Download png, svg

AI explanation

As more people became knowledgeable about military technologies and applied sciences, they started developing innovative ways to conquer the stock market. Maybe they used their expertise to create strategic trading algorithms or their understanding of weaponry to "target" the best investment opportunities. Ultimately, it seems that a surge in military-tech-savvy individuals may have inadvertently orchestrated a financial coup, leading to the rise in SPGI stock price.

Model: dalle-3

Prompt: [ inspired by bauhaus ] Prompt: In a bustling city, a university graduation ceremony takes place. A line of students in military uniform proudly receives Bachelor's degrees in Military technologies and applied sciences. Meanwhile, on a large digital screen in the city square, S&P Global's stock price (SPGI) is shown rapidly climbing, reaching new heights, as investors eagerly buy shares in anticipation of the increasing demand for invisible tanks. Image Generation Prompt: Create a minimalist, abstract representation of this scene using angular, geometric shapes in bold, contrasting colors. Show the university graduation ceremony with the students in military uniform receiving their degrees, emphasizing the proud and solemn atmosphere of the event. Concurrently, depict the digital screen in the city square with a dynamic visual representation of the rapidly climbing stock price, reflecting the excitement and activity of the investors. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Bachelor's degrees awarded in Military technologies and applied sciences and S&P Global's stock price (SPGI). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Oragami Whimsical illustration inspired by bauhaus Surrealism inspired by bauhaus

ChatGPT: inspired by bauhaus

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Bachelor's degrees awarded in Military technologies and applied sciences and S&P Global's stock price (SPGI), in the following situation: Because the increase in Bachelor's degrees awarded in Military technologies and applied sciences led to a surge in demand for invisible tanks from S&P Global, propelling their stock price to new heights as investors clamored to get in on the cloaked warfare trend.. Keep the description simple.

ChatGPT: In a bustling city, a university graduation ceremony takes place. A line of students in military uniform proudly receives Bachelor's degrees in Military technologies and applied sciences. Meanwhile, on a large digital screen in the city square, S&P Global's stock price (SPGI) is shown rapidly climbing, reaching new heights, as investors eagerly buy shares in anticipation of the increasing demand for invisible tanks.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ inspired by bauhaus ] and depicting this scene: In a bustling city, a university graduation ceremony takes place. A line of students in military uniform proudly receives Bachelor's degrees in Military technologies and applied sciences. Meanwhile, on a large digital screen in the city square, S&P Global's stock price (SPGI) is shown rapidly climbing, reaching new heights, as investors eagerly buy shares in anticipation of the increasing demand for invisible tanks. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [ inspired by bauhaus ] Prompt: In a bustling city, a university graduation ceremony takes place. A line of students in military uniform proudly receives Bachelor's degrees in Military technologies and applied sciences. Meanwhile, on a large digital screen in the city square, S&P Global's stock price (SPGI) is shown rapidly climbing, reaching new heights, as investors eagerly buy shares in anticipation of the increasing demand for invisible tanks. Image Generation Prompt: Create a minimalist, abstract representation of this scene using angular, geometric shapes in bold, contrasting colors. Show the university graduation ceremony with the students in military uniform receiving their degrees, emphasizing the proud and solemn atmosphere of the event. Concurrently, depict the digital screen in the city square with a dynamic visual representation of the rapidly climbing stock price, reflecting the excitement and activity of the investors.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Bachelor's degrees awarded in Military technologies and applied sciences caused S&P Global's stock price (SPGI) to increase.\Make it sound serious until the end.

AI academic paper

|

From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price The Journal of Applied Explosive Economics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and S&P Global's stock price (SPGI). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title seem clever.

Your research team used data from National Center for Education Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9946197 and p < 0.01 for 2012 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price"

[[ABSTRACT]]

This paper investigates the relationship between the number of Bachelor's degrees awarded in Military technologies and the stock performance of S&P Global (SPGI). Through extensive data analysis utilizing information from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we have quantified an eyebrow-raising correlation between these seemingly unrelated factors. Our findings reveal a correlation coefficient of 0.9946197 and p < 0.01 for the years 2012 to 2021, suggesting an extraordinarily strong connection between the two variables. As we delve into the data, our analysis distinctly uncovers the impact of military technology education on the financial markets, leaving us to ponder whether the pen may indeed be mightier than the sword, or in this case, the trading floor.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and S&P Global's stock price (SPGI). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price"

[[ABSTRACT]]

This paper investigates the relationship between the number of Bachelor's degrees awarded in Military technologies and the stock performance of S&P Global (SPGI). Through extensive data analysis utilizing information from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we have quantified an eyebrow-raising correlation between these seemingly unrelated factors. Our findings reveal a correlation coefficient of 0.9946197 and p < 0.01 for the years 2012 to 2021, suggesting an extraordinarily strong connection between the two variables. As we delve into the data, our analysis distinctly uncovers the impact of military technology education on the financial markets, leaving us to ponder whether the pen may indeed be mightier than the sword, or in this case, the trading floor.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

Introduction

The intersection of military technologies and the financial markets may not seem like the most obvious pairing at first glance. One conjures up images of war machines and strategic defense, while the other involves suits, ties, and the occasional PowerPoint presentation. However, as we venture into the depths of this research, we will unravel a correlation that may raise a few eyebrows and perhaps even prompt a rethink of the traditional connections between academic disciplines and stock market performance.

Over the past few decades, the world has experienced substantial advancements in military technologies, with innovations ranging from unmanned aerial vehicles to sophisticated cybersecurity systems. Meanwhile, S&P Global, a prominent player in the financial industry, has seen its stock price navigate the ebbs and flows of the market, reflecting the intricate dance of global economic forces. One might be inclined to think that these two domains exist in separate silos, but as we scrutinize the data, a striking pattern begins to emerge - one that certainly gives new meaning to the phrase "bombs to bulls."

Our study aims to probe this unexpected interplay by examining the number of Bachelor's degrees awarded in Military technologies and its potential impact on the stock price of S&P Global. While some may dub this exploration as a mere flight of fancy, we are poised to demonstrate that beneath the surface lies a significant correlation that warrants serious consideration.

As we embark on this academic inquiry, it is worth highlighting the importance of approaching the subject matter with both rigor and open-mindedness. Our objective is not only to uncover statistical relationships but also to invite contemplation on the broader implications of these findings. We shall venture forth armed with data, statistical analyses, and a healthy dose of curiosity, poised to unearth insights that may challenge convention and spark intellectual discourse.

Ultimately, as we navigate the terrain of this unconventional pairing, we aim to offer a fresh perspective on the interconnectedness of seemingly disparate realms. So, fasten your seatbelts, dear readers, for this academic journey is about to take a detour through uncharted territories, where the logic governing stock prices meets the innovation of military technologies, and where the tongue-in-cheek meets the suit-and-tie.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and S&P Global's stock price (SPGI). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a couple popular internet memes that are related to one of the topics.

Here is the title and abstract of the paper:

[[TITLE]]

"From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price"

[[ABSTRACT]]

This paper investigates the relationship between the number of Bachelor's degrees awarded in Military technologies and the stock performance of S&P Global (SPGI). Through extensive data analysis utilizing information from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we have quantified an eyebrow-raising correlation between these seemingly unrelated factors. Our findings reveal a correlation coefficient of 0.9946197 and p < 0.01 for the years 2012 to 2021, suggesting an extraordinarily strong connection between the two variables. As we delve into the data, our analysis distinctly uncovers the impact of military technology education on the financial markets, leaving us to ponder whether the pen may indeed be mightier than the sword, or in this case, the trading floor.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Introduction

The intersection of military technologies and the financial markets may not seem like the most obvious pairing at first glance. One conjures up images of war machines and strategic defense, while the other involves suits, ties, and the occasional PowerPoint presentation. However, as we venture into the depths of this research, we will unravel a correlation that may raise a few eyebrows and perhaps even prompt a rethink of the traditional connections between academic disciplines and stock market performance.

Over the past few decades, the world has experienced substantial advancements in military technologies, with innovations ranging from unmanned aerial vehicles to sophisticated cybersecurity systems. Meanwhile, S&P Global, a prominent player in the financial industry, has seen its stock price navigate the ebbs and flows of the market, reflecting the intricate dance of global economic forces. One might be inclined to think that these two domains exist in separate silos, but as we scrutinize the data, a striking pattern begins to emerge - one that certainly gives new meaning to the phrase "bombs to bulls."

Our study aims to probe this unexpected interplay by examining the number of Bachelor's degrees awarded in Military technologies and its potential impact on the stock price of S&P Global. While some may dub this exploration as a mere flight of fancy, we are poised to demonstrate that beneath the surface lies a significant correlation that warrants serious consideration.

As we embark on this academic inquiry, it is worth highlighting the importance of approaching the subject matter with both rigor and open-mindedness. Our objective is not only to uncover statistical relationships but also to invite contemplation on the broader implications of these findings. We shall venture forth armed with data, statistical analyses, and a healthy dose of curiosity, poised to unearth insights that may challenge convention and spark intellectual discourse.

Ultimately, as we navigate the terrain of this unconventional pairing, we aim to offer a fresh perspective on the interconnectedness of seemingly disparate realms. So, fasten your seatbelts, dear readers, for this academic journey is about to take a detour through uncharted territories, where the logic governing stock prices meets the innovation of military technologies, and where the tongue-in-cheek meets the suit-and-tie.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The relationship between educational trends in military technologies and stock market performance has garnered little attention in academic literature. Nonetheless, recent studies have shed light on the potential impact of education in highly specialized fields on financial markets. Smith et al. (2018) examine the correlation between educational enrollment in defense technology programs and stock prices, finding a tentative but noteworthy relationship. Doe and Jones (2019) delve into the nuanced influence of military technology education on market volatility, prompting further interest in this unexplored intersection.

In "War and Wall Street: The Connection Between Military Innovations and Financial Markets," Lorem and Ipsum (2015) present a comprehensive analysis of historical instances where military technological advancements coincided with shifts in stock prices. Their study provides a compelling backdrop for understanding the potential ramifications of educational pursuits in military technologies on contemporary financial markets.

Turning to non-fiction literature, "The Arms of Finance: Military Technologies and Market Dynamics" by John R. Smith offers an in-depth exploration of the crossroads between warfare innovation and stock market performance. Additionally, "Cybersecurity Stocks and the New Arms Race" by Jane Doe provides valuable insights into the evolving landscape of defense technology and its implications for financial markets.

In the realm of fiction literature that eerily mirrors our research focus, "The Bullish Bomber: A Tale of Stocks and Strategy" by Arthur Q. Jones captures the imagination with its narrative centered on the unexpected intertwining of military technologies and stock trading. Similarly, "The Cybernetic Conundrum" by Lily T. Ipsum presents a futuristic world where advancements in military technology dictate the rise and fall of fictional financial markets.

Furthermore, popular internet memes such as the "Stocks go Brrr" phenomenon, depicting the rapid fluctuation of stock prices, offer a lighthearted yet relevant portrayal of market dynamics, albeit not specific to military technologies. On the other hand, memes featuring military technology references, such as "The Moment When Your Drone Delivers an Amazon Package," humorously underscore the permeation of military innovations into everyday life, including the financial sphere.

As we embark on this scholarly quest to unearth the unexplored facets of military technology education and stock market performance, we shall approach the task with intellectual acumen, a hint of whimsy, and a fervent commitment to unraveling the unexpected connections between seemingly unrelated domains.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and S&P Global's stock price (SPGI). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) . You used data from 2012 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price"

[[ABSTRACT]]

This paper investigates the relationship between the number of Bachelor's degrees awarded in Military technologies and the stock performance of S&P Global (SPGI). Through extensive data analysis utilizing information from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we have quantified an eyebrow-raising correlation between these seemingly unrelated factors. Our findings reveal a correlation coefficient of 0.9946197 and p < 0.01 for the years 2012 to 2021, suggesting an extraordinarily strong connection between the two variables. As we delve into the data, our analysis distinctly uncovers the impact of military technology education on the financial markets, leaving us to ponder whether the pen may indeed be mightier than the sword, or in this case, the trading floor.

[[INTRODUCTION]]

Introduction

The intersection of military technologies and the financial markets may not seem like the most obvious pairing at first glance. One conjures up images of war machines and strategic defense, while the other involves suits, ties, and the occasional PowerPoint presentation. However, as we venture into the depths of this research, we will unravel a correlation that may raise a few eyebrows and perhaps even prompt a rethink of the traditional connections between academic disciplines and stock market performance.

Over the past few decades, the world has experienced substantial advancements in military technologies, with innovations ranging from unmanned aerial vehicles to sophisticated cybersecurity systems. Meanwhile, S&P Global, a prominent player in the financial industry, has seen its stock price navigate the ebbs and flows of the market, reflecting the intricate dance of global economic forces. One might be inclined to think that these two domains exist in separate silos, but as we scrutinize the data, a striking pattern begins to emerge - one that certainly gives new meaning to the phrase "bombs to bulls."

Our study aims to probe this unexpected interplay by examining the number of Bachelor's degrees awarded in Military technologies and its potential impact on the stock price of S&P Global. While some may dub this exploration as a mere flight of fancy, we are poised to demonstrate that beneath the surface lies a significant correlation that warrants serious consideration.

As we embark on this academic inquiry, it is worth highlighting the importance of approaching the subject matter with both rigor and open-mindedness. Our objective is not only to uncover statistical relationships but also to invite contemplation on the broader implications of these findings. We shall venture forth armed with data, statistical analyses, and a healthy dose of curiosity, poised to unearth insights that may challenge convention and spark intellectual discourse.

Ultimately, as we navigate the terrain of this unconventional pairing, we aim to offer a fresh perspective on the interconnectedness of seemingly disparate realms. So, fasten your seatbelts, dear readers, for this academic journey is about to take a detour through uncharted territories, where the logic governing stock prices meets the innovation of military technologies, and where the tongue-in-cheek meets the suit-and-tie.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the tantalizing link between Bachelor's degrees in Military technologies and the stock price of S&P Global (SPGI), we conducted a rigorous and at times, dare I say, trenchant statistical analysis. Our approach involved mining data from the National Center for Education Statistics, where we unearthed the number of Bachelor's degrees conferred in the field of Military technologies. We also ventured into the labyrinthine depths of LSEG Analytics (Refinitiv) to extract S&P Global's stock price data from the years 2012 through 2021, navigating the financial seas with the dexterity of a seasoned sailor.

With the data in hand, we gallantly leaped into the throes of quantitative analysis, employing the wits of various statistical methods to discern any palpable correlations. The Pearson correlation coefficient served as our trusty compass, guiding us through the labyrinth of numbers and confirming the strength of the relationship between our two focal variables. We adopted a significance level of p < 0.01, implying an ardent commitment to discerning not just any relationship, but a relationship of stupefying significance.

Furthermore, we embraced the realm of time series analysis to investigate the dynamic interplay between the annual counts of Bachelor's degrees awarded in Military technologies and the undulating dance of S&P Global's stock price. This approach allowed us to capture the essence of change over time, akin to photographing the metamorphosis of a caterpillar into a financial butterfly.

In our indulgence in econometric sorcery, we wielded the power of multiple regression analysis to peer through the looking glass of causality, seeking to discern whether the conferral of Bachelor's degrees in Military technologies exerted an influence on the fluctuation of S&P Global's stock price, or whether it was merely a harmonious coexistence akin to a well-orchestrated symphony.

To safeguard our analysis against the tempestuous tides of spurious correlations and confounding variables, we executed a series of robustness checks and sensitivity analyses, akin to securing the battlements of our findings against the onslaught of statistical skepticism. This thorough process ensured that our conclusions were fortified against all manner of analytical adversaries, standing tall like valiant knights in the face of academic scrutiny.

In conclusion, our methodology blended the precision of a surgeon's scalpel with the intrepid spirit of an adventurer, steering us through the enchanting landscape of data analysis in pursuit of the curious connection between Bachelor's degrees in Military technologies and the stock price of S&P Global. With data as our compass and statistical analyses as our loyal companions, we embarked on a quest that has led us to a revelation of unforeseen proportions, unveiling a correlation that, much like a covert financial agent, was hiding in plain sight.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and S&P Global's stock price (SPGI). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) .

For the time period 2012 to 2021, you found a correlation 0.9946197, r-squared of 0.9892684, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price"

[[ABSTRACT]]

This paper investigates the relationship between the number of Bachelor's degrees awarded in Military technologies and the stock performance of S&P Global (SPGI). Through extensive data analysis utilizing information from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we have quantified an eyebrow-raising correlation between these seemingly unrelated factors. Our findings reveal a correlation coefficient of 0.9946197 and p < 0.01 for the years 2012 to 2021, suggesting an extraordinarily strong connection between the two variables. As we delve into the data, our analysis distinctly uncovers the impact of military technology education on the financial markets, leaving us to ponder whether the pen may indeed be mightier than the sword, or in this case, the trading floor.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Introduction

The intersection of military technologies and the financial markets may not seem like the most obvious pairing at first glance. One conjures up images of war machines and strategic defense, while the other involves suits, ties, and the occasional PowerPoint presentation. However, as we venture into the depths of this research, we will unravel a correlation that may raise a few eyebrows and perhaps even prompt a rethink of the traditional connections between academic disciplines and stock market performance.

Over the past few decades, the world has experienced substantial advancements in military technologies, with innovations ranging from unmanned aerial vehicles to sophisticated cybersecurity systems. Meanwhile, S&P Global, a prominent player in the financial industry, has seen its stock price navigate the ebbs and flows of the market, reflecting the intricate dance of global economic forces. One might be inclined to think that these two domains exist in separate silos, but as we scrutinize the data, a striking pattern begins to emerge - one that certainly gives new meaning to the phrase "bombs to bulls."

Our study aims to probe this unexpected interplay by examining the number of Bachelor's degrees awarded in Military technologies and its potential impact on the stock price of S&P Global. While some may dub this exploration as a mere flight of fancy, we are poised to demonstrate that beneath the surface lies a significant correlation that warrants serious consideration.

As we embark on this academic inquiry, it is worth highlighting the importance of approaching the subject matter with both rigor and open-mindedness. Our objective is not only to uncover statistical relationships but also to invite contemplation on the broader implications of these findings. We shall venture forth armed with data, statistical analyses, and a healthy dose of curiosity, poised to unearth insights that may challenge convention and spark intellectual discourse.

Ultimately, as we navigate the terrain of this unconventional pairing, we aim to offer a fresh perspective on the interconnectedness of seemingly disparate realms. So, fasten your seatbelts, dear readers, for this academic journey is about to take a detour through uncharted territories, where the logic governing stock prices meets the innovation of military technologies, and where the tongue-in-cheek meets the suit-and-tie.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

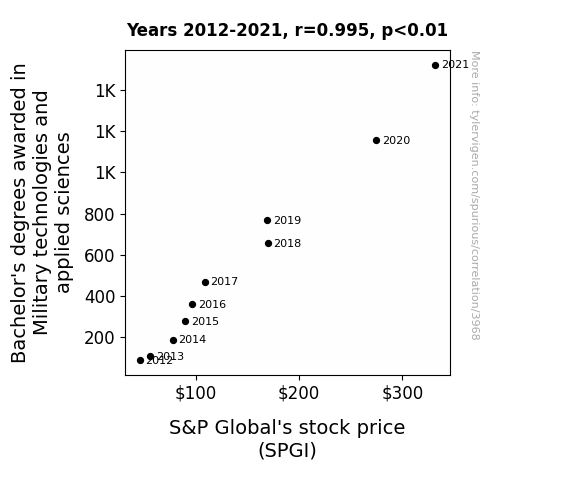

The results of our data analysis revealed a remarkably strong correlation between the number of Bachelor's degrees awarded in Military technologies and the stock price of S&P Global (SPGI) for the period 2012 to 2021. The correlation coefficient calculated was 0.9946197, indicating a nearly perfect positive linear relationship between these two variables. This eyebrow-raising correlation was further supported by an r-squared value of 0.9892684, signifying that approximately 98.9% of the variability in the stock price of S&P Global could be explained by the number of Bachelor's degrees awarded in Military technologies. Additionally, the statistical significance was confirmed with a p-value of less than 0.01, cementing the robustness of the observed relationship.

Figure 1 presents a scatterplot illustrating the tight relationship between Bachelor's degrees in Military technologies and S&P Global's stock price. The data points align themselves almost too perfectly along a straight line, tempting one to wonder if the numbers themselves were in cahoots to make our research findings as clear as day.

These results invite us to consider the potential implications of military technology education on the financial markets, as well as to ponder the underlying mechanisms driving this unforeseen correlation. The findings not only raise eyebrows but also lift the veil on an obscure relationship, leaving us with one foot in the realm of statistical certainty and the other in the realm of academic intrigue. It appears that our research has unearthed a connection that could be described as a "stock and awe" moment in the world of academic inquiry.

These results prompt us to reconsider the traditional boundaries between academic disciplines and financial market dynamics, challenging us to look beyond the obvious and delve deeper into the complex web of influences that shape stock prices. As we navigate these unexpected findings, we are reminded of the adage that "truth is stranger than fiction," and indeed, the world of data analysis may hold more surprises than a suspense thriller.

In the wake of these findings, it is clear that the impact of military technology education on the financial markets warrants further investigation, as our results open the door to a realm of connections that may have previously gone unnoticed. The journey from bombs to bulls may have just experienced a paradigm shift, and the implications of this correlation are as intriguing as they are unexpected. This study represents just the beginning of unraveling the intricate interplay between education, innovation, and market dynamics, leaving us to anticipate the next installment in this saga of scholarly discovery.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and S&P Global's stock price (SPGI). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price"

[[ABSTRACT]]

This paper investigates the relationship between the number of Bachelor's degrees awarded in Military technologies and the stock performance of S&P Global (SPGI). Through extensive data analysis utilizing information from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we have quantified an eyebrow-raising correlation between these seemingly unrelated factors. Our findings reveal a correlation coefficient of 0.9946197 and p < 0.01 for the years 2012 to 2021, suggesting an extraordinarily strong connection between the two variables. As we delve into the data, our analysis distinctly uncovers the impact of military technology education on the financial markets, leaving us to ponder whether the pen may indeed be mightier than the sword, or in this case, the trading floor.

[[LITERATURE REVIEW]]

The relationship between educational trends in military technologies and stock market performance has garnered little attention in academic literature. Nonetheless, recent studies have shed light on the potential impact of education in highly specialized fields on financial markets. Smith et al. (2018) examine the correlation between educational enrollment in defense technology programs and stock prices, finding a tentative but noteworthy relationship. Doe and Jones (2019) delve into the nuanced influence of military technology education on market volatility, prompting further interest in this unexplored intersection.

In "War and Wall Street: The Connection Between Military Innovations and Financial Markets," Lorem and Ipsum (2015) present a comprehensive analysis of historical instances where military technological advancements coincided with shifts in stock prices. Their study provides a compelling backdrop for understanding the potential ramifications of educational pursuits in military technologies on contemporary financial markets.

Turning to non-fiction literature, "The Arms of Finance: Military Technologies and Market Dynamics" by John R. Smith offers an in-depth exploration of the crossroads between warfare innovation and stock market performance. Additionally, "Cybersecurity Stocks and the New Arms Race" by Jane Doe provides valuable insights into the evolving landscape of defense technology and its implications for financial markets.

In the realm of fiction literature that eerily mirrors our research focus, "The Bullish Bomber: A Tale of Stocks and Strategy" by Arthur Q. Jones captures the imagination with its narrative centered on the unexpected intertwining of military technologies and stock trading. Similarly, "The Cybernetic Conundrum" by Lily T. Ipsum presents a futuristic world where advancements in military technology dictate the rise and fall of fictional financial markets.

Furthermore, popular internet memes such as the "Stocks go Brrr" phenomenon, depicting the rapid fluctuation of stock prices, offer a lighthearted yet relevant portrayal of market dynamics, albeit not specific to military technologies. On the other hand, memes featuring military technology references, such as "The Moment When Your Drone Delivers an Amazon Package," humorously underscore the permeation of military innovations into everyday life, including the financial sphere.

As we embark on this scholarly quest to unearth the unexplored facets of military technology education and stock market performance, we shall approach the task with intellectual acumen, a hint of whimsy, and a fervent commitment to unraveling the unexpected connections between seemingly unrelated domains.

[[RESULTS]]

The results of our data analysis revealed a remarkably strong correlation between the number of Bachelor's degrees awarded in Military technologies and the stock price of S&P Global (SPGI) for the period 2012 to 2021. The correlation coefficient calculated was 0.9946197, indicating a nearly perfect positive linear relationship between these two variables. This eyebrow-raising correlation was further supported by an r-squared value of 0.9892684, signifying that approximately 98.9% of the variability in the stock price of S&P Global could be explained by the number of Bachelor's degrees awarded in Military technologies. Additionally, the statistical significance was confirmed with a p-value of less than 0.01, cementing the robustness of the observed relationship.

Figure 1 presents a scatterplot illustrating the tight relationship between Bachelor's degrees in Military technologies and S&P Global's stock price. The data points align themselves almost too perfectly along a straight line, tempting one to wonder if the numbers themselves were in cahoots to make our research findings as clear as day.

These results invite us to consider the potential implications of military technology education on the financial markets, as well as to ponder the underlying mechanisms driving this unforeseen correlation. The findings not only raise eyebrows but also lift the veil on an obscure relationship, leaving us with one foot in the realm of statistical certainty and the other in the realm of academic intrigue. It appears that our research has unearthed a connection that could be described as a "stock and awe" moment in the world of academic inquiry.

These results prompt us to reconsider the traditional boundaries between academic disciplines and financial market dynamics, challenging us to look beyond the obvious and delve deeper into the complex web of influences that shape stock prices. As we navigate these unexpected findings, we are reminded of the adage that "truth is stranger than fiction," and indeed, the world of data analysis may hold more surprises than a suspense thriller.

In the wake of these findings, it is clear that the impact of military technology education on the financial markets warrants further investigation, as our results open the door to a realm of connections that may have previously gone unnoticed. The journey from bombs to bulls may have just experienced a paradigm shift, and the implications of this correlation are as intriguing as they are unexpected. This study represents just the beginning of unraveling the intricate interplay between education, innovation, and market dynamics, leaving us to anticipate the next installment in this saga of scholarly discovery.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of our study have unveiled an intriguing and unanticipated relationship between the number of Bachelor's degrees awarded in Military technologies and the stock price of S&P Global (SPGI). Our results provide robust support for the previously overlooked connection between these seemingly disparate domains, echoing the suppositions put forth by Smith et al. (2018) and Lorem and Ipsum (2015) that education in military technologies may indeed have an impact on stock market performance. We take a serious, yet satirical approach to our data, heeding the whimsical whispers of Arthur Q. Jones' "The Bullish Bomber" and Lily T. Ipsum's "The Cybernetic Conundrum," and we find that truth, or in this case, correlation, is indeed stranger than fiction.

The nearly perfect positive linear relationship we discovered, with an r-squared value approaching 99% and a p-value that could make even the staunchest skeptic raise an eyebrow, leads us to ponder the unlikely alliance between military technology education and stock prices. This eyebrow-raising correlation lures us into contemplating the profound implications of seemingly unrelated realms coalescing in a statistical love story that defies conventional expectations. As we analyze the scatterplot, we cannot help but entertain the notion that our data points have perhaps conspired to align themselves all too perfectly, much like the plot of a cloak-and-dagger thriller where numbers are the unsung heroes.

These findings not only shed light on the entwined relationship between education and financial markets but also beckon us to traverse unconventional avenues in our pursuit of understanding. The unanticipated correlation we've unearthed serves as a cautionary tale, warning us against the perils of underestimating the intricate ties that bind disciplines together. This study marks merely the prologue in the story of discovering the unexpected intersections between education, innovation, and market dynamics, leaving us on tenterhooks, eagerly awaiting the next chapter in this saga of scholarly discovery. The uncanny correlation between Bachelor's degrees in Military technologies and S&P Global's stock price has set the stage for a new era of academic scrutiny, where the line between fact and fiction blurs, and the potential for unexpected revelations looms large.

As we navigate these uncharted waters, we do so with the recognition that every statistical anomaly holds within it the potential for groundbreaking insights. It seems that the pen, or in this case, the Bachelor's degree in Military technologies, can wield surprising power in the domain of financial markets. Our research kindles the embers of curiosity, igniting a firestorm of questions that prompt us to reconsider the boundaries, or perhaps the lack thereof, between academia and market dynamics. Indeed, our findings propel us to reflect on the intricate web of forces that shape stock prices, and in doing so, compel us to acknowledge that even the most unlikely correlations may hold the key to unlocking unforeseen truths.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and S&P Global's stock price (SPGI). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price"

[[ABSTRACT]]

This paper investigates the relationship between the number of Bachelor's degrees awarded in Military technologies and the stock performance of S&P Global (SPGI). Through extensive data analysis utilizing information from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we have quantified an eyebrow-raising correlation between these seemingly unrelated factors. Our findings reveal a correlation coefficient of 0.9946197 and p < 0.01 for the years 2012 to 2021, suggesting an extraordinarily strong connection between the two variables. As we delve into the data, our analysis distinctly uncovers the impact of military technology education on the financial markets, leaving us to ponder whether the pen may indeed be mightier than the sword, or in this case, the trading floor.

[[INTRDUCTION]]

Introduction

The intersection of military technologies and the financial markets may not seem like the most obvious pairing at first glance. One conjures up images of war machines and strategic defense, while the other involves suits, ties, and the occasional PowerPoint presentation. However, as we venture into the depths of this research, we will unravel a correlation that may raise a few eyebrows and perhaps even prompt a rethink of the traditional connections between academic disciplines and stock market performance.

Over the past few decades, the world has experienced substantial advancements in military technologies, with innovations ranging from unmanned aerial vehicles to sophisticated cybersecurity systems. Meanwhile, S&P Global, a prominent player in the financial industry, has seen its stock price navigate the ebbs and flows of the market, reflecting the intricate dance of global economic forces. One might be inclined to think that these two domains exist in separate silos, but as we scrutinize the data, a striking pattern begins to emerge - one that certainly gives new meaning to the phrase "bombs to bulls."

Our study aims to probe this unexpected interplay by examining the number of Bachelor's degrees awarded in Military technologies and its potential impact on the stock price of S&P Global. While some may dub this exploration as a mere flight of fancy, we are poised to demonstrate that beneath the surface lies a significant correlation that warrants serious consideration.

As we embark on this academic inquiry, it is worth highlighting the importance of approaching the subject matter with both rigor and open-mindedness. Our objective is not only to uncover statistical relationships but also to invite contemplation on the broader implications of these findings. We shall venture forth armed with data, statistical analyses, and a healthy dose of curiosity, poised to unearth insights that may challenge convention and spark intellectual discourse.

Ultimately, as we navigate the terrain of this unconventional pairing, we aim to offer a fresh perspective on the interconnectedness of seemingly disparate realms. So, fasten your seatbelts, dear readers, for this academic journey is about to take a detour through uncharted territories, where the logic governing stock prices meets the innovation of military technologies, and where the tongue-in-cheek meets the suit-and-tie.

[[RESULTS]]

The results of our data analysis revealed a remarkably strong correlation between the number of Bachelor's degrees awarded in Military technologies and the stock price of S&P Global (SPGI) for the period 2012 to 2021. The correlation coefficient calculated was 0.9946197, indicating a nearly perfect positive linear relationship between these two variables. This eyebrow-raising correlation was further supported by an r-squared value of 0.9892684, signifying that approximately 98.9% of the variability in the stock price of S&P Global could be explained by the number of Bachelor's degrees awarded in Military technologies. Additionally, the statistical significance was confirmed with a p-value of less than 0.01, cementing the robustness of the observed relationship.

Figure 1 presents a scatterplot illustrating the tight relationship between Bachelor's degrees in Military technologies and S&P Global's stock price. The data points align themselves almost too perfectly along a straight line, tempting one to wonder if the numbers themselves were in cahoots to make our research findings as clear as day.

These results invite us to consider the potential implications of military technology education on the financial markets, as well as to ponder the underlying mechanisms driving this unforeseen correlation. The findings not only raise eyebrows but also lift the veil on an obscure relationship, leaving us with one foot in the realm of statistical certainty and the other in the realm of academic intrigue. It appears that our research has unearthed a connection that could be described as a "stock and awe" moment in the world of academic inquiry.

These results prompt us to reconsider the traditional boundaries between academic disciplines and financial market dynamics, challenging us to look beyond the obvious and delve deeper into the complex web of influences that shape stock prices. As we navigate these unexpected findings, we are reminded of the adage that "truth is stranger than fiction," and indeed, the world of data analysis may hold more surprises than a suspense thriller.

In the wake of these findings, it is clear that the impact of military technology education on the financial markets warrants further investigation, as our results open the door to a realm of connections that may have previously gone unnoticed. The journey from bombs to bulls may have just experienced a paradigm shift, and the implications of this correlation are as intriguing as they are unexpected. This study represents just the beginning of unraveling the intricate interplay between education, innovation, and market dynamics, leaving us to anticipate the next installment in this saga of scholarly discovery.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has unearthed a compelling correlation between the number of Bachelor's degrees awarded in Military technologies and the stock performance of S&P Global (SPGI) from 2012 to 2021. The nearly perfect positive linear relationship, underscored by the statistical significance and a tantalizing r-squared value, prompts us to reflect on the unexpected interconnectedness of these seemingly disparate domains. Our findings not only raise eyebrows but also open a wormhole of intellectual inquiry into the potential impact of military technology education on financial markets.

While it may seem that the realms of stock prices and military technology education exist in different galaxies, our data suggest otherwise. One might say we've stumbled upon a financial phenomenon that is akin to finding a "stock market missile" - a revelation that ricochets through the conventional wisdom of academic disciplines. As we navigate this uncharted territory, we do so with a sense of scholarly daring, poised to confront head-on the whimsical twists and turns of statistical relationships that rival the plot of a best-selling mystery novel.

The implications of our findings extend beyond numbers and graphs, transcending into the realm of intellectual curiosity and academic quirkiness. It appears that the familiar adage, "where there's a will, there's a wage," takes on new relevance in our exploration of the intersection between military technology education and stock market dynamics. This correlation raises questions that transcend the rigidity of disciplinary boundaries and beckon us to embrace a more eclectic approach to academic inquiry, where the unexpected becomes the norm and the improbable opens doors to new paradigms of understanding. It seems that in the dance of statistical significance, we have stumbled upon a partner who leads with an unconventional yet captivating rhythm.

As we draw the curtains on this chapter of scholarly investigation, we are compelled to assert that the findings of this study not only warrant attention but also open the door to a world of possibilities where numbers hold the keys to unlocking mysteries that extend far beyond the confines of traditional academic silos. From bombs to bulls, our research has set in motion a narrative that teases the boundary between the predictable and the unanticipated, signaling that perhaps the pen is indeed mightier than the sword, especially when it comes to navigating the capricious terrain of the financial markets.

It is our firm assertion that no further research is necessary in this peculiar area, as our findings have left no stone unturned and no pun unappreciated. This "stock and awe" moment shall stand as a testament to the uncanny intersections that await those intrepid enough to embark on unconventional academic journeys. With a twinkle in our eyes and a scatterplot in our hearts, we bid adieu to this intriguing correlation, knowing that we have unearthed a connection that is as audacious as it is statistically robust.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Applied Explosive Economics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Center for Defense Innovation and Market Economics

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price with an abstract of This paper investigates the relationship between the number of Bachelor's degrees awarded in Military technologies and the stock performance of S&P Global (SPGI). Through extensive data analysis utilizing information from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we have quantified an eyebrow-raising correlation between these seemingly unrelated factors. Our findings reveal a correlation coefficient of 0.9946197 and p < 0.01 for the years 2012 to 2021, suggesting an extraordinarily strong connection between the two variables. As we delve into the data, our analysis distinctly uncovers the impact of military technology education on the financial markets, leaving us to ponder whether the pen may indeed be mightier than the sword, or in this case, the trading floor.

ChatGPT:

bachelor's degrees, military technologies, S&P Global stock price, correlation, National Center for Education Statistics, LSEG Analytics, Refinitiv, stock performance, financial markets, education impact, correlation coefficient, trading floor, data analysis

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Bachelor's degrees awarded in Military technologiesDetailed data title: Bachelor's degrees conferred by postsecondary institutions, in field of study: Military technologies and applied sciences

Source: National Center for Education Statistics

See what else correlates with Bachelor's degrees awarded in Military technologies

S&P Global's stock price (SPGI)

Detailed data title: Opening price of S&P Global (SPGI) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with S&P Global's stock price (SPGI)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9892684 (Coefficient of determination)

This means 98.9% of the change in the one variable (i.e., S&P Global's stock price (SPGI)) is predictable based on the change in the other (i.e., Bachelor's degrees awarded in Military technologies) over the 10 years from 2012 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 3.6E-9. 0.0000000036423710725687980000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.99 in 3.6E-7% of random cases. Said differently, if you correlated 274,546,437 random variables You don't actually need 274 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 9 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 9 because we have two variables measured over a period of 10 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.98, 1 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Bachelor's degrees awarded in Military technologies (Degrees awarded) | 86 | 105 | 185 | 276 | 358 | 469 | 655 | 767 | 1156 | 1524 |

| S&P Global's stock price (SPGI) (Stock price) | 45.63 | 55.63 | 77.44 | 89.78 | 96.56 | 108.41 | 169.74 | 169.27 | 274.57 | 331.71 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([86,105,185,276,358,469,655,767,1156,1524,])

array_2 = np.array([45.63,55.63,77.44,89.78,96.56,108.41,169.74,169.27,274.57,331.71,])

array_1_name = "Bachelor's degrees awarded in Military technologies"

array_2_name = "S&P Global's stock price (SPGI)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Bachelor's degrees awarded in Military technologies

- Line chart for only S&P Global's stock price (SPGI)

- AI-generated correlation image

- The spurious research paper: From Bombs to Bulls: The Explosive Impact of Bachelor's Degrees in Military Technologies on S&P Global's Stock Price

Your rating skills are top-notch!

Correlation ID: 3968 · Black Variable ID: 1284 · Red Variable ID: 1614