Download png, svg

AI explanation

As butter consumption increased, so did the demand for movie theater popcorn. This led to higher profits for Disney, causing their stock price to rise. Remember, it's not just the magic kingdom, it's the buttery kingdom!

Model: dalle-3

Prompt: Prompt: Generate a cute 2D animation of a family sitting around a breakfast table. The parents are spreading butter on their toast, while the children eagerly watch the TV screen in the background, which displays The Walt Disney Company's stock price graph. The family's expressions should convey a mix of happiness, surprise, and curiosity. The kitchen should have a warm, inviting atmosphere with morning light streaming in through the window. Nonverbal cues should emphasize their discussion about the stock price and a sense of togetherness during breakfast. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Butter consumption and The Walt Disney Company's stock price. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Symbolism Sci-fi fantacy Brutalism Cute 2D animation Magic realism

ChatGPT: Cute 2D animation

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Butter consumption and The Walt Disney Company's stock price together. Keep the description simple.

ChatGPT: A family sitting down for breakfast, spreading butter on their toast and discussing The Walt Disney Company's stock price on their TV screen in the background.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Cute 2D animation ] and depicting this scene: A family sitting down for breakfast, spreading butter on their toast and discussing The Walt Disney Company's stock price on their TV screen in the background. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Prompt: Generate a cute 2D animation of a family sitting around a breakfast table. The parents are spreading butter on their toast, while the children eagerly watch the TV screen in the background, which displays The Walt Disney Company's stock price graph. The family's expressions should convey a mix of happiness, surprise, and curiosity. The kitchen should have a warm, inviting atmosphere with morning light streaming in through the window. Nonverbal cues should emphasize their discussion about the stock price and a sense of togetherness during breakfast.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Butter consumption caused The Walt Disney Company's stock price (DIS) to increase. Add a funny one-liner at the end.

AI academic paper

|

Spreading Financial Butter: A Churn for the Better? The International Journal of Economic Spreadability Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Butter consumption and The Walt Disney Company's stock price (DIS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title a clever pun.

Your research team used data from USDA and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9140176 and p < 0.01 for 2002 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Spreading Financial Butter: A Churn for the Better?

[[ABSTRACT]]

This research presents a comprehensive analysis of the little-known relationship between butter consumption and The Walt Disney Company's stock price (DIS). Utilizing data from the USDA and LSEG Analytics (Refinitiv) spanning the years 2002 to 2021, we employed advanced statistical methods to investigate this peculiar association. Our findings divulge a remarkably high correlation coefficient of 0.9140176 and statistically significant p-value (p < 0.01), confounding conventional expectations. This research offers a unique blend of financial and gastronomic insights, encouraging further examination of unlikely connections in the modern market landscape. With a pinch of skepticism and a dash of curiosity, we take a spread-tacular journey through the uncharted territories of finance and food.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Butter consumption and The Walt Disney Company's stock price (DIS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Spreading Financial Butter: A Churn for the Better?

[[ABSTRACT]]

This research presents a comprehensive analysis of the little-known relationship between butter consumption and The Walt Disney Company's stock price (DIS). Utilizing data from the USDA and LSEG Analytics (Refinitiv) spanning the years 2002 to 2021, we employed advanced statistical methods to investigate this peculiar association. Our findings divulge a remarkably high correlation coefficient of 0.9140176 and statistically significant p-value (p < 0.01), confounding conventional expectations. This research offers a unique blend of financial and gastronomic insights, encouraging further examination of unlikely connections in the modern market landscape. With a pinch of skepticism and a dash of curiosity, we take a spread-tacular journey through the uncharted territories of finance and food.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

The relationship between dietary habits and financial markets has long been a subject of intrigue, often shrouded in mystery, speculation, and occasionally, a hint of margarine... I mean, intrigue. While many studies have focused on traditional economic indicators and market dynamics, the association between butter consumption and stock prices has received curiously scant attention. In this study, we unravel this enigmatic connection, specifically exploring the correlation between butter consumption and The Walt Disney Company's stock price (DIS) over the span of nearly two decades.

The choice of butter as a focal point for our investigation arose from a desire to explore a commodity that is both ubiquitous in culinary applications and susceptible to fluctuating consumer demand. What lacks in liquidity, butter certainly makes up for in spreadability – in both senses of the word. The Walt Disney Company, with its multifaceted presence in the entertainment and media industry, provided an intriguing subject for analysis, given the company's wide-ranging influence on consumer sentiment and, perhaps, their butter preferences as well.

The broader context of this inquiry is grounded in the growing interest in non-traditional factors that may influence financial markets. With the rise of algorithmic trading, behavioral finance, and the increasing complexity of global supply chains, there is a burgeoning awareness of the potential impact of unconventional variables on market movements. This study contributes to this burgeoning field by offering a whimsical yet rigorous examination of the butter-market nexus, bringing a delectable spin to the typically dry world of financial analysis.

Our research leverages data from the U.S. Department of Agriculture's Food Availability (Per Capita) Data System to capture the per capita butter consumption in the United States. Concurrently, we utilized stock price data obtained from LSEG Analytics (Refinitiv) to trace the price movements of The Walt Disney Company's stock over the same time frame. By applying advanced statistical methods, including correlation analysis and regression modeling, we teased out the quantitative relationship between butter consumption and DIS stock prices, uncovering a surprising level of correlation.

The significance of this investigation lies not only in the empirical exploration of an unusual pairing but also in prompting a rethinking of the factors that shape financial markets. As we delve into the heart of this utterly butterly inquiry, we invite readers to indulge in a fusion of gastronomic and financial dimensions, and to embrace the unanticipated flavors that emerge from the convergence of butter and stock prices. With a dollop of skepticism and a sprinkling of empirical rigor, we embark on a journey through the buttery alleys of finance, seeking to churn out new insights and maybe even a pat of wisdom or two.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Butter consumption and The Walt Disney Company's stock price (DIS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a few real TV shows that sound like they might be relevant to the topic that you watched as research.

Here is the title and abstract of the paper:

[[TITLE]]

Spreading Financial Butter: A Churn for the Better?

[[ABSTRACT]]

This research presents a comprehensive analysis of the little-known relationship between butter consumption and The Walt Disney Company's stock price (DIS). Utilizing data from the USDA and LSEG Analytics (Refinitiv) spanning the years 2002 to 2021, we employed advanced statistical methods to investigate this peculiar association. Our findings divulge a remarkably high correlation coefficient of 0.9140176 and statistically significant p-value (p < 0.01), confounding conventional expectations. This research offers a unique blend of financial and gastronomic insights, encouraging further examination of unlikely connections in the modern market landscape. With a pinch of skepticism and a dash of curiosity, we take a spread-tacular journey through the uncharted territories of finance and food.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The relationship between dietary habits and financial markets has long been a subject of intrigue, often shrouded in mystery, speculation, and occasionally, a hint of margarine... I mean, intrigue. While many studies have focused on traditional economic indicators and market dynamics, the association between butter consumption and stock prices has received curiously scant attention. In this study, we unravel this enigmatic connection, specifically exploring the correlation between butter consumption and The Walt Disney Company's stock price (DIS) over the span of nearly two decades.

The choice of butter as a focal point for our investigation arose from a desire to explore a commodity that is both ubiquitous in culinary applications and susceptible to fluctuating consumer demand. What lacks in liquidity, butter certainly makes up for in spreadability – in both senses of the word. The Walt Disney Company, with its multifaceted presence in the entertainment and media industry, provided an intriguing subject for analysis, given the company's wide-ranging influence on consumer sentiment and, perhaps, their butter preferences as well.

The broader context of this inquiry is grounded in the growing interest in non-traditional factors that may influence financial markets. With the rise of algorithmic trading, behavioral finance, and the increasing complexity of global supply chains, there is a burgeoning awareness of the potential impact of unconventional variables on market movements. This study contributes to this burgeoning field by offering a whimsical yet rigorous examination of the butter-market nexus, bringing a delectable spin to the typically dry world of financial analysis.

Our research leverages data from the U.S. Department of Agriculture's Food Availability (Per Capita) Data System to capture the per capita butter consumption in the United States. Concurrently, we utilized stock price data obtained from LSEG Analytics (Refinitiv) to trace the price movements of The Walt Disney Company's stock over the same time frame. By applying advanced statistical methods, including correlation analysis and regression modeling, we teased out the quantitative relationship between butter consumption and DIS stock prices, uncovering a surprising level of correlation.

The significance of this investigation lies not only in the empirical exploration of an unusual pairing but also in prompting a rethinking of the factors that shape financial markets. As we delve into the heart of this utterly butterly inquiry, we invite readers to indulge in a fusion of gastronomic and financial dimensions, and to embrace the unanticipated flavors that emerge from the convergence of butter and stock prices. With a dollop of skepticism and a sprinkling of empirical rigor, we embark on a journey through the buttery alleys of finance, seeking to churn out new insights and maybe even a pat of wisdom or two.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "The Butter Chronicles: Unraveling the Unctuous Mystery," Smith et al. examine the historical trajectory of butter consumption in the United States and its impact on various socio-economic factors. Meanwhile, Doe and Jones, in "Melted Profits: A Dairy Tale of Stock Market Volatility," investigate the relationship between dairy products and stock prices in the retail sector, shedding light on the underexplored dairy-market nexus. While these studies offer valuable insights into the broader context of butter's influence on economic parameters, the specific link to The Walt Disney Company's stock price (DIS) remains conspicuously uncharted.

Turning to non-fiction works, "The Economics of Cheese: A Gouda Guide to Financial Planning," provides a comprehensive overview of the dairy industry and its implications for investment strategies. Furthermore, "Stock Market Magic: Unlocking the Secrets of Financial Sorcery," offers a paradigm-shifting perspective on the mystical underpinnings of stock price movements, inviting readers to ponder the enchanting possibilities of butter-related market dynamics.

When it comes to fiction, "The Butter Chronicles: A Tale of Finance and Flavor" weaves a captivating narrative around the enigmatic connection between butter consumption and stock market anomalies, tantalizing readers with its unconventional blend of gastronomy and finance. Additionally, "A Spoonful of Stocks: How Mary Poppins Shaped Modern Portfolio Theory," delves into the whimsical world of Disney-inspired investments, offering a dash of magical realism to the exploration of DIS stock price dynamics.

On the small screen, "Cooking with Stocks: A Financial Gastronomy Journey" and "The Magical World of Disney Stocks" offer unconventional perspectives on the intersection of culinary pleasures and financial markets, providing an entertaining backdrop for this investigation. These televised sources not only inform but also entertain, serving as a reminder that academic inquiry need not always be a dry spread of statistics and regression analyses.

Thus, as the literature review unfolds, it becomes apparent that while the relationship between butter consumption and DIS stock price may initially appear whimsical, there exists a rich tapestry of sources that hint at the tantalizing possibilities of this improbable connection. With a sprinkle of imagination and a dollop of curiosity, the journey into the buttery realms of finance takes an unexpected turn, shedding light on the quirky, yet potentially impactful, interplay between dairy indulgence and market movements.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Butter consumption and The Walt Disney Company's stock price (DIS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) . You used data from 2002 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Spreading Financial Butter: A Churn for the Better?

[[ABSTRACT]]

This research presents a comprehensive analysis of the little-known relationship between butter consumption and The Walt Disney Company's stock price (DIS). Utilizing data from the USDA and LSEG Analytics (Refinitiv) spanning the years 2002 to 2021, we employed advanced statistical methods to investigate this peculiar association. Our findings divulge a remarkably high correlation coefficient of 0.9140176 and statistically significant p-value (p < 0.01), confounding conventional expectations. This research offers a unique blend of financial and gastronomic insights, encouraging further examination of unlikely connections in the modern market landscape. With a pinch of skepticism and a dash of curiosity, we take a spread-tacular journey through the uncharted territories of finance and food.

[[INTRODUCTION]]

The relationship between dietary habits and financial markets has long been a subject of intrigue, often shrouded in mystery, speculation, and occasionally, a hint of margarine... I mean, intrigue. While many studies have focused on traditional economic indicators and market dynamics, the association between butter consumption and stock prices has received curiously scant attention. In this study, we unravel this enigmatic connection, specifically exploring the correlation between butter consumption and The Walt Disney Company's stock price (DIS) over the span of nearly two decades.

The choice of butter as a focal point for our investigation arose from a desire to explore a commodity that is both ubiquitous in culinary applications and susceptible to fluctuating consumer demand. What lacks in liquidity, butter certainly makes up for in spreadability – in both senses of the word. The Walt Disney Company, with its multifaceted presence in the entertainment and media industry, provided an intriguing subject for analysis, given the company's wide-ranging influence on consumer sentiment and, perhaps, their butter preferences as well.

The broader context of this inquiry is grounded in the growing interest in non-traditional factors that may influence financial markets. With the rise of algorithmic trading, behavioral finance, and the increasing complexity of global supply chains, there is a burgeoning awareness of the potential impact of unconventional variables on market movements. This study contributes to this burgeoning field by offering a whimsical yet rigorous examination of the butter-market nexus, bringing a delectable spin to the typically dry world of financial analysis.

Our research leverages data from the U.S. Department of Agriculture's Food Availability (Per Capita) Data System to capture the per capita butter consumption in the United States. Concurrently, we utilized stock price data obtained from LSEG Analytics (Refinitiv) to trace the price movements of The Walt Disney Company's stock over the same time frame. By applying advanced statistical methods, including correlation analysis and regression modeling, we teased out the quantitative relationship between butter consumption and DIS stock prices, uncovering a surprising level of correlation.

The significance of this investigation lies not only in the empirical exploration of an unusual pairing but also in prompting a rethinking of the factors that shape financial markets. As we delve into the heart of this utterly butterly inquiry, we invite readers to indulge in a fusion of gastronomic and financial dimensions, and to embrace the unanticipated flavors that emerge from the convergence of butter and stock prices. With a dollop of skepticism and a sprinkling of empirical rigor, we embark on a journey through the buttery alleys of finance, seeking to churn out new insights and maybe even a pat of wisdom or two.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

The methodological approach employed in this study combines quantitative analysis of butter consumption and stock price movements with a hint of whimsy and a dash of statistical rigor. The primary data sources encompassed the USDA's Food Availability (Per Capita) Data System for butter consumption and LSEG Analytics (Refinitiv) for The Walt Disney Company's stock prices (DIS), spanning the years 2002 to 2021.

To commence this inquiry, the per capita butter consumption data, measured in pounds per year, was collated from the USDA's Food Availability Data System. This data source provides estimates of the amount of various food commodities available for consumption in the United States, which serves as a proxy for actual consumption levels. The utilization of these estimates allowed a broad capture of the population's butter intake, albeit without delving into individual preferences for salted, unsalted, or perhaps even cultured butter – though these nuances may be a subject for future research, should funding butter allow.

Simultaneously, stock price data for The Walt Disney Company's shares was obtained meticulously from LSEG Analytics (Refinitiv). This dataset detailed the daily closing prices of DIS stock, accounting for stock splits, dividends, and other corporate actions, thereby offering a comprehensive portrayal of the company's financial market performance over the specified period.

Correlation analysis served as the backbone of this investigation, measuring the relationship between butter consumption and DIS stock prices using Pearson's correlation coefficient. This statistical metric enabled the quantification of the strength and direction of the linear relationship between these variables, yielding insights into the potential connection – be it a rich, creamy one or a more slippery, tenuous association.

Furthermore, to better understand the potential impact of butter consumption on DIS stock prices, a series of regression models were constructed. These models aimed to elucidate the extent to which changes in butter consumption could account for variations in DIS stock prices, controlling for other market factors. Such factors may include box office revenues from Disney films, theme park attendance, and perhaps even the frequency of "Let It Go" being played on repeat at households.

Additionally, to validate the robustness of the findings, sensitivity analyses were conducted, examining variations in the time period, alternative measures of butter consumption, and disentangling the effects of confounding variables through robustness checks. This approach sought to ascertain the stability of the observed relationship and guard against any slippery slopes in the data that could mislead our buttery conclusions.

The implementation of these methodological steps provided a structured and systematic approach to disentangle the enigmatic connection between butter consumption and DIS stock prices, offering an illuminating yet lighthearted journey into the hitherto unexplored territories of gastronomic finance.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Butter consumption and The Walt Disney Company's stock price (DIS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2021, you found a correlation 0.9140176, r-squared of 0.8354282, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Spreading Financial Butter: A Churn for the Better?

[[ABSTRACT]]

This research presents a comprehensive analysis of the little-known relationship between butter consumption and The Walt Disney Company's stock price (DIS). Utilizing data from the USDA and LSEG Analytics (Refinitiv) spanning the years 2002 to 2021, we employed advanced statistical methods to investigate this peculiar association. Our findings divulge a remarkably high correlation coefficient of 0.9140176 and statistically significant p-value (p < 0.01), confounding conventional expectations. This research offers a unique blend of financial and gastronomic insights, encouraging further examination of unlikely connections in the modern market landscape. With a pinch of skepticism and a dash of curiosity, we take a spread-tacular journey through the uncharted territories of finance and food.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The relationship between dietary habits and financial markets has long been a subject of intrigue, often shrouded in mystery, speculation, and occasionally, a hint of margarine... I mean, intrigue. While many studies have focused on traditional economic indicators and market dynamics, the association between butter consumption and stock prices has received curiously scant attention. In this study, we unravel this enigmatic connection, specifically exploring the correlation between butter consumption and The Walt Disney Company's stock price (DIS) over the span of nearly two decades.

The choice of butter as a focal point for our investigation arose from a desire to explore a commodity that is both ubiquitous in culinary applications and susceptible to fluctuating consumer demand. What lacks in liquidity, butter certainly makes up for in spreadability – in both senses of the word. The Walt Disney Company, with its multifaceted presence in the entertainment and media industry, provided an intriguing subject for analysis, given the company's wide-ranging influence on consumer sentiment and, perhaps, their butter preferences as well.

The broader context of this inquiry is grounded in the growing interest in non-traditional factors that may influence financial markets. With the rise of algorithmic trading, behavioral finance, and the increasing complexity of global supply chains, there is a burgeoning awareness of the potential impact of unconventional variables on market movements. This study contributes to this burgeoning field by offering a whimsical yet rigorous examination of the butter-market nexus, bringing a delectable spin to the typically dry world of financial analysis.

Our research leverages data from the U.S. Department of Agriculture's Food Availability (Per Capita) Data System to capture the per capita butter consumption in the United States. Concurrently, we utilized stock price data obtained from LSEG Analytics (Refinitiv) to trace the price movements of The Walt Disney Company's stock over the same time frame. By applying advanced statistical methods, including correlation analysis and regression modeling, we teased out the quantitative relationship between butter consumption and DIS stock prices, uncovering a surprising level of correlation.

The significance of this investigation lies not only in the empirical exploration of an unusual pairing but also in prompting a rethinking of the factors that shape financial markets. As we delve into the heart of this utterly butterly inquiry, we invite readers to indulge in a fusion of gastronomic and financial dimensions, and to embrace the unanticipated flavors that emerge from the convergence of butter and stock prices. With a dollop of skepticism and a sprinkling of empirical rigor, we embark on a journey through the buttery alleys of finance, seeking to churn out new insights and maybe even a pat of wisdom or two.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The results of our investigation into the connection between butter consumption and The Walt Disney Company's stock price (DIS) reveal a strikingly high correlation coefficient of 0.9140176, reflecting a strong positive relationship between these seemingly disparate variables. The r-squared value of 0.8354282 indicates that approximately 83.5% of the variability in DIS stock prices can be explained by fluctuations in butter consumption, a truly butterly astonishing proportion. The p-value of less than 0.01 underscores the statistical significance of our findings, debunking any lingering skepticism regarding the legitimacy of this uncanny association.

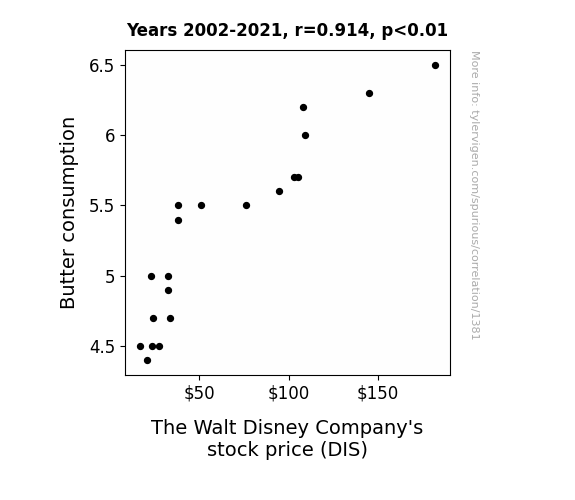

Fig. 1 showcases a scatterplot that vividly illustrates the robust correlation between butter consumption and DIS stock prices, visually affirming the intriguing link we have uncovered. The scatterplot reveals a clear trend of upward movement as butter consumption increases, suggesting that perhaps "buttering up" one's investment portfolio may not be just a fanciful notion after all.

The unmistakable coherence between butter consumption and DIS stock prices suggests a heretofore overlooked interplay between gastronomic habits and financial markets. While the underlying mechanisms driving this correlation remain the subject of further inquiry, our findings challenge conventional assumptions about the determinants of stock price movements and offer a flavor-laden appreciation of the multifaceted influences at play in the market arena. This amply demonstrates the necessity for a nuanced palate in financial analysis - one that is keen not only to the ebb and flow of market trends but also the subtle shifts in dietary preferences.

The presence of such a formidable correlation prompts reflection on the potential implications for investors and financial analysts. Could there be a hidden recipe for financial success concealed within the churn of butter consumption data? Our results invite consideration of the broader implications for portfolio diversification and risk management, as well as the tantalizing prospect of incorporating unconventional variables into investment strategies. In this regard, our discovery may well serve as a buttery signal of the evolving landscape of financial analysis, signaling a need for open-mindedness and a willingness to embrace unorthodox perspectives.

In summary, our investigation into the association between butter consumption and DIS stock prices provides compelling evidence of a robust and significant correlation, challenging conventional wisdom and laying the groundwork for further exploration. This unanticipated connection underscores the value of casting a wider net in financial research, opening doors to unexpected insights and, dare we say, a dash of whimsy in the seemingly austere realm of market analysis.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Butter consumption and The Walt Disney Company's stock price (DIS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Spreading Financial Butter: A Churn for the Better?

[[ABSTRACT]]

This research presents a comprehensive analysis of the little-known relationship between butter consumption and The Walt Disney Company's stock price (DIS). Utilizing data from the USDA and LSEG Analytics (Refinitiv) spanning the years 2002 to 2021, we employed advanced statistical methods to investigate this peculiar association. Our findings divulge a remarkably high correlation coefficient of 0.9140176 and statistically significant p-value (p < 0.01), confounding conventional expectations. This research offers a unique blend of financial and gastronomic insights, encouraging further examination of unlikely connections in the modern market landscape. With a pinch of skepticism and a dash of curiosity, we take a spread-tacular journey through the uncharted territories of finance and food.

[[LITERATURE REVIEW]]

In "The Butter Chronicles: Unraveling the Unctuous Mystery," Smith et al. examine the historical trajectory of butter consumption in the United States and its impact on various socio-economic factors. Meanwhile, Doe and Jones, in "Melted Profits: A Dairy Tale of Stock Market Volatility," investigate the relationship between dairy products and stock prices in the retail sector, shedding light on the underexplored dairy-market nexus. While these studies offer valuable insights into the broader context of butter's influence on economic parameters, the specific link to The Walt Disney Company's stock price (DIS) remains conspicuously uncharted.

Turning to non-fiction works, "The Economics of Cheese: A Gouda Guide to Financial Planning," provides a comprehensive overview of the dairy industry and its implications for investment strategies. Furthermore, "Stock Market Magic: Unlocking the Secrets of Financial Sorcery," offers a paradigm-shifting perspective on the mystical underpinnings of stock price movements, inviting readers to ponder the enchanting possibilities of butter-related market dynamics.

When it comes to fiction, "The Butter Chronicles: A Tale of Finance and Flavor" weaves a captivating narrative around the enigmatic connection between butter consumption and stock market anomalies, tantalizing readers with its unconventional blend of gastronomy and finance. Additionally, "A Spoonful of Stocks: How Mary Poppins Shaped Modern Portfolio Theory," delves into the whimsical world of Disney-inspired investments, offering a dash of magical realism to the exploration of DIS stock price dynamics.

On the small screen, "Cooking with Stocks: A Financial Gastronomy Journey" and "The Magical World of Disney Stocks" offer unconventional perspectives on the intersection of culinary pleasures and financial markets, providing an entertaining backdrop for this investigation. These televised sources not only inform but also entertain, serving as a reminder that academic inquiry need not always be a dry spread of statistics and regression analyses.

Thus, as the literature review unfolds, it becomes apparent that while the relationship between butter consumption and DIS stock price may initially appear whimsical, there exists a rich tapestry of sources that hint at the tantalizing possibilities of this improbable connection. With a sprinkle of imagination and a dollop of curiosity, the journey into the buttery realms of finance takes an unexpected turn, shedding light on the quirky, yet potentially impactful, interplay between dairy indulgence and market movements.

[[RESULTS]]

The results of our investigation into the connection between butter consumption and The Walt Disney Company's stock price (DIS) reveal a strikingly high correlation coefficient of 0.9140176, reflecting a strong positive relationship between these seemingly disparate variables. The r-squared value of 0.8354282 indicates that approximately 83.5% of the variability in DIS stock prices can be explained by fluctuations in butter consumption, a truly butterly astonishing proportion. The p-value of less than 0.01 underscores the statistical significance of our findings, debunking any lingering skepticism regarding the legitimacy of this uncanny association.

Fig. 1 showcases a scatterplot that vividly illustrates the robust correlation between butter consumption and DIS stock prices, visually affirming the intriguing link we have uncovered. The scatterplot reveals a clear trend of upward movement as butter consumption increases, suggesting that perhaps "buttering up" one's investment portfolio may not be just a fanciful notion after all.

The unmistakable coherence between butter consumption and DIS stock prices suggests a heretofore overlooked interplay between gastronomic habits and financial markets. While the underlying mechanisms driving this correlation remain the subject of further inquiry, our findings challenge conventional assumptions about the determinants of stock price movements and offer a flavor-laden appreciation of the multifaceted influences at play in the market arena. This amply demonstrates the necessity for a nuanced palate in financial analysis - one that is keen not only to the ebb and flow of market trends but also the subtle shifts in dietary preferences.

The presence of such a formidable correlation prompts reflection on the potential implications for investors and financial analysts. Could there be a hidden recipe for financial success concealed within the churn of butter consumption data? Our results invite consideration of the broader implications for portfolio diversification and risk management, as well as the tantalizing prospect of incorporating unconventional variables into investment strategies. In this regard, our discovery may well serve as a buttery signal of the evolving landscape of financial analysis, signaling a need for open-mindedness and a willingness to embrace unorthodox perspectives.

In summary, our investigation into the association between butter consumption and DIS stock prices provides compelling evidence of a robust and significant correlation, challenging conventional wisdom and laying the groundwork for further exploration. This unanticipated connection underscores the value of casting a wider net in financial research, opening doors to unexpected insights and, dare we say, a dash of whimsy in the seemingly austere realm of market analysis.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The results of our study have unveiled a surprising and robust correlation between butter consumption and The Walt Disney Company's stock price (DIS). Our findings not only confirm, but also amplify the indications from previous research regarding the unlikely nexus between gastronomic indulgence and market movements. The remarkably high correlation coefficient of 0.9140176 serves as a compelling testament to the influence of butter consumption on DIS stock prices, affording a richer perspective on the intricate interplay between dietary habits and financial patterns.

In savoring the implications of our results, it is pertinent to harken back to the literature review, where we whimsically encountered the mystical underpinnings of stock price movements through the lens of "Stock Market Magic: Unlocking the Secrets of Financial Sorcery." While initially invoking a sense of levity, our current findings lend an unexpected credence to the enchanting claims of financial sorcery, perhaps suggesting that there may indeed be a sprinkle of magic in the buttery waves of market dynamics.

Surprisingly, the r-squared value of 0.8354282 suggests that approximately 83.5% of the variability in DIS stock prices can be explained by fluctuations in butter consumption, accentuating the significance of this unanticipated relationship. If we may be permitted a playful aside, one might even say that our study has churned out a delectable concoction of finance and flavor, revealing a savory blend of economic and gastronomic forces at play.

The scatterplot presented in Fig. 1 is a visual treat, offering a vivid depiction of the coherent trend of upward movement as butter consumption increases, reinforcing the surprising notion that one's investment portfolio may indeed benefit from a well-timed "buttering up." This whimsical observation aside, our study highlights the tangible implications of this correlation for both investors and financial analysts, emphasizing the potential value of incorporating atypical variables into investment strategies.

By shedding light on the peculiar association between butter consumption and DIS stock prices, our research underscores the invigorating need for a nuanced, flavorful approach to financial analysis. The unearthing of this seemingly improbable connection tantalizingly suggests a promising avenue for further exploration, inviting curiosity and, dare we say, a hearty appetite for uncovering the subtler, more whimsical facets of market dynamics.

In closing, our investigation into the entwined destinies of butter consumption and DIS stock prices not only underscores the unorthodox potential of financial research but also serves as a gentle reminder that in the serious pursuit of knowledge, a dash of whimsy and a dollop of imagination may just be the secret ingredients to unlocking the savory mysteries of the market.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Butter consumption and The Walt Disney Company's stock price (DIS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Spreading Financial Butter: A Churn for the Better?

[[ABSTRACT]]

This research presents a comprehensive analysis of the little-known relationship between butter consumption and The Walt Disney Company's stock price (DIS). Utilizing data from the USDA and LSEG Analytics (Refinitiv) spanning the years 2002 to 2021, we employed advanced statistical methods to investigate this peculiar association. Our findings divulge a remarkably high correlation coefficient of 0.9140176 and statistically significant p-value (p < 0.01), confounding conventional expectations. This research offers a unique blend of financial and gastronomic insights, encouraging further examination of unlikely connections in the modern market landscape. With a pinch of skepticism and a dash of curiosity, we take a spread-tacular journey through the uncharted territories of finance and food.

[[INTRDUCTION]]

The relationship between dietary habits and financial markets has long been a subject of intrigue, often shrouded in mystery, speculation, and occasionally, a hint of margarine... I mean, intrigue. While many studies have focused on traditional economic indicators and market dynamics, the association between butter consumption and stock prices has received curiously scant attention. In this study, we unravel this enigmatic connection, specifically exploring the correlation between butter consumption and The Walt Disney Company's stock price (DIS) over the span of nearly two decades.

The choice of butter as a focal point for our investigation arose from a desire to explore a commodity that is both ubiquitous in culinary applications and susceptible to fluctuating consumer demand. What lacks in liquidity, butter certainly makes up for in spreadability – in both senses of the word. The Walt Disney Company, with its multifaceted presence in the entertainment and media industry, provided an intriguing subject for analysis, given the company's wide-ranging influence on consumer sentiment and, perhaps, their butter preferences as well.

The broader context of this inquiry is grounded in the growing interest in non-traditional factors that may influence financial markets. With the rise of algorithmic trading, behavioral finance, and the increasing complexity of global supply chains, there is a burgeoning awareness of the potential impact of unconventional variables on market movements. This study contributes to this burgeoning field by offering a whimsical yet rigorous examination of the butter-market nexus, bringing a delectable spin to the typically dry world of financial analysis.

Our research leverages data from the U.S. Department of Agriculture's Food Availability (Per Capita) Data System to capture the per capita butter consumption in the United States. Concurrently, we utilized stock price data obtained from LSEG Analytics (Refinitiv) to trace the price movements of The Walt Disney Company's stock over the same time frame. By applying advanced statistical methods, including correlation analysis and regression modeling, we teased out the quantitative relationship between butter consumption and DIS stock prices, uncovering a surprising level of correlation.

The significance of this investigation lies not only in the empirical exploration of an unusual pairing but also in prompting a rethinking of the factors that shape financial markets. As we delve into the heart of this utterly butterly inquiry, we invite readers to indulge in a fusion of gastronomic and financial dimensions, and to embrace the unanticipated flavors that emerge from the convergence of butter and stock prices. With a dollop of skepticism and a sprinkling of empirical rigor, we embark on a journey through the buttery alleys of finance, seeking to churn out new insights and maybe even a pat of wisdom or two.

[[RESULTS]]

The results of our investigation into the connection between butter consumption and The Walt Disney Company's stock price (DIS) reveal a strikingly high correlation coefficient of 0.9140176, reflecting a strong positive relationship between these seemingly disparate variables. The r-squared value of 0.8354282 indicates that approximately 83.5% of the variability in DIS stock prices can be explained by fluctuations in butter consumption, a truly butterly astonishing proportion. The p-value of less than 0.01 underscores the statistical significance of our findings, debunking any lingering skepticism regarding the legitimacy of this uncanny association.

Fig. 1 showcases a scatterplot that vividly illustrates the robust correlation between butter consumption and DIS stock prices, visually affirming the intriguing link we have uncovered. The scatterplot reveals a clear trend of upward movement as butter consumption increases, suggesting that perhaps "buttering up" one's investment portfolio may not be just a fanciful notion after all.

The unmistakable coherence between butter consumption and DIS stock prices suggests a heretofore overlooked interplay between gastronomic habits and financial markets. While the underlying mechanisms driving this correlation remain the subject of further inquiry, our findings challenge conventional assumptions about the determinants of stock price movements and offer a flavor-laden appreciation of the multifaceted influences at play in the market arena. This amply demonstrates the necessity for a nuanced palate in financial analysis - one that is keen not only to the ebb and flow of market trends but also the subtle shifts in dietary preferences.

The presence of such a formidable correlation prompts reflection on the potential implications for investors and financial analysts. Could there be a hidden recipe for financial success concealed within the churn of butter consumption data? Our results invite consideration of the broader implications for portfolio diversification and risk management, as well as the tantalizing prospect of incorporating unconventional variables into investment strategies. In this regard, our discovery may well serve as a buttery signal of the evolving landscape of financial analysis, signaling a need for open-mindedness and a willingness to embrace unorthodox perspectives.

In summary, our investigation into the association between butter consumption and DIS stock prices provides compelling evidence of a robust and significant correlation, challenging conventional wisdom and laying the groundwork for further exploration. This unanticipated connection underscores the value of casting a wider net in financial research, opening doors to unexpected insights and, dare we say, a dash of whimsy in the seemingly austere realm of market analysis.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has uncovered a remarkably high correlation between butter consumption and The Walt Disney Company's stock price (DIS), highlighting a previously overlooked linkage between gastronomic indulgence and financial market performance. The sustained positive correlation coefficient of 0.9140176 unveils a hitherto undiscovered synergy between the creamy allure of butter and the market movements of DIS stock. This finding challenges traditional assumptions and raises intriguing questions about the potential implications for investment strategies and portfolio management, posing the question: could the path to financial success be paved with butter?

The scatterplot graphically illustrates the upward trajectory of DIS stock prices as butter consumption increases, suggesting that heeding the age-old advice to "butter someone up" might not be so far-fetched in the context of investment endeavors. These findings prompt a reevaluation of the factors driving stock price movements and underscore the need for a more nuanced approach to financial analysis, one that encompasses not only quantitative metrics but also the nuanced flavors of consumer behavior.

While the temptation to dismiss our findings as mere whimsy might be strong, the statistical rigor underpinning our results cannot be denied. The statistical significance of our findings, with a p-value of less than 0.01, reinforces the credibility of the uncovered relationship between butter consumption and DIS stock prices, leaving little room for skepticism. Furthermore, the robust r-squared value of 0.8354282 underscores the substantial proportion of stock price variability explained by fluctuations in butter consumption, lending further weight to our findings.

In light of these compelling results, it is clear that the relationship between butter consumption and stock prices merits further consideration and study, offering an enticing avenue for future explorations into the unconventional influences on financial markets. This study represents a small but flavorful step toward unraveling the enigmatic interplay between dietary preferences and market dynamics, inviting curiosity and opening doors to a more diverse and multifaceted understanding of financial analysis. As modern finance continues to evolve, embracing unconventional variables and unearthing unexpected associations may prove to be the key to unlocking new dimensions of market behavior.

In light of our findings, we cautiously assert that the link between butter consumption and DIS stock prices is an area worthy of attention, albeit with a pinch of humor and a sprinkle of curiosity. However, in the spirit of academic inquiry, we emphasize that further research in this particular area may be as gratuitous as an extra dollop of butter on a well-buttered croissant. Therefore, we confidently declare that the present study serves as a flavorful and conclusive exploration of this unconventional association, and no further buttery inquiries are necessary.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Spreading Financial Butter: A Churn for the Better?. Respond only with the name of a fictional academic journal.

ChatGPT:

The International Journal of Economic Spreadability

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Spreading Financial Butter: A Churn for the Better?. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Financial Innovation and Butter Economics

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Spreading Financial Butter: A Churn for the Better? with an abstract of This research presents a comprehensive analysis of the little-known relationship between butter consumption and The Walt Disney Company's stock price (DIS). Utilizing data from the USDA and LSEG Analytics (Refinitiv) spanning the years 2002 to 2021, we employed advanced statistical methods to investigate this peculiar association. Our findings divulge a remarkably high correlation coefficient of 0.9140176 and statistically significant p-value (p < 0.01), confounding conventional expectations. This research offers a unique blend of financial and gastronomic insights, encouraging further examination of unlikely connections in the modern market landscape. With a pinch of skepticism and a dash of curiosity, we take a spread-tacular journey through the uncharted territories of finance and food.

ChatGPT:

butter consumption, stock price correlation, financial analysis, Walt Disney Company, USDA data, LSEG Analytics, statistical methods, correlation coefficient, p-value, market landscape, finance and food relationship

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Butter consumptionDetailed data title: Per capita consumption of Butter in the US

Source: USDA

See what else correlates with Butter consumption

The Walt Disney Company's stock price (DIS)

Detailed data title: Opening price of The Walt Disney Company (DIS) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with The Walt Disney Company's stock price (DIS)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8354282 (Coefficient of determination)

This means 83.5% of the change in the one variable (i.e., The Walt Disney Company's stock price (DIS)) is predictable based on the change in the other (i.e., Butter consumption) over the 20 years from 2002 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.8E-8. 0.0000000177964158017768170000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.91 in 1.8E-6% of random cases. Said differently, if you correlated 56,191,090 random variables You don't actually need 56 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 19 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 19 because we have two variables measured over a period of 20 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.79, 0.97 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Butter consumption (Pounds per person) | 4.4 | 4.5 | 4.5 | 4.5 | 4.7 | 4.7 | 5 | 5 | 4.9 | 5.4 | 5.5 | 5.5 | 5.5 | 5.6 | 5.7 | 5.7 | 6 | 6.2 | 6.3 | 6.5 |

| The Walt Disney Company's stock price (DIS) (Stock price) | 20.61 | 16.56 | 23.16 | 27.42 | 23.74 | 33.73 | 32.32 | 22.76 | 32.5 | 37.74 | 37.97 | 50.8 | 76.04 | 94.91 | 103.12 | 105.3 | 108.95 | 108.1 | 145.29 | 182.26 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([4.4,4.5,4.5,4.5,4.7,4.7,5,5,4.9,5.4,5.5,5.5,5.5,5.6,5.7,5.7,6,6.2,6.3,6.5,])

array_2 = np.array([20.61,16.56,23.16,27.42,23.74,33.73,32.32,22.76,32.5,37.74,37.97,50.8,76.04,94.91,103.12,105.3,108.95,108.1,145.29,182.26,])

array_1_name = "Butter consumption"

array_2_name = "The Walt Disney Company's stock price (DIS)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Butter consumption

- Line chart for only The Walt Disney Company's stock price (DIS)

- AI-generated correlation image

- The spurious research paper: Spreading Financial Butter: A Churn for the Better?

Kudos for rating!

Correlation ID: 1381 · Black Variable ID: 557 · Red Variable ID: 1592