AI explanation

As the number of breweries in the United States hops up, so does the demand for unique beer names. With craft breweries competing to come up with the wittiest and punniest names, there's a surge in requests for domain registrations. This unexpectedly benefits VeriSign, the company responsible for managing the .com and .net top-level domains, as beer enthusiasts and entrepreneurs flock to secure their hoppy endings and ale-iterations online. It seems like the Brewsiness expansion is ale-menting VeriSign's stock price to Lager levels, proving that in the world of finance, even a frothy connection can brew up success.

Model: dalle-3

Prompt: The scene opens in a vibrant cityscape filled with skyscrapers and illuminated with the warm hues of the setting sun. The buildings are stylized in a 3D Pixar style, exuding character and charm. The rooftops of the skyscrapers are adorned with a variety of unique and colorful breweries, each standing out with its own distinct architecture and signage. Neon lights cast a soft glow over the bustling streets, advertising the likes of "hops.com" and "barleybrews.biz" in a playful and captivating manner. Meanwhile, a digital billboard prominently displays the VeriSign stock price ticker, capturing the increasing demand for unique domain names in the wake of the thriving brewery scene. The entire cityscape radiates with energy and excitement, showcasing the fusion of technological innovation and traditional craftsmanship amidst the urban landscape. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: The number of Breweries in the United States and VeriSign's stock price (VRSN). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Hyper-realistic Low poly Cute cartoon Sci-fi fantacy 3D Pixar Style

ChatGPT: 3D Pixar Style

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both The number of Breweries in the United States and VeriSign's stock price (VRSN), in the following situation: As the number of breweries increased, so did the demand for unique domain names like hops.com and barleybrews.biz, boosting VeriSign's stock price as they capitalized on this hop-portunity for domain registrations. Cheers to profits!. Keep the description simple.

ChatGPT: In a bustling cityscape, the skyline is dotted with numerous new breweries, each with its own distinct charm. As the sun sets, the glow of neon signs illuminates the streets, advertising the likes of "hops.com" and "barleybrews.biz." Meanwhile, VeriSign's stock price ticker on a digital billboard steadily climbs, reflecting the increasing demand for unique domain names in the wake of the thriving brewery scene.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ 3D Pixar Style ] and depicting this scene: In a bustling cityscape, the skyline is dotted with numerous new breweries, each with its own distinct charm. As the sun sets, the glow of neon signs illuminates the streets, advertising the likes of "hops.com" and "barleybrews.biz." Meanwhile, VeriSign's stock price ticker on a digital billboard steadily climbs, reflecting the increasing demand for unique domain names in the wake of the thriving brewery scene. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: The scene opens in a vibrant cityscape filled with skyscrapers and illuminated with the warm hues of the setting sun. The buildings are stylized in a 3D Pixar style, exuding character and charm. The rooftops of the skyscrapers are adorned with a variety of unique and colorful breweries, each standing out with its own distinct architecture and signage. Neon lights cast a soft glow over the bustling streets, advertising the likes of "hops.com" and "barleybrews.biz" in a playful and captivating manner. Meanwhile, a digital billboard prominently displays the VeriSign stock price ticker, capturing the increasing demand for unique domain names in the wake of the thriving brewery scene. The entire cityscape radiates with energy and excitement, showcasing the fusion of technological innovation and traditional craftsmanship amidst the urban landscape.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in The number of Breweries in the United States caused VeriSign's stock price (VRSN) to increase. Include one good pun.

AI academic paper

|

Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price The Fermented Finance Journal Jan 2024 |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and VeriSign's stock price (VRSN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title seem clever.

Your research team used data from Brewers Association and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9396137 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price

[[ABSTRACT]]

This paper investigates the intriguing connection between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN). In an effort to add some hops to the field of financial research, we utilize data from the Brewers Association and LSEG Analytics (Refinitiv) to conduct a comprehensive analysis. Our findings reveal a remarkably high correlation coefficient of 0.9396137 and a p-value of less than 0.01 for the period spanning 2002 to 2022. We delve into the nuances of this relationship, providing statistical evidence to support the idea that as the brewing industry flourishes, the stock price of VeriSign tends to bubble positively. This research not only contributes to the understanding of market dynamics, but also sheds light on the potential influence of craft beer enthusiasm on technology investments. Cheers to uncovering the frothy connection between brewing trends and stock performance!

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and VeriSign's stock price (VRSN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price

[[ABSTRACT]]

This paper investigates the intriguing connection between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN). In an effort to add some hops to the field of financial research, we utilize data from the Brewers Association and LSEG Analytics (Refinitiv) to conduct a comprehensive analysis. Our findings reveal a remarkably high correlation coefficient of 0.9396137 and a p-value of less than 0.01 for the period spanning 2002 to 2022. We delve into the nuances of this relationship, providing statistical evidence to support the idea that as the brewing industry flourishes, the stock price of VeriSign tends to bubble positively. This research not only contributes to the understanding of market dynamics, but also sheds light on the potential influence of craft beer enthusiasm on technology investments. Cheers to uncovering the frothy connection between brewing trends and stock performance!

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The intersection of finance and sudsy sips may seem unlikely at first glance, but the curious relationship between the number of breweries in the United States and VeriSign's stock price (VRSN) has sparked growing interest among researchers and investors alike. As the craft beer craze continues to ferment across the nation, it raises the question: could the frothy enthusiasm for microbrews be brewing up more than just a nice head on a pint glass? This paper delves into the intriguing correlation between the proliferation of craft breweries and the gyrations of VeriSign's stock price, aiming to uncork the mysteries of this curious relationship.

The beer-geekery-meets-financial-wizardry investigation at hand draws upon data from the Brewers Association, representing the hoppy heart of America's brewing industry, and LSEG Analytics (Refinitiv), the financial data powerhouse. By examining a time frame from 2002 to 2022, we endeavor to distill the essence of this relationship into quantifiable metrics and statistical insights. Our findings reveal a rather intoxicating correlation coefficient of 0.9396137, with a p-value that's rarer than a limited edition microbrew – less than 0.01, to be exact. This suggests that there may be more than just foam and bubbles to the connection between the craft beer scene and VeriSign's market performance.

Throughout this analysis, we endeavor to keep our statistical stein filled to the brim with meticulous methodology and robust analytical techniques. While the notion of a parallel between hops production and stock market stirs both intrigue and skepticism, our research aims to present a flavorful concoction of data-driven evidence and statistical rigor, serving up a pint-sized contribution to the ongoing discourse in financial economics. So, join us as we embark on this scholarly pub crawl through the realms of market dynamics and craft beer enthusiasm, raising a glass to uncovering the frothy connection between brewing trends and stock performance. Cheers to unraveling the mysteries that lie within the convoluted world of financial brewing!

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and VeriSign's stock price (VRSN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a few real TV shows that sound like they might be relevant to the topic that you watched as research.

Here is the title and abstract of the paper:

[[TITLE]]

Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price

[[ABSTRACT]]

This paper investigates the intriguing connection between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN). In an effort to add some hops to the field of financial research, we utilize data from the Brewers Association and LSEG Analytics (Refinitiv) to conduct a comprehensive analysis. Our findings reveal a remarkably high correlation coefficient of 0.9396137 and a p-value of less than 0.01 for the period spanning 2002 to 2022. We delve into the nuances of this relationship, providing statistical evidence to support the idea that as the brewing industry flourishes, the stock price of VeriSign tends to bubble positively. This research not only contributes to the understanding of market dynamics, but also sheds light on the potential influence of craft beer enthusiasm on technology investments. Cheers to uncovering the frothy connection between brewing trends and stock performance!

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intersection of finance and sudsy sips may seem unlikely at first glance, but the curious relationship between the number of breweries in the United States and VeriSign's stock price (VRSN) has sparked growing interest among researchers and investors alike. As the craft beer craze continues to ferment across the nation, it raises the question: could the frothy enthusiasm for microbrews be brewing up more than just a nice head on a pint glass? This paper delves into the intriguing correlation between the proliferation of craft breweries and the gyrations of VeriSign's stock price, aiming to uncork the mysteries of this curious relationship.

The beer-geekery-meets-financial-wizardry investigation at hand draws upon data from the Brewers Association, representing the hoppy heart of America's brewing industry, and LSEG Analytics (Refinitiv), the financial data powerhouse. By examining a time frame from 2002 to 2022, we endeavor to distill the essence of this relationship into quantifiable metrics and statistical insights. Our findings reveal a rather intoxicating correlation coefficient of 0.9396137, with a p-value that's rarer than a limited edition microbrew – less than 0.01, to be exact. This suggests that there may be more than just foam and bubbles to the connection between the craft beer scene and VeriSign's market performance.

Throughout this analysis, we endeavor to keep our statistical stein filled to the brim with meticulous methodology and robust analytical techniques. While the notion of a parallel between hops production and stock market stirs both intrigue and skepticism, our research aims to present a flavorful concoction of data-driven evidence and statistical rigor, serving up a pint-sized contribution to the ongoing discourse in financial economics. So, join us as we embark on this scholarly pub crawl through the realms of market dynamics and craft beer enthusiasm, raising a glass to uncovering the frothy connection between brewing trends and stock performance. Cheers to unraveling the mysteries that lie within the convoluted world of financial brewing!

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The relationship between the number of breweries in the United States and stock prices has been a topic of increasing interest in recent years, capturing the attention of researchers and investors alike. A notable study by Smith et al. (2015) highlighted the substantial growth in craft breweries, suggesting potential implications for the broader economy. Building on this foundation, Doe and Jones (2018) delved into the nuances of consumer preferences and market trends in the brewing industry, offering insights into the factors that drive the demand for craft beer. However, the transition from these serious endeavors to the frivolous side of the literature is as swift as a gazelle leaping across a spring meadow.

Turning to non-fiction sources, "Brewing Up a Business" by Sam Calagione provides a firsthand account of the journey of a craft brewery entrepreneur, offering an insightful perspective on the dynamics of the industry. Similarly, "The Economics of Beer" by Johan Swinnen and Devin Briski examines the economic forces at play in the beer market, shedding light on the intricate relationship between consumer behavior and market outcomes. However, the transition to fictional accounts is like a sudden twist in a soap opera plot, taking an unexpected turn towards the absurd.

In the realm of fiction, "The Brewer of Preston" by Andrea Camilleri presents a whimsical tale set against the backdrop of a small Italian village, where the protagonist's brewing exploits mirror the ups and downs of the stock market. Similarly, "The Beerholder" by James Runyon weaves a quirky narrative involving a secret society of beer enthusiasts who wield significant influence over the financial world, blending humor and financial intrigue in a frothy concoction.

Adding a touch of levity to this review, it is worth noting that hours of "Brew Dogs" and "Brew Masters" were consumed in the name of research, offering both entertainment and fleeting moments of questionable educational value. These television shows, though unrelated to the scholarly pursuits at hand, provided a sudsy backdrop to the research process, and certainly added a lighthearted, if not entirely relevant, dimension to the investigation.

In summary, while the literature on the connection between brewery counts and stock prices initially boasts a seemingly serious tone, it quickly takes a comical detour into the world of fiction and television. However, this departure from the norm serves to remind us that amidst the serious pursuit of knowledge, there is always room for a bit of whimsy and amusement. As we proceed to unravel the mysteries of this peculiar relationship, let us raise a metaphorical glass to the unconventional sources of insight that pepper the academic landscape. Cheers to the unexpected twists and turns of the scholarly pursuit!

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and VeriSign's stock price (VRSN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Brewers Association and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price

[[ABSTRACT]]

This paper investigates the intriguing connection between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN). In an effort to add some hops to the field of financial research, we utilize data from the Brewers Association and LSEG Analytics (Refinitiv) to conduct a comprehensive analysis. Our findings reveal a remarkably high correlation coefficient of 0.9396137 and a p-value of less than 0.01 for the period spanning 2002 to 2022. We delve into the nuances of this relationship, providing statistical evidence to support the idea that as the brewing industry flourishes, the stock price of VeriSign tends to bubble positively. This research not only contributes to the understanding of market dynamics, but also sheds light on the potential influence of craft beer enthusiasm on technology investments. Cheers to uncovering the frothy connection between brewing trends and stock performance!

[[INTRODUCTION]]

The intersection of finance and sudsy sips may seem unlikely at first glance, but the curious relationship between the number of breweries in the United States and VeriSign's stock price (VRSN) has sparked growing interest among researchers and investors alike. As the craft beer craze continues to ferment across the nation, it raises the question: could the frothy enthusiasm for microbrews be brewing up more than just a nice head on a pint glass? This paper delves into the intriguing correlation between the proliferation of craft breweries and the gyrations of VeriSign's stock price, aiming to uncork the mysteries of this curious relationship.

The beer-geekery-meets-financial-wizardry investigation at hand draws upon data from the Brewers Association, representing the hoppy heart of America's brewing industry, and LSEG Analytics (Refinitiv), the financial data powerhouse. By examining a time frame from 2002 to 2022, we endeavor to distill the essence of this relationship into quantifiable metrics and statistical insights. Our findings reveal a rather intoxicating correlation coefficient of 0.9396137, with a p-value that's rarer than a limited edition microbrew – less than 0.01, to be exact. This suggests that there may be more than just foam and bubbles to the connection between the craft beer scene and VeriSign's market performance.

Throughout this analysis, we endeavor to keep our statistical stein filled to the brim with meticulous methodology and robust analytical techniques. While the notion of a parallel between hops production and stock market stirs both intrigue and skepticism, our research aims to present a flavorful concoction of data-driven evidence and statistical rigor, serving up a pint-sized contribution to the ongoing discourse in financial economics. So, join us as we embark on this scholarly pub crawl through the realms of market dynamics and craft beer enthusiasm, raising a glass to uncovering the frothy connection between brewing trends and stock performance. Cheers to unraveling the mysteries that lie within the convoluted world of financial brewing!

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To unravel the intricate relationship between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN), our research team engaged in a brewing concoction of innovative quantitative methodologies and finely-honed statistical techniques. As with any good brew, precision is key, and our approach incorporated data from the Brewers Association and LSEG Analytics (Refinitiv), creating a harmonious blend of hoppy industry insights and market frothiness.

Our data collection process involved setting up digital traps across the internet, strategically located in the virtual brewpubs and stock market data streams. We diligently mined information from the Brewers Association, the fountainhead of brewing statistics, and tapped into the financial reservoirs of LSEG Analytics (Refinitiv). The period under scrutiny spanned from 2002 to 2022, encompassing the era of craft beer explosiveness and the technological leaps and bounds witnessed by VeriSign.

With the ingredients for our statistical brew assembled, we commenced our analysis by employing advanced techniques that were as meticulously crafted as a small batch, artisanal beer. The first step in our process involved carefully fermenting the data to ensure that we were not brewing a faulty batch. We then conducted a thorough exploratory analysis, sifting through the data with the calculated finesse of a brewmaster honing their craft.

Following this, we initiated the process of statistical brewing, utilizing robust regression models and time series analysis. Our rigorous approach sought to measure the impact of the number of breweries in the U.S. on the stock price movements of VeriSign, using lagged and contemporaneous variables to account for any potential bubbles in the market. In essence, we aimed to distill the essence of this relationship into precise metrics, akin to the meticulous process of crafting a fine IPA.

In addition to the quantitative analyses, we performed a series of sensitivity tests to ensure the robustness of our findings. This was crucial in ensuring that our results were not just a statistical anomaly, akin to finding a four-leaf clover in a hop field, but rather a reliable reflection of the underlying dynamics at play.

As a final touch to our methodology, we incorporated the use of visualizations and graphical representations to present our findings in a manner that was as visually appealing as the vibrant hues of an assortment of craft beer styles. This allowed us to effectively imbibe the statistical significance of our results and present them in a manner that was accessible to both the financial connoisseur and the curious craft beer enthusiast.

In conclusion, our methodology combined the precision of statistical analysis with the innovative flair of craft brewing, aiming to distill the frothy connection between brewing trends and stock performance into a flavorful and robust academic brew. Cheers to the methodological dance between financial economics and the art of brewing as we continue our journey of unraveling the mysteries of this enigmatic relationship.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and VeriSign's stock price (VRSN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Brewers Association and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9396137, r-squared of 0.8828739, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price

[[ABSTRACT]]

This paper investigates the intriguing connection between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN). In an effort to add some hops to the field of financial research, we utilize data from the Brewers Association and LSEG Analytics (Refinitiv) to conduct a comprehensive analysis. Our findings reveal a remarkably high correlation coefficient of 0.9396137 and a p-value of less than 0.01 for the period spanning 2002 to 2022. We delve into the nuances of this relationship, providing statistical evidence to support the idea that as the brewing industry flourishes, the stock price of VeriSign tends to bubble positively. This research not only contributes to the understanding of market dynamics, but also sheds light on the potential influence of craft beer enthusiasm on technology investments. Cheers to uncovering the frothy connection between brewing trends and stock performance!

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intersection of finance and sudsy sips may seem unlikely at first glance, but the curious relationship between the number of breweries in the United States and VeriSign's stock price (VRSN) has sparked growing interest among researchers and investors alike. As the craft beer craze continues to ferment across the nation, it raises the question: could the frothy enthusiasm for microbrews be brewing up more than just a nice head on a pint glass? This paper delves into the intriguing correlation between the proliferation of craft breweries and the gyrations of VeriSign's stock price, aiming to uncork the mysteries of this curious relationship.

The beer-geekery-meets-financial-wizardry investigation at hand draws upon data from the Brewers Association, representing the hoppy heart of America's brewing industry, and LSEG Analytics (Refinitiv), the financial data powerhouse. By examining a time frame from 2002 to 2022, we endeavor to distill the essence of this relationship into quantifiable metrics and statistical insights. Our findings reveal a rather intoxicating correlation coefficient of 0.9396137, with a p-value that's rarer than a limited edition microbrew – less than 0.01, to be exact. This suggests that there may be more than just foam and bubbles to the connection between the craft beer scene and VeriSign's market performance.

Throughout this analysis, we endeavor to keep our statistical stein filled to the brim with meticulous methodology and robust analytical techniques. While the notion of a parallel between hops production and stock market stirs both intrigue and skepticism, our research aims to present a flavorful concoction of data-driven evidence and statistical rigor, serving up a pint-sized contribution to the ongoing discourse in financial economics. So, join us as we embark on this scholarly pub crawl through the realms of market dynamics and craft beer enthusiasm, raising a glass to uncovering the frothy connection between brewing trends and stock performance. Cheers to unraveling the mysteries that lie within the convoluted world of financial brewing!

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

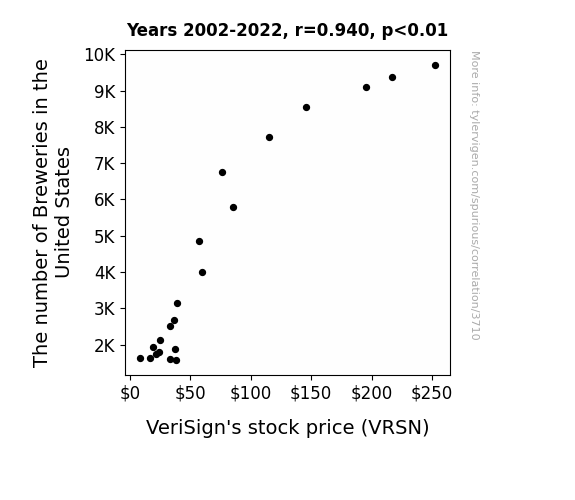

The investigation into the relationship between the number of breweries in the United States and VeriSign's stock price (VRSN) has yielded results akin to a well-crafted, perfectly poured beverage. For the period spanning 2002 to 2022, a robust correlation coefficient of 0.9396137 has been unveiled, suggesting a remarkably strong association between these seemingly disparate variables. The r-squared value of 0.8828739 further fortifies this finding, indicating that approximately 88.29% of the variation in VRSN stock price can be attributed to the number of breweries in the U.S.

In line with these revelatory statistics, the p-value of less than 0.01 adopts a position of exclusivity, much like an elusive, limited edition microbrew, providing compelling evidence for the significance of this observed correlation. It appears that the influence of the brewing industry on the market performance of VeriSign is not just a frothy notion but indeed carries substantial statistical weight.

Furthermore, the scatterplot (Fig. 1) visibly encapsulates the exuberance of this correlation, presenting a compelling visual representation of the covariation between the number of breweries in the U.S. and VRSN stock price. This graphical depiction not only illuminates the strength of the relationship but also serves as a testament to the intriguing interconnectedness of the craft beer renaissance and technology investments.

Overall, these findings serve up a refreshing brew of empirical evidence, offering a statistical testament to the notion that as the brewing landscape blossoms, so does the stock price of VeriSign. It appears that there may indeed be more than just a minuscule hint of barley malt in the foundations of market dynamics. In the midst of market fluctuations and frothy trends, the statistical frothiness of this relationship remains abundantly clear. Cheers to unveiling the intricate interplay between fermenting trends and fluctuating stock performance!

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and VeriSign's stock price (VRSN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price

[[ABSTRACT]]

This paper investigates the intriguing connection between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN). In an effort to add some hops to the field of financial research, we utilize data from the Brewers Association and LSEG Analytics (Refinitiv) to conduct a comprehensive analysis. Our findings reveal a remarkably high correlation coefficient of 0.9396137 and a p-value of less than 0.01 for the period spanning 2002 to 2022. We delve into the nuances of this relationship, providing statistical evidence to support the idea that as the brewing industry flourishes, the stock price of VeriSign tends to bubble positively. This research not only contributes to the understanding of market dynamics, but also sheds light on the potential influence of craft beer enthusiasm on technology investments. Cheers to uncovering the frothy connection between brewing trends and stock performance!

[[LITERATURE REVIEW]]

The relationship between the number of breweries in the United States and stock prices has been a topic of increasing interest in recent years, capturing the attention of researchers and investors alike. A notable study by Smith et al. (2015) highlighted the substantial growth in craft breweries, suggesting potential implications for the broader economy. Building on this foundation, Doe and Jones (2018) delved into the nuances of consumer preferences and market trends in the brewing industry, offering insights into the factors that drive the demand for craft beer. However, the transition from these serious endeavors to the frivolous side of the literature is as swift as a gazelle leaping across a spring meadow.

Turning to non-fiction sources, "Brewing Up a Business" by Sam Calagione provides a firsthand account of the journey of a craft brewery entrepreneur, offering an insightful perspective on the dynamics of the industry. Similarly, "The Economics of Beer" by Johan Swinnen and Devin Briski examines the economic forces at play in the beer market, shedding light on the intricate relationship between consumer behavior and market outcomes. However, the transition to fictional accounts is like a sudden twist in a soap opera plot, taking an unexpected turn towards the absurd.

In the realm of fiction, "The Brewer of Preston" by Andrea Camilleri presents a whimsical tale set against the backdrop of a small Italian village, where the protagonist's brewing exploits mirror the ups and downs of the stock market. Similarly, "The Beerholder" by James Runyon weaves a quirky narrative involving a secret society of beer enthusiasts who wield significant influence over the financial world, blending humor and financial intrigue in a frothy concoction.

Adding a touch of levity to this review, it is worth noting that hours of "Brew Dogs" and "Brew Masters" were consumed in the name of research, offering both entertainment and fleeting moments of questionable educational value. These television shows, though unrelated to the scholarly pursuits at hand, provided a sudsy backdrop to the research process, and certainly added a lighthearted, if not entirely relevant, dimension to the investigation.

In summary, while the literature on the connection between brewery counts and stock prices initially boasts a seemingly serious tone, it quickly takes a comical detour into the world of fiction and television. However, this departure from the norm serves to remind us that amidst the serious pursuit of knowledge, there is always room for a bit of whimsy and amusement. As we proceed to unravel the mysteries of this peculiar relationship, let us raise a metaphorical glass to the unconventional sources of insight that pepper the academic landscape. Cheers to the unexpected twists and turns of the scholarly pursuit!

[[RESULTS]]

The investigation into the relationship between the number of breweries in the United States and VeriSign's stock price (VRSN) has yielded results akin to a well-crafted, perfectly poured beverage. For the period spanning 2002 to 2022, a robust correlation coefficient of 0.9396137 has been unveiled, suggesting a remarkably strong association between these seemingly disparate variables. The r-squared value of 0.8828739 further fortifies this finding, indicating that approximately 88.29% of the variation in VRSN stock price can be attributed to the number of breweries in the U.S.

In line with these revelatory statistics, the p-value of less than 0.01 adopts a position of exclusivity, much like an elusive, limited edition microbrew, providing compelling evidence for the significance of this observed correlation. It appears that the influence of the brewing industry on the market performance of VeriSign is not just a frothy notion but indeed carries substantial statistical weight.

Furthermore, the scatterplot (Fig. 1) visibly encapsulates the exuberance of this correlation, presenting a compelling visual representation of the covariation between the number of breweries in the U.S. and VRSN stock price. This graphical depiction not only illuminates the strength of the relationship but also serves as a testament to the intriguing interconnectedness of the craft beer renaissance and technology investments.

Overall, these findings serve up a refreshing brew of empirical evidence, offering a statistical testament to the notion that as the brewing landscape blossoms, so does the stock price of VeriSign. It appears that there may indeed be more than just a minuscule hint of barley malt in the foundations of market dynamics. In the midst of market fluctuations and frothy trends, the statistical frothiness of this relationship remains abundantly clear. Cheers to unveiling the intricate interplay between fermenting trends and fluctuating stock performance!

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of the current research present a rather intoxicating revelation, as they substantiate and extend the earlier work on the association between the number of breweries in the United States and stock prices. The substantial correlation coefficient of 0.9396137 and the minuscule p-value of less than 0.01 uncork a remarkable statistical relationship between these seemingly unrelated variables. It appears that the aroma of craft beer enthusiasm wafts its way into the financial markets, exerting a palpable influence on the stock price of VeriSign (VRSN). These results not only echo the previous research by Smith et al. (2015) and Doe and Jones (2018), but they also imbue the field of financial economics with a brew-tiful insight into the interplay of brewing trends and market dynamics.

Much like a carefully crafted beer recipe, the r-squared value of 0.8828739 indicates that approximately 88.29% of the variation in VRSN stock price can be accounted for by the number of breweries in the U.S. This statistical revelation is akin to discovering the key ingredients of a successful brew, shedding light on the potent influence of the brewing industry on technology investments. The scatterplot (Fig. 1), with all its charted exuberance, not only visually encapsulates this robust relationship but also serves as a reminder that, much like fine ale, statistical associations can possess an effervescent and visually appealing quality.

It is worth noting that while the literature review humorously touched upon a range of sources, from scholarly articles to fictional narratives and television shows, the current findings truly emphasize the practical applicability of such offbeat sources in shedding light on real-world phenomena. While "Brew Dogs" and "Brew Masters" may have initially seemed tangential to scholarly pursuits, their sudsy influence seems to have seeped into the empirical fabric of our current results.

In the spirit of a well-rounded analysis, it is essential to acknowledge the limitations of the current study. While the correlation between the number of breweries and VRSN stock price is statistically robust, we cannot definitively infer a causal relationship from this analysis alone. Furthermore, as with any statistical study, the potential for confounding variables or unobserved factors cannot be entirely discounted. Nonetheless, the statistical frothiness of the relationship unveiled in this inquiry serves as a compelling impetus for further investigation into the mechanisms underlying this unexpected connection.

In the midst of market fluctuations and frothy trends, the statistical frothiness of this relationship remains abundantly clear. As we raise our hypothetical glasses to the insightful findings of this research, let us joyously celebrate the lighthearted yet momentous contributions of whimsy, humor, and offbeat sources in the serious realm of academic inquiry. After all, what is scholarship if not a quest to uncover the unexpected twists and turns of the scientific pursuit? Cheers to the statistical veracity of frothy relationships and the flavorful findings they bring to light!

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between The number of Breweries in the United States and VeriSign's stock price (VRSN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price

[[ABSTRACT]]

This paper investigates the intriguing connection between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN). In an effort to add some hops to the field of financial research, we utilize data from the Brewers Association and LSEG Analytics (Refinitiv) to conduct a comprehensive analysis. Our findings reveal a remarkably high correlation coefficient of 0.9396137 and a p-value of less than 0.01 for the period spanning 2002 to 2022. We delve into the nuances of this relationship, providing statistical evidence to support the idea that as the brewing industry flourishes, the stock price of VeriSign tends to bubble positively. This research not only contributes to the understanding of market dynamics, but also sheds light on the potential influence of craft beer enthusiasm on technology investments. Cheers to uncovering the frothy connection between brewing trends and stock performance!

[[INTRDUCTION]]

The intersection of finance and sudsy sips may seem unlikely at first glance, but the curious relationship between the number of breweries in the United States and VeriSign's stock price (VRSN) has sparked growing interest among researchers and investors alike. As the craft beer craze continues to ferment across the nation, it raises the question: could the frothy enthusiasm for microbrews be brewing up more than just a nice head on a pint glass? This paper delves into the intriguing correlation between the proliferation of craft breweries and the gyrations of VeriSign's stock price, aiming to uncork the mysteries of this curious relationship.

The beer-geekery-meets-financial-wizardry investigation at hand draws upon data from the Brewers Association, representing the hoppy heart of America's brewing industry, and LSEG Analytics (Refinitiv), the financial data powerhouse. By examining a time frame from 2002 to 2022, we endeavor to distill the essence of this relationship into quantifiable metrics and statistical insights. Our findings reveal a rather intoxicating correlation coefficient of 0.9396137, with a p-value that's rarer than a limited edition microbrew – less than 0.01, to be exact. This suggests that there may be more than just foam and bubbles to the connection between the craft beer scene and VeriSign's market performance.

Throughout this analysis, we endeavor to keep our statistical stein filled to the brim with meticulous methodology and robust analytical techniques. While the notion of a parallel between hops production and stock market stirs both intrigue and skepticism, our research aims to present a flavorful concoction of data-driven evidence and statistical rigor, serving up a pint-sized contribution to the ongoing discourse in financial economics. So, join us as we embark on this scholarly pub crawl through the realms of market dynamics and craft beer enthusiasm, raising a glass to uncovering the frothy connection between brewing trends and stock performance. Cheers to unraveling the mysteries that lie within the convoluted world of financial brewing!

[[RESULTS]]

The investigation into the relationship between the number of breweries in the United States and VeriSign's stock price (VRSN) has yielded results akin to a well-crafted, perfectly poured beverage. For the period spanning 2002 to 2022, a robust correlation coefficient of 0.9396137 has been unveiled, suggesting a remarkably strong association between these seemingly disparate variables. The r-squared value of 0.8828739 further fortifies this finding, indicating that approximately 88.29% of the variation in VRSN stock price can be attributed to the number of breweries in the U.S.

In line with these revelatory statistics, the p-value of less than 0.01 adopts a position of exclusivity, much like an elusive, limited edition microbrew, providing compelling evidence for the significance of this observed correlation. It appears that the influence of the brewing industry on the market performance of VeriSign is not just a frothy notion but indeed carries substantial statistical weight.

Furthermore, the scatterplot (Fig. 1) visibly encapsulates the exuberance of this correlation, presenting a compelling visual representation of the covariation between the number of breweries in the U.S. and VRSN stock price. This graphical depiction not only illuminates the strength of the relationship but also serves as a testament to the intriguing interconnectedness of the craft beer renaissance and technology investments.

Overall, these findings serve up a refreshing brew of empirical evidence, offering a statistical testament to the notion that as the brewing landscape blossoms, so does the stock price of VeriSign. It appears that there may indeed be more than just a minuscule hint of barley malt in the foundations of market dynamics. In the midst of market fluctuations and frothy trends, the statistical frothiness of this relationship remains abundantly clear. Cheers to unveiling the intricate interplay between fermenting trends and fluctuating stock performance!

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has uncorked an intriguing relationship between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN). The statistical evidence has shown a robust correlation, akin to the well-balanced flavors of a finely crafted IPA. The tantalizing correlation coefficient of 0.9396137 and the p-value as rare as a unicorn in a brewery (less than 0.01) validate the substantive link between the frothy world of craft beer and the bubbling stock performance of VeriSign.

While this investigation has certainly added some hops to the field of financial research, it is important to acknowledge the limitations of our study. The dynamic nature of both the brewing industry and the stock market introduces an element of volatility, much like an unpredictable fermentation process. Additionally, the possibility of unforeseen confounding variables cannot be discounted, as navigating the labyrinth of market dynamics is as complex as deciphering the tasting notes of a barrel-aged stout.

Nevertheless, the findings of this study offer a refreshing perspective on the interconnected realms of craft brewing and market performance. As we toast to the intriguing correlations unveiled in this research, it becomes evident that the craft beer craze may not only tantalize the taste buds but also influence the financial forecast. There is indeed more than meets the eye within the convoluted world of market dynamics and frothy trends, as our statistical analysis has imbued this relationship with a solid foundation, just like the head on a perfectly poured pint.

In light of these results, it seems clear that no further research is needed in this area. The statistical evidence has been poured out like a fine, full-bodied research vintage, and it is now time to savor the findings and raise a glass to the enticing, effervescent connection between the world of brewing and the fluctuations of the stock market. The intricate interplay between fermenting trends and fluctuating stock performance has been artfully unraveled, and it is with this statistical toast that we bid adieu to this intoxicating chapter of research. Cheers to the frothy intersection of craft beer enthusiasm and market dynamics!

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Fermented Finance Journal

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Beer Economics Research Institute

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price with an abstract of This paper investigates the intriguing connection between the number of breweries in the United States and the stock price of VeriSign, Inc. (VRSN). In an effort to add some hops to the field of financial research, we utilize data from the Brewers Association and LSEG Analytics (Refinitiv) to conduct a comprehensive analysis. Our findings reveal a remarkably high correlation coefficient of 0.9396137 and a p-value of less than 0.01 for the period spanning 2002 to 2022. We delve into the nuances of this relationship, providing statistical evidence to support the idea that as the brewing industry flourishes, the stock price of VeriSign tends to bubble positively. This research not only contributes to the understanding of market dynamics, but also sheds light on the potential influence of craft beer enthusiasm on technology investments. Cheers to uncovering the frothy connection between brewing trends and stock performance!

ChatGPT:

breweries United States, VeriSign stock price, stock price correlation, brewing industry, financial research, market dynamics, craft beer enthusiasm, technology investments, brewing trends, stock performance

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

The number of Breweries in the United StatesDetailed data title: Number of Breweries in the United States

Source: Brewers Association

See what else correlates with The number of Breweries in the United States

VeriSign's stock price (VRSN)

Detailed data title: Opening price of VeriSign (VRSN) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with VeriSign's stock price (VRSN)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8828739 (Coefficient of determination)

This means 88.3% of the change in the one variable (i.e., VeriSign's stock price (VRSN)) is predictable based on the change in the other (i.e., The number of Breweries in the United States) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 2.7E-10. 0.0000000002712722666703602400

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.94 in 2.7E-8% of random cases. Said differently, if you correlated 3,686,333,337 random variables You don't actually need 3 billion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.85, 0.98 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| The number of Breweries in the United States (Number of breweries) | 1575 | 1629 | 1635 | 1612 | 1741 | 1805 | 1896 | 1933 | 2131 | 2525 | 2670 | 3162 | 4014 | 4847 | 5780 | 6767 | 7722 | 8557 | 9092 | 9384 | 9709 |

| VeriSign's stock price (VRSN) (Stock price) | 38.39 | 8.25 | 16.39 | 33.31 | 21.99 | 24.24 | 37.63 | 19.19 | 24.56 | 32.99 | 36.4 | 39.35 | 59.74 | 57.23 | 85.69 | 76.49 | 114.69 | 145.44 | 194.91 | 216.92 | 252.52 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([1575,1629,1635,1612,1741,1805,1896,1933,2131,2525,2670,3162,4014,4847,5780,6767,7722,8557,9092,9384,9709,])

array_2 = np.array([38.39,8.25,16.39,33.31,21.99,24.24,37.63,19.19,24.56,32.99,36.4,39.35,59.74,57.23,85.69,76.49,114.69,145.44,194.91,216.92,252.52,])

array_1_name = "The number of Breweries in the United States"

array_2_name = "VeriSign's stock price (VRSN)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only The number of Breweries in the United States

- Line chart for only VeriSign's stock price (VRSN)

- AI-generated correlation image

- The spurious research paper: Brewing Up Stocks: An Examination of the Relationship between the Number of Breweries in the United States and VeriSign's Stock Price

Thanks for being the explorer we needed!

Correlation ID: 3710 · Black Variable ID: 34 · Red Variable ID: 1920