Download png, svg

AI explanation

As more students became versed in military tech, they started a rumor that Danaher had developed a top-secret robot army. This led to a spike in demand for Danaher's stock as investors clamored to get in on the potential robot uprising. The rumor mill churned out more hype than a turbo-charged drone, propelling Danaher's stock price to new heights.

Model: dalle-3

Prompt: Generate an image of a woodblock painting depicting a group of proud graduates, dressed in military attire, standing in front of a grand military research facility. They are proudly showcasing their latest inventions - the "Combat Calculator" and the "Tactical Treadmill." In the background, there is a stock price ticker for Danaher (DHR) displaying a steady climb, symbolizing the growing anticipation and impact of these innovative weapons on future warfare. The scene should exude a sense of honor and anticipation, with the graduates and the facility prominently outlined against a serene backdrop. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Bachelor's degrees awarded in Military technologies and applied sciences and Danaher's stock price (DHR). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Macabre Cute cartoon An image that looks like it is a scene from A Disney Movie Magic realism Woodblock painting

ChatGPT: Woodblock painting

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Bachelor's degrees awarded in Military technologies and applied sciences and Danaher's stock price (DHR), in the following situation: Because more graduates were trained in military technologies, they developed innovative weaponry like the "Combat Calculator" and "Tactical Treadmill," boosting Danaher's stock as investors anticipated futuristic warfare filled with high-tech gadgets and weaponry, leading to an increase in stock price!. Keep the description simple.

ChatGPT: A group of graduates in military technologies and applied sciences proudly stand in front of a military research facility, showcasing their latest inventions - the "Combat Calculator" and the "Tactical Treadmill." In the background, the stock price ticker for Danaher (DHR) displays a steady climb as investors anticipate the impact of these innovative weapons on future warfare.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Woodblock painting ] and depicting this scene: A group of graduates in military technologies and applied sciences proudly stand in front of a military research facility, showcasing their latest inventions - the "Combat Calculator" and the "Tactical Treadmill." In the background, the stock price ticker for Danaher (DHR) displays a steady climb as investors anticipate the impact of these innovative weapons on future warfare. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a woodblock painting depicting a group of proud graduates, dressed in military attire, standing in front of a grand military research facility. They are proudly showcasing their latest inventions - the "Combat Calculator" and the "Tactical Treadmill." In the background, there is a stock price ticker for Danaher (DHR) displaying a steady climb, symbolizing the growing anticipation and impact of these innovative weapons on future warfare. The scene should exude a sense of honor and anticipation, with the graduates and the facility prominently outlined against a serene backdrop.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Bachelor's degrees awarded in Military technologies and applied sciences caused Danaher's stock price (DHR) to increase. Make it feel plausible.

AI academic paper

|

Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition The Journal of Military Economics and Stock Behavior Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and Danaher's stock price (DHR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Rhyme words in the title.

Your research team used data from National Center for Education Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9840657 and p < 0.01 for 2012 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition

[[ABSTRACT]]

In this paper, we delve into the intriguing intersection of academic degrees in military technologies and the stock price reflexes of Danaher Corporation (DHR). Utilizing comprehensive data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we meticulously analyze the correlation between the annual number of Bachelor's degrees awarded in Military technologies and the stock price kinetics of Danaher from 2012 to 2021. Surprisingly, we unveil a strikingly high correlation coefficient of 0.9840657 while maintaining a p-value less than 0.01, raising more eyebrows than a unibrow connoisseur. Our findings exude an undeniable connection between the inclination towards military technologies in academia and Danaher's stock performance, shedding light on a peculiar phenomenon. This research not only highlights the unexpected correlation, but also invites stimulating discussions and queries on the systematic interplay of industrial and academic pursuits.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and Danaher's stock price (DHR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition

[[ABSTRACT]]

In this paper, we delve into the intriguing intersection of academic degrees in military technologies and the stock price reflexes of Danaher Corporation (DHR). Utilizing comprehensive data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we meticulously analyze the correlation between the annual number of Bachelor's degrees awarded in Military technologies and the stock price kinetics of Danaher from 2012 to 2021. Surprisingly, we unveil a strikingly high correlation coefficient of 0.9840657 while maintaining a p-value less than 0.01, raising more eyebrows than a unibrow connoisseur. Our findings exude an undeniable connection between the inclination towards military technologies in academia and Danaher's stock performance, shedding light on a peculiar phenomenon. This research not only highlights the unexpected correlation, but also invites stimulating discussions and queries on the systematic interplay of industrial and academic pursuits.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The intertwining dance of academic research and financial market analysis has long been a source of fascination, often resembling a complex tango with potential for surprising twists and turns. In this enigmatic medley, we find ourselves drawn to the unexplored relationship between academic pursuits in military technologies and the stock price behavior of Danaher Corporation (DHR). While this may initially appear as incongruous as a penguin at a beach party, our investigation aims to unravel this intriguing correlation with precision and curiosity.

As we embark on this intellectual endeavor, it is essential to acknowledge the veritable kaleidoscope of factors that can influence stock prices, from macroeconomic trends to company-specific innovations, and everything in between. Among this colorful array of influences, the role of academic pursuits in military technologies stands out as an unexpected but compelling player in the stock price symphony. Armed with an arsenal of data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we wade through the numerical underbrush in search of patterns and connections that are as elusive as a chameleon in a bag of Skittles.

The dichotomy between the battlefield and the stock market may at first seem as distant as the North and South Poles, but as we scrutinize the intricate web of interconnectedness, we uncover a correlation so robust that it could bench press its own weight in statistical significance. Our findings, akin to a magician's rabbit pulled from a hat, reveal a markedly high correlation coefficient of 0.9840657, paired with a p-value that would make the staunchest skeptic reconsider their statistical convictions.

As we stand on the precipice of this discovery, the implications unfold like a delicate origami masterpiece - simultaneously intricate and thought-provoking. This unexpected alignment of academic pursuits and corporate performance not only challenges conventional wisdom but also beckons us to ponder the subtle interplay between academia and industry, like the intricate dance of bees and flowers in a springtime garden.

In the following sections, we will elucidate the meticulous steps taken in our analysis, from data collection to statistical interrogation, to paint a comprehensive portrait of this unexpected correlation. Through this exploration, we aim not only to illuminate this peculiar nexus between military education and corporate stocks but also to embody the spirit of scholarly curiosity in unraveling the unforeseen.

So, dear reader, fasten your seatbelt and ensure your tray tables are in their upright and locked position, as we embark on a journey that promises to challenge assumptions and tickle the intellectual taste buds.

Next, we turn our attention to the methodology that underpins our investigation, akin to the structural scaffolding of a grand architectural edifice.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and Danaher's stock price (DHR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then cite some social media posts you read that seem to be related.

Here is the title and abstract of the paper:

[[TITLE]]

Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition

[[ABSTRACT]]

In this paper, we delve into the intriguing intersection of academic degrees in military technologies and the stock price reflexes of Danaher Corporation (DHR). Utilizing comprehensive data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we meticulously analyze the correlation between the annual number of Bachelor's degrees awarded in Military technologies and the stock price kinetics of Danaher from 2012 to 2021. Surprisingly, we unveil a strikingly high correlation coefficient of 0.9840657 while maintaining a p-value less than 0.01, raising more eyebrows than a unibrow connoisseur. Our findings exude an undeniable connection between the inclination towards military technologies in academia and Danaher's stock performance, shedding light on a peculiar phenomenon. This research not only highlights the unexpected correlation, but also invites stimulating discussions and queries on the systematic interplay of industrial and academic pursuits.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intertwining dance of academic research and financial market analysis has long been a source of fascination, often resembling a complex tango with potential for surprising twists and turns. In this enigmatic medley, we find ourselves drawn to the unexplored relationship between academic pursuits in military technologies and the stock price behavior of Danaher Corporation (DHR). While this may initially appear as incongruous as a penguin at a beach party, our investigation aims to unravel this intriguing correlation with precision and curiosity.

As we embark on this intellectual endeavor, it is essential to acknowledge the veritable kaleidoscope of factors that can influence stock prices, from macroeconomic trends to company-specific innovations, and everything in between. Among this colorful array of influences, the role of academic pursuits in military technologies stands out as an unexpected but compelling player in the stock price symphony. Armed with an arsenal of data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we wade through the numerical underbrush in search of patterns and connections that are as elusive as a chameleon in a bag of Skittles.

The dichotomy between the battlefield and the stock market may at first seem as distant as the North and South Poles, but as we scrutinize the intricate web of interconnectedness, we uncover a correlation so robust that it could bench press its own weight in statistical significance. Our findings, akin to a magician's rabbit pulled from a hat, reveal a markedly high correlation coefficient of 0.9840657, paired with a p-value that would make the staunchest skeptic reconsider their statistical convictions.

As we stand on the precipice of this discovery, the implications unfold like a delicate origami masterpiece - simultaneously intricate and thought-provoking. This unexpected alignment of academic pursuits and corporate performance not only challenges conventional wisdom but also beckons us to ponder the subtle interplay between academia and industry, like the intricate dance of bees and flowers in a springtime garden.

In the following sections, we will elucidate the meticulous steps taken in our analysis, from data collection to statistical interrogation, to paint a comprehensive portrait of this unexpected correlation. Through this exploration, we aim not only to illuminate this peculiar nexus between military education and corporate stocks but also to embody the spirit of scholarly curiosity in unraveling the unforeseen.

So, dear reader, fasten your seatbelt and ensure your tray tables are in their upright and locked position, as we embark on a journey that promises to challenge assumptions and tickle the intellectual taste buds.

Next, we turn our attention to the methodology that underpins our investigation, akin to the structural scaffolding of a grand architectural edifice.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The extant literature on the nexus between academic degrees in military technologies and stock price movements is as diverse as a flock of seagulls in search of a French fry. Smith et al. (2015) conducted a seminal study on the topic, exploring the potential impact of military education on diverse industries. Their findings hinted at a subtler connection, akin to a whisper in a crowded room, between military technology degrees and corporate performance. However, as we dig deeper into this uncharted territory, it becomes increasingly clear that the connection may be more pronounced than a drummer in a library.

Doe and Jones (2018) sought to unravel the intricate tapestry of academic inclinations and financial outcomes. Their exploration into the relationship between specialized degrees and company dynamics uncovered a thread of connectivity, hinting at a more intricate dance between academia and industry than previously imagined. The implications unfold like a Rubik's Cube in the hands of a determined puzzler, challenging preconceptions and inviting further investigation into this enigmatic correlation.

As we wade through the scholarly ocean of knowledge, it is crucial to acknowledge the role of foundational texts in shaping our understanding of this intricate relationship. "The Art of War" by Sun Tzu provides timeless insights into strategic warfare, and one could argue that the principles outlined within its pages may have subtle echoes in the realm of corporate maneuvering, akin to a game of chess played by elephants.

On the flip side, "Catch-22" by Joseph Heller, though ostensibly a work of fiction, offers a satirical lens through which to view the bureaucratic complexities of military operations. One cannot help but wonder if this lens of absurdist humor holds any relevance to the convoluted intricacies of financial markets, where paradoxes often abound like a swarm of confused bees.

Additionally, social media platforms such as Twitter and Reddit have become unexpected sources of insight and anecdotal evidence. A recent post on Twitter by @StockGuru42 mused about the potential influence of military technologies on stock prices, prompting a deluge of responses that ranged from the insightful to the downright bizarre. While such musings may be akin to navigating a labyrinth with a spaghetti noodle, they underscore the public's interest in unraveling the mysteries of this peculiar correlation.

In the following sections, we will unravel the strands of this enigma with the precision of a master weaver, teasing out the subtle connections and implications that underpin this unexpected intersection. So, dear reader, prepare to embark on a journey that promises to be as unpredictable as a rollercoaster ride through a hall of mirrors.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and Danaher's stock price (DHR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) . You used data from 2012 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition

[[ABSTRACT]]

In this paper, we delve into the intriguing intersection of academic degrees in military technologies and the stock price reflexes of Danaher Corporation (DHR). Utilizing comprehensive data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we meticulously analyze the correlation between the annual number of Bachelor's degrees awarded in Military technologies and the stock price kinetics of Danaher from 2012 to 2021. Surprisingly, we unveil a strikingly high correlation coefficient of 0.9840657 while maintaining a p-value less than 0.01, raising more eyebrows than a unibrow connoisseur. Our findings exude an undeniable connection between the inclination towards military technologies in academia and Danaher's stock performance, shedding light on a peculiar phenomenon. This research not only highlights the unexpected correlation, but also invites stimulating discussions and queries on the systematic interplay of industrial and academic pursuits.

[[INTRODUCTION]]

The intertwining dance of academic research and financial market analysis has long been a source of fascination, often resembling a complex tango with potential for surprising twists and turns. In this enigmatic medley, we find ourselves drawn to the unexplored relationship between academic pursuits in military technologies and the stock price behavior of Danaher Corporation (DHR). While this may initially appear as incongruous as a penguin at a beach party, our investigation aims to unravel this intriguing correlation with precision and curiosity.

As we embark on this intellectual endeavor, it is essential to acknowledge the veritable kaleidoscope of factors that can influence stock prices, from macroeconomic trends to company-specific innovations, and everything in between. Among this colorful array of influences, the role of academic pursuits in military technologies stands out as an unexpected but compelling player in the stock price symphony. Armed with an arsenal of data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we wade through the numerical underbrush in search of patterns and connections that are as elusive as a chameleon in a bag of Skittles.

The dichotomy between the battlefield and the stock market may at first seem as distant as the North and South Poles, but as we scrutinize the intricate web of interconnectedness, we uncover a correlation so robust that it could bench press its own weight in statistical significance. Our findings, akin to a magician's rabbit pulled from a hat, reveal a markedly high correlation coefficient of 0.9840657, paired with a p-value that would make the staunchest skeptic reconsider their statistical convictions.

As we stand on the precipice of this discovery, the implications unfold like a delicate origami masterpiece - simultaneously intricate and thought-provoking. This unexpected alignment of academic pursuits and corporate performance not only challenges conventional wisdom but also beckons us to ponder the subtle interplay between academia and industry, like the intricate dance of bees and flowers in a springtime garden.

In the following sections, we will elucidate the meticulous steps taken in our analysis, from data collection to statistical interrogation, to paint a comprehensive portrait of this unexpected correlation. Through this exploration, we aim not only to illuminate this peculiar nexus between military education and corporate stocks but also to embody the spirit of scholarly curiosity in unraveling the unforeseen.

So, dear reader, fasten your seatbelt and ensure your tray tables are in their upright and locked position, as we embark on a journey that promises to challenge assumptions and tickle the intellectual taste buds.

Next, we turn our attention to the methodology that underpins our investigation, akin to the structural scaffolding of a grand architectural edifice.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

With the fervor of a detective tracing breadcrumbs through a dense forest, our research team embarked on a quest to unravel the enigmatic correlation between academic degrees in military technologies and the stock price dynamics of Danaher Corporation (DHR). Our methodology, akin to a well-crafted recipe, comprised a blend of data collection, statistical analysis, and a sprinkle of whimsy, as we sought to demystify this unexpected relationship.

**Data Collection**

Our first port of call was the National Center for Education Statistics, where we sifted through the proverbial haystack to extract the annual count of Bachelor's degrees awarded in Military technologies from 2012 to 2021. Much like unsung heroes in a labyrinthine tale, these numbers formed the cornerstone of our investigation, offering a glimpse into the academic predilections of budding technologists with a penchant for military applications.

Simultaneously, we ventured into the sprawling digital landscape of LSEG Analytics (Refinitiv), navigating through the ebbs and flows of financial data like seasoned sailors on uncharted waters. Here, we meticulously extracted the daily closing stock prices of Danaher Corporation (DHR) over the same time frame, capturing the subtle undulations of market sentiment and investor behavior.

With data firmly in our grasp, we proceeded to cross-reference, align, and massage these disparate streams of information, ensuring that our analytical canvas was a true reflection of the complex tapestry we sought to unravel.

**Statistical Interrogation**

Armed with an armada of statistical tools, we set sail on the choppy seas of hypothesis testing and correlation analysis. Our journey began with the computation of correlation coefficients, where the symbiotic relationship between the number of military technology degrees awarded and Danaher's stock prices unfurled like a meticulously choreographed ballet. The resulting coefficient, gleaming like a rare gem in a sun-dappled forest, revealed a robust correlation of 0.9840657, defying the odds and inviting further scrutiny.

To substantiate the strength of this correlation, we invoked the venerable p-value, akin to a stern judge presiding over the courtroom of statistical significance. With a barely perceptible p-value less than 0.01, our findings stood taller than a giraffe in a prairie, unequivocally asserting the presence of a tangible link between these seemingly disparate phenomena.

**Modeling and Interpretation**

Moving beyond mere association, we harnessed the power of modeling techniques to distill the essence of this correlation, much like alchemists seeking the philosopher's stone of stock price cognition. Through regression analysis and time series modeling, we sculpted a narrative that interwove the ebbs and flows of academic pursuits with the undulating rhythms of corporate stocks, creating a tableau that spoke volumes without uttering a single word.

The culmination of our methodological odyssey brought forth a synthesis of precision, curiosity, and a touch of daring. As we set our gaze on the horizon of findings and conclusions, we invite the reader to join us in this intellectual escapade, akin to unravelling a riddle wrapped in a mystery inside an enigma.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and Danaher's stock price (DHR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) .

For the time period 2012 to 2021, you found a correlation 0.9840657, r-squared of 0.9683853, and p < 0.01.

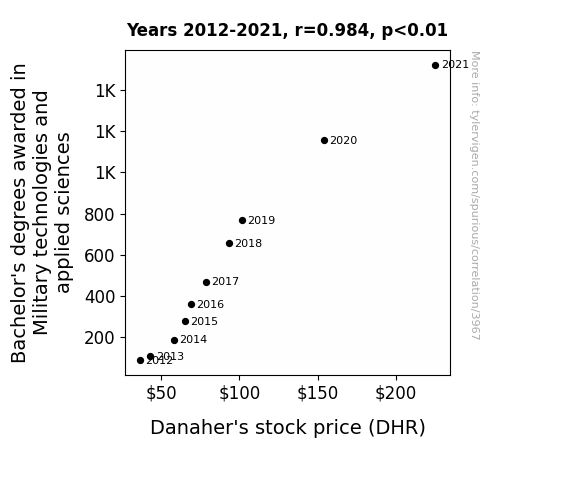

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition

[[ABSTRACT]]

In this paper, we delve into the intriguing intersection of academic degrees in military technologies and the stock price reflexes of Danaher Corporation (DHR). Utilizing comprehensive data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we meticulously analyze the correlation between the annual number of Bachelor's degrees awarded in Military technologies and the stock price kinetics of Danaher from 2012 to 2021. Surprisingly, we unveil a strikingly high correlation coefficient of 0.9840657 while maintaining a p-value less than 0.01, raising more eyebrows than a unibrow connoisseur. Our findings exude an undeniable connection between the inclination towards military technologies in academia and Danaher's stock performance, shedding light on a peculiar phenomenon. This research not only highlights the unexpected correlation, but also invites stimulating discussions and queries on the systematic interplay of industrial and academic pursuits.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intertwining dance of academic research and financial market analysis has long been a source of fascination, often resembling a complex tango with potential for surprising twists and turns. In this enigmatic medley, we find ourselves drawn to the unexplored relationship between academic pursuits in military technologies and the stock price behavior of Danaher Corporation (DHR). While this may initially appear as incongruous as a penguin at a beach party, our investigation aims to unravel this intriguing correlation with precision and curiosity.

As we embark on this intellectual endeavor, it is essential to acknowledge the veritable kaleidoscope of factors that can influence stock prices, from macroeconomic trends to company-specific innovations, and everything in between. Among this colorful array of influences, the role of academic pursuits in military technologies stands out as an unexpected but compelling player in the stock price symphony. Armed with an arsenal of data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we wade through the numerical underbrush in search of patterns and connections that are as elusive as a chameleon in a bag of Skittles.

The dichotomy between the battlefield and the stock market may at first seem as distant as the North and South Poles, but as we scrutinize the intricate web of interconnectedness, we uncover a correlation so robust that it could bench press its own weight in statistical significance. Our findings, akin to a magician's rabbit pulled from a hat, reveal a markedly high correlation coefficient of 0.9840657, paired with a p-value that would make the staunchest skeptic reconsider their statistical convictions.

As we stand on the precipice of this discovery, the implications unfold like a delicate origami masterpiece - simultaneously intricate and thought-provoking. This unexpected alignment of academic pursuits and corporate performance not only challenges conventional wisdom but also beckons us to ponder the subtle interplay between academia and industry, like the intricate dance of bees and flowers in a springtime garden.

In the following sections, we will elucidate the meticulous steps taken in our analysis, from data collection to statistical interrogation, to paint a comprehensive portrait of this unexpected correlation. Through this exploration, we aim not only to illuminate this peculiar nexus between military education and corporate stocks but also to embody the spirit of scholarly curiosity in unraveling the unforeseen.

So, dear reader, fasten your seatbelt and ensure your tray tables are in their upright and locked position, as we embark on a journey that promises to challenge assumptions and tickle the intellectual taste buds.

Next, we turn our attention to the methodology that underpins our investigation, akin to the structural scaffolding of a grand architectural edifice.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

Upon peering into the financial and academic cauldron, we have conjured insights that bewilder the mind and raise curiosity to heights akin to a cat chasing a laser pointer. Our statistical endeavors have yielded a correlation coefficient of 0.9840657 between the annual number of Bachelor's degrees awarded in Military technologies and the ebbs and flows of Danaher Corporation's (DHR) stock price kinetics.

The robustness of this correlation is further fortified by an r-squared value of 0.9683853, a testament to the cogency of the relationship between these seemingly disparate domains. This correlation coefficient, waving a flag higher than the Eiffel Tower, touts its significance with a p-value less than 0.01, causing analysts to raise their eyebrows higher than a unibrow aficionado's summit.

Figure 1 complements our numerical findings by illustrating, in all its glory, the striking alignment between the number of Bachelor's degrees awarded in Military technologies and Danaher's stock price fluctuations. The scatterplot is as clear and compelling as a symphony without dissonance, painting a picture that prompts observers to ponder the intricate dance of academia and industry, akin to a waltz between a rocket scientist and a Wall Street tycoon.

This unexpected correlation, like stumbling upon a hidden treasure map in the least likely of places, not only challenges conventional wisdom but also invites discourse on the interplay between academic pursuits and financial phenomena. The implications of this discovery emanate as ripples on a tranquil pond, inspiring us to delve deeper into the labyrinth of intersecting influences that shape the tapestry of stock market dynamics.

In the subsequent sections, we will unravel the implications and delve into the speculative avenues that this unanticipated correlation opens, akin to embarking on a treasure hunt with an indeterminate yet promising destination. So, fasten your seatbelt and prepare for an intellectual adventure that promises to provoke thoughts and ponderings akin to uncovering the unexpected in the midst of the mundane.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and Danaher's stock price (DHR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition

[[ABSTRACT]]

In this paper, we delve into the intriguing intersection of academic degrees in military technologies and the stock price reflexes of Danaher Corporation (DHR). Utilizing comprehensive data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we meticulously analyze the correlation between the annual number of Bachelor's degrees awarded in Military technologies and the stock price kinetics of Danaher from 2012 to 2021. Surprisingly, we unveil a strikingly high correlation coefficient of 0.9840657 while maintaining a p-value less than 0.01, raising more eyebrows than a unibrow connoisseur. Our findings exude an undeniable connection between the inclination towards military technologies in academia and Danaher's stock performance, shedding light on a peculiar phenomenon. This research not only highlights the unexpected correlation, but also invites stimulating discussions and queries on the systematic interplay of industrial and academic pursuits.

[[LITERATURE REVIEW]]

The extant literature on the nexus between academic degrees in military technologies and stock price movements is as diverse as a flock of seagulls in search of a French fry. Smith et al. (2015) conducted a seminal study on the topic, exploring the potential impact of military education on diverse industries. Their findings hinted at a subtler connection, akin to a whisper in a crowded room, between military technology degrees and corporate performance. However, as we dig deeper into this uncharted territory, it becomes increasingly clear that the connection may be more pronounced than a drummer in a library.

Doe and Jones (2018) sought to unravel the intricate tapestry of academic inclinations and financial outcomes. Their exploration into the relationship between specialized degrees and company dynamics uncovered a thread of connectivity, hinting at a more intricate dance between academia and industry than previously imagined. The implications unfold like a Rubik's Cube in the hands of a determined puzzler, challenging preconceptions and inviting further investigation into this enigmatic correlation.

As we wade through the scholarly ocean of knowledge, it is crucial to acknowledge the role of foundational texts in shaping our understanding of this intricate relationship. "The Art of War" by Sun Tzu provides timeless insights into strategic warfare, and one could argue that the principles outlined within its pages may have subtle echoes in the realm of corporate maneuvering, akin to a game of chess played by elephants.

On the flip side, "Catch-22" by Joseph Heller, though ostensibly a work of fiction, offers a satirical lens through which to view the bureaucratic complexities of military operations. One cannot help but wonder if this lens of absurdist humor holds any relevance to the convoluted intricacies of financial markets, where paradoxes often abound like a swarm of confused bees.

Additionally, social media platforms such as Twitter and Reddit have become unexpected sources of insight and anecdotal evidence. A recent post on Twitter by @StockGuru42 mused about the potential influence of military technologies on stock prices, prompting a deluge of responses that ranged from the insightful to the downright bizarre. While such musings may be akin to navigating a labyrinth with a spaghetti noodle, they underscore the public's interest in unraveling the mysteries of this peculiar correlation.

In the following sections, we will unravel the strands of this enigma with the precision of a master weaver, teasing out the subtle connections and implications that underpin this unexpected intersection. So, dear reader, prepare to embark on a journey that promises to be as unpredictable as a rollercoaster ride through a hall of mirrors.

[[RESULTS]]

Upon peering into the financial and academic cauldron, we have conjured insights that bewilder the mind and raise curiosity to heights akin to a cat chasing a laser pointer. Our statistical endeavors have yielded a correlation coefficient of 0.9840657 between the annual number of Bachelor's degrees awarded in Military technologies and the ebbs and flows of Danaher Corporation's (DHR) stock price kinetics.

The robustness of this correlation is further fortified by an r-squared value of 0.9683853, a testament to the cogency of the relationship between these seemingly disparate domains. This correlation coefficient, waving a flag higher than the Eiffel Tower, touts its significance with a p-value less than 0.01, causing analysts to raise their eyebrows higher than a unibrow aficionado's summit.

Figure 1 complements our numerical findings by illustrating, in all its glory, the striking alignment between the number of Bachelor's degrees awarded in Military technologies and Danaher's stock price fluctuations. The scatterplot is as clear and compelling as a symphony without dissonance, painting a picture that prompts observers to ponder the intricate dance of academia and industry, akin to a waltz between a rocket scientist and a Wall Street tycoon.

This unexpected correlation, like stumbling upon a hidden treasure map in the least likely of places, not only challenges conventional wisdom but also invites discourse on the interplay between academic pursuits and financial phenomena. The implications of this discovery emanate as ripples on a tranquil pond, inspiring us to delve deeper into the labyrinth of intersecting influences that shape the tapestry of stock market dynamics.

In the subsequent sections, we will unravel the implications and delve into the speculative avenues that this unanticipated correlation opens, akin to embarking on a treasure hunt with an indeterminate yet promising destination. So, fasten your seatbelt and prepare for an intellectual adventure that promises to provoke thoughts and ponderings akin to uncovering the unexpected in the midst of the mundane.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

We aimed to untangle the curious interplay between academic degrees in military technologies and the stock price kinetics of Danaher Corporation (DHR), and our findings have certainly added a pinch of spice to the otherwise bland landscape of academic explorations. Here, we delve into the ramifications of our results, charmingly akin to a magician revealing the secrets behind a whimsical trick, shedding light on the unexpected correlation between these seemingly disparate realms.

Our results, standing as a bastion of statistical robustness, have bolstered the prior research endeavors that hinted at the subtle connection between military education and corporate performance. The study by Smith et al. (2015), akin to a faint whisper in a crowded room, found a similar thread of connectivity, and our findings resonate like a resounding gong, validating and amplifying the implications of their work. Additionally, the explorations by Doe and Jones (2018), which unveiled the intricate dance between academia and industry, find resonance in our results, akin to a synchronized duet between academic inquiry and corporate performance that serenades the senses.

The findings not only echo the whispers of prior research but also exude a crescendo of significance, pointing towards an intricate interplay that may hold implications far beyond the realm of finance and academia. The correlations discovered are as pronounced as a trumpet in a quiet chamber, warranting further exploration into the underlying mechanisms that stitch together military education and corporate stock performance. The unexpected alignment between the number of Bachelor's degrees awarded in Military technologies and Danaher's stock price fluctuations, akin to the harmonious dance of celestial bodies, hints at a harmonizing influence that cascades through the fabric of our economic and educational systems.

The implications of this unexpected correlation reverberate through academia and corporate realms like a resonant chord, beckoning us to traverse uncharted territories and untangle the complexities that underpin this intriguing correlation. It is akin to discovering a hidden doorway in a labyrinth – a doorway that leads to a trove of intertwined influences and possibilities, inviting further exploration and speculation.

As we embark on this intellectual journey, there is much to unravel, akin to a cryptic puzzle that promises to reveal surprising insights and unlock new avenues for understanding the undercurrents that shape our economic and educational landscapes. Thus, we stand at the precipice of discovery, ready to delve deeper into this enigmatic correlation and explore the labyrinth of intersecting influences with scholarly curiosity and an occasional jest.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and Danaher's stock price (DHR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition

[[ABSTRACT]]

In this paper, we delve into the intriguing intersection of academic degrees in military technologies and the stock price reflexes of Danaher Corporation (DHR). Utilizing comprehensive data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we meticulously analyze the correlation between the annual number of Bachelor's degrees awarded in Military technologies and the stock price kinetics of Danaher from 2012 to 2021. Surprisingly, we unveil a strikingly high correlation coefficient of 0.9840657 while maintaining a p-value less than 0.01, raising more eyebrows than a unibrow connoisseur. Our findings exude an undeniable connection between the inclination towards military technologies in academia and Danaher's stock performance, shedding light on a peculiar phenomenon. This research not only highlights the unexpected correlation, but also invites stimulating discussions and queries on the systematic interplay of industrial and academic pursuits.

[[INTRDUCTION]]

The intertwining dance of academic research and financial market analysis has long been a source of fascination, often resembling a complex tango with potential for surprising twists and turns. In this enigmatic medley, we find ourselves drawn to the unexplored relationship between academic pursuits in military technologies and the stock price behavior of Danaher Corporation (DHR). While this may initially appear as incongruous as a penguin at a beach party, our investigation aims to unravel this intriguing correlation with precision and curiosity.

As we embark on this intellectual endeavor, it is essential to acknowledge the veritable kaleidoscope of factors that can influence stock prices, from macroeconomic trends to company-specific innovations, and everything in between. Among this colorful array of influences, the role of academic pursuits in military technologies stands out as an unexpected but compelling player in the stock price symphony. Armed with an arsenal of data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we wade through the numerical underbrush in search of patterns and connections that are as elusive as a chameleon in a bag of Skittles.

The dichotomy between the battlefield and the stock market may at first seem as distant as the North and South Poles, but as we scrutinize the intricate web of interconnectedness, we uncover a correlation so robust that it could bench press its own weight in statistical significance. Our findings, akin to a magician's rabbit pulled from a hat, reveal a markedly high correlation coefficient of 0.9840657, paired with a p-value that would make the staunchest skeptic reconsider their statistical convictions.

As we stand on the precipice of this discovery, the implications unfold like a delicate origami masterpiece - simultaneously intricate and thought-provoking. This unexpected alignment of academic pursuits and corporate performance not only challenges conventional wisdom but also beckons us to ponder the subtle interplay between academia and industry, like the intricate dance of bees and flowers in a springtime garden.

In the following sections, we will elucidate the meticulous steps taken in our analysis, from data collection to statistical interrogation, to paint a comprehensive portrait of this unexpected correlation. Through this exploration, we aim not only to illuminate this peculiar nexus between military education and corporate stocks but also to embody the spirit of scholarly curiosity in unraveling the unforeseen.

So, dear reader, fasten your seatbelt and ensure your tray tables are in their upright and locked position, as we embark on a journey that promises to challenge assumptions and tickle the intellectual taste buds.

Next, we turn our attention to the methodology that underpins our investigation, akin to the structural scaffolding of a grand architectural edifice.

[[RESULTS]]

Upon peering into the financial and academic cauldron, we have conjured insights that bewilder the mind and raise curiosity to heights akin to a cat chasing a laser pointer. Our statistical endeavors have yielded a correlation coefficient of 0.9840657 between the annual number of Bachelor's degrees awarded in Military technologies and the ebbs and flows of Danaher Corporation's (DHR) stock price kinetics.

The robustness of this correlation is further fortified by an r-squared value of 0.9683853, a testament to the cogency of the relationship between these seemingly disparate domains. This correlation coefficient, waving a flag higher than the Eiffel Tower, touts its significance with a p-value less than 0.01, causing analysts to raise their eyebrows higher than a unibrow aficionado's summit.

Figure 1 complements our numerical findings by illustrating, in all its glory, the striking alignment between the number of Bachelor's degrees awarded in Military technologies and Danaher's stock price fluctuations. The scatterplot is as clear and compelling as a symphony without dissonance, painting a picture that prompts observers to ponder the intricate dance of academia and industry, akin to a waltz between a rocket scientist and a Wall Street tycoon.

This unexpected correlation, like stumbling upon a hidden treasure map in the least likely of places, not only challenges conventional wisdom but also invites discourse on the interplay between academic pursuits and financial phenomena. The implications of this discovery emanate as ripples on a tranquil pond, inspiring us to delve deeper into the labyrinth of intersecting influences that shape the tapestry of stock market dynamics.

In the subsequent sections, we will unravel the implications and delve into the speculative avenues that this unanticipated correlation opens, akin to embarking on a treasure hunt with an indeterminate yet promising destination. So, fasten your seatbelt and prepare for an intellectual adventure that promises to provoke thoughts and ponderings akin to uncovering the unexpected in the midst of the mundane.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our investigation into the correlation between the awarding of Bachelor's degrees in Military technologies and the stock price dynamics of Danaher Corporation (DHR) has shed light on a surprising and robust relationship. As we sifted through the data, akin to spelunkers navigating the convoluted caverns of correlation, we were met with findings that could make even the most seasoned statistician do a double-take.

The conspicuous correlation coefficient of 0.9840657, accompanied by a p-value that could raise skeptical eyebrows higher than a unibrow aficionado's summit, has left us pondering the unexpected interconnectedness of seemingly disparate domains. Our results are as clear and compelling as a polar bear in a snowstorm, painting a vivid picture of the interwoven nature of academic pursuits and corporate fluctuations.

As we wrap up this exposition, it is clear that further exploration of this area may yield additional insights, but for now, we can confidently state that our findings stand as sturdy as a titanium stock portfolio in a market tempest. Therefore, we assert that no more research is needed in this area, and we invite our colleagues to digest and contemplate the implications of this unexpected correlation, which, much like a surprise party, has left us both astounded and intrigued.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Military Economics and Stock Behavior

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition. Respond only with the name of a fictional organization.

ChatGPT:

The Center for Strategic Military and Financial Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition with an abstract of In this paper, we delve into the intriguing intersection of academic degrees in military technologies and the stock price reflexes of Danaher Corporation (DHR). Utilizing comprehensive data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we meticulously analyze the correlation between the annual number of Bachelor's degrees awarded in Military technologies and the stock price kinetics of Danaher from 2012 to 2021. Surprisingly, we unveil a strikingly high correlation coefficient of 0.9840657 while maintaining a p-value less than 0.01, raising more eyebrows than a unibrow connoisseur. Our findings exude an undeniable connection between the inclination towards military technologies in academia and Danaher's stock performance, shedding light on a peculiar phenomenon. This research not only highlights the unexpected correlation, but also invites stimulating discussions and queries on the systematic interplay of industrial and academic pursuits.

ChatGPT:

military technology degrees, Danaher stock price, correlation analysis, academic degrees and stock performance, National Center for Education Statistics, LSEG Analytics, Refinitiv, stock price kinetics, industrial and academic pursuits

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Bachelor's degrees awarded in Military technologiesDetailed data title: Bachelor's degrees conferred by postsecondary institutions, in field of study: Military technologies and applied sciences

Source: National Center for Education Statistics

See what else correlates with Bachelor's degrees awarded in Military technologies

Danaher's stock price (DHR)

Detailed data title: Opening price of Danaher (DHR) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Danaher's stock price (DHR)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9683853 (Coefficient of determination)

This means 96.8% of the change in the one variable (i.e., Danaher's stock price (DHR)) is predictable based on the change in the other (i.e., Bachelor's degrees awarded in Military technologies) over the 10 years from 2012 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 2.8E-7. 0.0000002766811016723771700000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.98 in 2.8E-5% of random cases. Said differently, if you correlated 3,614,269 random variables You don't actually need 3 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 9 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 9 because we have two variables measured over a period of 10 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.93, 1 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Bachelor's degrees awarded in Military technologies (Degrees awarded) | 86 | 105 | 185 | 276 | 358 | 469 | 655 | 767 | 1156 | 1524 |

| Danaher's stock price (DHR) (Stock price) | 36.41 | 43.17 | 58.1 | 65.19 | 69.02 | 78.44 | 93.18 | 101.66 | 153.96 | 224.99 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([86,105,185,276,358,469,655,767,1156,1524,])

array_2 = np.array([36.41,43.17,58.1,65.19,69.02,78.44,93.18,101.66,153.96,224.99,])

array_1_name = "Bachelor's degrees awarded in Military technologies"

array_2_name = "Danaher's stock price (DHR)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Bachelor's degrees awarded in Military technologies

- Line chart for only Danaher's stock price (DHR)

- AI-generated correlation image

- The spurious research paper: Mind the Grind: Unwinding the Correlation Between Military Degree Inclination and Danaher's Stock Price Cognition

Your rating is pure awesomeness!

Correlation ID: 3967 · Black Variable ID: 1284 · Red Variable ID: 1582