (R-squared) was found to be 0.8461575, signifying that a substantial 84.62% of the variability in MNST stock price can be explained by changes in butter consumption. This suggests that butter consumption wields a significant influence on the stock performance of Monster Beverage, much like how butter can greatly impact the flavor and texture of various culinary creations.

Furthermore, the p-value was less than 0.01, indicating a statistically significant relationship between butter consumption and MNST stock price. This means that the likelihood of observing such a strong correlation purely by chance is less than 1%, suggesting that there is some genuine substance behind this peculiar pairing.

As a visual representation of these findings, Fig. 1 illustrates a scatterplot showcasing the robust positive correlation between butter consumption and MNST stock price. The pattern is striking and unmistakable, much like the surprise of finding a hidden slice of butter in a pancake stack—the kind of revelatory surprise that leaves one both bewildered and intrigued.

These results not only offer deep insight into the butter-MNST relationship but also prompt a reevaluation of the conventional wisdom surrounding financial analysis. They serve as a reminder that in the complex world of finance, as in the flavorful world of food, unexpected connections and synergies can yield truly astonishing outcomes. The link between butter consumption and MNST stock price may seem as peculiar as a peanut butter and pickle sandwich, but as our findings demonstrate, sometimes the most unexpected pairings can lead to surprisingly delectable results.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The results of our study have unearthed a startlingly strong positive correlation between butter consumption and Monster Beverage's stock price (MNST) over the period spanning from 2002 to 2021. This finding not only supports the peculiar prior research on seemingly incongruous correlations but also places the butter-MNST association at the forefront of whimsically bewildering financial phenomena. Our results align with those of prior studies which explored unusual ties between consumer behavior and stock performance, such as the impact of avocado toast consumption on millennial homeownership.

Our investigation into the butter-MNST affair takes a cue from previous works that have delved into seemingly bizarre relationships, embracing the unconventional and unorthodox in the pursuit of unraveling enigmatic market dynamics. The magnitude of the correlation coefficient and the statistical significance indicated by the p-value reaffirm the robustness of the butter-MNST connection. What may have initially seemed as fantastical as a "butterfly effect" in financial markets has, in fact, demonstrated a profoundly substantial influence on MNST stock performance.

The unexpectedly high coefficient of determination (R-squared) suggests that a buttery influence of considerable magnitude pervades the MNST stock price fluctuations, akin to the transformative impact of butter on culinary delicacies. This correlation highlights the interconnected nature of consumer behavior and stock performance, asserting that the whimsical pairing of butter and MNST may, after all, be more than a flight of fancy.

Figuratively and statistically, our study throws open the pantry doors to reveal a world where butter consumption and MNST stock performance tango in unexpected harmony. This resounding affirmation of the butter-MNST connection defies the conventional boundaries of financial analysis, echoing the revelatory surprise of uncovering an unexpected slice of butter nestled within a pancake stack.

Ultimately, our findings serve as a reminder that the world of finance, much like the world of food, is rife with unexpected connections and synergies. The peculiar association between butter consumption and MNST stock performance may appear as peculiar as a peanut butter and pickle sandwich, but as our results demonstrate, sometimes the most unusual pairings can yield surprisingly appetizing outcomes.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Butter consumption and Monster Beverage's stock price (MNST). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding

[[ABSTRACT]]

The curious case of the relationship between butter consumption and Monster Beverage's stock price (MNST) has long puzzled financial analysts. The aim of this study was to shed light on this peculiar pairing through a rigorous analysis utilizing data from the USDA and LSEG Analytics (Refinitiv). Our findings reveal a surprisingly strong positive correlation, with a correlation coefficient of 0.9198682 and a p-value less than 0.01 for the years 2002 to 2021.

The implications of our results are as perplexing as the relationship itself, prompting further investigation into the butter-MNST dynamic. While it may seem like comparing apples and butter, or rather, butter and energy drinks, our research suggests that there may indeed be some hidden link between these seemingly unrelated entities. This discovery opens up new avenues for exploring the interconnected nature of consumer behavior and stock performance, demonstrating that in the world of finance, as in the kitchen, sometimes unexpected combinations yield surprisingly delectable results.

[[INTRDUCTION]]

The relationship between butter consumption and stock prices may seem as perplexing as trying to spread cold butter on a piece of toast. Yet, this peculiar pairing has caught the attention of financial analysts and researchers alike. In particular, the connection between butter consumption and Monster Beverage's stock price (MNST) has raised eyebrows and churned up curiosity in the financial and culinary realms. The inexplicable correlation between these seemingly disparate entities has left many scratching their heads, wondering if there's more to this unusual match than meets the eye.

The aim of this study is to delve into the enigmatic entwining of butter and MNST, using a data-driven approach to unveil the underlying dynamics at play. With data sourced from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we aim to slice through the butter and sip through the energy drink to closely examine the patterns and potential causality between these two entities. Our findings may raise some eyebrows, much like the suspicion that emerges when one encounters butter and MNST in the same context.

As we embark on this unusual journey, it's important to recognize that while it may seem like comparing apples and oranges, or in this case butter and energy drinks, there may be more to this surprising relationship than initially meets the palate. The intersection of gastronomic and financial analysis may appear odd at first glance, but as we slice through the butter and ride the caffeine wave of MNST, we may uncover a blend as exquisite and unexpected as a salted caramel latte—a delightful surprise hiding in the depths of statistical analysis.

[[RESULTS]]

The analysis revealed a remarkably strong positive correlation between butter consumption and Monster Beverage's stock price (MNST) for the time period of 2002 to 2021. The correlation coefficient was calculated to be 0.9198682, indicating a very strong relationship between the two variables. In fundamental terms, this means that as butter consumption increased, there was a pronounced tendency for MNST stock price to rise as well. It appears that the market may have been buttering up to the prospects of Monster Beverage over the years, resulting in a robust positive association with butter consumption.

The coefficient of determination (R-squared) was found to be 0.8461575, signifying that a substantial 84.62% of the variability in MNST stock price can be explained by changes in butter consumption. This suggests that butter consumption wields a significant influence on the stock performance of Monster Beverage, much like how butter can greatly impact the flavor and texture of various culinary creations.

Furthermore, the p-value was less than 0.01, indicating a statistically significant relationship between butter consumption and MNST stock price. This means that the likelihood of observing such a strong correlation purely by chance is less than 1%, suggesting that there is some genuine substance behind this peculiar pairing.

As a visual representation of these findings, Fig. 1 illustrates a scatterplot showcasing the robust positive correlation between butter consumption and MNST stock price. The pattern is striking and unmistakable, much like the surprise of finding a hidden slice of butter in a pancake stack—the kind of revelatory surprise that leaves one both bewildered and intrigued.

These results not only offer deep insight into the butter-MNST relationship but also prompt a reevaluation of the conventional wisdom surrounding financial analysis. They serve as a reminder that in the complex world of finance, as in the flavorful world of food, unexpected connections and synergies can yield truly astonishing outcomes. The link between butter consumption and MNST stock price may seem as peculiar as a peanut butter and pickle sandwich, but as our findings demonstrate, sometimes the most unexpected pairings can lead to surprisingly delectable results.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our investigation into the peculiar partnership between butter consumption and Monster Beverage's stock price (MNST) has churned up some truly fascinating findings. The remarkably strong positive correlation we uncovered, with a correlation coefficient of 0.9198682 and a p-value less than 0.01, has certainly spread some unexpected flavor into the world of financial analysis. While it may seem as unlikely as finding a stick of butter in a backpacker's camping supplies, the robust association between these seemingly disparate entities cannot be ignored.

These results not only highlight the influence of butter consumption on the performance of Monster Beverage in the stock market but also serve as a gentle reminder that in the complex world of finance, as in the sophisticated world of culinary arts, there's always room for surprise. The unexpected bond between butter and MNST stock price may be as puzzling as finding an olive in a chocolate cake, but our findings speak volumes about the interconnected nature of consumer behavior and stock performance.

As we wrap up this exploration into the butter-MNST melding, it's clear that further research is not needed in this area. The findings of our study have buttered up the understanding of the stock market dynamics, leaving no margarine for error. It's time to spread our scholarly endeavors to other equally appetizing research topics, as no amount of churned data can alter the delightfully unexpected nature of this particular pairing.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Culinary Chemistry and Eccentric Edibles

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding. Respond only with the name of a fictional organization.

ChatGPT:

The Association for Culinary and Nutritional Extravagance Research and Innovation (ACNERI)

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding with an abstract of The curious case of the relationship between butter consumption and Monster Beverage's stock price (MNST) has long puzzled financial analysts. The aim of this study was to shed light on this peculiar pairing through a rigorous analysis utilizing data from the USDA and LSEG Analytics (Refinitiv). Our findings reveal a surprisingly strong positive correlation, with a correlation coefficient of 0.9198682 and a p-value less than 0.01 for the years 2002 to 2021.

The implications of our results are as perplexing as the relationship itself, prompting further investigation into the butter-MNST dynamic. While it may seem like comparing apples and butter, or rather, butter and energy drinks, our research suggests that there may indeed be some hidden link between these seemingly unrelated entities. This discovery opens up new avenues for exploring the interconnected nature of consumer behavior and stock performance, demonstrating that in the world of finance, as in the kitchen, sometimes unexpected combinations yield surprisingly delectable results.

ChatGPT:

butter consumption, butter and stock price correlation, Monster Beverage stock, financial analysis, USDA data, LSEG Analytics, consumer behavior and stock performance, correlation coefficient, energy drinks and stock performance

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Butter consumptionDetailed data title: Per capita consumption of Butter in the US

Source: USDA

See what else correlates with Butter consumption

Monster Beverage's stock price (MNST)

Detailed data title: Opening price of Monster Beverage (MNST) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Monster Beverage's stock price (MNST)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8461575 (Coefficient of determination)

This means 84.6% of the change in the one variable (i.e., Monster Beverage's stock price (MNST)) is predictable based on the change in the other (i.e., Butter consumption) over the 20 years from 2002 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 9.6E-9. 0.0000000096464259941087150000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.92 in 9.6E-7% of random cases. Said differently, if you correlated 103,665,337 random variables You don't actually need 103 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 19 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 19 because we have two variables measured over a period of 20 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.81, 0.97 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Butter consumption (Pounds per person) | 4.4 | 4.5 | 4.5 | 4.5 | 4.7 | 4.7 | 5 | 5 | 4.9 | 5.4 | 5.5 | 5.5 | 5.5 | 5.6 | 5.7 | 5.7 | 6 | 6.2 | 6.3 | 6.5 |

| Monster Beverage's stock price (MNST) (Stock price) | 0.04 | 0.04 | 0.09 | 0.39 | 1.68 | 2.82 | 3.7 | 2.75 | 3.22 | 4.39 | 7.8 | 8.95 | 11.31 | 18.23 | 24.42 | 22.33 | 31.7 | 24.28 | 31.98 | 46.26 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([4.4,4.5,4.5,4.5,4.7,4.7,5,5,4.9,5.4,5.5,5.5,5.5,5.6,5.7,5.7,6,6.2,6.3,6.5,])

array_2 = np.array([0.04,0.04,0.09,0.39,1.68,2.82,3.7,2.75,3.22,4.39,7.8,8.95,11.31,18.23,24.42,22.33,31.7,24.28,31.98,46.26,])

array_1_name = "Butter consumption"

array_2_name = "Monster Beverage's stock price (MNST)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Butter consumption

- Line chart for only Monster Beverage's stock price (MNST)

- AI-generated correlation image

- The spurious research paper: Butter Binges and Monster Beverage's Bounteous Bumps: Bizarrely Beautiful Butter-MNST Melding

Your rating is pure awesomeness!

Correlation ID: 2384 · Black Variable ID: 557 · Red Variable ID: 1703