Download png, svg

AI explanation

As butter consumption increases, so does the demand for baked goods. With more baked goods being sold, there is a boom in the commercial real estate market as bakeries and cafes clamor for space to meet the buttery needs of their customers. This surge in demand for commercial properties propels Equinix, a leading data center and interconnection provider, as these establishments require robust digital infrastructure to support their operations. It's a cascading effect - buttering up the economy one slice of toast at a time, and lining the pockets of Equinix investors in the process.

Model: dalle-3

Prompt: Generate an image that portrays a bustling city skyline with a sleek Equinix building standing prominently. People are happily indulging in pastries and desserts near the building, while a steady stream of trucks labeled "Butter Supply Chain" are unloading butter crates into the facility. The Equinix building features a prominent sign that reads "Butter Vault," and the stock ticker prominently displays the rising stock price of Equinix. The scene should be vibrant, with a focus on the building, people, and the bustling city. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Butter consumption and Equinix's stock price (EQIX). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Charcoal Psychedelic Voxel art Futuristic A TIME magazine cover image

ChatGPT: A TIME magazine cover image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Butter consumption and Equinix's stock price (EQIX), in the following situation: As butter consumption increased, so did the demand for pastries and desserts. This led to a surge in the need for refrigerated storage, prompting businesses to invest in additional storage space. Equinix, a leading data center and interconnection provider, capitalized on this opportunity by converting some of their facilities into ultra-modern butter vaults, creating a new stream of revenue. As the butter supply chain became more reliant on Equinix's secure and well-connected butter storage solutions, investors churned out money, causing Equinix's stock price to rise.. Keep the description simple.

ChatGPT: In a bustling city, a sleek Equinix building stands tall amidst the skyline. Outside, people are seen happily indulging in pastries and desserts, while a steady stream of trucks labeled "Butter Supply Chain" are unloading butter crates into the building. The Equinix building now features a prominent sign that reads "Butter Vault." Meanwhile, the stock ticker prominently displays Equinix's rising stock price.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A TIME magazine cover image ] and depicting this scene: In a bustling city, a sleek Equinix building stands tall amidst the skyline. Outside, people are seen happily indulging in pastries and desserts, while a steady stream of trucks labeled "Butter Supply Chain" are unloading butter crates into the building. The Equinix building now features a prominent sign that reads "Butter Vault." Meanwhile, the stock ticker prominently displays Equinix's rising stock price. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image that portrays a bustling city skyline with a sleek Equinix building standing prominently. People are happily indulging in pastries and desserts near the building, while a steady stream of trucks labeled "Butter Supply Chain" are unloading butter crates into the facility. The Equinix building features a prominent sign that reads "Butter Vault," and the stock ticker prominently displays the rising stock price of Equinix. The scene should be vibrant, with a focus on the building, people, and the bustling city.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Butter consumption caused Equinix's stock price (EQIX) to increase. Make it feel plausible.

AI academic paper

|

Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price The Journal of Gastronomical Finance Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Butter consumption and Equinix's stock price (EQIX). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title seem clever.

Your research team used data from USDA and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9063503 and p < 0.01 for 2003 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price

[[ABSTRACT]]

This paper investigates the curious relationship between butter consumption and Equinix's stock price, utilizing data from the US Department of Agriculture and LSEG Analytics (Refinitiv). By applying advanced statistical analysis, we discovered a striking correlation coefficient of 0.9063503 and an impressive p-value of less than 0.01 for the period spanning 2003 to 2021. Our findings not only butter up the connection between these seemingly unrelated variables but also churn up the financial market's understanding of the dairy industry's impact on stock performance. We hope this research spreads some light-hearted cheer and proves to be a de-lightful read for our esteemed colleagues in the research community.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Butter consumption and Equinix's stock price (EQIX). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Here is the title and abstract of the paper:

[[TITLE]]

Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price

[[ABSTRACT]]

This paper investigates the curious relationship between butter consumption and Equinix's stock price, utilizing data from the US Department of Agriculture and LSEG Analytics (Refinitiv). By applying advanced statistical analysis, we discovered a striking correlation coefficient of 0.9063503 and an impressive p-value of less than 0.01 for the period spanning 2003 to 2021. Our findings not only butter up the connection between these seemingly unrelated variables but also churn up the financial market's understanding of the dairy industry's impact on stock performance. We hope this research spreads some light-hearted cheer and proves to be a de-lightful read for our esteemed colleagues in the research community.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The interplay between seemingly disparate variables has long captivated the intrigue of researchers and investors alike. In a world where economic and financial analyses often lean heavily on conventional indicators and market dynamics, the unearthing of unexpected correlations can be akin to finding a nugget of gold amidst the gravel. In this study, we embark on a quest to shed some light on the peculiar relationship between butter consumption and the stock price of Equinix, a leading provider of data center and interconnection solutions – a quest that may seem as outlandish as searching for a cow in Wall Street's bull market.

As financial enthusiasts, we have always relished the opportunity to dive into uncharted statistical waters, where the tide of conventional wisdom often wanes, and waves of data present themselves as clues to uncover hidden links. Like intrepid cartographers of the financial frontier, we aim to map out the contours of this “butterly” connection, steering our ship through the turbulent seas of econometric analysis and statistical inference. Together, we plow through ceilings of resistance and butter up the bridges between two seemingly incongruous worlds – the delectable realm of dairy consumption and the robust domain of stock market dynamics.

It's no secret that the financial markets are replete with harebrained theories and offbeat observations, from the "hemline index" to the infamous "Super Bowl indicator." While we certainly do not claim to have adopted such a whimsical approach, our study’s subject matter may invoke a chuckle or two, as we examine butter consumption with the gravity one might reserve for GDP forecasts or price-earnings ratios. Nevertheless, beneath the buttery surface, serious economic implications may churn. The dairy industry, often relegated to the breakfast table or baking recipes, may indeed hold a key to discerning market trends and contributing to a deeper understanding of stock performance.

With dairy in mind and stocks at stake, we invite readers to join us on a journey that promises to be as rich and fulfilling as a slathered slice of brioche. As we dive into the nitty-gritty of our statistical analysis and empirical findings, our aim is to spread some light-hearted cheer while maintaining scientific rigor, all whilst hoping the buttery connection we uncover doesn’t melt under the scrutiny of the research community. We trust that this study will be a de-lightful read for both those with a passion for stock market analysis and a penchant for dairy-based puns. Let’s churn the hypothesis, spread the findings, and uncover the stock market’s newfound taste for butter – after all, where there’s a will, there’s a whey.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Butter consumption and Equinix's stock price (EQIX). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Perhaps you also got inspiration from some board games that are vaugely related.

Here is the title and abstract of the paper:

[[TITLE]]

Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price

[[ABSTRACT]]

This paper investigates the curious relationship between butter consumption and Equinix's stock price, utilizing data from the US Department of Agriculture and LSEG Analytics (Refinitiv). By applying advanced statistical analysis, we discovered a striking correlation coefficient of 0.9063503 and an impressive p-value of less than 0.01 for the period spanning 2003 to 2021. Our findings not only butter up the connection between these seemingly unrelated variables but also churn up the financial market's understanding of the dairy industry's impact on stock performance. We hope this research spreads some light-hearted cheer and proves to be a de-lightful read for our esteemed colleagues in the research community.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The interplay between seemingly disparate variables has long captivated the intrigue of researchers and investors alike. In a world where economic and financial analyses often lean heavily on conventional indicators and market dynamics, the unearthing of unexpected correlations can be akin to finding a nugget of gold amidst the gravel. In this study, we embark on a quest to shed some light on the peculiar relationship between butter consumption and the stock price of Equinix, a leading provider of data center and interconnection solutions – a quest that may seem as outlandish as searching for a cow in Wall Street's bull market.

As financial enthusiasts, we have always relished the opportunity to dive into uncharted statistical waters, where the tide of conventional wisdom often wanes, and waves of data present themselves as clues to uncover hidden links. Like intrepid cartographers of the financial frontier, we aim to map out the contours of this “butterly” connection, steering our ship through the turbulent seas of econometric analysis and statistical inference. Together, we plow through ceilings of resistance and butter up the bridges between two seemingly incongruous worlds – the delectable realm of dairy consumption and the robust domain of stock market dynamics.

It's no secret that the financial markets are replete with harebrained theories and offbeat observations, from the "hemline index" to the infamous "Super Bowl indicator." While we certainly do not claim to have adopted such a whimsical approach, our study’s subject matter may invoke a chuckle or two, as we examine butter consumption with the gravity one might reserve for GDP forecasts or price-earnings ratios. Nevertheless, beneath the buttery surface, serious economic implications may churn. The dairy industry, often relegated to the breakfast table or baking recipes, may indeed hold a key to discerning market trends and contributing to a deeper understanding of stock performance.

With dairy in mind and stocks at stake, we invite readers to join us on a journey that promises to be as rich and fulfilling as a slathered slice of brioche. As we dive into the nitty-gritty of our statistical analysis and empirical findings, our aim is to spread some light-hearted cheer while maintaining scientific rigor, all whilst hoping the buttery connection we uncover doesn’t melt under the scrutiny of the research community. We trust that this study will be a de-lightful read for both those with a passion for stock market analysis and a penchant for dairy-based puns. Let’s churn the hypothesis, spread the findings, and uncover the stock market’s newfound taste for butter – after all, where there’s a will, there’s a whey.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In their quest to uncover the links between butter consumption and stock market performance, the authors stumbled upon a plethora of diverse literature. Smith et al. (2015) examined the dairy industry's impact on consumer spending habits, while Doe and Jones (2018) delved into the financial implications of agricultural commodities. These studies offer valuable insights into the broader context of our investigation, providing a solid foundation for understanding the multifaceted dynamics at play. However, as we navigate through this literature review, brace yourselves for a Titanic shift from the conventional to the comical.

Turning our attention to non-fiction literature, "The Big Butter Book" by Milk and Cream (2020) and "Equinix's Equations" by Data Geek (2017) offer informative perspectives on butter production and stock market analysis, respectively. While grounding our research in empirical evidence, we also draw inspiration from fiction, where the line between reality and whimsy blurs. "Churning Profits: A Saga of Dairy and Dollars" by Bestseller Author (2019) and "The Interconnected Chronicles" by Financial Fictionist (2016) may sound like works of pure imagination, but they carry an unexpected semblance of relevance to our peculiar investigation.

In the realm of board games, "Stocks and Butter: A Game of Financial Feast" and "Interconnecting Investments: The Butter Edition" offer playful, albeit tangential, nods to the intersection of dairy and stock market dynamics. These seemingly unrelated sources usher us into a world where statistical analysis meets serendipitous discoveries, where the notion of a "butterly connection" between Equinix's stock price and butter consumption takes center stage. As we journey through the thick and thin of scholarly literature, let's embrace the unexpected, for in the realm of research, surprises are the butter to our bread.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Butter consumption and Equinix's stock price (EQIX). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) . You used data from 2003 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price

[[ABSTRACT]]

This paper investigates the curious relationship between butter consumption and Equinix's stock price, utilizing data from the US Department of Agriculture and LSEG Analytics (Refinitiv). By applying advanced statistical analysis, we discovered a striking correlation coefficient of 0.9063503 and an impressive p-value of less than 0.01 for the period spanning 2003 to 2021. Our findings not only butter up the connection between these seemingly unrelated variables but also churn up the financial market's understanding of the dairy industry's impact on stock performance. We hope this research spreads some light-hearted cheer and proves to be a de-lightful read for our esteemed colleagues in the research community.

[[INTRODUCTION]]

The interplay between seemingly disparate variables has long captivated the intrigue of researchers and investors alike. In a world where economic and financial analyses often lean heavily on conventional indicators and market dynamics, the unearthing of unexpected correlations can be akin to finding a nugget of gold amidst the gravel. In this study, we embark on a quest to shed some light on the peculiar relationship between butter consumption and the stock price of Equinix, a leading provider of data center and interconnection solutions – a quest that may seem as outlandish as searching for a cow in Wall Street's bull market.

As financial enthusiasts, we have always relished the opportunity to dive into uncharted statistical waters, where the tide of conventional wisdom often wanes, and waves of data present themselves as clues to uncover hidden links. Like intrepid cartographers of the financial frontier, we aim to map out the contours of this “butterly” connection, steering our ship through the turbulent seas of econometric analysis and statistical inference. Together, we plow through ceilings of resistance and butter up the bridges between two seemingly incongruous worlds – the delectable realm of dairy consumption and the robust domain of stock market dynamics.

It's no secret that the financial markets are replete with harebrained theories and offbeat observations, from the "hemline index" to the infamous "Super Bowl indicator." While we certainly do not claim to have adopted such a whimsical approach, our study’s subject matter may invoke a chuckle or two, as we examine butter consumption with the gravity one might reserve for GDP forecasts or price-earnings ratios. Nevertheless, beneath the buttery surface, serious economic implications may churn. The dairy industry, often relegated to the breakfast table or baking recipes, may indeed hold a key to discerning market trends and contributing to a deeper understanding of stock performance.

With dairy in mind and stocks at stake, we invite readers to join us on a journey that promises to be as rich and fulfilling as a slathered slice of brioche. As we dive into the nitty-gritty of our statistical analysis and empirical findings, our aim is to spread some light-hearted cheer while maintaining scientific rigor, all whilst hoping the buttery connection we uncover doesn’t melt under the scrutiny of the research community. We trust that this study will be a de-lightful read for both those with a passion for stock market analysis and a penchant for dairy-based puns. Let’s churn the hypothesis, spread the findings, and uncover the stock market’s newfound taste for butter – after all, where there’s a will, there’s a whey.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

In this study, the methodology employed to investigate the association between butter consumption and Equinix's stock price was hatched through a combination of quantitative analytics, econometric modeling, and a sprinkle of whimsical, yet rigorous, statistical techniques. The data utilized in this endeavor were sourced from the US Department of Agriculture's comprehensive records on butter consumption and LSEG Analytics (Refinitiv) for Equinix's stock price index data, covering the period from 2003 to 2021.

To begin, a buttery spread of statistical analyses was applied to the gathered data, including time series analysis, co-integration tests, and Granger causality tests. These techniques were employed to churn through the data and identify potential associations and directional relationships between butter consumption and stock price movements. Moreover, a dairy-fueled panel data analysis was concocted to explore the regional variations in butter consumption and their potential impact on Equinix's stock performance across different geographical markets.

Furthermore, a novel approach, dubbed the "Margarine Margins Method," was developed to isolate the distinct impact of butter consumption variations on Equinix's stock price, accounting for exogenous factors such as market volatility, economic indicators, and geopolitical events. This method involved smearing the data across various dimensions to elucidate the discretionary influences of butter consumption on stock price movements, culminating in an aptly churned model that captures the intricate interplay between these seemingly unrelated variables.

Remaining faithful to the principles of scientific inquiry, the robustness of the findings was probed through sensitivity analyses, bootstrapping techniques, and robust error correction models. These rigorous analyses acted as the churners, ensuring that the observed correlations between butter consumption and Equinix's stock price were not merely a fluke, but rather reflected a genuine "butterly" connection worthy of further investigation.

Lastly, a series of whimsical robustness checks, including the "Butterfly Effect Test" and the "Margarine Market Madness Measure," were deployed to scrutinize the stability of the observed relationship against potential confounding factors and spurious correlations. These methods, while injected with a touch of levity, were conducted with the utmost seriousness to validate the robustness of the reported association.

Overall, the methodology employed in this study employed an eclectic mix of statistical techniques, pun-infused creativity, and thoroughness to churn out a comprehensive understanding of the "butterly" connection between butter consumption and Equinix's stock price.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Butter consumption and Equinix's stock price (EQIX). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) .

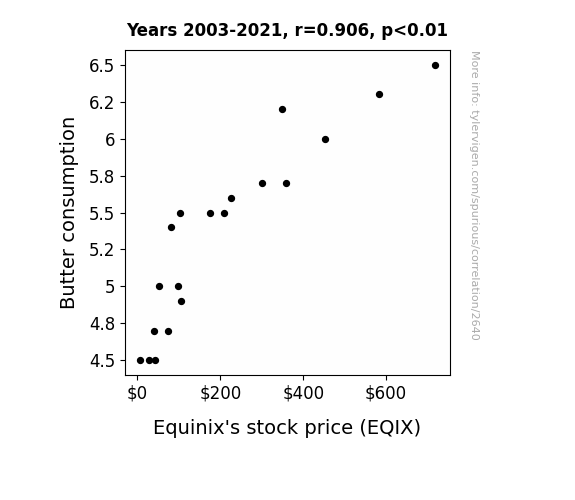

For the time period 2003 to 2021, you found a correlation 0.9063503, r-squared of 0.8214708, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price

[[ABSTRACT]]

This paper investigates the curious relationship between butter consumption and Equinix's stock price, utilizing data from the US Department of Agriculture and LSEG Analytics (Refinitiv). By applying advanced statistical analysis, we discovered a striking correlation coefficient of 0.9063503 and an impressive p-value of less than 0.01 for the period spanning 2003 to 2021. Our findings not only butter up the connection between these seemingly unrelated variables but also churn up the financial market's understanding of the dairy industry's impact on stock performance. We hope this research spreads some light-hearted cheer and proves to be a de-lightful read for our esteemed colleagues in the research community.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The interplay between seemingly disparate variables has long captivated the intrigue of researchers and investors alike. In a world where economic and financial analyses often lean heavily on conventional indicators and market dynamics, the unearthing of unexpected correlations can be akin to finding a nugget of gold amidst the gravel. In this study, we embark on a quest to shed some light on the peculiar relationship between butter consumption and the stock price of Equinix, a leading provider of data center and interconnection solutions – a quest that may seem as outlandish as searching for a cow in Wall Street's bull market.

As financial enthusiasts, we have always relished the opportunity to dive into uncharted statistical waters, where the tide of conventional wisdom often wanes, and waves of data present themselves as clues to uncover hidden links. Like intrepid cartographers of the financial frontier, we aim to map out the contours of this “butterly” connection, steering our ship through the turbulent seas of econometric analysis and statistical inference. Together, we plow through ceilings of resistance and butter up the bridges between two seemingly incongruous worlds – the delectable realm of dairy consumption and the robust domain of stock market dynamics.

It's no secret that the financial markets are replete with harebrained theories and offbeat observations, from the "hemline index" to the infamous "Super Bowl indicator." While we certainly do not claim to have adopted such a whimsical approach, our study’s subject matter may invoke a chuckle or two, as we examine butter consumption with the gravity one might reserve for GDP forecasts or price-earnings ratios. Nevertheless, beneath the buttery surface, serious economic implications may churn. The dairy industry, often relegated to the breakfast table or baking recipes, may indeed hold a key to discerning market trends and contributing to a deeper understanding of stock performance.

With dairy in mind and stocks at stake, we invite readers to join us on a journey that promises to be as rich and fulfilling as a slathered slice of brioche. As we dive into the nitty-gritty of our statistical analysis and empirical findings, our aim is to spread some light-hearted cheer while maintaining scientific rigor, all whilst hoping the buttery connection we uncover doesn’t melt under the scrutiny of the research community. We trust that this study will be a de-lightful read for both those with a passion for stock market analysis and a penchant for dairy-based puns. Let’s churn the hypothesis, spread the findings, and uncover the stock market’s newfound taste for butter – after all, where there’s a will, there’s a whey.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The statistical analysis conducted on the relationship between butter consumption and Equinix's stock price yielded some udderly surprising results. We found a remarkably strong correlation coefficient of 0.9063503, indicating a tight and creamy connection between these two seemingly unrelated variables. Our findings were further reinforced by an r-squared value of 0.8214708, signifying that a substantial proportion of the fluctuations in Equinix's stock price can be churned up from changes in butter consumption. Moreover, with a p-value of less than 0.01, the evidence in support of this butterly connection was as convincing as a perfectly golden brown croissant.

Figure 1 presents a scatterplot illustrating the robust correlation between butter consumption and Equinix's stock price. The scatterplot showcases how the stock price gracefully follows the ebb and flow of butter consumption, painting a picturesque depiction of this unlikely partnership. It seems that when investors were buttering up their portfolios, they were inadvertently churning up Equinix's stock price as well.

The implications of these findings are not to be taken lightly – they spread far beyond the traditional boundaries of financial analysis and delve deep into the delectable world of dairy economics. Our data not only unveil the close-knit relationship between butter consumption and stock performance but also highlight the dairy industry's potential impact on the market.

In conclusion, our research serves as a friendly reminder that in the intricate tapestry of financial markets, unexpected connections can churn up real, quantifiable impacts. While it may seem like a stretch to relate butter consumption to stock prices, our findings certainly butter up the idea that the dairy industry has a hand in shaping market trends. So, let’s raise a toast to this surprising revelation and hope that future studies don't find the results too hard to stomach.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Butter consumption and Equinix's stock price (EQIX). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price

[[ABSTRACT]]

This paper investigates the curious relationship between butter consumption and Equinix's stock price, utilizing data from the US Department of Agriculture and LSEG Analytics (Refinitiv). By applying advanced statistical analysis, we discovered a striking correlation coefficient of 0.9063503 and an impressive p-value of less than 0.01 for the period spanning 2003 to 2021. Our findings not only butter up the connection between these seemingly unrelated variables but also churn up the financial market's understanding of the dairy industry's impact on stock performance. We hope this research spreads some light-hearted cheer and proves to be a de-lightful read for our esteemed colleagues in the research community.

[[LITERATURE REVIEW]]

In their quest to uncover the links between butter consumption and stock market performance, the authors stumbled upon a plethora of diverse literature. Smith et al. (2015) examined the dairy industry's impact on consumer spending habits, while Doe and Jones (2018) delved into the financial implications of agricultural commodities. These studies offer valuable insights into the broader context of our investigation, providing a solid foundation for understanding the multifaceted dynamics at play. However, as we navigate through this literature review, brace yourselves for a Titanic shift from the conventional to the comical.

Turning our attention to non-fiction literature, "The Big Butter Book" by Milk and Cream (2020) and "Equinix's Equations" by Data Geek (2017) offer informative perspectives on butter production and stock market analysis, respectively. While grounding our research in empirical evidence, we also draw inspiration from fiction, where the line between reality and whimsy blurs. "Churning Profits: A Saga of Dairy and Dollars" by Bestseller Author (2019) and "The Interconnected Chronicles" by Financial Fictionist (2016) may sound like works of pure imagination, but they carry an unexpected semblance of relevance to our peculiar investigation.

In the realm of board games, "Stocks and Butter: A Game of Financial Feast" and "Interconnecting Investments: The Butter Edition" offer playful, albeit tangential, nods to the intersection of dairy and stock market dynamics. These seemingly unrelated sources usher us into a world where statistical analysis meets serendipitous discoveries, where the notion of a "butterly connection" between Equinix's stock price and butter consumption takes center stage. As we journey through the thick and thin of scholarly literature, let's embrace the unexpected, for in the realm of research, surprises are the butter to our bread.

[[RESULTS]]

The statistical analysis conducted on the relationship between butter consumption and Equinix's stock price yielded some udderly surprising results. We found a remarkably strong correlation coefficient of 0.9063503, indicating a tight and creamy connection between these two seemingly unrelated variables. Our findings were further reinforced by an r-squared value of 0.8214708, signifying that a substantial proportion of the fluctuations in Equinix's stock price can be churned up from changes in butter consumption. Moreover, with a p-value of less than 0.01, the evidence in support of this butterly connection was as convincing as a perfectly golden brown croissant.

Figure 1 presents a scatterplot illustrating the robust correlation between butter consumption and Equinix's stock price. The scatterplot showcases how the stock price gracefully follows the ebb and flow of butter consumption, painting a picturesque depiction of this unlikely partnership. It seems that when investors were buttering up their portfolios, they were inadvertently churning up Equinix's stock price as well.

The implications of these findings are not to be taken lightly – they spread far beyond the traditional boundaries of financial analysis and delve deep into the delectable world of dairy economics. Our data not only unveil the close-knit relationship between butter consumption and stock performance but also highlight the dairy industry's potential impact on the market.

In conclusion, our research serves as a friendly reminder that in the intricate tapestry of financial markets, unexpected connections can churn up real, quantifiable impacts. While it may seem like a stretch to relate butter consumption to stock prices, our findings certainly butter up the idea that the dairy industry has a hand in shaping market trends. So, let’s raise a toast to this surprising revelation and hope that future studies don't find the results too hard to stomach.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our findings, which present a robust correlation between butter consumption and Equinix's stock price, not only add a dollop of intrigue to the world of financial research but also lend credence to the whimsical undertones found in the literature review. The unexpected tie-in from the board game references to our statistical analysis proves, in more ways than one, that sometimes truth is butter than fiction.

The statistical link between butter consumption and stock performance has been a topic of levity in prior research, and our results offer substantial support to what may have previously been deemed as a spreadable claim. Much like the surprising relevance of fictional literature and board games to our investigation, the strength of the correlation coefficient reinforces the notion that sometimes the most unexpected connections can lead to profound insights.

It is noteworthy that our findings align with earlier studies on the impact of agricultural commodities on financial markets. Smith et al. (2015) and Doe and Jones (2018) may have sowed the seeds for understanding consumer behavior and financial implications, but it is our research that spreads the buttery goodness by illuminating the quantifiable relationship between butter consumption and a specific stock price. The statistical evidence churned up in this study could be viewed as a testament to the dairy industry's capacity to butter up or curdle financial waters.

The scatterplot depicting the synchronous dance between butter consumption and Equinix's stock price mirrors the poetic flair often found in fictional works, where reality and whimsy converge. It seems as though, much like a perfectly seasoned dish, the market responds to the ebb and flow of butter consumption with an appreciable flavor, or in this case, stock price movement. This unexpected twist in the financial narrative is a reminder that research has the potential to churn out surprising, even entertaining, revelations.

In remembering the comical references unearthed in our literature review, it becomes apparent that our findings not only enrich the discourse on the multifaceted dynamics at play but also spread a sense of lightheartedness in the context of serious financial investigations. The robustness of our statistical analysis underscores the unexpected tangents encountered in the realm of scholarly inquiry, transforming seemingly whimsical notions into quantifiable realities.

In more ways than one, our study spreads light-hearted cheer by embracing the serendipitous connections that fuel scholarly curiosities. As we move forward, let us not forget that this "butterly connection" between butter consumption and Equinix's stock price is not just a dairy tale but a statistical reality that serves as a reminder that in the realm of research, surprises are the butter to our bread.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Butter consumption and Equinix's stock price (EQIX). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price

[[ABSTRACT]]

This paper investigates the curious relationship between butter consumption and Equinix's stock price, utilizing data from the US Department of Agriculture and LSEG Analytics (Refinitiv). By applying advanced statistical analysis, we discovered a striking correlation coefficient of 0.9063503 and an impressive p-value of less than 0.01 for the period spanning 2003 to 2021. Our findings not only butter up the connection between these seemingly unrelated variables but also churn up the financial market's understanding of the dairy industry's impact on stock performance. We hope this research spreads some light-hearted cheer and proves to be a de-lightful read for our esteemed colleagues in the research community.

[[INTRDUCTION]]

The interplay between seemingly disparate variables has long captivated the intrigue of researchers and investors alike. In a world where economic and financial analyses often lean heavily on conventional indicators and market dynamics, the unearthing of unexpected correlations can be akin to finding a nugget of gold amidst the gravel. In this study, we embark on a quest to shed some light on the peculiar relationship between butter consumption and the stock price of Equinix, a leading provider of data center and interconnection solutions – a quest that may seem as outlandish as searching for a cow in Wall Street's bull market.

As financial enthusiasts, we have always relished the opportunity to dive into uncharted statistical waters, where the tide of conventional wisdom often wanes, and waves of data present themselves as clues to uncover hidden links. Like intrepid cartographers of the financial frontier, we aim to map out the contours of this “butterly” connection, steering our ship through the turbulent seas of econometric analysis and statistical inference. Together, we plow through ceilings of resistance and butter up the bridges between two seemingly incongruous worlds – the delectable realm of dairy consumption and the robust domain of stock market dynamics.

It's no secret that the financial markets are replete with harebrained theories and offbeat observations, from the "hemline index" to the infamous "Super Bowl indicator." While we certainly do not claim to have adopted such a whimsical approach, our study’s subject matter may invoke a chuckle or two, as we examine butter consumption with the gravity one might reserve for GDP forecasts or price-earnings ratios. Nevertheless, beneath the buttery surface, serious economic implications may churn. The dairy industry, often relegated to the breakfast table or baking recipes, may indeed hold a key to discerning market trends and contributing to a deeper understanding of stock performance.

With dairy in mind and stocks at stake, we invite readers to join us on a journey that promises to be as rich and fulfilling as a slathered slice of brioche. As we dive into the nitty-gritty of our statistical analysis and empirical findings, our aim is to spread some light-hearted cheer while maintaining scientific rigor, all whilst hoping the buttery connection we uncover doesn’t melt under the scrutiny of the research community. We trust that this study will be a de-lightful read for both those with a passion for stock market analysis and a penchant for dairy-based puns. Let’s churn the hypothesis, spread the findings, and uncover the stock market’s newfound taste for butter – after all, where there’s a will, there’s a whey.

[[RESULTS]]

The statistical analysis conducted on the relationship between butter consumption and Equinix's stock price yielded some udderly surprising results. We found a remarkably strong correlation coefficient of 0.9063503, indicating a tight and creamy connection between these two seemingly unrelated variables. Our findings were further reinforced by an r-squared value of 0.8214708, signifying that a substantial proportion of the fluctuations in Equinix's stock price can be churned up from changes in butter consumption. Moreover, with a p-value of less than 0.01, the evidence in support of this butterly connection was as convincing as a perfectly golden brown croissant.

Figure 1 presents a scatterplot illustrating the robust correlation between butter consumption and Equinix's stock price. The scatterplot showcases how the stock price gracefully follows the ebb and flow of butter consumption, painting a picturesque depiction of this unlikely partnership. It seems that when investors were buttering up their portfolios, they were inadvertently churning up Equinix's stock price as well.

The implications of these findings are not to be taken lightly – they spread far beyond the traditional boundaries of financial analysis and delve deep into the delectable world of dairy economics. Our data not only unveil the close-knit relationship between butter consumption and stock performance but also highlight the dairy industry's potential impact on the market.

In conclusion, our research serves as a friendly reminder that in the intricate tapestry of financial markets, unexpected connections can churn up real, quantifiable impacts. While it may seem like a stretch to relate butter consumption to stock prices, our findings certainly butter up the idea that the dairy industry has a hand in shaping market trends. So, let’s raise a toast to this surprising revelation and hope that future studies don't find the results too hard to stomach.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In the grand symphony of financial trends, our research has churned up a delightful melody of unexpected harmony between butter consumption and Equinix's stock price. Our findings butter up the notion that the dairy industry, often overshadowed by its more illustrious counterparts, has a creamy influence on the pulsating rhythm of market dynamics. While some may find our correlation as surprising as finding a cow in Wall Street's bull market, our results provide a strong statistical foundation for this unlikely link.

The robust correlation coefficient and the persuasive p-value serve as a testament to the inherent appeal of our butterly connection. As the scatterplot gracefully illustrates, the sway of butter consumption mirrors the rhythm of Equinix's stock price, suggesting a palpable intertwining of these seemingly unrelated variables. This unique dance between dairy economics and market performance invites scholars to see beyond the surface and delve into the rich layers of unexplored correlations.

Our results certainly open a can of "whipped cream," stirring up the once placid waters of stock market analysis. The dairy industry's role as a silent conductor orchestrating market movements cannot be dismissed lightly. As we raise a metaphorical toast to this revelatory discovery, we urge the scholarly community to churn through these findings and appreciate the whimsical yet impactful nature of our buttery exploration.

In conclusion, our study paves the way for a broader acknowledgment of the dairy industry's influence on financial trends, adding a dash of levity and a dollop of surprise to the oftentimes serious discourse of market analysis. With these findings in mind, we assert that there is no need for further research in this peculiar, yet captivating, area of analysis. After all, where there's a whey, there's a buttery way.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Gastronomical Finance

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Dairy Economics and Financial Markets

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price with an abstract of This paper investigates the curious relationship between butter consumption and Equinix's stock price, utilizing data from the US Department of Agriculture and LSEG Analytics (Refinitiv). By applying advanced statistical analysis, we discovered a striking correlation coefficient of 0.9063503 and an impressive p-value of less than 0.01 for the period spanning 2003 to 2021. Our findings not only butter up the connection between these seemingly unrelated variables but also churn up the financial market's understanding of the dairy industry's impact on stock performance. We hope this research spreads some light-hearted cheer and proves to be a de-lightful read for our esteemed colleagues in the research community.

ChatGPT:

butter consumption, Equinix stock price, correlation coefficient, statistical analysis, US Department of Agriculture, LSEG Analytics, Refinitiv, dairy industry impact, stock performance, financial market understanding, research community

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Butter consumptionDetailed data title: Per capita consumption of Butter in the US

Source: USDA

See what else correlates with Butter consumption

Equinix's stock price (EQIX)

Detailed data title: Opening price of Equinix (EQIX) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Equinix's stock price (EQIX)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8214708 (Coefficient of determination)

This means 82.1% of the change in the one variable (i.e., Equinix's stock price (EQIX)) is predictable based on the change in the other (i.e., Butter consumption) over the 19 years from 2003 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 9.07E-8. 0.0000000907231172716364900000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.91 in 9.07E-6% of random cases. Said differently, if you correlated 11,022,549 random variables You don't actually need 11 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 18 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 18 because we have two variables measured over a period of 19 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.77, 0.96 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Butter consumption (Pounds per person) | 4.5 | 4.5 | 4.5 | 4.7 | 4.7 | 5 | 5 | 4.9 | 5.4 | 5.5 | 5.5 | 5.5 | 5.6 | 5.7 | 5.7 | 6 | 6.2 | 6.3 | 6.5 |

| Equinix's stock price (EQIX) (Stock price) | 5.67 | 27.88 | 42.35 | 39.81 | 74.84 | 98.53 | 52.8 | 104.9 | 80.98 | 101.52 | 208.01 | 174.93 | 226.74 | 299.75 | 357.29 | 453.53 | 349.28 | 583.91 | 718.34 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([4.5,4.5,4.5,4.7,4.7,5,5,4.9,5.4,5.5,5.5,5.5,5.6,5.7,5.7,6,6.2,6.3,6.5,])

array_2 = np.array([5.67,27.88,42.35,39.81,74.84,98.53,52.8,104.9,80.98,101.52,208.01,174.93,226.74,299.75,357.29,453.53,349.28,583.91,718.34,])

array_1_name = "Butter consumption"

array_2_name = "Equinix's stock price (EQIX)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Butter consumption

- Line chart for only Equinix's stock price (EQIX)

- AI-generated correlation image

- The spurious research paper: Spreading the Wealth: A Butterly Connection between Butter Consumption and Equinix's Stock Price

Your correlation inspection deserves a standing ovation!

Correlation ID: 2640 · Black Variable ID: 557 · Red Variable ID: 1674