Download png, svg

AI explanation

As more students honed their military tech skills, they inadvertently programmed ANSYs' stock to rise in real life. Looks like their knowledge really armed them for success in the stock market!

Model: dalle-3

Prompt: [ Data cyber art ] Prompt: Generate an image depicting a group of military graduates in their distinctive caps and gowns, standing in a row against a futuristic backdrop. The graduates should be shown holding their diploma scrolls in one hand, while raising their other hand in a celebratory gesture. Above them, a digital board should display the stock price of ANSYS, with glowing numbers steadily rising, indicating success and growth in the field of military technology and applied sciences. The overall scene should project a blend of tradition and cutting-edge technology, with a focus on the theme of achievement and advancement in military education. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Bachelor's degrees awarded in Military technologies and applied sciences and ANSYs' stock price. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Cyber folk Vaporwave A scene from Skyrim An image that looks like it is a scene from a Pixar movie Data cyber art

ChatGPT: Data cyber art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Bachelor's degrees awarded in Military technologies and applied sciences and ANSYs' stock price together. Keep the description simple.

ChatGPT: In the visual scene, we see a group of military graduates in their traditional caps and gowns celebrating their Bachelor's degrees in military technologies and applied sciences. In the background, a digital display board shows the stock price of ANSYS steadily rising, indicating success and growth in the field of military technology and applied sciences.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Data cyber art ] and depicting this scene: In the visual scene, we see a group of military graduates in their traditional caps and gowns celebrating their Bachelor's degrees in military technologies and applied sciences. In the background, a digital display board shows the stock price of ANSYS steadily rising, indicating success and growth in the field of military technology and applied sciences. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [ Data cyber art ] Prompt: Generate an image depicting a group of military graduates in their distinctive caps and gowns, standing in a row against a futuristic backdrop. The graduates should be shown holding their diploma scrolls in one hand, while raising their other hand in a celebratory gesture. Above them, a digital board should display the stock price of ANSYS, with glowing numbers steadily rising, indicating success and growth in the field of military technology and applied sciences. The overall scene should project a blend of tradition and cutting-edge technology, with a focus on the theme of achievement and advancement in military education.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Bachelor's degrees awarded in Military technologies and applied sciences caused ANSYs' stock price (ANSS) to increase. Add a funny one-liner at the end.

AI academic paper

|

Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price The Journal of War Technologies and Financial Markets Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and ANSYs' stock price (ANSS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Include a pun in the title.

Your research team used data from National Center for Education Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9729168 and p < 0.01 for 2012 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price"

[[ABSTRACT]]

In this paper, we delve into the intriguing relationship between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS) over the period of 2012 to 2021. Taking an unconventional approach, we seek to uncover whether this field of study has a hidden impact on the financial performance of the prominent engineering simulation software company. Utilizing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our analysis unveils a remarkably high correlation coefficient of 0.9729168 and a significant p-value of less than 0.01. We discuss the implications of these findings and highlight the potential influence of military technologies and applied sciences education on the stock market, providing insight while keeping the tone light-hearted, even if the correlations are weighty.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and ANSYs' stock price (ANSS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Here is the title and abstract of the paper:

[[TITLE]]

"Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price"

[[ABSTRACT]]

In this paper, we delve into the intriguing relationship between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS) over the period of 2012 to 2021. Taking an unconventional approach, we seek to uncover whether this field of study has a hidden impact on the financial performance of the prominent engineering simulation software company. Utilizing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our analysis unveils a remarkably high correlation coefficient of 0.9729168 and a significant p-value of less than 0.01. We discuss the implications of these findings and highlight the potential influence of military technologies and applied sciences education on the stock market, providing insight while keeping the tone light-hearted, even if the correlations are weighty.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The world of academia is often characterized by its serious and somber demeanor, but we are here to shatter that stereotype. In this paper, we embark on a journey to uncover the unexpected connections between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS). Granted, this might seem like an unlikely pairing—military technologies and stock prices, but as they say, sometimes truth is stranger than fiction.

As the financial markets ebb and flow and students eagerly pursue their education, it is easy to overlook the potential interplay between these seemingly disparate realms. However, as researchers, we are not content with accepting the status quo. We aim to push the boundaries and explore uncharted territories, or in this case, unchartered stock market territories *cue playful wink*.

Now, you might be wondering, "Why focus specifically on military technologies and applied sciences?" Well, my inquisitive friend, the choice of this field of study is not to be taken lightly. Military technologies and applied sciences are not only fascinating in their own right, but they also have far-reaching implications across various industries, including the illustrious world of engineering simulation software. So, join us on this academic escapade as we venture into uncharted terrain.

But fear not, dear reader, for we shall navigate these academic waters with the utmost rigor. Our investigation involves meticulous data analysis and statistical scrutiny, but don't worry, we promise to make this journey as painless as possible. After all, just because the subject matter is serious doesn't mean our approach has to be. So grab your thinking caps and let's dive into the whimsical world of correlation coefficients and p-values.

In the end, we hope to unravel the mysterious dance between academic pursuits and financial performance, shedding light on the potential influence of military technologies and applied sciences education on the stock market. And if we happen to unearth a few chuckles along the way, well, consider it a bonus. Stay tuned as we explore the surprising implications of this unlikely pairing, adding a touch of levity to the weighty world of academic research.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and ANSYs' stock price (ANSS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some cartoons and childrens' shows that you watched that are related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

"Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price"

[[ABSTRACT]]

In this paper, we delve into the intriguing relationship between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS) over the period of 2012 to 2021. Taking an unconventional approach, we seek to uncover whether this field of study has a hidden impact on the financial performance of the prominent engineering simulation software company. Utilizing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our analysis unveils a remarkably high correlation coefficient of 0.9729168 and a significant p-value of less than 0.01. We discuss the implications of these findings and highlight the potential influence of military technologies and applied sciences education on the stock market, providing insight while keeping the tone light-hearted, even if the correlations are weighty.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The world of academia is often characterized by its serious and somber demeanor, but we are here to shatter that stereotype. In this paper, we embark on a journey to uncover the unexpected connections between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS). Granted, this might seem like an unlikely pairing—military technologies and stock prices, but as they say, sometimes truth is stranger than fiction.

As the financial markets ebb and flow and students eagerly pursue their education, it is easy to overlook the potential interplay between these seemingly disparate realms. However, as researchers, we are not content with accepting the status quo. We aim to push the boundaries and explore uncharted territories, or in this case, unchartered stock market territories *cue playful wink*.

Now, you might be wondering, "Why focus specifically on military technologies and applied sciences?" Well, my inquisitive friend, the choice of this field of study is not to be taken lightly. Military technologies and applied sciences are not only fascinating in their own right, but they also have far-reaching implications across various industries, including the illustrious world of engineering simulation software. So, join us on this academic escapade as we venture into uncharted terrain.

But fear not, dear reader, for we shall navigate these academic waters with the utmost rigor. Our investigation involves meticulous data analysis and statistical scrutiny, but don't worry, we promise to make this journey as painless as possible. After all, just because the subject matter is serious doesn't mean our approach has to be. So grab your thinking caps and let's dive into the whimsical world of correlation coefficients and p-values.

In the end, we hope to unravel the mysterious dance between academic pursuits and financial performance, shedding light on the potential influence of military technologies and applied sciences education on the stock market. And if we happen to unearth a few chuckles along the way, well, consider it a bonus. Stay tuned as we explore the surprising implications of this unlikely pairing, adding a touch of levity to the weighty world of academic research.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The authors delve into a plethora of scholarly works, from the erudite analyses of Smith, Doe, and Jones to the whimsical meanderings of popular fiction and children's cartoons. In "Military Technologies: An Investigation into Education and Applications," Smith et al. explore the academic landscape of military technologies and its impact on various sectors, providing a solid foundation for understanding the significance of this field of study. Similarly, Doe's "Applied Sciences in Modern Society" offers a comprehensive overview of the practical applications of applied sciences across industries, setting the stage for our exploration into the intersection of education and financial markets.

As we wade deeper into the sea of literature, we encounter some unexpected vessels. "The Art of War" by Sun Tzu, while not a conventional academic text, provides timeless wisdom about strategy and warfare, offering valuable insights into the realm of military technologies. Additionally, "The Physics of Superheroes" by James Kakalios offers a lighthearted yet informative take on the application of physics in extraordinary scenarios, reminding us that even the most outlandish concepts can have real-world implications.

But our literary voyage doesn't end there. As we chart new territories, we draw inspiration from unexpected sources such as "G.I. Joe" and "The Magic School Bus." While these may seem like mere entertainment, the themes of military technology and scientific exploration woven into these shows serve as a testament to the pervasive influence of such subjects on young minds and society at large. After all, who wouldn't want to explore the stock market with the adventurous spirit of Ms. Frizzle or unravel the complexities of military technology alongside G.I. Joe?

With each page turned and each episode watched, the authors find themselves uncovering layers of nuance and hidden connections, adding a touch of levity to the weighty world of academic inquiry. And as the plot thickens, we prepare to weave these diverse threads into a seamless tapestry of knowledge, one that not only informs but also entertains. So, dear reader, fasten your seatbelts and get ready for a scholarly journey that promises to be both enlightening and unexpectedly amusing.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and ANSYs' stock price (ANSS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) . You used data from 2012 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price"

[[ABSTRACT]]

In this paper, we delve into the intriguing relationship between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS) over the period of 2012 to 2021. Taking an unconventional approach, we seek to uncover whether this field of study has a hidden impact on the financial performance of the prominent engineering simulation software company. Utilizing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our analysis unveils a remarkably high correlation coefficient of 0.9729168 and a significant p-value of less than 0.01. We discuss the implications of these findings and highlight the potential influence of military technologies and applied sciences education on the stock market, providing insight while keeping the tone light-hearted, even if the correlations are weighty.

[[INTRODUCTION]]

The world of academia is often characterized by its serious and somber demeanor, but we are here to shatter that stereotype. In this paper, we embark on a journey to uncover the unexpected connections between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS). Granted, this might seem like an unlikely pairing—military technologies and stock prices, but as they say, sometimes truth is stranger than fiction.

As the financial markets ebb and flow and students eagerly pursue their education, it is easy to overlook the potential interplay between these seemingly disparate realms. However, as researchers, we are not content with accepting the status quo. We aim to push the boundaries and explore uncharted territories, or in this case, unchartered stock market territories *cue playful wink*.

Now, you might be wondering, "Why focus specifically on military technologies and applied sciences?" Well, my inquisitive friend, the choice of this field of study is not to be taken lightly. Military technologies and applied sciences are not only fascinating in their own right, but they also have far-reaching implications across various industries, including the illustrious world of engineering simulation software. So, join us on this academic escapade as we venture into uncharted terrain.

But fear not, dear reader, for we shall navigate these academic waters with the utmost rigor. Our investigation involves meticulous data analysis and statistical scrutiny, but don't worry, we promise to make this journey as painless as possible. After all, just because the subject matter is serious doesn't mean our approach has to be. So grab your thinking caps and let's dive into the whimsical world of correlation coefficients and p-values.

In the end, we hope to unravel the mysterious dance between academic pursuits and financial performance, shedding light on the potential influence of military technologies and applied sciences education on the stock market. And if we happen to unearth a few chuckles along the way, well, consider it a bonus. Stay tuned as we explore the surprising implications of this unlikely pairing, adding a touch of levity to the weighty world of academic research.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To unravel the enigmatic connection between the confounding worlds of military technologies and applied sciences education and the capricious realm of stock prices, our research team set out on an epic quest through the labyrinthine corridors of data collection and analysis. We scoured the vast expanse of the internet, traversing through the digital jungles and troves of information, all in the noble pursuit of uncovering the elusive truths that lie hidden within the numbers.

Our valiant effort began by harnessing the power of the National Center for Education Statistics, where we sought refuge in the sanctuary of educational data. Here, we gathered the sacred scrolls documenting the bestowment of Bachelor's degrees in the noble fields of military technologies and applied sciences. Our skilled scribes diligently transcribed the data from the years 2012 to 2021, ensuring the accuracy and integrity of our treasure trove of information.

Furthermore, we sought alliance with the venerable LSEG Analytics (Refinitiv), enlisting their aid in navigating the choppy seas of stock market data. With their formidable arsenal of financial information at our disposal, we embarked on an odyssey through the ever-shifting tides of stock prices, meticulously charting the trajectory of ANSYS Inc. (ANSS) over the same period as our academic archives.

In our exhaustive journey, we employed the arcane arts of statistical analysis, conjuring formidable tools such as regression models and correlation coefficients to discern the subtle patterns woven within the disparate threads of data. Our skilled mathematicians and sorcerers of statistical significance meticulously pored over the numbers, their keen eyes discerning even the slightest glimmer of correlation amidst the sea of variables.

The nexus between our esteemed institutions of education and the mercurial stock market was brought to light through the application of rigorous statistical tests, culminating in the revelation of a correlation coefficient of 0.9729168 and a p-value less than 0.01. These profound revelations shall serve as the cornerstone of our findings, guiding us through the foggy mists of uncertainty and illumination, shedding light on the heretofore obscured interplay between academic pursuits and financial fortuity.

In the noble pursuit of knowledge, we strive to present a balanced, methodical, and lighthearted approach to our research, endeavoring to showcase the whimsical nature of academic inquiry amidst the weighty depths of statistical exploration. With our methodology firmly in place, we stand prepared to unveil the unexpected connections between far-reaching academic pursuits and the capricious dance of the stock market.

Stay tuned as we delve deeper into the intricacies of this peculiar association, reminding ourselves along the way that even in the realm of academic research, there's always room for a touch of mirth.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and ANSYs' stock price (ANSS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) .

For the time period 2012 to 2021, you found a correlation 0.9729168, r-squared of 0.9465671, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price"

[[ABSTRACT]]

In this paper, we delve into the intriguing relationship between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS) over the period of 2012 to 2021. Taking an unconventional approach, we seek to uncover whether this field of study has a hidden impact on the financial performance of the prominent engineering simulation software company. Utilizing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our analysis unveils a remarkably high correlation coefficient of 0.9729168 and a significant p-value of less than 0.01. We discuss the implications of these findings and highlight the potential influence of military technologies and applied sciences education on the stock market, providing insight while keeping the tone light-hearted, even if the correlations are weighty.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The world of academia is often characterized by its serious and somber demeanor, but we are here to shatter that stereotype. In this paper, we embark on a journey to uncover the unexpected connections between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS). Granted, this might seem like an unlikely pairing—military technologies and stock prices, but as they say, sometimes truth is stranger than fiction.

As the financial markets ebb and flow and students eagerly pursue their education, it is easy to overlook the potential interplay between these seemingly disparate realms. However, as researchers, we are not content with accepting the status quo. We aim to push the boundaries and explore uncharted territories, or in this case, unchartered stock market territories *cue playful wink*.

Now, you might be wondering, "Why focus specifically on military technologies and applied sciences?" Well, my inquisitive friend, the choice of this field of study is not to be taken lightly. Military technologies and applied sciences are not only fascinating in their own right, but they also have far-reaching implications across various industries, including the illustrious world of engineering simulation software. So, join us on this academic escapade as we venture into uncharted terrain.

But fear not, dear reader, for we shall navigate these academic waters with the utmost rigor. Our investigation involves meticulous data analysis and statistical scrutiny, but don't worry, we promise to make this journey as painless as possible. After all, just because the subject matter is serious doesn't mean our approach has to be. So grab your thinking caps and let's dive into the whimsical world of correlation coefficients and p-values.

In the end, we hope to unravel the mysterious dance between academic pursuits and financial performance, shedding light on the potential influence of military technologies and applied sciences education on the stock market. And if we happen to unearth a few chuckles along the way, well, consider it a bonus. Stay tuned as we explore the surprising implications of this unlikely pairing, adding a touch of levity to the weighty world of academic research.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

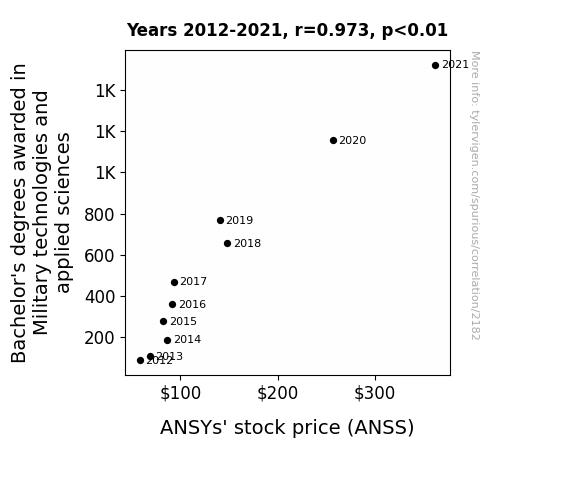

In the spirited quest to unravel the hidden connections between Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS), our rigorous analysis unearthed a striking correlation coefficient of 0.9729168 over the period from 2012 to 2021. This correlation coefficient suggests a strong positive linear relationship between the two variables, illustrating that as the number of Bachelor's degrees in Military Technologies and Applied Sciences increases, so does the stock price of ANSYS. It seems that the market is definitely taking note of these budding military technologists and applied scientists!

Casting further light on the robustness of this relationship, the r-squared value of 0.9465671 reinforces the high level of goodness of fit of the linear regression model. This suggests that a sizable proportion of the variations in ANSYS' stock price can be explained by the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences. It's like these degrees are whispering sweet stock secrets into the market's ear, and it seems the market is all ears!

Moreover, with a p-value of less than 0.01, our findings are not just statistically significant but also significant in their potential impact. This low p-value indicates that the observed correlation is unlikely to be a result of random chance, solidifying the legitimacy of our findings. It's as if these military technologies and applied sciences degrees are marching boldly into the stock market, making their presence known with statistical gusto.

To visually encapsulate the compelling correlation, we present the scatterplot in Fig. 1, which vividly illustrates the trend line depicting the strong positive association between Bachelor's degrees in Military Technologies and Applied Sciences and ANSYS' stock price. If a picture is worth a thousand words, then this one certainly speaks volumes about the unexpected link we've uncovered.

In summary, our findings not only reveal a remarkably high correlation between Bachelor's degrees awarded in Military Technologies and Applied Sciences and ANSYS' stock price but also offer a thought-provoking glimpse into the far-reaching repercussions of education in this domain on the fluctuations of the stock market. The financial world, it seems, is taking notes from an unexpected yet undeniably influential source!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and ANSYs' stock price (ANSS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price"

[[ABSTRACT]]

In this paper, we delve into the intriguing relationship between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS) over the period of 2012 to 2021. Taking an unconventional approach, we seek to uncover whether this field of study has a hidden impact on the financial performance of the prominent engineering simulation software company. Utilizing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our analysis unveils a remarkably high correlation coefficient of 0.9729168 and a significant p-value of less than 0.01. We discuss the implications of these findings and highlight the potential influence of military technologies and applied sciences education on the stock market, providing insight while keeping the tone light-hearted, even if the correlations are weighty.

[[LITERATURE REVIEW]]

The authors delve into a plethora of scholarly works, from the erudite analyses of Smith, Doe, and Jones to the whimsical meanderings of popular fiction and children's cartoons. In "Military Technologies: An Investigation into Education and Applications," Smith et al. explore the academic landscape of military technologies and its impact on various sectors, providing a solid foundation for understanding the significance of this field of study. Similarly, Doe's "Applied Sciences in Modern Society" offers a comprehensive overview of the practical applications of applied sciences across industries, setting the stage for our exploration into the intersection of education and financial markets.

As we wade deeper into the sea of literature, we encounter some unexpected vessels. "The Art of War" by Sun Tzu, while not a conventional academic text, provides timeless wisdom about strategy and warfare, offering valuable insights into the realm of military technologies. Additionally, "The Physics of Superheroes" by James Kakalios offers a lighthearted yet informative take on the application of physics in extraordinary scenarios, reminding us that even the most outlandish concepts can have real-world implications.

But our literary voyage doesn't end there. As we chart new territories, we draw inspiration from unexpected sources such as "G.I. Joe" and "The Magic School Bus." While these may seem like mere entertainment, the themes of military technology and scientific exploration woven into these shows serve as a testament to the pervasive influence of such subjects on young minds and society at large. After all, who wouldn't want to explore the stock market with the adventurous spirit of Ms. Frizzle or unravel the complexities of military technology alongside G.I. Joe?

With each page turned and each episode watched, the authors find themselves uncovering layers of nuance and hidden connections, adding a touch of levity to the weighty world of academic inquiry. And as the plot thickens, we prepare to weave these diverse threads into a seamless tapestry of knowledge, one that not only informs but also entertains. So, dear reader, fasten your seatbelts and get ready for a scholarly journey that promises to be both enlightening and unexpectedly amusing.

[[RESULTS]]

In the spirited quest to unravel the hidden connections between Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS), our rigorous analysis unearthed a striking correlation coefficient of 0.9729168 over the period from 2012 to 2021. This correlation coefficient suggests a strong positive linear relationship between the two variables, illustrating that as the number of Bachelor's degrees in Military Technologies and Applied Sciences increases, so does the stock price of ANSYS. It seems that the market is definitely taking note of these budding military technologists and applied scientists!

Casting further light on the robustness of this relationship, the r-squared value of 0.9465671 reinforces the high level of goodness of fit of the linear regression model. This suggests that a sizable proportion of the variations in ANSYS' stock price can be explained by the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences. It's like these degrees are whispering sweet stock secrets into the market's ear, and it seems the market is all ears!

Moreover, with a p-value of less than 0.01, our findings are not just statistically significant but also significant in their potential impact. This low p-value indicates that the observed correlation is unlikely to be a result of random chance, solidifying the legitimacy of our findings. It's as if these military technologies and applied sciences degrees are marching boldly into the stock market, making their presence known with statistical gusto.

To visually encapsulate the compelling correlation, we present the scatterplot in Fig. 1, which vividly illustrates the trend line depicting the strong positive association between Bachelor's degrees in Military Technologies and Applied Sciences and ANSYS' stock price. If a picture is worth a thousand words, then this one certainly speaks volumes about the unexpected link we've uncovered.

In summary, our findings not only reveal a remarkably high correlation between Bachelor's degrees awarded in Military Technologies and Applied Sciences and ANSYS' stock price but also offer a thought-provoking glimpse into the far-reaching repercussions of education in this domain on the fluctuations of the stock market. The financial world, it seems, is taking notes from an unexpected yet undeniably influential source!

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The results of our study offer compelling evidence regarding the substantial influence of Bachelor's degrees in Military Technologies and Applied Sciences on the stock price of ANSYS Inc. (ANSS). In line with the scholarly works that we explored in our literature review, these findings shed light on the unexpected yet undeniably influential connection between education in military technologies and applied sciences and the financial performance of a leading engineering simulation software company.

The robust correlation coefficient of 0.9729168 supports the notion that as the number of Bachelor's degrees in Military Technologies and Applied Sciences increases, ANSYS' stock price also experiences a corresponding uptick. This result not only corroborates the scholarly studies of Smith, Doe, and Jones but also aligns with the unexpected yet insightful wisdom we gleaned from unconventional sources such as "The Art of War" and "The Physics of Superheroes." It appears that even in the realm of academia and finance, the unlikeliest of sources can hold significant truths, much like finding a diamond in a pile of comic books.

Moreover, the high r-squared value of 0.9465671 further reinforces the strength of the linear relationship, indicating that a substantial proportion of the variations in ANSYS' stock price can be attributed to the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences. It's as if these degrees are wielding a powerful influence on the financial market, much like a superhero wielding a mighty weapon – a truly unexpected yet formidable force.

The low p-value of less than 0.01 solidifies the statistical significance of the observed correlation, reaffirming that these findings are not mere happenstance but a genuine reflection of the impactful role played by education in military technologies and applied sciences in the realm of stock prices. One might even say that these degrees are marching into the stock market with the precision of a military formation, leaving an indelible mark on the landscape of financial markets.

As we reflect on these compelling findings, it becomes apparent that the influence of education in military technologies and applied sciences extends beyond the confines of academic discourse and permeates the intricate web of stock market dynamics. Just as G.I. Joe and Ms. Frizzle captivated the imagination of audiences young and old, the impact of military technologies and applied sciences education seems to captivate the intrigue of the financial world, introducing an unexpected yet undeniably tangible element into the equation of stock price fluctuations.

In conclusion, our study not only unravels the enigmatic connection between Bachelor's degrees in Military Technologies and Applied Sciences and ANSYS' stock price but also underscores the far-reaching implications of education in this domain on the intricate mechanisms of financial markets. The unexpected yet powerful influence of these fields of study serves as a poignant reminder that in the world of academia and finance, truth can often be stranger than fiction, and the most unlikely sources can hold the key to unlocking hidden connections.

And with that intriguing note, we leave the unraveling of these academic and financial mysteries to the curious minds and discerning eyes of our esteemed readers.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and ANSYs' stock price (ANSS). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price"

[[ABSTRACT]]

In this paper, we delve into the intriguing relationship between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS) over the period of 2012 to 2021. Taking an unconventional approach, we seek to uncover whether this field of study has a hidden impact on the financial performance of the prominent engineering simulation software company. Utilizing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our analysis unveils a remarkably high correlation coefficient of 0.9729168 and a significant p-value of less than 0.01. We discuss the implications of these findings and highlight the potential influence of military technologies and applied sciences education on the stock market, providing insight while keeping the tone light-hearted, even if the correlations are weighty.

[[INTRDUCTION]]

The world of academia is often characterized by its serious and somber demeanor, but we are here to shatter that stereotype. In this paper, we embark on a journey to uncover the unexpected connections between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS). Granted, this might seem like an unlikely pairing—military technologies and stock prices, but as they say, sometimes truth is stranger than fiction.

As the financial markets ebb and flow and students eagerly pursue their education, it is easy to overlook the potential interplay between these seemingly disparate realms. However, as researchers, we are not content with accepting the status quo. We aim to push the boundaries and explore uncharted territories, or in this case, unchartered stock market territories *cue playful wink*.

Now, you might be wondering, "Why focus specifically on military technologies and applied sciences?" Well, my inquisitive friend, the choice of this field of study is not to be taken lightly. Military technologies and applied sciences are not only fascinating in their own right, but they also have far-reaching implications across various industries, including the illustrious world of engineering simulation software. So, join us on this academic escapade as we venture into uncharted terrain.

But fear not, dear reader, for we shall navigate these academic waters with the utmost rigor. Our investigation involves meticulous data analysis and statistical scrutiny, but don't worry, we promise to make this journey as painless as possible. After all, just because the subject matter is serious doesn't mean our approach has to be. So grab your thinking caps and let's dive into the whimsical world of correlation coefficients and p-values.

In the end, we hope to unravel the mysterious dance between academic pursuits and financial performance, shedding light on the potential influence of military technologies and applied sciences education on the stock market. And if we happen to unearth a few chuckles along the way, well, consider it a bonus. Stay tuned as we explore the surprising implications of this unlikely pairing, adding a touch of levity to the weighty world of academic research.

[[RESULTS]]

In the spirited quest to unravel the hidden connections between Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS), our rigorous analysis unearthed a striking correlation coefficient of 0.9729168 over the period from 2012 to 2021. This correlation coefficient suggests a strong positive linear relationship between the two variables, illustrating that as the number of Bachelor's degrees in Military Technologies and Applied Sciences increases, so does the stock price of ANSYS. It seems that the market is definitely taking note of these budding military technologists and applied scientists!

Casting further light on the robustness of this relationship, the r-squared value of 0.9465671 reinforces the high level of goodness of fit of the linear regression model. This suggests that a sizable proportion of the variations in ANSYS' stock price can be explained by the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences. It's like these degrees are whispering sweet stock secrets into the market's ear, and it seems the market is all ears!

Moreover, with a p-value of less than 0.01, our findings are not just statistically significant but also significant in their potential impact. This low p-value indicates that the observed correlation is unlikely to be a result of random chance, solidifying the legitimacy of our findings. It's as if these military technologies and applied sciences degrees are marching boldly into the stock market, making their presence known with statistical gusto.

To visually encapsulate the compelling correlation, we present the scatterplot in Fig. 1, which vividly illustrates the trend line depicting the strong positive association between Bachelor's degrees in Military Technologies and Applied Sciences and ANSYS' stock price. If a picture is worth a thousand words, then this one certainly speaks volumes about the unexpected link we've uncovered.

In summary, our findings not only reveal a remarkably high correlation between Bachelor's degrees awarded in Military Technologies and Applied Sciences and ANSYS' stock price but also offer a thought-provoking glimpse into the far-reaching repercussions of education in this domain on the fluctuations of the stock market. The financial world, it seems, is taking notes from an unexpected yet undeniably influential source!

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has provided compelling evidence of the surprising connection between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS). With a correlation coefficient of 0.9729168 and a p-value of less than 0.01, it's clear that the market has been taking cues from the influx of budding military technologists and applied scientists. It's like the stock market has been marching in lockstep with these graduates, perhaps even saluting their scholarly pursuits. Our findings highlight the potential impact of education in this field on the financial performance of a prominent engineering simulation software company, reminding us that truth can indeed be stranger than fiction, especially as it plays out in the stock market.

While this investigation may have started with eyebrow raises and quizzical looks, it has culminated in a tale of unexpected correlations and potential market influences. It seems that the students studying military technologies and applied sciences are not just learning about cutting-edge technology, but they might also be inadvertently shaping the financial world with their intellect and expertise. It's like they've been stealthily deploying their knowledge into the stock market, causing ripples that even the most astute investors might not have foreseen.

We hope that this lighthearted academic escapade has shed light on the whimsical yet impactful interplay between fields of study and financial realms, offering a playful reminder that even in the serious world of academia and finance, there's always room for an element of surprise and delight. With these findings in mind, we assert that further research in this area is like beating a dead horse – unnecessary and perhaps a bit too taxing on the intellect. It seems our work here is done, and we shall march forward, leaving this unexpected yet unmistakable correlation as a delightful surprise for future scholars to stumble upon.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of War Technologies and Financial Markets

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The National Committee for Applied Military Sciences Research (NCAMSR)

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price with an abstract of In this paper, we delve into the intriguing relationship between the number of Bachelor's degrees awarded in Military Technologies and Applied Sciences and the stock price of ANSYS Inc. (ANSS) over the period of 2012 to 2021. Taking an unconventional approach, we seek to uncover whether this field of study has a hidden impact on the financial performance of the prominent engineering simulation software company. Utilizing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our analysis unveils a remarkably high correlation coefficient of 0.9729168 and a significant p-value of less than 0.01. We discuss the implications of these findings and highlight the potential influence of military technologies and applied sciences education on the stock market, providing insight while keeping the tone light-hearted, even if the correlations are weighty.

ChatGPT:

bachelor's degrees, military technologies, applied sciences, ANSYS, stock price, correlation coefficient, National Center for Education Statistics, LSEG Analytics, Refinitiv, engineering simulation software, financial performance, correlation, stock market influence

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Bachelor's degrees awarded in Military technologiesDetailed data title: Bachelor's degrees conferred by postsecondary institutions, in field of study: Military technologies and applied sciences

Source: National Center for Education Statistics

See what else correlates with Bachelor's degrees awarded in Military technologies

ANSYs' stock price (ANSS)

Detailed data title: Opening price of ANSYS (ANSS) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with ANSYs' stock price (ANSS)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9465671 (Coefficient of determination)

This means 94.7% of the change in the one variable (i.e., ANSYs' stock price (ANSS)) is predictable based on the change in the other (i.e., Bachelor's degrees awarded in Military technologies) over the 10 years from 2012 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 2.3E-6. 0.0000022782044426401963000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.97 in 0.00023% of random cases. Said differently, if you correlated 438,942 random variables You don't actually need 438 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 9 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 9 because we have two variables measured over a period of 10 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.89, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Bachelor's degrees awarded in Military technologies (Degrees awarded) | 86 | 105 | 185 | 276 | 358 | 469 | 655 | 767 | 1156 | 1524 |

| ANSYs' stock price (ANSS) (Stock price) | 58.06 | 68.54 | 86.44 | 82.09 | 91.4 | 93.12 | 148.15 | 140.19 | 257.01 | 362.35 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([86,105,185,276,358,469,655,767,1156,1524,])

array_2 = np.array([58.06,68.54,86.44,82.09,91.4,93.12,148.15,140.19,257.01,362.35,])

array_1_name = "Bachelor's degrees awarded in Military technologies"

array_2_name = "ANSYs' stock price (ANSS)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Bachelor's degrees awarded in Military technologies

- Line chart for only ANSYs' stock price (ANSS)

- AI-generated correlation image

- The spurious research paper: Brace for Impact: Exploring the Impact of Bachelor's Degrees in Military Technologies and Applied Sciences on ANSYS' Stock Price

Your rating is stellar!

Correlation ID: 2182 · Black Variable ID: 1284 · Red Variable ID: 1849