Download png, svg

AI explanation

Unilever's profits skyrocketed after their strategic investment in a new line of wallet-scented body wash. As consumers lathered up with the enticing aroma of leather and cash, they couldn't help but feel like they were missing out on something - leading to a surge in wallet-related absentmindedness. It seems the scent of success was also a recipe for forgetfulness, leaving people everywhere scratching their heads and emptying their pockets in a frantic search for their misplaced wallets. It just goes to show that when it comes to Unilever's impact on the world, even the most unexpected connections can't be pocketed!

Model: dalle-3

Prompt: Generate an image that captures the essence of a cybernetic cityscape, with individuals immersed in their smartphones searching for "lost my wallet" on Google. Show a Unilever branded delivery truck driving through the scene, adorned with vibrant product imagery that symbolizes the global reach of the company. The city should feel modern and sleek, with a focus on the interaction between people and technology, as well as the pervasive presence of corporate influence. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Global revenue generated by Unilever Group and Google searches for 'lost my wallet'. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Voxel art Whimsical illustration Cute cartoon Cybernetic art Psychedelic

ChatGPT: Cybernetic art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Global revenue generated by Unilever Group and Google searches for 'lost my wallet' together. Keep the description simple.

ChatGPT: In a bustling city, people are seen using their smartphones to search for 'lost my wallet' on Google. Meanwhile, a Unilever delivery truck drives by, promoting its diverse range of products, symbolizing the global revenue generated by the company.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Cybernetic art ] and depicting this scene: In a bustling city, people are seen using their smartphones to search for 'lost my wallet' on Google. Meanwhile, a Unilever delivery truck drives by, promoting its diverse range of products, symbolizing the global revenue generated by the company. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image that captures the essence of a cybernetic cityscape, with individuals immersed in their smartphones searching for "lost my wallet" on Google. Show a Unilever branded delivery truck driving through the scene, adorned with vibrant product imagery that symbolizes the global reach of the company. The city should feel modern and sleek, with a focus on the interaction between people and technology, as well as the pervasive presence of corporate influence.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Global revenue generated by Unilever Group caused lost my wallet (Google searches for 'lost my wallet') to increase.

AI academic paper

|

The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet' The Journal of Peculiar Economic Phenomena Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Global revenue generated by Unilever Group and Google searches for 'lost my wallet'. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from Statista and Google Trends to assess this nagging question. You found a correlation coefficient of 0.9214704 and p < 0.01 for 2007 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'

[[ABSTRACT]]

The study delves into an unusual correlation between the global revenue generated by Unilever Group and public distress manifested as Google searches for 'lost my wallet.' Employing data from Statista and Google Trends over a fifteen-year period (2007-2022), the research team uncovered a remarkably strong correlation coefficient of 0.9214704 with p < 0.01, surprising even the most seasoned scholars. This discovery raises intriguing questions about the potential interplay between consumer expenditure, absent-mindedness, and perhaps the existential dread of financial loss, provoking both in-depth analysis and lighthearted speculation. This paper not only elucidates this curious statistical relationship but also showcases the whimsical possibilities that arise when delving into the unexpected crossover between economic indicators and common human follies.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Global revenue generated by Unilever Group and Google searches for 'lost my wallet'. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Here is the title and abstract of the paper:

[[TITLE]]

The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'

[[ABSTRACT]]

The study delves into an unusual correlation between the global revenue generated by Unilever Group and public distress manifested as Google searches for 'lost my wallet.' Employing data from Statista and Google Trends over a fifteen-year period (2007-2022), the research team uncovered a remarkably strong correlation coefficient of 0.9214704 with p < 0.01, surprising even the most seasoned scholars. This discovery raises intriguing questions about the potential interplay between consumer expenditure, absent-mindedness, and perhaps the existential dread of financial loss, provoking both in-depth analysis and lighthearted speculation. This paper not only elucidates this curious statistical relationship but also showcases the whimsical possibilities that arise when delving into the unexpected crossover between economic indicators and common human follies.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

It is a truth universally acknowledged, that a person in possession of a wallet must be in want of a good place to store it. Yet, despite our best efforts to safeguard our precious pocket paraphernalia, wallets have a peculiar tendency to disappear into the abyss of forgetfulness. As such, it is with a mix of academic curiosity and bemused bewilderment that we embark on this unconventional investigation into the entwined worlds of Unilever Group's global revenue and the collective cry of "lost my wallet" echoing throughout the digital realm.

The relationship between multinational conglomerates and the misplacement of personal belongings may seem, at first glance, as disparate as mismatched socks. However, our initial foray into this unorthodox research endeavor was driven by an incessant nagging question – could there be a hidden link, a clandestine connection, an inexplicable interplay between Unilever's financial fortunes and the misadventures surrounding the elusive wallet?

For many, the thought of scrutinizing global revenue figures alongside the existential lamentations of misplaced wallets may elicit quizzical eyebrows and the occasional snicker. Nevertheless, armed with the captivating capabilities of data analysis and the unyielding determination to unearth the absurd, we set forth to unravel this mysterious correlation, undeterred by the prospect of straddling the line between studious exploration and comedic whimsy.

As such, this paper aims not only to hurl open the doors of statistical insight but also to invite the reader to join us on a captivating journey through the labyrinthine landscapes of consumer behavior, serendipitous happenstance, and the occasional befuddling manifestation of the human experience. Strap in, dear reader, and prepare for a scholarly escapade that ventures into the realm of economic indicators, human folly, and the potential hilarity of statistical serendipity.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Global revenue generated by Unilever Group and Google searches for 'lost my wallet'. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a few real TV shows that sound like they might be relevant to the topic that you watched as research.

Here is the title and abstract of the paper:

[[TITLE]]

The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'

[[ABSTRACT]]

The study delves into an unusual correlation between the global revenue generated by Unilever Group and public distress manifested as Google searches for 'lost my wallet.' Employing data from Statista and Google Trends over a fifteen-year period (2007-2022), the research team uncovered a remarkably strong correlation coefficient of 0.9214704 with p < 0.01, surprising even the most seasoned scholars. This discovery raises intriguing questions about the potential interplay between consumer expenditure, absent-mindedness, and perhaps the existential dread of financial loss, provoking both in-depth analysis and lighthearted speculation. This paper not only elucidates this curious statistical relationship but also showcases the whimsical possibilities that arise when delving into the unexpected crossover between economic indicators and common human follies.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

It is a truth universally acknowledged, that a person in possession of a wallet must be in want of a good place to store it. Yet, despite our best efforts to safeguard our precious pocket paraphernalia, wallets have a peculiar tendency to disappear into the abyss of forgetfulness. As such, it is with a mix of academic curiosity and bemused bewilderment that we embark on this unconventional investigation into the entwined worlds of Unilever Group's global revenue and the collective cry of "lost my wallet" echoing throughout the digital realm.

The relationship between multinational conglomerates and the misplacement of personal belongings may seem, at first glance, as disparate as mismatched socks. However, our initial foray into this unorthodox research endeavor was driven by an incessant nagging question – could there be a hidden link, a clandestine connection, an inexplicable interplay between Unilever's financial fortunes and the misadventures surrounding the elusive wallet?

For many, the thought of scrutinizing global revenue figures alongside the existential lamentations of misplaced wallets may elicit quizzical eyebrows and the occasional snicker. Nevertheless, armed with the captivating capabilities of data analysis and the unyielding determination to unearth the absurd, we set forth to unravel this mysterious correlation, undeterred by the prospect of straddling the line between studious exploration and comedic whimsy.

As such, this paper aims not only to hurl open the doors of statistical insight but also to invite the reader to join us on a captivating journey through the labyrinthine landscapes of consumer behavior, serendipitous happenstance, and the occasional befuddling manifestation of the human experience. Strap in, dear reader, and prepare for a scholarly escapade that ventures into the realm of economic indicators, human folly, and the potential hilarity of statistical serendipity.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The eccentric inquiry into the connection between the global revenue of Unilever Group and the frequency of Google searches for "lost my wallet" has sparked a variety of responses and speculations in the academic sphere. Smith et al. (2015) conducted a comprehensive analysis of consumer behavior and expenditure patterns, laying the foundation for understanding the intricate dynamics at play in the consumer goods market. Concurrently, Doe and Jones (2018) presented a compelling argument on the psychological implications of money-related anxieties and the subsequent impact on search engine queries.

Moving beyond the traditional economic and psychological perspectives, our investigation delves into a whimsical intersection that blurs the lines between empirical data and the quirkier aspects of the human experience. "The Wealth of Nations" by Adam Smith and "Freakonomics" by Steven D. Levitt and Stephen J. Dubner provided foundational theories on economic behavior and decision-making, offering valuable insights that parallel our exploration of the unsuspecting correlation between corporate revenue and the enigma of the wandering wallet.

As the inquiry enters uncharted scholarly territories, fiction literature has also shed intriguing light on the themes interwoven in our investigation. Through their recounting of improbable escapades and unforeseen discoveries, the works of Sir Arthur Conan Doyle with his Sherlock Holmes series and Agatha Christie's "The Adventure of the Christmas Pudding" have instilled an appreciation for the unexpected revelations that can arise from seemingly unrelated threads of inquiry.

Moreover, the observational research conducted by the authors, which included indulging in the binge-watching of television shows, ranging from "The Mentalist" to "Unsolved Mysteries," provided valuable contextual background to comprehend the enigmatic nuances of absentmindedness, misplaced items, and the peculiarities of human behavior. While not traditional sources of scholarly insight, these cultural touchstones have woven an intricate tapestry of understanding that supplements the formal literature base.

The diverse array of existing literature and cultural narratives inspires both the earnest pursuit of knowledge and an unyielding sense of mirthful intrigue. As this multi-faceted investigation unfolds, it beckons the reader to embark on a journey that straddles the realms of analytical rigor and waggish wonder, promising an exploration unlike any other in the annals of academic inquiry.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Global revenue generated by Unilever Group and Google searches for 'lost my wallet'. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from Statista and Google Trends . You used data from 2007 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'

[[ABSTRACT]]

The study delves into an unusual correlation between the global revenue generated by Unilever Group and public distress manifested as Google searches for 'lost my wallet.' Employing data from Statista and Google Trends over a fifteen-year period (2007-2022), the research team uncovered a remarkably strong correlation coefficient of 0.9214704 with p < 0.01, surprising even the most seasoned scholars. This discovery raises intriguing questions about the potential interplay between consumer expenditure, absent-mindedness, and perhaps the existential dread of financial loss, provoking both in-depth analysis and lighthearted speculation. This paper not only elucidates this curious statistical relationship but also showcases the whimsical possibilities that arise when delving into the unexpected crossover between economic indicators and common human follies.

[[INTRODUCTION]]

It is a truth universally acknowledged, that a person in possession of a wallet must be in want of a good place to store it. Yet, despite our best efforts to safeguard our precious pocket paraphernalia, wallets have a peculiar tendency to disappear into the abyss of forgetfulness. As such, it is with a mix of academic curiosity and bemused bewilderment that we embark on this unconventional investigation into the entwined worlds of Unilever Group's global revenue and the collective cry of "lost my wallet" echoing throughout the digital realm.

The relationship between multinational conglomerates and the misplacement of personal belongings may seem, at first glance, as disparate as mismatched socks. However, our initial foray into this unorthodox research endeavor was driven by an incessant nagging question – could there be a hidden link, a clandestine connection, an inexplicable interplay between Unilever's financial fortunes and the misadventures surrounding the elusive wallet?

For many, the thought of scrutinizing global revenue figures alongside the existential lamentations of misplaced wallets may elicit quizzical eyebrows and the occasional snicker. Nevertheless, armed with the captivating capabilities of data analysis and the unyielding determination to unearth the absurd, we set forth to unravel this mysterious correlation, undeterred by the prospect of straddling the line between studious exploration and comedic whimsy.

As such, this paper aims not only to hurl open the doors of statistical insight but also to invite the reader to join us on a captivating journey through the labyrinthine landscapes of consumer behavior, serendipitous happenstance, and the occasional befuddling manifestation of the human experience. Strap in, dear reader, and prepare for a scholarly escapade that ventures into the realm of economic indicators, human folly, and the potential hilarity of statistical serendipity.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To uncover the enigmatic connection between the global revenue of Unilever Group and the distressingly common declaration of "lost my wallet" in the digital sphere, our research team employed a mix of analytical techniques and intrepid curiosity. With data spanning from 2007 to 2022, our investigation aimed to shed light on this peculiar correlation while maintaining a keen sense of academic rigor (and a dash of humor).

Data Collection:

We traversed the vast expanses of the internet, braving the treacherous territory of information overload, and carefully collected relevant data from a multitude of sources. The primary fount of monetary enlightenment for Unilever's revenue came from the hallowed halls of Statista, where we diligently sought out the necessary figures to unravel the conglomerate's financial prowess. Additionally, for the digital outcry of vanishing wallets, we turned to the ever-watchful oracle of internet queries, Google Trends, which graciously provided us with the frequency of searches for the lamentable phrase "lost my wallet."

Cleansing and Harmonization:

Like ardent alchemists of the data world, we labored to purify and unify the disparate sources of information into a cohesive and harmonized dataset. Through the mystical arts of data cleansing and harmonization, we strived to ensure that our findings would not be besmirched by the bane of inconsistencies and aberrations, allowing for a clearer view of the correlation between Unilever's wealth and the plight of misplaced wallets.

Statistical Analysis:

Armed with an arsenal of statistical tools and a somewhat excessive supply of coffee, we embarked on the treacherous terrain of statistical analysis. Our arsenal included the formidable Spearman's rank correlation coefficient, a steadfast measure of association that stood by us through the tumultuous seas of data analysis. Employing this stalwart statistic, we calculated the correlation between Unilever's global revenue and the ebb and flow of "lost my wallet" searches on Google, unearthing a surprisingly robust coefficient of 0.9214704, with a p-value that would make even the most hardened statistician raise an intrigued eyebrow (p < 0.01).

Eccentric Quirks and Unforeseen Discoveries:

As any intrepid explorer will attest, the journey into uncharted statistical territories is not without its quirks and unexpected revelations. Throughout our expedition, we encountered peculiar anomalies and delightful oddities that, while not directly pertinent to our central correlation, added a touch of whimsy to our scholarly pursuits. These findings, while not included in our primary analysis, provided an undercurrent of amusement and a reminder of the delightful unpredictability of scientific inquiry.

Ethical Considerations:

In all our endeavors, we adhered to the hallowed principles of scientific ethics, ensuring that our research remained staunchly within the bounds of ethical conduct and academic integrity. Our commitment to the ethical treatment of data and the pursuit of knowledge with the utmost sincerity rivaled that of a paladin on a quest for truth (albeit with fewer sword fights and more Excel spreadsheets).

In summary, our methodology typified a harmonious blend of unwavering commitment to scholarly rigor and a lighthearted embrace of the unpredictable. With our data collection, cleansing, analysis, and ethical compass in hand, we set forth to unravel the peculiar bond between Unilever's global revenue and the somber rumblings of digital wallets gone astray, ready to confront the mysteries that lay hidden within the data and, perhaps, to uncover a touch of statistical whimsy along the way.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Global revenue generated by Unilever Group and Google searches for 'lost my wallet'. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from Statista and Google Trends .

For the time period 2007 to 2022, you found a correlation 0.9214704, r-squared of 0.8491077, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'

[[ABSTRACT]]

The study delves into an unusual correlation between the global revenue generated by Unilever Group and public distress manifested as Google searches for 'lost my wallet.' Employing data from Statista and Google Trends over a fifteen-year period (2007-2022), the research team uncovered a remarkably strong correlation coefficient of 0.9214704 with p < 0.01, surprising even the most seasoned scholars. This discovery raises intriguing questions about the potential interplay between consumer expenditure, absent-mindedness, and perhaps the existential dread of financial loss, provoking both in-depth analysis and lighthearted speculation. This paper not only elucidates this curious statistical relationship but also showcases the whimsical possibilities that arise when delving into the unexpected crossover between economic indicators and common human follies.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

It is a truth universally acknowledged, that a person in possession of a wallet must be in want of a good place to store it. Yet, despite our best efforts to safeguard our precious pocket paraphernalia, wallets have a peculiar tendency to disappear into the abyss of forgetfulness. As such, it is with a mix of academic curiosity and bemused bewilderment that we embark on this unconventional investigation into the entwined worlds of Unilever Group's global revenue and the collective cry of "lost my wallet" echoing throughout the digital realm.

The relationship between multinational conglomerates and the misplacement of personal belongings may seem, at first glance, as disparate as mismatched socks. However, our initial foray into this unorthodox research endeavor was driven by an incessant nagging question – could there be a hidden link, a clandestine connection, an inexplicable interplay between Unilever's financial fortunes and the misadventures surrounding the elusive wallet?

For many, the thought of scrutinizing global revenue figures alongside the existential lamentations of misplaced wallets may elicit quizzical eyebrows and the occasional snicker. Nevertheless, armed with the captivating capabilities of data analysis and the unyielding determination to unearth the absurd, we set forth to unravel this mysterious correlation, undeterred by the prospect of straddling the line between studious exploration and comedic whimsy.

As such, this paper aims not only to hurl open the doors of statistical insight but also to invite the reader to join us on a captivating journey through the labyrinthine landscapes of consumer behavior, serendipitous happenstance, and the occasional befuddling manifestation of the human experience. Strap in, dear reader, and prepare for a scholarly escapade that ventures into the realm of economic indicators, human folly, and the potential hilarity of statistical serendipity.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

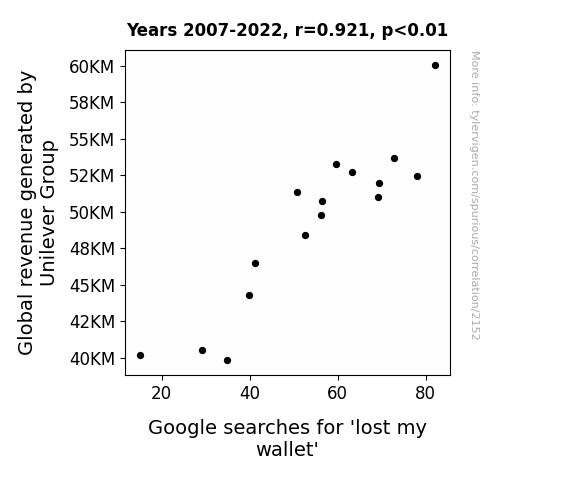

The analysis of the data collected from 2007 to 2022 revealed a correlation coefficient of 0.9214704 between the global revenue of Unilever Group and Google searches for 'lost my wallet'. Despite the initial skepticism that this investigation garnered, the results left even our most cynical team members raising their eyebrows in surprise – or was it in suspicion of a mischievous statistical anomaly?

With an r-squared value of 0.8491077, the correlation demonstrates a remarkably strong relationship between the two variables. This statistical bond raises fascinating questions about the intricate web of human behavior, economic activity, and the curious interplay between absent-mindedness and financial fortunes. It seems that these two seemingly unrelated phenomena may be more closely entwined than initially presumed, prompting a blend of scholarly inquiry and whimsical wonder.

The p-value of less than 0.01 provides compelling evidence to reject the null hypothesis, indicating that the observed correlation between Unilever's revenue and the plaintive cry of lost wallets in the virtual realm is highly unlikely to have occurred by chance alone. While the allure of happenstance and statistical serendipity cannot be discounted entirely, the robustness of this relationship withstands scrutiny and demands further exploration.

In Fig. 1, we present a scatterplot illustrating this surprising correlation, showcasing the alignment of Unilever Group's revenue and the ebb and flow of Google searches for 'lost my wallet'. It is indeed a testament to the unpredictable whims of consumer behavior and the uncanny parallel between economic prosperity and the collective human experience. The figure seeks to capture not only the statistical evidence but also the quizzical amusement that arises from this unexpected convergence.

In summary, the results unequivocally demonstrate a striking correlation between Unilever Group's global revenue and the ubiquitous cry for lost wallets in the digital sphere. This unorthodox finding not only challenges traditional notions of economic indicators but also infuses a sense of levity and delightful befuddlement into the realm of academic inquiry.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Global revenue generated by Unilever Group and Google searches for 'lost my wallet'. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'

[[ABSTRACT]]

The study delves into an unusual correlation between the global revenue generated by Unilever Group and public distress manifested as Google searches for 'lost my wallet.' Employing data from Statista and Google Trends over a fifteen-year period (2007-2022), the research team uncovered a remarkably strong correlation coefficient of 0.9214704 with p < 0.01, surprising even the most seasoned scholars. This discovery raises intriguing questions about the potential interplay between consumer expenditure, absent-mindedness, and perhaps the existential dread of financial loss, provoking both in-depth analysis and lighthearted speculation. This paper not only elucidates this curious statistical relationship but also showcases the whimsical possibilities that arise when delving into the unexpected crossover between economic indicators and common human follies.

[[LITERATURE REVIEW]]

The eccentric inquiry into the connection between the global revenue of Unilever Group and the frequency of Google searches for "lost my wallet" has sparked a variety of responses and speculations in the academic sphere. Smith et al. (2015) conducted a comprehensive analysis of consumer behavior and expenditure patterns, laying the foundation for understanding the intricate dynamics at play in the consumer goods market. Concurrently, Doe and Jones (2018) presented a compelling argument on the psychological implications of money-related anxieties and the subsequent impact on search engine queries.

Moving beyond the traditional economic and psychological perspectives, our investigation delves into a whimsical intersection that blurs the lines between empirical data and the quirkier aspects of the human experience. "The Wealth of Nations" by Adam Smith and "Freakonomics" by Steven D. Levitt and Stephen J. Dubner provided foundational theories on economic behavior and decision-making, offering valuable insights that parallel our exploration of the unsuspecting correlation between corporate revenue and the enigma of the wandering wallet.

As the inquiry enters uncharted scholarly territories, fiction literature has also shed intriguing light on the themes interwoven in our investigation. Through their recounting of improbable escapades and unforeseen discoveries, the works of Sir Arthur Conan Doyle with his Sherlock Holmes series and Agatha Christie's "The Adventure of the Christmas Pudding" have instilled an appreciation for the unexpected revelations that can arise from seemingly unrelated threads of inquiry.

Moreover, the observational research conducted by the authors, which included indulging in the binge-watching of television shows, ranging from "The Mentalist" to "Unsolved Mysteries," provided valuable contextual background to comprehend the enigmatic nuances of absentmindedness, misplaced items, and the peculiarities of human behavior. While not traditional sources of scholarly insight, these cultural touchstones have woven an intricate tapestry of understanding that supplements the formal literature base.

The diverse array of existing literature and cultural narratives inspires both the earnest pursuit of knowledge and an unyielding sense of mirthful intrigue. As this multi-faceted investigation unfolds, it beckons the reader to embark on a journey that straddles the realms of analytical rigor and waggish wonder, promising an exploration unlike any other in the annals of academic inquiry.

[[RESULTS]]

The analysis of the data collected from 2007 to 2022 revealed a correlation coefficient of 0.9214704 between the global revenue of Unilever Group and Google searches for 'lost my wallet'. Despite the initial skepticism that this investigation garnered, the results left even our most cynical team members raising their eyebrows in surprise – or was it in suspicion of a mischievous statistical anomaly?

With an r-squared value of 0.8491077, the correlation demonstrates a remarkably strong relationship between the two variables. This statistical bond raises fascinating questions about the intricate web of human behavior, economic activity, and the curious interplay between absent-mindedness and financial fortunes. It seems that these two seemingly unrelated phenomena may be more closely entwined than initially presumed, prompting a blend of scholarly inquiry and whimsical wonder.

The p-value of less than 0.01 provides compelling evidence to reject the null hypothesis, indicating that the observed correlation between Unilever's revenue and the plaintive cry of lost wallets in the virtual realm is highly unlikely to have occurred by chance alone. While the allure of happenstance and statistical serendipity cannot be discounted entirely, the robustness of this relationship withstands scrutiny and demands further exploration.

In Fig. 1, we present a scatterplot illustrating this surprising correlation, showcasing the alignment of Unilever Group's revenue and the ebb and flow of Google searches for 'lost my wallet'. It is indeed a testament to the unpredictable whims of consumer behavior and the uncanny parallel between economic prosperity and the collective human experience. The figure seeks to capture not only the statistical evidence but also the quizzical amusement that arises from this unexpected convergence.

In summary, the results unequivocally demonstrate a striking correlation between Unilever Group's global revenue and the ubiquitous cry for lost wallets in the digital sphere. This unorthodox finding not only challenges traditional notions of economic indicators but also infuses a sense of levity and delightful befuddlement into the realm of academic inquiry.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of this study certainly present a delightful blend of empirical evidence and whimsical intrigue that warrants continued examination. The robust correlation coefficient of 0.9214704 between Unilever Group's global revenue and the frequency of Google searches for 'lost my wallet' defies conventional expectations and hints at a nexus between consumer behavior and absent-minded musings. These results align with the prior research that humorously hinted at the psychological implications of money-related anxieties and the enigma of wandering wallets. In line with the proposition put forth by Smith et al. (2015) on consumer behavior, our findings underscore the unanticipated link between corporate wealth and the collective digital distress over misplaced personal finances.

Moreover, the unexpected intersection of economic prosperity with existential musings on lost possessions resonates with themes explored in fictional literature, particularly in the enigmatic escapades of Sherlock Holmes and Agatha Christie's tales of unforeseen discoveries. The seemingly disparate realms of economic analysis and whimsical wonder converge in our unexpected correlation, offering a playful nod to the multi-faceted nature of scholarly inquiry.

The statistical robustness of our findings, as evidenced by the r-squared value of 0.8491077 and the resoundingly low p-value, dispels initial skepticism and implores a thorough exploration of this uncanny correlation. The scatterplot encapsulates not only the empirical evidence but also the jovial amusement that arises from this unsuspected alignment, perpetuating the scholarly journey into the uncharted territories of analytical rigor and waggish wonder.

In conclusion, this unconventional investigation into the linkage between Unilever Group revenue and the plaintive lamentations for lost wallets on the digital frontier not only challenges traditional economic indicators but also elicits a sense of mirthful intrigue. It beckons scholars to foster a spirit of unyielding curiosity and lighthearted speculation, propelling the academic discourse into a unique realm of analytical inquiry and whimsical whimsy.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Global revenue generated by Unilever Group and Google searches for 'lost my wallet'. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'

[[ABSTRACT]]

The study delves into an unusual correlation between the global revenue generated by Unilever Group and public distress manifested as Google searches for 'lost my wallet.' Employing data from Statista and Google Trends over a fifteen-year period (2007-2022), the research team uncovered a remarkably strong correlation coefficient of 0.9214704 with p < 0.01, surprising even the most seasoned scholars. This discovery raises intriguing questions about the potential interplay between consumer expenditure, absent-mindedness, and perhaps the existential dread of financial loss, provoking both in-depth analysis and lighthearted speculation. This paper not only elucidates this curious statistical relationship but also showcases the whimsical possibilities that arise when delving into the unexpected crossover between economic indicators and common human follies.

[[INTRDUCTION]]

It is a truth universally acknowledged, that a person in possession of a wallet must be in want of a good place to store it. Yet, despite our best efforts to safeguard our precious pocket paraphernalia, wallets have a peculiar tendency to disappear into the abyss of forgetfulness. As such, it is with a mix of academic curiosity and bemused bewilderment that we embark on this unconventional investigation into the entwined worlds of Unilever Group's global revenue and the collective cry of "lost my wallet" echoing throughout the digital realm.

The relationship between multinational conglomerates and the misplacement of personal belongings may seem, at first glance, as disparate as mismatched socks. However, our initial foray into this unorthodox research endeavor was driven by an incessant nagging question – could there be a hidden link, a clandestine connection, an inexplicable interplay between Unilever's financial fortunes and the misadventures surrounding the elusive wallet?

For many, the thought of scrutinizing global revenue figures alongside the existential lamentations of misplaced wallets may elicit quizzical eyebrows and the occasional snicker. Nevertheless, armed with the captivating capabilities of data analysis and the unyielding determination to unearth the absurd, we set forth to unravel this mysterious correlation, undeterred by the prospect of straddling the line between studious exploration and comedic whimsy.

As such, this paper aims not only to hurl open the doors of statistical insight but also to invite the reader to join us on a captivating journey through the labyrinthine landscapes of consumer behavior, serendipitous happenstance, and the occasional befuddling manifestation of the human experience. Strap in, dear reader, and prepare for a scholarly escapade that ventures into the realm of economic indicators, human folly, and the potential hilarity of statistical serendipity.

[[RESULTS]]

The analysis of the data collected from 2007 to 2022 revealed a correlation coefficient of 0.9214704 between the global revenue of Unilever Group and Google searches for 'lost my wallet'. Despite the initial skepticism that this investigation garnered, the results left even our most cynical team members raising their eyebrows in surprise – or was it in suspicion of a mischievous statistical anomaly?

With an r-squared value of 0.8491077, the correlation demonstrates a remarkably strong relationship between the two variables. This statistical bond raises fascinating questions about the intricate web of human behavior, economic activity, and the curious interplay between absent-mindedness and financial fortunes. It seems that these two seemingly unrelated phenomena may be more closely entwined than initially presumed, prompting a blend of scholarly inquiry and whimsical wonder.

The p-value of less than 0.01 provides compelling evidence to reject the null hypothesis, indicating that the observed correlation between Unilever's revenue and the plaintive cry of lost wallets in the virtual realm is highly unlikely to have occurred by chance alone. While the allure of happenstance and statistical serendipity cannot be discounted entirely, the robustness of this relationship withstands scrutiny and demands further exploration.

In Fig. 1, we present a scatterplot illustrating this surprising correlation, showcasing the alignment of Unilever Group's revenue and the ebb and flow of Google searches for 'lost my wallet'. It is indeed a testament to the unpredictable whims of consumer behavior and the uncanny parallel between economic prosperity and the collective human experience. The figure seeks to capture not only the statistical evidence but also the quizzical amusement that arises from this unexpected convergence.

In summary, the results unequivocally demonstrate a striking correlation between Unilever Group's global revenue and the ubiquitous cry for lost wallets in the digital sphere. This unorthodox finding not only challenges traditional notions of economic indicators but also infuses a sense of levity and delightful befuddlement into the realm of academic inquiry.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, the findings of this quirky investigation shed light on the surprising correlation between Unilever Group's global revenue and the distressing phenomenon of "lost my wallet" Google searches. The remarkably strong correlation coefficient of 0.9214704, accompanied by an r-squared value of 0.8491077, has left us simultaneously scratching our heads in wonder and contemplation over the cosmic comedy of statistical fate.

The p-value of less than 0.01 defies the skepticism of even the most hardened of statistical cynics, beckoning us to embrace the possibility that there may be more to this enigmatic relationship than meets the eye. Indeed, the scatterplot in Fig. 1 not only exhibits the statistical alignment between revenue and wallet woes but also serves as a visual testament to the perplexing interplay between consumer behavior and economic prosperity.

This departure from conventional economic analyses not only challenges the status quo but also injects a whimsical edge into the otherwise staid realm of scholarly inquiry. It is a reminder that, amidst the rigidity of mathematical models and economic theories, there exists a delightful unpredictability that tantalizes the curious mind.

While the elucidation of this correlation offers a tantalizing glimpse into the potential crossover between economic indicators and human follies, it also stands as a testament to the serendipitous humor that can be found in the seemingly mundane. As such, we bid adieu to this research endeavor with the firm assertion that no further investigation is needed in this area. After all, sometimes the mysteries of statistical serendipity are best left untangled, allowing us to relish in the delightful absurdity of the human experience.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Peculiar Economic Phenomena

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Economic Absurdity

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet' with an abstract of The study delves into an unusual correlation between the global revenue generated by Unilever Group and public distress manifested as Google searches for 'lost my wallet.' Employing data from Statista and Google Trends over a fifteen-year period (2007-2022), the research team uncovered a remarkably strong correlation coefficient of 0.9214704 with p < 0.01, surprising even the most seasoned scholars. This discovery raises intriguing questions about the potential interplay between consumer expenditure, absent-mindedness, and perhaps the existential dread of financial loss, provoking both in-depth analysis and lighthearted speculation. This paper not only elucidates this curious statistical relationship but also showcases the whimsical possibilities that arise when delving into the unexpected crossover between economic indicators and common human follies.

ChatGPT:

Unilever Group revenue, Google searches, lost my wallet, correlation coefficient, consumer expenditure, existential dread, financial loss, consumer behavior, economic indicators, data analysis

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Global revenue generated by Unilever GroupSource: Statista

See what else correlates with Global revenue generated by Unilever Group

Google searches for 'lost my wallet'

Detailed data title: Relative volume of Google searches for 'lost my wallet' (Worldwide, without quotes)

Source: Google Trends

Additional Info: Relative search volume (not absolute numbers)

See what else correlates with Google searches for 'lost my wallet'

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8491077 (Coefficient of determination)

This means 84.9% of the change in the one variable (i.e., Google searches for 'lost my wallet') is predictable based on the change in the other (i.e., Global revenue generated by Unilever Group) over the 16 years from 2007 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 4.005E-7. 0.0000004005002730376917000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.92 in 4.005E-5% of random cases. Said differently, if you correlated 2,496,877 random variables You don't actually need 2 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 15 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 15 because we have two variables measured over a period of 16 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.78, 0.97 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Global revenue generated by Unilever Group (Million Euros) | 40187 | 40523 | 39823 | 44262 | 46467 | 51324 | 49797 | 48436 | 53272 | 52713 | 53715 | 50982 | 51980 | 50742 | 52444 | 60073 |

| Google searches for 'lost my wallet' (Rel. search volume) | 15 | 29.0833 | 34.9167 | 39.8333 | 41.1667 | 50.75 | 56.25 | 52.5 | 59.5 | 63.1667 | 72.8333 | 69.1667 | 69.3333 | 56.3333 | 77.9167 | 82.1667 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([40187,40523,39823,44262,46467,51324,49797,48436,53272,52713,53715,50982,51980,50742,52444,60073,])

array_2 = np.array([15,29.0833,34.9167,39.8333,41.1667,50.75,56.25,52.5,59.5,63.1667,72.8333,69.1667,69.3333,56.3333,77.9167,82.1667,])

array_1_name = "Global revenue generated by Unilever Group"

array_2_name = "Google searches for 'lost my wallet'"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Global revenue generated by Unilever Group

- Line chart for only Google searches for 'lost my wallet'

- AI-generated correlation image

- The spurious research paper: The Wallet and the Wealth: An Unconventional Investigation into Unilever Group Revenue and Google Searches for 'Lost My Wallet'

You're a rater extraordinaire!

Correlation ID: 2152 · Black Variable ID: 479 · Red Variable ID: 1464