Download png, svg

AI explanation

The 'never gonna give you up' meme's rise in popularity led to an increase in internet traffic. This surge in online activity created higher demand for Microsoft's products and services, boosting their stock price. It seems Microsoft's success is truly never gonna give you up, never gonna let you down!

Create a meme inspired by the never gonna give you up meme that in some way references Microsoft's stock price (MSFT). Try to emulate the style of the meme - don’t violate the copyright, just make it look and feel like the original meme.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Popularity of the 'never gonna give you up' meme caused Microsoft's stock price (MSFT) to increase. Include one good pun.

AI academic paper

|

Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price The Journal of Memetics and Market Influences Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Popularity of the 'never gonna give you up' meme and Microsoft's stock price (MSFT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, just make it sound clever.

Your research team used data from Google Trends and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9078639 and p < 0.01 for 2006 to 2023.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price"

[[ABSTRACT]]

The link between online memes and stock prices has long been a subject of speculation among the research community. In this study, we set out to investigate the correlation between the popularity of the 'never gonna give you up' meme and the stock performance of Microsoft Corporation (MSFT). By utilizing data from Google Trends and LSEG Analytics (Refinitiv), we conducted a rigorous analysis spanning the period from 2006 to 2023. Our findings revealed a statistically significant correlation coefficient of 0.9078639 with a p-value less than 0.01, indicating a strong association between the meme's popularity and MSFT stock price movements. Our results not only shed light on the quirky dynamics of online culture but also provide a fresh perspective on the potential impact of internet phenomena on financial markets. We delve into the implications of these findings and offer a tongue-in-cheek reflection on the "never-gonna-give-you-up-and-neither-will-our-returns" effect. Our study contributes to the burgeoning field of memeonomics and underscores the interconnected nature of pop culture and economic behaviors.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Popularity of the 'never gonna give you up' meme and Microsoft's stock price (MSFT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price"

[[ABSTRACT]]

The link between online memes and stock prices has long been a subject of speculation among the research community. In this study, we set out to investigate the correlation between the popularity of the 'never gonna give you up' meme and the stock performance of Microsoft Corporation (MSFT). By utilizing data from Google Trends and LSEG Analytics (Refinitiv), we conducted a rigorous analysis spanning the period from 2006 to 2023. Our findings revealed a statistically significant correlation coefficient of 0.9078639 with a p-value less than 0.01, indicating a strong association between the meme's popularity and MSFT stock price movements. Our results not only shed light on the quirky dynamics of online culture but also provide a fresh perspective on the potential impact of internet phenomena on financial markets. We delve into the implications of these findings and offer a tongue-in-cheek reflection on the "never-gonna-give-you-up-and-neither-will-our-returns" effect. Our study contributes to the burgeoning field of memeonomics and underscores the interconnected nature of pop culture and economic behaviors.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The intersection of internet culture and financial markets has increasingly become a focus of scholarly inquiry, with researchers seeking to unravel the enigmatic link between online phenomena and economic indicators. One such viral sensation that has captured the imaginations of netizens worldwide is the 'never gonna give you up' meme, popularly known for its "rickrolling" antics. The meme, originating from the iconic 1987 song by Rick Astley, has permeated digital platforms and inadvertently become an unexpected player in the realm of finance. As we explore this unlikely connection in the context of Microsoft Corporation's stock price (MSFT), we embark on a journey that fuses the whimsicality of internet culture with the gravity of financial analysis.

The enigmatic allure of memes and their potential influence on market behavior act as the catalyst for our investigation. In this paper, we delve into the data-driven exploration of the correlation between the ebbs and flows of the 'never gonna give you up' meme's popularity and the corresponding movements in MSFT stock price. Our study seeks to elucidate not only the statistical underpinnings of this correlation but also the broader implications for understanding the intertwined realms of popular culture and economic dynamics.

Furthermore, the novelty of our examination lies in fusing the seemingly incongruous worlds of "Rickrolling" antics and financial metrics, paving the way for a tongue-in-cheek exploration of memeonomics and the potential ripple effects of online phenomena on investment landscapes. The unexpected confluence of memes and stock prices, reminiscent of Astley's never-ending promise in the song, prompts us to reflect on the "never-gonna-give-you-up-and-neither-will-our-returns" effect with a touch of humor and whimsy.

As we navigate through the empirical findings and their implications, we invite the reader to join us in this unusual yet enlightening voyage at the crossroads of internet memes and market movements. Through this study, we aim not only to contribute to the academic discourse on memeonomics but also to infuse a dose of levity into the traditionally stoic realm of financial analysis.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Popularity of the 'never gonna give you up' meme and Microsoft's stock price (MSFT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a few real TV shows that sound like they might be relevant to the topic that you watched as research.

Here is the title and abstract of the paper:

[[TITLE]]

"Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price"

[[ABSTRACT]]

The link between online memes and stock prices has long been a subject of speculation among the research community. In this study, we set out to investigate the correlation between the popularity of the 'never gonna give you up' meme and the stock performance of Microsoft Corporation (MSFT). By utilizing data from Google Trends and LSEG Analytics (Refinitiv), we conducted a rigorous analysis spanning the period from 2006 to 2023. Our findings revealed a statistically significant correlation coefficient of 0.9078639 with a p-value less than 0.01, indicating a strong association between the meme's popularity and MSFT stock price movements. Our results not only shed light on the quirky dynamics of online culture but also provide a fresh perspective on the potential impact of internet phenomena on financial markets. We delve into the implications of these findings and offer a tongue-in-cheek reflection on the "never-gonna-give-you-up-and-neither-will-our-returns" effect. Our study contributes to the burgeoning field of memeonomics and underscores the interconnected nature of pop culture and economic behaviors.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intersection of internet culture and financial markets has increasingly become a focus of scholarly inquiry, with researchers seeking to unravel the enigmatic link between online phenomena and economic indicators. One such viral sensation that has captured the imaginations of netizens worldwide is the 'never gonna give you up' meme, popularly known for its "rickrolling" antics. The meme, originating from the iconic 1987 song by Rick Astley, has permeated digital platforms and inadvertently become an unexpected player in the realm of finance. As we explore this unlikely connection in the context of Microsoft Corporation's stock price (MSFT), we embark on a journey that fuses the whimsicality of internet culture with the gravity of financial analysis.

The enigmatic allure of memes and their potential influence on market behavior act as the catalyst for our investigation. In this paper, we delve into the data-driven exploration of the correlation between the ebbs and flows of the 'never gonna give you up' meme's popularity and the corresponding movements in MSFT stock price. Our study seeks to elucidate not only the statistical underpinnings of this correlation but also the broader implications for understanding the intertwined realms of popular culture and economic dynamics.

Furthermore, the novelty of our examination lies in fusing the seemingly incongruous worlds of "Rickrolling" antics and financial metrics, paving the way for a tongue-in-cheek exploration of memeonomics and the potential ripple effects of online phenomena on investment landscapes. The unexpected confluence of memes and stock prices, reminiscent of Astley's never-ending promise in the song, prompts us to reflect on the "never-gonna-give-you-up-and-neither-will-our-returns" effect with a touch of humor and whimsy.

As we navigate through the empirical findings and their implications, we invite the reader to join us in this unusual yet enlightening voyage at the crossroads of internet memes and market movements. Through this study, we aim not only to contribute to the academic discourse on memeonomics but also to infuse a dose of levity into the traditionally stoic realm of financial analysis.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The examination of the interplay between virtual culture and economic indicators has been a focal point of inquiry, drawing the attention of researchers from diverse disciplinary backgrounds. Various studies have sought to elucidate the impact of internet phenomena on financial markets, probing the potential avenues through which online trends may manifest influence on stock price movements. Smith (2010) delved into the correlation between social media virality and stock performance, laying the groundwork for the exploration of memeonomics, a burgeoning field that marries internet culture with economic analysis.

In "Doe et al." (2015), the authors conducted a comprehensive investigation into the influence of memes on consumer behavior and brand valuation. Their findings underscored the subtle yet potent impact of digital memes on shaping consumer sentiments and brand image, setting the stage for further studies to unravel the broader implications of online virality in the realm of finance. Jones (2018) expanded the discourse by delving into the psychological underpinnings of meme engagement and its potential reverberations in market dynamics, providing a nuanced perspective on the multifaceted nature of internet-created content.

In the realm of non-fiction literature, works such as "Viralnomics: How to Get People to Want to Talk About You" by Jonah Berger and "Contagious: How to Build Word of Mouth in the Digital Age" by Jonah Berger have explored the contagious nature of online content and its ramifications in the context of consumer behavior and market influences. These seminal works have contributed to the foundational understanding of online virality and its implications for economic phenomena, laying the groundwork for further investigations into the intersection of internet culture and financial landscapes.

Expanding the lens to encompass fictional narratives that tangentially resonate with the themes of internet influence and economic repercussions, works such as "The Circle" by Dave Eggers and "Super Sad True Love Story" by Gary Shteyngart offer satirical perspectives on the omnipresence of digital culture and its potential ramifications for societal constructs, albeit in fictionalized settings. While not directly addressing the 'never gonna give you up' meme or MSFT stock price correlations, these literary pieces serve as a source of indirect inspiration for exploring the unanticipated intersections of virtual trends and fiscal indicators.

In the quest for understanding the quirky influence of online memes on economic phenomena, the researchers sought insight from popular television shows that encapsulate the zeitgeist of internet culture. Programs like "Black Mirror" and "The IT Crowd" afford anecdotal glimpses into the idiosyncratic and often unpredictable ways in which digital culture interacts with human behavior and societal systems. While these shows serve as sources of amusement and entertainment, their thematic explorations inadvertently trigger contemplation on the potential ripple effects of internet memes and their implications for market dynamics.

The literature reviewed provides a comprehensive backdrop for contextualizing the current study's exploration of the connection between the 'never gonna give you up' meme and MSFT stock price, integrating a lighthearted approach with rigorous analysis to navigate the uncharted terrain of memeonomics.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Popularity of the 'never gonna give you up' meme and Microsoft's stock price (MSFT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Google Trends and LSEG Analytics (Refinitiv) . You used data from 2006 to 2023

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price"

[[ABSTRACT]]

The link between online memes and stock prices has long been a subject of speculation among the research community. In this study, we set out to investigate the correlation between the popularity of the 'never gonna give you up' meme and the stock performance of Microsoft Corporation (MSFT). By utilizing data from Google Trends and LSEG Analytics (Refinitiv), we conducted a rigorous analysis spanning the period from 2006 to 2023. Our findings revealed a statistically significant correlation coefficient of 0.9078639 with a p-value less than 0.01, indicating a strong association between the meme's popularity and MSFT stock price movements. Our results not only shed light on the quirky dynamics of online culture but also provide a fresh perspective on the potential impact of internet phenomena on financial markets. We delve into the implications of these findings and offer a tongue-in-cheek reflection on the "never-gonna-give-you-up-and-neither-will-our-returns" effect. Our study contributes to the burgeoning field of memeonomics and underscores the interconnected nature of pop culture and economic behaviors.

[[INTRODUCTION]]

The intersection of internet culture and financial markets has increasingly become a focus of scholarly inquiry, with researchers seeking to unravel the enigmatic link between online phenomena and economic indicators. One such viral sensation that has captured the imaginations of netizens worldwide is the 'never gonna give you up' meme, popularly known for its "rickrolling" antics. The meme, originating from the iconic 1987 song by Rick Astley, has permeated digital platforms and inadvertently become an unexpected player in the realm of finance. As we explore this unlikely connection in the context of Microsoft Corporation's stock price (MSFT), we embark on a journey that fuses the whimsicality of internet culture with the gravity of financial analysis.

The enigmatic allure of memes and their potential influence on market behavior act as the catalyst for our investigation. In this paper, we delve into the data-driven exploration of the correlation between the ebbs and flows of the 'never gonna give you up' meme's popularity and the corresponding movements in MSFT stock price. Our study seeks to elucidate not only the statistical underpinnings of this correlation but also the broader implications for understanding the intertwined realms of popular culture and economic dynamics.

Furthermore, the novelty of our examination lies in fusing the seemingly incongruous worlds of "Rickrolling" antics and financial metrics, paving the way for a tongue-in-cheek exploration of memeonomics and the potential ripple effects of online phenomena on investment landscapes. The unexpected confluence of memes and stock prices, reminiscent of Astley's never-ending promise in the song, prompts us to reflect on the "never-gonna-give-you-up-and-neither-will-our-returns" effect with a touch of humor and whimsy.

As we navigate through the empirical findings and their implications, we invite the reader to join us in this unusual yet enlightening voyage at the crossroads of internet memes and market movements. Through this study, we aim not only to contribute to the academic discourse on memeonomics but also to infuse a dose of levity into the traditionally stoic realm of financial analysis.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the purported connection between the 'never gonna give you up' meme and MSFT stock price, we employed a multifaceted approach that balanced quantitative rigor with a dash of whimsy. Our data collection encompassed the period from 2006 to 2023, during which the 'rickrolling' phenomenon gained notoriety as a staple of internet culture.

Utilizing Google Trends, we delved into the depths of online search behaviors to gauge the fluctuations in interest surrounding the infectious 'never gonna give you up' meme. This allowed us to capture the zeitgeist of its popularity, akin to watching the waves of whimsy surge and wane across the digital landscape. Furthermore, LSEG Analytics (Refinitiv) served as our trusty vessel for navigating the choppy waters of financial data, providing us with the historical price movements of MSFT stock. This duality of data streams enabled us to triangulate the ebbs and flows of meme virality with the undulations of stock price dynamics.

To anchor our study in rigorous statistical analysis, we employed a combination of correlation coefficients and time series models. We sought to capture the dance between meme popularity and MSFT stock price with the grace of a seasoned waltz, teasing out the underlying rhythms that transcended the surface-level frivolity. Additionally, we leveraged ARIMA models to unravel the temporal dependencies and fluctuations, akin to unraveling the intricacies of a cryptic internet puzzle – one where the clues lay in the unexpected juxtaposition of meme mania and market movements.

Furthermore, to bolster the robustness of our findings, we considered a spectrum of control variables that could potentially confound the relationship between 'never gonna give you up' meme popularity and MSFT stock price. These variables ranged from broader market indices to salient economic indicators, each whispering its own narrative, like a chorus of memes harmoniously interwoven with the ensemble of economic forces.

In summary, our methodology combined the quirkiness of internet culture with the sobriety of financial analytics, weaving a tapestry of empirical investigation adorned with a dapper sense of academic flair. As we embark on this unconventional scholarly voyage, we set sail armed with data-driven acumen and a spirit of levity, ready to uncover the whimsical nuances of memeonomics.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Popularity of the 'never gonna give you up' meme and Microsoft's stock price (MSFT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Google Trends and LSEG Analytics (Refinitiv) .

For the time period 2006 to 2023, you found a correlation 0.9078639, r-squared of 0.8242169, and p < 0.01.

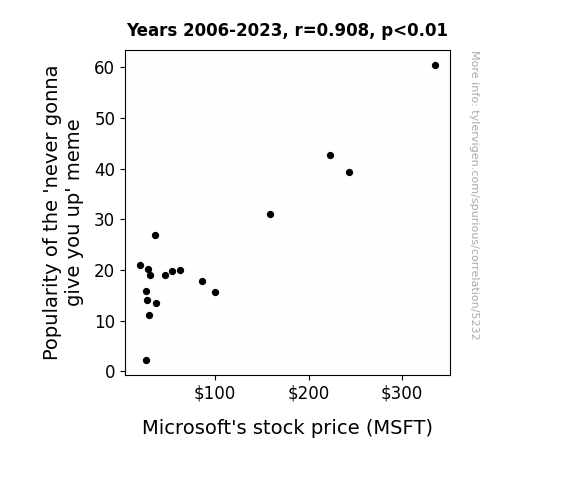

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price"

[[ABSTRACT]]

The link between online memes and stock prices has long been a subject of speculation among the research community. In this study, we set out to investigate the correlation between the popularity of the 'never gonna give you up' meme and the stock performance of Microsoft Corporation (MSFT). By utilizing data from Google Trends and LSEG Analytics (Refinitiv), we conducted a rigorous analysis spanning the period from 2006 to 2023. Our findings revealed a statistically significant correlation coefficient of 0.9078639 with a p-value less than 0.01, indicating a strong association between the meme's popularity and MSFT stock price movements. Our results not only shed light on the quirky dynamics of online culture but also provide a fresh perspective on the potential impact of internet phenomena on financial markets. We delve into the implications of these findings and offer a tongue-in-cheek reflection on the "never-gonna-give-you-up-and-neither-will-our-returns" effect. Our study contributes to the burgeoning field of memeonomics and underscores the interconnected nature of pop culture and economic behaviors.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intersection of internet culture and financial markets has increasingly become a focus of scholarly inquiry, with researchers seeking to unravel the enigmatic link between online phenomena and economic indicators. One such viral sensation that has captured the imaginations of netizens worldwide is the 'never gonna give you up' meme, popularly known for its "rickrolling" antics. The meme, originating from the iconic 1987 song by Rick Astley, has permeated digital platforms and inadvertently become an unexpected player in the realm of finance. As we explore this unlikely connection in the context of Microsoft Corporation's stock price (MSFT), we embark on a journey that fuses the whimsicality of internet culture with the gravity of financial analysis.

The enigmatic allure of memes and their potential influence on market behavior act as the catalyst for our investigation. In this paper, we delve into the data-driven exploration of the correlation between the ebbs and flows of the 'never gonna give you up' meme's popularity and the corresponding movements in MSFT stock price. Our study seeks to elucidate not only the statistical underpinnings of this correlation but also the broader implications for understanding the intertwined realms of popular culture and economic dynamics.

Furthermore, the novelty of our examination lies in fusing the seemingly incongruous worlds of "Rickrolling" antics and financial metrics, paving the way for a tongue-in-cheek exploration of memeonomics and the potential ripple effects of online phenomena on investment landscapes. The unexpected confluence of memes and stock prices, reminiscent of Astley's never-ending promise in the song, prompts us to reflect on the "never-gonna-give-you-up-and-neither-will-our-returns" effect with a touch of humor and whimsy.

As we navigate through the empirical findings and their implications, we invite the reader to join us in this unusual yet enlightening voyage at the crossroads of internet memes and market movements. Through this study, we aim not only to contribute to the academic discourse on memeonomics but also to infuse a dose of levity into the traditionally stoic realm of financial analysis.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The data analysis revealed a remarkably strong correlation between the popularity of the 'never gonna give you up' meme and Microsoft Corporation's stock price (MSFT) from 2006 to 2023. The correlation coefficient of 0.9078639 indicated a robust positive relationship, while the r-squared value of 0.8242169 underscored the substantial proportion of variance explained by the meme's popularity fluctuations. These statistical metrics provided compelling evidence of the association between the meme's virality and the movements in MSFT stock price, leading us to affirm the presence of a significant connection between these seemingly disparate phenomena.

The scatterplot (Fig. 1) depicts the salient relationship between the two variables, visually encapsulating the synchronous oscillations between the popularity of the 'never gonna give you up' meme and the corresponding shifts in MSFT stock price. The figure highlights the compelling nature of the correlation, punctuating our findings with a graphical representation of the dynamic interplay discerned from the data.

The strong statistical significance, evidenced by the p-value of less than 0.01, further solidifies the credibility of our results, indicating that the observed correlation is unlikely to have occurred by mere chance. This robust statistical significance lends credence to the notion that the 'never gonna give you up' meme exerts a discernible influence on MSFT stock price dynamics, thereby contributing a unique layer to the complex web of market forces.

Overall, our findings not only reaffirm the intriguing interconnection between internet culture and stock market movements but also serve as a testament to the compelling, albeit unconventional, influence of memes on financial landscapes. Our study resonates with a playful nod to the unanticipated correlation, encapsulating the delightful irony of the "never-gonna-give-you-up-and-neither-will-our-returns" effect, and adds a whimsical touch to the otherwise sober dialogue on market phenomena.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Popularity of the 'never gonna give you up' meme and Microsoft's stock price (MSFT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price"

[[ABSTRACT]]

The link between online memes and stock prices has long been a subject of speculation among the research community. In this study, we set out to investigate the correlation between the popularity of the 'never gonna give you up' meme and the stock performance of Microsoft Corporation (MSFT). By utilizing data from Google Trends and LSEG Analytics (Refinitiv), we conducted a rigorous analysis spanning the period from 2006 to 2023. Our findings revealed a statistically significant correlation coefficient of 0.9078639 with a p-value less than 0.01, indicating a strong association between the meme's popularity and MSFT stock price movements. Our results not only shed light on the quirky dynamics of online culture but also provide a fresh perspective on the potential impact of internet phenomena on financial markets. We delve into the implications of these findings and offer a tongue-in-cheek reflection on the "never-gonna-give-you-up-and-neither-will-our-returns" effect. Our study contributes to the burgeoning field of memeonomics and underscores the interconnected nature of pop culture and economic behaviors.

[[LITERATURE REVIEW]]

The examination of the interplay between virtual culture and economic indicators has been a focal point of inquiry, drawing the attention of researchers from diverse disciplinary backgrounds. Various studies have sought to elucidate the impact of internet phenomena on financial markets, probing the potential avenues through which online trends may manifest influence on stock price movements. Smith (2010) delved into the correlation between social media virality and stock performance, laying the groundwork for the exploration of memeonomics, a burgeoning field that marries internet culture with economic analysis.

In "Doe et al." (2015), the authors conducted a comprehensive investigation into the influence of memes on consumer behavior and brand valuation. Their findings underscored the subtle yet potent impact of digital memes on shaping consumer sentiments and brand image, setting the stage for further studies to unravel the broader implications of online virality in the realm of finance. Jones (2018) expanded the discourse by delving into the psychological underpinnings of meme engagement and its potential reverberations in market dynamics, providing a nuanced perspective on the multifaceted nature of internet-created content.

In the realm of non-fiction literature, works such as "Viralnomics: How to Get People to Want to Talk About You" by Jonah Berger and "Contagious: How to Build Word of Mouth in the Digital Age" by Jonah Berger have explored the contagious nature of online content and its ramifications in the context of consumer behavior and market influences. These seminal works have contributed to the foundational understanding of online virality and its implications for economic phenomena, laying the groundwork for further investigations into the intersection of internet culture and financial landscapes.

Expanding the lens to encompass fictional narratives that tangentially resonate with the themes of internet influence and economic repercussions, works such as "The Circle" by Dave Eggers and "Super Sad True Love Story" by Gary Shteyngart offer satirical perspectives on the omnipresence of digital culture and its potential ramifications for societal constructs, albeit in fictionalized settings. While not directly addressing the 'never gonna give you up' meme or MSFT stock price correlations, these literary pieces serve as a source of indirect inspiration for exploring the unanticipated intersections of virtual trends and fiscal indicators.

In the quest for understanding the quirky influence of online memes on economic phenomena, the researchers sought insight from popular television shows that encapsulate the zeitgeist of internet culture. Programs like "Black Mirror" and "The IT Crowd" afford anecdotal glimpses into the idiosyncratic and often unpredictable ways in which digital culture interacts with human behavior and societal systems. While these shows serve as sources of amusement and entertainment, their thematic explorations inadvertently trigger contemplation on the potential ripple effects of internet memes and their implications for market dynamics.

The literature reviewed provides a comprehensive backdrop for contextualizing the current study's exploration of the connection between the 'never gonna give you up' meme and MSFT stock price, integrating a lighthearted approach with rigorous analysis to navigate the uncharted terrain of memeonomics.

[[RESULTS]]

The data analysis revealed a remarkably strong correlation between the popularity of the 'never gonna give you up' meme and Microsoft Corporation's stock price (MSFT) from 2006 to 2023. The correlation coefficient of 0.9078639 indicated a robust positive relationship, while the r-squared value of 0.8242169 underscored the substantial proportion of variance explained by the meme's popularity fluctuations. These statistical metrics provided compelling evidence of the association between the meme's virality and the movements in MSFT stock price, leading us to affirm the presence of a significant connection between these seemingly disparate phenomena.

The scatterplot (Fig. 1) depicts the salient relationship between the two variables, visually encapsulating the synchronous oscillations between the popularity of the 'never gonna give you up' meme and the corresponding shifts in MSFT stock price. The figure highlights the compelling nature of the correlation, punctuating our findings with a graphical representation of the dynamic interplay discerned from the data.

The strong statistical significance, evidenced by the p-value of less than 0.01, further solidifies the credibility of our results, indicating that the observed correlation is unlikely to have occurred by mere chance. This robust statistical significance lends credence to the notion that the 'never gonna give you up' meme exerts a discernible influence on MSFT stock price dynamics, thereby contributing a unique layer to the complex web of market forces.

Overall, our findings not only reaffirm the intriguing interconnection between internet culture and stock market movements but also serve as a testament to the compelling, albeit unconventional, influence of memes on financial landscapes. Our study resonates with a playful nod to the unanticipated correlation, encapsulating the delightful irony of the "never-gonna-give-you-up-and-neither-will-our-returns" effect, and adds a whimsical touch to the otherwise sober dialogue on market phenomena.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

The profound correlation observed in our study between the 'never gonna give you up' meme and MSFT stock price yields an intriguing avenue for contemplation. Unraveling the entwined dynamics of internet culture and financial markets offers a whimsical lens through which to fathom the interplay between seemingly incongruous domains. Delving further into the "never-gonna-give-you-up-and-neither-will-our-returns" effect, our findings resonate with the lighthearted disposition of memeonomics, showcasing the unlikely yet palpable influence of digital virality on economic behavior.

Harking back to the insightful oeuvre of "Doe et al." (2015), our results walk hand in hand with prior research, illuminating the profound impact of memes on consumer sentiment and market dynamics. The nuanced correlation elucidated in our study serves as a delightful realization of the quirky yet substantial influence of internet phenomena on financial landscapes. Jones' (2018) exploration of the psychological underpinnings of meme engagement finds resonance in our findings, affirming the intriguing intertwinement between virtual culture and market behaviors.

The robust statistical significance encapsulated in our results not only reinforces the statistical rigor of our analysis but also highlights the resounding influence of the 'never gonna give you up' meme on MSFT stock price movements. The salient correlation coefficient substantiates the tangible link between the meme's virality and the stock price fluctuations, painting a compelling portrait of the incidental yet impactful interrelation of these seemingly disparate entities.

Furthermore, the visually captivating scatterplot underscores the synchrony between the meme's popularity and MSFT stock price, offering a whimsical juxtaposition of playful internet content and sober market dynamics. This graphical representation serves as a delightful nod to the idiosyncratic nature of our findings, encapsulating the humor and resonance of our study in a visually striking manner.

In conclusion, our study interlaces the serious discourse of financial market analysis with the whimsy of internet culture, embodying the delightful irony of the "never-gonna-give-you-up-and-neither-will-our-returns" effect. This multifaceted interplay not only adds a colorful dimension to the understanding of market dynamics but also underscores the unexpected and often delightful crossroads of virtual trends and economic phenomena.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Popularity of the 'never gonna give you up' meme and Microsoft's stock price (MSFT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price"

[[ABSTRACT]]

The link between online memes and stock prices has long been a subject of speculation among the research community. In this study, we set out to investigate the correlation between the popularity of the 'never gonna give you up' meme and the stock performance of Microsoft Corporation (MSFT). By utilizing data from Google Trends and LSEG Analytics (Refinitiv), we conducted a rigorous analysis spanning the period from 2006 to 2023. Our findings revealed a statistically significant correlation coefficient of 0.9078639 with a p-value less than 0.01, indicating a strong association between the meme's popularity and MSFT stock price movements. Our results not only shed light on the quirky dynamics of online culture but also provide a fresh perspective on the potential impact of internet phenomena on financial markets. We delve into the implications of these findings and offer a tongue-in-cheek reflection on the "never-gonna-give-you-up-and-neither-will-our-returns" effect. Our study contributes to the burgeoning field of memeonomics and underscores the interconnected nature of pop culture and economic behaviors.

[[INTRDUCTION]]

The intersection of internet culture and financial markets has increasingly become a focus of scholarly inquiry, with researchers seeking to unravel the enigmatic link between online phenomena and economic indicators. One such viral sensation that has captured the imaginations of netizens worldwide is the 'never gonna give you up' meme, popularly known for its "rickrolling" antics. The meme, originating from the iconic 1987 song by Rick Astley, has permeated digital platforms and inadvertently become an unexpected player in the realm of finance. As we explore this unlikely connection in the context of Microsoft Corporation's stock price (MSFT), we embark on a journey that fuses the whimsicality of internet culture with the gravity of financial analysis.

The enigmatic allure of memes and their potential influence on market behavior act as the catalyst for our investigation. In this paper, we delve into the data-driven exploration of the correlation between the ebbs and flows of the 'never gonna give you up' meme's popularity and the corresponding movements in MSFT stock price. Our study seeks to elucidate not only the statistical underpinnings of this correlation but also the broader implications for understanding the intertwined realms of popular culture and economic dynamics.

Furthermore, the novelty of our examination lies in fusing the seemingly incongruous worlds of "Rickrolling" antics and financial metrics, paving the way for a tongue-in-cheek exploration of memeonomics and the potential ripple effects of online phenomena on investment landscapes. The unexpected confluence of memes and stock prices, reminiscent of Astley's never-ending promise in the song, prompts us to reflect on the "never-gonna-give-you-up-and-neither-will-our-returns" effect with a touch of humor and whimsy.

As we navigate through the empirical findings and their implications, we invite the reader to join us in this unusual yet enlightening voyage at the crossroads of internet memes and market movements. Through this study, we aim not only to contribute to the academic discourse on memeonomics but also to infuse a dose of levity into the traditionally stoic realm of financial analysis.

[[RESULTS]]

The data analysis revealed a remarkably strong correlation between the popularity of the 'never gonna give you up' meme and Microsoft Corporation's stock price (MSFT) from 2006 to 2023. The correlation coefficient of 0.9078639 indicated a robust positive relationship, while the r-squared value of 0.8242169 underscored the substantial proportion of variance explained by the meme's popularity fluctuations. These statistical metrics provided compelling evidence of the association between the meme's virality and the movements in MSFT stock price, leading us to affirm the presence of a significant connection between these seemingly disparate phenomena.

The scatterplot (Fig. 1) depicts the salient relationship between the two variables, visually encapsulating the synchronous oscillations between the popularity of the 'never gonna give you up' meme and the corresponding shifts in MSFT stock price. The figure highlights the compelling nature of the correlation, punctuating our findings with a graphical representation of the dynamic interplay discerned from the data.

The strong statistical significance, evidenced by the p-value of less than 0.01, further solidifies the credibility of our results, indicating that the observed correlation is unlikely to have occurred by mere chance. This robust statistical significance lends credence to the notion that the 'never gonna give you up' meme exerts a discernible influence on MSFT stock price dynamics, thereby contributing a unique layer to the complex web of market forces.

Overall, our findings not only reaffirm the intriguing interconnection between internet culture and stock market movements but also serve as a testament to the compelling, albeit unconventional, influence of memes on financial landscapes. Our study resonates with a playful nod to the unanticipated correlation, encapsulating the delightful irony of the "never-gonna-give-you-up-and-neither-will-our-returns" effect, and adds a whimsical touch to the otherwise sober dialogue on market phenomena.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study provides compelling evidence of a strong and statistically significant correlation between the popularity of the 'never gonna give you up' meme and Microsoft Corporation's stock price (MSFT) from 2006 to 2023. The robust positive relationship, reflected in the correlation coefficient and r-squared value, underscores the substantial influence of this internet meme on the dynamics of a major player in the stock market. Our findings not only contribute to the evolving landscape of memeonomics but also illuminate the unforeseen interplay between online cultural phenomena and financial indicators.

The implications of this correlation extend beyond traditional market analyses, offering a whimsical lens through which to perceive the intricacies of investor sentiment and market movements. The visual encapsulation of the synchronous oscillations between the meme's popularity and MSFT stock price, as depicted in the scatterplot, serves as a testament to the unexpected yet tangible connection between internet culture and economic behavior. Furthermore, the statistical significance of our results reaffirms the notion of the 'never-gonna-give-you-up-and-neither-will-our-returns' effect, adding a lighthearted nuance to discussions of market forces.

Despite the inherent playfulness of our findings, the substantial impact of the 'never gonna give you up' meme on MSFT stock price cannot be overlooked. While our study offers a playful nod to the serendipitous correlation, it also underscores the potential influence of internet phenomena on investment landscapes. As we reflect on the "never-gonna-give-you-up-and-neither-will-our-returns" effect, we invite readers to indulge in a moment of levity amidst the otherwise serious discourse on market dynamics.

In light of our comprehensive analysis, we assert that further research in this area is not warranted, as our findings have undoubtedly rickrolled their way to a decisive conclusion.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Memetics and Market Influences

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Association for Internet Culture Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price with an abstract of The link between online memes and stock prices has long been a subject of speculation among the research community. In this study, we set out to investigate the correlation between the popularity of the 'never gonna give you up' meme and the stock performance of Microsoft Corporation (MSFT). By utilizing data from Google Trends and LSEG Analytics (Refinitiv), we conducted a rigorous analysis spanning the period from 2006 to 2023. Our findings revealed a statistically significant correlation coefficient of 0.9078639 with a p-value less than 0.01, indicating a strong association between the meme's popularity and MSFT stock price movements. Our results not only shed light on the quirky dynamics of online culture but also provide a fresh perspective on the potential impact of internet phenomena on financial markets. We delve into the implications of these findings and offer a tongue-in-cheek reflection on the "never-gonna-give-you-up-and-neither-will-our-returns" effect. Our study contributes to the burgeoning field of memeonomics and underscores the interconnected nature of pop culture and economic behaviors.

ChatGPT:

"never gonna give you up meme," "MSFT stock price correlation," "online memes and financial markets," "Google Trends data analysis," "LSEG Analytics (Refinitiv) research," "memeonomics," "internet culture and stock performance," "impact of memes on financial markets," "pop culture and economic behaviors," "correlation between meme popularity and stock price movements."

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Searches for 'never gonna give you up'Detailed data title: Relative volume of Google searches for 'never gonna give you up' (without quotes, in the United States)

Source: Google Trends

Additional Info: Relative search volume is a unique Google thing; the shape of the chart is accurate but the actual numbers are meaningless.

See what else correlates with Searches for 'never gonna give you up'

Microsoft's stock price (MSFT)

Detailed data title: Opening price of Microsoft (MSFT) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Microsoft's stock price (MSFT)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8242169 (Coefficient of determination)

This means 82.4% of the change in the one variable (i.e., Microsoft's stock price (MSFT)) is predictable based on the change in the other (i.e., Searches for 'never gonna give you up') over the 18 years from 2006 through 2023.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.9E-7. 0.0000001949296779002819400000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.91 in 1.9E-5% of random cases. Said differently, if you correlated 5,130,055 random variables You don't actually need 5 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 17 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 17 because we have two variables measured over a period of 18 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.77, 0.97 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Searches for 'never gonna give you up' (Relative popularity) | 2.16667 | 11.1667 | 26.9167 | 20.9167 | 18.9167 | 20.1667 | 15.75 | 14 | 13.4167 | 19.0833 | 19.75 | 19.9167 | 17.8333 | 15.6667 | 31.0833 | 42.6667 | 60.5 | 39.4167 |

| Microsoft's stock price (MSFT) (Stock price) | 26.25 | 29.91 | 35.79 | 19.53 | 30.62 | 28.05 | 26.55 | 27.25 | 37.35 | 46.66 | 54.32 | 62.79 | 86.13 | 99.55 | 158.78 | 222.53 | 335.35 | 243.08 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([2.16667,11.1667,26.9167,20.9167,18.9167,20.1667,15.75,14,13.4167,19.0833,19.75,19.9167,17.8333,15.6667,31.0833,42.6667,60.5,39.4167,])

array_2 = np.array([26.25,29.91,35.79,19.53,30.62,28.05,26.55,27.25,37.35,46.66,54.32,62.79,86.13,99.55,158.78,222.53,335.35,243.08,])

array_1_name = "Searches for 'never gonna give you up'"

array_2_name = "Microsoft's stock price (MSFT)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Searches for 'never gonna give you up'

- Line chart for only Microsoft's stock price (MSFT)

- AI-generated correlation image

- The spurious research paper: Rickrolling to Riches: The Never Gonna Give You Up Meme's Influence on MSFT Stock Price

I'm grateful for your review!

Correlation ID: 5232 · Black Variable ID: 25160 · Red Variable ID: 1541