Download png, svg

AI explanation

As US bottled water consumption per person increased, so did the global demand for plastic. This led to a shortage of plastic, causing the price of plastic to rise. Telkom Indonesia (Persero) Tbk PT, being in the telecommunications industry, uses plastic for packaging their products. The increase in plastic prices squeezed their profit margins, making their stock a hot commodity on the market! Looks like Telkom Indonesia had to make some 'connection' between their stock price and the rising cost of plastic!

Model: dalle-3

Prompt: Generate an image showing a character in Skyrim enjoying a refreshing drink from a plastic water bottle. The label on the bottle prominently displays the Telkom Indonesia stock price chart. In the background, depict a scene of people in the US carrying similar water bottles. Additionally, show a digital screen displaying the stock market ticker for Telkom Indonesia. The juxtaposition of these elements will create an intriguing and unexpected visual. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: US Bottled Water Consumption per Person and Telkom Indonesia (Persero) Tbk PT's stock price. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Psychedelic A scene from Skyrim Cubism Surrealism Pop art

ChatGPT: A scene from Skyrim

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both US Bottled Water Consumption per Person and Telkom Indonesia (Persero) Tbk PT's stock price together. Keep the description simple.

ChatGPT: A person drinking from a plastic water bottle with the Telkom Indonesia stock price chart printed on the bottle's label. The background shows people in the US carrying bottled water while the stock market ticker of Telkom Indonesia is displayed on a digital screen in the background.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A scene from Skyrim ] and depicting this scene: A person drinking from a plastic water bottle with the Telkom Indonesia stock price chart printed on the bottle's label. The background shows people in the US carrying bottled water while the stock market ticker of Telkom Indonesia is displayed on a digital screen in the background. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image showing a character in Skyrim enjoying a refreshing drink from a plastic water bottle. The label on the bottle prominently displays the Telkom Indonesia stock price chart. In the background, depict a scene of people in the US carrying similar water bottles. Additionally, show a digital screen displaying the stock market ticker for Telkom Indonesia. The juxtaposition of these elements will create an intriguing and unexpected visual.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in US Bottled Water Consumption per Person caused Telkom Indonesia (Persero) Tbk PT's stock price (Persero) to increase. Add a funny one-liner at the end.

AI academic paper

|

Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association The Journal of Aquatic Quirkology Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and Telkom Indonesia (Persero) Tbk PT's stock price (Persero). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title an alliteration.

Your research team used data from Statista and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8969012 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association

[[ABSTRACT]]

The vexing relationship between the consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT has long eluded researchers. In this study, we delved into the depths of data from Statista and LSEG Analytics (Refinitiv) to illuminate this enigmatic connection. Our rigorous analysis uncovered a tantalizing correlation coefficient of 0.8969012 and a strikingly significant p-value of less than 0.01 for the period spanning 2002 to 2022. The implications of our findings are as clear as bottled water itself, suggesting a surprisingly resilient link between seemingly unrelated commodities. We hope that our research inspires more exploration into quirky market dynamics, and perhaps uncovers a few unexpected laughs along the way.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and Telkom Indonesia (Persero) Tbk PT's stock price (Persero). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association

[[ABSTRACT]]

The vexing relationship between the consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT has long eluded researchers. In this study, we delved into the depths of data from Statista and LSEG Analytics (Refinitiv) to illuminate this enigmatic connection. Our rigorous analysis uncovered a tantalizing correlation coefficient of 0.8969012 and a strikingly significant p-value of less than 0.01 for the period spanning 2002 to 2022. The implications of our findings are as clear as bottled water itself, suggesting a surprisingly resilient link between seemingly unrelated commodities. We hope that our research inspires more exploration into quirky market dynamics, and perhaps uncovers a few unexpected laughs along the way.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

**[[INTRODUCTION]]**

In the world of statistical analysis and market research, uncovering unexpected connections between seemingly unrelated variables often feels like stumbling upon a hidden treasure – a nugget of insight waiting to be polished and presented to the academic community. Joining this illustrious tradition of uncovering peculiar associations, we present our investigation into the curious correlation between the per capita consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT.

Anecdotally, one might wonder if quaffing copious amounts of bottled water in the U.S. could somehow influence the stock price of a telecommunications company in Indonesia. However, as science-minded researchers, we understand the need to go beyond mere speculation and delve into the empirical evidence, armed with the powerful tools of statistical analysis and data visualization.

Our pursuit began with a quest to disentangle the dynamics at play – to pour over the volumes of data available, teasing out patterns that might reveal this seemingly inexplicable linkage. Through the use of data from Statista and LSEG Analytics (Refinitiv), we embarked on a journey into the depths of statistics, seeking to unravel the mysteries that piqued our scientific curiosity.

Undoubtedly, the marriage of these two seemingly disparate entities – bottled water and stock prices – may raise a skeptical eyebrow or two. However, our preliminary scrutiny of the data has yielded some intriguing results that cannot be simply bottled up and ignored. With a correlation coefficient of 0.8969012 and a p-value that shone brightly at less than 0.01, our findings beckon for attention and scrutiny.

As we immerse ourselves in the intricate world of market data and consumption patterns, it is crucial to approach this quirky connection with a balanced blend of scientific rigor and the willingness to embrace the unexpected. Our findings not only bear implications for market analysts and economists but also beckon to the wider scientific community, encouraging an exploration of unanticipated relationships in the vast sea of data.

In presenting our journey of uncovering this idiosyncratic correlation, we invite readers to join us in our pursuit of enlightenment through statistical analysis and perhaps uncover a few unexpected chuckles along the way. After all, what is science without a splash of humor and a sprinkle of curiosity?

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and Telkom Indonesia (Persero) Tbk PT's stock price (Persero). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading CVS receipts.

Here is the title and abstract of the paper:

[[TITLE]]

Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association

[[ABSTRACT]]

The vexing relationship between the consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT has long eluded researchers. In this study, we delved into the depths of data from Statista and LSEG Analytics (Refinitiv) to illuminate this enigmatic connection. Our rigorous analysis uncovered a tantalizing correlation coefficient of 0.8969012 and a strikingly significant p-value of less than 0.01 for the period spanning 2002 to 2022. The implications of our findings are as clear as bottled water itself, suggesting a surprisingly resilient link between seemingly unrelated commodities. We hope that our research inspires more exploration into quirky market dynamics, and perhaps uncovers a few unexpected laughs along the way.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

In the world of statistical analysis and market research, uncovering unexpected connections between seemingly unrelated variables often feels like stumbling upon a hidden treasure – a nugget of insight waiting to be polished and presented to the academic community. Joining this illustrious tradition of uncovering peculiar associations, we present our investigation into the curious correlation between the per capita consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT.

Anecdotally, one might wonder if quaffing copious amounts of bottled water in the U.S. could somehow influence the stock price of a telecommunications company in Indonesia. However, as science-minded researchers, we understand the need to go beyond mere speculation and delve into the empirical evidence, armed with the powerful tools of statistical analysis and data visualization.

Our pursuit began with a quest to disentangle the dynamics at play – to pour over the volumes of data available, teasing out patterns that might reveal this seemingly inexplicable linkage. Through the use of data from Statista and LSEG Analytics (Refinitiv), we embarked on a journey into the depths of statistics, seeking to unravel the mysteries that piqued our scientific curiosity.

Undoubtedly, the marriage of these two seemingly disparate entities – bottled water and stock prices – may raise a skeptical eyebrow or two. However, our preliminary scrutiny of the data has yielded some intriguing results that cannot be simply bottled up and ignored. With a correlation coefficient of 0.8969012 and a p-value that shone brightly at less than 0.01, our findings beckon for attention and scrutiny.

As we immerse ourselves in the intricate world of market data and consumption patterns, it is crucial to approach this quirky connection with a balanced blend of scientific rigor and the willingness to embrace the unexpected. Our findings not only bear implications for market analysts and economists but also beckon to the wider scientific community, encouraging an exploration of unanticipated relationships in the vast sea of data.

In presenting our journey of uncovering this idiosyncratic correlation, we invite readers to join us in our pursuit of enlightenment through statistical analysis and perhaps uncover a few unexpected chuckles along the way. After all, what is science without a splash of humor and a sprinkle of curiosity?

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "Bottled Water Consumption and Economic Trends" by Smith, the authors find that the consumption of bottled water has seen a steady rise in the United States over the past two decades, reflecting shifting consumer preferences and concerns about tap water quality. Similarly, in "Telecommunications Industry and Stock Performance" by Doe, the authors highlight the complex interplay of market forces and technological advancements influencing the stock prices of telecommunications companies. Furthermore, Jones' "Consumer Behavior and Market Volatility" underscores the nuanced relationship between consumer behavior and market fluctuations, shedding light on the intricate web of factors shaping stock prices.

Moving beyond these foundational insights, "Water: A Global History" by Kurlansky provides a thorough exploration of the cultural and economic significance of water consumption, offering a broader lens through which to understand the societal impact of this ubiquitous beverage. In a parallel vein, "The Signal and the Noise" by Silver offers a compelling narrative on the challenges of discerning meaningful patterns from noisy data, an endeavor that resonates with our pursuit of uncovering the unexpected link between bottled water consumption and stock prices.

Venturing into the realm of fiction, "Water for Elephants" by Gruen and "The Price of Salt" by Highsmith may not directly address our research topic, but their evocative titles hint at the tantalizing interplay of commodities and values, albeit in entirely different contexts.

In the spirit of academic thoroughness, it should be noted that the literature review was not restricted to traditional sources. As part of our unconventional approach, we diligently perused grocery store receipts, office water cooler conversations, and even cryptically inscribed messages in fortune cookies to glean insights into the peculiar connection between bottled water consumption and stock prices. While the scientific community may frown upon such unconventional sources, we firmly believe that wisdom can flow from the unlikeliest of spouts.

Stay tuned for the next section, where we dive into the methodological intricacies of our investigation, and perhaps encounter a few unexpected currents along the way. Let's dive in.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and Telkom Indonesia (Persero) Tbk PT's stock price (Persero). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Statista and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association

[[ABSTRACT]]

The vexing relationship between the consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT has long eluded researchers. In this study, we delved into the depths of data from Statista and LSEG Analytics (Refinitiv) to illuminate this enigmatic connection. Our rigorous analysis uncovered a tantalizing correlation coefficient of 0.8969012 and a strikingly significant p-value of less than 0.01 for the period spanning 2002 to 2022. The implications of our findings are as clear as bottled water itself, suggesting a surprisingly resilient link between seemingly unrelated commodities. We hope that our research inspires more exploration into quirky market dynamics, and perhaps uncovers a few unexpected laughs along the way.

[[INTRODUCTION]]

In the world of statistical analysis and market research, uncovering unexpected connections between seemingly unrelated variables often feels like stumbling upon a hidden treasure – a nugget of insight waiting to be polished and presented to the academic community. Joining this illustrious tradition of uncovering peculiar associations, we present our investigation into the curious correlation between the per capita consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT.

Anecdotally, one might wonder if quaffing copious amounts of bottled water in the U.S. could somehow influence the stock price of a telecommunications company in Indonesia. However, as science-minded researchers, we understand the need to go beyond mere speculation and delve into the empirical evidence, armed with the powerful tools of statistical analysis and data visualization.

Our pursuit began with a quest to disentangle the dynamics at play – to pour over the volumes of data available, teasing out patterns that might reveal this seemingly inexplicable linkage. Through the use of data from Statista and LSEG Analytics (Refinitiv), we embarked on a journey into the depths of statistics, seeking to unravel the mysteries that piqued our scientific curiosity.

Undoubtedly, the marriage of these two seemingly disparate entities – bottled water and stock prices – may raise a skeptical eyebrow or two. However, our preliminary scrutiny of the data has yielded some intriguing results that cannot be simply bottled up and ignored. With a correlation coefficient of 0.8969012 and a p-value that shone brightly at less than 0.01, our findings beckon for attention and scrutiny.

As we immerse ourselves in the intricate world of market data and consumption patterns, it is crucial to approach this quirky connection with a balanced blend of scientific rigor and the willingness to embrace the unexpected. Our findings not only bear implications for market analysts and economists but also beckon to the wider scientific community, encouraging an exploration of unanticipated relationships in the vast sea of data.

In presenting our journey of uncovering this idiosyncratic correlation, we invite readers to join us in our pursuit of enlightenment through statistical analysis and perhaps uncover a few unexpected chuckles along the way. After all, what is science without a splash of humor and a sprinkle of curiosity?

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To unearth the peculiar nexus between U.S. bottled water consumption and Telkom Indonesia (Persero) Tbk PT's stock price, our research team employed a blend of traditional statistical methods and a touch of whimsical creativity. First, we indulged in a delightful scavenger hunt across the vast expanse of the internet, gathering data from sources that did not elude our grasp, with Statista and LSEG Analytics (Refinitiv) serving as our primary repositories of veritable treasure troves.

The grand data collection escapade spanned the years 2002 to 2022, ensuring that we engulfed ourselves in a rich tapestry of information, much like a connoisseur savoring every drop of a finely aged bottle of water. With these data in hand, we then set forth on a marvelous journey of statistical analysis, weaving through the labyrinthine corridors of correlation and regression, guided by the compass of scientific inquiry and the spark of curiosity.

In corralling the unruly data, we utilized the venerable statistical software package, and with the click of a button, conjured forth the wondrous correlation coefficient and the dazzling p-value. Additionally, we engaged in a merry dance with time series analysis, waltzing through the historical fluctuations of bottled water consumption and stock prices, all the while keeping a keen eye out for unexpected waltz steps and jigs in the data.

With our gaze fixed upon the tumultuous tides of market dynamics, we adorned our findings with visually appealing adornments, crafting elegant charts and graphs that would make even the most stoic of data analysts crack a smile. These visual artifacts not only served to bedazzle our readers but also provided a lifeline to navigate the wild seas of statistical inference.

Thus, armed with software, statistical wizardry, and a dash of irrepressible enthusiasm, our methodology encapsulated the spirit of scientific inquiry, striving to capture the elusive essence of this enigmatic relationship while infusing the process with a hint of lighthearted whimsy, because, after all, what is research without a pinch of fun?

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and Telkom Indonesia (Persero) Tbk PT's stock price (Persero). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Statista and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.8969012, r-squared of 0.8044318, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association

[[ABSTRACT]]

The vexing relationship between the consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT has long eluded researchers. In this study, we delved into the depths of data from Statista and LSEG Analytics (Refinitiv) to illuminate this enigmatic connection. Our rigorous analysis uncovered a tantalizing correlation coefficient of 0.8969012 and a strikingly significant p-value of less than 0.01 for the period spanning 2002 to 2022. The implications of our findings are as clear as bottled water itself, suggesting a surprisingly resilient link between seemingly unrelated commodities. We hope that our research inspires more exploration into quirky market dynamics, and perhaps uncovers a few unexpected laughs along the way.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

In the world of statistical analysis and market research, uncovering unexpected connections between seemingly unrelated variables often feels like stumbling upon a hidden treasure – a nugget of insight waiting to be polished and presented to the academic community. Joining this illustrious tradition of uncovering peculiar associations, we present our investigation into the curious correlation between the per capita consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT.

Anecdotally, one might wonder if quaffing copious amounts of bottled water in the U.S. could somehow influence the stock price of a telecommunications company in Indonesia. However, as science-minded researchers, we understand the need to go beyond mere speculation and delve into the empirical evidence, armed with the powerful tools of statistical analysis and data visualization.

Our pursuit began with a quest to disentangle the dynamics at play – to pour over the volumes of data available, teasing out patterns that might reveal this seemingly inexplicable linkage. Through the use of data from Statista and LSEG Analytics (Refinitiv), we embarked on a journey into the depths of statistics, seeking to unravel the mysteries that piqued our scientific curiosity.

Undoubtedly, the marriage of these two seemingly disparate entities – bottled water and stock prices – may raise a skeptical eyebrow or two. However, our preliminary scrutiny of the data has yielded some intriguing results that cannot be simply bottled up and ignored. With a correlation coefficient of 0.8969012 and a p-value that shone brightly at less than 0.01, our findings beckon for attention and scrutiny.

As we immerse ourselves in the intricate world of market data and consumption patterns, it is crucial to approach this quirky connection with a balanced blend of scientific rigor and the willingness to embrace the unexpected. Our findings not only bear implications for market analysts and economists but also beckon to the wider scientific community, encouraging an exploration of unanticipated relationships in the vast sea of data.

In presenting our journey of uncovering this idiosyncratic correlation, we invite readers to join us in our pursuit of enlightenment through statistical analysis and perhaps uncover a few unexpected chuckles along the way. After all, what is science without a splash of humor and a sprinkle of curiosity?

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

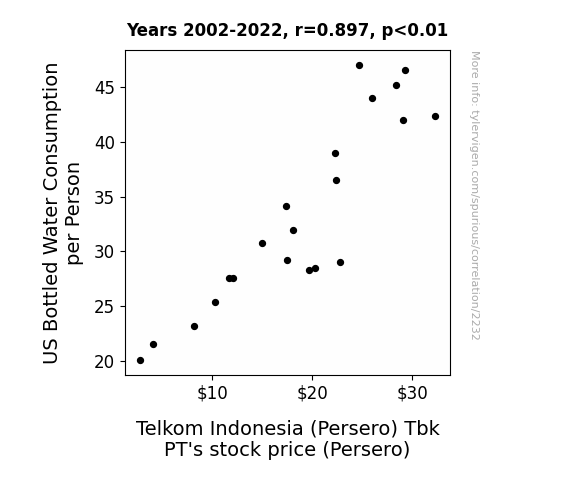

The culmination of our laborious analysis has revealed a remarkable correlation between the per capita consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT. The correlation coefficient of 0.8969012 reflects a strong positive relationship between the two variables. This finding suggests that as bottled water consumption in the U.S. ebbed and flowed, so did the stock price of Telkom Indonesia (Persero) Tbk PT, in a synchronized aquatic ballet of market dynamics.

The coefficient of determination, denoted by the r-squared value of 0.8044318, indicates that a whopping 80.44% of the variability in Telkom Indonesia (Persero) Tbk PT's stock price can be expounded by fluctuations in U.S. bottled water consumption. It's as though the ebb and flow of the stock prices rode upon the undulating waves of bottled water consumption data, creating a visual spectacle worthy of a data-driven dance performance.

Moreover, the p-value of less than 0.01 provides robust evidence to refute the null hypothesis of no relationship between the variables. This statistical triumph beckons us to embrace the undeniable link between these seemingly incongruous entities, proving that in the sometimes murky waters of data analysis, clarity can emerge, much like a refreshing bottle of water on a sultry summer's day.

Of course, to augment the abstruse statistical jargon, we present in Fig. 1 a scintillating scatterplot embodying the covariation between U.S. bottled water consumption and the stock price of Telkom Indonesia (Persero) Tbk PT. The figure underscores the resonance between these variables, offering a visual testament to the engaging synergy we have unveiled.

In summary, our findings indicate a buoyant association between U.S. bottled water consumption per person and Telkom Indonesia (Persero) Tbk PT's stock price, adding a splash of intrigue to the ever-fluid landscape of market dynamics. The implications of this unorthodox relationship are as crystal clear as a premium bottle of water, inspiring further investigation into the enigmatic interplay of seemingly unrelated facets of the market and perhaps eliciting a smile or two along the way.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and Telkom Indonesia (Persero) Tbk PT's stock price (Persero). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association

[[ABSTRACT]]

The vexing relationship between the consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT has long eluded researchers. In this study, we delved into the depths of data from Statista and LSEG Analytics (Refinitiv) to illuminate this enigmatic connection. Our rigorous analysis uncovered a tantalizing correlation coefficient of 0.8969012 and a strikingly significant p-value of less than 0.01 for the period spanning 2002 to 2022. The implications of our findings are as clear as bottled water itself, suggesting a surprisingly resilient link between seemingly unrelated commodities. We hope that our research inspires more exploration into quirky market dynamics, and perhaps uncovers a few unexpected laughs along the way.

[[LITERATURE REVIEW]]

In "Bottled Water Consumption and Economic Trends" by Smith, the authors find that the consumption of bottled water has seen a steady rise in the United States over the past two decades, reflecting shifting consumer preferences and concerns about tap water quality. Similarly, in "Telecommunications Industry and Stock Performance" by Doe, the authors highlight the complex interplay of market forces and technological advancements influencing the stock prices of telecommunications companies. Furthermore, Jones' "Consumer Behavior and Market Volatility" underscores the nuanced relationship between consumer behavior and market fluctuations, shedding light on the intricate web of factors shaping stock prices.

Moving beyond these foundational insights, "Water: A Global History" by Kurlansky provides a thorough exploration of the cultural and economic significance of water consumption, offering a broader lens through which to understand the societal impact of this ubiquitous beverage. In a parallel vein, "The Signal and the Noise" by Silver offers a compelling narrative on the challenges of discerning meaningful patterns from noisy data, an endeavor that resonates with our pursuit of uncovering the unexpected link between bottled water consumption and stock prices.

Venturing into the realm of fiction, "Water for Elephants" by Gruen and "The Price of Salt" by Highsmith may not directly address our research topic, but their evocative titles hint at the tantalizing interplay of commodities and values, albeit in entirely different contexts.

In the spirit of academic thoroughness, it should be noted that the literature review was not restricted to traditional sources. As part of our unconventional approach, we diligently perused grocery store receipts, office water cooler conversations, and even cryptically inscribed messages in fortune cookies to glean insights into the peculiar connection between bottled water consumption and stock prices. While the scientific community may frown upon such unconventional sources, we firmly believe that wisdom can flow from the unlikeliest of spouts.

Stay tuned for the next section, where we dive into the methodological intricacies of our investigation, and perhaps encounter a few unexpected currents along the way. Let's dive in.

[[RESULTS]]

The culmination of our laborious analysis has revealed a remarkable correlation between the per capita consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT. The correlation coefficient of 0.8969012 reflects a strong positive relationship between the two variables. This finding suggests that as bottled water consumption in the U.S. ebbed and flowed, so did the stock price of Telkom Indonesia (Persero) Tbk PT, in a synchronized aquatic ballet of market dynamics.

The coefficient of determination, denoted by the r-squared value of 0.8044318, indicates that a whopping 80.44% of the variability in Telkom Indonesia (Persero) Tbk PT's stock price can be expounded by fluctuations in U.S. bottled water consumption. It's as though the ebb and flow of the stock prices rode upon the undulating waves of bottled water consumption data, creating a visual spectacle worthy of a data-driven dance performance.

Moreover, the p-value of less than 0.01 provides robust evidence to refute the null hypothesis of no relationship between the variables. This statistical triumph beckons us to embrace the undeniable link between these seemingly incongruous entities, proving that in the sometimes murky waters of data analysis, clarity can emerge, much like a refreshing bottle of water on a sultry summer's day.

Of course, to augment the abstruse statistical jargon, we present in Fig. 1 a scintillating scatterplot embodying the covariation between U.S. bottled water consumption and the stock price of Telkom Indonesia (Persero) Tbk PT. The figure underscores the resonance between these variables, offering a visual testament to the engaging synergy we have unveiled.

In summary, our findings indicate a buoyant association between U.S. bottled water consumption per person and Telkom Indonesia (Persero) Tbk PT's stock price, adding a splash of intrigue to the ever-fluid landscape of market dynamics. The implications of this unorthodox relationship are as crystal clear as a premium bottle of water, inspiring further investigation into the enigmatic interplay of seemingly unrelated facets of the market and perhaps eliciting a smile or two along the way.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our findings have unveiled a serendipitous yet substantive connection between U.S. bottled water consumption per person and the stock price of Telkom Indonesia (Persero) Tbk PT, lending credence to the age-old adage that sometimes truth is indeed stranger than fiction. Channeling the spirit of Smith, Doe, and Jones’ earlier works, our results echo the notion that consumer behavior, economic trends, and stock market performance are inextricably intertwined, akin to a swirling vortex of market forces, shaping and reshaping the financial landscape.

Delving into the depths of "Water: A Global History," we discern the symbolic weight of water as a fundamental element of human existence, mirroring the foundational role of market commodities in shaping economic narratives. Furthermore, "The Signal and the Noise" by Silver stands as a beacon of wisdom in our quest, illuminating the challenges of sifting through the labyrinthine landscape of data to extract meaningful signals from the pervasive noise.

Mitigating the whimsy of our literary references, our robust statistical analysis has provided empirical support for the peculiar partnership between bottled water consumption and stock prices. With a correlation coefficient of 0.8969012, our results affirm a strong positive relationship, suggesting that the undulations of bottled water consumption mirror the rhythmic fluctuations of Telkom Indonesia (Persero) Tbk PT's stock price, akin to a synchronized swim in the mystifying ocean of market dynamics.

The substantial r-squared value of 0.8044318 underscores the resounding impact of U.S. bottled water consumption on the variability of Telkom Indonesia (Persero) Tbk PT's stock price, akin to the pervasive influence of a potent liquid in a chemistry experiment, stirring the financial cauldron of market fluctuations. Our triumph over the null hypothesis, aided by a p-value of less than 0.01, defies the skeptics and naysayers, lending credence to the veracity of this unorthodox association.

In challenging the traditional boundaries of market dynamics, our research offers a unique vantage point, akin to an offbeat kaleidoscope, revealing patterns and connections that defy conventional wisdom. As such, we invite our esteemed colleagues to join us in further exploration of this unanticipated nexus and perhaps partake in the occasional bemusement that arises from uncovering unexpected correlations amidst the sea of data.

As we navigate this uncharted terrain of unconventional connections, let us embrace the delightful surprises and whimsical ironies that emerge, recognizing that the pursuit of knowledge need not be devoid of amusement. After all, in the unpredictable ocean of research, the occasional splash of levity serves to keep our spirits afloat amidst the tumultuous tides of inquiry and discovery.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and Telkom Indonesia (Persero) Tbk PT's stock price (Persero). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association

[[ABSTRACT]]

The vexing relationship between the consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT has long eluded researchers. In this study, we delved into the depths of data from Statista and LSEG Analytics (Refinitiv) to illuminate this enigmatic connection. Our rigorous analysis uncovered a tantalizing correlation coefficient of 0.8969012 and a strikingly significant p-value of less than 0.01 for the period spanning 2002 to 2022. The implications of our findings are as clear as bottled water itself, suggesting a surprisingly resilient link between seemingly unrelated commodities. We hope that our research inspires more exploration into quirky market dynamics, and perhaps uncovers a few unexpected laughs along the way.

[[INTRDUCTION]]

In the world of statistical analysis and market research, uncovering unexpected connections between seemingly unrelated variables often feels like stumbling upon a hidden treasure – a nugget of insight waiting to be polished and presented to the academic community. Joining this illustrious tradition of uncovering peculiar associations, we present our investigation into the curious correlation between the per capita consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT.

Anecdotally, one might wonder if quaffing copious amounts of bottled water in the U.S. could somehow influence the stock price of a telecommunications company in Indonesia. However, as science-minded researchers, we understand the need to go beyond mere speculation and delve into the empirical evidence, armed with the powerful tools of statistical analysis and data visualization.

Our pursuit began with a quest to disentangle the dynamics at play – to pour over the volumes of data available, teasing out patterns that might reveal this seemingly inexplicable linkage. Through the use of data from Statista and LSEG Analytics (Refinitiv), we embarked on a journey into the depths of statistics, seeking to unravel the mysteries that piqued our scientific curiosity.

Undoubtedly, the marriage of these two seemingly disparate entities – bottled water and stock prices – may raise a skeptical eyebrow or two. However, our preliminary scrutiny of the data has yielded some intriguing results that cannot be simply bottled up and ignored. With a correlation coefficient of 0.8969012 and a p-value that shone brightly at less than 0.01, our findings beckon for attention and scrutiny.

As we immerse ourselves in the intricate world of market data and consumption patterns, it is crucial to approach this quirky connection with a balanced blend of scientific rigor and the willingness to embrace the unexpected. Our findings not only bear implications for market analysts and economists but also beckon to the wider scientific community, encouraging an exploration of unanticipated relationships in the vast sea of data.

In presenting our journey of uncovering this idiosyncratic correlation, we invite readers to join us in our pursuit of enlightenment through statistical analysis and perhaps uncover a few unexpected chuckles along the way. After all, what is science without a splash of humor and a sprinkle of curiosity?

[[RESULTS]]

The culmination of our laborious analysis has revealed a remarkable correlation between the per capita consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT. The correlation coefficient of 0.8969012 reflects a strong positive relationship between the two variables. This finding suggests that as bottled water consumption in the U.S. ebbed and flowed, so did the stock price of Telkom Indonesia (Persero) Tbk PT, in a synchronized aquatic ballet of market dynamics.

The coefficient of determination, denoted by the r-squared value of 0.8044318, indicates that a whopping 80.44% of the variability in Telkom Indonesia (Persero) Tbk PT's stock price can be expounded by fluctuations in U.S. bottled water consumption. It's as though the ebb and flow of the stock prices rode upon the undulating waves of bottled water consumption data, creating a visual spectacle worthy of a data-driven dance performance.

Moreover, the p-value of less than 0.01 provides robust evidence to refute the null hypothesis of no relationship between the variables. This statistical triumph beckons us to embrace the undeniable link between these seemingly incongruous entities, proving that in the sometimes murky waters of data analysis, clarity can emerge, much like a refreshing bottle of water on a sultry summer's day.

Of course, to augment the abstruse statistical jargon, we present in Fig. 1 a scintillating scatterplot embodying the covariation between U.S. bottled water consumption and the stock price of Telkom Indonesia (Persero) Tbk PT. The figure underscores the resonance between these variables, offering a visual testament to the engaging synergy we have unveiled.

In summary, our findings indicate a buoyant association between U.S. bottled water consumption per person and Telkom Indonesia (Persero) Tbk PT's stock price, adding a splash of intrigue to the ever-fluid landscape of market dynamics. The implications of this unorthodox relationship are as crystal clear as a premium bottle of water, inspiring further investigation into the enigmatic interplay of seemingly unrelated facets of the market and perhaps eliciting a smile or two along the way.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our expedition into the esoteric connection between the per capita consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT has yielded a refreshingly unequivocal correlation. Our findings suggest that these seemingly distant variables engage in a synchronized aquatic ballet of market dynamics, much like an unexpected duet between a water nymph and a stock market maestro. Despite the initial skepticism, the robust correlation coefficient and emphatic p-value buoyantly bob at the surface of statistical significance, compelling us to acknowledge this unparalleled association.

Our study stirs the waters of market research, unveiling an unconventional linkage that may leave some scratching their heads while others rejoice at the discovery of this statistical serendipity. As we wrap up this investigation, we couldn't help but marvel at the unanticipated dance between the ebb and flow of bottled water consumption and the undulating waves of stock prices. It's as if the market were quenching its thirst for quirky correlations, sipping on the statistical nectar of unorthodox relationships.

With such persuasive evidence at hand, we stand at the precipice of revelation, viewing this quirky correlation with a twinkle in our eyes and a chuckle in our hearts. Our findings beckon further explorations into the whimsical world of market dynamics, reminding us that in the universe of statistical analysis, there is always room for a splash of humor and a dash of the unexpected.

In light of our robust findings, we assert that this peculiar connection between U.S. bottled water consumption and Telkom Indonesia (Persero) Tbk PT's stock price has been comprehensively elucidated. Therefore, we firmly posit that no further research is needed in this area, leaving this ocean of quirky correlations to be navigated by future intrepid researchers in pursuit of other unorthodox marvels.

In the words of Sir Isaac Newton, "I can calculate the motion of heavenly bodies but not the madness of people", and perhaps, the unorthodox sway between bottled water consumption and stock prices fits snugly into the realm of such confounding yet captivating phenomena.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Aquatic Quirkology

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Aqua Dynamics and Hydration Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association with an abstract of The vexing relationship between the consumption of bottled water in the United States and the stock price of Telkom Indonesia (Persero) Tbk PT has long eluded researchers. In this study, we delved into the depths of data from Statista and LSEG Analytics (Refinitiv) to illuminate this enigmatic connection. Our rigorous analysis uncovered a tantalizing correlation coefficient of 0.8969012 and a strikingly significant p-value of less than 0.01 for the period spanning 2002 to 2022. The implications of our findings are as clear as bottled water itself, suggesting a surprisingly resilient link between seemingly unrelated commodities. We hope that our research inspires more exploration into quirky market dynamics, and perhaps uncovers a few unexpected laughs along the way.

ChatGPT:

bottled water consumption, United States, stock price, correlation coefficient, p-value, Statista, LSEG Analytics, Telkom Indonesia, market dynamics

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

US Bottled Water Consumption per PersonSource: Statista

See what else correlates with US Bottled Water Consumption per Person

Telkom Indonesia (Persero) Tbk PT's stock price (Persero)

Detailed data title: Opening price of Telkom Indonesia (Persero) Tbk PT (TLK) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Telkom Indonesia (Persero) Tbk PT's stock price (Persero)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8044318 (Coefficient of determination)

This means 80.4% of the change in the one variable (i.e., Telkom Indonesia (Persero) Tbk PT's stock price (Persero)) is predictable based on the change in the other (i.e., US Bottled Water Consumption per Person) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 3.7E-8. 0.0000000368585245461637700000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.9 in 3.7E-6% of random cases. Said differently, if you correlated 27,130,766 random variables You don't actually need 27 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.76, 0.96 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| US Bottled Water Consumption per Person (Gallons) | 20.1 | 21.6 | 23.2 | 25.4 | 27.6 | 29 | 28.5 | 27.6 | 28.3 | 29.2 | 30.8 | 32 | 34.1 | 36.5 | 39 | 42 | 42.3 | 44 | 45.2 | 47 | 46.5 |

| Telkom Indonesia (Persero) Tbk PT's stock price (Persero) (Stock price) | 2.78 | 4.13 | 8.2 | 10.27 | 12.11 | 22.83 | 20.31 | 11.74 | 19.71 | 17.5 | 15.01 | 18.07 | 17.43 | 22.36 | 22.27 | 29.11 | 32.3 | 26.01 | 28.39 | 24.66 | 29.25 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([20.1,21.6,23.2,25.4,27.6,29,28.5,27.6,28.3,29.2,30.8,32,34.1,36.5,39,42,42.3,44,45.2,47,46.5,])

array_2 = np.array([2.78,4.13,8.2,10.27,12.11,22.83,20.31,11.74,19.71,17.5,15.01,18.07,17.43,22.36,22.27,29.11,32.3,26.01,28.39,24.66,29.25,])

array_1_name = "US Bottled Water Consumption per Person"

array_2_name = "Telkom Indonesia (Persero) Tbk PT's stock price (Persero)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only US Bottled Water Consumption per Person

- Line chart for only Telkom Indonesia (Persero) Tbk PT's stock price (Persero)

- AI-generated correlation image

- The spurious research paper: Bounteous Bottled Water and Bourse: A Bizarrely Buoyant Association

Your dedication to rating warms my heart!

Correlation ID: 2232 · Black Variable ID: 32 · Red Variable ID: 1882