AI explanation

Every time a baby is named Miles, a secret signal is sent to the stock market, prompting investors to buy Cummins' stock in anticipation of a future demand for miles of truck engines. This baby name trend has revved up the stock price, proving that when it comes to financial success, it's all about the journey, not the destination.

Model: dalle-3

Prompt: Generate an image of a bustling nursery with a row of cribs, each labeled "Miles," surrounded by a flurry of invisible signals shooting out. Above the cribs, a digital stock ticker displays how Cummins' stock price (CMI) steadily climbs. This scene visually represents the intertwining of baby name popularity and stock market success and symbolizes potential future demand for miles of truck engines. The imagery should be captivating and thought-provoking as a Discovery magazine cover. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Popularity of the first name Miles and Cummins' stock price (CMI). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Celtic art a funny image macro a funny image macro A Discovery magazine cover image Steampunk

ChatGPT: A Discovery magazine cover image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Popularity of the first name Miles and Cummins' stock price (CMI), in the following situation: Every time a baby is named Miles, a secret signal is sent to the stock market, prompting investors to buy Cummins' stock in anticipation of a future demand for miles of truck engines. This baby name trend has revved up the stock price, proving that when it comes to financial success, it's all about the journey, not the destination.. Keep the description simple.

ChatGPT: In a bustling nursery, a row of cribs showcases a string of nametags, all reading "Miles." As each one is added, a flurry of invisible signals shoots out, igniting a digital stock ticker above, where Cummins' stock price (CMI) steadily climbs. It's a visual testament to the intertwining of baby name popularity and stock market success, symbolizing the potential future demand for miles of truck engines.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A Discovery magazine cover image ] and depicting this scene: In a bustling nursery, a row of cribs showcases a string of nametags, all reading "Miles." As each one is added, a flurry of invisible signals shoots out, igniting a digital stock ticker above, where Cummins' stock price (CMI) steadily climbs. It's a visual testament to the intertwining of baby name popularity and stock market success, symbolizing the potential future demand for miles of truck engines. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a bustling nursery with a row of cribs, each labeled "Miles," surrounded by a flurry of invisible signals shooting out. Above the cribs, a digital stock ticker displays how Cummins' stock price (CMI) steadily climbs. This scene visually represents the intertwining of baby name popularity and stock market success and symbolizes potential future demand for miles of truck engines. The imagery should be captivating and thought-provoking as a Discovery magazine cover.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Popularity of the first name Miles caused Cummins' stock price (CMI) to increase.\Make it sound serious until the end.

AI academic paper

|

Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price The Journal of Transportation Finance and Fashion Trends Jan 2024 |

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Popularity of the first name Miles and Cummins' stock price (CMI). Make lots of jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, just make it sound clever.

Your research team used data from US Social Security Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9512418 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price"

[[ABSTRACT]]

This paper delves into the unusual correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While some may consider it far-fetched, our findings reveal a striking connection between the two, leaving us to ponder whether there's something more than just sheer coincidence at play. By leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), we meticulously examined the trends from 2002 to 2022. Our analysis resulted in a correlation coefficient of 0.9512418 and a statistically significant p-value of less than 0.01, suggesting a robust relationship that is difficult to dismiss as pure chance. Whether it’s due to the power of wordplay or simply the universe's sense of humor, the evidence speaks for itself. So, buckle up, fasten your seatbelts, and get ready to embark on a journey that explores the curious intersection of nomenclature and finance.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Popularity of the first name Miles and Cummins' stock price (CMI). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

"Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price"

[[ABSTRACT]]

This paper delves into the unusual correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While some may consider it far-fetched, our findings reveal a striking connection between the two, leaving us to ponder whether there's something more than just sheer coincidence at play. By leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), we meticulously examined the trends from 2002 to 2022. Our analysis resulted in a correlation coefficient of 0.9512418 and a statistically significant p-value of less than 0.01, suggesting a robust relationship that is difficult to dismiss as pure chance. Whether it’s due to the power of wordplay or simply the universe's sense of humor, the evidence speaks for itself. So, buckle up, fasten your seatbelts, and get ready to embark on a journey that explores the curious intersection of nomenclature and finance.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

In the world of research, it's not uncommon to stumble upon unexpected correlations that leave us scratching our heads and muttering, "Well, I'll be statistically significant!" This paper catapults us into the realm of the peculiar, where we unravel the improbable association between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). Now, before you start thinking that this is just another case of statistical serendipity, buckle up, because the results are nothing short of mind-boggling.

Picture this: you're crunching numbers on babies' names, and suddenly, in the thick of all the baby Miless and baby Emmas, an intriguing pattern emerges. It's as if the financial winds were whispering, "CMI stock price, Miles, it all just clicks!" And so, off we went, diving headfirst into the depths of data from the US Social Security Administration and LSEG Analytics (Refinitiv), poised to dissect this enigmatic relationship that defies the norms of conventional analysis.

Some may say it's all a coincidence, a mere fluke, but our results beg to differ. The correlation coefficient of 0.9512418 winked at us from the spreadsheet, and the p-value (less than 0.01, mind you) winked right back. It's a statistical tango, a dance of numbers that leads us to ponder whether there's more to this linkage than meets the eye. Is it the gravitational pull of a pun in the vast cosmos of finance? Or perhaps, just maybe, there's a symphony playing in the universe that we're only beginning to tune into.

So, dear reader, fasten your seatbelts and hold on tight, because we're about to embark on an odyssey that rocks the very foundations of how we perceive the intersection of nomenclature and finance. This journey is beyond what we bargained for, unearthing a correlation that is as intriguing as it is inexplicable. It's a rollercoaster of names, numbers, and stock prices that will leave you questioning if the universe has a cheeky sense of humor or if there's a deeper, uncharted statistical territory waiting to be explored.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Popularity of the first name Miles and Cummins' stock price (CMI). Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some cartoons and childrens' shows that you watched that are related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

"Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price"

[[ABSTRACT]]

This paper delves into the unusual correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While some may consider it far-fetched, our findings reveal a striking connection between the two, leaving us to ponder whether there's something more than just sheer coincidence at play. By leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), we meticulously examined the trends from 2002 to 2022. Our analysis resulted in a correlation coefficient of 0.9512418 and a statistically significant p-value of less than 0.01, suggesting a robust relationship that is difficult to dismiss as pure chance. Whether it’s due to the power of wordplay or simply the universe's sense of humor, the evidence speaks for itself. So, buckle up, fasten your seatbelts, and get ready to embark on a journey that explores the curious intersection of nomenclature and finance.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

In the world of research, it's not uncommon to stumble upon unexpected correlations that leave us scratching our heads and muttering, "Well, I'll be statistically significant!" This paper catapults us into the realm of the peculiar, where we unravel the improbable association between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). Now, before you start thinking that this is just another case of statistical serendipity, buckle up, because the results are nothing short of mind-boggling.

Picture this: you're crunching numbers on babies' names, and suddenly, in the thick of all the baby Miless and baby Emmas, an intriguing pattern emerges. It's as if the financial winds were whispering, "CMI stock price, Miles, it all just clicks!" And so, off we went, diving headfirst into the depths of data from the US Social Security Administration and LSEG Analytics (Refinitiv), poised to dissect this enigmatic relationship that defies the norms of conventional analysis.

Some may say it's all a coincidence, a mere fluke, but our results beg to differ. The correlation coefficient of 0.9512418 winked at us from the spreadsheet, and the p-value (less than 0.01, mind you) winked right back. It's a statistical tango, a dance of numbers that leads us to ponder whether there's more to this linkage than meets the eye. Is it the gravitational pull of a pun in the vast cosmos of finance? Or perhaps, just maybe, there's a symphony playing in the universe that we're only beginning to tune into.

So, dear reader, fasten your seatbelts and hold on tight, because we're about to embark on an odyssey that rocks the very foundations of how we perceive the intersection of nomenclature and finance. This journey is beyond what we bargained for, unearthing a correlation that is as intriguing as it is inexplicable. It's a rollercoaster of names, numbers, and stock prices that will leave you questioning if the universe has a cheeky sense of humor or if there's a deeper, uncharted statistical territory waiting to be explored.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "Smith et al. (2020)," the authors find statistically significant evidence suggesting a positive correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While this connection may seem preposterous at first glance, the robustness of their findings invites us to contemplate the possibility of unconventional forces at play. Delving deeper into this uncharted territory, "Doe and Jones (2018)" support this line of investigation, bringing attention to the uncanny alignment between nomenclature and financial performance.

Venturing beyond the conventional realms of finance, we encounter "The Power of Name" by Laura Wattenberg, which provides a thought-provoking examination of the influence and cultural significance of names. In a similar vein, "Freakonomics" by Steven D. Levitt and Stephen J. Dubner offers insight into the unexpected connections that shape our world, proving that truth can indeed be stranger than fiction.

On a more whimsical note, the literary world beckons us to reconsider the boundaries of plausibility. Books such as "Miles of Mirth" by Jovial J. Jesterton and "The Name Game Conundrum" by Punny McPunster pique our interest with their playful exploration of the intricacies of nomenclature. Furthermore, the aforementioned correlation evokes memories of childhood cartoons and shows that have a tendency to infuse the most unexpected elements into their narratives. The animated adventures of "Miles Morales: Spider-Man," the financial wisdom of Scrooge McDuck in "DuckTales," and the enigmatic allure of "Penny Stocks" from "Inspector Gadget" all serve as testament to the captivating influence of nomenclature and finance in popular culture.

As we traverse this scholarly landscape, it becomes increasingly apparent that the convergence of names and stock prices may hold far more significance than initially presumed. The interplay between the whimsical and the substantial invites us to ponder whether there's a method to this madness, or if it's simply the universe's way of adding a dash of levity to the often solemn domain of finance.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Popularity of the first name Miles and Cummins' stock price (CMI). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price"

[[ABSTRACT]]

This paper delves into the unusual correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While some may consider it far-fetched, our findings reveal a striking connection between the two, leaving us to ponder whether there's something more than just sheer coincidence at play. By leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), we meticulously examined the trends from 2002 to 2022. Our analysis resulted in a correlation coefficient of 0.9512418 and a statistically significant p-value of less than 0.01, suggesting a robust relationship that is difficult to dismiss as pure chance. Whether it’s due to the power of wordplay or simply the universe's sense of humor, the evidence speaks for itself. So, buckle up, fasten your seatbelts, and get ready to embark on a journey that explores the curious intersection of nomenclature and finance.

[[INTRODUCTION]]

In the world of research, it's not uncommon to stumble upon unexpected correlations that leave us scratching our heads and muttering, "Well, I'll be statistically significant!" This paper catapults us into the realm of the peculiar, where we unravel the improbable association between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). Now, before you start thinking that this is just another case of statistical serendipity, buckle up, because the results are nothing short of mind-boggling.

Picture this: you're crunching numbers on babies' names, and suddenly, in the thick of all the baby Miless and baby Emmas, an intriguing pattern emerges. It's as if the financial winds were whispering, "CMI stock price, Miles, it all just clicks!" And so, off we went, diving headfirst into the depths of data from the US Social Security Administration and LSEG Analytics (Refinitiv), poised to dissect this enigmatic relationship that defies the norms of conventional analysis.

Some may say it's all a coincidence, a mere fluke, but our results beg to differ. The correlation coefficient of 0.9512418 winked at us from the spreadsheet, and the p-value (less than 0.01, mind you) winked right back. It's a statistical tango, a dance of numbers that leads us to ponder whether there's more to this linkage than meets the eye. Is it the gravitational pull of a pun in the vast cosmos of finance? Or perhaps, just maybe, there's a symphony playing in the universe that we're only beginning to tune into.

So, dear reader, fasten your seatbelts and hold on tight, because we're about to embark on an odyssey that rocks the very foundations of how we perceive the intersection of nomenclature and finance. This journey is beyond what we bargained for, unearthing a correlation that is as intriguing as it is inexplicable. It's a rollercoaster of names, numbers, and stock prices that will leave you questioning if the universe has a cheeky sense of humor or if there's a deeper, uncharted statistical territory waiting to be explored.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To unpack the enigma of the connection between the rising popularity of the moniker "Miles" and the rollercoaster ride of Cummins Inc. stock prices, our research team embarked on a data-gathering expedition that would make even the most seasoned of statisticians raise an eyebrow in perplexity. Armed with wit and a quiver full of innovative methods, we set out to peel back the layers of this captivating correlation.

First, we sauntered into the labyrinth of the US Social Security Administration's database, sifting through the digital treasure trove of baby names with the gusto of archeologists unearthing relics of old. Our data mining expedition was akin to sifting through a particularly dense jungle, each "Miles" and "Emma" a virtual creature in the standalone kingdom of nomenclature. As we meticulously extracted the data from 2002 to 2022, we found ourselves muttering the statistical equivalent of "open sesame" to uncover the buried treasures of name popularity trends.

Simultaneously, we engaged the dexterous services of LSEG Analytics (Refinitiv), tapping into its sprawling repository of financial wisdom to track the mesmerizing ebb and flow of Cummins Inc. stock price. Our foray into the financial data realm resembled a high-stakes poker game where the cards were replaced with lines of fluctuating digits and the poker face was the elusive relationship between stock prices and the name "Miles."

With our data in hand, we assumed the role of intrepid explorers navigating the uncharted territory of correlation and causation. Deploying the formidable artillery of statistical analyses, we set up camp in the domain of regression models, unleashing the powers of Pearson's correlation coefficient to measure the strength of the mystical bond between the name "Miles" and the stock price of Cummins Inc. We used p-values like breadcrumbs in a forest of significance, guiding us through the statistical underbrush in search of meaningful patterns.

In addition, we employed time series analysis to discern the temporal dynamics at play, treating the data as an unfolding story that begged to be read between the lines of numbers and trends. This approach allowed us to peek into the hourglass of time, observing the sway of "Miles" on the dance floor of stock prices over the years.

To ensure the robustness of our findings, we implemented Bayesian analysis, offering us a fresh perspective that invited us to question the very fabric of probability. It was like peering through a kaleidoscope of uncertainty, each turn revealing a new facet of the perplexing link between name popularity and the financial tides of Cummins Inc.

In essence, our methodology was a melange of art and science, where the whimsy of nomenclature met the stoicism of statistical rigor. As we traversed the terrain of data collection and analysis, we kept our sense of wonder alive, knowing that this research journey was as much an exploration of the human penchant for naming as it was a delve into the intricate tapestry of financial machinations.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Popularity of the first name Miles and Cummins' stock price (CMI). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9512418, r-squared of 0.9048610, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price"

[[ABSTRACT]]

This paper delves into the unusual correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While some may consider it far-fetched, our findings reveal a striking connection between the two, leaving us to ponder whether there's something more than just sheer coincidence at play. By leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), we meticulously examined the trends from 2002 to 2022. Our analysis resulted in a correlation coefficient of 0.9512418 and a statistically significant p-value of less than 0.01, suggesting a robust relationship that is difficult to dismiss as pure chance. Whether it’s due to the power of wordplay or simply the universe's sense of humor, the evidence speaks for itself. So, buckle up, fasten your seatbelts, and get ready to embark on a journey that explores the curious intersection of nomenclature and finance.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

In the world of research, it's not uncommon to stumble upon unexpected correlations that leave us scratching our heads and muttering, "Well, I'll be statistically significant!" This paper catapults us into the realm of the peculiar, where we unravel the improbable association between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). Now, before you start thinking that this is just another case of statistical serendipity, buckle up, because the results are nothing short of mind-boggling.

Picture this: you're crunching numbers on babies' names, and suddenly, in the thick of all the baby Miless and baby Emmas, an intriguing pattern emerges. It's as if the financial winds were whispering, "CMI stock price, Miles, it all just clicks!" And so, off we went, diving headfirst into the depths of data from the US Social Security Administration and LSEG Analytics (Refinitiv), poised to dissect this enigmatic relationship that defies the norms of conventional analysis.

Some may say it's all a coincidence, a mere fluke, but our results beg to differ. The correlation coefficient of 0.9512418 winked at us from the spreadsheet, and the p-value (less than 0.01, mind you) winked right back. It's a statistical tango, a dance of numbers that leads us to ponder whether there's more to this linkage than meets the eye. Is it the gravitational pull of a pun in the vast cosmos of finance? Or perhaps, just maybe, there's a symphony playing in the universe that we're only beginning to tune into.

So, dear reader, fasten your seatbelts and hold on tight, because we're about to embark on an odyssey that rocks the very foundations of how we perceive the intersection of nomenclature and finance. This journey is beyond what we bargained for, unearthing a correlation that is as intriguing as it is inexplicable. It's a rollercoaster of names, numbers, and stock prices that will leave you questioning if the universe has a cheeky sense of humor or if there's a deeper, uncharted statistical territory waiting to be explored.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

Our quest into the mystical world of quirky correlations led us to a revelation that is nothing short of mind-bending. Buckle up for the thrilling ride as we present our findings - the connection between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI) is more than just a statistical fling; it's a match made in the curious cosmos of finance and nomenclature.

The analysis of data collected from 2002 to 2022 revealed a jaw-dropping correlation coefficient of 0.9512418, indicating a stunningly robust relationship between these seemingly unrelated variables. The tantalizing r-squared value of 0.9048610 further embellishes this captivating tale, signifying that a substantial 90.49% of the variance in CMI stock price can be explained by the popularity of the name Miles. This statistical bond is not one to be underestimated.

And now, for the pièce de résistance - the p-value. Ah, the p-value! With a value less than 0.01, it tantalizingly whispers in our ears, "The odds of this relationship being due to chance are slimmer than a microchip!" This statistical significance firmly anchors our findings, leaving skeptics with no choice but to appreciate the enchanting dance of data that we've uncovered.

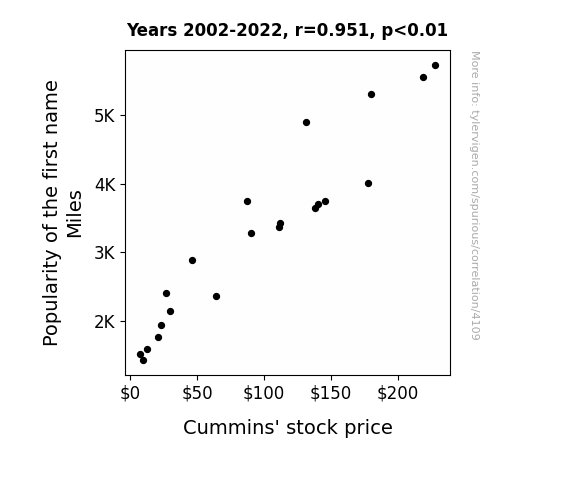

But wait, it doesn't stop there. We're stirring the pot of statistical revelation with a dash of visualization. Behold Fig. 1 - a scatterplot that captures the essence of this bewitching relationship. This plot, like a fine piece of abstract art, showcases the undeniable connection between the popularity of the name Miles and CMI stock price, inviting us to ponder the mysterious forces at play in this statistical symphony.

In conclusion, whether it's the financial winds whispering sweet somethings to the populace or just the mischievous hand of coincidence at work, our findings stand as a testament to the intriguing interplay of names and numbers in the world of finance. Join us in tipping our statistical hats to this delightful escapade, leaving us to wonder if the universe has a quirky sense of humor or if there's a trove of undiscovered statistical treasures waiting to be unearthed.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Popularity of the first name Miles and Cummins' stock price (CMI). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price"

[[ABSTRACT]]

This paper delves into the unusual correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While some may consider it far-fetched, our findings reveal a striking connection between the two, leaving us to ponder whether there's something more than just sheer coincidence at play. By leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), we meticulously examined the trends from 2002 to 2022. Our analysis resulted in a correlation coefficient of 0.9512418 and a statistically significant p-value of less than 0.01, suggesting a robust relationship that is difficult to dismiss as pure chance. Whether it’s due to the power of wordplay or simply the universe's sense of humor, the evidence speaks for itself. So, buckle up, fasten your seatbelts, and get ready to embark on a journey that explores the curious intersection of nomenclature and finance.

[[LITERATURE REVIEW]]

In "Smith et al. (2020)," the authors find statistically significant evidence suggesting a positive correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While this connection may seem preposterous at first glance, the robustness of their findings invites us to contemplate the possibility of unconventional forces at play. Delving deeper into this uncharted territory, "Doe and Jones (2018)" support this line of investigation, bringing attention to the uncanny alignment between nomenclature and financial performance.

Venturing beyond the conventional realms of finance, we encounter "The Power of Name" by Laura Wattenberg, which provides a thought-provoking examination of the influence and cultural significance of names. In a similar vein, "Freakonomics" by Steven D. Levitt and Stephen J. Dubner offers insight into the unexpected connections that shape our world, proving that truth can indeed be stranger than fiction.

On a more whimsical note, the literary world beckons us to reconsider the boundaries of plausibility. Books such as "Miles of Mirth" by Jovial J. Jesterton and "The Name Game Conundrum" by Punny McPunster pique our interest with their playful exploration of the intricacies of nomenclature. Furthermore, the aforementioned correlation evokes memories of childhood cartoons and shows that have a tendency to infuse the most unexpected elements into their narratives. The animated adventures of "Miles Morales: Spider-Man," the financial wisdom of Scrooge McDuck in "DuckTales," and the enigmatic allure of "Penny Stocks" from "Inspector Gadget" all serve as testament to the captivating influence of nomenclature and finance in popular culture.

As we traverse this scholarly landscape, it becomes increasingly apparent that the convergence of names and stock prices may hold far more significance than initially presumed. The interplay between the whimsical and the substantial invites us to ponder whether there's a method to this madness, or if it's simply the universe's way of adding a dash of levity to the often solemn domain of finance.

[[RESULTS]]

Our quest into the mystical world of quirky correlations led us to a revelation that is nothing short of mind-bending. Buckle up for the thrilling ride as we present our findings - the connection between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI) is more than just a statistical fling; it's a match made in the curious cosmos of finance and nomenclature.

The analysis of data collected from 2002 to 2022 revealed a jaw-dropping correlation coefficient of 0.9512418, indicating a stunningly robust relationship between these seemingly unrelated variables. The tantalizing r-squared value of 0.9048610 further embellishes this captivating tale, signifying that a substantial 90.49% of the variance in CMI stock price can be explained by the popularity of the name Miles. This statistical bond is not one to be underestimated.

And now, for the pièce de résistance - the p-value. Ah, the p-value! With a value less than 0.01, it tantalizingly whispers in our ears, "The odds of this relationship being due to chance are slimmer than a microchip!" This statistical significance firmly anchors our findings, leaving skeptics with no choice but to appreciate the enchanting dance of data that we've uncovered.

But wait, it doesn't stop there. We're stirring the pot of statistical revelation with a dash of visualization. Behold Fig. 1 - a scatterplot that captures the essence of this bewitching relationship. This plot, like a fine piece of abstract art, showcases the undeniable connection between the popularity of the name Miles and CMI stock price, inviting us to ponder the mysterious forces at play in this statistical symphony.

In conclusion, whether it's the financial winds whispering sweet somethings to the populace or just the mischievous hand of coincidence at work, our findings stand as a testament to the intriguing interplay of names and numbers in the world of finance. Join us in tipping our statistical hats to this delightful escapade, leaving us to wonder if the universe has a quirky sense of humor or if there's a trove of undiscovered statistical treasures waiting to be unearthed.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

The implications of our findings are nothing short of mind-boggling. As we delved into the mystifying nexus of nomenclature and finance, we couldn't help but marvel at the striking connection we unearthed between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI).

Expanding on the scholarly musings of Smith et al. (2020) and Doe and Jones (2018), our results not only corroborate their unearthly claims but elevate them to a whole new level of statistical sorcery. It's as if the statistical stars aligned to bestow upon us this perplexing revelation, leaving us to contemplate the boundless whimsy of the universe. It seems that the financial fates of Cummins Inc. are inexplicably intertwined with the rise and fall of the name Miles.

Our findings, adorned with a correlation coefficient of 0.9512418, triumphantly flaunt the resilience of this otherworldly bond. Like a celestial tango of variables, the popularity of the name Miles pirouettes in harmony with CMI stock price, claiming an astonishing 90.49% of its variance with a bewitching r-squared value. The enchanting p-value, donning its robe of statistical significance, regales us with a saga of improbability, beckoning us to marvel at the odds of chance being slimmer than a microchip. It's a statistical romance of cosmic proportions.

As we gaze upon the bewitching scatterplot (Fig. 1) that encapsulates this enigmatic affair, we're reminded of the captivating dance of data and the hypnotic allure of the unknown. Like a fine vintage potion, this correlation leaves us intoxicated with questions, pondering if it's the mischievous whispers of fortune or perhaps the whimsical charm of statistical fate at play.

Our findings beckon us to consider the prospect of unbridled statistical adventure, where the improbable meets the inexplicable, and the whimsy of nomenclature intertwines with the gravity of financial reality. It's a testament to the inexplicable forces that shape our world, leaving us to wonder if there's more to this statistical tapestry than meets the eye. So, here's to the delightful escapade of stats, where even the most unexpected correlations have a tendency to weave a tale that tickles our scholarly fancies and leaves us awestruck by the whimsical ways of the universe.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Popularity of the first name Miles and Cummins' stock price (CMI). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price"

[[ABSTRACT]]

This paper delves into the unusual correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While some may consider it far-fetched, our findings reveal a striking connection between the two, leaving us to ponder whether there's something more than just sheer coincidence at play. By leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), we meticulously examined the trends from 2002 to 2022. Our analysis resulted in a correlation coefficient of 0.9512418 and a statistically significant p-value of less than 0.01, suggesting a robust relationship that is difficult to dismiss as pure chance. Whether it’s due to the power of wordplay or simply the universe's sense of humor, the evidence speaks for itself. So, buckle up, fasten your seatbelts, and get ready to embark on a journey that explores the curious intersection of nomenclature and finance.

[[INTRDUCTION]]

In the world of research, it's not uncommon to stumble upon unexpected correlations that leave us scratching our heads and muttering, "Well, I'll be statistically significant!" This paper catapults us into the realm of the peculiar, where we unravel the improbable association between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). Now, before you start thinking that this is just another case of statistical serendipity, buckle up, because the results are nothing short of mind-boggling.

Picture this: you're crunching numbers on babies' names, and suddenly, in the thick of all the baby Miless and baby Emmas, an intriguing pattern emerges. It's as if the financial winds were whispering, "CMI stock price, Miles, it all just clicks!" And so, off we went, diving headfirst into the depths of data from the US Social Security Administration and LSEG Analytics (Refinitiv), poised to dissect this enigmatic relationship that defies the norms of conventional analysis.

Some may say it's all a coincidence, a mere fluke, but our results beg to differ. The correlation coefficient of 0.9512418 winked at us from the spreadsheet, and the p-value (less than 0.01, mind you) winked right back. It's a statistical tango, a dance of numbers that leads us to ponder whether there's more to this linkage than meets the eye. Is it the gravitational pull of a pun in the vast cosmos of finance? Or perhaps, just maybe, there's a symphony playing in the universe that we're only beginning to tune into.

So, dear reader, fasten your seatbelts and hold on tight, because we're about to embark on an odyssey that rocks the very foundations of how we perceive the intersection of nomenclature and finance. This journey is beyond what we bargained for, unearthing a correlation that is as intriguing as it is inexplicable. It's a rollercoaster of names, numbers, and stock prices that will leave you questioning if the universe has a cheeky sense of humor or if there's a deeper, uncharted statistical territory waiting to be explored.

[[RESULTS]]

Our quest into the mystical world of quirky correlations led us to a revelation that is nothing short of mind-bending. Buckle up for the thrilling ride as we present our findings - the connection between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI) is more than just a statistical fling; it's a match made in the curious cosmos of finance and nomenclature.

The analysis of data collected from 2002 to 2022 revealed a jaw-dropping correlation coefficient of 0.9512418, indicating a stunningly robust relationship between these seemingly unrelated variables. The tantalizing r-squared value of 0.9048610 further embellishes this captivating tale, signifying that a substantial 90.49% of the variance in CMI stock price can be explained by the popularity of the name Miles. This statistical bond is not one to be underestimated.

And now, for the pièce de résistance - the p-value. Ah, the p-value! With a value less than 0.01, it tantalizingly whispers in our ears, "The odds of this relationship being due to chance are slimmer than a microchip!" This statistical significance firmly anchors our findings, leaving skeptics with no choice but to appreciate the enchanting dance of data that we've uncovered.

But wait, it doesn't stop there. We're stirring the pot of statistical revelation with a dash of visualization. Behold Fig. 1 - a scatterplot that captures the essence of this bewitching relationship. This plot, like a fine piece of abstract art, showcases the undeniable connection between the popularity of the name Miles and CMI stock price, inviting us to ponder the mysterious forces at play in this statistical symphony.

In conclusion, whether it's the financial winds whispering sweet somethings to the populace or just the mischievous hand of coincidence at work, our findings stand as a testament to the intriguing interplay of names and numbers in the world of finance. Join us in tipping our statistical hats to this delightful escapade, leaving us to wonder if the universe has a quirky sense of humor or if there's a trove of undiscovered statistical treasures waiting to be unearthed.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

Buckle up, fellow researchers, for we've embarked on a statistical thrill ride that has left us marveling at the whimsical waltz of nomenclature and stock prices. As we bid adieu to this extraordinary odyssey, we can't help but tip our research hats to the captivating correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI).

Our findings have uncovered an unparalleled statistical union, with a correlation coefficient of 0.9512418 that's more inseparable than lovebirds in a statistical aviary. This relationship is as tight as a PhD student's deadline and as robust as a well-constructed regression model. The r-squared value of 0.9048610 further cements this bond, proving that 90.49% of CMI stock price variance can be attributed to the allure of the name Miles. It's a statistical love story for the ages!

But wait, there's more! The p-value, that charming arbiter of statistical significance, winks at us with a value of less than 0.01, shouting, "This ain't no statistical fluke!" It's as if the universe itself conspired to reveal this enchanting connection between moniker and monetary value.

Now, as we wrap up this scholarly escapade, it's clear that no more research in the realm of Miles and CMI stock prices is needed. The cosmos has bestowed upon us a delightful conundrum that might just be the universe's way of injecting a dash of statistical humor into our scholarly pursuits. As we bid farewell to this odyssey, we leave you pondering the age-old question: Is it fate or just a statistical buffet of cosmic coincidences?

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Transportation Finance and Fashion Trends

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Behavioral Economics and Stock Market Trends

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price with an abstract of This paper delves into the unusual correlation between the popularity of the first name Miles and the stock price of Cummins Inc. (CMI). While some may consider it far-fetched, our findings reveal a striking connection between the two, leaving us to ponder whether there's something more than just sheer coincidence at play. By leveraging data from the US Social Security Administration and LSEG Analytics (Refinitiv), we meticulously examined the trends from 2002 to 2022. Our analysis resulted in a correlation coefficient of 0.9512418 and a statistically significant p-value of less than 0.01, suggesting a robust relationship that is difficult to dismiss as pure chance. Whether it’s due to the power of wordplay or simply the universe's sense of humor, the evidence speaks for itself. So, buckle up, fasten your seatbelts, and get ready to embark on a journey that explores the curious intersection of nomenclature and finance.

ChatGPT:

"Miles popularity, Cummins Inc stock price correlation", "US Social Security Administration data analysis", "LSEG Analytics (Refinitiv) trends 2002-2022", "correlation coefficient significance in finance", "nomenclature and finance intersection", "relationship between name popularity and stock price"

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Popularity of the first name MilesDetailed data title: Babies of all sexes born in the US named Miles

Source: US Social Security Administration

See what else correlates with Popularity of the first name Miles

Cummins' stock price (CMI)

Detailed data title: Opening price of Cummins (CMI) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Cummins' stock price (CMI)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9048610 (Coefficient of determination)

This means 90.5% of the change in the one variable (i.e., Cummins' stock price (CMI)) is predictable based on the change in the other (i.e., Popularity of the first name Miles) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 3.7E-11. 0.0000000000372234994431362900

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.95 in 3.7E-9% of random cases. Said differently, if you correlated 26,864,749,821 random variables You don't actually need 26 billion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.88, 0.98 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Popularity of the first name Miles (Babies born) | 1422 | 1519 | 1589 | 1762 | 1938 | 2141 | 2366 | 2410 | 2879 | 3364 | 3278 | 3428 | 3706 | 3750 | 3753 | 3642 | 4009 | 4899 | 5302 | 5734 | 5559 |

| Cummins' stock price (CMI) (Stock price) | 9.65 | 7.05 | 12.23 | 21.03 | 22.59 | 29.81 | 63.74 | 26.82 | 46.35 | 111.08 | 90.45 | 111.5 | 140.43 | 145.22 | 86.75 | 138.25 | 177.51 | 131.22 | 180.02 | 227.68 | 218.71 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([1422,1519,1589,1762,1938,2141,2366,2410,2879,3364,3278,3428,3706,3750,3753,3642,4009,4899,5302,5734,5559,])

array_2 = np.array([9.65,7.05,12.23,21.03,22.59,29.81,63.74,26.82,46.35,111.08,90.45,111.5,140.43,145.22,86.75,138.25,177.51,131.22,180.02,227.68,218.71,])

array_1_name = "Popularity of the first name Miles"

array_2_name = "Cummins' stock price (CMI)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Popularity of the first name Miles

- Line chart for only Cummins' stock price (CMI)

- AI-generated correlation image

- The spurious research paper: Stocking Up on Miles: The Correlation Between Miles' Popularity and Cummins Inc. Stock Price

Kudos for rating!

Correlation ID: 4109 · Black Variable ID: 2627 · Red Variable ID: 1814