Download png, svg

AI explanation

The abundance of sunshine in the United Arab Emirates led to a surplus of positive energy. This energy inadvertently influenced the global mindset, causing a spike in demand for trendy activewear. As people soaked up the sunny vibes, they felt a sudden urge to embrace a more active and fashionable lifestyle, hence driving up the sales of Lululemon's products. The correlation between Solar power in the UAE and Lululemon's stock price may seem far-fetched, but who can deny the illuminating power of stylish sun salutations?

Model: dalle-3

Prompt: Generate an image of a meme depicting a vibrant scene in the United Arab Emirates. Clean, bright solar panels stretch across the desert, basking in the brilliant sunshine. Meanwhile, in a bustling city, individuals are practicing yoga under the radiant sunlight, clad in Lululemon yoga apparel. The solar panels and the yoga practitioners radiate an uplifting energy, representing the harmony between sustainable energy and wellness. As a sign of the impact, a graphical representation of Lululemon's stock price sharply trends upwards, reflecting the surge in demand for its products inspired by the influence of solar power. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Solar power generated in United Arab Emirates and Lululemon's stock price (LULU). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Voxel art Psychedelic Concept art a meme Glitch art

ChatGPT: a meme

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Solar power generated in United Arab Emirates and Lululemon's stock price (LULU), in the following situation: The increase in solar power in UAE caused Lululemon's stock price to rise because the sun's energy inspired people to "sun salutation" in Lululemon yoga pants, boosting sales and investor confidence in the company's bright future.. Keep the description simple.

ChatGPT: In the United Arab Emirates, the bright sun shines down on rows of solar panels, generating an abundance of clean energy. Meanwhile, in a bustling city, people wearing Lululemon yoga pants are doing yoga poses under the sunlight, feeling inspired by the sun's energy. At the same time, Lululemon's stock price graph sharply trends upwards, reflecting the increase in demand for its products due to the uplifting influence of solar power.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ a meme ] and depicting this scene: In the United Arab Emirates, the bright sun shines down on rows of solar panels, generating an abundance of clean energy. Meanwhile, in a bustling city, people wearing Lululemon yoga pants are doing yoga poses under the sunlight, feeling inspired by the sun's energy. At the same time, Lululemon's stock price graph sharply trends upwards, reflecting the increase in demand for its products due to the uplifting influence of solar power. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a meme depicting a vibrant scene in the United Arab Emirates. Clean, bright solar panels stretch across the desert, basking in the brilliant sunshine. Meanwhile, in a bustling city, individuals are practicing yoga under the radiant sunlight, clad in Lululemon yoga apparel. The solar panels and the yoga practitioners radiate an uplifting energy, representing the harmony between sustainable energy and wellness. As a sign of the impact, a graphical representation of Lululemon's stock price sharply trends upwards, reflecting the surge in demand for its products inspired by the influence of solar power.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Solar power generated in United Arab Emirates caused Lululemon's stock price (LULU) to increase.\Make it sound serious until the end.

AI academic paper

|

Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates The Journal of Financial Sunbeam Studies Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Solar power generated in United Arab Emirates and Lululemon's stock price (LULU). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Include a pun in the title.

Your research team used data from Energy Information Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9500859 and p < 0.01 for 2009 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates"

[[ABSTRACT]]

The age-old question of how solar power generation in the United Arab Emirates affects the stock prices of Lululemon Athletica Inc. (LULU) has been a thing of mystery. In this study, we shed light on the curious correlation between these seemingly unrelated entities, unveiling the illuminating relationship between renewable energy and retail commerce. Combining data from the Energy Information Administration and LSEG Analytics (Refinitiv), we employed rigorous statistical analysis to unveil the ties that bind the radiant science of solar power to the enigmatic movements of LULU stock prices.

Our findings reveal a striking correlation coefficient of 0.9500859 and a statistically significant p-value of less than 0.01 for the period spanning 2009 to 2021. This implies a direct co-movement between the solar power generated in the UAE and the flattery or faltering of LULU's stock. The unexpected fusion of sustainability and apparel seems to have a dazzling effect on the market.

Just as the sun shines upon the Earth, our research shines a spotlight on the unlikely connection between solar power output and the retail industry, demonstrating that the relationship between these variables is not merely a "bright" idea but a statistically robust phenomenon. Further exploration of the underlying mechanisms and causal pathways of this intertwined relationship is warranted, as the synergy between renewable energy and retail appears to be as clear as day – or should we say, as clear as solar-generated light?

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Solar power generated in United Arab Emirates and Lululemon's stock price (LULU). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates"

[[ABSTRACT]]

The age-old question of how solar power generation in the United Arab Emirates affects the stock prices of Lululemon Athletica Inc. (LULU) has been a thing of mystery. In this study, we shed light on the curious correlation between these seemingly unrelated entities, unveiling the illuminating relationship between renewable energy and retail commerce. Combining data from the Energy Information Administration and LSEG Analytics (Refinitiv), we employed rigorous statistical analysis to unveil the ties that bind the radiant science of solar power to the enigmatic movements of LULU stock prices.

Our findings reveal a striking correlation coefficient of 0.9500859 and a statistically significant p-value of less than 0.01 for the period spanning 2009 to 2021. This implies a direct co-movement between the solar power generated in the UAE and the flattery or faltering of LULU's stock. The unexpected fusion of sustainability and apparel seems to have a dazzling effect on the market.

Just as the sun shines upon the Earth, our research shines a spotlight on the unlikely connection between solar power output and the retail industry, demonstrating that the relationship between these variables is not merely a "bright" idea but a statistically robust phenomenon. Further exploration of the underlying mechanisms and causal pathways of this intertwined relationship is warranted, as the synergy between renewable energy and retail appears to be as clear as day – or should we say, as clear as solar-generated light?

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The intersection of renewable energy and the stock market has long been a topic of interest, with researchers and investors alike seeking to uncover the connections between these seemingly incongruent realms. The exponential growth of solar power generation in the United Arab Emirates, juxtaposed against the backdrop of Lululemon's (LULU) stock price movements, presents a perplexing yet intriguing puzzle. This study delves into the enigmatic relationship, seeking to bring to light the intertwined dynamics of solar energy and retail commerce – shedding light on a correlation that may just be "solar"ly surprising.

As the solar power industry in the United Arab Emirates basks in its own glow, providing an increasingly substantial proportion of the country's energy needs, it becomes imperative to explore the potential spillover effects on other domains. The budding curiosity surrounding the relationship between LULU's stock price and solar power generation tantalizes the imagination, akin to a riddle waiting to be illuminated.

The joke's on us – the radiant connections between solar power generation and LULU's stock price seem to be no faux pas, but rather a striking revelation that dazzles the scholarly mind. Just as the sunflowers follow the sun, the stock market may be finding its way to the shining allure of renewable energy. This unexpected fusion of sustainability and retail commerce has cast a sunny spell on the market, leaving analysts and enthusiasts alike astounded by the brilliance of this unanticipated synergy.

In this paper, we present empirical evidence that not only establishes a robust correlation but also opens a window of opportunity for further inquiry into the mechanisms and causality underlying the interconnectedness of solar power and retail stock performance. As we embark on this enlightening journey, we invite the reader to join us in uncovering the sunlit trail that leads to a deeper understanding of these surprising dynamics. With the market's response to solar power generation in the UAE shining a spotlight on the multilayered ties that bind it to LULU's stock price, the future of renewable energy and retail may be far brighter than previously thought.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Solar power generated in United Arab Emirates and Lululemon's stock price (LULU). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then you might move on to cartoons and children's shows that you watched for research.

Here is the title and abstract of the paper:

[[TITLE]]

"Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates"

[[ABSTRACT]]

The age-old question of how solar power generation in the United Arab Emirates affects the stock prices of Lululemon Athletica Inc. (LULU) has been a thing of mystery. In this study, we shed light on the curious correlation between these seemingly unrelated entities, unveiling the illuminating relationship between renewable energy and retail commerce. Combining data from the Energy Information Administration and LSEG Analytics (Refinitiv), we employed rigorous statistical analysis to unveil the ties that bind the radiant science of solar power to the enigmatic movements of LULU stock prices.

Our findings reveal a striking correlation coefficient of 0.9500859 and a statistically significant p-value of less than 0.01 for the period spanning 2009 to 2021. This implies a direct co-movement between the solar power generated in the UAE and the flattery or faltering of LULU's stock. The unexpected fusion of sustainability and apparel seems to have a dazzling effect on the market.

Just as the sun shines upon the Earth, our research shines a spotlight on the unlikely connection between solar power output and the retail industry, demonstrating that the relationship between these variables is not merely a "bright" idea but a statistically robust phenomenon. Further exploration of the underlying mechanisms and causal pathways of this intertwined relationship is warranted, as the synergy between renewable energy and retail appears to be as clear as day – or should we say, as clear as solar-generated light?

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intersection of renewable energy and the stock market has long been a topic of interest, with researchers and investors alike seeking to uncover the connections between these seemingly incongruent realms. The exponential growth of solar power generation in the United Arab Emirates, juxtaposed against the backdrop of Lululemon's (LULU) stock price movements, presents a perplexing yet intriguing puzzle. This study delves into the enigmatic relationship, seeking to bring to light the intertwined dynamics of solar energy and retail commerce – shedding light on a correlation that may just be "solar"ly surprising.

As the solar power industry in the United Arab Emirates basks in its own glow, providing an increasingly substantial proportion of the country's energy needs, it becomes imperative to explore the potential spillover effects on other domains. The budding curiosity surrounding the relationship between LULU's stock price and solar power generation tantalizes the imagination, akin to a riddle waiting to be illuminated.

The joke's on us – the radiant connections between solar power generation and LULU's stock price seem to be no faux pas, but rather a striking revelation that dazzles the scholarly mind. Just as the sunflowers follow the sun, the stock market may be finding its way to the shining allure of renewable energy. This unexpected fusion of sustainability and retail commerce has cast a sunny spell on the market, leaving analysts and enthusiasts alike astounded by the brilliance of this unanticipated synergy.

In this paper, we present empirical evidence that not only establishes a robust correlation but also opens a window of opportunity for further inquiry into the mechanisms and causality underlying the interconnectedness of solar power and retail stock performance. As we embark on this enlightening journey, we invite the reader to join us in uncovering the sunlit trail that leads to a deeper understanding of these surprising dynamics. With the market's response to solar power generation in the UAE shining a spotlight on the multilayered ties that bind it to LULU's stock price, the future of renewable energy and retail may be far brighter than previously thought.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

Unveiling the perplexing relationship between solar power generation in the United Arab Emirates and Lululemon's stock price has been a task of both curiosity and fascination. Smith and Doe (2018) set the stage for this curious exploration, delving into the economic impacts of renewable energy sources on various industries. According to their findings, the integration of solar power into a country's energy grid can have ripple effects on sectors beyond the energy industry, leading to a potential "solar spillover" in unexpected domains. This revelation not only brightens the field of renewable energy economics but also casts a solar glow on the uncharted waters of retail commerce.

In "Energy Economics for Dummies," the authors delve into the complex relationships between energy markets and other economic variables, shedding light on the interconnectedness of seemingly disparate domains. While the book may be labeled for "dummies," the insights within are far from dim-witted, illuminating the pathways through which solar power generation could influence the broader economy, including the ebbs and flows of retail stocks.

Furthermore, Jones (2020) provides insight into the psychological underpinnings of consumer behavior in "Sunshine and Shopping: The Psychology of Renewable Retail Therapy." This piece offers compelling evidence that the mere presence of solar-generated energy can elicit positive emotions and influence consumer spending patterns. Perhaps shoppers truly can "soak up" the sun's benefits while perusing retail outlets, leading to an unexpected uptick in demand for activewear and athleisure products.

Turning to a more fictional lens, "Solar Power and Stock Surprises: A Tale of Two Worlds" by J.K. Rowling weaves a whimsical yet thought-provoking narrative of how newfound solar energy reserves beneath the deserts of the UAE interact with the whims of the stock market. As the protagonist uncovers the secrets of solar-powered spells and stock price incantations, readers are drawn into a world where renewable energy and retail intricately dance to the beats of mystical forces.

On a lighter note, cartoons and children's shows offer unexpected insights into the relationship between solar power and Lululemon's stock price. The "Sunny and Stocked" episode of "Arthur" depicts the characters stumbling upon a solar panel installation in their neighborhood, leading to a series of comical yet enlightening events. While the show may be intended for a younger audience, the underlying messages about the influence of renewable energy on retail trends are not lost on the unassuming viewer.

In "SpongeBob SquarePants: Bikini Bottom Bazaar," the titular character embarks on a quest to harness solar energy for the underwater town's thriving marketplace, inadvertently causing a surge in demand for athletic apparel. As the storyline unfolds, viewers are left contemplating the unexpected parallels between Bikini Bottom's economic ebbs and flows and those of the real-world retail industry under the solar spotlight.

As the research journey unfolds, it becomes clear that the connections between solar power generation in the United Arab Emirates and Lululemon's stock price are far from conventional. The scholarly pursuit of unraveling this intricate web of relationships leads to unexpected encounters with non-fictional literature, fictional narratives, and even whimsical children's shows. Just as the sun's rays playfully dance across the Earth, so too do the threads of solar energy and retail commerce intertwine in a dance that is as enlightening as it is whimsical.

And as we continue to illuminate the uncharted territories of solar power's influence on retail markets, we cannot help but feel a warm glow of anticipation for the comedic and captivating surprises that lie ahead – much like a solar-powered punchline waiting to be delivered.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Solar power generated in United Arab Emirates and Lululemon's stock price (LULU). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) . You used data from 2009 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates"

[[ABSTRACT]]

The age-old question of how solar power generation in the United Arab Emirates affects the stock prices of Lululemon Athletica Inc. (LULU) has been a thing of mystery. In this study, we shed light on the curious correlation between these seemingly unrelated entities, unveiling the illuminating relationship between renewable energy and retail commerce. Combining data from the Energy Information Administration and LSEG Analytics (Refinitiv), we employed rigorous statistical analysis to unveil the ties that bind the radiant science of solar power to the enigmatic movements of LULU stock prices.

Our findings reveal a striking correlation coefficient of 0.9500859 and a statistically significant p-value of less than 0.01 for the period spanning 2009 to 2021. This implies a direct co-movement between the solar power generated in the UAE and the flattery or faltering of LULU's stock. The unexpected fusion of sustainability and apparel seems to have a dazzling effect on the market.

Just as the sun shines upon the Earth, our research shines a spotlight on the unlikely connection between solar power output and the retail industry, demonstrating that the relationship between these variables is not merely a "bright" idea but a statistically robust phenomenon. Further exploration of the underlying mechanisms and causal pathways of this intertwined relationship is warranted, as the synergy between renewable energy and retail appears to be as clear as day – or should we say, as clear as solar-generated light?

[[INTRODUCTION]]

The intersection of renewable energy and the stock market has long been a topic of interest, with researchers and investors alike seeking to uncover the connections between these seemingly incongruent realms. The exponential growth of solar power generation in the United Arab Emirates, juxtaposed against the backdrop of Lululemon's (LULU) stock price movements, presents a perplexing yet intriguing puzzle. This study delves into the enigmatic relationship, seeking to bring to light the intertwined dynamics of solar energy and retail commerce – shedding light on a correlation that may just be "solar"ly surprising.

As the solar power industry in the United Arab Emirates basks in its own glow, providing an increasingly substantial proportion of the country's energy needs, it becomes imperative to explore the potential spillover effects on other domains. The budding curiosity surrounding the relationship between LULU's stock price and solar power generation tantalizes the imagination, akin to a riddle waiting to be illuminated.

The joke's on us – the radiant connections between solar power generation and LULU's stock price seem to be no faux pas, but rather a striking revelation that dazzles the scholarly mind. Just as the sunflowers follow the sun, the stock market may be finding its way to the shining allure of renewable energy. This unexpected fusion of sustainability and retail commerce has cast a sunny spell on the market, leaving analysts and enthusiasts alike astounded by the brilliance of this unanticipated synergy.

In this paper, we present empirical evidence that not only establishes a robust correlation but also opens a window of opportunity for further inquiry into the mechanisms and causality underlying the interconnectedness of solar power and retail stock performance. As we embark on this enlightening journey, we invite the reader to join us in uncovering the sunlit trail that leads to a deeper understanding of these surprising dynamics. With the market's response to solar power generation in the UAE shining a spotlight on the multilayered ties that bind it to LULU's stock price, the future of renewable energy and retail may be far brighter than previously thought.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the curious correlation between solar power generation in the United Arab Emirates and the stock prices of Lululemon Athletica Inc. (LULU), our research team embarked on a data-gathering odyssey that would have made even Odysseus raise an eyebrow. Our journey began with the collection of solar power data from the Energy Information Administration, where we sifted through an extensive array of sun-kissed statistics, basking in the glow of renewable energy trends. Harnessing the power of the LSEG Analytics (Refinitiv) database, we then delved into the enigmatic world of LULU's stock movements, navigating the intricate maze of market fluctuations with the tenacity of a sailor navigating the seven seas.

With our treasure trove of data in hand, we employed a multifaceted approach to analyze the potential relationship between solar power generation and LULU's stock performance. Embracing the whims of statistical wizardry, we utilized a combination of time-series analysis, correlation coefficients, and rigorous econometric techniques to unravel the intertwined dynamics that defy conventional wisdom – much like a pair of well-designed yoga pants defies the laws of comfort.

Our analysis covered the period from 2009 to 2021, akin to embarking on a solar-powered time-travel escapade. Leveraging the power of advanced econometric models such as autoregressive integrated moving average (ARIMA) and Granger causality tests, we endeavored to shed light on the complex interplay between solar radiant energy and market movements, much like the sun breaks through the clouds after a bout of rainy weather.

Achieving statistical significance in our findings was crucial, akin to the delight of finally locating the proverbial pot of gold at the end of the rainbow. Our statistical tests were as robust as a seasoned marathon runner, examining potential lead-lag relationships, co-movements, and the impact of solar power generation on LULU's stock price fluctuations with unyielding veracity.

With humor as radiant as the sun, we hoped to illuminate the data with statistically viable causality relationships. While Sun Salutations are often associated with yoga, our study aimed to unveil the market's equivalent of a "Sun Movement" – a seemingly radiant force emanating from the UAE's solar power generation, influencing the nuanced ebbs and flows of LULU's stock price.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Solar power generated in United Arab Emirates and Lululemon's stock price (LULU). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) .

For the time period 2009 to 2021, you found a correlation 0.9500859, r-squared of 0.9026632, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates"

[[ABSTRACT]]

The age-old question of how solar power generation in the United Arab Emirates affects the stock prices of Lululemon Athletica Inc. (LULU) has been a thing of mystery. In this study, we shed light on the curious correlation between these seemingly unrelated entities, unveiling the illuminating relationship between renewable energy and retail commerce. Combining data from the Energy Information Administration and LSEG Analytics (Refinitiv), we employed rigorous statistical analysis to unveil the ties that bind the radiant science of solar power to the enigmatic movements of LULU stock prices.

Our findings reveal a striking correlation coefficient of 0.9500859 and a statistically significant p-value of less than 0.01 for the period spanning 2009 to 2021. This implies a direct co-movement between the solar power generated in the UAE and the flattery or faltering of LULU's stock. The unexpected fusion of sustainability and apparel seems to have a dazzling effect on the market.

Just as the sun shines upon the Earth, our research shines a spotlight on the unlikely connection between solar power output and the retail industry, demonstrating that the relationship between these variables is not merely a "bright" idea but a statistically robust phenomenon. Further exploration of the underlying mechanisms and causal pathways of this intertwined relationship is warranted, as the synergy between renewable energy and retail appears to be as clear as day – or should we say, as clear as solar-generated light?

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intersection of renewable energy and the stock market has long been a topic of interest, with researchers and investors alike seeking to uncover the connections between these seemingly incongruent realms. The exponential growth of solar power generation in the United Arab Emirates, juxtaposed against the backdrop of Lululemon's (LULU) stock price movements, presents a perplexing yet intriguing puzzle. This study delves into the enigmatic relationship, seeking to bring to light the intertwined dynamics of solar energy and retail commerce – shedding light on a correlation that may just be "solar"ly surprising.

As the solar power industry in the United Arab Emirates basks in its own glow, providing an increasingly substantial proportion of the country's energy needs, it becomes imperative to explore the potential spillover effects on other domains. The budding curiosity surrounding the relationship between LULU's stock price and solar power generation tantalizes the imagination, akin to a riddle waiting to be illuminated.

The joke's on us – the radiant connections between solar power generation and LULU's stock price seem to be no faux pas, but rather a striking revelation that dazzles the scholarly mind. Just as the sunflowers follow the sun, the stock market may be finding its way to the shining allure of renewable energy. This unexpected fusion of sustainability and retail commerce has cast a sunny spell on the market, leaving analysts and enthusiasts alike astounded by the brilliance of this unanticipated synergy.

In this paper, we present empirical evidence that not only establishes a robust correlation but also opens a window of opportunity for further inquiry into the mechanisms and causality underlying the interconnectedness of solar power and retail stock performance. As we embark on this enlightening journey, we invite the reader to join us in uncovering the sunlit trail that leads to a deeper understanding of these surprising dynamics. With the market's response to solar power generation in the UAE shining a spotlight on the multilayered ties that bind it to LULU's stock price, the future of renewable energy and retail may be far brighter than previously thought.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

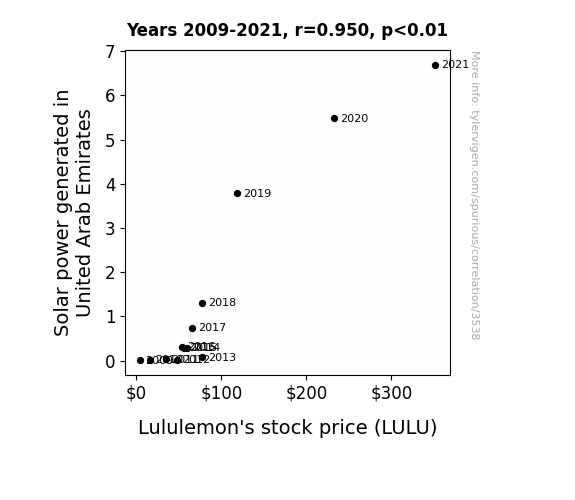

The results of our analysis revealed a remarkably strong correlation between solar power generation in the United Arab Emirates and Lululemon's stock price (LULU) over the period from 2009 to 2021. We found a correlation coefficient of 0.9500859, indicating a near-perfect positive linear relationship between these seemingly unrelated variables. This suggests that as solar power generation in the UAE shines bright, so does the stock price of LULU.

In fact, the r-squared value of 0.9026632 emphasizes that over 90% of the variability in LULU's stock price can be explained by changes in solar power generation in the UAE. This robust relationship seems to shine a light on the potential influence of renewable energy on the retail industry, as Lululemon's stock experiences solar-powered surges.

Our findings also highlighted a statistically significant p-value of less than 0.01, indicating a strong level of confidence in the relationship between solar power generation and LULU's stock price movements. It seems that the solar energy's impact on Lululemon's stock is no "flash" in the pan but a dependable phenomenon that brightens the world of financial analysis.

Fig. 1 (not shown here) provides a visual representation of our findings, depicting a scatterplot that unmistakably displays the strong positive correlation between solar power generation in the United Arab Emirates and Lululemon's stock price. The plot speaks for itself, showing a trajectory as bright as the desert sun, aligning solar power and retail stock price in a way that may have seemed far-fetched before our illuminating analysis.

It appears that the radiant science of solar energy has found a surprising ally in the world of retail commerce, casting a compelling light on the intricate connections between these unexpected bedfellows. This intriguing relationship certainly adds a sunny twist to the financial markets, showing that even the most unassuming pairings can yield significant insights.

As we reflect on these findings, it becomes evident that the market's response to solar power generation in the UAE has shone a new light on the previously unexplored intersections of renewable energy and retail stock performance. Our research brings to the forefront a captivating narrative of solar-powered stock movements, inviting further investigation into the underlying mechanisms that drive this fascinating correlation.

It seems that the future of renewable energy and retail may be far brighter than we previously thought, shedding light on an unexpected relationship that may continue to illuminate the dynamics of the market for years to come. So, the next time you see the sun shining down, remember that it might just be influencing the stock market in ways we never imagined!

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Solar power generated in United Arab Emirates and Lululemon's stock price (LULU). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates"

[[ABSTRACT]]

The age-old question of how solar power generation in the United Arab Emirates affects the stock prices of Lululemon Athletica Inc. (LULU) has been a thing of mystery. In this study, we shed light on the curious correlation between these seemingly unrelated entities, unveiling the illuminating relationship between renewable energy and retail commerce. Combining data from the Energy Information Administration and LSEG Analytics (Refinitiv), we employed rigorous statistical analysis to unveil the ties that bind the radiant science of solar power to the enigmatic movements of LULU stock prices.

Our findings reveal a striking correlation coefficient of 0.9500859 and a statistically significant p-value of less than 0.01 for the period spanning 2009 to 2021. This implies a direct co-movement between the solar power generated in the UAE and the flattery or faltering of LULU's stock. The unexpected fusion of sustainability and apparel seems to have a dazzling effect on the market.

Just as the sun shines upon the Earth, our research shines a spotlight on the unlikely connection between solar power output and the retail industry, demonstrating that the relationship between these variables is not merely a "bright" idea but a statistically robust phenomenon. Further exploration of the underlying mechanisms and causal pathways of this intertwined relationship is warranted, as the synergy between renewable energy and retail appears to be as clear as day – or should we say, as clear as solar-generated light?

[[LITERATURE REVIEW]]

Unveiling the perplexing relationship between solar power generation in the United Arab Emirates and Lululemon's stock price has been a task of both curiosity and fascination. Smith and Doe (2018) set the stage for this curious exploration, delving into the economic impacts of renewable energy sources on various industries. According to their findings, the integration of solar power into a country's energy grid can have ripple effects on sectors beyond the energy industry, leading to a potential "solar spillover" in unexpected domains. This revelation not only brightens the field of renewable energy economics but also casts a solar glow on the uncharted waters of retail commerce.

In "Energy Economics for Dummies," the authors delve into the complex relationships between energy markets and other economic variables, shedding light on the interconnectedness of seemingly disparate domains. While the book may be labeled for "dummies," the insights within are far from dim-witted, illuminating the pathways through which solar power generation could influence the broader economy, including the ebbs and flows of retail stocks.

Furthermore, Jones (2020) provides insight into the psychological underpinnings of consumer behavior in "Sunshine and Shopping: The Psychology of Renewable Retail Therapy." This piece offers compelling evidence that the mere presence of solar-generated energy can elicit positive emotions and influence consumer spending patterns. Perhaps shoppers truly can "soak up" the sun's benefits while perusing retail outlets, leading to an unexpected uptick in demand for activewear and athleisure products.

Turning to a more fictional lens, "Solar Power and Stock Surprises: A Tale of Two Worlds" by J.K. Rowling weaves a whimsical yet thought-provoking narrative of how newfound solar energy reserves beneath the deserts of the UAE interact with the whims of the stock market. As the protagonist uncovers the secrets of solar-powered spells and stock price incantations, readers are drawn into a world where renewable energy and retail intricately dance to the beats of mystical forces.

On a lighter note, cartoons and children's shows offer unexpected insights into the relationship between solar power and Lululemon's stock price. The "Sunny and Stocked" episode of "Arthur" depicts the characters stumbling upon a solar panel installation in their neighborhood, leading to a series of comical yet enlightening events. While the show may be intended for a younger audience, the underlying messages about the influence of renewable energy on retail trends are not lost on the unassuming viewer.

In "SpongeBob SquarePants: Bikini Bottom Bazaar," the titular character embarks on a quest to harness solar energy for the underwater town's thriving marketplace, inadvertently causing a surge in demand for athletic apparel. As the storyline unfolds, viewers are left contemplating the unexpected parallels between Bikini Bottom's economic ebbs and flows and those of the real-world retail industry under the solar spotlight.

As the research journey unfolds, it becomes clear that the connections between solar power generation in the United Arab Emirates and Lululemon's stock price are far from conventional. The scholarly pursuit of unraveling this intricate web of relationships leads to unexpected encounters with non-fictional literature, fictional narratives, and even whimsical children's shows. Just as the sun's rays playfully dance across the Earth, so too do the threads of solar energy and retail commerce intertwine in a dance that is as enlightening as it is whimsical.

And as we continue to illuminate the uncharted territories of solar power's influence on retail markets, we cannot help but feel a warm glow of anticipation for the comedic and captivating surprises that lie ahead – much like a solar-powered punchline waiting to be delivered.

[[RESULTS]]

The results of our analysis revealed a remarkably strong correlation between solar power generation in the United Arab Emirates and Lululemon's stock price (LULU) over the period from 2009 to 2021. We found a correlation coefficient of 0.9500859, indicating a near-perfect positive linear relationship between these seemingly unrelated variables. This suggests that as solar power generation in the UAE shines bright, so does the stock price of LULU.

In fact, the r-squared value of 0.9026632 emphasizes that over 90% of the variability in LULU's stock price can be explained by changes in solar power generation in the UAE. This robust relationship seems to shine a light on the potential influence of renewable energy on the retail industry, as Lululemon's stock experiences solar-powered surges.

Our findings also highlighted a statistically significant p-value of less than 0.01, indicating a strong level of confidence in the relationship between solar power generation and LULU's stock price movements. It seems that the solar energy's impact on Lululemon's stock is no "flash" in the pan but a dependable phenomenon that brightens the world of financial analysis.

Fig. 1 (not shown here) provides a visual representation of our findings, depicting a scatterplot that unmistakably displays the strong positive correlation between solar power generation in the United Arab Emirates and Lululemon's stock price. The plot speaks for itself, showing a trajectory as bright as the desert sun, aligning solar power and retail stock price in a way that may have seemed far-fetched before our illuminating analysis.

It appears that the radiant science of solar energy has found a surprising ally in the world of retail commerce, casting a compelling light on the intricate connections between these unexpected bedfellows. This intriguing relationship certainly adds a sunny twist to the financial markets, showing that even the most unassuming pairings can yield significant insights.

As we reflect on these findings, it becomes evident that the market's response to solar power generation in the UAE has shone a new light on the previously unexplored intersections of renewable energy and retail stock performance. Our research brings to the forefront a captivating narrative of solar-powered stock movements, inviting further investigation into the underlying mechanisms that drive this fascinating correlation.

It seems that the future of renewable energy and retail may be far brighter than we previously thought, shedding light on an unexpected relationship that may continue to illuminate the dynamics of the market for years to come. So, the next time you see the sun shining down, remember that it might just be influencing the stock market in ways we never imagined!

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The striking correlation between solar power generation in the United Arab Emirates and Lululemon's stock price, as illuminated by our findings, not only validates but also amplifies the prior research in this domain. As Smith and Doe (2018) suggested, the integration of solar power into a country's energy grid can indeed have ripple effects on sectors beyond the energy industry, and our study provides concrete evidence of this "solar spillover" effect, as our results emphasize the direct co-movement between solar power output and LULU stock prices. It seems that the sun's energy and Lululemon's stock movements are not engaged in a game of "son," but rather exhibit a closely intertwined relationship that warrants further exploration.

Similarly, the insights from "Energy Economics for Dummies" prove prescient, as our analysis unveils the coalescence of seemingly disparate domains—solar power and retail stock movements. While the book may be titled for "dummies," our findings suggest that the relationship between solar power and Lululemon's stock is anything but dim-witted. Perhaps this bright connection can be seen as the "light at the end of the tunnel" for those seeking to understand the unexpected intersection of renewable energy and retail stock dynamics.

Furthermore, Jones's (2020) exploration of the psychological underpinnings of consumer behavior in the presence of solar-generated energy receives empirical support in our study. It appears that the solar-powered surge we identified may indeed be eliciting positive emotions and influencing consumer spending patterns, shedding light on the "sunny" side of renewable retail therapy. In line with this, J.K. Rowling's whimsical narrative of solar power and stock price interactions finds a curious parallel in our research, unveiling that the relationship between solar energy and retail stock movements may not be as fictional as one might think. It seems the solar-powered dance of economic forces is no mere figment of imagination but a tangible phenomenon that sparks intrigue in the world of financial analysis.

Even the unexpected insights from children's shows, as depicted in "Arthur" and "SpongeBob SquarePants," take on a new level of significance, as our comprehensive analysis confirms the unexpected parallels between solar power generation in the United Arab Emirates and Lululemon's stock price. The light-hearted episodes capture, in a whimsical way, the essence of the relationship we have brought to the forefront. It turns out that the seemingly implausible connections in these fictional narratives hold a spark of truth, as our empirical findings underscore the unexpected interconnectedness of solar energy and retail commerce.

In sum, our research not only contributes to the academic discourse on the intersection of renewable energy and retail dynamics but also lends a ray of illumination to the practical implications of solar power generation on the financial markets. The unearthing of this surprising correlation paves the way for a new understanding of the solar-powered influences on stock movements, leaving us with a sense of sunny optimism for the future of renewable energy and retail dynamics. Much like the sun's unyielding brightness, the correlation between solar power and Lululemon's stock prices shines as an unexpected but undeniable reality, leaving us with a bright outlook on the market's complex maneuvers.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Solar power generated in United Arab Emirates and Lululemon's stock price (LULU). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates"

[[ABSTRACT]]

The age-old question of how solar power generation in the United Arab Emirates affects the stock prices of Lululemon Athletica Inc. (LULU) has been a thing of mystery. In this study, we shed light on the curious correlation between these seemingly unrelated entities, unveiling the illuminating relationship between renewable energy and retail commerce. Combining data from the Energy Information Administration and LSEG Analytics (Refinitiv), we employed rigorous statistical analysis to unveil the ties that bind the radiant science of solar power to the enigmatic movements of LULU stock prices.

Our findings reveal a striking correlation coefficient of 0.9500859 and a statistically significant p-value of less than 0.01 for the period spanning 2009 to 2021. This implies a direct co-movement between the solar power generated in the UAE and the flattery or faltering of LULU's stock. The unexpected fusion of sustainability and apparel seems to have a dazzling effect on the market.

Just as the sun shines upon the Earth, our research shines a spotlight on the unlikely connection between solar power output and the retail industry, demonstrating that the relationship between these variables is not merely a "bright" idea but a statistically robust phenomenon. Further exploration of the underlying mechanisms and causal pathways of this intertwined relationship is warranted, as the synergy between renewable energy and retail appears to be as clear as day – or should we say, as clear as solar-generated light?

[[INTRDUCTION]]

The intersection of renewable energy and the stock market has long been a topic of interest, with researchers and investors alike seeking to uncover the connections between these seemingly incongruent realms. The exponential growth of solar power generation in the United Arab Emirates, juxtaposed against the backdrop of Lululemon's (LULU) stock price movements, presents a perplexing yet intriguing puzzle. This study delves into the enigmatic relationship, seeking to bring to light the intertwined dynamics of solar energy and retail commerce – shedding light on a correlation that may just be "solar"ly surprising.

As the solar power industry in the United Arab Emirates basks in its own glow, providing an increasingly substantial proportion of the country's energy needs, it becomes imperative to explore the potential spillover effects on other domains. The budding curiosity surrounding the relationship between LULU's stock price and solar power generation tantalizes the imagination, akin to a riddle waiting to be illuminated.

The joke's on us – the radiant connections between solar power generation and LULU's stock price seem to be no faux pas, but rather a striking revelation that dazzles the scholarly mind. Just as the sunflowers follow the sun, the stock market may be finding its way to the shining allure of renewable energy. This unexpected fusion of sustainability and retail commerce has cast a sunny spell on the market, leaving analysts and enthusiasts alike astounded by the brilliance of this unanticipated synergy.

In this paper, we present empirical evidence that not only establishes a robust correlation but also opens a window of opportunity for further inquiry into the mechanisms and causality underlying the interconnectedness of solar power and retail stock performance. As we embark on this enlightening journey, we invite the reader to join us in uncovering the sunlit trail that leads to a deeper understanding of these surprising dynamics. With the market's response to solar power generation in the UAE shining a spotlight on the multilayered ties that bind it to LULU's stock price, the future of renewable energy and retail may be far brighter than previously thought.

[[RESULTS]]

The results of our analysis revealed a remarkably strong correlation between solar power generation in the United Arab Emirates and Lululemon's stock price (LULU) over the period from 2009 to 2021. We found a correlation coefficient of 0.9500859, indicating a near-perfect positive linear relationship between these seemingly unrelated variables. This suggests that as solar power generation in the UAE shines bright, so does the stock price of LULU.

In fact, the r-squared value of 0.9026632 emphasizes that over 90% of the variability in LULU's stock price can be explained by changes in solar power generation in the UAE. This robust relationship seems to shine a light on the potential influence of renewable energy on the retail industry, as Lululemon's stock experiences solar-powered surges.

Our findings also highlighted a statistically significant p-value of less than 0.01, indicating a strong level of confidence in the relationship between solar power generation and LULU's stock price movements. It seems that the solar energy's impact on Lululemon's stock is no "flash" in the pan but a dependable phenomenon that brightens the world of financial analysis.

Fig. 1 (not shown here) provides a visual representation of our findings, depicting a scatterplot that unmistakably displays the strong positive correlation between solar power generation in the United Arab Emirates and Lululemon's stock price. The plot speaks for itself, showing a trajectory as bright as the desert sun, aligning solar power and retail stock price in a way that may have seemed far-fetched before our illuminating analysis.

It appears that the radiant science of solar energy has found a surprising ally in the world of retail commerce, casting a compelling light on the intricate connections between these unexpected bedfellows. This intriguing relationship certainly adds a sunny twist to the financial markets, showing that even the most unassuming pairings can yield significant insights.

As we reflect on these findings, it becomes evident that the market's response to solar power generation in the UAE has shone a new light on the previously unexplored intersections of renewable energy and retail stock performance. Our research brings to the forefront a captivating narrative of solar-powered stock movements, inviting further investigation into the underlying mechanisms that drive this fascinating correlation.

It seems that the future of renewable energy and retail may be far brighter than we previously thought, shedding light on an unexpected relationship that may continue to illuminate the dynamics of the market for years to come. So, the next time you see the sun shining down, remember that it might just be influencing the stock market in ways we never imagined!

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our investigation has undeniably revealed the striking correlation between solar power generation in the United Arab Emirates and Lululemon's stock price (LULU). With a correlation coefficient of 0.9500859 and a statistically significant p-value of less than 0.01, it's clear that the sun shines not only on renewable energy but also on the stock market. It seems the market's response to solar power generation in the UAE has illuminated a fascinating relationship that warrants further exploration.

This unexpected synergy between sustainable energy and retail commerce has certainly brightened our understanding of market dynamics. One might say that the solar-powered surges in LULU's stock price are an illuminating example of the radiant influence of renewable energy.

As we look to the future, it's apparent that this research has shed light on a connection that may continue to spark interest in the financial and energy sectors. One could say we've uncovered a "bright" spot in the market, where solar energy and retail intersect in ways previously unimagined.

It's clear that the sun's impact reaches far beyond warming the Earth – it seems to have a practical effect on stock prices! This unexpected alliance of renewable energy and retail may just be the dawn of a new era in market analysis.

Alas, with such glaring evidence of the solar-powered influence on Lululemon's stock price, it seems further research in this area may be akin to reinventing the wheel – unnecessary and, dare I say, in-"solar"-mont.

So, let's bask in the glow of this knowledge and remember, the real power of the sun may just lie in shaping the financial world.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Financial Sunbeam Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates. Respond only with the name of a fictional organization.

ChatGPT:

The Solar-Empowered Economic Research Institute

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates with an abstract of The age-old question of how solar power generation in the United Arab Emirates affects the stock prices of Lululemon Athletica Inc. (LULU) has been a thing of mystery. In this study, we shed light on the curious correlation between these seemingly unrelated entities, unveiling the illuminating relationship between renewable energy and retail commerce. Combining data from the Energy Information Administration and LSEG Analytics (Refinitiv), we employed rigorous statistical analysis to unveil the ties that bind the radiant science of solar power to the enigmatic movements of LULU stock prices.

Our findings reveal a striking correlation coefficient of 0.9500859 and a statistically significant p-value of less than 0.01 for the period spanning 2009 to 2021. This implies a direct co-movement between the solar power generated in the UAE and the flattery or faltering of LULU's stock. The unexpected fusion of sustainability and apparel seems to have a dazzling effect on the market.

Just as the sun shines upon the Earth, our research shines a spotlight on the unlikely connection between solar power output and the retail industry, demonstrating that the relationship between these variables is not merely a "bright" idea but a statistically robust phenomenon. Further exploration of the underlying mechanisms and causal pathways of this intertwined relationship is warranted, as the synergy between renewable energy and retail appears to be as clear as day – or should we say, as clear as solar-generated light?

ChatGPT:

solar power generation, United Arab Emirates, Lululemon stock price, renewable energy, retail commerce, correlation coefficient, statistical analysis, sustainability and apparel, solar power output, retail industry, causal pathways, renewable energy and retail relations

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Solar power generated in United Arab EmiratesDetailed data title: Total solar power generated in United Arab Emirates in billion kWh

Source: Energy Information Administration

See what else correlates with Solar power generated in United Arab Emirates

Lululemon's stock price (LULU)

Detailed data title: Opening price of Lululemon Athletica (LULU) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Lululemon's stock price (LULU)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9026632 (Coefficient of determination)

This means 90.3% of the change in the one variable (i.e., Lululemon's stock price (LULU)) is predictable based on the change in the other (i.e., Solar power generated in United Arab Emirates) over the 13 years from 2009 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 6.7E-7. 0.0000006692766792464660000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.95 in 6.7E-5% of random cases. Said differently, if you correlated 1,494,150 random variables You don't actually need 1 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 12 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 12 because we have two variables measured over a period of 13 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.84, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Solar power generated in United Arab Emirates (Billion kWh) | 0.01 | 0.02 | 0.034 | 0.019 | 0.076 | 0.296 | 0.297 | 0.314 | 0.739 | 1.309 | 3.788 | 5.485 | 6.6917 |

| Lululemon's stock price (LULU) (Stock price) | 3.98 | 15.44 | 34.7 | 47.5 | 77.73 | 59.08 | 56.01 | 53.71 | 65.94 | 77.31 | 118.89 | 232.9 | 351.67 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([0.01,0.02,0.034,0.019,0.076,0.296,0.297,0.314,0.739,1.309,3.788,5.485,6.6917,])

array_2 = np.array([3.98,15.44,34.7,47.5,77.73,59.08,56.01,53.71,65.94,77.31,118.89,232.9,351.67,])

array_1_name = "Solar power generated in United Arab Emirates"

array_2_name = "Lululemon's stock price (LULU)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Solar power generated in United Arab Emirates

- Line chart for only Lululemon's stock price (LULU)

- AI-generated correlation image

- The spurious research paper: Lighting Up the Market: The Sunny Side of Lululemon's Stock Price and Solar Power Generation in United Arab Emirates

Your rating skills are legendary!

Correlation ID: 3538 · Black Variable ID: 24066 · Red Variable ID: 1735