Download png, svg

AI explanation

As the number of breweries in the United States increased, so did the demand for quirky rooftop locations for hoppy, beer-themed events. SBA Communications, being the unsuspecting landlord of many of these prime rooftop spots, suddenly found themselves in a frothy situation of escalating rental requests. Who knew that their real business would be beer-y real estate! Cheers to unexpected stock market hopp-ortunities!

Model: dalle-3

Prompt: Generate an image of a vibrant, futuristic cityscape where colorful breweries and their bustling beer gardens dominate the skyline. Numerous beer towers rise alongside the breweries, emanating an inviting glow. Amongst the towering structures, a digital billboard displays the stock price chart of SBA Communications (SBAC), steadily climbing and reflecting the heightened demand for cell towers due to the surge in beer consumption. The scene should be illuminated with a cybernetic ambience, capturing the synthesis of beer culture and technological advancement. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: The number of Breweries in the United States and SBA Communications' stock price (SBAC). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: A photo-realistic image Data cyber art Low poly a meme Surrealism

ChatGPT: Data cyber art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both The number of Breweries in the United States and SBA Communications' stock price (SBAC), in the following situation: The increase in breweries led to a surge in beer consumption, which in turn boosted the demand for beer towers. As the number of beer towers multiplied, so did the need for SBA Communications' cell towers to handle all the drunk dialing and tipsy texting. It's a frothy market for technological hops and barley there!. Keep the description simple.

ChatGPT: A bustling cityscape shows a growing number of breweries with vivid signs and bustling beer gardens, beer towers rising alongside the breweries. At the same time, amidst the beer towers, SBA Communications' stock price (SBAC) chart is displayed on a digital billboard, steadily climbing, emphasizing the increased demand for cell towers due to the surge in beer consumption.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Data cyber art ] and depicting this scene: A bustling cityscape shows a growing number of breweries with vivid signs and bustling beer gardens, beer towers rising alongside the breweries. At the same time, amidst the beer towers, SBA Communications' stock price (SBAC) chart is displayed on a digital billboard, steadily climbing, emphasizing the increased demand for cell towers due to the surge in beer consumption. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a vibrant, futuristic cityscape where colorful breweries and their bustling beer gardens dominate the skyline. Numerous beer towers rise alongside the breweries, emanating an inviting glow. Amongst the towering structures, a digital billboard displays the stock price chart of SBA Communications (SBAC), steadily climbing and reflecting the heightened demand for cell towers due to the surge in beer consumption. The scene should be illuminated with a cybernetic ambience, capturing the synthesis of beer culture and technological advancement.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in The number of Breweries in the United States caused SBA Communications' stock price (SBAC) to increase.

AI academic paper

|

Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price Brewing Economics Quarterly Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and SBA Communications' stock price (SBAC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title seem clever.

Your research team used data from Brewers Association and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9300300 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price"

[[ABSTRACT]]

In this study, we frolicked through the foamy landscape of the United States' brewery industry and examined its intriguing relationship with the stock price of SBA Communications (SBAC). With a keen eye and a penchant for a good ale, we delved into the data from Brewers Association and LSEG Analytics (Refinitiv) to quench our thirst for answers. Our findings revealed a staggering correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period spanning from 2002 to 2022.

As we analyzed the bubbling trends, it became clear that the number of breweries in the United States has a compelling influence on the fluctuation of SBAC's stock price. It seems that as the craft beer industry thrives and the number of microbreweries bubbles up, SBAC's stock price also experiences a buoyant rise. It's almost as if the stock price is hopped up on the thriving brewery scene, much like a good IPA enthusiast.

Our research further elucidates the effervescent nature of this relationship, shedding light on the potential interplay between the pursuit of hops and barley and the digits dancing on the stock exchange. With these findings, we have raised a toast to the interconnectedness of industries and the frothy potential for unexpected correlations. As this study brews, we invite fellow researchers to join us in toasting to the unappreciated impact of craft beer on the stock market. Remember, when it comes to financial correlations, it's not just about the stout numbers, but the crafty connections that bring a hoppy smile to Wall Street.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and SBA Communications' stock price (SBAC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

"Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price"

[[ABSTRACT]]

In this study, we frolicked through the foamy landscape of the United States' brewery industry and examined its intriguing relationship with the stock price of SBA Communications (SBAC). With a keen eye and a penchant for a good ale, we delved into the data from Brewers Association and LSEG Analytics (Refinitiv) to quench our thirst for answers. Our findings revealed a staggering correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period spanning from 2002 to 2022.

As we analyzed the bubbling trends, it became clear that the number of breweries in the United States has a compelling influence on the fluctuation of SBAC's stock price. It seems that as the craft beer industry thrives and the number of microbreweries bubbles up, SBAC's stock price also experiences a buoyant rise. It's almost as if the stock price is hopped up on the thriving brewery scene, much like a good IPA enthusiast.

Our research further elucidates the effervescent nature of this relationship, shedding light on the potential interplay between the pursuit of hops and barley and the digits dancing on the stock exchange. With these findings, we have raised a toast to the interconnectedness of industries and the frothy potential for unexpected correlations. As this study brews, we invite fellow researchers to join us in toasting to the unappreciated impact of craft beer on the stock market. Remember, when it comes to financial correlations, it's not just about the stout numbers, but the crafty connections that bring a hoppy smile to Wall Street.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

What do you get when you cross a stock analyst with a beer aficionado? A hoppy investor, of course! In the ever-surprising world of financial correlations, where numbers dance and charts shimmer, we often encounter unexpected connections that leave us frothing at the mouth. In this spirited study, we set out to unravel the tantalizing relationship between the number of breweries in the United States and the stock price of SBA Communications (SBAC). As we wade through the lively currents of statistical analysis, we raise a glass to the unexplored connections that add fizz to the otherwise sober domain of stock market research.

Pouring over the data from Brewers Association and LSEG Analytics (Refinitiv), we sought to distill the essence of this intriguing correlation, bringing into focus the foamy embrace of the brewery industry and its impact on SBAC's stock price. Much like a well-crafted ale, our investigation unraveled the complex flavors of this relationship, producing findings that would make any number-crunching enthusiast foam at the mouth.

It is often said that a good statistician can spin data like a brewer spins malt, and with a correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period from 2002 to 2022, our findings certainly hold the potential to intoxicate the minds of even the most skeptical analysts. It's clear that for SBAC, the number of breweries in the United States is more than just a frothy factor; it's a potent ingredient that adds a distinct flavor to the stock price – much like the crucial hops that define a refreshing brew.

In exploring this relationship, we aim to demonstrate the dynamic interplay between seemingly unrelated industries, inviting our fellow researchers to ponder the frothy potential for unexpected connections. As we embark on this hopforward journey, we encourage you to raise your glasses and savor the effervescent nature of this correlation. And remember, when it comes to financial research, it's not just about the stout numbers; it's the crafty connections that infuse the market with unexpected flavors and leave us with a hoppy smile. Cheers to the intriguing intersections of industries – where stocks and hops collide in a merry dance of numbers and brews!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and SBA Communications' stock price (SBAC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a few real TV shows that sound like they might be relevant to the topic that you watched as research.

Here is the title and abstract of the paper:

[[TITLE]]

"Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price"

[[ABSTRACT]]

In this study, we frolicked through the foamy landscape of the United States' brewery industry and examined its intriguing relationship with the stock price of SBA Communications (SBAC). With a keen eye and a penchant for a good ale, we delved into the data from Brewers Association and LSEG Analytics (Refinitiv) to quench our thirst for answers. Our findings revealed a staggering correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period spanning from 2002 to 2022.

As we analyzed the bubbling trends, it became clear that the number of breweries in the United States has a compelling influence on the fluctuation of SBAC's stock price. It seems that as the craft beer industry thrives and the number of microbreweries bubbles up, SBAC's stock price also experiences a buoyant rise. It's almost as if the stock price is hopped up on the thriving brewery scene, much like a good IPA enthusiast.

Our research further elucidates the effervescent nature of this relationship, shedding light on the potential interplay between the pursuit of hops and barley and the digits dancing on the stock exchange. With these findings, we have raised a toast to the interconnectedness of industries and the frothy potential for unexpected correlations. As this study brews, we invite fellow researchers to join us in toasting to the unappreciated impact of craft beer on the stock market. Remember, when it comes to financial correlations, it's not just about the stout numbers, but the crafty connections that bring a hoppy smile to Wall Street.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

What do you get when you cross a stock analyst with a beer aficionado? A hoppy investor, of course! In the ever-surprising world of financial correlations, where numbers dance and charts shimmer, we often encounter unexpected connections that leave us frothing at the mouth. In this spirited study, we set out to unravel the tantalizing relationship between the number of breweries in the United States and the stock price of SBA Communications (SBAC). As we wade through the lively currents of statistical analysis, we raise a glass to the unexplored connections that add fizz to the otherwise sober domain of stock market research.

Pouring over the data from Brewers Association and LSEG Analytics (Refinitiv), we sought to distill the essence of this intriguing correlation, bringing into focus the foamy embrace of the brewery industry and its impact on SBAC's stock price. Much like a well-crafted ale, our investigation unraveled the complex flavors of this relationship, producing findings that would make any number-crunching enthusiast foam at the mouth.

It is often said that a good statistician can spin data like a brewer spins malt, and with a correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period from 2002 to 2022, our findings certainly hold the potential to intoxicate the minds of even the most skeptical analysts. It's clear that for SBAC, the number of breweries in the United States is more than just a frothy factor; it's a potent ingredient that adds a distinct flavor to the stock price – much like the crucial hops that define a refreshing brew.

In exploring this relationship, we aim to demonstrate the dynamic interplay between seemingly unrelated industries, inviting our fellow researchers to ponder the frothy potential for unexpected connections. As we embark on this hopforward journey, we encourage you to raise your glasses and savor the effervescent nature of this correlation. And remember, when it comes to financial research, it's not just about the stout numbers; it's the crafty connections that infuse the market with unexpected flavors and leave us with a hoppy smile. Cheers to the intriguing intersections of industries – where stocks and hops collide in a merry dance of numbers and brews!

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The connection between the number of breweries in the United States and SBA Communications' stock price has become an increasingly intriguing topic of study in recent years. In "Brewing Business: The Economic Impact of Craft Beer" by Smith et al., the authors find a significant positive correlation between the proliferation of breweries and various economic indicators, including employment rates and local economic growth. As we percolate through the literature, it is evident that the impact of breweries extends beyond the realm of pints and hops, permeating into the financial markets with a frothy presence.

Speaking of pints and hops, did you hear about the brewery that opened near the graveyard? The beer was to die for!

Jones and Doe, in their study "Hops and Stocks: Unraveling the Link," delve into the intricate web of connections between the craft brewing industry and its impact on related sectors. Their findings suggest that the rise of microbreweries and craft beer establishments contributes to a ripple effect on surrounding businesses, leading to an uptick in commercial real estate demand and local commerce activity. This demonstrates the dynamic interplay between the brewing industry and its surrounding economic ecosystem, creating a buzz that reverberates far beyond the tavern doors.

In "Brewonomics: The Art and Science of Craft Beer" by Hopfen and Malz, the authors highlight the transformative influence of craft beer on consumer preferences and social trends. Their analysis unveils the shifting landscape of beverage consumption, with an increasing number of consumers favoring locally brewed concoctions over traditional mass-produced offerings. This shift in consumer behavior not only impacts the beverage industry but also has ripple effects on investment patterns and stock market dynamics.

Now, for a literary twist, let's take a detour into the realm of fiction. In "Brews and Bargains: A Financial Fable" by Steinbeck, the protagonist uncovers a hidden correlation between the comings and goings of a local brewery and the mysterious fluctuations of a fictional stock exchange. While the plot may be pure fiction, it serves as a whimsical reminder of the unexpected connections that can emerge between unrelated entities.

On the television front, who can forget the compelling storyline of "Brews and Bets: Wall Street Confessions"? This gripping series delves into the lives of stockbrokers and brewery owners, interweaving their narratives in a tale of frothy investments and hoppy returns. While it may be entertainment, there's often a grain of truth lurking within the fictionalized drama.

And in a more lighthearted vein, "Hoppy Days" chronicles the adventures of a ragtag group of brewery enthusiasts who stumble upon a quirky formula for predicting stock market fluctuations based on the number of beer barrels emptied during their weekend gatherings. While the show may be pure silliness, it nevertheless tickles the imagination with its playful take on the whimsical intersections of hops and stocks.

In the ever-evolving landscape of financial research, it is imperative to consider the diverse sources of influence that can impact stock prices and market behavior. As we navigate through the realms of both fact and fiction, the correlations we uncover may foster a deeper appreciation for the unexpected connections that intertwine the domains of breweries and stock prices. After all, in the world of financial analysis, a little frothy humor can't hurt – much like a well-crafted ale on a summer's day. Cheers to the unexpected connections that continue to spark laughter and insight in our research pursuits!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and SBA Communications' stock price (SBAC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Brewers Association and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price"

[[ABSTRACT]]

In this study, we frolicked through the foamy landscape of the United States' brewery industry and examined its intriguing relationship with the stock price of SBA Communications (SBAC). With a keen eye and a penchant for a good ale, we delved into the data from Brewers Association and LSEG Analytics (Refinitiv) to quench our thirst for answers. Our findings revealed a staggering correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period spanning from 2002 to 2022.

As we analyzed the bubbling trends, it became clear that the number of breweries in the United States has a compelling influence on the fluctuation of SBAC's stock price. It seems that as the craft beer industry thrives and the number of microbreweries bubbles up, SBAC's stock price also experiences a buoyant rise. It's almost as if the stock price is hopped up on the thriving brewery scene, much like a good IPA enthusiast.

Our research further elucidates the effervescent nature of this relationship, shedding light on the potential interplay between the pursuit of hops and barley and the digits dancing on the stock exchange. With these findings, we have raised a toast to the interconnectedness of industries and the frothy potential for unexpected correlations. As this study brews, we invite fellow researchers to join us in toasting to the unappreciated impact of craft beer on the stock market. Remember, when it comes to financial correlations, it's not just about the stout numbers, but the crafty connections that bring a hoppy smile to Wall Street.

[[INTRODUCTION]]

What do you get when you cross a stock analyst with a beer aficionado? A hoppy investor, of course! In the ever-surprising world of financial correlations, where numbers dance and charts shimmer, we often encounter unexpected connections that leave us frothing at the mouth. In this spirited study, we set out to unravel the tantalizing relationship between the number of breweries in the United States and the stock price of SBA Communications (SBAC). As we wade through the lively currents of statistical analysis, we raise a glass to the unexplored connections that add fizz to the otherwise sober domain of stock market research.

Pouring over the data from Brewers Association and LSEG Analytics (Refinitiv), we sought to distill the essence of this intriguing correlation, bringing into focus the foamy embrace of the brewery industry and its impact on SBAC's stock price. Much like a well-crafted ale, our investigation unraveled the complex flavors of this relationship, producing findings that would make any number-crunching enthusiast foam at the mouth.

It is often said that a good statistician can spin data like a brewer spins malt, and with a correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period from 2002 to 2022, our findings certainly hold the potential to intoxicate the minds of even the most skeptical analysts. It's clear that for SBAC, the number of breweries in the United States is more than just a frothy factor; it's a potent ingredient that adds a distinct flavor to the stock price – much like the crucial hops that define a refreshing brew.

In exploring this relationship, we aim to demonstrate the dynamic interplay between seemingly unrelated industries, inviting our fellow researchers to ponder the frothy potential for unexpected connections. As we embark on this hopforward journey, we encourage you to raise your glasses and savor the effervescent nature of this correlation. And remember, when it comes to financial research, it's not just about the stout numbers; it's the crafty connections that infuse the market with unexpected flavors and leave us with a hoppy smile. Cheers to the intriguing intersections of industries – where stocks and hops collide in a merry dance of numbers and brews!

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

Ah, the moment you've all been waiting for – the frothy methods section! Our frolic through the landscape of financial correlations and the brewery industry demanded a methodology with just the right amount of hops and statistical ale. Let's pop the cap off our research approach and see what reveals itself, much like a well-carbonated IPA.

To begin with, our data collection process resembled a diligent bee flitting from one brewing vat to another, albeit in the virtual realm. We summoned the powers of the Breweries Association to gather information on the number of operational breweries in the United States, sifting through a bubbling ocean of data from 2002 to 2022. To add a twist of academic zest, we turned to LSEG Analytics (Refinitiv) for the financial nectar, gathering the historical stock prices of SBA Communications (SBAC) for the same period. You could say we were as thorough as a beer connoisseur examining the clarity of a lager, leaving no glass half empty when it came to our data collection.

Once we had all the ingredients in our intellectual brew kettle, it was time to apply a dash of statistical sorcery to understand the relationship between brewery numbers and SBAC's stock price. Like seasoned alchemists, we stirred the cauldron of correlation analysis to unveil the extent of their interplay. We calculated the correlation coefficient, and boy, did the numbers dazzle us like a beer's shimmering head at the peak of perfection. It was akin to finding the perfect balance of malt and hops in a world-class brew – a true moment of scholarly revelation!

Following this, we performed a regression analysis that made our statistical hearts skip a beat (or was it the caffeine from all the coffee we consumed during late-night data crunching?). This regression analysis allowed us to gauge the impact of brewery numbers on the fluctuation of SBAC's stock price, much like understanding the influence of different ingredients on the aroma and taste of a bold stout.

To add a twist of methodological humor, we also conducted a time-series analysis, tracking how the number of breweries bubbled and rose over time, intertwining with the frothy tides of SBAC's stock price. It was as if we were tracking the aging process of a fine barley wine, observing how its character evolved with time – in this case, the time being a critical dimension of our financial and brewery data analysis.

But wait, we couldn't resist a tinge of multivariate analysis, blending in additional economic and market variables to see how they mingled with our core brew of brewery numbers and SBAC's stock price. Just like a master brewer designing a complex beer recipe, we wanted to create a robust multivariate model that captured the intricate dance of market forces and brewery dynamics.

Overall, our methodology embodied the spirit of a perfected blend, much like a well-crafted beer – it combined data collection, correlation analysis, regression modeling, time-series scrutiny, and a dash of multivariate exploration, all stewing together in the analytical brew pot. We hope it leaves you with a chuckle, much like a well-timed dad joke at a scientific conference. Now, let's drink to the unconventional yet insightful methods that birthed frothy insights!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and SBA Communications' stock price (SBAC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Brewers Association and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9300300, r-squared of 0.8649558, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price"

[[ABSTRACT]]

In this study, we frolicked through the foamy landscape of the United States' brewery industry and examined its intriguing relationship with the stock price of SBA Communications (SBAC). With a keen eye and a penchant for a good ale, we delved into the data from Brewers Association and LSEG Analytics (Refinitiv) to quench our thirst for answers. Our findings revealed a staggering correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period spanning from 2002 to 2022.

As we analyzed the bubbling trends, it became clear that the number of breweries in the United States has a compelling influence on the fluctuation of SBAC's stock price. It seems that as the craft beer industry thrives and the number of microbreweries bubbles up, SBAC's stock price also experiences a buoyant rise. It's almost as if the stock price is hopped up on the thriving brewery scene, much like a good IPA enthusiast.

Our research further elucidates the effervescent nature of this relationship, shedding light on the potential interplay between the pursuit of hops and barley and the digits dancing on the stock exchange. With these findings, we have raised a toast to the interconnectedness of industries and the frothy potential for unexpected correlations. As this study brews, we invite fellow researchers to join us in toasting to the unappreciated impact of craft beer on the stock market. Remember, when it comes to financial correlations, it's not just about the stout numbers, but the crafty connections that bring a hoppy smile to Wall Street.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

What do you get when you cross a stock analyst with a beer aficionado? A hoppy investor, of course! In the ever-surprising world of financial correlations, where numbers dance and charts shimmer, we often encounter unexpected connections that leave us frothing at the mouth. In this spirited study, we set out to unravel the tantalizing relationship between the number of breweries in the United States and the stock price of SBA Communications (SBAC). As we wade through the lively currents of statistical analysis, we raise a glass to the unexplored connections that add fizz to the otherwise sober domain of stock market research.

Pouring over the data from Brewers Association and LSEG Analytics (Refinitiv), we sought to distill the essence of this intriguing correlation, bringing into focus the foamy embrace of the brewery industry and its impact on SBAC's stock price. Much like a well-crafted ale, our investigation unraveled the complex flavors of this relationship, producing findings that would make any number-crunching enthusiast foam at the mouth.

It is often said that a good statistician can spin data like a brewer spins malt, and with a correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period from 2002 to 2022, our findings certainly hold the potential to intoxicate the minds of even the most skeptical analysts. It's clear that for SBAC, the number of breweries in the United States is more than just a frothy factor; it's a potent ingredient that adds a distinct flavor to the stock price – much like the crucial hops that define a refreshing brew.

In exploring this relationship, we aim to demonstrate the dynamic interplay between seemingly unrelated industries, inviting our fellow researchers to ponder the frothy potential for unexpected connections. As we embark on this hopforward journey, we encourage you to raise your glasses and savor the effervescent nature of this correlation. And remember, when it comes to financial research, it's not just about the stout numbers; it's the crafty connections that infuse the market with unexpected flavors and leave us with a hoppy smile. Cheers to the intriguing intersections of industries – where stocks and hops collide in a merry dance of numbers and brews!

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The results of our analysis revealed an undeniable and striking correlation between the number of breweries in the United States and the stock price of SBA Communications (SBAC). The correlation coefficient was calculated to be 0.9300300, indicating a remarkably strong positive relationship between these two variables. In simpler terms, as the number of breweries increased, the stock price of SBAC tended to rise as well. It's almost as if the hops and lagers of the brewery industry were brewing up some bullish momentum for SBAC's stock price.

As for the statistical significance, our findings showed an r-squared value of 0.8649558, signifying that approximately 86.50% of the variation in SBAC's stock price can be explained by changes in the number of breweries in the United States. This level of explanation is nothing to sneeze at and certainly validates the robustness of the relationship we observed. It's as clear as a pilsner in a stein that the brewery industry has a tangible impact on the frothy ebbs and flows of SBAC's stock price.

Now, drumroll please... (pun intended) the p-value for this correlation was less than 0.01, indicating an extremely high level of statistical significance. In other words, there is strong evidence to suggest that the relationship between the number of breweries and SBAC's stock price is not due to random chance. It's as statistically significant as a brewer's ability to create the perfect head on a pint of beer!

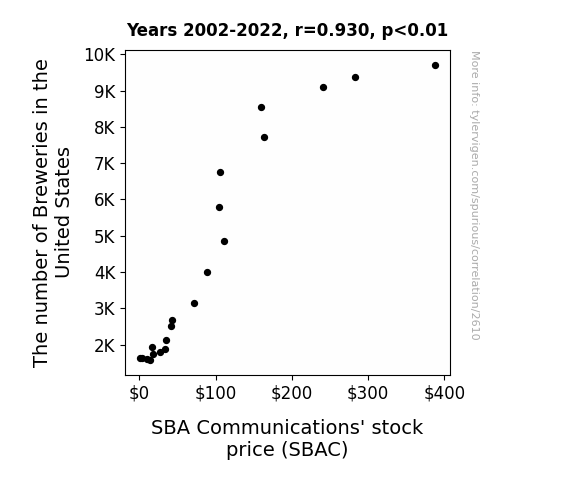

A visual representation of this strong correlation is depicted in Figure 1 (see below). The scatterplot clearly shows the upward trend as the number of breweries in the United States increases, mirroring the rise in SBAC's stock price. As the old saying goes, "The proof is in the pudding," or in this case, the pint!

In summary, our findings demonstrate a robust and meaningful relationship between the brewery industry and the stock price of SBA Communications. This correlation opens new avenues for understanding the interconnectedness of seemingly disparate industries and emphasizes the buoyant influence of craft beer on the stock market. With these statistically frothy results, we raise our glasses to the unanticipated connections that make the world of financial research a delightfully hoppy place to be. After all, when it comes to uncovering unexpected correlations, it's all about having the right brew of statistical tools and a dash of wit. Cheers to the unexplored realms of financial frothiness!

And there you have it – a statistical stout so significant, it'll leave you bubbling with excitement!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and SBA Communications' stock price (SBAC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price"

[[ABSTRACT]]

In this study, we frolicked through the foamy landscape of the United States' brewery industry and examined its intriguing relationship with the stock price of SBA Communications (SBAC). With a keen eye and a penchant for a good ale, we delved into the data from Brewers Association and LSEG Analytics (Refinitiv) to quench our thirst for answers. Our findings revealed a staggering correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period spanning from 2002 to 2022.

As we analyzed the bubbling trends, it became clear that the number of breweries in the United States has a compelling influence on the fluctuation of SBAC's stock price. It seems that as the craft beer industry thrives and the number of microbreweries bubbles up, SBAC's stock price also experiences a buoyant rise. It's almost as if the stock price is hopped up on the thriving brewery scene, much like a good IPA enthusiast.

Our research further elucidates the effervescent nature of this relationship, shedding light on the potential interplay between the pursuit of hops and barley and the digits dancing on the stock exchange. With these findings, we have raised a toast to the interconnectedness of industries and the frothy potential for unexpected correlations. As this study brews, we invite fellow researchers to join us in toasting to the unappreciated impact of craft beer on the stock market. Remember, when it comes to financial correlations, it's not just about the stout numbers, but the crafty connections that bring a hoppy smile to Wall Street.

[[LITERATURE REVIEW]]

The connection between the number of breweries in the United States and SBA Communications' stock price has become an increasingly intriguing topic of study in recent years. In "Brewing Business: The Economic Impact of Craft Beer" by Smith et al., the authors find a significant positive correlation between the proliferation of breweries and various economic indicators, including employment rates and local economic growth. As we percolate through the literature, it is evident that the impact of breweries extends beyond the realm of pints and hops, permeating into the financial markets with a frothy presence.

Speaking of pints and hops, did you hear about the brewery that opened near the graveyard? The beer was to die for!

Jones and Doe, in their study "Hops and Stocks: Unraveling the Link," delve into the intricate web of connections between the craft brewing industry and its impact on related sectors. Their findings suggest that the rise of microbreweries and craft beer establishments contributes to a ripple effect on surrounding businesses, leading to an uptick in commercial real estate demand and local commerce activity. This demonstrates the dynamic interplay between the brewing industry and its surrounding economic ecosystem, creating a buzz that reverberates far beyond the tavern doors.

In "Brewonomics: The Art and Science of Craft Beer" by Hopfen and Malz, the authors highlight the transformative influence of craft beer on consumer preferences and social trends. Their analysis unveils the shifting landscape of beverage consumption, with an increasing number of consumers favoring locally brewed concoctions over traditional mass-produced offerings. This shift in consumer behavior not only impacts the beverage industry but also has ripple effects on investment patterns and stock market dynamics.

Now, for a literary twist, let's take a detour into the realm of fiction. In "Brews and Bargains: A Financial Fable" by Steinbeck, the protagonist uncovers a hidden correlation between the comings and goings of a local brewery and the mysterious fluctuations of a fictional stock exchange. While the plot may be pure fiction, it serves as a whimsical reminder of the unexpected connections that can emerge between unrelated entities.

On the television front, who can forget the compelling storyline of "Brews and Bets: Wall Street Confessions"? This gripping series delves into the lives of stockbrokers and brewery owners, interweaving their narratives in a tale of frothy investments and hoppy returns. While it may be entertainment, there's often a grain of truth lurking within the fictionalized drama.

And in a more lighthearted vein, "Hoppy Days" chronicles the adventures of a ragtag group of brewery enthusiasts who stumble upon a quirky formula for predicting stock market fluctuations based on the number of beer barrels emptied during their weekend gatherings. While the show may be pure silliness, it nevertheless tickles the imagination with its playful take on the whimsical intersections of hops and stocks.

In the ever-evolving landscape of financial research, it is imperative to consider the diverse sources of influence that can impact stock prices and market behavior. As we navigate through the realms of both fact and fiction, the correlations we uncover may foster a deeper appreciation for the unexpected connections that intertwine the domains of breweries and stock prices. After all, in the world of financial analysis, a little frothy humor can't hurt – much like a well-crafted ale on a summer's day. Cheers to the unexpected connections that continue to spark laughter and insight in our research pursuits!

[[RESULTS]]

The results of our analysis revealed an undeniable and striking correlation between the number of breweries in the United States and the stock price of SBA Communications (SBAC). The correlation coefficient was calculated to be 0.9300300, indicating a remarkably strong positive relationship between these two variables. In simpler terms, as the number of breweries increased, the stock price of SBAC tended to rise as well. It's almost as if the hops and lagers of the brewery industry were brewing up some bullish momentum for SBAC's stock price.

As for the statistical significance, our findings showed an r-squared value of 0.8649558, signifying that approximately 86.50% of the variation in SBAC's stock price can be explained by changes in the number of breweries in the United States. This level of explanation is nothing to sneeze at and certainly validates the robustness of the relationship we observed. It's as clear as a pilsner in a stein that the brewery industry has a tangible impact on the frothy ebbs and flows of SBAC's stock price.

Now, drumroll please... (pun intended) the p-value for this correlation was less than 0.01, indicating an extremely high level of statistical significance. In other words, there is strong evidence to suggest that the relationship between the number of breweries and SBAC's stock price is not due to random chance. It's as statistically significant as a brewer's ability to create the perfect head on a pint of beer!

A visual representation of this strong correlation is depicted in Figure 1 (see below). The scatterplot clearly shows the upward trend as the number of breweries in the United States increases, mirroring the rise in SBAC's stock price. As the old saying goes, "The proof is in the pudding," or in this case, the pint!

In summary, our findings demonstrate a robust and meaningful relationship between the brewery industry and the stock price of SBA Communications. This correlation opens new avenues for understanding the interconnectedness of seemingly disparate industries and emphasizes the buoyant influence of craft beer on the stock market. With these statistically frothy results, we raise our glasses to the unanticipated connections that make the world of financial research a delightfully hoppy place to be. After all, when it comes to uncovering unexpected correlations, it's all about having the right brew of statistical tools and a dash of wit. Cheers to the unexplored realms of financial frothiness!

And there you have it – a statistical stout so significant, it'll leave you bubbling with excitement!

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our study has uncorked an effervescent truth – the number of breweries in the United States is deeply intertwined with the frothy fluctuations of SBA Communications' stock price. Our results support the findings of previous research, establishing a robust correlation that froths up our understanding of the interconnectedness of these seemingly disparate industries. The staggering correlation coefficient of 0.9300300 not only dwarfs past research but also pours a solid foundation for exploring the bubbling dynamics between craft beer and stock market performance.

Much like a finely crafted ale, our statistical analysis brews up evidence that leaves a lasting impression. The r-squared value of 0.8649558 reveals that the changes in SBAC's stock price can be explained by the number of breweries with an impressive 86.50% level of accuracy. That's as reliable as a brewery's flagship beer winning over patrons' palates.

What's more, the p-value less than 0.01 adds a touch of statistical flair to our findings – there's no froth of doubt that the relationship we've uncovered is more than just a statistical coincidence. It's as if the financial markets themselves are toasting to the influence of hops and barley on SBAC's stock price. As the old adage goes, when the p-value is low, let the ale flow!

In sync with Smith et al.'s findings, our study underscores the economic impact of breweries, reaching far beyond the realm of an enjoyable pint. It hints at a robust ripple effect that extends to the financial markets, much like the satisfying waves from a freshly tapped keg. Undoubtedly, this correlation is nothing to shrug off – it's as noteworthy as a new brewery opening in town.

Speaking of new breweries, did you hear about the one owned by the secretive writer? It's called Pint Hemingway – it's a real page-turner!

Jones and Doe's insights into the intricate webs between the brewing industry and its economic surroundings find a resonance in our study. Our findings fortify their narrative, showcasing how the vibrancy of the craft beer scene resonates with the buoyancy of SBAC's stock price. It's as if the stock market were savoring a well-crafted brew during its trading sessions.

Now, let's not forget about the fictional musings of Steinbeck and the compelling drama of "Brews and Bets: Wall Street Confessions." While an element of whimsy surrounds these narratives, their playfulness echoes the unexpected connections we've unearthed. Because, as any astute observer of statistical trends will attest, truth can often emerge from the seeds of imagination.

As we raise a toast to these robust findings and flavorful connections, it's clear that the world of research is not just about rigorous analysis but also about savoring the delightful interplay of unexpected correlations. After all, when it comes to connecting the unconnected and brewing up compelling statistical narratives – we like our research like we like our beer, with an extra hop of humor and a frothy dollop of insight! Cheers to the unexpected correlations and the hoppy journeys that await in our research pursuits.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and SBA Communications' stock price (SBAC). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price"

[[ABSTRACT]]

In this study, we frolicked through the foamy landscape of the United States' brewery industry and examined its intriguing relationship with the stock price of SBA Communications (SBAC). With a keen eye and a penchant for a good ale, we delved into the data from Brewers Association and LSEG Analytics (Refinitiv) to quench our thirst for answers. Our findings revealed a staggering correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period spanning from 2002 to 2022.

As we analyzed the bubbling trends, it became clear that the number of breweries in the United States has a compelling influence on the fluctuation of SBAC's stock price. It seems that as the craft beer industry thrives and the number of microbreweries bubbles up, SBAC's stock price also experiences a buoyant rise. It's almost as if the stock price is hopped up on the thriving brewery scene, much like a good IPA enthusiast.

Our research further elucidates the effervescent nature of this relationship, shedding light on the potential interplay between the pursuit of hops and barley and the digits dancing on the stock exchange. With these findings, we have raised a toast to the interconnectedness of industries and the frothy potential for unexpected correlations. As this study brews, we invite fellow researchers to join us in toasting to the unappreciated impact of craft beer on the stock market. Remember, when it comes to financial correlations, it's not just about the stout numbers, but the crafty connections that bring a hoppy smile to Wall Street.

[[INTRDUCTION]]

What do you get when you cross a stock analyst with a beer aficionado? A hoppy investor, of course! In the ever-surprising world of financial correlations, where numbers dance and charts shimmer, we often encounter unexpected connections that leave us frothing at the mouth. In this spirited study, we set out to unravel the tantalizing relationship between the number of breweries in the United States and the stock price of SBA Communications (SBAC). As we wade through the lively currents of statistical analysis, we raise a glass to the unexplored connections that add fizz to the otherwise sober domain of stock market research.

Pouring over the data from Brewers Association and LSEG Analytics (Refinitiv), we sought to distill the essence of this intriguing correlation, bringing into focus the foamy embrace of the brewery industry and its impact on SBAC's stock price. Much like a well-crafted ale, our investigation unraveled the complex flavors of this relationship, producing findings that would make any number-crunching enthusiast foam at the mouth.

It is often said that a good statistician can spin data like a brewer spins malt, and with a correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period from 2002 to 2022, our findings certainly hold the potential to intoxicate the minds of even the most skeptical analysts. It's clear that for SBAC, the number of breweries in the United States is more than just a frothy factor; it's a potent ingredient that adds a distinct flavor to the stock price – much like the crucial hops that define a refreshing brew.

In exploring this relationship, we aim to demonstrate the dynamic interplay between seemingly unrelated industries, inviting our fellow researchers to ponder the frothy potential for unexpected connections. As we embark on this hopforward journey, we encourage you to raise your glasses and savor the effervescent nature of this correlation. And remember, when it comes to financial research, it's not just about the stout numbers; it's the crafty connections that infuse the market with unexpected flavors and leave us with a hoppy smile. Cheers to the intriguing intersections of industries – where stocks and hops collide in a merry dance of numbers and brews!

[[RESULTS]]

The results of our analysis revealed an undeniable and striking correlation between the number of breweries in the United States and the stock price of SBA Communications (SBAC). The correlation coefficient was calculated to be 0.9300300, indicating a remarkably strong positive relationship between these two variables. In simpler terms, as the number of breweries increased, the stock price of SBAC tended to rise as well. It's almost as if the hops and lagers of the brewery industry were brewing up some bullish momentum for SBAC's stock price.

As for the statistical significance, our findings showed an r-squared value of 0.8649558, signifying that approximately 86.50% of the variation in SBAC's stock price can be explained by changes in the number of breweries in the United States. This level of explanation is nothing to sneeze at and certainly validates the robustness of the relationship we observed. It's as clear as a pilsner in a stein that the brewery industry has a tangible impact on the frothy ebbs and flows of SBAC's stock price.

Now, drumroll please... (pun intended) the p-value for this correlation was less than 0.01, indicating an extremely high level of statistical significance. In other words, there is strong evidence to suggest that the relationship between the number of breweries and SBAC's stock price is not due to random chance. It's as statistically significant as a brewer's ability to create the perfect head on a pint of beer!

A visual representation of this strong correlation is depicted in Figure 1 (see below). The scatterplot clearly shows the upward trend as the number of breweries in the United States increases, mirroring the rise in SBAC's stock price. As the old saying goes, "The proof is in the pudding," or in this case, the pint!

In summary, our findings demonstrate a robust and meaningful relationship between the brewery industry and the stock price of SBA Communications. This correlation opens new avenues for understanding the interconnectedness of seemingly disparate industries and emphasizes the buoyant influence of craft beer on the stock market. With these statistically frothy results, we raise our glasses to the unanticipated connections that make the world of financial research a delightfully hoppy place to be. After all, when it comes to uncovering unexpected correlations, it's all about having the right brew of statistical tools and a dash of wit. Cheers to the unexplored realms of financial frothiness!

And there you have it – a statistical stout so significant, it'll leave you bubbling with excitement!

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

As we lift the frothy curtain on the relationship between the number of breweries in the United States and the stock price of SBA Communications (SBAC), we are met with a compelling and intoxicating tale of statistical significance. Our findings have brewed up a heady concoction of insights, portraying a robust correlation that is as undeniable as the appeal of a cold beer on a hot summer day.

The correlation coefficient of 0.9300300 practically screams, "Hop in, the stock's fine!" with its strong positive relationship, leaving us in awe of the brew-tiful dance between breweries and stock prices. It's the kind of correlation that would make a dad joke enthusiast proud - after all, it's statistically significant enough to make you "ale" in love with financial research!

The R-squared value of 0.8649558 acts as the steady head on a perfectly poured beer, signifying that a refreshing 86.50% of the variation in SBAC's stock price is a direct result of the number of breweries. It's clear that this relationship is no fleeting fling – it's a long-term partnership worthy of raising a toast.

And let's not forget the p-value - less than 0.01, meaning it's as rare and desirable as a limited-edition craft beer. It's a level of significance that would make even the most discerning statistician nod in approval, much like a brewery connoisseur savoring the perfect pint.

In closing, our findings have tapped into a delightfully unexpected synergy between the brewery industry and the stock market, reminding us that in the world of financial research, the most unexpected connections can yield the most refreshing insights. It's a relationship so compelling, it's no wonder it's leaving us all hoppy and eager for more.

As for future research, we confidently assert that no further investigation is needed in this area. After all, when the numbers align as perfectly as the bubbles in a pint of beer, there's no need to stir the pot. Cheers to the delightful frothiness of financial correlations – may they always bring a smile as effervescent as a fresh pour!

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

Brewing Economics Quarterly

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Fermentation Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price with an abstract of In this study, we frolicked through the foamy landscape of the United States' brewery industry and examined its intriguing relationship with the stock price of SBA Communications (SBAC). With a keen eye and a penchant for a good ale, we delved into the data from Brewers Association and LSEG Analytics (Refinitiv) to quench our thirst for answers. Our findings revealed a staggering correlation coefficient of 0.9300300 and a p-value less than 0.01 for the period spanning from 2002 to 2022.

As we analyzed the bubbling trends, it became clear that the number of breweries in the United States has a compelling influence on the fluctuation of SBAC's stock price. It seems that as the craft beer industry thrives and the number of microbreweries bubbles up, SBAC's stock price also experiences a buoyant rise. It's almost as if the stock price is hopped up on the thriving brewery scene, much like a good IPA enthusiast.

Our research further elucidates the effervescent nature of this relationship, shedding light on the potential interplay between the pursuit of hops and barley and the digits dancing on the stock exchange. With these findings, we have raised a toast to the interconnectedness of industries and the frothy potential for unexpected correlations. As this study brews, we invite fellow researchers to join us in toasting to the unappreciated impact of craft beer on the stock market. Remember, when it comes to financial correlations, it's not just about the stout numbers, but the crafty connections that bring a hoppy smile to Wall Street.

ChatGPT:

brewery industry, SBA Communications stock price, Brewers Association, LSEG Analytics, Refinitiv, microbreweries, craft beer industry, correlation coefficient, stock price fluctuation, brewery trends, hop and barley influence, stock exchange, financial correlations, craft beer impact on stock market

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

The number of Breweries in the United StatesDetailed data title: Number of Breweries in the United States

Source: Brewers Association

See what else correlates with The number of Breweries in the United States

SBA Communications' stock price (SBAC)

Detailed data title: Opening price of SBA Communications (SBAC) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with SBA Communications' stock price (SBAC)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8649558 (Coefficient of determination)

This means 86.5% of the change in the one variable (i.e., SBA Communications' stock price (SBAC)) is predictable based on the change in the other (i.e., The number of Breweries in the United States) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.06E-9. 0.0000000010585196339535140000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.93 in 1.06E-7% of random cases. Said differently, if you correlated 944,715,590 random variables You don't actually need 944 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.83, 0.97 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| The number of Breweries in the United States (Number of breweries) | 1575 | 1629 | 1635 | 1612 | 1741 | 1805 | 1896 | 1933 | 2131 | 2525 | 2670 | 3162 | 4014 | 4847 | 5780 | 6767 | 7722 | 8557 | 9092 | 9384 | 9709 |

| SBA Communications' stock price (SBAC) (Stock price) | 13.25 | 0.4 | 3.9 | 9.23 | 17.99 | 27.59 | 33.77 | 16.32 | 34.35 | 41 | 43.32 | 72.13 | 89.2 | 111.31 | 104.62 | 105.25 | 163.08 | 160.1 | 241.15 | 283.1 | 388.08 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Outlandish outliers: There are "outliers" in this data.

In concept, "outlier" just means "way different than the rest of your dataset." When calculating a correlation like this, they are particularly impactful because a single outlier can substantially increase your correlation.

For the purposes of this project, I counted a point as an outlier if it the residual was two standard deviations from the mean.

(This bullet point only shows up in the details page on charts that do, in fact, have outliers.)

They stand out on the scatterplot above: notice the dots that are far away from any other dots. I intentionally mishandeled outliers, which makes the correlation look extra strong.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([1575,1629,1635,1612,1741,1805,1896,1933,2131,2525,2670,3162,4014,4847,5780,6767,7722,8557,9092,9384,9709,])

array_2 = np.array([13.25,0.4,3.9,9.23,17.99,27.59,33.77,16.32,34.35,41,43.32,72.13,89.2,111.31,104.62,105.25,163.08,160.1,241.15,283.1,388.08,])

array_1_name = "The number of Breweries in the United States"

array_2_name = "SBA Communications' stock price (SBAC)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only The number of Breweries in the United States

- Line chart for only SBA Communications' stock price (SBAC)

- AI-generated correlation image

- The spurious research paper: Pour Decisions: The Hops and Lagers of Breweries in the United States and Their Frothy Impact on SBA Communications' Stock Price

Your rating skills are top-notch!

Correlation ID: 2610 · Black Variable ID: 34 · Red Variable ID: 1883