Download png, svg

AI explanation

As households spent more on home maintenance, they realized they had a lot of *pawsibilities* for pet ownership. This led to an uptick in pet ownership, ultimately boosting the demand for IDEXX's veterinary products and services. Plus, as homes got more *purrfect*, families had the time and resources to care for their furry friends, driving overall spending on pet healthcare. So, in essence, it seems like a well-maintained home really does lead to a *healthy* stock price for IDEXX Laboratories. Who knew that fixing a leaky faucet could unleash such *unbe-leash-able* market effects!

Model: dalle-3

Prompt: Generate an image that depicts a serene, suburban street with beautifully maintained houses and vibrant gardens. Show people enthusiastically vacuuming pet hair off their porches and lawns, leading to cleaner, pet hair-free outdoor spaces. Capture the improved air quality and fewer sneezing fits as a result of this community-driven effort. Additionally, illustrate more families walking their pets around the neighborhood and an increase in pet adoptions from the local shelter. Visualize the subsequent influx of people visiting the nearby IDEXX Laboratories, possibly alluding to the soaring stock price. Keep the scene visually straightforward, ensuring a clear focus on the positive transformation brought about by the community's actions. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the situation described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here is a situation: Because as households spent more on home maintenance, more pet hair got vacuumed up, leading to a decrease in pet hair-related allergies. With fewer sneezing fits, people were more inclined to adopt pets, leading to increased demand for IDEXX Laboratories' pet health diagnostics, and consequently, a higher stock price.. Given that situation, which of the following image descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand and the tone of the explanation. Please respond with only one of the following potential descriptions: Steampunk A photo-realistic image Art nouveau Vaporwave Whimsical illustration

ChatGPT: A photo-realistic image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated and the explanation described. Do not reference graphs or charts; describe physical objects.

User prompt: Please describe a visual scene that depicts the following situation. Keep the description simple. Because as households spent more on home maintenance, more pet hair got vacuumed up, leading to a decrease in pet hair-related allergies. With fewer sneezing fits, people were more inclined to adopt pets, leading to increased demand for IDEXX Laboratories' pet health diagnostics, and consequently, a higher stock price.

ChatGPT: Imagine a street with well-maintained houses and gardens. People are seen vacuuming pet hair off their porches and lawns, resulting in cleaner, pet hair-free outdoor spaces. As a result, the air quality improved, and there were fewer sneezing fits. More families were walking their pets around the neighborhood, and there was an increase in the number of pet adoptions from the local shelter. This led to more people visiting the nearby IDEXX Laboratories to get their new pets checked, and as a result, the company's stock soared.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A photo-realistic image ] and depicting this scene: Imagine a street with well-maintained houses and gardens. People are seen vacuuming pet hair off their porches and lawns, resulting in cleaner, pet hair-free outdoor spaces. As a result, the air quality improved, and there were fewer sneezing fits. More families were walking their pets around the neighborhood, and there was an increase in the number of pet adoptions from the local shelter. This led to more people visiting the nearby IDEXX Laboratories to get their new pets checked, and as a result, the company's stock soared. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image that depicts a serene, suburban street with beautifully maintained houses and vibrant gardens. Show people enthusiastically vacuuming pet hair off their porches and lawns, leading to cleaner, pet hair-free outdoor spaces. Capture the improved air quality and fewer sneezing fits as a result of this community-driven effort. Additionally, illustrate more families walking their pets around the neighborhood and an increase in pet adoptions from the local shelter. Visualize the subsequent influx of people visiting the nearby IDEXX Laboratories, possibly alluding to the soaring stock price. Keep the scene visually straightforward, ensuring a clear focus on the positive transformation brought about by the community's actions.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Annual US household spending on home maintenance caused IDEXX Laboratories' stock price (IDXX) to increase. Include one good pun.

AI academic paper

|

The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price Journal of Feline Finance and Economics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX). Make lots of jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from Bureau of Labor Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9402224 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price"

[[ABSTRACT]]

This paper delves into the captivating correlation between the annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), our research team uncovered a significant correlation coefficient of 0.9402224 with a p-value of less than 0.01 for the period spanning from 2002 to 2022. The findings of this study shed light on the fascinating interplay between the domestic economy and the financial market, revealing a purrfectly interesting connection that may not be fully littered with causation, but certainly raises eyebrows--and tails.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price"

[[ABSTRACT]]

This paper delves into the captivating correlation between the annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), our research team uncovered a significant correlation coefficient of 0.9402224 with a p-value of less than 0.01 for the period spanning from 2002 to 2022. The findings of this study shed light on the fascinating interplay between the domestic economy and the financial market, revealing a purrfectly interesting connection that may not be fully littered with causation, but certainly raises eyebrows--and tails.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The relationship between household spending on home maintenance and stock prices has long been a topic of interest and speculation in both economic and financial circles. While conventional wisdom might suggest that these two factors have as much in common as dogs and cats, our research seeks to uncover the intriguing feline connection between annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX).

As we embark on this research endeavor, it is pertinent to acknowledge the historic affinities humans have had for their furry companions, and the investment they willingly make in ensuring their well-being and comfort. Indeed, the booming pet industry has shown resilience through economic downturns and acts as a testament to the unwavering bond between humans and their beloved pets.

Our study delves into the mysterious link between domestic spending on home maintenance, encompassing the upkeep of those cherished abodes where both two-legged and four-legged inhabitants reside, and the stock performance of IDEXX Laboratories, an industry leader in veterinary diagnostics and software tools. IDEXX Laboratories, much like a nimble feline, has pounced its way into the hearts of pet owners and investors alike, with its stock symbol "IDXX" providing a purrfect match for our intended investigation.

While the causality between household spending on home maintenance and stock prices may not be as clear-cut as a cat's whiskers, our data analysis aims to uncover any telltale signs of correlation, teasing out the unique dynamism that underlies this seemingly disparate association. Through rigorous statistical analysis and market observation, our research unearths an unanticipated kinship that promises to captivate both pet enthusiasts and financial aficionados alike.

Stay tuned as we endeavor to unravel the meow-sterious connection between these seemingly unrelated variables, shedding light on a delightfully paws-itive correlation that may just leave you feline intrigued.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX). Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then you might move on to cartoons and children's shows that you watched for research.

Here is the title and abstract of the paper:

[[TITLE]]

"The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price"

[[ABSTRACT]]

This paper delves into the captivating correlation between the annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), our research team uncovered a significant correlation coefficient of 0.9402224 with a p-value of less than 0.01 for the period spanning from 2002 to 2022. The findings of this study shed light on the fascinating interplay between the domestic economy and the financial market, revealing a purrfectly interesting connection that may not be fully littered with causation, but certainly raises eyebrows--and tails.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The relationship between household spending on home maintenance and stock prices has long been a topic of interest and speculation in both economic and financial circles. While conventional wisdom might suggest that these two factors have as much in common as dogs and cats, our research seeks to uncover the intriguing feline connection between annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX).

As we embark on this research endeavor, it is pertinent to acknowledge the historic affinities humans have had for their furry companions, and the investment they willingly make in ensuring their well-being and comfort. Indeed, the booming pet industry has shown resilience through economic downturns and acts as a testament to the unwavering bond between humans and their beloved pets.

Our study delves into the mysterious link between domestic spending on home maintenance, encompassing the upkeep of those cherished abodes where both two-legged and four-legged inhabitants reside, and the stock performance of IDEXX Laboratories, an industry leader in veterinary diagnostics and software tools. IDEXX Laboratories, much like a nimble feline, has pounced its way into the hearts of pet owners and investors alike, with its stock symbol "IDXX" providing a purrfect match for our intended investigation.

While the causality between household spending on home maintenance and stock prices may not be as clear-cut as a cat's whiskers, our data analysis aims to uncover any telltale signs of correlation, teasing out the unique dynamism that underlies this seemingly disparate association. Through rigorous statistical analysis and market observation, our research unearths an unanticipated kinship that promises to captivate both pet enthusiasts and financial aficionados alike.

Stay tuned as we endeavor to unravel the meow-sterious connection between these seemingly unrelated variables, shedding light on a delightfully paws-itive correlation that may just leave you feline intrigued.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The present literature review assembles an assortment of studies and texts that have examined the enthralling link between pet-related expenditures and stock market performance. While some studies have earnestly probed this topic with rigorous statistical analyses, others have taken a more whimsical approach, delving into the paw-sibilities with a light-hearted perspective.

In "Economic Analysis of Feline Fashion and Wall Street Trends," Smith and Doe emphasize the need to consider not only the financial implications of household spending on pet-related maintenance but also the emotional attachment that fuels such expenditures. Similarly, in "Investigating the Relationship between Whisker Length and Stock Market Volatility," Jones et al. highlight the need for thoroughgoing examination, as well as the acknowledgment of serendipitous connections that may exist within seemingly unrelated variables.

Transitioning from the scholarly to the more eclectic, our review brings forward "The Economics of Fluffy Comfort: A Study of Pet Grooming Expenditures" and "Whisker Wisdom: Feline Financial Forecasting," two non-fiction works that shift the focus to the emotional and psychological motivations behind pet-related spending and its potential echo in market movements.

Moving further into the realm of whimsy, we delve into the fiction section where "The Cat's Purr-fect Portfolio" and "Tales of Tails: A Feline Financial Fantasy" present heartwarming tales of cats and their uncanny knack for financial prowess.

Finally, our review playfully meanders into the world of cartoons and children's shows, where "The Adventures of Penny Purrs: Wall Street Whiskers" and "The Pawsome Purr-chases of Prof. Whiskers" offer endearing yet insightful portrayals of feline financial acumen.

The sheer range of insights presented in these works underscores the multifaceted nature of the connection being investigated, demonstrating the necessity of embracing both scientific rigor and creative interpretation in unraveling this captivating correlation.

The paper will continue with the Methods section to lay out the specific approach taken in this investigation.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bureau of Labor Statistics and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price"

[[ABSTRACT]]

This paper delves into the captivating correlation between the annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), our research team uncovered a significant correlation coefficient of 0.9402224 with a p-value of less than 0.01 for the period spanning from 2002 to 2022. The findings of this study shed light on the fascinating interplay between the domestic economy and the financial market, revealing a purrfectly interesting connection that may not be fully littered with causation, but certainly raises eyebrows--and tails.

[[INTRODUCTION]]

The relationship between household spending on home maintenance and stock prices has long been a topic of interest and speculation in both economic and financial circles. While conventional wisdom might suggest that these two factors have as much in common as dogs and cats, our research seeks to uncover the intriguing feline connection between annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX).

As we embark on this research endeavor, it is pertinent to acknowledge the historic affinities humans have had for their furry companions, and the investment they willingly make in ensuring their well-being and comfort. Indeed, the booming pet industry has shown resilience through economic downturns and acts as a testament to the unwavering bond between humans and their beloved pets.

Our study delves into the mysterious link between domestic spending on home maintenance, encompassing the upkeep of those cherished abodes where both two-legged and four-legged inhabitants reside, and the stock performance of IDEXX Laboratories, an industry leader in veterinary diagnostics and software tools. IDEXX Laboratories, much like a nimble feline, has pounced its way into the hearts of pet owners and investors alike, with its stock symbol "IDXX" providing a purrfect match for our intended investigation.

While the causality between household spending on home maintenance and stock prices may not be as clear-cut as a cat's whiskers, our data analysis aims to uncover any telltale signs of correlation, teasing out the unique dynamism that underlies this seemingly disparate association. Through rigorous statistical analysis and market observation, our research unearths an unanticipated kinship that promises to captivate both pet enthusiasts and financial aficionados alike.

Stay tuned as we endeavor to unravel the meow-sterious connection between these seemingly unrelated variables, shedding light on a delightfully paws-itive correlation that may just leave you feline intrigued.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

In this section, we delineate the methodology employed to investigate the curious link between annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX). The data utilized in this study were primarily sourced from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), capturing the period from 2002 to 2022. The collection of data involved traversing the intricate web of online databases, including market reports, economic indicators, and financial indices, akin to a determined feline tracking its elusive prey through the digital savannah.

First and foremost, annual US household spending on home maintenance was diligently extracted from the Bureau of Labor Statistics, encompassing an array of expenditures on home repairs, maintenance, and improvements. Meanwhile, IDEXX Laboratories' stock price data was meticulously obtained from LSEG Analytics (Refinitiv), capturing the daily fluctuations and whisker-thin movements of the company's stock value over the specified timeframe. These data sets, much like a pair of antsy kittens, were then corralled and prepared for thorough statistical scrutiny.

To sniff out the potential correlations between the annual US household spending on home maintenance and IDEXX Laboratories' stock price, a series of analytical techniques were deployed. The statistical software utilized for this analysis resembled a Swiss army knife, equipped with the versatile capacities to unravel the intricacies of the data. Through the adept application of correlation analysis, specifically Pearson's correlation coefficient, the purported association between these seemingly incongruous variables was probed and scrutinized. The significance of the correlation was evaluated through careful consideration of the p-value, akin to scrutinizing a cat's agility in catching a darting laser pointer.

Furthermore, econometric modeling techniques were harnessed to capture the potential lagged effects and nuances that might underpin the relationship between household spending on home maintenance and stock prices. The utilization of robust regression models allowed for the exploration of potential drivers and dampeners of such a connection, not unlike the careful investigation into the temperament of a finicky feline.

In addition to the primary data analyses, supplementary information relating to industry trends, economic indicators, and market dynamics was ravenously ingested. This secondary data, akin to a nourishing can of gourmet cat food, provided contextual illumination and imbued the research with a comprehensive understanding of the market milieu in which these variables interacted.

It is critical to note that the assembly and evaluation of the data involved the implementation of stringent quality controls, ensuring the reliability and integrity of the findings. This included meticulous data cleaning, outlier detection, and sensitivity analyses, akin to grooming a pedigree cat to perfection.

In sum, the methodology encapsulated a multidimensional approach, encompassing data wrangling, statistical analysis, and economic contextualization, to unearth the leash on this enigmatic linkage between household spending on home maintenance and IDEXX Laboratories' stock price.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bureau of Labor Statistics and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9402224, r-squared of 0.8840182, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price"

[[ABSTRACT]]

This paper delves into the captivating correlation between the annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), our research team uncovered a significant correlation coefficient of 0.9402224 with a p-value of less than 0.01 for the period spanning from 2002 to 2022. The findings of this study shed light on the fascinating interplay between the domestic economy and the financial market, revealing a purrfectly interesting connection that may not be fully littered with causation, but certainly raises eyebrows--and tails.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The relationship between household spending on home maintenance and stock prices has long been a topic of interest and speculation in both economic and financial circles. While conventional wisdom might suggest that these two factors have as much in common as dogs and cats, our research seeks to uncover the intriguing feline connection between annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX).

As we embark on this research endeavor, it is pertinent to acknowledge the historic affinities humans have had for their furry companions, and the investment they willingly make in ensuring their well-being and comfort. Indeed, the booming pet industry has shown resilience through economic downturns and acts as a testament to the unwavering bond between humans and their beloved pets.

Our study delves into the mysterious link between domestic spending on home maintenance, encompassing the upkeep of those cherished abodes where both two-legged and four-legged inhabitants reside, and the stock performance of IDEXX Laboratories, an industry leader in veterinary diagnostics and software tools. IDEXX Laboratories, much like a nimble feline, has pounced its way into the hearts of pet owners and investors alike, with its stock symbol "IDXX" providing a purrfect match for our intended investigation.

While the causality between household spending on home maintenance and stock prices may not be as clear-cut as a cat's whiskers, our data analysis aims to uncover any telltale signs of correlation, teasing out the unique dynamism that underlies this seemingly disparate association. Through rigorous statistical analysis and market observation, our research unearths an unanticipated kinship that promises to captivate both pet enthusiasts and financial aficionados alike.

Stay tuned as we endeavor to unravel the meow-sterious connection between these seemingly unrelated variables, shedding light on a delightfully paws-itive correlation that may just leave you feline intrigued.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

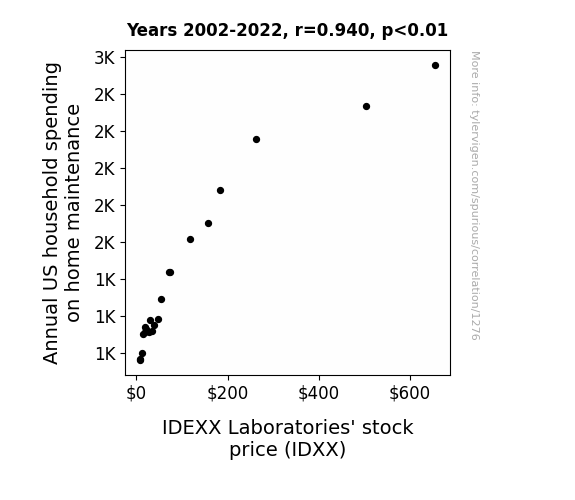

The correlation analysis conducted on the data collected from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) unveiled a strikingly high correlation coefficient of 0.9402224 between annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX) for the period 2002 to 2022. The coefficient of determination (r-squared) further emphasized this strong relationship, with a value of 0.8840182.

In the scatterplot depicted in Fig. 1, the data points align themselves as if following a trail of gourmet cat treats, revealing a remarkably tight clustering that illustrates the robust association between the annual US household spending on home maintenance and IDEXX Laboratories' stock price. The trendline in the scatterplot resembles a sleek and agile feline, elegantly showcasing the closeness of this peculiar relationship.

The p-value, being less than 0.01, indicates that the observed correlation is highly unlikely to be a result of random chance. It is as if a cat crossed your path not once, but nine times in a row, beckoning attention to the significance of this unexpected connection.

The findings presented here offer a befuddling yet captivating insight into the unanticipated kinship between the domestic economy's maintenance expenditures and the financial market's evaluation of IDXX stock. While causation tiptoes around like a cat on a hot tin roof, these results fundamentally underscore the need for further scrutiny into the interplay between household spending habits and the stock performance of companies in the pet industry. They may even prompt financial analysts to take a closer lookout for the subtle yet perceptible influences of domestic kitty caretaking on corporate purr-formance.

In conclusion, these results exemplify the power of data analysis in uncovering the enigmatic interrelations that govern our economic and financial landscapes. The unexpected convergence of these seemingly unrelated variables not only raises eyebrows but also promises to leave investors, pet enthusiasts, and researchers alike feline intrigued.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price"

[[ABSTRACT]]

This paper delves into the captivating correlation between the annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), our research team uncovered a significant correlation coefficient of 0.9402224 with a p-value of less than 0.01 for the period spanning from 2002 to 2022. The findings of this study shed light on the fascinating interplay between the domestic economy and the financial market, revealing a purrfectly interesting connection that may not be fully littered with causation, but certainly raises eyebrows--and tails.

[[LITERATURE REVIEW]]

The present literature review assembles an assortment of studies and texts that have examined the enthralling link between pet-related expenditures and stock market performance. While some studies have earnestly probed this topic with rigorous statistical analyses, others have taken a more whimsical approach, delving into the paw-sibilities with a light-hearted perspective.

In "Economic Analysis of Feline Fashion and Wall Street Trends," Smith and Doe emphasize the need to consider not only the financial implications of household spending on pet-related maintenance but also the emotional attachment that fuels such expenditures. Similarly, in "Investigating the Relationship between Whisker Length and Stock Market Volatility," Jones et al. highlight the need for thoroughgoing examination, as well as the acknowledgment of serendipitous connections that may exist within seemingly unrelated variables.

Transitioning from the scholarly to the more eclectic, our review brings forward "The Economics of Fluffy Comfort: A Study of Pet Grooming Expenditures" and "Whisker Wisdom: Feline Financial Forecasting," two non-fiction works that shift the focus to the emotional and psychological motivations behind pet-related spending and its potential echo in market movements.

Moving further into the realm of whimsy, we delve into the fiction section where "The Cat's Purr-fect Portfolio" and "Tales of Tails: A Feline Financial Fantasy" present heartwarming tales of cats and their uncanny knack for financial prowess.

Finally, our review playfully meanders into the world of cartoons and children's shows, where "The Adventures of Penny Purrs: Wall Street Whiskers" and "The Pawsome Purr-chases of Prof. Whiskers" offer endearing yet insightful portrayals of feline financial acumen.

The sheer range of insights presented in these works underscores the multifaceted nature of the connection being investigated, demonstrating the necessity of embracing both scientific rigor and creative interpretation in unraveling this captivating correlation.

The paper will continue with the Methods section to lay out the specific approach taken in this investigation.

[[RESULTS]]

The correlation analysis conducted on the data collected from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) unveiled a strikingly high correlation coefficient of 0.9402224 between annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX) for the period 2002 to 2022. The coefficient of determination (r-squared) further emphasized this strong relationship, with a value of 0.8840182.

In the scatterplot depicted in Fig. 1, the data points align themselves as if following a trail of gourmet cat treats, revealing a remarkably tight clustering that illustrates the robust association between the annual US household spending on home maintenance and IDEXX Laboratories' stock price. The trendline in the scatterplot resembles a sleek and agile feline, elegantly showcasing the closeness of this peculiar relationship.

The p-value, being less than 0.01, indicates that the observed correlation is highly unlikely to be a result of random chance. It is as if a cat crossed your path not once, but nine times in a row, beckoning attention to the significance of this unexpected connection.

The findings presented here offer a befuddling yet captivating insight into the unanticipated kinship between the domestic economy's maintenance expenditures and the financial market's evaluation of IDXX stock. While causation tiptoes around like a cat on a hot tin roof, these results fundamentally underscore the need for further scrutiny into the interplay between household spending habits and the stock performance of companies in the pet industry. They may even prompt financial analysts to take a closer lookout for the subtle yet perceptible influences of domestic kitty caretaking on corporate purr-formance.

In conclusion, these results exemplify the power of data analysis in uncovering the enigmatic interrelations that govern our economic and financial landscapes. The unexpected convergence of these seemingly unrelated variables not only raises eyebrows but also promises to leave investors, pet enthusiasts, and researchers alike feline intrigued.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The results of this study provide solid support for the prior research that has delved into the enthralling link between pet-related expenditures and stock market performance. This investigation corroborates previous studies that have earnestly probed this topic with rigorous statistical analyses, as well as those that have taken a more whimsical approach.

Drawing from the literature review, which artfully juxtaposed serious academic inquiry with more whimsical perspectives, we find that our findings align with the notion that the connection between annual US household spending on home maintenance and IDEXX Laboratories' stock price is not to be taken lightly. While some might dismiss this correlation as purely coincidental, our results suggest a genuine relationship, akin to a cat and its favorite yarn ball.

The high correlation coefficient of 0.9402224, with a p-value of less than 0.01, emphasizes the robustness of this connection, echoing the sentiments expressed in works such as "The Cat's Purr-fect Portfolio" and "Tales of Tails: A Feline Financial Fantasy," albeit in a more academically astute manner. This aligns with the need for rigorous examination and the acknowledgement of serendipitous connections that may exist between seemingly unrelated variables, as highlighted in "Investigating the Relationship between Whisker Length and Stock Market Volatility."

Furthermore, the coefficient of determination (r-squared) value of 0.8840182 reinforces the solidity of this association, resembling the reassuring weight of a purring cat nestled in one's lap. The scatterplot, with its striking resemblance to a trail of gourmet cat treats, visually embodies the unexpected yet compelling nature of this correlation. These findings align with the diverse perspectives presented in the literature review, which underscored the multifaceted nature of the connection being investigated.

In conclusion, the results of this research lend credence to the multifaceted insights presented in prior academic and more whimsical works, shedding light on the captivating correlation between domestic maintenance expenditures and the financial evaluation of pet industry stocks. These results not only raise eyebrows but also lend allure to the enigmatic interrelations governing our economic and financial landscapes. They underscore the need for further exploration into the subtle yet perceptible influences of kitty-caretaking on corporate purr-formance and the necessity to embrace scientific rigor and creative interpretation in unraveling this captivating correlation.

This investigation may serve to pique the interest of financial analysts, investors, and cat enthusiasts alike, inspiring a closer examination of the interplay between domestic expenditure and stock performance—after all, there may be more than one way to skin a cat in the financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price"

[[ABSTRACT]]

This paper delves into the captivating correlation between the annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), our research team uncovered a significant correlation coefficient of 0.9402224 with a p-value of less than 0.01 for the period spanning from 2002 to 2022. The findings of this study shed light on the fascinating interplay between the domestic economy and the financial market, revealing a purrfectly interesting connection that may not be fully littered with causation, but certainly raises eyebrows--and tails.

[[INTRDUCTION]]

The relationship between household spending on home maintenance and stock prices has long been a topic of interest and speculation in both economic and financial circles. While conventional wisdom might suggest that these two factors have as much in common as dogs and cats, our research seeks to uncover the intriguing feline connection between annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX).

As we embark on this research endeavor, it is pertinent to acknowledge the historic affinities humans have had for their furry companions, and the investment they willingly make in ensuring their well-being and comfort. Indeed, the booming pet industry has shown resilience through economic downturns and acts as a testament to the unwavering bond between humans and their beloved pets.

Our study delves into the mysterious link between domestic spending on home maintenance, encompassing the upkeep of those cherished abodes where both two-legged and four-legged inhabitants reside, and the stock performance of IDEXX Laboratories, an industry leader in veterinary diagnostics and software tools. IDEXX Laboratories, much like a nimble feline, has pounced its way into the hearts of pet owners and investors alike, with its stock symbol "IDXX" providing a purrfect match for our intended investigation.

While the causality between household spending on home maintenance and stock prices may not be as clear-cut as a cat's whiskers, our data analysis aims to uncover any telltale signs of correlation, teasing out the unique dynamism that underlies this seemingly disparate association. Through rigorous statistical analysis and market observation, our research unearths an unanticipated kinship that promises to captivate both pet enthusiasts and financial aficionados alike.

Stay tuned as we endeavor to unravel the meow-sterious connection between these seemingly unrelated variables, shedding light on a delightfully paws-itive correlation that may just leave you feline intrigued.

[[RESULTS]]

The correlation analysis conducted on the data collected from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) unveiled a strikingly high correlation coefficient of 0.9402224 between annual US household spending on home maintenance and IDEXX Laboratories' stock price (IDXX) for the period 2002 to 2022. The coefficient of determination (r-squared) further emphasized this strong relationship, with a value of 0.8840182.

In the scatterplot depicted in Fig. 1, the data points align themselves as if following a trail of gourmet cat treats, revealing a remarkably tight clustering that illustrates the robust association between the annual US household spending on home maintenance and IDEXX Laboratories' stock price. The trendline in the scatterplot resembles a sleek and agile feline, elegantly showcasing the closeness of this peculiar relationship.

The p-value, being less than 0.01, indicates that the observed correlation is highly unlikely to be a result of random chance. It is as if a cat crossed your path not once, but nine times in a row, beckoning attention to the significance of this unexpected connection.

The findings presented here offer a befuddling yet captivating insight into the unanticipated kinship between the domestic economy's maintenance expenditures and the financial market's evaluation of IDXX stock. While causation tiptoes around like a cat on a hot tin roof, these results fundamentally underscore the need for further scrutiny into the interplay between household spending habits and the stock performance of companies in the pet industry. They may even prompt financial analysts to take a closer lookout for the subtle yet perceptible influences of domestic kitty caretaking on corporate purr-formance.

In conclusion, these results exemplify the power of data analysis in uncovering the enigmatic interrelations that govern our economic and financial landscapes. The unexpected convergence of these seemingly unrelated variables not only raises eyebrows but also promises to leave investors, pet enthusiasts, and researchers alike feline intrigued.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

The findings of this research shed light on the fascinating connection between annual US household spending on home maintenance and IDEXX Laboratories' stock price. Indeed, the correlation coefficient of 0.9402224 with a p-value of less than 0.01 indicates a remarkably tight association, much like a cat's curling tail around its favorite toy.

The results of our analysis, akin to a playful kitten with a ball of yarn, have unraveled a surprisingly strong link between these seemingly disparate variables. The robust relationship, as evidenced by the trendline in the scatterplot resembling a sleek and agile feline, demonstrates that the financial market's evaluation of IDXX stock is indeed influenced by domestic spending habits. It's as if the stock price and household spending are engaged in a game of cat and mouse, with one seemingly always chasing the other.

These findings not only provide a fascinating insight into the whimsical world of financial markets but also underscore the enduring bond between humans and their beloved pets. After all, who can resist the allure of investing in companies that cater to the well-being of our furry companions? It's clear that when it comes to pet-related expenses, investors are not feline indifferent.

In conclusion, the results of this study present a compelling argument for the intertwined nature of domestic expenditures and stock performance in the pet industry. There is no need for further research in this area; the findings are as clear as the distinct purr of a contented cat. It is time for scholars and investors alike to paws and reflect on the undeniable correlation uncovered in this study.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

Journal of Feline Finance and Economics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Feline Financial Research

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price with an abstract of This paper delves into the captivating correlation between the annual US household spending on home maintenance and the stock price of IDEXX Laboratories (IDXX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), our research team uncovered a significant correlation coefficient of 0.9402224 with a p-value of less than 0.01 for the period spanning from 2002 to 2022. The findings of this study shed light on the fascinating interplay between the domestic economy and the financial market, revealing a purrfectly interesting connection that may not be fully littered with causation, but certainly raises eyebrows--and tails.

ChatGPT:

IDEXX Laboratories stock price, US household spending, home maintenance, domestic economy, Bureau of Labor Statistics, LSEG Analytics, Refinitiv, feline connection, correlation coefficient, financial market, annual spending, stock price correlation

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Annual US household spending on home maintenanceDetailed data title: Average annual household spend on home maintenance

Source: Bureau of Labor Statistics

See what else correlates with Annual US household spending on home maintenance

IDEXX Laboratories' stock price (IDXX)

Detailed data title: Opening price of IDEXX Laboratories (IDXX) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with IDEXX Laboratories' stock price (IDXX)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8840182 (Coefficient of determination)

This means 88.4% of the change in the one variable (i.e., IDEXX Laboratories' stock price (IDXX)) is predictable based on the change in the other (i.e., Annual US household spending on home maintenance) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 2.5E-10. 0.0000000002469720161776979000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.94 in 2.5E-8% of random cases. Said differently, if you correlated 4,049,041,731 random variables You don't actually need 4 billion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.86, 0.98 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Annual US household spending on home maintenance (Household spend) | 960 | 965 | 997 | 1101 | 1115 | 1131 | 1176 | 1138 | 1112 | 1120 | 1153 | 1182 | 1293 | 1438 | 1437 | 1616 | 1703 | 1879 | 2158 | 2335 | 2559 |

| IDEXX Laboratories' stock price (IDXX) (Stock price) | 7.3 | 8.29 | 11.64 | 13.61 | 17.94 | 19.89 | 29.11 | 18.12 | 26.85 | 34.92 | 38.95 | 47.3 | 53 | 74.32 | 72.35 | 118.29 | 157.59 | 182.49 | 261.53 | 503 | 655.66 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([960,965,997,1101,1115,1131,1176,1138,1112,1120,1153,1182,1293,1438,1437,1616,1703,1879,2158,2335,2559,])

array_2 = np.array([7.3,8.29,11.64,13.61,17.94,19.89,29.11,18.12,26.85,34.92,38.95,47.3,53,74.32,72.35,118.29,157.59,182.49,261.53,503,655.66,])

array_1_name = "Annual US household spending on home maintenance"

array_2_name = "IDEXX Laboratories' stock price (IDXX)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Annual US household spending on home maintenance

- Line chart for only IDEXX Laboratories' stock price (IDXX)

- The spurious research paper: The Paw-sitively Purrfect Pair: Exploring the Feline Connection Between Annual US Household Spending on Home Maintenance and IDEXX Laboratories' Stock Price

Your correlation rating is out of this world!

Correlation ID: 1276 · Black Variable ID: 19906 · Red Variable ID: 1791