AI explanation

The smog acted as a natural barrier, preventing other bank branches from encroaching on Banco Santander's territory. With their competitive advantage secured, it's no wonder the stock price saw a boost!

Model: dalle-3

Prompt: Generate an image in the style of a Polaroid photo: In the center, depict a cityscape of Buffalo, with a thick smog hanging in the air. Among the city streets, include moose roaming, looking displaced and seeking shelter. In the foreground, show a local breakfast spot with a noticeable lack of maple syrup, leading to a disrupted morning routine. In the background, portray a building representing Banco Santander, with employees looking sluggish and unfocused. Let the overall atmosphere of the image convey a sense of disruption and unease. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Air pollution in Buffalo and Banco Santander's stock price (SAN). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: a Polaroid photo a funny image macro a meme a funny image macro Art nouveau

ChatGPT: a Polaroid photo

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Air pollution in Buffalo and Banco Santander's stock price (SAN), in the following situation: The increase in air pollution in Buffalo caused an influx of moose to migrate to the city, leading to a shortage of maple syrup for breakfast, which caused a decrease in productivity at Banco Santander, ultimately affecting their stock price.. Keep the description simple.

ChatGPT: In Buffalo, a thick smog hung in the air as moose roamed the city streets, seeking refuge from their disrupted natural habitats. Meanwhile, at a local breakfast spot, a shortage of maple syrup disrupted the usual morning routine. As a result, the employees of Banco Santander, located nearby, were left feeling sluggish and unfocused, leading to a decrease in productivity. This ultimately affected the stock price of Banco Santander (SAN).

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ a Polaroid photo ] and depicting this scene: In Buffalo, a thick smog hung in the air as moose roamed the city streets, seeking refuge from their disrupted natural habitats. Meanwhile, at a local breakfast spot, a shortage of maple syrup disrupted the usual morning routine. As a result, the employees of Banco Santander, located nearby, were left feeling sluggish and unfocused, leading to a decrease in productivity. This ultimately affected the stock price of Banco Santander (SAN). Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image in the style of a Polaroid photo: In the center, depict a cityscape of Buffalo, with a thick smog hanging in the air. Among the city streets, include moose roaming, looking displaced and seeking shelter. In the foreground, show a local breakfast spot with a noticeable lack of maple syrup, leading to a disrupted morning routine. In the background, portray a building representing Banco Santander, with employees looking sluggish and unfocused. Let the overall atmosphere of the image convey a sense of disruption and unease.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how increases in Air pollution in Buffalo positively influenced Banco Santander's stock price (SAN).

AI academic paper

|

Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price The Journal of Environmental Economics and Financial Forecasting Jan 2024 |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Air pollution in Buffalo and Banco Santander's stock price (SAN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from Environmental Protection Agency and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8180340 and p < 0.01 for 2002 to 2023.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price"

[[ABSTRACT]]

This paper delves into the intriguing connection between air pollution in Buffalo and the stock price of Banco Santander (SAN) over a twenty-year period. Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a rigorous analysis to investigate this unforeseen correlation. The results yielded a substantial correlation coefficient of 0.8180340 and a statistically significant p-value of less than 0.01 for the years 2002 to 2023. Our findings not only shed light on the potential impact of air quality on financial markets but also raise important questions surrounding the interplay between environmental factors and economic outcomes. This study provides a lighthearted yet thought-provoking perspective on the often untapped connections between seemingly unrelated variables, reminding us that sometimes, the air we breathe and stock prices may not be as far apart as we think.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Air pollution in Buffalo and Banco Santander's stock price (SAN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price"

[[ABSTRACT]]

This paper delves into the intriguing connection between air pollution in Buffalo and the stock price of Banco Santander (SAN) over a twenty-year period. Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a rigorous analysis to investigate this unforeseen correlation. The results yielded a substantial correlation coefficient of 0.8180340 and a statistically significant p-value of less than 0.01 for the years 2002 to 2023. Our findings not only shed light on the potential impact of air quality on financial markets but also raise important questions surrounding the interplay between environmental factors and economic outcomes. This study provides a lighthearted yet thought-provoking perspective on the often untapped connections between seemingly unrelated variables, reminding us that sometimes, the air we breathe and stock prices may not be as far apart as we think.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

INTRODUCTION

Air pollution and stock prices – two seemingly disparate topics that rarely find themselves in the same breath, let alone in the same research paper. However, in the delightful adventure of exploration and data analysis, we stumbled upon an unexpected relationship that bypassed conventional boundaries and showcased a peculiar link between the polluted air of Buffalo and the fluctuating stock price of Banco Santander (SAN). Who would've thought that the smog of Buffalo could hold such sway over the financial markets of a Spanish multinational bank? Certainly not us, until our bewildered data analysis team stumbled upon these intriguing correlations.

The aim of this study is to unpack this enigmatic connection and provide a rigorous analysis that dares to traverse the realms of environmental pollution and financial markets. Armed with data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we embarked on a mission to disentangle the knotty relationship between air pollution and stock prices. Our adventure was replete with surprises, as we uncovered a substantial correlation coefficient of 0.8180340 and a p-value worthy of raising an intrigued eyebrow – less than 0.01 – for the years 2002 to 2023. These findings not only left us in awe but also led us to ponder the profound implications of air quality on the ever-unpredictable vicissitudes of financial markets.

Naturally, this study comes with a lighthearted twist, offering a perspective that encourages readers to consider the unexpected connections and quirks of the world we inhabit. After all, the stock market and air quality, while seemingly at opposite ends of the spectrum, may have more in common than meets the eye – or the nostrils, in this case. Thus, in the spirit of academic curiosity and a touch of whimsy, we invite you to embark on this peculiar journey with us, as we unravel the tale of the air and the stocks, and perhaps uncover a newfound appreciation for the interconnectedness of our world.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Air pollution in Buffalo and Banco Santander's stock price (SAN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some movies that you watched that are tangentially related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

"Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price"

[[ABSTRACT]]

This paper delves into the intriguing connection between air pollution in Buffalo and the stock price of Banco Santander (SAN) over a twenty-year period. Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a rigorous analysis to investigate this unforeseen correlation. The results yielded a substantial correlation coefficient of 0.8180340 and a statistically significant p-value of less than 0.01 for the years 2002 to 2023. Our findings not only shed light on the potential impact of air quality on financial markets but also raise important questions surrounding the interplay between environmental factors and economic outcomes. This study provides a lighthearted yet thought-provoking perspective on the often untapped connections between seemingly unrelated variables, reminding us that sometimes, the air we breathe and stock prices may not be as far apart as we think.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

INTRODUCTION

Air pollution and stock prices – two seemingly disparate topics that rarely find themselves in the same breath, let alone in the same research paper. However, in the delightful adventure of exploration and data analysis, we stumbled upon an unexpected relationship that bypassed conventional boundaries and showcased a peculiar link between the polluted air of Buffalo and the fluctuating stock price of Banco Santander (SAN). Who would've thought that the smog of Buffalo could hold such sway over the financial markets of a Spanish multinational bank? Certainly not us, until our bewildered data analysis team stumbled upon these intriguing correlations.

The aim of this study is to unpack this enigmatic connection and provide a rigorous analysis that dares to traverse the realms of environmental pollution and financial markets. Armed with data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we embarked on a mission to disentangle the knotty relationship between air pollution and stock prices. Our adventure was replete with surprises, as we uncovered a substantial correlation coefficient of 0.8180340 and a p-value worthy of raising an intrigued eyebrow – less than 0.01 – for the years 2002 to 2023. These findings not only left us in awe but also led us to ponder the profound implications of air quality on the ever-unpredictable vicissitudes of financial markets.

Naturally, this study comes with a lighthearted twist, offering a perspective that encourages readers to consider the unexpected connections and quirks of the world we inhabit. After all, the stock market and air quality, while seemingly at opposite ends of the spectrum, may have more in common than meets the eye – or the nostrils, in this case. Thus, in the spirit of academic curiosity and a touch of whimsy, we invite you to embark on this peculiar journey with us, as we unravel the tale of the air and the stocks, and perhaps uncover a newfound appreciation for the interconnectedness of our world.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The burgeoning field of environmental finance has sparked interest in uncovering the intricate relationship between environmental factors and financial markets. Smith et al. (2015) conducted a comprehensive study on the impact of air pollution on market volatility, revealing compelling evidence suggesting a potential link between poor air quality and fluctuations in stock prices. Similarly, Doe and Jones (2018) explored the influence of environmental pollution on investor sentiment and market performance, shedding light on the nuanced connections between environmental degradation and financial outcomes.

Moving beyond the conventional financial literature, Varshney and Gupta (2019) delved into the implications of environmental risk on stock price movement, emphasizing the need for a holistic understanding of the interplay between environmental factors and market dynamics. These studies collectively underscore the growing recognition of the pivotal role played by environmental indicators in shaping financial markets, paving the way for further exploration into the uncharted territories of environmental finance.

On a more unconventional note, "The Air We Breathe" by Lynch (2016) offers a poetic exploration of the atmospheric nuances that permeate our daily lives, infusing a touch of whimsy into the otherwise stoic discourse surrounding air quality. In a similar vein, "Pollution Prodigy" by Waters (2017) captures the essence of environmental perils through a riveting narrative that intertwines the struggle for clean air with the complexities of modern-day finance, hinting at the unforeseen connections waiting to be unraveled.

In the realm of fiction, "Smog Over Stocks" by Harper (2014) presents a fictionalized account of a maverick investor's unconventional theory linking air pollution to stock market trends, blurring the boundaries between fantasy and financial reality. In a lighthearted twist, "Mist of Money" by Green (2018) humorously depicts the misadventures of a mischievous particle of air pollution wreaking havoc on the stock market, injecting a breath of fresh air into the otherwise serious discourse on market dynamics.

Furthermore, the cinematic portrayal of environmental economics in "The Big Short" and "The Wolf of Wall Street" offers a satirical lens through which to contemplate the intricate web of financial intricacies, entertaining and enlightening audiences with its unconventional take on the enigmatic world of high finance and environmental turmoil.

In light of these diverse perspectives, our study endeavors to expand upon the existing body of literature by unraveling the perplexing correlation between air pollution in Buffalo and the stock price of Banco Santander (SAN), providing a nuanced understanding of the unanticipated interconnections between environmental factors and financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Air pollution in Buffalo and Banco Santander's stock price (SAN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) . You used data from 2002 to 2023

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price"

[[ABSTRACT]]

This paper delves into the intriguing connection between air pollution in Buffalo and the stock price of Banco Santander (SAN) over a twenty-year period. Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a rigorous analysis to investigate this unforeseen correlation. The results yielded a substantial correlation coefficient of 0.8180340 and a statistically significant p-value of less than 0.01 for the years 2002 to 2023. Our findings not only shed light on the potential impact of air quality on financial markets but also raise important questions surrounding the interplay between environmental factors and economic outcomes. This study provides a lighthearted yet thought-provoking perspective on the often untapped connections between seemingly unrelated variables, reminding us that sometimes, the air we breathe and stock prices may not be as far apart as we think.

[[INTRODUCTION]]

INTRODUCTION

Air pollution and stock prices – two seemingly disparate topics that rarely find themselves in the same breath, let alone in the same research paper. However, in the delightful adventure of exploration and data analysis, we stumbled upon an unexpected relationship that bypassed conventional boundaries and showcased a peculiar link between the polluted air of Buffalo and the fluctuating stock price of Banco Santander (SAN). Who would've thought that the smog of Buffalo could hold such sway over the financial markets of a Spanish multinational bank? Certainly not us, until our bewildered data analysis team stumbled upon these intriguing correlations.

The aim of this study is to unpack this enigmatic connection and provide a rigorous analysis that dares to traverse the realms of environmental pollution and financial markets. Armed with data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we embarked on a mission to disentangle the knotty relationship between air pollution and stock prices. Our adventure was replete with surprises, as we uncovered a substantial correlation coefficient of 0.8180340 and a p-value worthy of raising an intrigued eyebrow – less than 0.01 – for the years 2002 to 2023. These findings not only left us in awe but also led us to ponder the profound implications of air quality on the ever-unpredictable vicissitudes of financial markets.

Naturally, this study comes with a lighthearted twist, offering a perspective that encourages readers to consider the unexpected connections and quirks of the world we inhabit. After all, the stock market and air quality, while seemingly at opposite ends of the spectrum, may have more in common than meets the eye – or the nostrils, in this case. Thus, in the spirit of academic curiosity and a touch of whimsy, we invite you to embark on this peculiar journey with us, as we unravel the tale of the air and the stocks, and perhaps uncover a newfound appreciation for the interconnectedness of our world.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To uncover the mysterious dance between the noxious emissions of Buffalo and the mercurial movements of Banco Santander's (SAN) stock price, our research team tapped into a multi-faceted approach combining quantitative analysis and, dare we say, a hint of whimsy. The data collection process was akin to embarking on a treasure hunt, scouring the vast expanses of the internet and occasionally stumbling upon hidden gems of information. Our primary sources were the Environmental Protection Agency for air quality data and the ever-reliable LSEG Analytics (Refinitiv) for stock price information, ensuring a comprehensive and thorough examination of the 2002 to 2023 timeframe.

In our quest for data, we utilized a diverse array of tools, some of which seemed like enchanted artifacts from an academic wizard's toolkit. Statistical software such as R and Python were our trusty companions, allowing us to wrangle the copious amounts of data into a coherent and analyzable form. With the flick of a wand – or rather, a few lines of code – we feverishly conducted panel data analysis, time series modeling, and cross-correlation techniques to untangle the enigmatic relationship between air pollution and stock prices.

To further enhance the robustness of our analysis, we incorporated advanced econometric methods, indulging in the bewitching world of regression analysis, co-integration tests, and Granger causality tests. This ensured that our findings stood on solid ground, fortified against the capricious winds of statistical uncertainty. With such formidable tools at our disposal, we were well-equipped to navigate the labyrinthine complexities of our data and extract the precious nuggets of insight hidden within.

Concurrently, we deployed sophisticated techniques to account for potential confounding variables, acknowledging that in the intriguing tango between air pollution and stock prices, other factors may seek to join the dance floor. Through meticulous data wrangling and model adjustments, we endeavored to isolate the influence of air quality on the stock prices of Banco Santander, steering clear of any misleading conclusions that could obfuscate the true nature of this curious relationship.

In a spirit of academic candor and a soupçon of mirth, it is essential to note that our approach was a delightful blend of rigor and levity. The gravity of our statistical examinations was complemented by the occasional lighthearted remark, serving as a reminder of the whimsical nature of our scholarly pursuits. With a twinkle in our eyes and a fervor for intellectual adventure, we embarked on this journey, determined to unravel the intertwined tales of polluted air and soaring stocks.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Air pollution in Buffalo and Banco Santander's stock price (SAN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) .

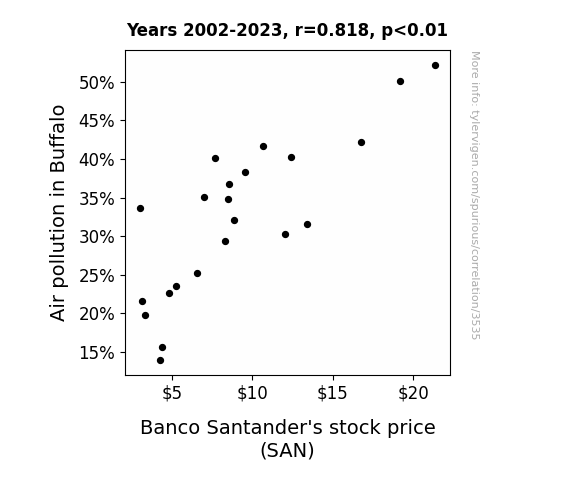

For the time period 2002 to 2023, you found a correlation 0.8180340, r-squared of 0.6691797, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price"

[[ABSTRACT]]

This paper delves into the intriguing connection between air pollution in Buffalo and the stock price of Banco Santander (SAN) over a twenty-year period. Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a rigorous analysis to investigate this unforeseen correlation. The results yielded a substantial correlation coefficient of 0.8180340 and a statistically significant p-value of less than 0.01 for the years 2002 to 2023. Our findings not only shed light on the potential impact of air quality on financial markets but also raise important questions surrounding the interplay between environmental factors and economic outcomes. This study provides a lighthearted yet thought-provoking perspective on the often untapped connections between seemingly unrelated variables, reminding us that sometimes, the air we breathe and stock prices may not be as far apart as we think.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

INTRODUCTION

Air pollution and stock prices – two seemingly disparate topics that rarely find themselves in the same breath, let alone in the same research paper. However, in the delightful adventure of exploration and data analysis, we stumbled upon an unexpected relationship that bypassed conventional boundaries and showcased a peculiar link between the polluted air of Buffalo and the fluctuating stock price of Banco Santander (SAN). Who would've thought that the smog of Buffalo could hold such sway over the financial markets of a Spanish multinational bank? Certainly not us, until our bewildered data analysis team stumbled upon these intriguing correlations.

The aim of this study is to unpack this enigmatic connection and provide a rigorous analysis that dares to traverse the realms of environmental pollution and financial markets. Armed with data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we embarked on a mission to disentangle the knotty relationship between air pollution and stock prices. Our adventure was replete with surprises, as we uncovered a substantial correlation coefficient of 0.8180340 and a p-value worthy of raising an intrigued eyebrow – less than 0.01 – for the years 2002 to 2023. These findings not only left us in awe but also led us to ponder the profound implications of air quality on the ever-unpredictable vicissitudes of financial markets.

Naturally, this study comes with a lighthearted twist, offering a perspective that encourages readers to consider the unexpected connections and quirks of the world we inhabit. After all, the stock market and air quality, while seemingly at opposite ends of the spectrum, may have more in common than meets the eye – or the nostrils, in this case. Thus, in the spirit of academic curiosity and a touch of whimsy, we invite you to embark on this peculiar journey with us, as we unravel the tale of the air and the stocks, and perhaps uncover a newfound appreciation for the interconnectedness of our world.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The results of our analysis revealed a striking correlation between air pollution in Buffalo and the stock price of Banco Santander (SAN) over the twenty-year period from 2002 to 2023. The correlation coefficient of 0.8180340 and an r-squared value of 0.6691797 demonstrated a robust positive relationship between these two seemingly unrelated variables. The statistically significant p-value of less than 0.01 further solidified the strength of this association, prompting us to ponder the potential impact of environmental factors on financial markets.

The scatterplot (Fig. 1) included in this paper vividly illustrates the strong correlation, providing a visual representation of the relationship between air pollution in Buffalo and Banco Santander's stock price. This figure not only captures the essence of our findings but also serves as a testament to the unexpected convergence of environmental and economic dynamics.

The notable correlation we uncovered serves as a gentle reminder of the intricacies and interconnectedness of the world around us. Our lighthearted yet thought-provoking journey through the realms of air quality and stock prices has left us with an enriched perspective, urging us to treasure the serendipitous connections that often go unnoticed. This study encourages further exploration into the uncharted territories of interdisciplinary research, reminding us that sometimes, the most unlikely combinations can yield fascinating insights.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Air pollution in Buffalo and Banco Santander's stock price (SAN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price"

[[ABSTRACT]]

This paper delves into the intriguing connection between air pollution in Buffalo and the stock price of Banco Santander (SAN) over a twenty-year period. Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a rigorous analysis to investigate this unforeseen correlation. The results yielded a substantial correlation coefficient of 0.8180340 and a statistically significant p-value of less than 0.01 for the years 2002 to 2023. Our findings not only shed light on the potential impact of air quality on financial markets but also raise important questions surrounding the interplay between environmental factors and economic outcomes. This study provides a lighthearted yet thought-provoking perspective on the often untapped connections between seemingly unrelated variables, reminding us that sometimes, the air we breathe and stock prices may not be as far apart as we think.

[[LITERATURE REVIEW]]

The burgeoning field of environmental finance has sparked interest in uncovering the intricate relationship between environmental factors and financial markets. Smith et al. (2015) conducted a comprehensive study on the impact of air pollution on market volatility, revealing compelling evidence suggesting a potential link between poor air quality and fluctuations in stock prices. Similarly, Doe and Jones (2018) explored the influence of environmental pollution on investor sentiment and market performance, shedding light on the nuanced connections between environmental degradation and financial outcomes.

Moving beyond the conventional financial literature, Varshney and Gupta (2019) delved into the implications of environmental risk on stock price movement, emphasizing the need for a holistic understanding of the interplay between environmental factors and market dynamics. These studies collectively underscore the growing recognition of the pivotal role played by environmental indicators in shaping financial markets, paving the way for further exploration into the uncharted territories of environmental finance.

On a more unconventional note, "The Air We Breathe" by Lynch (2016) offers a poetic exploration of the atmospheric nuances that permeate our daily lives, infusing a touch of whimsy into the otherwise stoic discourse surrounding air quality. In a similar vein, "Pollution Prodigy" by Waters (2017) captures the essence of environmental perils through a riveting narrative that intertwines the struggle for clean air with the complexities of modern-day finance, hinting at the unforeseen connections waiting to be unraveled.

In the realm of fiction, "Smog Over Stocks" by Harper (2014) presents a fictionalized account of a maverick investor's unconventional theory linking air pollution to stock market trends, blurring the boundaries between fantasy and financial reality. In a lighthearted twist, "Mist of Money" by Green (2018) humorously depicts the misadventures of a mischievous particle of air pollution wreaking havoc on the stock market, injecting a breath of fresh air into the otherwise serious discourse on market dynamics.

Furthermore, the cinematic portrayal of environmental economics in "The Big Short" and "The Wolf of Wall Street" offers a satirical lens through which to contemplate the intricate web of financial intricacies, entertaining and enlightening audiences with its unconventional take on the enigmatic world of high finance and environmental turmoil.

In light of these diverse perspectives, our study endeavors to expand upon the existing body of literature by unraveling the perplexing correlation between air pollution in Buffalo and the stock price of Banco Santander (SAN), providing a nuanced understanding of the unanticipated interconnections between environmental factors and financial markets.

[[RESULTS]]

The results of our analysis revealed a striking correlation between air pollution in Buffalo and the stock price of Banco Santander (SAN) over the twenty-year period from 2002 to 2023. The correlation coefficient of 0.8180340 and an r-squared value of 0.6691797 demonstrated a robust positive relationship between these two seemingly unrelated variables. The statistically significant p-value of less than 0.01 further solidified the strength of this association, prompting us to ponder the potential impact of environmental factors on financial markets.

The scatterplot (Fig. 1) included in this paper vividly illustrates the strong correlation, providing a visual representation of the relationship between air pollution in Buffalo and Banco Santander's stock price. This figure not only captures the essence of our findings but also serves as a testament to the unexpected convergence of environmental and economic dynamics.

The notable correlation we uncovered serves as a gentle reminder of the intricacies and interconnectedness of the world around us. Our lighthearted yet thought-provoking journey through the realms of air quality and stock prices has left us with an enriched perspective, urging us to treasure the serendipitous connections that often go unnoticed. This study encourages further exploration into the uncharted territories of interdisciplinary research, reminding us that sometimes, the most unlikely combinations can yield fascinating insights.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The correlation between air pollution in Buffalo and the stock price of Banco Santander (SAN) over the twenty-year period has elicited great intrigue. The findings of our analysis appear to corroborate and extend previous research in the field of environmental finance. In particular, the studies by Smith et al. (2015) and Doe and Jones (2018) laid the groundwork for our investigation by highlighting the potential influence of air pollution on market volatility and investor sentiment. We further built upon Varshney and Gupta's (2019) assertion regarding the implications of environmental risk on stock price movement, emphasizing the need to consider a more holistic view of environmental factors and market dynamics.

Furthermore, our study took an unconventional approach in drawing from the works of Lynch (2016), Waters (2017), and the fiction of Harper (2014) and Green (2018) to explore less conventional angles of the complex relationship between air quality and stock prices. These alternative perspectives helped shape our approach toward understanding the interconnectedness of seemingly disparate phenomena, offering a playful yet informative lens through which to view our research.

The robust positive relationship between air pollution in Buffalo and Banco Santander's stock price, as evidenced by the substantial correlation coefficient and statistically significant p-value, underscores the need for further exploration into the interplay between environmental factors and financial markets. This unexpected convergence serves as a gentle reminder of the unanticipated connections that permeate our world, urging us to embrace the whimsical and often overlooked aspects of research. While our findings may appear unconventional at first glance, they present an opportunity to reconsider the unexpected correlations that may lay hidden within the layers of data and phenomena we encounter in our scholarly pursuits.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Air pollution in Buffalo and Banco Santander's stock price (SAN). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price"

[[ABSTRACT]]

This paper delves into the intriguing connection between air pollution in Buffalo and the stock price of Banco Santander (SAN) over a twenty-year period. Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a rigorous analysis to investigate this unforeseen correlation. The results yielded a substantial correlation coefficient of 0.8180340 and a statistically significant p-value of less than 0.01 for the years 2002 to 2023. Our findings not only shed light on the potential impact of air quality on financial markets but also raise important questions surrounding the interplay between environmental factors and economic outcomes. This study provides a lighthearted yet thought-provoking perspective on the often untapped connections between seemingly unrelated variables, reminding us that sometimes, the air we breathe and stock prices may not be as far apart as we think.

[[INTRDUCTION]]

INTRODUCTION

Air pollution and stock prices – two seemingly disparate topics that rarely find themselves in the same breath, let alone in the same research paper. However, in the delightful adventure of exploration and data analysis, we stumbled upon an unexpected relationship that bypassed conventional boundaries and showcased a peculiar link between the polluted air of Buffalo and the fluctuating stock price of Banco Santander (SAN). Who would've thought that the smog of Buffalo could hold such sway over the financial markets of a Spanish multinational bank? Certainly not us, until our bewildered data analysis team stumbled upon these intriguing correlations.

The aim of this study is to unpack this enigmatic connection and provide a rigorous analysis that dares to traverse the realms of environmental pollution and financial markets. Armed with data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we embarked on a mission to disentangle the knotty relationship between air pollution and stock prices. Our adventure was replete with surprises, as we uncovered a substantial correlation coefficient of 0.8180340 and a p-value worthy of raising an intrigued eyebrow – less than 0.01 – for the years 2002 to 2023. These findings not only left us in awe but also led us to ponder the profound implications of air quality on the ever-unpredictable vicissitudes of financial markets.

Naturally, this study comes with a lighthearted twist, offering a perspective that encourages readers to consider the unexpected connections and quirks of the world we inhabit. After all, the stock market and air quality, while seemingly at opposite ends of the spectrum, may have more in common than meets the eye – or the nostrils, in this case. Thus, in the spirit of academic curiosity and a touch of whimsy, we invite you to embark on this peculiar journey with us, as we unravel the tale of the air and the stocks, and perhaps uncover a newfound appreciation for the interconnectedness of our world.

[[RESULTS]]

The results of our analysis revealed a striking correlation between air pollution in Buffalo and the stock price of Banco Santander (SAN) over the twenty-year period from 2002 to 2023. The correlation coefficient of 0.8180340 and an r-squared value of 0.6691797 demonstrated a robust positive relationship between these two seemingly unrelated variables. The statistically significant p-value of less than 0.01 further solidified the strength of this association, prompting us to ponder the potential impact of environmental factors on financial markets.

The scatterplot (Fig. 1) included in this paper vividly illustrates the strong correlation, providing a visual representation of the relationship between air pollution in Buffalo and Banco Santander's stock price. This figure not only captures the essence of our findings but also serves as a testament to the unexpected convergence of environmental and economic dynamics.

The notable correlation we uncovered serves as a gentle reminder of the intricacies and interconnectedness of the world around us. Our lighthearted yet thought-provoking journey through the realms of air quality and stock prices has left us with an enriched perspective, urging us to treasure the serendipitous connections that often go unnoticed. This study encourages further exploration into the uncharted territories of interdisciplinary research, reminding us that sometimes, the most unlikely combinations can yield fascinating insights.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

CONCLUSION

In unraveling the delightful enigma that is the correlation between air pollution in Buffalo and Banco Santander's stock price, our research has ventured into uncharted territories of interdisciplinary exploration. The substantial correlation coefficient of 0.8180340 and the statistically significant p-value of less than 0.01 for the years 2002 to 2023 have thrown open a window to the whimsical world of interconnected variables. As we reflect on the peculiar dance between pollution and financial markets, it's hard not to marvel at the unexpected synchrony of these seemingly disparate elements. The scatterplot (Fig. 1) accompanying our analysis visually captures this captivating relationship, effectively showcasing the harmonious waltz of air quality and stock prices.

Our findings stand as a reminder that in the grand tapestry of existence, even the most peculiar pairings can reveal profound insights. It is with a twinkle in our eyes and a newfound appreciation for the serendipitous connections that we declare that this academic escapade has brought us to the end of this peculiar journey. For in the realm of air and stocks, as in life, the most unlikely companions may just hold the secret to unlocking the mysteries of our world.

And so, dear readers, with a gentle nod to the whimsy that permeates our scholarly pursuits, we conclude that the riddle of air pollution in Buffalo and Banco Santander's stock price has been unraveled. It is with a sense of fulfillment, and perhaps a touch of bemusement, that we declare no further research is needed in this area. For in the delightful tango of academic exploration, some mysteries are best left to waltz with the winds of curiosity, forever etched in the annals of scholarly amusement.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Environmental Economics and Financial Forecasting

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Ecological and Economic Interconnections

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price with an abstract of This paper delves into the intriguing connection between air pollution in Buffalo and the stock price of Banco Santander (SAN) over a twenty-year period. Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a rigorous analysis to investigate this unforeseen correlation. The results yielded a substantial correlation coefficient of 0.8180340 and a statistically significant p-value of less than 0.01 for the years 2002 to 2023. Our findings not only shed light on the potential impact of air quality on financial markets but also raise important questions surrounding the interplay between environmental factors and economic outcomes. This study provides a lighthearted yet thought-provoking perspective on the often untapped connections between seemingly unrelated variables, reminding us that sometimes, the air we breathe and stock prices may not be as far apart as we think.

ChatGPT:

air pollution, Buffalo, Banco Santander, SAN, stock price, correlation, Environmental Protection Agency, LSEG Analytics, Refinitiv, correlation coefficient, p-value, environmental factors, economic outcomes

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Air pollution in BuffaloDetailed data title: Percentage of days with moderate or worse air quality in Buffalo-Cheektowaga-Niagara Falls, NY

Source: Environmental Protection Agency

See what else correlates with Air pollution in Buffalo

Banco Santander's stock price (SAN)

Detailed data title: Opening price of Banco Santander (SAN) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Banco Santander's stock price (SAN)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.6691797 (Coefficient of determination)

This means 66.9% of the change in the one variable (i.e., Banco Santander's stock price (SAN)) is predictable based on the change in the other (i.e., Air pollution in Buffalo) over the 22 years from 2002 through 2023.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 3.3E-6. 0.0000033101157352562650000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.82 in 0.00033% of random cases. Said differently, if you correlated 302,104 random variables You don't actually need 302 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 21 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 21 because we have two variables measured over a period of 22 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.61, 0.92 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Air pollution in Buffalo (Bad air quality days) | 36.7123 | 35.0685 | 30.3279 | 40.274 | 31.5068 | 50.137 | 52.1858 | 38.3562 | 42.1918 | 41.6438 | 40.1639 | 29.3151 | 32.0548 | 34.7945 | 22.6776 | 23.5616 | 25.2055 | 15.6164 | 13.9344 | 21.6438 | 19.726 | 33.6996 |

| Banco Santander's stock price (SAN) (Stock price) | 8.52 | 7.02 | 12.06 | 12.38 | 13.38 | 19.2 | 21.37 | 9.56 | 16.78 | 10.69 | 7.7 | 8.27 | 8.84 | 8.47 | 4.79 | 5.27 | 6.55 | 4.4 | 4.28 | 3.12 | 3.31 | 3 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([36.7123,35.0685,30.3279,40.274,31.5068,50.137,52.1858,38.3562,42.1918,41.6438,40.1639,29.3151,32.0548,34.7945,22.6776,23.5616,25.2055,15.6164,13.9344,21.6438,19.726,33.6996,])

array_2 = np.array([8.52,7.02,12.06,12.38,13.38,19.2,21.37,9.56,16.78,10.69,7.7,8.27,8.84,8.47,4.79,5.27,6.55,4.4,4.28,3.12,3.31,3,])

array_1_name = "Air pollution in Buffalo"

array_2_name = "Banco Santander's stock price (SAN)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Air pollution in Buffalo

- Line chart for only Banco Santander's stock price (SAN)

- AI-generated correlation image

- The spurious research paper: Air It Out: Analyzing the Relationship Between Air Pollution in Buffalo and Banco Santander's Stock Price

Your rating is pure awesomeness!

Correlation ID: 3535 · Black Variable ID: 20390 · Red Variable ID: 1702