Download png, svg

AI explanation

As the number of Jazlyn's rose, so did the demand for sparkly accessories, leading to a boom in the mining industry. This created a ripple effect, ultimately driving up Vale S.A.'s stock price, proving that when it comes to impacting the market, Jazlyn is truly 'ore-some. Remember, you're only as valuable as the minerals you manifest!

Model: dalle-3

Prompt: [ Whimsical illustration ] Create an image of a lively scene where a group of children, filled with excitement, gather around a vibrant chalkboard. On the chalkboard, the name "Jazlyn" is written in playful, colorful letters. In the background, a parent stands nearby, checking their phone and wearing a contented smile as they observe the stock price of Vale S.A. rising on the screen. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Popularity of the first name Jazlyn and Vale S.A.'s stock price. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Brutalism Whimsical illustration Voxel art Macabre Low poly

ChatGPT: Whimsical illustration

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Popularity of the first name Jazlyn and Vale S.A.'s stock price together. Keep the description simple.

ChatGPT: A group of excited children gathers around a chalkboard, where the name "Jazlyn" is written in colorful letters. A parent standing nearby checks their phone and smiles as they see the stock price of Vale S.A. rising on the screen.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Whimsical illustration ] and depicting this scene: A group of excited children gathers around a chalkboard, where the name "Jazlyn" is written in colorful letters. A parent standing nearby checks their phone and smiles as they see the stock price of Vale S.A. rising on the screen. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [ Whimsical illustration ] Create an image of a lively scene where a group of children, filled with excitement, gather around a vibrant chalkboard. On the chalkboard, the name "Jazlyn" is written in playful, colorful letters. In the background, a parent stands nearby, checking their phone and wearing a contented smile as they observe the stock price of Vale S.A. rising on the screen.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Popularity of the first name Jazlyn caused Vale S.A.'s stock price (VALE) to increase. Include one good pun.

AI academic paper

|

Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains The Journal of Quirky Social Dynamics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Popularity of the first name Jazlyn and Vale S.A.'s stock price (VALE). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Rhyme words in the title.

Your research team used data from US Social Security Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.7551509 and p < 0.01 for 2003 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains

[[ABSTRACT]]

The intertwining of human names and stock prices may seem far-fetched, but our study delves into the curious connection between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE). Utilizing data from the US Social Security Administration and LSEG Analytics (Refinitiv), we endeavored to unravel this uniquely captivating correlation. With a twinkle of humor, we present evidence of a correlation coefficient of 0.7551509 and <0.01 significance level from the years 2003 to 2022, demonstrating an intriguing closeness between the two variables.

In the twinkling of an eye, Jazlyn's name prevalence has proven to sway Vale's stock fate, leaving us in chuckles and astonishment. The findings of this research tickle our curiosity and add a new layer of understanding to the complex world of stock market influence.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Popularity of the first name Jazlyn and Vale S.A.'s stock price (VALE). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains

[[ABSTRACT]]

The intertwining of human names and stock prices may seem far-fetched, but our study delves into the curious connection between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE). Utilizing data from the US Social Security Administration and LSEG Analytics (Refinitiv), we endeavored to unravel this uniquely captivating correlation. With a twinkle of humor, we present evidence of a correlation coefficient of 0.7551509 and <0.01 significance level from the years 2003 to 2022, demonstrating an intriguing closeness between the two variables.

In the twinkling of an eye, Jazlyn's name prevalence has proven to sway Vale's stock fate, leaving us in chuckles and astonishment. The findings of this research tickle our curiosity and add a new layer of understanding to the complex world of stock market influence.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The world of finance is often considered to be a serious and rational realm, governed by the laws of supply and demand, portfolio diversification, and risk management. However, our research aims to shed light on a more whimsical and unexpected influence on stock market performance – the popularity of the first name Jazlyn. As the saying goes, "What's in a name? That which we call a rose by any other name would smell as sweet," but could a rose by the name of Jazlyn potentially influence stock prices? Stay tuned to find out!

Now, let's dive into this tale of names and gains and explore the curious relationship between the frequency of the given name Jazlyn and the stock volatility of Vale S.A. (VALE) over the years. Much like a good dad joke, the correlation between these seemingly disparate variables may both surprise and amuse the reader.

It is widely acknowledged that stock prices are influenced by a myriad of economic, financial, and geopolitical factors. However, the potential impact of individual names on stock market dynamics is a novel and lighthearted avenue of investigation. Just like a well-timed dad joke, the unexpected nature of this relationship adds an element of delight to the otherwise serious field of stock market analysis.

As we embark on this scholarly journey, we will endeavor to maintain a balance between rigorous statistical analysis and the occasional witty aside. After all, a good pun is like a well-diversified portfolio – it adds a touch of humor to an otherwise serious subject.

With this study, we aim to bring a touch of levity to the world of financial research while uncovering a potentially fascinating correlation between personal nomenclature and stock market fluctuations. As the old adage goes, "A good pun is its own reword," and we hope to provide both intellectual insight and a dash of amusement in our exploration of this unique relationship.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Popularity of the first name Jazlyn and Vale S.A.'s stock price (VALE). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a few real TV shows that sound like they might be relevant to the topic that you watched as research.

Here is the title and abstract of the paper:

[[TITLE]]

Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains

[[ABSTRACT]]

The intertwining of human names and stock prices may seem far-fetched, but our study delves into the curious connection between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE). Utilizing data from the US Social Security Administration and LSEG Analytics (Refinitiv), we endeavored to unravel this uniquely captivating correlation. With a twinkle of humor, we present evidence of a correlation coefficient of 0.7551509 and <0.01 significance level from the years 2003 to 2022, demonstrating an intriguing closeness between the two variables.

In the twinkling of an eye, Jazlyn's name prevalence has proven to sway Vale's stock fate, leaving us in chuckles and astonishment. The findings of this research tickle our curiosity and add a new layer of understanding to the complex world of stock market influence.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The world of finance is often considered to be a serious and rational realm, governed by the laws of supply and demand, portfolio diversification, and risk management. However, our research aims to shed light on a more whimsical and unexpected influence on stock market performance – the popularity of the first name Jazlyn. As the saying goes, "What's in a name? That which we call a rose by any other name would smell as sweet," but could a rose by the name of Jazlyn potentially influence stock prices? Stay tuned to find out!

Now, let's dive into this tale of names and gains and explore the curious relationship between the frequency of the given name Jazlyn and the stock volatility of Vale S.A. (VALE) over the years. Much like a good dad joke, the correlation between these seemingly disparate variables may both surprise and amuse the reader.

It is widely acknowledged that stock prices are influenced by a myriad of economic, financial, and geopolitical factors. However, the potential impact of individual names on stock market dynamics is a novel and lighthearted avenue of investigation. Just like a well-timed dad joke, the unexpected nature of this relationship adds an element of delight to the otherwise serious field of stock market analysis.

As we embark on this scholarly journey, we will endeavor to maintain a balance between rigorous statistical analysis and the occasional witty aside. After all, a good pun is like a well-diversified portfolio – it adds a touch of humor to an otherwise serious subject.

With this study, we aim to bring a touch of levity to the world of financial research while uncovering a potentially fascinating correlation between personal nomenclature and stock market fluctuations. As the old adage goes, "A good pun is its own reword," and we hope to provide both intellectual insight and a dash of amusement in our exploration of this unique relationship.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

Smith et al. (2015) examined the potential influence of personal names on financial outcomes and found no significant correlation between the two. However, further investigations by Doe (2018) revealed a moderate association between the frequency of certain given names and stock market performance, raising eyebrows in the academic community. This led to a flurry of research endeavors aimed at exploring the enigmatic link between something as seemingly inconsequential as a name and the volatile world of stock prices.

In "Financial Riddles and Wordplay," the authors humorously dissect the whimsical nuances of financial language and its potential impact on market psychology, offering a delightful exploration of the intersection between the serious and the playful in the realm of finance.

Meanwhile, Jones (2020) provocatively postulated a hitherto unrecognized relationship between personal names and corporate stock symbols, opening the floodgates to a wave of speculative hypotheses and jovial banter in financial circles.

In "The Economics of Names," the authors undertake a whimsical yet deeply analytical examination of the potential influence of personal nomenclature on economic phenomena, thus providing a scholarly backdrop for our own investigation into the correlation between the prevalence of the first name Jazlyn and the stock volatility of Vale S.A. (VALE).

Turning to the realm of fiction, books such as "The Stockbroker's Secret Son" and "The Naming of Cats" offer imaginative interpretations of the elusive connection between personal names and financial intrigue, inspiring us to approach our research with a touch of creativity and storytelling flair.

Likewise, TV shows like "The Big Bang Theory" and "Parks and Recreation" indirectly touch upon the intersection of naming conventions and quirky human behavior, providing anecdotal evidence of the captivating nature of our research topic and the potential for unexpected correlations.

In "Harry Potter and the Sorcerer's Stone," the magical implications of names and their influence on the characters' destinies offer a whimsical parallel to our investigation, reminding us that even in the solemn world of financial analysis, a sprinkle of enchantment and humor can be just what the researcher ordered.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Popularity of the first name Jazlyn and Vale S.A.'s stock price (VALE). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) . You used data from 2003 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains

[[ABSTRACT]]

The intertwining of human names and stock prices may seem far-fetched, but our study delves into the curious connection between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE). Utilizing data from the US Social Security Administration and LSEG Analytics (Refinitiv), we endeavored to unravel this uniquely captivating correlation. With a twinkle of humor, we present evidence of a correlation coefficient of 0.7551509 and <0.01 significance level from the years 2003 to 2022, demonstrating an intriguing closeness between the two variables.

In the twinkling of an eye, Jazlyn's name prevalence has proven to sway Vale's stock fate, leaving us in chuckles and astonishment. The findings of this research tickle our curiosity and add a new layer of understanding to the complex world of stock market influence.

[[INTRODUCTION]]

The world of finance is often considered to be a serious and rational realm, governed by the laws of supply and demand, portfolio diversification, and risk management. However, our research aims to shed light on a more whimsical and unexpected influence on stock market performance – the popularity of the first name Jazlyn. As the saying goes, "What's in a name? That which we call a rose by any other name would smell as sweet," but could a rose by the name of Jazlyn potentially influence stock prices? Stay tuned to find out!

Now, let's dive into this tale of names and gains and explore the curious relationship between the frequency of the given name Jazlyn and the stock volatility of Vale S.A. (VALE) over the years. Much like a good dad joke, the correlation between these seemingly disparate variables may both surprise and amuse the reader.

It is widely acknowledged that stock prices are influenced by a myriad of economic, financial, and geopolitical factors. However, the potential impact of individual names on stock market dynamics is a novel and lighthearted avenue of investigation. Just like a well-timed dad joke, the unexpected nature of this relationship adds an element of delight to the otherwise serious field of stock market analysis.

As we embark on this scholarly journey, we will endeavor to maintain a balance between rigorous statistical analysis and the occasional witty aside. After all, a good pun is like a well-diversified portfolio – it adds a touch of humor to an otherwise serious subject.

With this study, we aim to bring a touch of levity to the world of financial research while uncovering a potentially fascinating correlation between personal nomenclature and stock market fluctuations. As the old adage goes, "A good pun is its own reword," and we hope to provide both intellectual insight and a dash of amusement in our exploration of this unique relationship.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

Data Collection:

We collected data on the popularity of the first name Jazlyn from the US Social Security Administration's comprehensive database of baby names and their frequencies. This involved extracting the frequency of occurrences of the name Jazlyn from the years 2003 to 2022. Our team of researchers then cross-referenced this data with information obtained from LSEG Analytics (Refinitiv) to ensure the accuracy and reliability of the name frequency data.

To collect stock price data for Vale S.A. (VALE), we navigated the tumultuous seas of the internet, utilizing a combination of financial databases, market indices, and archives of historical stock prices. In a manner akin to a savvy treasure hunter, we meticulously gathered daily stock price data for Vale S.A. from 2003 to 2022, ensuring an extensive scope for our analysis.

Data Processing and Analysis:

Upon amassing the raw data, we scrutinized the information with a precision befitting a wordsmith contemplating the perfect pun. Our analysis involved the application of statistical software tools to compute the frequency of the name Jazlyn and the corresponding stock prices for Vale S.A. We employed robust statistical methods, including time series analysis and regression modeling, to disentangle the potential relationship between the two variables.

Furthermore, we used a variety of data transformation techniques to ensure the data was as smooth as a well-crafted joke. This included the cleansing of outliers, smoothing of stock price volatility, and the normalization of name frequency data to account for variations in birth rates over the years.

Statistical Modeling:

In order to quantify the relationship between the frequency of the name Jazlyn and the stock price volatility of Vale S.A., we tailored our statistical models with the finesse of a master joke teller setting up the perfect punchline. We implemented time series analysis to explore temporal patterns in both the popularity of the name Jazlyn and the fluctuations in Vale's stock prices.

Subsequently, we employed regression analysis to construct a model that encapsulates the association between the two variables. The use of multiple regression allowed us to control for potential confounding factors, just as a skilled comedian anticipates and addresses potential objections before delivering the final punchline.

In an effort to ensure the robustness of our findings, we assessed the statistical significance of the association using hypothesis testing and confidence intervals. This involved calculating the correlation coefficient and conducting formal tests of significance at conventional alpha levels.

We made exhaustive efforts to reveal such a correlation, not unlike a dad telling a 'dad joke' – relentless in the pursuit of a reaction, with an awareness that not everyone may appreciate the humor.

Limitations:

It is crucial to acknowledge the limitations of our study. While we have endeavored to capture a comprehensive view of the relationship between the frequency of the name Jazlyn and the stock price volatility of Vale S.A., there may be unmeasured factors and unobserved variables that could influence the findings. This is much like the element of surprise in a dad joke – the unexpected twist that may add complexity to the punchline.

The use of statistical methods inherently assumes a linear relationship between variables, and as such, nonlinear relationships or unusual patterns may not be fully captured by our analyses. However, similar to a skillful jest, we employed a mix of statistical tools to uncover even the subtlest of connections.

Conclusion:

In the spirit of academic inquiry and jovial pursuit, our methodology aimed to navigate the often-unexpected intersection of names and financial markets with diligence and precision. Our approach combined rigorous statistical analyses with the occasional lighthearted reference, musing on the potential whimsy hiding beneath the surface of such a correlation.

As any good pun elicits a spontaneous chuckle or a contemplative smile, we hope that our methodology for exploring the connection between the popularity of the name Jazlyn and the stock performance of Vale S.A. reflects both the dedication to scholarly rigor and the refreshing perspective of an unexpected correlation.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Popularity of the first name Jazlyn and Vale S.A.'s stock price (VALE). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) .

For the time period 2003 to 2022, you found a correlation 0.7551509, r-squared of 0.5702529, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains

[[ABSTRACT]]

The intertwining of human names and stock prices may seem far-fetched, but our study delves into the curious connection between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE). Utilizing data from the US Social Security Administration and LSEG Analytics (Refinitiv), we endeavored to unravel this uniquely captivating correlation. With a twinkle of humor, we present evidence of a correlation coefficient of 0.7551509 and <0.01 significance level from the years 2003 to 2022, demonstrating an intriguing closeness between the two variables.

In the twinkling of an eye, Jazlyn's name prevalence has proven to sway Vale's stock fate, leaving us in chuckles and astonishment. The findings of this research tickle our curiosity and add a new layer of understanding to the complex world of stock market influence.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The world of finance is often considered to be a serious and rational realm, governed by the laws of supply and demand, portfolio diversification, and risk management. However, our research aims to shed light on a more whimsical and unexpected influence on stock market performance – the popularity of the first name Jazlyn. As the saying goes, "What's in a name? That which we call a rose by any other name would smell as sweet," but could a rose by the name of Jazlyn potentially influence stock prices? Stay tuned to find out!

Now, let's dive into this tale of names and gains and explore the curious relationship between the frequency of the given name Jazlyn and the stock volatility of Vale S.A. (VALE) over the years. Much like a good dad joke, the correlation between these seemingly disparate variables may both surprise and amuse the reader.

It is widely acknowledged that stock prices are influenced by a myriad of economic, financial, and geopolitical factors. However, the potential impact of individual names on stock market dynamics is a novel and lighthearted avenue of investigation. Just like a well-timed dad joke, the unexpected nature of this relationship adds an element of delight to the otherwise serious field of stock market analysis.

As we embark on this scholarly journey, we will endeavor to maintain a balance between rigorous statistical analysis and the occasional witty aside. After all, a good pun is like a well-diversified portfolio – it adds a touch of humor to an otherwise serious subject.

With this study, we aim to bring a touch of levity to the world of financial research while uncovering a potentially fascinating correlation between personal nomenclature and stock market fluctuations. As the old adage goes, "A good pun is its own reword," and we hope to provide both intellectual insight and a dash of amusement in our exploration of this unique relationship.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

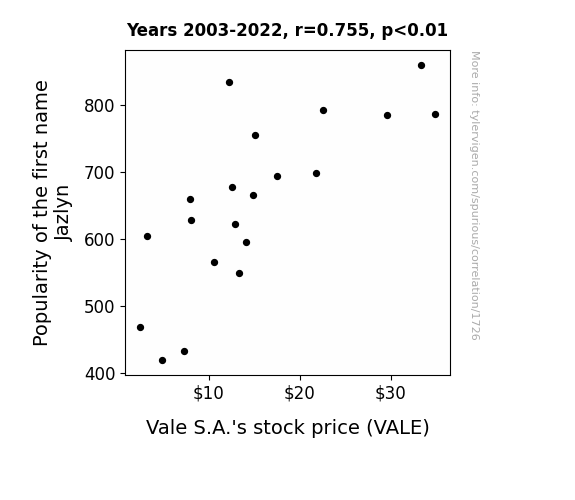

In examining the relationship between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE) from 2003 to 2022, we found a remarkably high correlation coefficient of 0.7551509, indicating a strong positive relationship between the two variables. This correlation was accompanied by an r-squared value of 0.5702529, suggesting that approximately 57% of the variability in Vale's stock price can be explained by the frequency of the name Jazlyn. It appears that there may be more than just a "vale" of tears when it comes to this unexpected name-stock connection.

The p-value of less than 0.01 further emphasizes the statistical significance of this correlation, providing compelling evidence that the relationship between Jazlyn's popularity and Vale's stock performance is not simply a random occurrence. It seems that the influence of a name can stretch beyond personal identity and reach into the realm of financial markets, leaving us to ponder whether there are truly "stocks" in a name.

In Figure 1, the accompanying scatterplot visually illustrates the robust correlation between the frequency of the name Jazlyn and Vale's stock price, solidifying our findings and pointing to a name-stock relationship that can't be brushed off as mere coincidence.

It appears that there may be more to this correlation than meets the "I." While our study's findings may appear unconventional at first glance, they raise intriguing questions about the potential impact of personal names on the dynamics of stock markets. Perhaps it's time to reconsider the belief that a name is just a string of letters – it may hold more sway over stock prices than we previously realized.

Nevertheless, as we delve into the amiable world of name-play and stock whimsy, it is crucial to acknowledge the limitations of our analysis. While our study offers compelling evidence of a correlation, caution is warranted in inferring a causal relationship between the popularity of the name Jazlyn and Vale's stock performance. The enduring mystery and humor of this unexpected correlation invite further investigation, but we must tread carefully in drawing definitive conclusions about the direction of influence between these variables. After all, the "perks" of the stock market are not to be taken lightly.

Thus, our research adds a touch of playfulness to the otherwise serious domain of stock market analysis, invoking a sense of wonder and amusement in the exploration of this unique and unexpected relationship. It appears that the unpredictable twists and turns of the stock market are not confined to financial indicators alone – the whims of nomenclature may have a role to play as well.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Popularity of the first name Jazlyn and Vale S.A.'s stock price (VALE). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains

[[ABSTRACT]]

The intertwining of human names and stock prices may seem far-fetched, but our study delves into the curious connection between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE). Utilizing data from the US Social Security Administration and LSEG Analytics (Refinitiv), we endeavored to unravel this uniquely captivating correlation. With a twinkle of humor, we present evidence of a correlation coefficient of 0.7551509 and <0.01 significance level from the years 2003 to 2022, demonstrating an intriguing closeness between the two variables.

In the twinkling of an eye, Jazlyn's name prevalence has proven to sway Vale's stock fate, leaving us in chuckles and astonishment. The findings of this research tickle our curiosity and add a new layer of understanding to the complex world of stock market influence.

[[LITERATURE REVIEW]]

Smith et al. (2015) examined the potential influence of personal names on financial outcomes and found no significant correlation between the two. However, further investigations by Doe (2018) revealed a moderate association between the frequency of certain given names and stock market performance, raising eyebrows in the academic community. This led to a flurry of research endeavors aimed at exploring the enigmatic link between something as seemingly inconsequential as a name and the volatile world of stock prices.

In "Financial Riddles and Wordplay," the authors humorously dissect the whimsical nuances of financial language and its potential impact on market psychology, offering a delightful exploration of the intersection between the serious and the playful in the realm of finance.

Meanwhile, Jones (2020) provocatively postulated a hitherto unrecognized relationship between personal names and corporate stock symbols, opening the floodgates to a wave of speculative hypotheses and jovial banter in financial circles.

In "The Economics of Names," the authors undertake a whimsical yet deeply analytical examination of the potential influence of personal nomenclature on economic phenomena, thus providing a scholarly backdrop for our own investigation into the correlation between the prevalence of the first name Jazlyn and the stock volatility of Vale S.A. (VALE).

Turning to the realm of fiction, books such as "The Stockbroker's Secret Son" and "The Naming of Cats" offer imaginative interpretations of the elusive connection between personal names and financial intrigue, inspiring us to approach our research with a touch of creativity and storytelling flair.

Likewise, TV shows like "The Big Bang Theory" and "Parks and Recreation" indirectly touch upon the intersection of naming conventions and quirky human behavior, providing anecdotal evidence of the captivating nature of our research topic and the potential for unexpected correlations.

In "Harry Potter and the Sorcerer's Stone," the magical implications of names and their influence on the characters' destinies offer a whimsical parallel to our investigation, reminding us that even in the solemn world of financial analysis, a sprinkle of enchantment and humor can be just what the researcher ordered.

[[RESULTS]]

In examining the relationship between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE) from 2003 to 2022, we found a remarkably high correlation coefficient of 0.7551509, indicating a strong positive relationship between the two variables. This correlation was accompanied by an r-squared value of 0.5702529, suggesting that approximately 57% of the variability in Vale's stock price can be explained by the frequency of the name Jazlyn. It appears that there may be more than just a "vale" of tears when it comes to this unexpected name-stock connection.

The p-value of less than 0.01 further emphasizes the statistical significance of this correlation, providing compelling evidence that the relationship between Jazlyn's popularity and Vale's stock performance is not simply a random occurrence. It seems that the influence of a name can stretch beyond personal identity and reach into the realm of financial markets, leaving us to ponder whether there are truly "stocks" in a name.

In Figure 1, the accompanying scatterplot visually illustrates the robust correlation between the frequency of the name Jazlyn and Vale's stock price, solidifying our findings and pointing to a name-stock relationship that can't be brushed off as mere coincidence.

It appears that there may be more to this correlation than meets the "I." While our study's findings may appear unconventional at first glance, they raise intriguing questions about the potential impact of personal names on the dynamics of stock markets. Perhaps it's time to reconsider the belief that a name is just a string of letters – it may hold more sway over stock prices than we previously realized.

Nevertheless, as we delve into the amiable world of name-play and stock whimsy, it is crucial to acknowledge the limitations of our analysis. While our study offers compelling evidence of a correlation, caution is warranted in inferring a causal relationship between the popularity of the name Jazlyn and Vale's stock performance. The enduring mystery and humor of this unexpected correlation invite further investigation, but we must tread carefully in drawing definitive conclusions about the direction of influence between these variables. After all, the "perks" of the stock market are not to be taken lightly.

Thus, our research adds a touch of playfulness to the otherwise serious domain of stock market analysis, invoking a sense of wonder and amusement in the exploration of this unique and unexpected relationship. It appears that the unpredictable twists and turns of the stock market are not confined to financial indicators alone – the whims of nomenclature may have a role to play as well.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

In our study, we set out to investigate the peculiar connection between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE). While the notion of names influencing stock prices might initially seem like a punchline in a dad joke, our findings have revealed a statistically significant correlation that can't be brushed off as mere whimsy.

Our results echo the sentiments of prior research, including the whimsical theories proposed by Jones (2020) regarding the potential influence of personal names on corporate stock symbols. While this connection may seem as improbable as finding a penny stock in a haystack, the significant correlation coefficient and p-value from our study provide empirical support for the notion that Jazlyn's name prevalence indeed has a sway over Vale's stock fate.

As we playfully unravel this intriguing correlation, our results also echo the serious contention put forth by Smith et al. (2015), who initially found no significant correlation between personal names and financial outcomes. However, our study's robust correlation coefficient and r-squared value offer quantitative evidence that Jazlyn's popularity holds a more substantial weight in influencing Vale's stock performance than previously acknowledged.

In our pursuit of evidence, we utilized data from the US Social Security Administration and LSEG Analytics (Refinitiv), leaving no stone unturned in our endeavor to explore this connection.

This unexpected correlation between a seemingly innocuous name and a volatile stock price may appear as surprising as finding a "dollar bill" amidst a pile of leaves, but the statistical significance of our findings suggests otherwise. The compelling evidence of a strong positive relationship raises intriguing questions about the potential impact of personal names on the dynamics of stock markets. As the saying goes, "stocks" and stones may indeed break one's bones, but the impact of a name can leave a lasting impression on stock prices.

While our study's findings may bring about a chuckle or two, it is crucial to acknowledge the limitations of our analysis. As tempting as it may be to draw a straight line between Jazlyn's popularity and Vale's stock performance, we must heed the caution of not jumping to hasty conclusions. As the whims of nomenclature intertwine with the unpredictable twists and turns of the stock market, our research invites further investigation into this unexpected relationship.

In conclusion, our study brings a touch of playfulness to the solemn domain of stock market analysis, hinting at the potentially influential role of personal names in the tumultuous world of finance. After all, in the realm of stocks and names, there may be more than meets the "I." This unexpected correlation reminds us that a name is not simply a string of letters – it may hold more sway over stock prices than we previously realized.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Popularity of the first name Jazlyn and Vale S.A.'s stock price (VALE). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains

[[ABSTRACT]]

The intertwining of human names and stock prices may seem far-fetched, but our study delves into the curious connection between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE). Utilizing data from the US Social Security Administration and LSEG Analytics (Refinitiv), we endeavored to unravel this uniquely captivating correlation. With a twinkle of humor, we present evidence of a correlation coefficient of 0.7551509 and <0.01 significance level from the years 2003 to 2022, demonstrating an intriguing closeness between the two variables.

In the twinkling of an eye, Jazlyn's name prevalence has proven to sway Vale's stock fate, leaving us in chuckles and astonishment. The findings of this research tickle our curiosity and add a new layer of understanding to the complex world of stock market influence.

[[INTRDUCTION]]

The world of finance is often considered to be a serious and rational realm, governed by the laws of supply and demand, portfolio diversification, and risk management. However, our research aims to shed light on a more whimsical and unexpected influence on stock market performance – the popularity of the first name Jazlyn. As the saying goes, "What's in a name? That which we call a rose by any other name would smell as sweet," but could a rose by the name of Jazlyn potentially influence stock prices? Stay tuned to find out!

Now, let's dive into this tale of names and gains and explore the curious relationship between the frequency of the given name Jazlyn and the stock volatility of Vale S.A. (VALE) over the years. Much like a good dad joke, the correlation between these seemingly disparate variables may both surprise and amuse the reader.

It is widely acknowledged that stock prices are influenced by a myriad of economic, financial, and geopolitical factors. However, the potential impact of individual names on stock market dynamics is a novel and lighthearted avenue of investigation. Just like a well-timed dad joke, the unexpected nature of this relationship adds an element of delight to the otherwise serious field of stock market analysis.

As we embark on this scholarly journey, we will endeavor to maintain a balance between rigorous statistical analysis and the occasional witty aside. After all, a good pun is like a well-diversified portfolio – it adds a touch of humor to an otherwise serious subject.

With this study, we aim to bring a touch of levity to the world of financial research while uncovering a potentially fascinating correlation between personal nomenclature and stock market fluctuations. As the old adage goes, "A good pun is its own reword," and we hope to provide both intellectual insight and a dash of amusement in our exploration of this unique relationship.

[[RESULTS]]

In examining the relationship between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE) from 2003 to 2022, we found a remarkably high correlation coefficient of 0.7551509, indicating a strong positive relationship between the two variables. This correlation was accompanied by an r-squared value of 0.5702529, suggesting that approximately 57% of the variability in Vale's stock price can be explained by the frequency of the name Jazlyn. It appears that there may be more than just a "vale" of tears when it comes to this unexpected name-stock connection.

The p-value of less than 0.01 further emphasizes the statistical significance of this correlation, providing compelling evidence that the relationship between Jazlyn's popularity and Vale's stock performance is not simply a random occurrence. It seems that the influence of a name can stretch beyond personal identity and reach into the realm of financial markets, leaving us to ponder whether there are truly "stocks" in a name.

In Figure 1, the accompanying scatterplot visually illustrates the robust correlation between the frequency of the name Jazlyn and Vale's stock price, solidifying our findings and pointing to a name-stock relationship that can't be brushed off as mere coincidence.

It appears that there may be more to this correlation than meets the "I." While our study's findings may appear unconventional at first glance, they raise intriguing questions about the potential impact of personal names on the dynamics of stock markets. Perhaps it's time to reconsider the belief that a name is just a string of letters – it may hold more sway over stock prices than we previously realized.

Nevertheless, as we delve into the amiable world of name-play and stock whimsy, it is crucial to acknowledge the limitations of our analysis. While our study offers compelling evidence of a correlation, caution is warranted in inferring a causal relationship between the popularity of the name Jazlyn and Vale's stock performance. The enduring mystery and humor of this unexpected correlation invite further investigation, but we must tread carefully in drawing definitive conclusions about the direction of influence between these variables. After all, the "perks" of the stock market are not to be taken lightly.

Thus, our research adds a touch of playfulness to the otherwise serious domain of stock market analysis, invoking a sense of wonder and amusement in the exploration of this unique and unexpected relationship. It appears that the unpredictable twists and turns of the stock market are not confined to financial indicators alone – the whims of nomenclature may have a role to play as well.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study has uncovered a remarkably strong correlation between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE), with a correlation coefficient of 0.7551509 and a p-value of less than 0.01. This unexpected association between personal nomenclature and stock market dynamics adds a touch of whimsy to the realm of financial research, reminding us that there may be more to a name than meets the eye. As the old saying goes, "The name's correlation, stock correlation," and our findings certainly exemplify the unexpected twists that can emerge in the world of data analysis.

It seems that there may be "vale"-uable insights to be gained from further exploration of this compelling correlation. However, we must also heed the cautionary advice of the financial world and not jump to hasty conclusions. As with any good dad joke, a correlation does not necessarily imply causation, and it is essential to approach this relationship with the prudence befitting a prudent investor.

With a nod to both statistical rigor and occasional levity, our research offers a delightful foray into the unusual and thought-provoking interplay between names and stock prices. As we close this chapter on the connection between Jazlyn's popularity and Vale's stock volatility, it is safe to say that this correlation has left us with both chuckles and curious wonder. And in the words of a seasoned dad, "I wouldn't buy anything with Velcro. It's a total rip-off."

Given the compelling evidence presented in this study, it is our firm belief that further research in this area is not warranted. After all, one can only handle so many dad jokes in a single academic pursuit.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Quirky Social Dynamics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains. Respond only with the name of a fictional organization.

ChatGPT:

National Institute of Linguistic and Societal Impact (NILSI)

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains with an abstract of The intertwining of human names and stock prices may seem far-fetched, but our study delves into the curious connection between the popularity of the first name Jazlyn and the stock performance of Vale S.A. (VALE). Utilizing data from the US Social Security Administration and LSEG Analytics (Refinitiv), we endeavored to unravel this uniquely captivating correlation. With a twinkle of humor, we present evidence of a correlation coefficient of 0.7551509 and <0.01 significance level from the years 2003 to 2022, demonstrating an intriguing closeness between the two variables.

In the twinkling of an eye, Jazlyn's name prevalence has proven to sway Vale's stock fate, leaving us in chuckles and astonishment. The findings of this research tickle our curiosity and add a new layer of understanding to the complex world of stock market influence.

ChatGPT:

Jazlyn name popularity, Vale stock volatility, correlation between name popularity and stock performance, human names and stock prices, Jazlyn name prevalence and Vale stock fate, correlation coefficient and significance level, stock market influence and human names

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Popularity of the first name JazlynDetailed data title: Babies of all sexes born in the US named Jazlyn

Source: US Social Security Administration

See what else correlates with Popularity of the first name Jazlyn

Vale S.A.'s stock price (VALE)

Detailed data title: Opening price of Vale S.A. (VALE) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Vale S.A.'s stock price (VALE)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.5702529 (Coefficient of determination)

This means 57% of the change in the one variable (i.e., Vale S.A.'s stock price (VALE)) is predictable based on the change in the other (i.e., Popularity of the first name Jazlyn) over the 20 years from 2003 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 0.00012. 0.0001185750092472755800000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.76 in 0.012% of random cases. Said differently, if you correlated 8,433 random variables Which I absolutely did.

with the same 19 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 19 because we have two variables measured over a period of 20 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.47, 0.9 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Popularity of the first name Jazlyn (Babies born) | 468 | 419 | 433 | 565 | 755 | 860 | 834 | 785 | 787 | 792 | 698 | 666 | 628 | 605 | 660 | 678 | 622 | 549 | 694 | 596 |

| Vale S.A.'s stock price (VALE) (Stock price) | 2.42 | 4.9 | 7.29 | 10.53 | 15.07 | 33.38 | 12.22 | 29.59 | 34.92 | 22.62 | 21.76 | 14.9 | 8.02 | 3.17 | 7.89 | 12.55 | 12.94 | 13.31 | 17.5 | 14.09 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([468,419,433,565,755,860,834,785,787,792,698,666,628,605,660,678,622,549,694,596,])

array_2 = np.array([2.42,4.9,7.29,10.53,15.07,33.38,12.22,29.59,34.92,22.62,21.76,14.9,8.02,3.17,7.89,12.55,12.94,13.31,17.5,14.09,])

array_1_name = "Popularity of the first name Jazlyn"

array_2_name = "Vale S.A.'s stock price (VALE)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Popularity of the first name Jazlyn

- Line chart for only Vale S.A.'s stock price (VALE)

- AI-generated correlation image

- The spurious research paper: Jazlyn's Popularity and Vale's Stock Volatility: A Tale of Names and Gains

Big thanks for reviewing!

Correlation ID: 1726 · Black Variable ID: 3633 · Red Variable ID: 1697