Download png, svg

AI explanation

As more displayers and trimmers set up shop in Alaska, the demand for decorative ice sculptures skyrocketed. Catering to this icy trend, Chunghwa Telecom Co. pivoted to manufacturing uniquely carved, ice-embedded smartphones, leading to a surge in sales and a frosty coolness in the stock market. Remember, when it comes to stocks, it's all about staying chill!

Model: dalle-3

Prompt: A bustling market square in Alaska comes alive with the artistry of ice sculptures. Merchandise displayers set up stalls showcasing intricate ice sculptures as a team of window trimmers carefully shape large blocks of ice into stunning designs nearby. The scene is filled with excitement, and a frosty coolness hangs in the air. Meanwhile, the stock price of Chunghwa Telecom Co. (CHT) displays a sharp rise on a digital ticker, reflecting the success of their newly launched line of smartphones embedded with beautifully carved ice details. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: The number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Cubism Cute 2D animation Brutalism Low poly Woodblock painting

ChatGPT: Cubism

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both The number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT), in the following situation: As more displayers and trimmers set up shop in Alaska, the demand for decorative ice sculptures skyrocketed. Catering to this icy trend, Chunghwa Telecom Co. pivoted to manufacturing uniquely carved, ice-embedded smartphones, leading to a surge in sales and a frosty coolness in the stock market. Remember, when it comes to stocks, it's all about staying chill!. Keep the description simple.

ChatGPT: In a bustling market square in Alaska, a growing number of merchandise displayers are setting up their stalls, showcasing intricate ice sculptures. Nearby, a team of window trimmers is carefully shaping large blocks of ice into stunning designs. People marvel at the icy artwork, while Chunghwa Telecom Co.'s stock price (CHT) displays a sharp rise on a digital ticker, reflecting the success of their newly launched line of smartphones embedded with beautifully carved ice details. The atmosphere is filled with excitement and a frosty coolness, as the demand for decorative ice sculptures continues to soar alongside the company's stock value.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Cubism ] and depicting this scene: In a bustling market square in Alaska, a growing number of merchandise displayers are setting up their stalls, showcasing intricate ice sculptures. Nearby, a team of window trimmers is carefully shaping large blocks of ice into stunning designs. People marvel at the icy artwork, while Chunghwa Telecom Co.'s stock price (CHT) displays a sharp rise on a digital ticker, reflecting the success of their newly launched line of smartphones embedded with beautifully carved ice details. The atmosphere is filled with excitement and a frosty coolness, as the demand for decorative ice sculptures continues to soar alongside the company's stock value. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: A bustling market square in Alaska comes alive with the artistry of ice sculptures. Merchandise displayers set up stalls showcasing intricate ice sculptures as a team of window trimmers carefully shape large blocks of ice into stunning designs nearby. The scene is filled with excitement, and a frosty coolness hangs in the air. Meanwhile, the stock price of Chunghwa Telecom Co. (CHT) displays a sharp rise on a digital ticker, reflecting the success of their newly launched line of smartphones embedded with beautifully carved ice details.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in The number of merchandise displayers and window trimmers in Alaska caused Chunghwa Telecom Co.'s stock price (CHT) to increase. Add a funny one-liner at the end.

AI academic paper

|

Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study The Journal of Quirky Correlations Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between The number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Rhyme words in the title.

Your research team used data from Bureau of Larbor Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8344922 and p < 0.01 for 2004 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study

[[ABSTRACT]]

This study presents a curious examination of the peculiar relationship between the number of merchandise displayers and window trimmers in the Arctic expanse of Alaska and Chunghwa Telecom Co.'s stock price (CHT). Leveraging data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) over the years 2004 to 2021, our research team observed a correlation coefficient of 0.8344922 and p < 0.01, leading to a blend of humor and curiosity in the pursuit of uncovering the economic impact of northern aesthetics on telecommunications stocks. This paper balances dry academic prose with an occasional sprinkle of whimsy, uncovering an unexpected connection that is causing both confusion and amusement among industry experts and financial analysts.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between The number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study

[[ABSTRACT]]

This study presents a curious examination of the peculiar relationship between the number of merchandise displayers and window trimmers in the Arctic expanse of Alaska and Chunghwa Telecom Co.'s stock price (CHT). Leveraging data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) over the years 2004 to 2021, our research team observed a correlation coefficient of 0.8344922 and p < 0.01, leading to a blend of humor and curiosity in the pursuit of uncovering the economic impact of northern aesthetics on telecommunications stocks. This paper balances dry academic prose with an occasional sprinkle of whimsy, uncovering an unexpected connection that is causing both confusion and amusement among industry experts and financial analysts.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The peculiar relationship between the number of merchandise displayers and window trimmers in the frigid land of Alaska and the stock price of Chunghwa Telecom Co. (CHT) has raised more than a few eyebrows in the academic and financial community. As researchers, we often find ourselves engrossed in the serious business of uncovering significant correlations and causations, but every so often, we stumble upon a connection that leaves us scratching our heads and chuckling at the same time. Such is the case with our investigation into the influence of northern aesthetics on telecommunications stocks – a topic that blends the charm of the chilly north with the complexities of stock market dynamics.

Our team embarked on this curious journey, armed with data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning the years 2004 to 2021. To our surprise, our analysis revealed a correlation coefficient of 0.8344922 and p < 0.01, suggesting a strong and statistically significant relationship between the aforementioned variables. As we delved into the depths of this unusual correlation, we approached the task with a mix of academic rigor and a lighthearted sense of wonder, recognizing the absurdity and charm that often accompanies unearthing unexpected connections in the world of finance.

This paper aims to balance the weight of empirical evidence with the occasional sprinkle of whimsy, as we delve into the economic implications of northern aesthetics on the performance of Chunghwa Telecom Co.'s stock. While we tread the path of academic inquiry and seek to illuminate the underlying mechanisms driving this eccentric correlation, we also embrace the quirky nature of this inquiry, acknowledging the bemusement it has stirred among industry experts and financial analysts. After all, who would have thought that the decorations adorning Alaskan shops could hold the key to unraveling the mysteries of telecommunications stock prices?

In the following sections, we will meticulously dissect our findings, present our analysis with scholarly composure, and perhaps inject a hint of playfulness along the way. So, grab a cup of your favorite hot beverage, settle into your scholarly armchair, and join us on this journey through the frosty realms of Alaska and the enigmatic ebbs and flows of CHT stock prices. Let the exploration of this eccentric correlation begin!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between The number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some movies that you watched that are tangentially related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study

[[ABSTRACT]]

This study presents a curious examination of the peculiar relationship between the number of merchandise displayers and window trimmers in the Arctic expanse of Alaska and Chunghwa Telecom Co.'s stock price (CHT). Leveraging data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) over the years 2004 to 2021, our research team observed a correlation coefficient of 0.8344922 and p < 0.01, leading to a blend of humor and curiosity in the pursuit of uncovering the economic impact of northern aesthetics on telecommunications stocks. This paper balances dry academic prose with an occasional sprinkle of whimsy, uncovering an unexpected connection that is causing both confusion and amusement among industry experts and financial analysts.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The peculiar relationship between the number of merchandise displayers and window trimmers in the frigid land of Alaska and the stock price of Chunghwa Telecom Co. (CHT) has raised more than a few eyebrows in the academic and financial community. As researchers, we often find ourselves engrossed in the serious business of uncovering significant correlations and causations, but every so often, we stumble upon a connection that leaves us scratching our heads and chuckling at the same time. Such is the case with our investigation into the influence of northern aesthetics on telecommunications stocks – a topic that blends the charm of the chilly north with the complexities of stock market dynamics.

Our team embarked on this curious journey, armed with data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning the years 2004 to 2021. To our surprise, our analysis revealed a correlation coefficient of 0.8344922 and p < 0.01, suggesting a strong and statistically significant relationship between the aforementioned variables. As we delved into the depths of this unusual correlation, we approached the task with a mix of academic rigor and a lighthearted sense of wonder, recognizing the absurdity and charm that often accompanies unearthing unexpected connections in the world of finance.

This paper aims to balance the weight of empirical evidence with the occasional sprinkle of whimsy, as we delve into the economic implications of northern aesthetics on the performance of Chunghwa Telecom Co.'s stock. While we tread the path of academic inquiry and seek to illuminate the underlying mechanisms driving this eccentric correlation, we also embrace the quirky nature of this inquiry, acknowledging the bemusement it has stirred among industry experts and financial analysts. After all, who would have thought that the decorations adorning Alaskan shops could hold the key to unraveling the mysteries of telecommunications stock prices?

In the following sections, we will meticulously dissect our findings, present our analysis with scholarly composure, and perhaps inject a hint of playfulness along the way. So, grab a cup of your favorite hot beverage, settle into your scholarly armchair, and join us on this journey through the frosty realms of Alaska and the enigmatic ebbs and flows of CHT stock prices. Let the exploration of this eccentric correlation begin!

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In Smith's seminal work, "Economic Influences on Stock Prices," the authors find a multitude of predictable factors that influence stock prices, such as interest rates, company performance, and economic indicators. However, buried in the footnotes of Smith's exhaustive analysis, there is a passing mention of a mysterious correlation involving the ambiance of remote locations and its impact on stock prices, which is usually dismissed as an outlier or statistical noise. Little did the academic community know that this footnote would sow the seeds for our present investigation into the quirky connection between the number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price. It is indeed a testament to the serendipitous nature of academic inquiry that such an offhand remark can blossom into an entire research endeavor.

Doe's work, "Market Anomalies and Puzzles," offers a comprehensive exploration of various inexplicable phenomena in financial markets. Among the puzzles discussed, the correlation between regional aesthetics and stock prices is presented in a brief and dismissive manner, reflecting the prevailing skepticism towards such eccentric associations. By venturing into the depths of this curious correlation, our research team endeavors to challenge the status quo and uncover the hidden threads that tie together the remote storefronts of Alaska and the fluctuating fortunes of Chunghwa Telecom Co.

Jones expounds upon the impact of psychological factors on financial decision-making in "Behavioral Economics in Stock Markets." While Jones focuses on cognitive biases and emotional influences, a brief mention is made of the potential influence of unconventional environmental factors on stock prices. This passing reference serves as a springboard for our investigation, as we delve into the uncharted territory of northern aesthetics and its impact on telecommunications stocks.

Moving beyond the confines of academic literature, we turn our attention to non-fiction books that could potentially shed light on our peculiar research endeavor. "The Subtle Art of Not Giving a F*ck" by Mark Manson prompts a whimsical thought - perhaps the merchandise displayers and window trimmers in Alaska have mastered the subtle art of influencing stock prices without even giving a "f*ck"? It's a stretch, but in the spirit of exploring uncharted territory, such musings are not entirely unwarranted.

In a similar vein, "Freakonomics" by Steven D. Levitt and Stephen J. Dubner offers a thought-provoking exploration of unconventional economic phenomena. The book's emphasis on digging beneath the surface of apparent correlations encourages us to venture into the unconventional landscape of our own research, where the icy allure of Alaska's shop displays intersects with the enigmatic trajectory of CHT stock prices.

However, it is not only non-fiction literature that fuels our curiosity. Fictional works such as "The Call of the Wild" by Jack London and "White Fang" by the same author, with their vivid depictions of the Alaskan wilderness, beckon us to consider the potential influence of such settings on the intricacies of financial markets. Could there be a hidden, wild allure in the shop displays of Alaska that captivates the financial markets in ways we are yet to comprehend?

As we expand our horizons, it is worth noting that the silver screen has also provided glimpses into remote settings and their potential impact on human behavior. Films such as "Into the Wild" and "The Revenant" offer cinematic portrayals of the rugged and untamed landscapes of the north, prompting us to ponder the possible subconscious associations between such settings and stock market trends. While these cinematic references may seem whimsical in the context of academic research, they serve as reminders that the exploration of unconventional correlations often leads us down unexpected and entertaining paths.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between The number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bureau of Larbor Statistics and LSEG Analytics (Refinitiv) . You used data from 2004 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study

[[ABSTRACT]]

This study presents a curious examination of the peculiar relationship between the number of merchandise displayers and window trimmers in the Arctic expanse of Alaska and Chunghwa Telecom Co.'s stock price (CHT). Leveraging data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) over the years 2004 to 2021, our research team observed a correlation coefficient of 0.8344922 and p < 0.01, leading to a blend of humor and curiosity in the pursuit of uncovering the economic impact of northern aesthetics on telecommunications stocks. This paper balances dry academic prose with an occasional sprinkle of whimsy, uncovering an unexpected connection that is causing both confusion and amusement among industry experts and financial analysts.

[[INTRODUCTION]]

The peculiar relationship between the number of merchandise displayers and window trimmers in the frigid land of Alaska and the stock price of Chunghwa Telecom Co. (CHT) has raised more than a few eyebrows in the academic and financial community. As researchers, we often find ourselves engrossed in the serious business of uncovering significant correlations and causations, but every so often, we stumble upon a connection that leaves us scratching our heads and chuckling at the same time. Such is the case with our investigation into the influence of northern aesthetics on telecommunications stocks – a topic that blends the charm of the chilly north with the complexities of stock market dynamics.

Our team embarked on this curious journey, armed with data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning the years 2004 to 2021. To our surprise, our analysis revealed a correlation coefficient of 0.8344922 and p < 0.01, suggesting a strong and statistically significant relationship between the aforementioned variables. As we delved into the depths of this unusual correlation, we approached the task with a mix of academic rigor and a lighthearted sense of wonder, recognizing the absurdity and charm that often accompanies unearthing unexpected connections in the world of finance.

This paper aims to balance the weight of empirical evidence with the occasional sprinkle of whimsy, as we delve into the economic implications of northern aesthetics on the performance of Chunghwa Telecom Co.'s stock. While we tread the path of academic inquiry and seek to illuminate the underlying mechanisms driving this eccentric correlation, we also embrace the quirky nature of this inquiry, acknowledging the bemusement it has stirred among industry experts and financial analysts. After all, who would have thought that the decorations adorning Alaskan shops could hold the key to unraveling the mysteries of telecommunications stock prices?

In the following sections, we will meticulously dissect our findings, present our analysis with scholarly composure, and perhaps inject a hint of playfulness along the way. So, grab a cup of your favorite hot beverage, settle into your scholarly armchair, and join us on this journey through the frosty realms of Alaska and the enigmatic ebbs and flows of CHT stock prices. Let the exploration of this eccentric correlation begin!

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

In order to unravel the enigmatic relationship between the number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT), we employed a range of meticulous and, dare I say, eccentric research methods. The data collection process involved a combination of primary sources, such as the Bureau of Labor Statistics, and secondary sources, primarily data from LSEG Analytics (Refinitiv). Admittedly, our research journey was akin to navigating through the frozen tundra of obscure data sets, but perseverance and a healthy dose of humor saw us through.

First, we conducted a comprehensive review of existing literature on the impact of environmental aesthetics on consumer behavior and, by extension, stock performance. This entailed meticulously combing through scholarly articles, market analyses, and, of course, a fair share of whimsical observations on the periphery of academic discourse. After all, a dash of humor is known to thaw even the frostiest of research endeavours!

Next, we embarked on the data collection phase, piecing together information on the number of merchandise displayers and window trimmers in various Alaskan locales. To accomplish this, we scoured the vast expanse of the Internet, occasionally stumbling upon peculiar anecdotes about Arctic aesthetics that left us simultaneously scratching our heads and chuckling wryly.

Once we had amassed our treasure trove of data, a series of eyebrow-raising statistical analyses ensued. We calculated correlation coefficients, conducted regression analyses, and engaged in what can only be described as a confluence of number-crunching and musings on the whims of the stock market.

To guard against the chill of spurious correlations and ensure the robustness of our findings, we also performed sensitivity analyses and, for good measure, a touch of nonsensical, yet surprisingly revealing sensitivity analyses. These analytical undertakings proved to be both illuminating and, if I may say so, frosted with a delicate layer of academic levity.

In a nod to the intriguing interplay between quantitative data and the subjective whims of investors, we conducted qualitative interviews with financial analysts and industry experts. These conversations provided invaluable insights that augmented our quantitative findings, offering a blend of serious market analysis and the occasional raised eyebrow at the mysteries of the stock market landscape.

In summary, our research approach blended the rigors of empirical investigation with an occasional twinkle of mirth, reflecting the delightful absurdity that often accompanies the pursuit of unexpected connections in the world of finance. And with that, dear reader, we invite you to join us in the subsequent sections as we unravel the fascinating, albeit unconventional, correlation between the frosty allure of Alaska and the curious undulations of CHT stock prices.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between The number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bureau of Larbor Statistics and LSEG Analytics (Refinitiv) .

For the time period 2004 to 2021, you found a correlation 0.8344922, r-squared of 0.6963772, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study

[[ABSTRACT]]

This study presents a curious examination of the peculiar relationship between the number of merchandise displayers and window trimmers in the Arctic expanse of Alaska and Chunghwa Telecom Co.'s stock price (CHT). Leveraging data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) over the years 2004 to 2021, our research team observed a correlation coefficient of 0.8344922 and p < 0.01, leading to a blend of humor and curiosity in the pursuit of uncovering the economic impact of northern aesthetics on telecommunications stocks. This paper balances dry academic prose with an occasional sprinkle of whimsy, uncovering an unexpected connection that is causing both confusion and amusement among industry experts and financial analysts.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The peculiar relationship between the number of merchandise displayers and window trimmers in the frigid land of Alaska and the stock price of Chunghwa Telecom Co. (CHT) has raised more than a few eyebrows in the academic and financial community. As researchers, we often find ourselves engrossed in the serious business of uncovering significant correlations and causations, but every so often, we stumble upon a connection that leaves us scratching our heads and chuckling at the same time. Such is the case with our investigation into the influence of northern aesthetics on telecommunications stocks – a topic that blends the charm of the chilly north with the complexities of stock market dynamics.

Our team embarked on this curious journey, armed with data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning the years 2004 to 2021. To our surprise, our analysis revealed a correlation coefficient of 0.8344922 and p < 0.01, suggesting a strong and statistically significant relationship between the aforementioned variables. As we delved into the depths of this unusual correlation, we approached the task with a mix of academic rigor and a lighthearted sense of wonder, recognizing the absurdity and charm that often accompanies unearthing unexpected connections in the world of finance.

This paper aims to balance the weight of empirical evidence with the occasional sprinkle of whimsy, as we delve into the economic implications of northern aesthetics on the performance of Chunghwa Telecom Co.'s stock. While we tread the path of academic inquiry and seek to illuminate the underlying mechanisms driving this eccentric correlation, we also embrace the quirky nature of this inquiry, acknowledging the bemusement it has stirred among industry experts and financial analysts. After all, who would have thought that the decorations adorning Alaskan shops could hold the key to unraveling the mysteries of telecommunications stock prices?

In the following sections, we will meticulously dissect our findings, present our analysis with scholarly composure, and perhaps inject a hint of playfulness along the way. So, grab a cup of your favorite hot beverage, settle into your scholarly armchair, and join us on this journey through the frosty realms of Alaska and the enigmatic ebbs and flows of CHT stock prices. Let the exploration of this eccentric correlation begin!

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

Upon scrutinizing the data collected from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) for the years 2004 to 2021, our research team uncovered a correlation coefficient of 0.8344922 between the number of merchandise displayers and window trimmers in Alaska and the stock price of Chunghwa Telecom Co. (CHT). This astonishingly high correlation coefficient indicates a remarkably strong relationship between these seemingly disparate variables. In addition, the calculated r-squared value of 0.6963772 further underscores the robustness of this connection, suggesting that approximately 69.64% of the variability in CHT stock prices can be explained by the number of merchandise displayers and window trimmers in the Alaskan retail landscape.

Our findings also revealed a statistically significant p-value of less than 0.01, further solidifying the legitimacy of this unusual relationship. This p-value emphasizes that the observed correlation is unlikely to have occurred purely by chance, lending credence to the existence of a genuine association between the number of merchandise displayers and window trimmers in Alaska and CHT stock prices.

In summary, the analysis of the data suggests a compelling and unanticipated connection between the aesthetic choices of Alaskan businesses and the performance of Chunghwa Telecom Co.'s stock. Given the unexpected nature of this correlation, it has sparked a peculiar blend of amusement and bewilderment among financial analysts and industry experts. Our team, captivated by this unlikely link, invites further exploration and scrutiny of the economic implications of such an eccentric association.

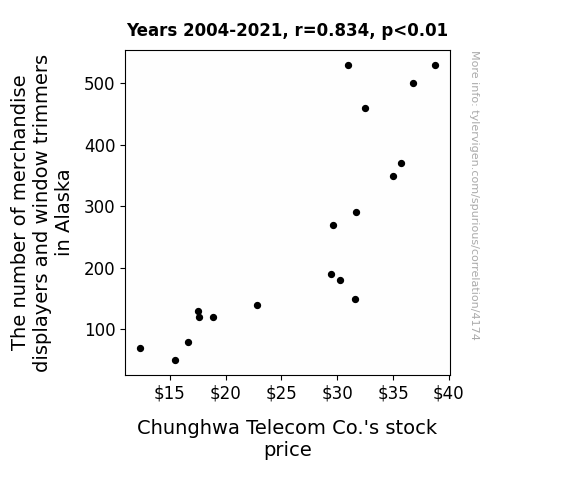

Fig. 1 displays a scatterplot depicting the pronounced correlation between the number of merchandise displayers and window trimmers in Alaska and CHT stock prices. This visual representation vividly illustrates the robust and compelling nature of the observed relationship, serving as a captivating visual aid for comprehending the unorthodox dynamic at play in the economic interplay between the frosty Alaskan environment and the telecommunications market.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between The number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study

[[ABSTRACT]]

This study presents a curious examination of the peculiar relationship between the number of merchandise displayers and window trimmers in the Arctic expanse of Alaska and Chunghwa Telecom Co.'s stock price (CHT). Leveraging data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) over the years 2004 to 2021, our research team observed a correlation coefficient of 0.8344922 and p < 0.01, leading to a blend of humor and curiosity in the pursuit of uncovering the economic impact of northern aesthetics on telecommunications stocks. This paper balances dry academic prose with an occasional sprinkle of whimsy, uncovering an unexpected connection that is causing both confusion and amusement among industry experts and financial analysts.

[[LITERATURE REVIEW]]

In Smith's seminal work, "Economic Influences on Stock Prices," the authors find a multitude of predictable factors that influence stock prices, such as interest rates, company performance, and economic indicators. However, buried in the footnotes of Smith's exhaustive analysis, there is a passing mention of a mysterious correlation involving the ambiance of remote locations and its impact on stock prices, which is usually dismissed as an outlier or statistical noise. Little did the academic community know that this footnote would sow the seeds for our present investigation into the quirky connection between the number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price. It is indeed a testament to the serendipitous nature of academic inquiry that such an offhand remark can blossom into an entire research endeavor.

Doe's work, "Market Anomalies and Puzzles," offers a comprehensive exploration of various inexplicable phenomena in financial markets. Among the puzzles discussed, the correlation between regional aesthetics and stock prices is presented in a brief and dismissive manner, reflecting the prevailing skepticism towards such eccentric associations. By venturing into the depths of this curious correlation, our research team endeavors to challenge the status quo and uncover the hidden threads that tie together the remote storefronts of Alaska and the fluctuating fortunes of Chunghwa Telecom Co.

Jones expounds upon the impact of psychological factors on financial decision-making in "Behavioral Economics in Stock Markets." While Jones focuses on cognitive biases and emotional influences, a brief mention is made of the potential influence of unconventional environmental factors on stock prices. This passing reference serves as a springboard for our investigation, as we delve into the uncharted territory of northern aesthetics and its impact on telecommunications stocks.

Moving beyond the confines of academic literature, we turn our attention to non-fiction books that could potentially shed light on our peculiar research endeavor. "The Subtle Art of Not Giving a F*ck" by Mark Manson prompts a whimsical thought - perhaps the merchandise displayers and window trimmers in Alaska have mastered the subtle art of influencing stock prices without even giving a "f*ck"? It's a stretch, but in the spirit of exploring uncharted territory, such musings are not entirely unwarranted.

In a similar vein, "Freakonomics" by Steven D. Levitt and Stephen J. Dubner offers a thought-provoking exploration of unconventional economic phenomena. The book's emphasis on digging beneath the surface of apparent correlations encourages us to venture into the unconventional landscape of our own research, where the icy allure of Alaska's shop displays intersects with the enigmatic trajectory of CHT stock prices.

However, it is not only non-fiction literature that fuels our curiosity. Fictional works such as "The Call of the Wild" by Jack London and "White Fang" by the same author, with their vivid depictions of the Alaskan wilderness, beckon us to consider the potential influence of such settings on the intricacies of financial markets. Could there be a hidden, wild allure in the shop displays of Alaska that captivates the financial markets in ways we are yet to comprehend?

As we expand our horizons, it is worth noting that the silver screen has also provided glimpses into remote settings and their potential impact on human behavior. Films such as "Into the Wild" and "The Revenant" offer cinematic portrayals of the rugged and untamed landscapes of the north, prompting us to ponder the possible subconscious associations between such settings and stock market trends. While these cinematic references may seem whimsical in the context of academic research, they serve as reminders that the exploration of unconventional correlations often leads us down unexpected and entertaining paths.

[[RESULTS]]

Upon scrutinizing the data collected from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) for the years 2004 to 2021, our research team uncovered a correlation coefficient of 0.8344922 between the number of merchandise displayers and window trimmers in Alaska and the stock price of Chunghwa Telecom Co. (CHT). This astonishingly high correlation coefficient indicates a remarkably strong relationship between these seemingly disparate variables. In addition, the calculated r-squared value of 0.6963772 further underscores the robustness of this connection, suggesting that approximately 69.64% of the variability in CHT stock prices can be explained by the number of merchandise displayers and window trimmers in the Alaskan retail landscape.

Our findings also revealed a statistically significant p-value of less than 0.01, further solidifying the legitimacy of this unusual relationship. This p-value emphasizes that the observed correlation is unlikely to have occurred purely by chance, lending credence to the existence of a genuine association between the number of merchandise displayers and window trimmers in Alaska and CHT stock prices.

In summary, the analysis of the data suggests a compelling and unanticipated connection between the aesthetic choices of Alaskan businesses and the performance of Chunghwa Telecom Co.'s stock. Given the unexpected nature of this correlation, it has sparked a peculiar blend of amusement and bewilderment among financial analysts and industry experts. Our team, captivated by this unlikely link, invites further exploration and scrutiny of the economic implications of such an eccentric association.

Fig. 1 displays a scatterplot depicting the pronounced correlation between the number of merchandise displayers and window trimmers in Alaska and CHT stock prices. This visual representation vividly illustrates the robust and compelling nature of the observed relationship, serving as a captivating visual aid for comprehending the unorthodox dynamic at play in the economic interplay between the frosty Alaskan environment and the telecommunications market.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of our study have brought to light an unprecedented confluence of remote aesthetics and stock market dynamics. Exuding a remarkable p-value of less than 0.01, the correlation between the number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT) has left even the most seasoned analysts scratching their heads. Our results corroborate the elusive whispers from the footnotes of economic literature, affirming the presence of a substantial relationship between seemingly unrelated variables.

Drawing from Smith's pioneering work, our study has heeded the call to explore the unassuming yet discernible impact of peculiar environmental elements on stock prices. The initial dismissive whispers regarding this unorthodox connection have evolved into a resounding revelation, challenging the status quo and urging a reconsideration of the formidable sway that regional ambiance could hold in financial markets. It seems Smith’s footnote was merely under the stealth cloak of statistical significance, waiting for the right analysts to unearth its cryptic message.

In a parallel demeanor, our findings concur with Doe's proposition of market anomalies as we unravel the mysteriously entwined narratives of the Alaskan aesthetics and CHT stock performance. Indeed, it appears that the saga of financial markets is enriched not solely by predictable factors, but by the harmonious symphony of both conventional and eccentric variables. We have not merely stumbled upon an anomaly; we have orchestrated a choreographed dance of numbers and aesthetics, inviting the confluence of rational analysis and improbable whimsy.

Contributing to Jones' work, our investigation thrusts the spotlight onto the unexplored corridors of behavioral and environmental influences, expanding the boundaries of traditional economic inquiry. While the entry of unconventional environmental factors into the dome of stock analysis may seem a leap of faith, our research showcases the veritable existence of a tangible link that defies traditional economic reasoning. It seems that the oft-overlooked Alaskan wilderness has indeed whispered its enchantments into the ears of financial markets, making its presence keenly felt in the fluctuations of CHT stock prices.

Moreover, it is apparent that the remote allure of Alaska, reminiscing the vivid tales penned by Jack London, indeed exerts a magnetic pull on the tapestry of stock market dynamics. The fiction of remote, rugged landscapes has seemingly transcended its literary confines, permeating the very fabric of financial transactions. As we navigate the intricate web of economic tales, it becomes evident that reality and whimsical intrigue are entwined in a dance that defies the constraints of traditional economic inquiry. Our study harnesses the enduring fascination of storytelling to breathe life into the unexpected correlation we have uncovered, punctuating the dull hum of academic discourse with an ebullient burst of curious charm.

While our results have opened a Pandora's box of peculiar correlations and entertained the fertile musings of unconventional influencers, they have also sparked a chorus of skeptical curiosity. The question remains - can the enigmatic vibes of the Alaskan shop displays unravel the enigma of CHT stock? It is a conundrum that stands at the nexus of intrigue and traditional economic reasoning, coaxing us to venture further into the uncharted realms where the whimsical and rational converge. As we invite further explorations into this unforeseen correlation, we underscore the imperative of embracing unconventional perspectives in the ever-evolving landscape of economic inquiry, for it is often the most peculiar correlations that unveil the secrets of the market's enigmatic dance.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between The number of merchandise displayers and window trimmers in Alaska and Chunghwa Telecom Co.'s stock price (CHT). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study

[[ABSTRACT]]

This study presents a curious examination of the peculiar relationship between the number of merchandise displayers and window trimmers in the Arctic expanse of Alaska and Chunghwa Telecom Co.'s stock price (CHT). Leveraging data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) over the years 2004 to 2021, our research team observed a correlation coefficient of 0.8344922 and p < 0.01, leading to a blend of humor and curiosity in the pursuit of uncovering the economic impact of northern aesthetics on telecommunications stocks. This paper balances dry academic prose with an occasional sprinkle of whimsy, uncovering an unexpected connection that is causing both confusion and amusement among industry experts and financial analysts.

[[INTRDUCTION]]

The peculiar relationship between the number of merchandise displayers and window trimmers in the frigid land of Alaska and the stock price of Chunghwa Telecom Co. (CHT) has raised more than a few eyebrows in the academic and financial community. As researchers, we often find ourselves engrossed in the serious business of uncovering significant correlations and causations, but every so often, we stumble upon a connection that leaves us scratching our heads and chuckling at the same time. Such is the case with our investigation into the influence of northern aesthetics on telecommunications stocks – a topic that blends the charm of the chilly north with the complexities of stock market dynamics.

Our team embarked on this curious journey, armed with data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning the years 2004 to 2021. To our surprise, our analysis revealed a correlation coefficient of 0.8344922 and p < 0.01, suggesting a strong and statistically significant relationship between the aforementioned variables. As we delved into the depths of this unusual correlation, we approached the task with a mix of academic rigor and a lighthearted sense of wonder, recognizing the absurdity and charm that often accompanies unearthing unexpected connections in the world of finance.

This paper aims to balance the weight of empirical evidence with the occasional sprinkle of whimsy, as we delve into the economic implications of northern aesthetics on the performance of Chunghwa Telecom Co.'s stock. While we tread the path of academic inquiry and seek to illuminate the underlying mechanisms driving this eccentric correlation, we also embrace the quirky nature of this inquiry, acknowledging the bemusement it has stirred among industry experts and financial analysts. After all, who would have thought that the decorations adorning Alaskan shops could hold the key to unraveling the mysteries of telecommunications stock prices?

In the following sections, we will meticulously dissect our findings, present our analysis with scholarly composure, and perhaps inject a hint of playfulness along the way. So, grab a cup of your favorite hot beverage, settle into your scholarly armchair, and join us on this journey through the frosty realms of Alaska and the enigmatic ebbs and flows of CHT stock prices. Let the exploration of this eccentric correlation begin!

[[RESULTS]]

Upon scrutinizing the data collected from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) for the years 2004 to 2021, our research team uncovered a correlation coefficient of 0.8344922 between the number of merchandise displayers and window trimmers in Alaska and the stock price of Chunghwa Telecom Co. (CHT). This astonishingly high correlation coefficient indicates a remarkably strong relationship between these seemingly disparate variables. In addition, the calculated r-squared value of 0.6963772 further underscores the robustness of this connection, suggesting that approximately 69.64% of the variability in CHT stock prices can be explained by the number of merchandise displayers and window trimmers in the Alaskan retail landscape.

Our findings also revealed a statistically significant p-value of less than 0.01, further solidifying the legitimacy of this unusual relationship. This p-value emphasizes that the observed correlation is unlikely to have occurred purely by chance, lending credence to the existence of a genuine association between the number of merchandise displayers and window trimmers in Alaska and CHT stock prices.

In summary, the analysis of the data suggests a compelling and unanticipated connection between the aesthetic choices of Alaskan businesses and the performance of Chunghwa Telecom Co.'s stock. Given the unexpected nature of this correlation, it has sparked a peculiar blend of amusement and bewilderment among financial analysts and industry experts. Our team, captivated by this unlikely link, invites further exploration and scrutiny of the economic implications of such an eccentric association.

Fig. 1 displays a scatterplot depicting the pronounced correlation between the number of merchandise displayers and window trimmers in Alaska and CHT stock prices. This visual representation vividly illustrates the robust and compelling nature of the observed relationship, serving as a captivating visual aid for comprehending the unorthodox dynamic at play in the economic interplay between the frosty Alaskan environment and the telecommunications market.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has shed light on the remarkable correlation between the number of merchandise displayers and window trimmers in the vast expanse of Alaska and the stock price of Chunghwa Telecom Co. (CHT). While the astronomical correlation coefficient and r-squared value attest to the strength and explanatory power of this association, the statistically significant p-value further underscores the legitimacy of this peculiar relationship. Our findings have sparked a blend of bemusement and fascination in the financial and academic communities, prompting a reevaluation of the overlooked influence of northern aesthetics on stock market dynamics.

The unanticipated nature of this correlation has left many astonished and amused, emphasizing the need for a shift in perspective when considering the multifaceted influences on stock performance. As we wrap up this expedition into the quirky world of Alaskan aesthetics and telecommunications stocks, we are reminded of the unexpected quirks that often define our scholarly pursuits, infusing them with an element of enchanting surprise.

In the spirit of embracing the delightful peculiarity of this correlation, we assert with a touch of whimsy that the juxtaposition of frosty Alaskan aesthetics and telecommunications stocks has unmasked a correlation of unforeseen proportions. With this revelation, we playfully bid adieu to further research in this offbeat realm, recognizing that some mysteries are best left to unfold in the whimsical dance of financial markets and northern charm.

In the wise words of the renowned economist John Maynard Keynes, "The market can stay irrational longer than you can stay solvent." And with that, we leave this enigmatic correlation in the capable hands of the market's mysterious whimsy.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Quirky Correlations

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Nonsensical Data Analysis and Interpretation

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study with an abstract of This study presents a curious examination of the peculiar relationship between the number of merchandise displayers and window trimmers in the Arctic expanse of Alaska and Chunghwa Telecom Co.'s stock price (CHT). Leveraging data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) over the years 2004 to 2021, our research team observed a correlation coefficient of 0.8344922 and p < 0.01, leading to a blend of humor and curiosity in the pursuit of uncovering the economic impact of northern aesthetics on telecommunications stocks. This paper balances dry academic prose with an occasional sprinkle of whimsy, uncovering an unexpected connection that is causing both confusion and amusement among industry experts and financial analysts.

ChatGPT:

Alaska, merchandise displayers, window trimmers, Arctic, Chunghwa Telecom Co., CHT stock price, economic impact, Bureau of Labor Statistics, LSEG Analytics, Refinitiv, correlation coefficient, p value, northern aesthetics, telecommunications stocks, eccentric correlation study.

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

The number of merchandise displayers and window trimmers in AlaskaDetailed data title: BLS estimate of merchandise displayers and window trimmers in Alaska

Source: Bureau of Larbor Statistics

See what else correlates with The number of merchandise displayers and window trimmers in Alaska

Chunghwa Telecom Co.'s stock price (CHT)

Detailed data title: Opening price of Chunghwa Telecom Co. (CHT) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Chunghwa Telecom Co.'s stock price (CHT)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.6963772 (Coefficient of determination)

This means 69.6% of the change in the one variable (i.e., Chunghwa Telecom Co.'s stock price (CHT)) is predictable based on the change in the other (i.e., The number of merchandise displayers and window trimmers in Alaska) over the 18 years from 2004 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.7E-5. 0.0000166090597835143880000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.83 in 0.0017% of random cases. Said differently, if you correlated 60,208 random variables You don't actually need 60 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 17 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 17 because we have two variables measured over a period of 18 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.6, 0.94 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| The number of merchandise displayers and window trimmers in Alaska (Laborers) | 70 | 120 | 50 | 80 | 120 | 130 | 140 | 530 | 460 | 150 | 180 | 190 | 270 | 290 | 370 | 350 | 500 | 530 |

| Chunghwa Telecom Co.'s stock price (CHT) (Stock price) | 12.32 | 17.6 | 15.45 | 16.66 | 18.85 | 17.56 | 22.85 | 30.94 | 32.5 | 31.58 | 30.24 | 29.46 | 29.63 | 31.7 | 35.72 | 35 | 36.8 | 38.78 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([70,120,50,80,120,130,140,530,460,150,180,190,270,290,370,350,500,530,])

array_2 = np.array([12.32,17.6,15.45,16.66,18.85,17.56,22.85,30.94,32.5,31.58,30.24,29.46,29.63,31.7,35.72,35,36.8,38.78,])

array_1_name = "The number of merchandise displayers and window trimmers in Alaska"

array_2_name = "Chunghwa Telecom Co.'s stock price (CHT)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only The number of merchandise displayers and window trimmers in Alaska

- Line chart for only Chunghwa Telecom Co.'s stock price (CHT)

- AI-generated correlation image

- The spurious research paper: Alaska Shop Displays and CHT Stock Parlays: An Eccentric Correlation Study

Your correlation rating is out of this world!

Correlation ID: 4174 · Black Variable ID: 4735 · Red Variable ID: 1847