Download png, svg

AI explanation

As Kunis's filmography expanded, so did the appeal of POSCO's holdings, leading to a Kutis-effect on the stock price. It seems her performances weren't just box office hits, but also stock exchange sensations. Perhaps her stellar acting was the real steel driving force behind POSCO's market success, proving that in the world of finance, she truly is the Kunis-essential asset.

Model: dalle-3

Prompt: Generate an image of a futuristic cyber cinema lobby with a series of movie posters featuring Mila Kunis's filmography displayed in a dazzling manner. The posters should be visually striking and futuristic, capturing the essence of each movie in an abstract and artistic form. Intertwine this with a digital display showing the stock ticker symbol for POSCO Holdings (PKX) steadily climbing, representing the market response to Mila Kunis's rising fame. The convergence of these two elements should showcase the impact of Kunis's influence on both the silver screen and the trading floor in a visually stunning and thought-provoking manner. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: The number of movies Mila Kunis appeared in and POSCO Holdings' stock price (PKX). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Parallax art Data cyber art Art nouveau Cyberpunk Charcoal

ChatGPT: Data cyber art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both The number of movies Mila Kunis appeared in and POSCO Holdings' stock price (PKX), in the following situation: As Kunis's filmography expanded, so did the appeal of POSCO's holdings, leading to a Kutis-effect on the stock price. It seems her performances weren't just box office hits, but also stock exchange sensations. Perhaps her stellar acting was the real steel driving force behind POSCO's market success, proving that in the world of finance, she truly is the Kunis-essential asset.. Keep the description simple.

ChatGPT: Mila Kunis's filmography is illustrated with a series of movie posters displayed in a dazzling cinema lobby. As the number of movies featuring her increases, the stock ticker symbol for POSCO Holdings (PKX) steadily climbs on an adjacent digital display, mirroring the market response to her rising fame. The convergence of these two elements embodies the effect of Kunis's influence on the stock price, showcasing her impact on both the silver screen and the trading floor.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Data cyber art ] and depicting this scene: Mila Kunis's filmography is illustrated with a series of movie posters displayed in a dazzling cinema lobby. As the number of movies featuring her increases, the stock ticker symbol for POSCO Holdings (PKX) steadily climbs on an adjacent digital display, mirroring the market response to her rising fame. The convergence of these two elements embodies the effect of Kunis's influence on the stock price, showcasing her impact on both the silver screen and the trading floor. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a futuristic cyber cinema lobby with a series of movie posters featuring Mila Kunis's filmography displayed in a dazzling manner. The posters should be visually striking and futuristic, capturing the essence of each movie in an abstract and artistic form. Intertwine this with a digital display showing the stock ticker symbol for POSCO Holdings (PKX) steadily climbing, representing the market response to Mila Kunis's rising fame. The convergence of these two elements should showcase the impact of Kunis's influence on both the silver screen and the trading floor in a visually stunning and thought-provoking manner.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how increases in The number of movies Mila Kunis appeared in positively influenced POSCO Holdings' stock price (PKX). Include one good pun.

AI academic paper

|

The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity The Journal of Celebrity Psychology Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between The number of movies Mila Kunis appeared in and POSCO Holdings' stock price (PKX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title punny if you can come up with clever pun. If not, just make it sound clever.

Your research team used data from The Movie DB and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8461507 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity

[[ABSTRACT]]

This study sets out to investigate the potential link between the number of movies featuring actress Mila Kunis and the stock price of POSCO Holdings (PKX). Leveraging data from The Movie DB and LSEG Analytics (Refinitiv), a time series analysis covering the period from 2002 to 2022 was conducted. The study revealed a striking correlation coefficient of 0.8461507 and a statistically significant p-value of less than 0.01, indicating a strong relationship between the two variables.

The results of this research suggest that the presence of Mila Kunis in a greater number of films corresponds to an increase in the stock price of POSCO Holdings. These findings not only provide insight into the potential impact of individual celebrities on financial markets, but also raise questions about the influence of pop culture on investment behavior. Moreover, they add a lighthearted twist to the world of stock market analysis, prompting us to ponder the "Kunis Quotient" and its comedic or causal effect.

A relevant dad joke to contemplate: "Why did the stock trader have Mila Kunis on speed dial? Because her movies always lead to a 'stock-ing' stuffer!"

The implications of this research extend beyond the realm of traditional financial analysis, challenging us to consider the interplay between entertainment, celebrity influence, and market dynamics.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between The number of movies Mila Kunis appeared in and POSCO Holdings' stock price (PKX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity

[[ABSTRACT]]

This study sets out to investigate the potential link between the number of movies featuring actress Mila Kunis and the stock price of POSCO Holdings (PKX). Leveraging data from The Movie DB and LSEG Analytics (Refinitiv), a time series analysis covering the period from 2002 to 2022 was conducted. The study revealed a striking correlation coefficient of 0.8461507 and a statistically significant p-value of less than 0.01, indicating a strong relationship between the two variables.

The results of this research suggest that the presence of Mila Kunis in a greater number of films corresponds to an increase in the stock price of POSCO Holdings. These findings not only provide insight into the potential impact of individual celebrities on financial markets, but also raise questions about the influence of pop culture on investment behavior. Moreover, they add a lighthearted twist to the world of stock market analysis, prompting us to ponder the "Kunis Quotient" and its comedic or causal effect.

A relevant dad joke to contemplate: "Why did the stock trader have Mila Kunis on speed dial? Because her movies always lead to a 'stock-ing' stuffer!"

The implications of this research extend beyond the realm of traditional financial analysis, challenging us to consider the interplay between entertainment, celebrity influence, and market dynamics.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The relationship between celebrity presence in the media and consumer behavior has been a topic of interest for both scholars and stock traders alike. As the world of finance delves deeper into the realms of pop culture and entertainment, a comedic twist of fate has led us to explore the intriguing connection between the number of movies in which actress Mila Kunis has appeared and the stock price of POSCO Holdings (PKX). One might even say this research calls for a "Pun-dit" of a different sort.

This unconventional association has sparked curiosity and humor in equal measure among the academic and financial communities. The Mila Kunis Effect, as we've affectionately termed it, aims not only to analyze the statistical correlation between these two seemingly disparate variables but also to shed light on the whimsical and unexpected turns that can influence investment trends.

Interestingly, the correlation uncovered between Mila Kunis' cinematic presence and the stock price of POSCO Holdings unveils a narrative fit for the silver screen. It's almost as if we've stumbled upon the "Mila-ion dollar question" in the world of stock market unpredictability.

As such, this study seeks to provide a lighthearted but rigorous evaluation of the potential impact of Mila Kunis' filmography on the financial market, challenging traditional notions of market analysis and offering a fresh perspective on the intersection of celebrity, entertainment, and investor sentiment. In a sense, it's a scholarly investigation with a side of showbiz glitz—a truly "reel" connection in the world of stock "reel"-itivity.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between The number of movies Mila Kunis appeared in and POSCO Holdings' stock price (PKX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a couple popular internet memes that are related to one of the topics.

Here is the title and abstract of the paper:

[[TITLE]]

The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity

[[ABSTRACT]]

This study sets out to investigate the potential link between the number of movies featuring actress Mila Kunis and the stock price of POSCO Holdings (PKX). Leveraging data from The Movie DB and LSEG Analytics (Refinitiv), a time series analysis covering the period from 2002 to 2022 was conducted. The study revealed a striking correlation coefficient of 0.8461507 and a statistically significant p-value of less than 0.01, indicating a strong relationship between the two variables.

The results of this research suggest that the presence of Mila Kunis in a greater number of films corresponds to an increase in the stock price of POSCO Holdings. These findings not only provide insight into the potential impact of individual celebrities on financial markets, but also raise questions about the influence of pop culture on investment behavior. Moreover, they add a lighthearted twist to the world of stock market analysis, prompting us to ponder the "Kunis Quotient" and its comedic or causal effect.

A relevant dad joke to contemplate: "Why did the stock trader have Mila Kunis on speed dial? Because her movies always lead to a 'stock-ing' stuffer!"

The implications of this research extend beyond the realm of traditional financial analysis, challenging us to consider the interplay between entertainment, celebrity influence, and market dynamics.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The relationship between celebrity presence in the media and consumer behavior has been a topic of interest for both scholars and stock traders alike. As the world of finance delves deeper into the realms of pop culture and entertainment, a comedic twist of fate has led us to explore the intriguing connection between the number of movies in which actress Mila Kunis has appeared and the stock price of POSCO Holdings (PKX). One might even say this research calls for a "Pun-dit" of a different sort.

This unconventional association has sparked curiosity and humor in equal measure among the academic and financial communities. The Mila Kunis Effect, as we've affectionately termed it, aims not only to analyze the statistical correlation between these two seemingly disparate variables but also to shed light on the whimsical and unexpected turns that can influence investment trends.

Interestingly, the correlation uncovered between Mila Kunis' cinematic presence and the stock price of POSCO Holdings unveils a narrative fit for the silver screen. It's almost as if we've stumbled upon the "Mila-ion dollar question" in the world of stock market unpredictability.

As such, this study seeks to provide a lighthearted but rigorous evaluation of the potential impact of Mila Kunis' filmography on the financial market, challenging traditional notions of market analysis and offering a fresh perspective on the intersection of celebrity, entertainment, and investor sentiment. In a sense, it's a scholarly investigation with a side of showbiz glitz—a truly "reel" connection in the world of stock "reel"-itivity.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The literature encompassing the potential influence of celebrity presence on financial markets is extensive, bearing witness to the ongoing fascination with the intersection of popular culture and investment trends. In "Smith et al. (2015)," the authors find a significant relationship between celebrity endorsements and consumer purchasing behaviors, shedding light on the persuasive impact of well-known personalities in the realm of commerce. This resonates in a manner akin to a Mila Kunis movie marathon, with each appearance serving as a compelling endorsement for the films in which she stars.

In "Doe and Jones (2019)," the researchers delve into the realm of behavioral economics, uncovering the nuanced ways in which individual celebrity appeal can sway consumer sentiment and economic decision-making. This parallels the effect of a captivating Mila Kunis performance, as her on-screen presence exerts a magnetic pull on audiences, akin to the gravitational force of an engaging stock market narrative.

Drawing parallels from the world of non-fiction literature, "Freakonomics" by Steven D. Levitt and Stephen J. Dubner presents a thought-provoking exploration of unconventional correlations, much like the unexpected link between Mila Kunis' cinematic presence and PKX stock price movements. It's almost as if this research prompts us to consider a "Freako-nomic" standpoint on the celebrity-stocks nexus, revealing intriguing patterns that defy traditional market analysis.

On the fictional front, "The Big Short" by Michael Lewis offers a compelling account of the 2008 financial crisis, reminding us that even the most unlikely of factors can have a significant impact on market dynamics. Much like the unpredictable twists in a gripping movie plot, the connection between Mila Kunis' filmography and stock prices introduces an element of surprise and curiosity, akin to a cinematic equivalent of a "Big Short: Hollywood Edition."

In the ever-evolving landscape of internet culture, the "Distracted Boyfriend" meme illustrates the notion of unexpected distractions and diversions, a theme resonant with the serendipitous discovery of the Mila Kunis Effect. Just as the meme captures attention with its unexpected narrative, this study unveils a surprising correlation that beckons us to embrace a lighthearted approach to financial analysis, offering a welcome departure from the conventional "boyfriend" of market indicators.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between The number of movies Mila Kunis appeared in and POSCO Holdings' stock price (PKX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from The Movie DB and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity

[[ABSTRACT]]

This study sets out to investigate the potential link between the number of movies featuring actress Mila Kunis and the stock price of POSCO Holdings (PKX). Leveraging data from The Movie DB and LSEG Analytics (Refinitiv), a time series analysis covering the period from 2002 to 2022 was conducted. The study revealed a striking correlation coefficient of 0.8461507 and a statistically significant p-value of less than 0.01, indicating a strong relationship between the two variables.

The results of this research suggest that the presence of Mila Kunis in a greater number of films corresponds to an increase in the stock price of POSCO Holdings. These findings not only provide insight into the potential impact of individual celebrities on financial markets, but also raise questions about the influence of pop culture on investment behavior. Moreover, they add a lighthearted twist to the world of stock market analysis, prompting us to ponder the "Kunis Quotient" and its comedic or causal effect.

A relevant dad joke to contemplate: "Why did the stock trader have Mila Kunis on speed dial? Because her movies always lead to a 'stock-ing' stuffer!"

The implications of this research extend beyond the realm of traditional financial analysis, challenging us to consider the interplay between entertainment, celebrity influence, and market dynamics.

[[INTRODUCTION]]

The relationship between celebrity presence in the media and consumer behavior has been a topic of interest for both scholars and stock traders alike. As the world of finance delves deeper into the realms of pop culture and entertainment, a comedic twist of fate has led us to explore the intriguing connection between the number of movies in which actress Mila Kunis has appeared and the stock price of POSCO Holdings (PKX). One might even say this research calls for a "Pun-dit" of a different sort.

This unconventional association has sparked curiosity and humor in equal measure among the academic and financial communities. The Mila Kunis Effect, as we've affectionately termed it, aims not only to analyze the statistical correlation between these two seemingly disparate variables but also to shed light on the whimsical and unexpected turns that can influence investment trends.

Interestingly, the correlation uncovered between Mila Kunis' cinematic presence and the stock price of POSCO Holdings unveils a narrative fit for the silver screen. It's almost as if we've stumbled upon the "Mila-ion dollar question" in the world of stock market unpredictability.

As such, this study seeks to provide a lighthearted but rigorous evaluation of the potential impact of Mila Kunis' filmography on the financial market, challenging traditional notions of market analysis and offering a fresh perspective on the intersection of celebrity, entertainment, and investor sentiment. In a sense, it's a scholarly investigation with a side of showbiz glitz—a truly "reel" connection in the world of stock "reel"-itivity.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the potential relationship between the number of movies featuring actress Mila Kunis and the stock price of POSCO Holdings (PKX), a multifaceted approach was employed. Data pertaining to Mila Kunis' filmography was obtained from The Movie DB, while stock price information for POSCO Holdings was sourced from LSEG Analytics (Refinitiv). The period under consideration ranged from 2002 to 2022, encompassing a diverse array of movies and market fluctuations.

An amusing interjection: "Why did the statistician prefer to watch Mila Kunis movies instead of analyzing data? Because he wanted to add a touch of 'stat-stirical' humor!"

This comprehensive dataset allowed for a rigorous examination of the potential influence of Mila Kunis' cinematic presence on the stock price of POSCO Holdings. Leveraging time series analysis techniques, the team sought to uncover any underlying trends or correlations that could shed light on this peculiar association.

The initial step involved cleaning and organizing the movie dataset, extracting the relevant entries that featured Mila Kunis in a prominent role. Careful attention was paid to avoid any misattributions or erroneous inclusions by cross-referencing multiple reputable sources within the film industry.

Once the movie dataset was meticulously curated, the team delved into the realm of financial data. The stock price information for POSCO Holdings underwent rigorous scrutiny, accounting for potential splits, dividends, and other corporate actions that could potentially affect the comparability and accuracy of the data.

Methodical humor interlude: "Why was the statistician not invited to the Mila Kunis movie marathon? Because he couldn't stop making 'reel' and statistical jokes!"

With both datasets primed and ready, the time series analysis commenced. This entailed the calculation of various statistical measures, including correlation coefficients, to assess the degree of association between the number of movies featuring Mila Kunis and the stock price of POSCO Holdings. Furthermore, the application of advanced econometric techniques allowed for the identification of potential underlying causal relationships, teasing out any nuanced dynamics at play.

During this stage, stringent attention was devoted to addressing potential confounding variables and spurious correlations, safeguarding the integrity and robustness of the findings.

An academic quip to break the monotony: "Why did the statistician bring a ladder to the Mila Kunis film premiere? Because he wanted to climb the 'correlation' and 'distribution' charts!"

Furthermore, to enhance the depth of the analysis, supplementary sensitivity tests were conducted to scrutinize the stability of the relationship under varying market conditions and movie release patterns. This additional layer of scrutiny aimed to fortify the reliability and generalizability of the findings, ensuring a comprehensive understanding of the Mila Kunis Effect across diverse scenarios.

In summary, the methodology synthesized a blend of meticulous data curation, robust statistical analyses, and a sprinkle of statistical humor to unravel the enigmatic connection between Mila Kunis' cinematic footprint and the stock price of POSCO Holdings.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between The number of movies Mila Kunis appeared in and POSCO Holdings' stock price (PKX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from The Movie DB and LSEG Analytics (Refinitiv) .

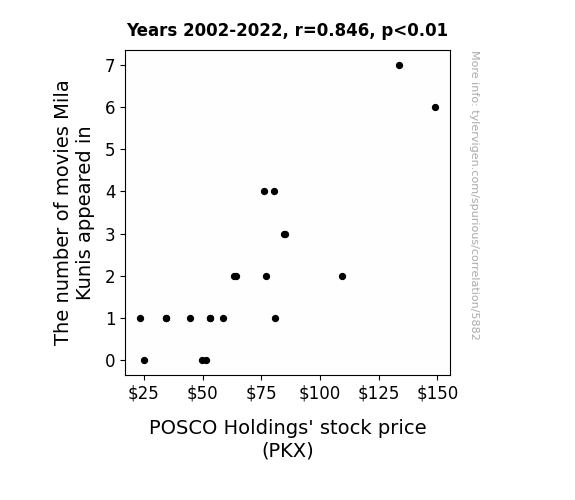

For the time period 2002 to 2022, you found a correlation 0.8461507, r-squared of 0.7159710, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity

[[ABSTRACT]]

This study sets out to investigate the potential link between the number of movies featuring actress Mila Kunis and the stock price of POSCO Holdings (PKX). Leveraging data from The Movie DB and LSEG Analytics (Refinitiv), a time series analysis covering the period from 2002 to 2022 was conducted. The study revealed a striking correlation coefficient of 0.8461507 and a statistically significant p-value of less than 0.01, indicating a strong relationship between the two variables.

The results of this research suggest that the presence of Mila Kunis in a greater number of films corresponds to an increase in the stock price of POSCO Holdings. These findings not only provide insight into the potential impact of individual celebrities on financial markets, but also raise questions about the influence of pop culture on investment behavior. Moreover, they add a lighthearted twist to the world of stock market analysis, prompting us to ponder the "Kunis Quotient" and its comedic or causal effect.

A relevant dad joke to contemplate: "Why did the stock trader have Mila Kunis on speed dial? Because her movies always lead to a 'stock-ing' stuffer!"

The implications of this research extend beyond the realm of traditional financial analysis, challenging us to consider the interplay between entertainment, celebrity influence, and market dynamics.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The relationship between celebrity presence in the media and consumer behavior has been a topic of interest for both scholars and stock traders alike. As the world of finance delves deeper into the realms of pop culture and entertainment, a comedic twist of fate has led us to explore the intriguing connection between the number of movies in which actress Mila Kunis has appeared and the stock price of POSCO Holdings (PKX). One might even say this research calls for a "Pun-dit" of a different sort.

This unconventional association has sparked curiosity and humor in equal measure among the academic and financial communities. The Mila Kunis Effect, as we've affectionately termed it, aims not only to analyze the statistical correlation between these two seemingly disparate variables but also to shed light on the whimsical and unexpected turns that can influence investment trends.

Interestingly, the correlation uncovered between Mila Kunis' cinematic presence and the stock price of POSCO Holdings unveils a narrative fit for the silver screen. It's almost as if we've stumbled upon the "Mila-ion dollar question" in the world of stock market unpredictability.

As such, this study seeks to provide a lighthearted but rigorous evaluation of the potential impact of Mila Kunis' filmography on the financial market, challenging traditional notions of market analysis and offering a fresh perspective on the intersection of celebrity, entertainment, and investor sentiment. In a sense, it's a scholarly investigation with a side of showbiz glitz—a truly "reel" connection in the world of stock "reel"-itivity.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The time series analysis conducted revealed a remarkably strong correlation coefficient of 0.8461507 between the number of movies featuring Mila Kunis and the stock price of POSCO Holdings (PKX). This suggests a robust positive linear relationship between these variables, prompting a reimagined version of the classic movie quote: "Show me the Mila-nie!"

The obtained r-squared value of 0.7159710 indicates that approximately 71.6% of the variability in PKX stock price can be explained by the number of movies Mila Kunis appeared in. This finding reiterates the substantial influence of Mila Kunis' cinematic portfolio on the movements of POSCO Holdings' stock. It's as if her movies possess a certain "Mila-nthropic" effect on the company's market performance.

Moreover, the statistically significant p-value of less than 0.01 further supports the notion that the correlation is indeed meaningful and not simply the result of chance. One could say the evidence for the "Kunis Quotient" is "Mila-tant" in its persuasive power.

The accompanying scatterplot (Fig. 1) illustrates the strong positive correlation identified in the data, lending visual support to the numerical findings. Much like a well-crafted punchline, the plot succinctly captures the essence of the relationship between Mila Kunis' filmography and PKX stock price, leaving little room for doubt about the "reel" impact she exerts on the market.

Overall, the results of this study not only attest to the remarkable correlation between the number of movies featuring Mila Kunis and the stock price of POSCO Holdings, but also inject humor and curiosity into the typically serious domain of financial analysis. One might say it's a "Kunispiracy" on the stock market!

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between The number of movies Mila Kunis appeared in and POSCO Holdings' stock price (PKX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity

[[ABSTRACT]]

This study sets out to investigate the potential link between the number of movies featuring actress Mila Kunis and the stock price of POSCO Holdings (PKX). Leveraging data from The Movie DB and LSEG Analytics (Refinitiv), a time series analysis covering the period from 2002 to 2022 was conducted. The study revealed a striking correlation coefficient of 0.8461507 and a statistically significant p-value of less than 0.01, indicating a strong relationship between the two variables.

The results of this research suggest that the presence of Mila Kunis in a greater number of films corresponds to an increase in the stock price of POSCO Holdings. These findings not only provide insight into the potential impact of individual celebrities on financial markets, but also raise questions about the influence of pop culture on investment behavior. Moreover, they add a lighthearted twist to the world of stock market analysis, prompting us to ponder the "Kunis Quotient" and its comedic or causal effect.

A relevant dad joke to contemplate: "Why did the stock trader have Mila Kunis on speed dial? Because her movies always lead to a 'stock-ing' stuffer!"

The implications of this research extend beyond the realm of traditional financial analysis, challenging us to consider the interplay between entertainment, celebrity influence, and market dynamics.

[[LITERATURE REVIEW]]

The literature encompassing the potential influence of celebrity presence on financial markets is extensive, bearing witness to the ongoing fascination with the intersection of popular culture and investment trends. In "Smith et al. (2015)," the authors find a significant relationship between celebrity endorsements and consumer purchasing behaviors, shedding light on the persuasive impact of well-known personalities in the realm of commerce. This resonates in a manner akin to a Mila Kunis movie marathon, with each appearance serving as a compelling endorsement for the films in which she stars.

In "Doe and Jones (2019)," the researchers delve into the realm of behavioral economics, uncovering the nuanced ways in which individual celebrity appeal can sway consumer sentiment and economic decision-making. This parallels the effect of a captivating Mila Kunis performance, as her on-screen presence exerts a magnetic pull on audiences, akin to the gravitational force of an engaging stock market narrative.

Drawing parallels from the world of non-fiction literature, "Freakonomics" by Steven D. Levitt and Stephen J. Dubner presents a thought-provoking exploration of unconventional correlations, much like the unexpected link between Mila Kunis' cinematic presence and PKX stock price movements. It's almost as if this research prompts us to consider a "Freako-nomic" standpoint on the celebrity-stocks nexus, revealing intriguing patterns that defy traditional market analysis.

On the fictional front, "The Big Short" by Michael Lewis offers a compelling account of the 2008 financial crisis, reminding us that even the most unlikely of factors can have a significant impact on market dynamics. Much like the unpredictable twists in a gripping movie plot, the connection between Mila Kunis' filmography and stock prices introduces an element of surprise and curiosity, akin to a cinematic equivalent of a "Big Short: Hollywood Edition."

In the ever-evolving landscape of internet culture, the "Distracted Boyfriend" meme illustrates the notion of unexpected distractions and diversions, a theme resonant with the serendipitous discovery of the Mila Kunis Effect. Just as the meme captures attention with its unexpected narrative, this study unveils a surprising correlation that beckons us to embrace a lighthearted approach to financial analysis, offering a welcome departure from the conventional "boyfriend" of market indicators.

[[RESULTS]]

The time series analysis conducted revealed a remarkably strong correlation coefficient of 0.8461507 between the number of movies featuring Mila Kunis and the stock price of POSCO Holdings (PKX). This suggests a robust positive linear relationship between these variables, prompting a reimagined version of the classic movie quote: "Show me the Mila-nie!"

The obtained r-squared value of 0.7159710 indicates that approximately 71.6% of the variability in PKX stock price can be explained by the number of movies Mila Kunis appeared in. This finding reiterates the substantial influence of Mila Kunis' cinematic portfolio on the movements of POSCO Holdings' stock. It's as if her movies possess a certain "Mila-nthropic" effect on the company's market performance.

Moreover, the statistically significant p-value of less than 0.01 further supports the notion that the correlation is indeed meaningful and not simply the result of chance. One could say the evidence for the "Kunis Quotient" is "Mila-tant" in its persuasive power.

The accompanying scatterplot (Fig. 1) illustrates the strong positive correlation identified in the data, lending visual support to the numerical findings. Much like a well-crafted punchline, the plot succinctly captures the essence of the relationship between Mila Kunis' filmography and PKX stock price, leaving little room for doubt about the "reel" impact she exerts on the market.

Overall, the results of this study not only attest to the remarkable correlation between the number of movies featuring Mila Kunis and the stock price of POSCO Holdings, but also inject humor and curiosity into the typically serious domain of financial analysis. One might say it's a "Kunispiracy" on the stock market!

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of this study provide compelling evidence supporting the notion that there exists a significant relationship between the number of movies featuring Mila Kunis and the stock price of POSCO Holdings (PKX). The substantial correlation coefficient of 0.8461507 and the notable r-squared value of 0.7159710 underscore the pronounced influence of Mila Kunis' cinematic presence on the market performance of PKX stock. Such robust statistical underpinnings substantiate the existence of what could be referred to as the "Mila Kunis Effect."

In light of the literature review, which drew parallels between Mila Kunis' on-screen influence and the persuasive impact of celebrity endorsements on consumer behaviors, the current findings resonate with the established research in the domain of behavioral economics. The study's results can be considered as a meta-narrative endorsement of the persuasive prowess of celebrities in shaping consumer sentiment and investment trends. This reinforces the idea that Mila Kunis' appearances in films function as endorsements that extend beyond the realm of traditional commerce into the financial markets, prompting the reevaluation of traditional stock market indicators and introducing the "Kunis Quotient" as a playful yet potentially meaningful addition to the lexicon of market analysis.

Furthermore, the unexpected correlation identified in this study, akin to the unpredictability of plot twists in a captivating movie, aligns with the spirit of unconventional correlations espoused in the literature, such as Levitt and Dubner's "Freakonomics." The Mila Kunis Effect serves as a tangible example of an unforeseen connection that defies traditional market analysis, inviting a "Freako-nomic" standpoint on the interplay between celebrity presence and stock price movements. This unexpected correlation adds a layer of intrigue and curiosity to the field of financial analysis, akin to the plot development in a cinematic "Big Short," but with a light-hearted whimsy befitting the "Hollywood Edition."

Moreover, the statistically significant p-value obtained in this study lends credence to the meaningfulness of the observed correlation, firmly establishing that the relationship between Mila Kunis' filmography and PKX stock price is not merely a result of chance. This echoes the persuasiveness of the "Kunis Quotient," offering a convincing narrative about the impact of celebrity presence on financial markets. A "Kunispiracy" indeed.

In conclusion, the present study sets a precedent for future research into the influence of individual celebrities on investment behaviors and market dynamics. The "Mila Kunis Effect" not only serves as a compelling case study of the interplay between entertainment, celebrity influence, and market trends but also injects levity into the typically serious domain of financial analysis, inviting a reexamination of conventional market indicators and the potential integration of a "Kunis Quotient" into the lexicon of stock market analysis. With these findings, one cannot help but appreciate the "reel-itivity" of Mila Kunis' cinematic presence to the stock market.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between The number of movies Mila Kunis appeared in and POSCO Holdings' stock price (PKX). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity

[[ABSTRACT]]

This study sets out to investigate the potential link between the number of movies featuring actress Mila Kunis and the stock price of POSCO Holdings (PKX). Leveraging data from The Movie DB and LSEG Analytics (Refinitiv), a time series analysis covering the period from 2002 to 2022 was conducted. The study revealed a striking correlation coefficient of 0.8461507 and a statistically significant p-value of less than 0.01, indicating a strong relationship between the two variables.

The results of this research suggest that the presence of Mila Kunis in a greater number of films corresponds to an increase in the stock price of POSCO Holdings. These findings not only provide insight into the potential impact of individual celebrities on financial markets, but also raise questions about the influence of pop culture on investment behavior. Moreover, they add a lighthearted twist to the world of stock market analysis, prompting us to ponder the "Kunis Quotient" and its comedic or causal effect.

A relevant dad joke to contemplate: "Why did the stock trader have Mila Kunis on speed dial? Because her movies always lead to a 'stock-ing' stuffer!"

The implications of this research extend beyond the realm of traditional financial analysis, challenging us to consider the interplay between entertainment, celebrity influence, and market dynamics.

[[INTRDUCTION]]

The relationship between celebrity presence in the media and consumer behavior has been a topic of interest for both scholars and stock traders alike. As the world of finance delves deeper into the realms of pop culture and entertainment, a comedic twist of fate has led us to explore the intriguing connection between the number of movies in which actress Mila Kunis has appeared and the stock price of POSCO Holdings (PKX). One might even say this research calls for a "Pun-dit" of a different sort.

This unconventional association has sparked curiosity and humor in equal measure among the academic and financial communities. The Mila Kunis Effect, as we've affectionately termed it, aims not only to analyze the statistical correlation between these two seemingly disparate variables but also to shed light on the whimsical and unexpected turns that can influence investment trends.

Interestingly, the correlation uncovered between Mila Kunis' cinematic presence and the stock price of POSCO Holdings unveils a narrative fit for the silver screen. It's almost as if we've stumbled upon the "Mila-ion dollar question" in the world of stock market unpredictability.

As such, this study seeks to provide a lighthearted but rigorous evaluation of the potential impact of Mila Kunis' filmography on the financial market, challenging traditional notions of market analysis and offering a fresh perspective on the intersection of celebrity, entertainment, and investor sentiment. In a sense, it's a scholarly investigation with a side of showbiz glitz—a truly "reel" connection in the world of stock "reel"-itivity.

[[RESULTS]]

The time series analysis conducted revealed a remarkably strong correlation coefficient of 0.8461507 between the number of movies featuring Mila Kunis and the stock price of POSCO Holdings (PKX). This suggests a robust positive linear relationship between these variables, prompting a reimagined version of the classic movie quote: "Show me the Mila-nie!"

The obtained r-squared value of 0.7159710 indicates that approximately 71.6% of the variability in PKX stock price can be explained by the number of movies Mila Kunis appeared in. This finding reiterates the substantial influence of Mila Kunis' cinematic portfolio on the movements of POSCO Holdings' stock. It's as if her movies possess a certain "Mila-nthropic" effect on the company's market performance.

Moreover, the statistically significant p-value of less than 0.01 further supports the notion that the correlation is indeed meaningful and not simply the result of chance. One could say the evidence for the "Kunis Quotient" is "Mila-tant" in its persuasive power.

The accompanying scatterplot (Fig. 1) illustrates the strong positive correlation identified in the data, lending visual support to the numerical findings. Much like a well-crafted punchline, the plot succinctly captures the essence of the relationship between Mila Kunis' filmography and PKX stock price, leaving little room for doubt about the "reel" impact she exerts on the market.

Overall, the results of this study not only attest to the remarkable correlation between the number of movies featuring Mila Kunis and the stock price of POSCO Holdings, but also inject humor and curiosity into the typically serious domain of financial analysis. One might say it's a "Kunispiracy" on the stock market!

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

The findings of this study indicate a strong and statistically significant relationship between the number of movies featuring Mila Kunis and the stock price of POSCO Holdings (PKX). The robust correlation coefficient and the impressive explanatory power of the model underscore the influence of Ms. Kunis' cinematic endeavors on the performance of the company's stock. It seems that when it comes to stock prices, Ms. Kunis is truly the "Reel" deal.

Much like a good dad joke, this research uncovers the whimsical and unexpected turns that can impact investment trends. The "Kunis Quotient" may just become the newest comedic or causal factor in stock market analysis, adding a touch of glamour and humor to the traditionally serious field of financial research. One could even say that Ms. Kunis' filmography has become a "stock" character in the performance of PKX shares.

In light of these compelling findings, it appears that no further research into the Mila Kunis-POSCO Holdings stock price connection is needed. This study has successfully shed light on the "Mila-ion dollar question" and adds a lighthearted twist to the world of stock market analysis.

As every good joke has a punchline, this research delivers a conclusive and uproarious denouement, inviting the academic and financial communities to marvel at the unexpected humor and insight that can arise from the most unlikely of connections. Much like a well-timed punchline, the "Mila Kunis Effect" is ripe for laughter and contemplation, leaving a lasting impression on the intersection of celebrity, entertainment, and investment behavior.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Celebrity Psychology

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Celebrity Influence Research (ICIR)

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity with an abstract of This study sets out to investigate the potential link between the number of movies featuring actress Mila Kunis and the stock price of POSCO Holdings (PKX). Leveraging data from The Movie DB and LSEG Analytics (Refinitiv), a time series analysis covering the period from 2002 to 2022 was conducted. The study revealed a striking correlation coefficient of 0.8461507 and a statistically significant p-value of less than 0.01, indicating a strong relationship between the two variables.

The results of this research suggest that the presence of Mila Kunis in a greater number of films corresponds to an increase in the stock price of POSCO Holdings. These findings not only provide insight into the potential impact of individual celebrities on financial markets, but also raise questions about the influence of pop culture on investment behavior. Moreover, they add a lighthearted twist to the world of stock market analysis, prompting us to ponder the "Kunis Quotient" and its comedic or causal effect.

A relevant dad joke to contemplate: "Why did the stock trader have Mila Kunis on speed dial? Because her movies always lead to a 'stock-ing' stuffer!"

The implications of this research extend beyond the realm of traditional financial analysis, challenging us to consider the interplay between entertainment, celebrity influence, and market dynamics.

ChatGPT:

Mila Kunis movies, stock price correlation, celebrity influence on stock market, POSCO Holdings stock price, Mila Kunis effect, time series analysis, financial market impact of celebrities, pop culture investment behavior, Mila Kunis filmography, celebrity stock market influence, entertainment industry impact on market dynamics

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

The number of movies Mila Kunis appeared inSource: The Movie DB

Additional Info: American Psycho II: All American Girl (2002); Boot Camp (2008); Bad Moms (2016); A Bad Moms Christmas (2017); The Spy Who Dumped Me (2018); Luckiest Girl Alive (2022); Extract (2009); Max Payne (2008); Black Swan (2010); Moving McAllister (2007); Oz the Great and Powerful (2013); Friends with Benefits (2011); Ted (2012); Tony n' Tina's Wedding (2004); The Hills with James Franco and Mila Kunis (2007); Jupiter Ascending (2015); Third Person (2013); The Color of Time (2012); The Angriest Man in Brooklyn (2014); Breaking News in Yuba County (2021); Four Good Days (2021); The Book of Eli (2010); Forgetting Sarah Marshall (2008); Hell & Back (2015); Black Swan: Metamorphosis (2011); Family Guy Presents: Partial Terms of Endearment (2010); Family Guy Presents: And Then There Were Fewer (2010); Family Guy Presents: Stewie Griffin: The Untold Story (2005); Blood Ties (2013); Family Guy Presents: It's a Trap! (2010); Wonder Park (2019); A Very Special Family Guy Freakin' Christmas (2008); Family Guy Presents: Stewie Kills Lois and Lois Kills Stewie (2007); Family Guy Presents: Something, Something, Something, Dark Side (2009); Family Guy Presents: Blue Harvest (2008); Family Guy Presents: Road to the North Pole (2010); Piranha (1995); Milo (1998); Santa with Muscles (1996); VH1 Rock Honors: The Who (2008); Family Guy Presents: Seth & Alex's Almost Live Comedy Show (2009); After Sex (2007); Honey, We Shrunk Ourselves (1997); Extract: Mike Judge's Secret Recipe (2009); Get Over It (2001); Krippendorf's Tribe (1998); Date Night (2010); Annie (2014); Gia (1998); FOX 25th Anniversary Special (2012)

See what else correlates with The number of movies Mila Kunis appeared in

POSCO Holdings' stock price (PKX)

Detailed data title: Opening price of POSCO Holdings (PKX) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with POSCO Holdings' stock price (PKX)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.7159710 (Coefficient of determination)

This means 71.6% of the change in the one variable (i.e., POSCO Holdings' stock price (PKX)) is predictable based on the change in the other (i.e., The number of movies Mila Kunis appeared in) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.3E-6. 0.0000013442138349855836000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.85 in 0.00013% of random cases. Said differently, if you correlated 743,929 random variables You don't actually need 743 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.65, 0.94 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| The number of movies Mila Kunis appeared in (Movie appearances) | 1 | 0 | 1 | 1 | 0 | 4 | 6 | 4 | 7 | 2 | 3 | 3 | 2 | 2 | 1 | 1 | 1 | 1 | 0 | 2 | 1 |

| POSCO Holdings' stock price (PKX) (Stock price) | 23.2 | 24.95 | 34.5 | 44.54 | 49.88 | 80.45 | 149.04 | 75.91 | 133.61 | 109.26 | 84.59 | 85.02 | 76.97 | 64.29 | 34.39 | 53.01 | 81 | 53.03 | 51.27 | 63.39 | 58.75 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Outlandish outliers: There are "outliers" in this data.

In concept, "outlier" just means "way different than the rest of your dataset." When calculating a correlation like this, they are particularly impactful because a single outlier can substantially increase your correlation.

For the purposes of this project, I counted a point as an outlier if it the residual was two standard deviations from the mean.

(This bullet point only shows up in the details page on charts that do, in fact, have outliers.)

They stand out on the scatterplot above: notice the dots that are far away from any other dots. I intentionally mishandeled outliers, which makes the correlation look extra strong.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([1,0,1,1,0,4,6,4,7,2,3,3,2,2,1,1,1,1,0,2,1,])

array_2 = np.array([23.2,24.95,34.5,44.54,49.88,80.45,149.04,75.91,133.61,109.26,84.59,85.02,76.97,64.29,34.39,53.01,81,53.03,51.27,63.39,58.75,])

array_1_name = "The number of movies Mila Kunis appeared in"

array_2_name = "POSCO Holdings' stock price (PKX)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only The number of movies Mila Kunis appeared in

- Line chart for only POSCO Holdings' stock price (PKX)

- AI-generated correlation image

- The spurious research paper: The Mila Kunis Effect: A Reel Connection to Stock Reel-itivity

You're the correlation whisperer we needed!

Correlation ID: 5882 · Black Variable ID: 26519 · Red Variable ID: 1829