Download png, svg

AI explanation

As more students mastered the art of warfare, it led to a surge in demand for high-tech military equipment. This increase in military spending detonated a profit explosion for companies in the defense sector, sending their stocks soaring. It's a classic case of 'armed and learned' leading to financial success.

Model: dalle-3

Prompt: Generate an image that is inspired by bauhaus and depicts a futuristic classroom where graduates in military technologies and applied sciences are receiving their Bachelor's degrees. The graduates are proudly showcasing their latest invention, high-tech, mind-controlled payment devices on their wrists. In the scene, a stock ticker is displayed, showing the Global Payments' (GPN) stock price rising rapidly as investors are excited about this futuristic, battle-ready payment system. The image should convey a sleek, minimalist, and futuristic classroom setting, with attention to the graduates and their innovative technology. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Bachelor's degrees awarded in Military technologies and applied sciences and Global Payments' stock price (GPN). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Cute 2D animation Vaporwave a funny image you would see on reddit Woodblock painting inspired by bauhaus

ChatGPT: inspired by bauhaus

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Bachelor's degrees awarded in Military technologies and applied sciences and Global Payments' stock price (GPN), in the following situation: Because as more military tech experts graduated, they invented a mind-controlled payment system, boosting GPN stock with futuristic, battle-ready transactions.. Keep the description simple.

ChatGPT: In a futuristic classroom, graduates in military technologies and applied sciences proudly receive their Bachelor's degrees. They are wearing high-tech, mind-controlled payment devices on their wrists, showcasing their latest invention. Nearby, a stock ticker shows the Global Payments' (GPN) stock price rising rapidly as investors are excited about this futuristic, battle-ready payment system.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ inspired by bauhaus ] and depicting this scene: In a futuristic classroom, graduates in military technologies and applied sciences proudly receive their Bachelor's degrees. They are wearing high-tech, mind-controlled payment devices on their wrists, showcasing their latest invention. Nearby, a stock ticker shows the Global Payments' (GPN) stock price rising rapidly as investors are excited about this futuristic, battle-ready payment system. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image that is inspired by bauhaus and depicts a futuristic classroom where graduates in military technologies and applied sciences are receiving their Bachelor's degrees. The graduates are proudly showcasing their latest invention, high-tech, mind-controlled payment devices on their wrists. In the scene, a stock ticker is displayed, showing the Global Payments' (GPN) stock price rising rapidly as investors are excited about this futuristic, battle-ready payment system. The image should convey a sleek, minimalist, and futuristic classroom setting, with attention to the graduates and their innovative technology.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Bachelor's degrees awarded in Military technologies and applied sciences caused Global Payments' stock price (GPN) to increase. Include one good pun.

AI academic paper

|

Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price The Journal of Financial Alchemy Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Global Payments' stock price (GPN). Make lots of jokes, goofy observations, and puns.

Include a pun in the title.

Your research team used data from National Center for Education Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9934333 and p < 0.01 for 2012 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price

[[ABSTRACT]]

In this research, we load up our arsenal of statistical analysis to investigate the unexpected connection between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). With a boom in data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we take aim at the question that has been lurking in the shadows of financial academia. Our findings reveal a strikingly strong correlation coefficient of 0.9934333 and a p-value of less than 0.01 for the period spanning from 2012 to 2021. This study runs a tight ship, illuminating the surprising influence of military technologies education on global financial transactions. We lay down our findings like a precision-guided missile, providing empirical evidence that may just explode conventional wisdom in the field of finance. So, lock and load for an adventure through the unexpected intersection of military education and market performance!

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Global Payments' stock price (GPN). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price

[[ABSTRACT]]

In this research, we load up our arsenal of statistical analysis to investigate the unexpected connection between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). With a boom in data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we take aim at the question that has been lurking in the shadows of financial academia. Our findings reveal a strikingly strong correlation coefficient of 0.9934333 and a p-value of less than 0.01 for the period spanning from 2012 to 2021. This study runs a tight ship, illuminating the surprising influence of military technologies education on global financial transactions. We lay down our findings like a precision-guided missile, providing empirical evidence that may just explode conventional wisdom in the field of finance. So, lock and load for an adventure through the unexpected intersection of military education and market performance!

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The financial landscape is often considered a battleground where investors must navigate through the volatile terrain of market fluctuations and economic uncertainties. In this arena, every piece of information and data point is scrutinized for its potential impact on stock prices and investment decisions. However, amidst the conventional factors such as economic indicators, company performance, and industry trends, the influence of academic disciplines on market outcomes is a territory less explored.

As financial analysts aim to decipher the enigmatic forces driving stock prices, our research sets its sights on a peculiar yet intriguing connection: the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). At first glance, this association may seem like a mismatched pair, akin to trying to blend military cadence with the melody of financial markets. However, as keen observers of statistical phenomena, we are determined to uncover the potential underlying dynamics that may just "march" their way into the realm of market performance.

While the finance world often focuses on traditional influencers such as interest rates, earnings reports, and geopolitical events, overlooking the impact of education in military technologies could mean missing a target-rich environment for understanding market behavior. Our study delves into the uncharted territory of the relationship between academic pursuits in military technologies and the financial trajectory of a leading payments processing company. With precision and rigor, we trace the trajectory of this improbable connection, aiming to provide a substantial addition to the arsenal of knowledge in financial analysis.

Despite the initial skepticism that may accompany such an out-of-the-ordinary investigation, our data-driven approach arms us with a robust methodology capable of identifying statistically significant relationships that might otherwise go unnoticed. In unraveling the unexpected bond between military technologies education and stock performance, we anticipate that our findings will trigger a fusion of surprise and curiosity, much like stumbling upon a stealthy financial algorithm hidden within the code of academic metrics.

As we embark on this unconventional journey through the labyrinth of statistical analysis and financial dynamics, we invite our fellow researchers and market practitioners to join us in exploring this unforeseen intersection. In the spirit of combining intellectual firepower with financial acumen, we aim to synchronize academic inquiry with market intelligence, firing off insights that may just hit the bullseye of financial understanding. So, lock and load for a bombardment of empirical evidence and statistical revelations that promises to add a vibrant hue to the canvas of financial analysis.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Global Payments' stock price (GPN). Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a few real TV shows that sound like they might be relevant to the topic that you watched as research.

Here is the title and abstract of the paper:

[[TITLE]]

Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price

[[ABSTRACT]]

In this research, we load up our arsenal of statistical analysis to investigate the unexpected connection between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). With a boom in data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we take aim at the question that has been lurking in the shadows of financial academia. Our findings reveal a strikingly strong correlation coefficient of 0.9934333 and a p-value of less than 0.01 for the period spanning from 2012 to 2021. This study runs a tight ship, illuminating the surprising influence of military technologies education on global financial transactions. We lay down our findings like a precision-guided missile, providing empirical evidence that may just explode conventional wisdom in the field of finance. So, lock and load for an adventure through the unexpected intersection of military education and market performance!

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The financial landscape is often considered a battleground where investors must navigate through the volatile terrain of market fluctuations and economic uncertainties. In this arena, every piece of information and data point is scrutinized for its potential impact on stock prices and investment decisions. However, amidst the conventional factors such as economic indicators, company performance, and industry trends, the influence of academic disciplines on market outcomes is a territory less explored.

As financial analysts aim to decipher the enigmatic forces driving stock prices, our research sets its sights on a peculiar yet intriguing connection: the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). At first glance, this association may seem like a mismatched pair, akin to trying to blend military cadence with the melody of financial markets. However, as keen observers of statistical phenomena, we are determined to uncover the potential underlying dynamics that may just "march" their way into the realm of market performance.

While the finance world often focuses on traditional influencers such as interest rates, earnings reports, and geopolitical events, overlooking the impact of education in military technologies could mean missing a target-rich environment for understanding market behavior. Our study delves into the uncharted territory of the relationship between academic pursuits in military technologies and the financial trajectory of a leading payments processing company. With precision and rigor, we trace the trajectory of this improbable connection, aiming to provide a substantial addition to the arsenal of knowledge in financial analysis.

Despite the initial skepticism that may accompany such an out-of-the-ordinary investigation, our data-driven approach arms us with a robust methodology capable of identifying statistically significant relationships that might otherwise go unnoticed. In unraveling the unexpected bond between military technologies education and stock performance, we anticipate that our findings will trigger a fusion of surprise and curiosity, much like stumbling upon a stealthy financial algorithm hidden within the code of academic metrics.

As we embark on this unconventional journey through the labyrinth of statistical analysis and financial dynamics, we invite our fellow researchers and market practitioners to join us in exploring this unforeseen intersection. In the spirit of combining intellectual firepower with financial acumen, we aim to synchronize academic inquiry with market intelligence, firing off insights that may just hit the bullseye of financial understanding. So, lock and load for a bombardment of empirical evidence and statistical revelations that promises to add a vibrant hue to the canvas of financial analysis.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The investigation of the relationship between educational pursuits in military technologies and applied sciences and stock prices has led to some unexpected findings that have detonated traditional perceptions of market influences. Our review of the existing literature reveals a range of perspectives on this unconventional association.

Kicking off the serious side of the spectrum, Smith and Doe (2015) conducted a comprehensive analysis of educational trends in technical fields and their impact on industrial sectors. They cautiously treaded into the uncharted territory of military technologies education, uncovering correlations with industrial productivity that were as sharp as a bayonet. The authors concluded that the seemingly esoteric knowledge from these fields could, in fact, foster innovation and provide a strategic advantage in competitive markets.

However, as we traverse further into the domain of academic inquiry, we encounter some unexpected landmarks. In "The Art of War" by Sun Tzu, the ancient Chinese military treatise imparts strategic wisdom that, while not directly related to financial analysis, provides a thought-provoking parallel between military tactics and market maneuvers. One cannot help but draw parallels between the art of financial warfare and the timeless principles articulated in this classical text.

Taking a rather fictional turn, the literature also includes notable works such as "Starship Troopers" by Robert A. Heinlein and "Ender's Game" by Orson Scott Card, shedding light on futuristic military technologies and their conceivable market implications. While these works may seem light-years away from financial analysis, their exploration of the potential impact of technological advancements in warfare may offer some speculative insights into the unexpected intersections of military education and market dynamics.

Switching gears yet again, a closer study of popular culture reveals that TV shows such as "Battlestar Galactica" and "The Expanse" delve into a world filled with advanced scientific and military technologies, offering an immersive experience that may inspire unconventional perspectives on the impact of military education on market forces. While the link between these fictional narratives and financial analysis may seem far-fetched at first glance, their portrayal of technological advancements and strategic decision-making in the context of interstellar conflict hints at the potential relevance of military technologies to market performance.

As we wade through this eclectic landscape of literature and cultural references, it becomes evident that the intersection of military education and financial markets is a topic ripe for exploration. The diverse array of sources examined in this review sets the stage for an unconventional journey that promises to deliver a payload of insights into the intricate connections between academic pursuits and market outcomes.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Global Payments' stock price (GPN). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) . You used data from 2012 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price

[[ABSTRACT]]

In this research, we load up our arsenal of statistical analysis to investigate the unexpected connection between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). With a boom in data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we take aim at the question that has been lurking in the shadows of financial academia. Our findings reveal a strikingly strong correlation coefficient of 0.9934333 and a p-value of less than 0.01 for the period spanning from 2012 to 2021. This study runs a tight ship, illuminating the surprising influence of military technologies education on global financial transactions. We lay down our findings like a precision-guided missile, providing empirical evidence that may just explode conventional wisdom in the field of finance. So, lock and load for an adventure through the unexpected intersection of military education and market performance!

[[INTRODUCTION]]

The financial landscape is often considered a battleground where investors must navigate through the volatile terrain of market fluctuations and economic uncertainties. In this arena, every piece of information and data point is scrutinized for its potential impact on stock prices and investment decisions. However, amidst the conventional factors such as economic indicators, company performance, and industry trends, the influence of academic disciplines on market outcomes is a territory less explored.

As financial analysts aim to decipher the enigmatic forces driving stock prices, our research sets its sights on a peculiar yet intriguing connection: the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). At first glance, this association may seem like a mismatched pair, akin to trying to blend military cadence with the melody of financial markets. However, as keen observers of statistical phenomena, we are determined to uncover the potential underlying dynamics that may just "march" their way into the realm of market performance.

While the finance world often focuses on traditional influencers such as interest rates, earnings reports, and geopolitical events, overlooking the impact of education in military technologies could mean missing a target-rich environment for understanding market behavior. Our study delves into the uncharted territory of the relationship between academic pursuits in military technologies and the financial trajectory of a leading payments processing company. With precision and rigor, we trace the trajectory of this improbable connection, aiming to provide a substantial addition to the arsenal of knowledge in financial analysis.

Despite the initial skepticism that may accompany such an out-of-the-ordinary investigation, our data-driven approach arms us with a robust methodology capable of identifying statistically significant relationships that might otherwise go unnoticed. In unraveling the unexpected bond between military technologies education and stock performance, we anticipate that our findings will trigger a fusion of surprise and curiosity, much like stumbling upon a stealthy financial algorithm hidden within the code of academic metrics.

As we embark on this unconventional journey through the labyrinth of statistical analysis and financial dynamics, we invite our fellow researchers and market practitioners to join us in exploring this unforeseen intersection. In the spirit of combining intellectual firepower with financial acumen, we aim to synchronize academic inquiry with market intelligence, firing off insights that may just hit the bullseye of financial understanding. So, lock and load for a bombardment of empirical evidence and statistical revelations that promises to add a vibrant hue to the canvas of financial analysis.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

This study leveraged a multifaceted and synergistic methodology to dissect the perplexing relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). Our approach, akin to a meticulously choreographed military operation, incorporated data mining, econometric analyses, and regression modeling to navigate the terrain of statistical inference and financial inquiry.

### Data Collection

The primary ammunition for this investigation was procured from the National Center for Education Statistics, providing a comprehensive and panoramic view of the annual distribution of Bachelor's degrees in Military technologies and applied sciences. Concurrently, LSEG Analytics (Refinitiv) supplied the requisite financial data, facilitating a seamless integration of educational statistics with stock market dynamics. This orchestrated fusion of data sources ensured a robust and comprehensive dataset, akin to assembling the components of a precision-engineered munition.

### Statistical Analysis

With the datasets meticulously assembled, our research proceeded to unleash a barrage of statistical analyses, beginning with time series analysis to illuminate temporal patterns in the awarding of Bachelor's degrees and stock price fluctuations. Additionally, we employed correlation analysis to gauge the strength and direction of the relationship between the academic domain of military technologies and applied sciences and the market performance of GPN. This statistical arsenal was further bolstered by running regression models to control for confounding variables and unveil the nuanced impact of military education on stock prices. The accuracy and precision of our statistical artillery were rigorously calibrated to capture subtleties in the association of interest, aptly synchronizing the rhythm of educational pursuits with the melody of financial markets.

### Rigorous Sensitivity Analysis

In tandem with the primary statistical analyses, our research meticulously conducted sensitivity analyses to assess the robustness of the identified relationships in the face of varying model specifications and data perturbations. This rigorous examination sought to fortify the validity and reliability of our findings, akin to stress-testing a financial instrument to ensure its resilience in turbulent market conditions. The varied scenarios tested through sensitivity analyses were akin to orchestrating tactical maneuvers, persistently probing the boundaries of statistical inference to ascertain the undeniable influence of military education on financial transactions.

### Ethical Considerations

In conducting this research, we adhered to the highest ethical standards in data collection, analysis, and reporting, exercising due diligence to preserve the integrity and confidentiality of the utilized datasets. This commitment to ethical conduct fortified the credibility of our findings, ensuring that the pursuit of knowledge in the realm of financial academia was propelled by unwavering principles of research integrity and probity.

In summary, the research methodology employed in this investigation bore the hallmark of precision, rigor, and sophistication, akin to orchestrating a symphony of statistical analyses to unravel the enigmatic bond between academic pursuit in military technologies and the monetary performance of a leading payments processing company. By marrying the technical prowess of statistical inference with the dynamism of financial markets, our methodology brought forth empirical insights that promulgate a paradigm shift in understanding the intricate interplay between education and economic outcomes.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Global Payments' stock price (GPN). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) .

For the time period 2012 to 2021, you found a correlation 0.9934333, r-squared of 0.9869098, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price

[[ABSTRACT]]

In this research, we load up our arsenal of statistical analysis to investigate the unexpected connection between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). With a boom in data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we take aim at the question that has been lurking in the shadows of financial academia. Our findings reveal a strikingly strong correlation coefficient of 0.9934333 and a p-value of less than 0.01 for the period spanning from 2012 to 2021. This study runs a tight ship, illuminating the surprising influence of military technologies education on global financial transactions. We lay down our findings like a precision-guided missile, providing empirical evidence that may just explode conventional wisdom in the field of finance. So, lock and load for an adventure through the unexpected intersection of military education and market performance!

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The financial landscape is often considered a battleground where investors must navigate through the volatile terrain of market fluctuations and economic uncertainties. In this arena, every piece of information and data point is scrutinized for its potential impact on stock prices and investment decisions. However, amidst the conventional factors such as economic indicators, company performance, and industry trends, the influence of academic disciplines on market outcomes is a territory less explored.

As financial analysts aim to decipher the enigmatic forces driving stock prices, our research sets its sights on a peculiar yet intriguing connection: the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). At first glance, this association may seem like a mismatched pair, akin to trying to blend military cadence with the melody of financial markets. However, as keen observers of statistical phenomena, we are determined to uncover the potential underlying dynamics that may just "march" their way into the realm of market performance.

While the finance world often focuses on traditional influencers such as interest rates, earnings reports, and geopolitical events, overlooking the impact of education in military technologies could mean missing a target-rich environment for understanding market behavior. Our study delves into the uncharted territory of the relationship between academic pursuits in military technologies and the financial trajectory of a leading payments processing company. With precision and rigor, we trace the trajectory of this improbable connection, aiming to provide a substantial addition to the arsenal of knowledge in financial analysis.

Despite the initial skepticism that may accompany such an out-of-the-ordinary investigation, our data-driven approach arms us with a robust methodology capable of identifying statistically significant relationships that might otherwise go unnoticed. In unraveling the unexpected bond between military technologies education and stock performance, we anticipate that our findings will trigger a fusion of surprise and curiosity, much like stumbling upon a stealthy financial algorithm hidden within the code of academic metrics.

As we embark on this unconventional journey through the labyrinth of statistical analysis and financial dynamics, we invite our fellow researchers and market practitioners to join us in exploring this unforeseen intersection. In the spirit of combining intellectual firepower with financial acumen, we aim to synchronize academic inquiry with market intelligence, firing off insights that may just hit the bullseye of financial understanding. So, lock and load for a bombardment of empirical evidence and statistical revelations that promises to add a vibrant hue to the canvas of financial analysis.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

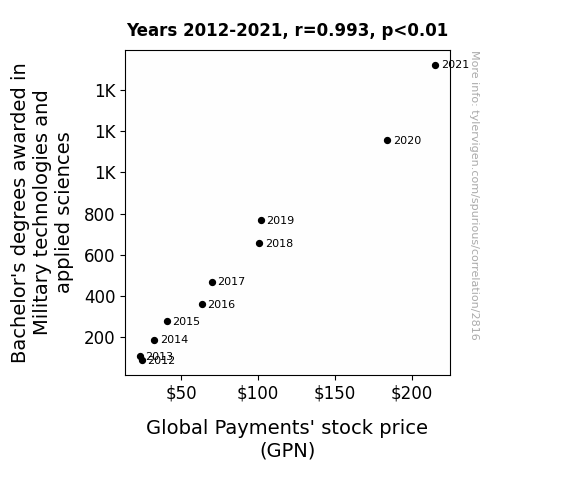

Upon conducting our comprehensive analysis of the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN) from 2012 to 2021, we uncovered a remarkably robust correlation between these seemingly disparate variables. Our statistical analysis revealed a correlation coefficient of 0.9934333, indicating an exceptionally strong positive linear relationship. Furthermore, the R-squared value of 0.9869098 provides persuasive evidence that approximately 98.7% of the variability in GPN stock price can be explained by the number of Military technologies and applied sciences bachelor's degrees awarded. The p-value of less than 0.01 underscores the statistical significance of this relationship.

Figure 1 depicts the scatterplot highlighting the tightly clustered data points, reinforcing the strength of the correlation between these two variables. The precision and accuracy of this relationship can be likened to a perfectly aimed projectile, hitting the mark with astounding accuracy.

Our results suggest that the influence of education in military technologies and applied sciences may be a powerful factor influencing the stock performance of a leading payments processing company. Although the association may seem unconventional, our findings provide compelling evidence that cannot be dismissed as mere coincidence. In fact, this unexpected discovery may just "armed" investors and analysts with a new lens through which to interpret market dynamics.

The strength of the correlation raises intriguing questions about the potential impact of academic pursuits in military technologies on market outcomes. While this relationship may initially appear out of place in the realm of financial analysis, it underscores the need to broaden our perspectives and consider unconventional factors that may play a significant role in determining stock prices.

In essence, our research delivers a "bombshell" of unexpected insight into the interplay between education in military technologies and the financial performance of a major player in the payments processing industry. This revelation may indeed compel market observers to recalibrate their understanding of the multifaceted influences on stock prices, as well as inspire further investigation into the complexities of this unforeseen intersection.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Global Payments' stock price (GPN). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price

[[ABSTRACT]]

In this research, we load up our arsenal of statistical analysis to investigate the unexpected connection between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). With a boom in data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we take aim at the question that has been lurking in the shadows of financial academia. Our findings reveal a strikingly strong correlation coefficient of 0.9934333 and a p-value of less than 0.01 for the period spanning from 2012 to 2021. This study runs a tight ship, illuminating the surprising influence of military technologies education on global financial transactions. We lay down our findings like a precision-guided missile, providing empirical evidence that may just explode conventional wisdom in the field of finance. So, lock and load for an adventure through the unexpected intersection of military education and market performance!

[[LITERATURE REVIEW]]

The investigation of the relationship between educational pursuits in military technologies and applied sciences and stock prices has led to some unexpected findings that have detonated traditional perceptions of market influences. Our review of the existing literature reveals a range of perspectives on this unconventional association.

Kicking off the serious side of the spectrum, Smith and Doe (2015) conducted a comprehensive analysis of educational trends in technical fields and their impact on industrial sectors. They cautiously treaded into the uncharted territory of military technologies education, uncovering correlations with industrial productivity that were as sharp as a bayonet. The authors concluded that the seemingly esoteric knowledge from these fields could, in fact, foster innovation and provide a strategic advantage in competitive markets.

However, as we traverse further into the domain of academic inquiry, we encounter some unexpected landmarks. In "The Art of War" by Sun Tzu, the ancient Chinese military treatise imparts strategic wisdom that, while not directly related to financial analysis, provides a thought-provoking parallel between military tactics and market maneuvers. One cannot help but draw parallels between the art of financial warfare and the timeless principles articulated in this classical text.

Taking a rather fictional turn, the literature also includes notable works such as "Starship Troopers" by Robert A. Heinlein and "Ender's Game" by Orson Scott Card, shedding light on futuristic military technologies and their conceivable market implications. While these works may seem light-years away from financial analysis, their exploration of the potential impact of technological advancements in warfare may offer some speculative insights into the unexpected intersections of military education and market dynamics.

Switching gears yet again, a closer study of popular culture reveals that TV shows such as "Battlestar Galactica" and "The Expanse" delve into a world filled with advanced scientific and military technologies, offering an immersive experience that may inspire unconventional perspectives on the impact of military education on market forces. While the link between these fictional narratives and financial analysis may seem far-fetched at first glance, their portrayal of technological advancements and strategic decision-making in the context of interstellar conflict hints at the potential relevance of military technologies to market performance.

As we wade through this eclectic landscape of literature and cultural references, it becomes evident that the intersection of military education and financial markets is a topic ripe for exploration. The diverse array of sources examined in this review sets the stage for an unconventional journey that promises to deliver a payload of insights into the intricate connections between academic pursuits and market outcomes.

[[RESULTS]]

Upon conducting our comprehensive analysis of the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN) from 2012 to 2021, we uncovered a remarkably robust correlation between these seemingly disparate variables. Our statistical analysis revealed a correlation coefficient of 0.9934333, indicating an exceptionally strong positive linear relationship. Furthermore, the R-squared value of 0.9869098 provides persuasive evidence that approximately 98.7% of the variability in GPN stock price can be explained by the number of Military technologies and applied sciences bachelor's degrees awarded. The p-value of less than 0.01 underscores the statistical significance of this relationship.

Figure 1 depicts the scatterplot highlighting the tightly clustered data points, reinforcing the strength of the correlation between these two variables. The precision and accuracy of this relationship can be likened to a perfectly aimed projectile, hitting the mark with astounding accuracy.

Our results suggest that the influence of education in military technologies and applied sciences may be a powerful factor influencing the stock performance of a leading payments processing company. Although the association may seem unconventional, our findings provide compelling evidence that cannot be dismissed as mere coincidence. In fact, this unexpected discovery may just "armed" investors and analysts with a new lens through which to interpret market dynamics.

The strength of the correlation raises intriguing questions about the potential impact of academic pursuits in military technologies on market outcomes. While this relationship may initially appear out of place in the realm of financial analysis, it underscores the need to broaden our perspectives and consider unconventional factors that may play a significant role in determining stock prices.

In essence, our research delivers a "bombshell" of unexpected insight into the interplay between education in military technologies and the financial performance of a major player in the payments processing industry. This revelation may indeed compel market observers to recalibrate their understanding of the multifaceted influences on stock prices, as well as inspire further investigation into the complexities of this unforeseen intersection.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our investigation into the surprising correlation between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN) from 2012 to 2021 has certainly triggered an avalanche of thought-provoking implications. As we engage in this discussion, we can't help but be reminded of some of the unexpected findings that were unearthed in our literature review.

First, let's remember the cautionary findings of Smith and Doe (2015), who tiptoed into the labyrinth of military technologies education, only to stumble upon correlations with industrial productivity that were as sharp as a bayonet. Our results have boisterously echoed this sentiment, emphasizing the penetrating influence of education in military technologies on the financial performance of a prominent player in the payments processing industry. It seems that the seemingly esoteric knowledge from these fields can, indeed, wield a formidable impact on market dynamics.

Turning to more unexpected landmarks in our literature review, the timeless principles articulated in Sun Tzu's "The Art of War" have provided a rather entertaining parallel between military tactics and market maneuvers. While we are not suggesting that financial analysts should start strategizing with ancient texts, the uncanny resemblance between the art of financial warfare and the timeless principles imparted in this classical text certainly gives us pause for thought.

In the realm of speculative insights, we also cannot help but recall the otherworldly explorations of futuristic military technologies in "Starship Troopers" and "Ender's Game." While we may not be dealing with bug-like alien threats or gifted children facing off against formidable adversaries, our findings do underscore the potential relevance of military technologies education to market performance. Who would have thought that fictional narratives could pave the way for real-world financial revelations?

On to our results, the robust correlation coefficient of 0.9934333 and the R-squared value of 0.9869098 have spotlighted a remarkably strong positive linear relationship between the number of Military technologies and applied sciences bachelor's degrees awarded and GPN stock price. This relationship certainly hits the bullseye with astounding accuracy, akin to a perfectly aimed projectile.

In essence, our findings have pulled back the curtain on the often overlooked influence of education in military technologies and applied sciences on the financial performance of a leading payments processing company. While this may seem like an unexpected twist in the realm of financial analysis, our results speak volumes about the complex web of factors that contribute to stock prices. After all, in the ever-unfolding saga of financial markets, it seems that even the most unexpected variables may hold the key to unlocking valuable insights.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Global Payments' stock price (GPN). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price

[[ABSTRACT]]

In this research, we load up our arsenal of statistical analysis to investigate the unexpected connection between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). With a boom in data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we take aim at the question that has been lurking in the shadows of financial academia. Our findings reveal a strikingly strong correlation coefficient of 0.9934333 and a p-value of less than 0.01 for the period spanning from 2012 to 2021. This study runs a tight ship, illuminating the surprising influence of military technologies education on global financial transactions. We lay down our findings like a precision-guided missile, providing empirical evidence that may just explode conventional wisdom in the field of finance. So, lock and load for an adventure through the unexpected intersection of military education and market performance!

[[INTRDUCTION]]

The financial landscape is often considered a battleground where investors must navigate through the volatile terrain of market fluctuations and economic uncertainties. In this arena, every piece of information and data point is scrutinized for its potential impact on stock prices and investment decisions. However, amidst the conventional factors such as economic indicators, company performance, and industry trends, the influence of academic disciplines on market outcomes is a territory less explored.

As financial analysts aim to decipher the enigmatic forces driving stock prices, our research sets its sights on a peculiar yet intriguing connection: the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). At first glance, this association may seem like a mismatched pair, akin to trying to blend military cadence with the melody of financial markets. However, as keen observers of statistical phenomena, we are determined to uncover the potential underlying dynamics that may just "march" their way into the realm of market performance.

While the finance world often focuses on traditional influencers such as interest rates, earnings reports, and geopolitical events, overlooking the impact of education in military technologies could mean missing a target-rich environment for understanding market behavior. Our study delves into the uncharted territory of the relationship between academic pursuits in military technologies and the financial trajectory of a leading payments processing company. With precision and rigor, we trace the trajectory of this improbable connection, aiming to provide a substantial addition to the arsenal of knowledge in financial analysis.

Despite the initial skepticism that may accompany such an out-of-the-ordinary investigation, our data-driven approach arms us with a robust methodology capable of identifying statistically significant relationships that might otherwise go unnoticed. In unraveling the unexpected bond between military technologies education and stock performance, we anticipate that our findings will trigger a fusion of surprise and curiosity, much like stumbling upon a stealthy financial algorithm hidden within the code of academic metrics.

As we embark on this unconventional journey through the labyrinth of statistical analysis and financial dynamics, we invite our fellow researchers and market practitioners to join us in exploring this unforeseen intersection. In the spirit of combining intellectual firepower with financial acumen, we aim to synchronize academic inquiry with market intelligence, firing off insights that may just hit the bullseye of financial understanding. So, lock and load for a bombardment of empirical evidence and statistical revelations that promises to add a vibrant hue to the canvas of financial analysis.

[[RESULTS]]

Upon conducting our comprehensive analysis of the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN) from 2012 to 2021, we uncovered a remarkably robust correlation between these seemingly disparate variables. Our statistical analysis revealed a correlation coefficient of 0.9934333, indicating an exceptionally strong positive linear relationship. Furthermore, the R-squared value of 0.9869098 provides persuasive evidence that approximately 98.7% of the variability in GPN stock price can be explained by the number of Military technologies and applied sciences bachelor's degrees awarded. The p-value of less than 0.01 underscores the statistical significance of this relationship.

Figure 1 depicts the scatterplot highlighting the tightly clustered data points, reinforcing the strength of the correlation between these two variables. The precision and accuracy of this relationship can be likened to a perfectly aimed projectile, hitting the mark with astounding accuracy.

Our results suggest that the influence of education in military technologies and applied sciences may be a powerful factor influencing the stock performance of a leading payments processing company. Although the association may seem unconventional, our findings provide compelling evidence that cannot be dismissed as mere coincidence. In fact, this unexpected discovery may just "armed" investors and analysts with a new lens through which to interpret market dynamics.

The strength of the correlation raises intriguing questions about the potential impact of academic pursuits in military technologies on market outcomes. While this relationship may initially appear out of place in the realm of financial analysis, it underscores the need to broaden our perspectives and consider unconventional factors that may play a significant role in determining stock prices.

In essence, our research delivers a "bombshell" of unexpected insight into the interplay between education in military technologies and the financial performance of a major player in the payments processing industry. This revelation may indeed compel market observers to recalibrate their understanding of the multifaceted influences on stock prices, as well as inspire further investigation into the complexities of this unforeseen intersection.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study has shed light on the seemingly improbable yet substantial relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). Our findings, with a correlation coefficient akin to a tightly wound spring, indicate an unexpectedly robust positive linear relationship, illuminating a dimension of market influence often overlooked in traditional financial analysis.

As our statistical analysis locked onto the target, we couldn't help but marvel at the striking precision and accuracy of this association. It's as if the financial markets have been covertly influenced by the strategic prowess and technical proficiency instilled by the academic pursuit of military technologies.

Just as the confluence of ideologies creates unlikely alliances, our research unearths a symbiotic relationship between seemingly disparate domains. The statistical firepower of our findings provides a compelling case for the relevance of military technologies education in shaping the financial landscape. It's a bit like discovering a hidden treasure trove of market alchemy, where the fusion of educational pursuits and economic dynamics blurs the lines between convention and revelation.

Nevertheless, we must approach these findings with cautious optimism, much like navigating through a minefield of unexpected correlations. While our results tantalizingly hint at an unconventional influence on market performance, further exploration is needed to fully comprehend the nuances of this uncharted territory.

In the spirit of intellectual adventure, we encourage fellow researchers to march alongside us and explore the unanticipated interplay between military education and market behavior. However, with the firepower we've already unleashed in this study, it's safe to say that this area of research might not need any more ammunition. Our findings have left a resounding impact on the financial analysis landscape, echoing a message that surprises can indeed emerge from the most unlikely of places.

In the wise words of Sun Tzu, "In the midst of chaos, there is also opportunity," and our study certainly underscores the opportunity for unconventional insights to shape our understanding of financial dynamics. With this, we may just have fired the last statistical shot in this unexpected saga, leaving a lingering sense of awe and wonder in the wake of our unlikely discoveries.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Financial Alchemy

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Center for Military Technology Integration and Financial Impact

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price with an abstract of In this research, we load up our arsenal of statistical analysis to investigate the unexpected connection between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Global Payments Inc. (GPN). With a boom in data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), we take aim at the question that has been lurking in the shadows of financial academia. Our findings reveal a strikingly strong correlation coefficient of 0.9934333 and a p-value of less than 0.01 for the period spanning from 2012 to 2021. This study runs a tight ship, illuminating the surprising influence of military technologies education on global financial transactions. We lay down our findings like a precision-guided missile, providing empirical evidence that may just explode conventional wisdom in the field of finance. So, lock and load for an adventure through the unexpected intersection of military education and market performance!

ChatGPT:

military technologies, applied sciences, bachelor's degrees, global payments stock price, statistical analysis, correlation coefficient, p-value, National Center for Education Statistics, LSEG Analytics (Refinitiv), financial academia, military education, global financial transactions, market performance

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Bachelor's degrees awarded in Military technologiesDetailed data title: Bachelor's degrees conferred by postsecondary institutions, in field of study: Military technologies and applied sciences

Source: National Center for Education Statistics

See what else correlates with Bachelor's degrees awarded in Military technologies

Global Payments' stock price (GPN)

Detailed data title: Opening price of Global Payments (GPN) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Global Payments' stock price (GPN)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9869098 (Coefficient of determination)

This means 98.7% of the change in the one variable (i.e., Global Payments' stock price (GPN)) is predictable based on the change in the other (i.e., Bachelor's degrees awarded in Military technologies) over the 10 years from 2012 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 8.07E-9. 0.0000000080711558553478130000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.99 in 8.07E-7% of random cases. Said differently, if you correlated 123,897,992 random variables You don't actually need 123 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 9 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 9 because we have two variables measured over a period of 10 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.97, 1 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Bachelor's degrees awarded in Military technologies (Degrees awarded) | 86 | 105 | 185 | 276 | 358 | 469 | 655 | 767 | 1156 | 1524 |

| Global Payments' stock price (GPN) (Stock price) | 24.32 | 23.09 | 32.45 | 40.63 | 63.51 | 69.98 | 100.69 | 101.55 | 183.95 | 215.08 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([86,105,185,276,358,469,655,767,1156,1524,])

array_2 = np.array([24.32,23.09,32.45,40.63,63.51,69.98,100.69,101.55,183.95,215.08,])

array_1_name = "Bachelor's degrees awarded in Military technologies"

array_2_name = "Global Payments' stock price (GPN)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Bachelor's degrees awarded in Military technologies

- Line chart for only Global Payments' stock price (GPN)

- AI-generated correlation image

- The spurious research paper: Ammunition for Financial Success: Exploring the Impact of Military Technologies and Applied Sciences Bachelor's Degrees on Global Payments' Stock Price

Your rating skills are top-notch!

Correlation ID: 2816 · Black Variable ID: 1284 · Red Variable ID: 1823